Content

What is the Current Graphite Electrode Market Size and Share?

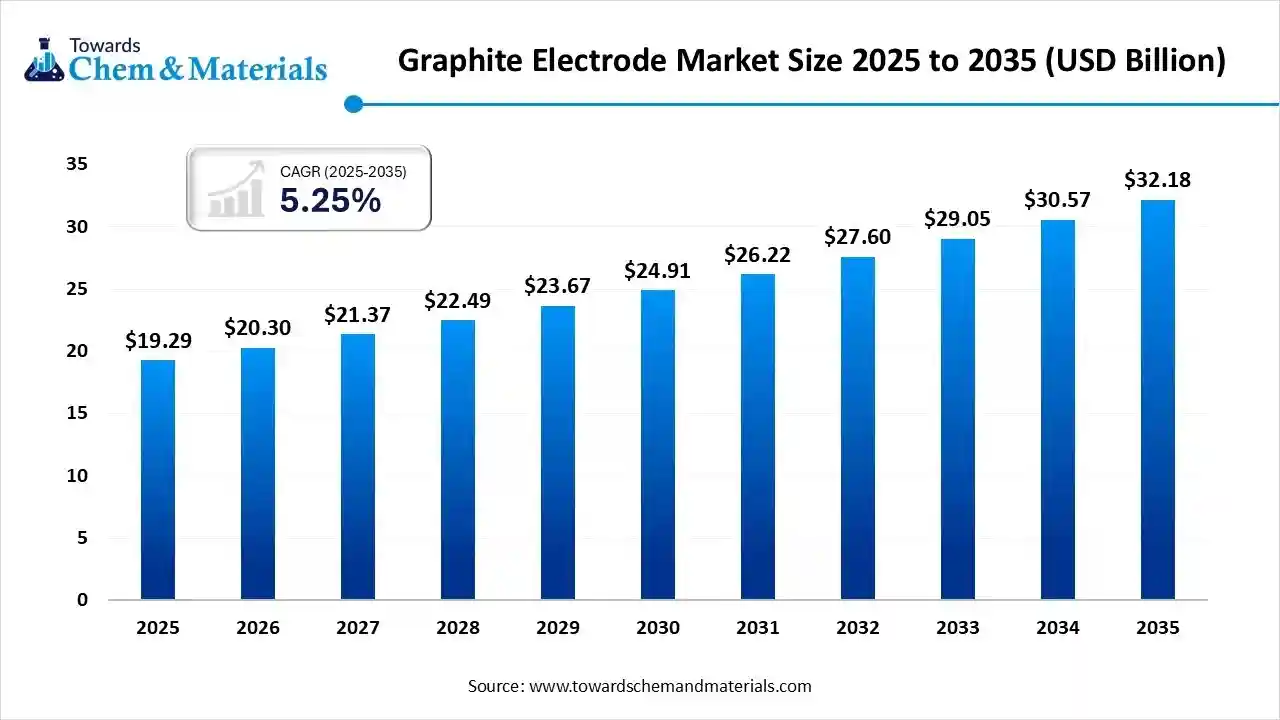

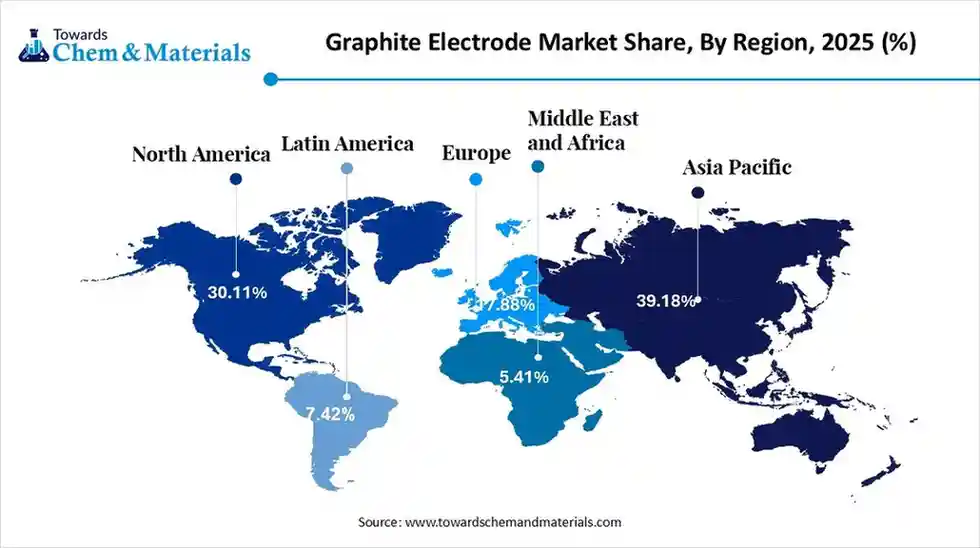

The global graphite electrode market size was estimated at USD 19.29 billion in 2025 and is predicted to increase from USD 20.30 billion in 2026 and is projected to reach around USD 32.18 billion by 2035, The market is expanding at a CAGR of 5.25% between 2026 and 2035. Asia Pacific dominated the graphite electrode market with a market share of 39.18% the global market in 2025.The increased need for steel purity and steel in the heavy manufacturing sector has accelerated market growth in the past few years.

Key Takeaways

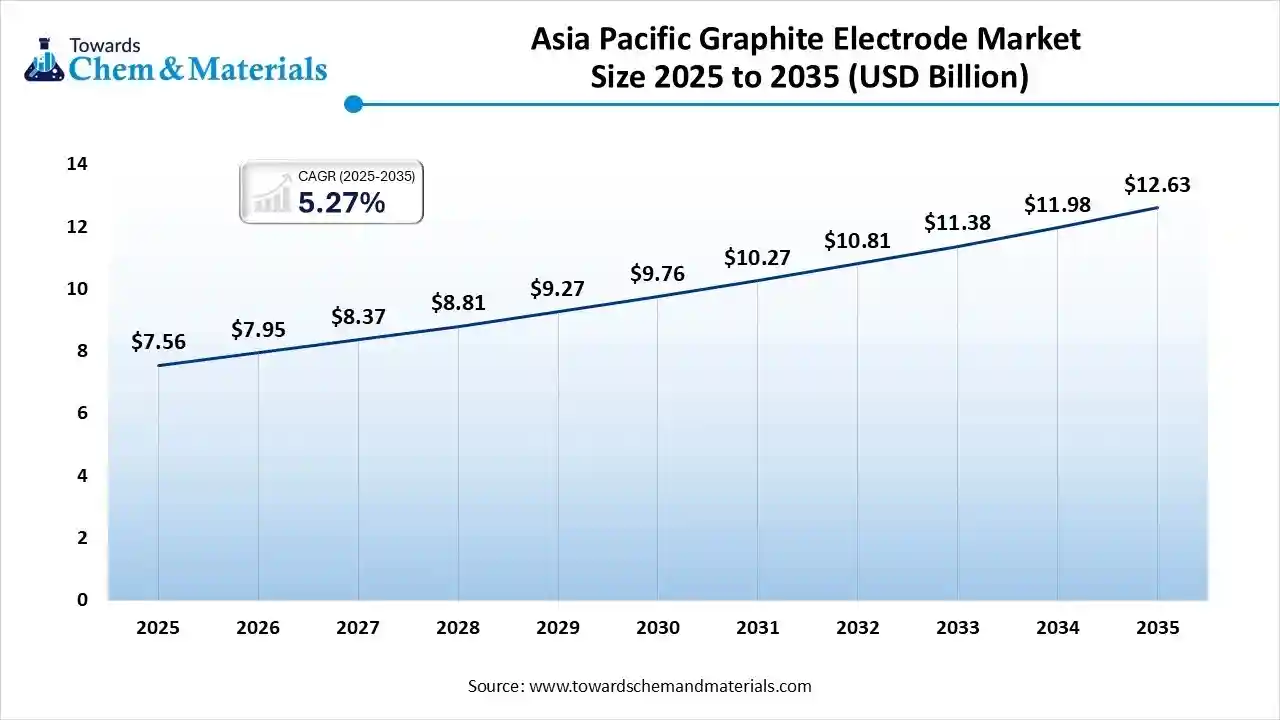

- By region, Asia Pacific led the organic fertilizers market with the largest revenue share of over 39.18% in 2025.

- By region, North America region is anticipated to capture a greater portion of the market with a significant CAGR in the future.

- By application type, the electric arc furnaces (EAF) segment dominated the market in 2025.

- By grade type, the high powered segment dominated the market in 2025.

- By grade type, the ultra high powered segment is expected to grow at a rapid CAGR during the forecast period.

Unbreakable at High Temperature: The Electrode That Fuels Steel

The graphite electrode refers to the high-temperature conductive rods, which are primarily made from petroleum coke and needle coke. This graphite electrode is mainly used for carrying electric current into electric arc furnaces in steel scrap melting. Also, by handling extremely high temperatures without breaking while efficiently conducting electric current, the graphite electrode strengthened the bottom line for the production firms in recent years.

Graphite Electrode Market Trends:

- The emergence of the ultra-high efficiency electrodes has attracted increased capital and investment in manufacturing in the past few years. Moreover, several manufacturers have been seen in testing the electrodes with modified crystal alignment, which is likely to reduce energy loss in the furnaces nowadays. Furthermore, providing the lower operational cost and lower emissions, these electrodes are expected to support stronger cash flows for manufacturing enterprises during the projected period.

- The increasing usage of recycled carbon sources in the electrode production is driving substantial financial gains in the manufacturing sector in recent years. Moreover, the major manufacturers are using materials such as recovered carbon or pyrolyzed plastic waste while replacing petroleum coke in graphite electrode production in the current period.

- The sudden increased demand for the electrode in non-steel applications is positively impacting revenue potential and industry scalability nowadays. Moreover, the manufacturers of the silicon metals, advanced carbon materials, and next-generation energy storage have been seen under the heavy demand for graphite electrodes.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 19.29 Billion |

| Revenue Forecast in 2035 | USD 32.18 Billion |

| Growth Rate | CAGR 5.25% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Grade, By Application, By Region |

| Key companies profiled | GrafTech International, Zhongze Group, Dan Carbon, Showa Denko (now Resonac Holdings Corporation), Tokai Carbon, Graphite India, Resonac Holdings Corporation, Fangda Carbon New Material Co., Ltd., Sangraf International, SEC Carbon, Ltd., Nippon Carbon. |

Zero Guesswork: AI Perfects Electrode Performance

The rise of AI-assisted furnace systems that monitor electrode wear, arc stability, and heat distribution in real time is anticipated to increase return on investment for manufacturers in the upcoming years. The goal is to prevent breakage, reduce power spikes, and use electrodes more efficiently. Sensors inside the furnace track vibration, temperature, and arc movement, while the Artificial Intelligence software adjusts the electrode position automatically.

Trade Analysis of the Graphite Electrode Market: Import, Export, Consumption, and Production Statistics

- China has observed sophisticated export of graphite to the United States in 2024, and the estimated export was US$45.08 as per the published report.

- India becomes the 18th crucial graphite exporter in the world and exported around $300k worth of natural graphite in 2023, as per the released report.

Value Chain Analysis Graphite Electrode Market:

- Distribution to Industrial Users : Graphite electrodes are primarily distributed to industrial users through direct sales and specialized distributors/traders, with the vast majority consumed by the steel industry. Key global players leverage integrated supply chains and strategic partnerships to serve these industrial consumers.

- Key Players: GrafTech International Ltd. (U.S.), Resonac Holdings Corporation (formerly Showa Denko K.K.) (Japan), and Tokai Carbon Co., Ltd. (Japan)

- Chemical Synthesis and Processing: The chemical synthesis and processing of graphite electrodes involve a complex, multi-stage manufacturing process that transforms carbonaceous raw materials into high-purity, conductive graphite used primarily in electric arc furnaces (EAFs). The quality and performance of the final electrodes depend heavily on the raw materials and the precision of each processing step.

- Key Players: SGL Carbon SE (Germany), HEG Limited (India), and Graphite India Limited (India)

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring in the graphite electrode market are crucial aspects spanning manufacturing, use in steelmaking, and disposal. Regulations are driven by the need to manage environmental impact, primarily emissions from production and use, and ensure occupational safety.

- Key Agencies: REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), and RoHS (Restriction of Hazardous Substances Directive)

Graphite Electrode Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Clean Air Act (CAA) | Reducing air emissions from steel manufacturing |

| European Union | European Commission (EC) | Industrial Emissions Directive (IED) | Achieving climate neutrality through decarbonization of the steel industry |

| China | Ministry of Ecology and Environment (MEE) | Environmental Protection Law | Strengthening environmental protection and cracking down on pollution |

Segmental Insights

Application Type Insights

How did the EAF Segment Dominate the Graphite Electrode Market in 2025?

The electric arc furnaces (EAF) segment dominated the market in 2025, akin to the greater shift towards scrap-based and energy-efficient steel production in the manufacturing field. By using minimum energy to scrap and produce a high-temperature arc, the EAF segment has gained major industry share in recent years. Furthermore, the EAF segment has allowed the smaller regional mills to operate profitably without any major or expansive investment in the current period. These factors have actively improved the financial performance and sector attractiveness over the past few years.

Grade Type Insights

Why does the High-Powered (HP) Segment Dominate the Graphite Electrode Market?

The high powered segment dominated the market in 2025, akin to its offering, such as the best balance of performance and cost. Furthermore, many medium-sized steel plants prefer HP grades since they handle strong heat loads without the high price of ultra-high-powered grades. HP electrodes also fit older furnaces that cannot operate at extremely high currents.

The ultra high powered segment is expected to grow at a rapid CAGR akin to the greater shift of the steel plants to faster melting, higher output, and lower energy waste. UHP electrodes can handle extreme temperatures and very high currents, so they melt scrap much quicker. New EAF plants in the U.S., India, China, and Europe are being designed to run mainly on UHF electrodes because they help cut electricity costs and carbon emissions.

Regional Insights

The Asia Pacific graphite electrode market size was estimated at USD 7.56 billion in 2025 and is projected to reach USD 12.63 billion by 2035, growing at a CAGR of 5.27% from 2026 to 2035. Asia Pacific dominated the market share 39.18% in 2025, akin to the presence of the world's finest and enlarged steel recycling infrastructure nowadays. Moreover, the major manufacturers in the region have seen under the heavy EAF expansion programs, which have rapidly created profitable pathways for the sector participants in recent years. Moreover, the governments of the regional countries, such as India, China, and Japan, have been heavily focusing on cleaner steel production in recent years.

Low-Cost Inputs Fuel China’s Dominance in Electrode Manufacturing

China maintained its dominance in the graphite electrode market owing to the country's heavy steel exports and EAF installation products around the country nowadays. Moreover, having access to the local needle coke, petroleum coke, and coal tars, the local manufacturers have gained major industry attention in the past few years while lowering production costs.

North America Graphite Electrode Market Examination

North America is expected to capture a major share of the graphite electrode market with a rapid CAGR, akin to the sudden shift towards low-carbon steel production. Furthermore, the regional manufacturers are seen as interested in the new EAF steel mills establishments nowadays, which are likely to unlock new business opportunities for producers in the upcoming years. Also, the major steel makers in the region are observed in replacing old blast furnaces while adding mini mills in the current period.

Efficiency-Driven Steel Mills Elevate United States Electrode Consumption

The United States is expected to emerge as a prominent country for the graphite electrode market in the coming years, due to the increasing demand for higher-quality graphite electrodes in the past years. Also, the American manufacturers are using the UHP electrodes to reduce electricity use and improve the melting efficiency in the present period. Also, the emergence of smart furnace systems is actively generating value-added opportunities for industry participants nowadays.

Europe Graphite Electrode Market Evaluation

Europe is a notably growing region owing to the heavy environmental rules and regulations implementation. This implementation of the rules is influencing manufacturers to switch old blast furnaces to EAF operation in the region. Also, the regional countries like Italy, Japan, Germany, and France have been observed under the greater investment in modern steel plants in recent years.

Germany Emerges as a Powerhouse for High-Performance Specialty Steels

Germany is expected to gain a major industry owing to the rapid shift towards energy-efficient steel plant designs and the increasing need for ultra-pure specialty steels from sectors such as the automotive, engineering, and machinery. Also, the move towards scrap steel recycling is expected to pave the way for economic benefits in the manufacturing sector of Germany during the forecast period.

Graphite Electrode Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the graphite electrode market. Several new steel plants are being built to support construction, energy, and infrastructure projects in the region. Countries are shifting from importing steel to producing locally, increasing EAF installations. EAF plants fit the region well because they operate efficiently even with fluctuating electricity supply. Many projects in the UAE, Saudi Arabia, Egypt, and South Africa require large volumes of steel, which increases electrode usage.

Made in Saudi Arabia Push Accelerates EAF and Electrode Adoption

Saudi Arabia is expected to emerge as a prominent country for the market in the coming years. The country is building almost everything at once, like new cities, factories, airports, and business zones. To keep up, Saudi steel companies are adding more electric arc furnaces, which depend on graphite electrodes for every melt. Since the government wants more Made in Saudi Arabia materials, local steel production is rising fast.

South America Graphite Electrode Market Evaluation

South America is a notably growing region due to the region has been seen in reinventing its steel industry in recent years. Instead of relying on imported materials, countries want to recycle local scrap and make cleaner steel. This shift naturally increases the use of EAFs, which depend heavily on graphite electrodes. Brazil and its neighbors are upgrading old equipment, adding modern furnaces, and energizing local manufacturing.

Graphite Electrodes Power Brazil’s New Steel-Making Era

Brazil is expected to gain a major industry due to the country is reshaping how it makes steel in the current period. More steelmakers are choosing electric arc furnaces, which melt scrap quickly and depend on graphite electrodes for every batch. Brazil's booming construction and car industries need plenty of high-quality steel, pushing mills to upgrade to faster, more powerful furnaces.

Recent Developments

- In Aug 2025, Graphite India is planning to expand the graphite electrodes division capacity in the coming years. This capacity is likely to expand by 25000 TPA as per the published report.(Source: scanx.trade )

Top Vendors in the Graphite Electrode Market & Their Offerings:

- GrafTech International: A leading global manufacturer of high-quality graphite electrode products, essential for electric arc furnace (EAF) steel production and a key provider of innovative and reliable graphite solutions.

- Zhongze Group: A major Chinese producer of graphite electrodes, providing a wide range of products for the global steel industry with a focus on quality and international standards.

- Dan Carbon: A company specializing in the production of high-quality carbon and graphite products, including various grades of graphite electrodes used primarily in steel-making and other high-temperature industrial processes.

- Showa Denko (now Resonac Holdings Corporation): A key player in the chemical and industrial materials sector, providing a range of products including high-performance graphite electrodes for the global steel industry as part of its materials business.

Top Companies in the Graphite Electrode Market

- GrafTech International

- Showa Denko (now Resonac Holdings Corporation)

- Dan Carbon

- Zhongze Group

- Tokai Carbon

- Graphite India

- Resonac Holdings Corporation

- Fangda Carbon New Material Co., Ltd.

- Sangraf International

- SEC Carbon, Ltd.

- Nippon Carbon.

Segments Covered

By Grade

- Ultra High Powered (UHP)

- High Powered (HP)

- Regular Powered (RP)

By Application

- Electric Arc Furnace (EAF)

- Basic Oxygen Furnace (BOF)

- Non-steel Application

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa