Content

What is the Current Membrane Filtration Market Size and Share?

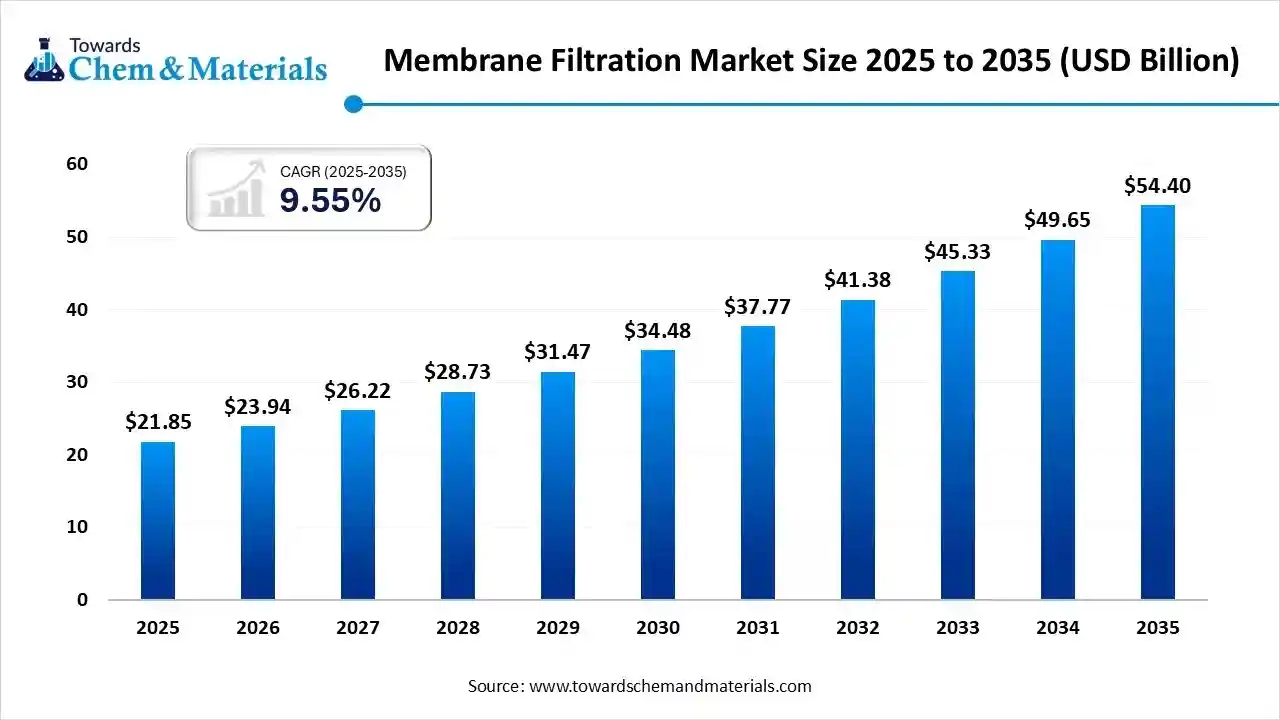

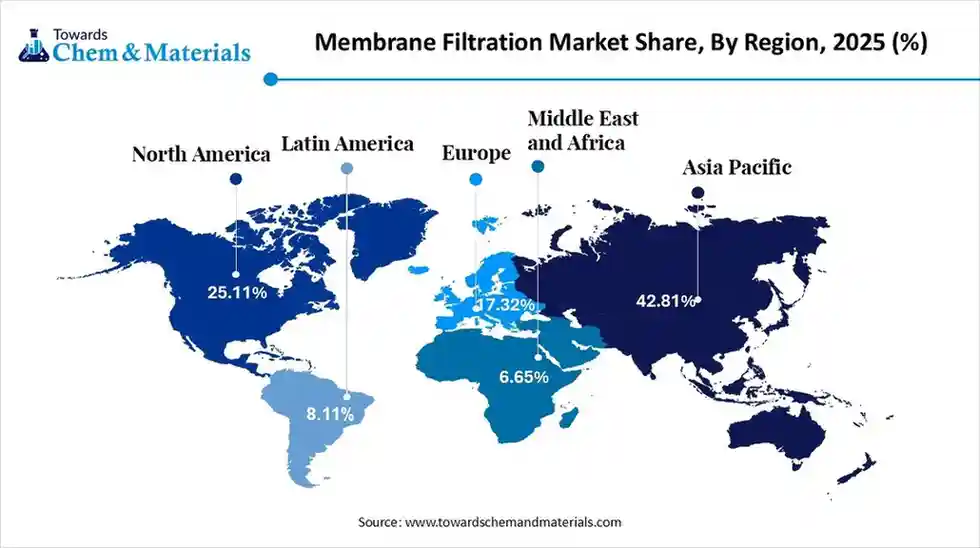

The global membrane filtration market size was estimated at USD 21.85 billion in 2025 and is predicted to increase from USD 23.94 billion in 2026 and is projected to reach around USD 54.40 billion by 2035, The market is expanding at a CAGR of 9.55% between 2026 and 2035. Asia Pacific dominated the membrane filtration market with a market share of 42.81% the global market in 2025.The growth of the market is driven by the soaring demand for clean water, stricter environmental rules, and growth in pharma/biopharma.

Key Takeaways

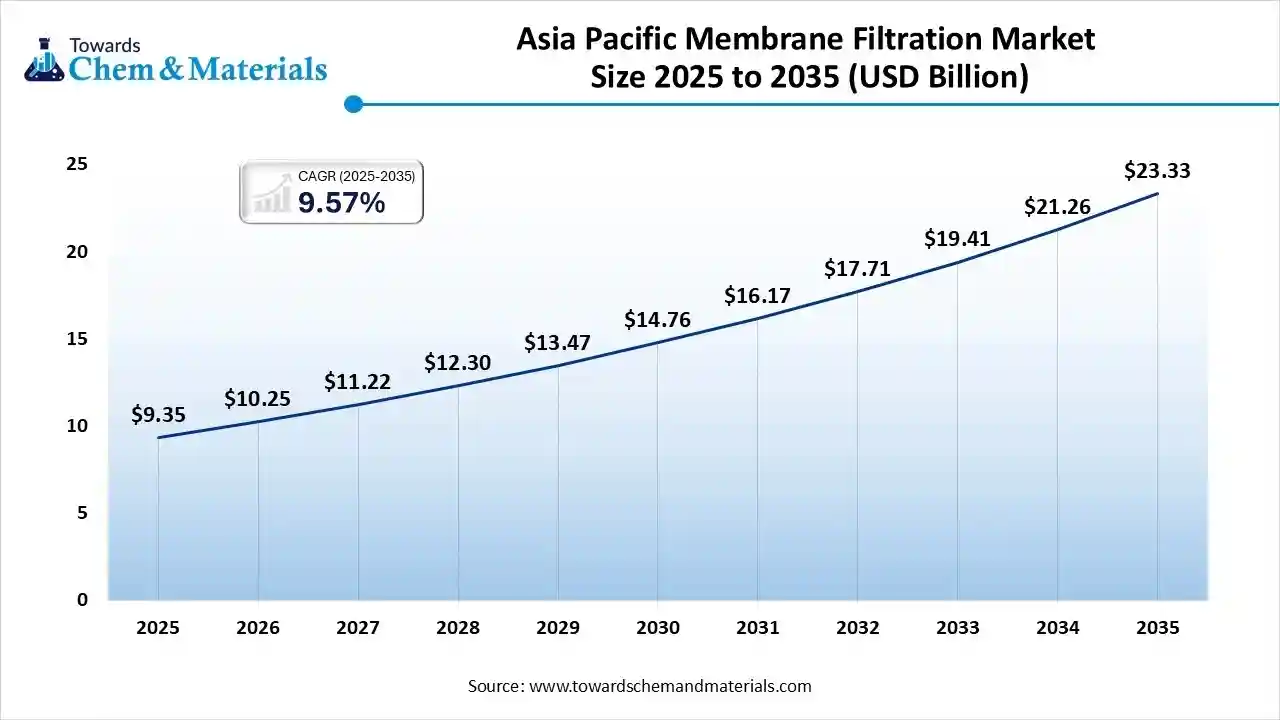

- By region, Asia Pacific led the membrane filtration market with the largest revenue share of over 42.81% in 2025.

- By product type, the reverse osmosis segment led the market with the largest revenue share of 33.11% in 2025.

- By application, the water and wastewater segment led the market with the largest revenue share of 53.23% in 2025.

Market Overview

What is the significance of the Membrane Filtration Market?

The significance of the membrane filtration market lies in its crucial role for water purification, ensuring clean, safe water by removing contaminants, and for enhancing product quality & shelf life in food & beverage, and pharma industries, meeting stringent regulations and consumer demand for pure, additive-free goods, all while offering cost-effective and sustainable solutions. Its importance is growing due to rising populations, water scarcity, and stricter health standards, making it a vital technology for health, safety, and sustainability.

Membrane Filtration Market Growth Trends:

- Smart Filtration: Integration of IoT and automation for better monitoring and control.

- Nanofiltration: Growing demand for removing smaller contaminants, especially in pharma and F&B.

- Membrane Bioreactors: High growth in wastewater treatment for compact, high-quality effluent.

- Advanced Materials: Focus on polymers (PES, PVDF) and ceramics with improved performance.

- Single-Use Systems: Increasing in biopharma for flexibility and reduced contamination risk.

- Sustainability: Solutions like Zero Liquid Discharge (ZLD) systems are gaining traction.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 23.94 Billion |

| Revenue Forecast in 2035 | USD 54.40 Billion |

| Growth Rate | CAGR 9.55% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments Covered | By Product Type, By Application, By Regions |

| Key companies profiled | DuPont (DuPont Water Solutions), 3M Purification Inc., Toray Industries, Inc., Koch Separation Solutions (KSS), GEA Group AG , Pall Corporation, Alfa Laval AB , SPX Flow Inc. , Veolia , Prominent GmbH , Pentair Plc., Porvair Filtration Group , LG Chem, Merck KGaA, SUEZ (Degremont), Evoqua Water Technologies, Hydranautics (Nitto Denko Corporation), Synder Filtration, Inc., DIC Corporation, Sartorius AG, Asahi Kasei Corporation, Pervatech B.V. |

Key Technological Shifts In The Membrane Filtration Market:

Key shifts in membrane filtration involve moving towards smarter, digitalized systems (AI/IoT) for predictive maintenance, developing novel materials for durability & efficiency, increasing energy efficiency to cut costs, embracing single-use technologies in pharma for safety, and integrating nanotechnology for superior performance, all driven by demands for sustainability, lower operating costs, and improved water quality.

Trade Analysis Of Membrane Filtration Market: Import & Export Statistics

- According to Global Export data, between June 2024 and May 2025 (TTM), the world exported 14,953 shipments of Membrane Filters. These exports involved 3,561 exporters and reached 4,244 buyers, showing a 17% increase compared to the previous twelve months.

- Most of these exports from the world went to Vietnam, India, and the United States. Globally, the leading exporters are China, India, and the United States, with China at the top with 10,636 shipments, followed by India with 7,676, and the U.S. with 4,899 shipments.

- According to India Export data, India exported 2,904 shipments of Membrane Filters from June 2024 to May 2025 (TTM). These exports involved 237 Indian exporters and reached 592 buyers, showing a 27% growth compared to the previous year.

- Most of these shipments from India went to the United States, Spain, and Russia.

Membrane Filtration Market Value Chain Analysis

- Chemical Synthesis and Processing: Membrane filtration systems are developed using polymeric materials and ceramic materials through processes such as phase inversion, sintering, coating, and extrusion to produce microfiltration, ultrafiltration, nanofiltration, and reverse osmosis membranes used for liquid separation.

- Key players: DuPont (FilmTec), Hydranautics, Toray Industries Inc., SUEZ WTS (Veolia), 3M Company

- Quality Testing and Certification:Membranes undergo testing for pore size accuracy, permeability, salt rejection, chemical resistance, and durability under standards such as ISO 9001, NSF/ANSI 61 for drinking water components, and ASTM testing protocols.

- Key players: NSF International, SGS, TÜV SÜD, Intertek.

- Distribution to Industrial Users: Membrane filtration systems are supplied to water treatment, wastewater management, food & beverage processing, pharmaceuticals, and bioprocessing industries via engineering firms, system integrators, and specialised distributors.

- Key players: DuPont, Toray Industries, Hydranautics, Veolia.

Membrane Filtration Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. Environmental Protection Agency (EPA) | Safe Drinking Water Act (SDWA), Clean Water Act (CWA), National Primary Drinking Water Regulations (NPDWR) | Water quality standards, removal efficiency, membrane material safety, and discharge compliance | EPA sets strict limits for contaminants; membrane systems used for PFAS removal are receiving heightened regulatory focus. |

| United States | Food and Drug Administration (FDA) | 21 CFR Regulations for Food Contact Substances, Good Manufacturing Practices (GMP) | Membrane materials for food & beverage filtration, sanitary design, migration limits | Required for membranes used in dairy, beverages, and pharma-grade filtration. |

| United States | Occupational Safety & Health Administration (OSHA) | OSHA Worker Safety Standards, Hazard Communication Standard | Worker exposure, chemical handling, and membrane cleaning chemicals | Ensures safe handling of cleaning agents and membrane modules in industrial plants. |

| United States | American Water Works Association (AWWA) | AWWA Membrane Standards (e.g., AWWA M46) | System design, performance validation, operational standards | Widely used as industry benchmarks for municipal membrane installations. |

| United States | NSF International (NSF) | NSF/ANSI 61 (Drinking Water Components), NSF/ANSI 58 (RO Systems) | Certification of membrane modules for drinking water, material safety, and contaminant reduction claims | Mandatory for products used in potable water systems across most states. |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated The Membrane Filtration Market In 2025?

The reverse osmosis segment dominated the market with a share of 33.11% in 2025. The reverse osmosis segment dominates the market due to its superior ability to remove dissolved solids, microorganisms, and contaminants across industrial and municipal applications. Advancements in RO membrane durability, energy-efficient low-pressure systems, and improved fouling resistance are further accelerating adoption. Moreover, the rising emphasis on sustainable water treatment solutions and the need for water reuse in industries is expanding the application scope for RO systems.

The ultrafiltration segment expects the fastest growth in the market during the forecast period. Ultrafiltration is witnessing strong growth as industries prioritise cost-effective and efficient separation technologies for macromolecules and suspended solids. Increasing investments in wastewater recycling, the shift toward membrane-based separation over conventional filtration, and innovations that enhance membrane permeability and chemical resistance are contributing to market expansion. UF’s ability to handle high turbidity and deliver consistent performance makes it a preferred choice across food, beverage, and industrial sectors.

Application Insights

How Did the Application Segment Dominated The Membrane Filtration Market In 2025?

The water and wastewater segment dominated the market with a share of 53.23% in 2025. Water and wastewater applications account for the largest market share due to rising freshwater scarcity, stringent discharge regulations, and increasing adoption of advanced membrane technologies by municipalities and industries growing need for decentralised treatment units, coupled with government initiatives promoting water reuse, is fueling demand. Ongoing upgrades to ageing water infrastructure and the integration of membranes in zero-liquid-discharge systems are further supporting segment growth.

The food and beverages segment is projected to grow at the fastest CAGR between 2026 and 2035. The food and beverages segment continues to expand due to the growing requirement for product consistency, safety, and compliance with global quality standards. Increasing consumer demand for minimally processed and high-purity products is boosting adoption. Additionally, membrane systems offer significant advantages such as reduced thermal degradation, lower energy consumption, and improved yield, making them increasingly preferred across F&B processing facilities.

Regional Insights

The Asia Pacific membrane filtration market size was valued at USD 9.35 billion in 2025 and is expected to reach USD 23.33 billion by 2035, growing at a CAGR of 9.57% from 2026 to 2035. Asia Pacific dominates the market in 2025. Asia Pacific is a growing region due to rapid industrialisation, urbanisation, and rising water scarcity, which increases dependence on membrane-based purification systems. Expansion in food processing, pharmaceuticals, electronics, and wastewater treatment plants significantly boosts adoption. Government initiatives supporting industrial effluent control and clean water access continue to accelerate membrane demand across emerging economies.

India: Membrane Filtration Market Growth Trends

India experiences strong adoption of membrane filtration due to rising wastewater treatment needs, growing food processing industries, and government initiatives such as Jal Jeevan Mission and zero-liquid-discharge mandates. Pharmaceutical exports and dairy production expansion increase the requirement for ultrafiltration and reverse osmosis membranes. As industries modernise, demand for cost-efficient, high-performance membrane systems continues to surge.

North America's Growth Is Driven By Strict Regulatory Standards

North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035. The growth of the membrane filtration market is driven by the development of advanced water treatment infrastructure, high adoption across various sectors like food & beverage, pharmaceutical, and biotechnology sectors and strict regulatory standards. Increasing investments in municipal wastewater treatment modernisation due to rising demand for high-purity filtration support strong growth in the market.

United States: Membrane Filtration Market Growth Trends

The US dominates the North American market due to substantial spending on wastewater treatment upgrades, stringent EPA water quality standards, and strong penetration of ultrafiltration, nanofiltration, and reverse osmosis technologies. Growing pharmaceutical manufacturing, expansion of dairy processing plants, and increasing reuse of industrial wastewater further accelerate demand. Continuous innovation in polymeric and ceramic membranes enhances adoption across multiple industries.

Europe Is Experiencing Growth Driven By Advanced Manufacturing

Europe’s membrane filtration market is shaped by strict water quality directives, advanced industrial manufacturing, and strong sustainability mandates focused on reducing water waste. Countries across the region are increasingly adopting membrane technologies for municipal water purification, food processing, and biopharmaceutical production. Strong emphasis on energy-efficient, low-fouling, and high-selectivity membranes drives continuous technology upgrades.

Germany: Membrane Filtration Market Growth Trends

Germany leads European adoption due to its advanced industrial base, strict wastewater discharge laws, and high investment in precision filtration technologies. In the German market food & beverage companies increasingly use membrane filtration for dairy, brewing, and ingredient concentration, along with pharmaceutical manufacturing companies, who demand high-purity filtration due to the need for sterilisation and purification. Strong engineering capabilities and innovation in ceramic membranes further strengthen the country’s market position.

South America Industrial Growth And Demand For Waste Management Drives Growth

South America’s membrane filtration market grows steadily, driven by increasing awareness of water reuse, industrial wastewater management needs, and rising adoption in the food & beverage industry. Economic development in manufacturing, dairy, and beverage processing boosts filtration requirements. Gradual regulatory tightening and investment in water infrastructure support the region’s long-term market expansion.

Brazil: Membrane Filtration Market Growth Trends

Brazil leads the region with growing adoption of membrane filtration for municipal water treatment, sugarcane processing, brewing, and pharmaceutical manufacturing. Increasing industrial activities and pollution management needs drive the shift toward efficient ultrafiltration and reverse osmosis systems. Government support for improving water security and reducing environmental impact strengthens membrane technology penetration across major industries.

MEA shows rising demand for membrane filtration due to its chronic water scarcity, strong reliance on desalination, and increasing industrial diversification. Reverse osmosis membranes dominate due to large-scale desalination projects, while food processing, chemicals, and pharmaceuticals increasingly incorporate membrane systems. Government investments in water infrastructure continue to drive strong growth across the region.

South Africa: Membrane Filtration Market Growth Trends

South Africa adopts membrane filtration widely for industrial effluent management, municipal water purification, and mining wastewater treatment. Increasing pressure to improve water quality and reuse industrial water encourages the adoption of advanced membrane technologies. Expanding food processing, brewing, and dairy industries further boost demand for ultrafiltration and microfiltration systems in the country.

Recent Developments

- In August 2025, Transfilm Technology launched a new independent membrane company named IonClear to serve North American markets. The company's debut was announced in late August and September 2025.(Source: www.filtsep.com)

- In September 2025, ZwitterCo introduced its Evolution membrane product line, utilising proprietary zwitterionic anti-fouling chemistry to enhance efficiency in dairy and food processing. These membranes are designed to reduce organic fouling, leading to more efficient cleaning and operational savings.(Source: www.filtsep.com)

- In June 2025, Asahi Kasei announced the launch of a new membrane system for producing Water for Injection (WFI) in the pharmaceutical industry. (Source: www.asahi-kasei.com)

Top Players in the Membrane Filtration Market & Their Offerings:

- DuPont (DuPont Water Solutions): DuPont is a global leader in membrane filtration, offering a wide range of RO, NF, UF, and MF membrane technologies.

- 3M Purification Inc.: 3M offers membrane-based filtration products for industrial, residential, and commercial applications.

- Toray Industries, Inc.: Toray is a major manufacturer of RO and UF membranes known for high permeability and energy-efficient water treatment performance. The company supplies solutions for desalination, industrial wastewater treatment, and ultrapure water production across global markets.

- Koch Separation Solutions (KSS): KSS specialises in UF, RO, and MBR membrane systems used in dairy processing, bioprocessing, industrial water treatment, and wastewater recovery. Its advanced membrane technologies emphasise improved productivity, contaminant removal, and operational efficiency.

Top Companies in the Membrane Filtration Market

- DuPont (DuPont Water Solutions)

- 3M Purification Inc.

- Toray Industries, Inc.

- Koch Separation Solutions (KSS)

- GEA Group AG

- Pall Corporation

- Alfa Laval AB

- SPX Flow Inc.

- Veolia

- Prominent GmbH

- Pentair Plc.

- Porvair Filtration Group

- LG Chem

- Merck KGaA

- SUEZ (Degremont)

- Evoqua Water Technologies

- Hydranautics (Nitto Denko Corporation)

- Synder Filtration, Inc.

- DIC Corporation

- Sartorius AG

- Asahi Kasei Corporation

- Pervatech B.V.

Segments Covered

By Product Type

- Reverse Osmosis

- Ultrafiltration

- Microfiltration

- Nanofiltration

By Application

- Water & Wastewater

- Food & Beverages

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa