Content

What is the Current Cathodic Protection Market Size and Share?

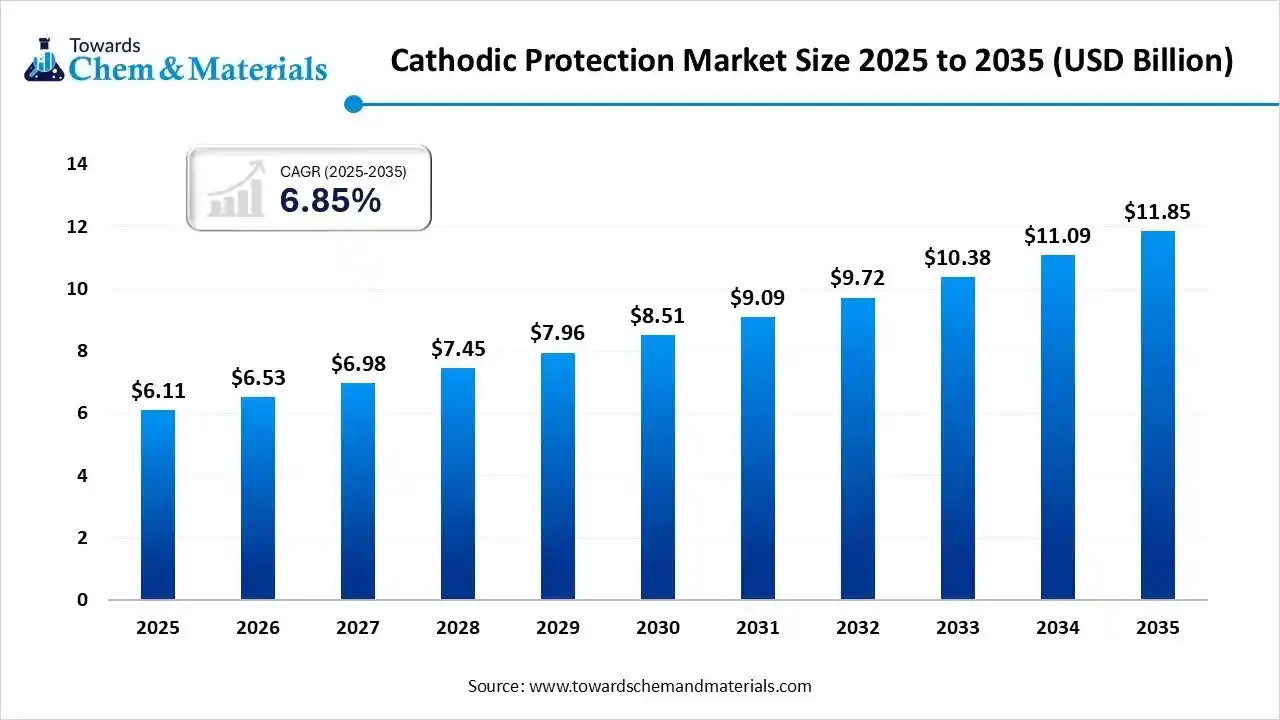

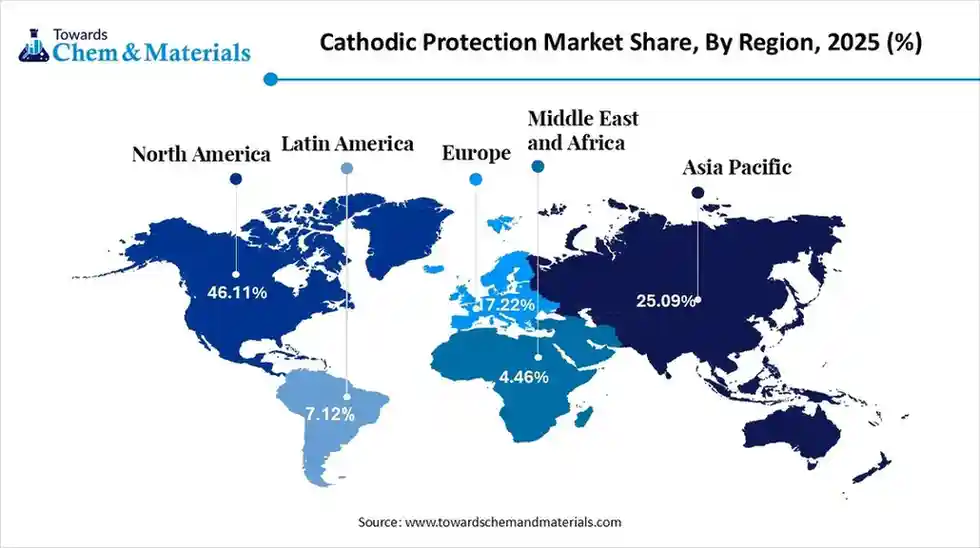

The global cathodic protection market size was estimated at USD 6.11 billion in 2025 and is predicted to increase from USD 6.53 billion in 2026 and is projected to reach around USD 11.85 billion by 2035, The market is expanding at a CAGR of 6.85% between 2026 and 2035. North America dominated the cathodic protection market with a market share of 46.11% the global market in 2025. The ongoing expansion of the oil & gas industry is the key factor driving market growth. Also, growing demand for sustainable solutions, coupled with its extensive application in the water and marine sectors, can fuel market growth further.

Key Takeaways

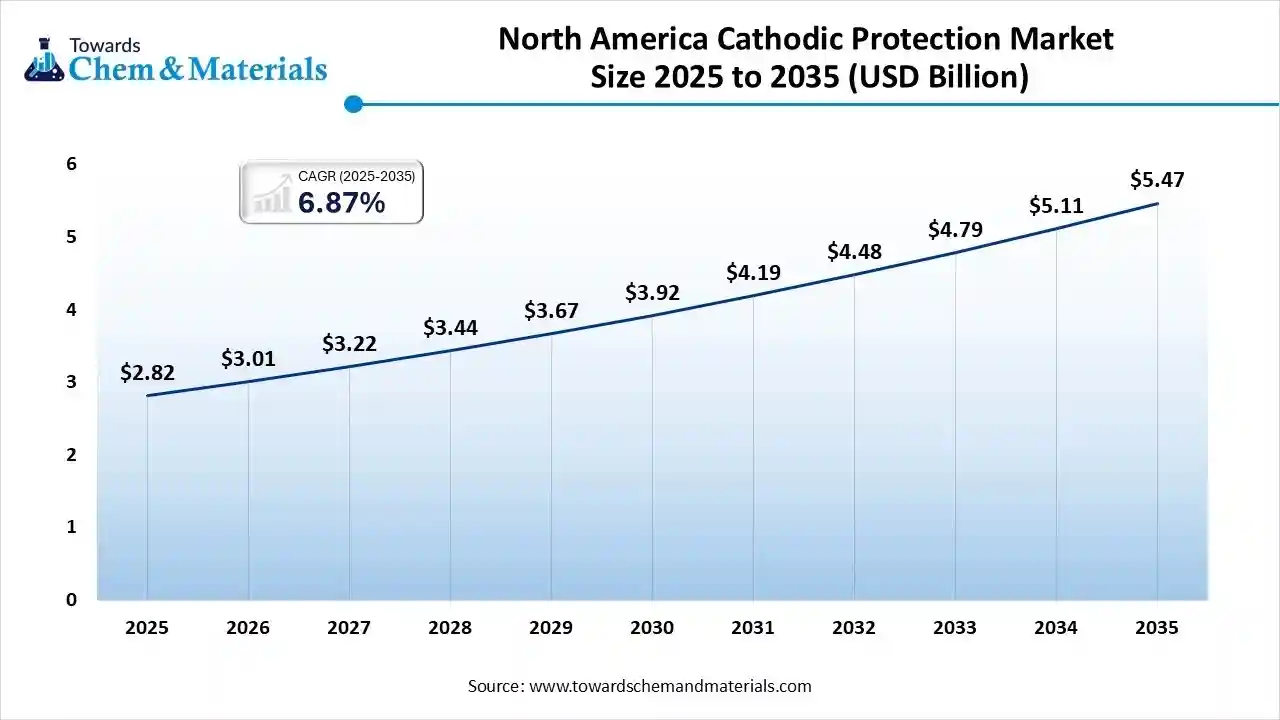

- By region, North America led the cathodic protection market with the largest revenue share of over 46.11% in 2025.

- By protection method, the galvanic anode segment dominated the market with the largest share in 2025.

- By protection method, the impressed current systems segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the oil and gas segment held the largest market share in 2025.

- By application, the marine segment is expected to grow at the fastest CAGR over the forecast period.

- By component type, the anodes segment dominated the market by holding the largest share in 2025.

- By component type, the power supply segment is expected to grow at the fastest CAGR over the forecast period.

- By deployment type, the onshore segment held the largest market share in 2025.

- By deployment type, the offshore segment is expected to grow at the fastest CAGR during the projected period.

What is Cathodic Protection?

The market refers to the industry selling products and services to prevent metal corrosion, mainly for submerged assets such as tanks, pipelines, and marine structures, using methods such as sacrificial anodes or impressed current to push metal into a cathodic state, hence stopping corrosion.

Cathodic Protection Market Trends

- The growing focus on asset integrity management is the latest trend in the market. Cathodic protection systems can minimize corrosion-related failures, support pipeline safety, and facilitate smooth infrastructure maintenance across various environmental conditions.

- Surge in infrastructure investment and industrial growth in the emerging regions are amplifying the product demand further, as providers are rapidly advancing with IoT-enabled monitoring, digital instrumentation, and predictive maintenance technologies.

- The growing emphasis on sustainability is another major trend in the market, shaping positive market growth. This includes creating more energy-efficient solar-powered rectifiers for off-grid applications and designing non-toxic, greener materials for galvanic anodes.

- The ongoing construction activities across developing countries will further offer lucrative opportunities for market expansion in the foreseeable future. Also, the development of innovative technologies such as public-private partnerships and portable interrupters for infrastructure development can further impact positive market growth.

- Governments across the globe are implementing stringent regulations and funding programs to ensure the longevity and safety of crucial assets like bridges, pipelines, and marine structures. This compliance is a major driver for the modernization of cathodic protection systems.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 6.53 Billion |

| Revenue Forecast in 2035 | USD 11.85 Billion |

| Growth Rate | CAGR 6.85% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Protection Method, By Application , By Component Type , By Deployment Type, By Region |

| Key companies profiled | Corrpro Companies Inc, Aegion Corporation, Cathodic Protection Co Ltd, CMP Europe, Farwest Corrosion Control Company, Imenco AS,James Fisher, MATCOR, Inc, Nakabohtec Corrosion Protecting Co, The Nippon Corrosion Engineering Co |

How Cutting Edge Technologies are revolutionizing the Cathodic Protection Market?

Advanced technologies are transforming the market by converting it from a reactive, traditional discipline into a predictive, data-driven, and highly efficient field. Furthermore, cutting-edge simulation and modelling tools, such as the creation of digital twins of assets, help engineers to better known corrosion mechanisms and strengthen CP system design and performance before its implementation.

Trade Analysis of Cathodic Protection Market: Import & Export Statistics:

- In October 2025, China's phosphate ore imports surged 22.9% month-over-month (MoM) to 200,000 metric tons (mt) with higher volume but lower prices (down 3.6% MoM), as phosphoric acid exports also grew significantly (up 25.8% MoM).

- India ranks as the world's fourth-largest iron ore producer, with production increasing from around 258 million tonnes (MMT) in 2022-23 to approximately 277 MMT in 2023-24, marking a significant 7.4% rise driven by strong demand from the steel industry and broader economic growth.

Cathodic Protection Market Value Chain Analysis

- Feedstock Procurement : It is the sourcing and acquisition of crucial intermediate and raw materials used to produce components such as reference electrodes, anodes, and protective coatings.

Major Players: Aegion Corporation, BAC Corrosion Control Ltd. - Chemical Synthesis and Processing :This stage emphasizes the manufacturing and use of specialized materials, chemicals, and processes like protective coatings, corrosion inhibitors, and anode materials.

- Major Players: Corrpro, The Lubrizol Corporation.

- Packaging and Labelling :It includes the crucial process of designing cathodic protection (CP) components for safe transit and storage, to ensure they meet industry standards and regulations.

- Major Players: MATCOR, Inc., Daubert Cromwell

- Regulatory Compliance and Safety Monitoring : It involves the adherence to strict industry standards and the growing use of advanced monitoring technologies to ensure the integrity of critical infrastructure such as storage tanks and pipelines.

- Major Players: MESA Products, Inc., Cenozon.

Cathodic Protection Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | Regulations from entities like the Department of Transportation (DOT) are critical, enforcing compliance with standards like NACE (AMPP) for pipeline safety and environmental protection. |

| Europe | European countries largely adopt the unified EN standards, making them legal requirements for companies operating infrastructure. Adherence is crucial for avoiding legal issues and ensuring safety. |

| India | India's CP regulations are guided by the Bureau of Indian Standards (BIS). The IS 8062 standard is a key document, outlining the principles and minimum requirements for controlling external corrosion of buried pipelines and structures. |

Segment Insights

Protection Method Insights

How Much Share Did the Galvanic Anode Segment Held in 2025?

The galvanic anode segment dominated the market with the largest share in 2025. The dominance of the segment can be attributed to its low maintenance, simplicity, and efficient corrosion control in different applications. These systems use metal anodes that corrode, which makes them crucial for smaller assets.

The impressed current systems segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing industrial demands and increasing environmental/regulatory pressures from the government. These systems are highly efficient and offer a scalable solution for complex structures.

Application Insights

Which Application Type Segment Dominated the Cathodic Protection Market in 2025?

The oil and gas segment held the largest market share in 2025. The growth of the segment can be boosted by rising demand for corrosion prevention in tank installations and pipelines. Also, the wide networks of storage tanks, old pipelines, and offshore platforms are more susceptible to corrosion, requiring CP for asset preservation and operational safety.

The marine segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the ongoing technological innovations in corrosion prevention methods, along with the stringent regulatory compliance. Marine structures such as offshore platforms, piers, and ship hulls are widely exposed to highly corrosive saltwater environments, requiring strong protective coatings.

Component Type Insights

Which Component Type Segment Dominated the Cathodic Protection Market in 2025?

The anodes segment dominated the market by holding the largest share in 2025. The dominance of the segment is owing to its effectiveness in safeguarding various marine and pipeline structures from corrosion. In addition, the ongoing infrastructure development in emerging nations fuels the need for cost-effective corrosion measures for new projects.

The power supply segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to rapid technological innovations in monitoring and efficiency. Furthermore, there is an increasing trend towards more sustainable and economical solutions, such as the adoption of power-efficient rectifiers as the main AC-to-DC power source.

Deployment Type Insights

Which Deployment Type Segment Dominated the Cathodic Protection Market in 2025?

The onshore segment held the largest market share in 2025. The dominance of the segment can be attributed to the growing oil & gas exploration and transportation, along with the government's emphasis on asset integrity. Onshore pipelines are longer and more intricate than offshore, creating a greater demand for effective CP. Cathodic protection is crucial for protecting the various critical assets in different soil conditions.

The offshore segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the rapid growth of offshore wind energy and the surge in deepwater exploration activities. Moreover, the expanding offshore wind industry requires CP for turbines, foundations, and subsea cables, which will impact positive segment growth soon.

Regional Insights

The North America cathodic protection market size was valued at USD 2.82 billion in 2025 and is expected to reach USD 5.47 billion by 2035, growing at a CAGR of 6.87% from 2026 to 2035. North America dominated the market with the largest share 46.11% in 2025. The dominance of the region can be attributed to the growing emphasis on the maintenance of aging pipelines, along with the rapid surge in infrastructure investments. In addition, government bodies are enforcing stringent safety and environmental regulations that require efficient corrosion control for pipelines and other infrastructure.

U.S. Cathodic Protection Market Trends

In North America, the U.S. dominated the market owing to heavy investments in new transport and energy projects, which are fuelling demand for asset preservation in sectors such as water, marine, and power. Also, extensive U.S. offshore platforms and pipeline networks need continuous protection, fuelling CP demand for retrofitting and maintenance.

Which is the Fastest Growing Region in the Market?

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the ongoing industrialization, urbanization, and growing investments in infrastructure projects, especially in emerging economies. Moreover, extensive growth in water, energy, and chemical infrastructure creates more demand for corrosion control.

China Cathodic Protection Market Trends

In the Asia Pacific, China led the market due to growing emphasis on longevity, asset integrity, and maritime assets. The country's huge spending on railways, new roads, and ports creates a huge demand for protecting new metal structures such as utilities, bridges, and pipelines.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by increasing industry emphasis on energy-efficient, smart tech for remote monitoring of assets such as storage tanks and cross-border pipelines. Also, the region has an extensive network of advanced infrastructure, which necessitates constant maintenance.

Germany Cathodic Protection Market Trends

The growth of the market in Germany can be fuelled by ongoing government emphasis on asset integrity, particularly for water systems, crucial pipelines, and maritime assets. Rising awareness of safety and lifecycle costs fuels the adoption of CP to protect critical assets such as storage tanks.

South America held a significant market share in 2025. The growth of the region can be linked to the surge in exploration and extraction activities, which require more storage tanks, pipelines, and offshore facilities. Governments and industries are enforcing stringent mandates for corrosion control, impelling asset owners to adopt CP solutions for safety protection.

Brazil Cathodic Protection Market Trends

The growth of the market in the country can be driven by the country's wide coastline and humid climate, which propels corrosion, requiring CP to safeguard marine assets and industrial facilities. Brazil's expanding offshore exploration necessitates strong CP for integrity and safety.

The cathodic protection market in the Middle East and Africa (MEA) is growing steadily, driven by the region’s heavy reliance on oil & gas, marine, water infrastructure and industrial projects. Key growth drivers are expansion of pipelines and offshore oil & gas infrastructure, increasing marine and water-distribution networks, and growing regulatory and maintenance standards for asset integrity.

The Saudi Arabia market for Cathodic Protection (CP) is rapidly expanding, driven by large-scale investments in oil & gas infrastructure, pipelines, storage tanks and offshore facilities. Key drivers include the expansion of oil & gas projects, regulatory requirements enforcing corrosion-control standards, and emerging applications in water, marine and renewable-energy infrastructures.

Recent Developments

- In July 2025, NDT Global announces the strategic addition of Entegra, a major technology company specializing in Ultra-High-Resolution Magnetic Flux Leakage (UHR MFL). Together, these companies are affirming their stance and rewriting the future of pipeline integrity.(Source: www.lacaisse.com)

- In January 2023, FORCE Technology was selected to design cathodic protection for TetraSub.In addition, the company has also established corrosion reviews in the TetraSub and TetraSpar projects and helped in distinguishing the corrosion protection strategy.(Source: www.4coffshore.com)

Companies List

Corrpro Companies Inc: Corrpro Companies, Inc. (US) is a major player in the cathodic protection (CP) market, offering comprehensive corrosion control through engineering, materials, installation, and inspection for diverse industries like oil & gas, water/wastewater, and infrastructure.

Aegion Corporation: Aegion Corporation is a significant global player in

the cathodic protection (CP) market, offering comprehensive corrosion engineering, products (like anodes and coatings), and services for critical infrastructure such as pipelines, water systems, and offshore platforms.

Top Companies in the Cathodic Protection Market

- Aegion Corporation

- Corrpro Companies Inc

- Cathodic Protection Co Ltd

- CMP Europe

- Farwest Corrosion Control Company

- Imenco AS

- James Fisher

- MATCOR, Inc

- Nakabohtec Corrosion Protecting Co

- The Nippon Corrosion Engineering Co

Segments Covered

By Protection Method

- Galvanic Anode

- Impressed Current

- Hybrid Cathodic Protection

By Application

- Oil Gas

- Marine

- Water Wastewater

- Infrastructure

- Transportation

By Component Type

- Anodes

- Power Supply

- Control Systems

- Monitoring Equipment

By Deployment Type

- Onshore

- Offshore

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa