Content

Recycled Plastic Pipes Market Size and Forecast 2025 to 2034

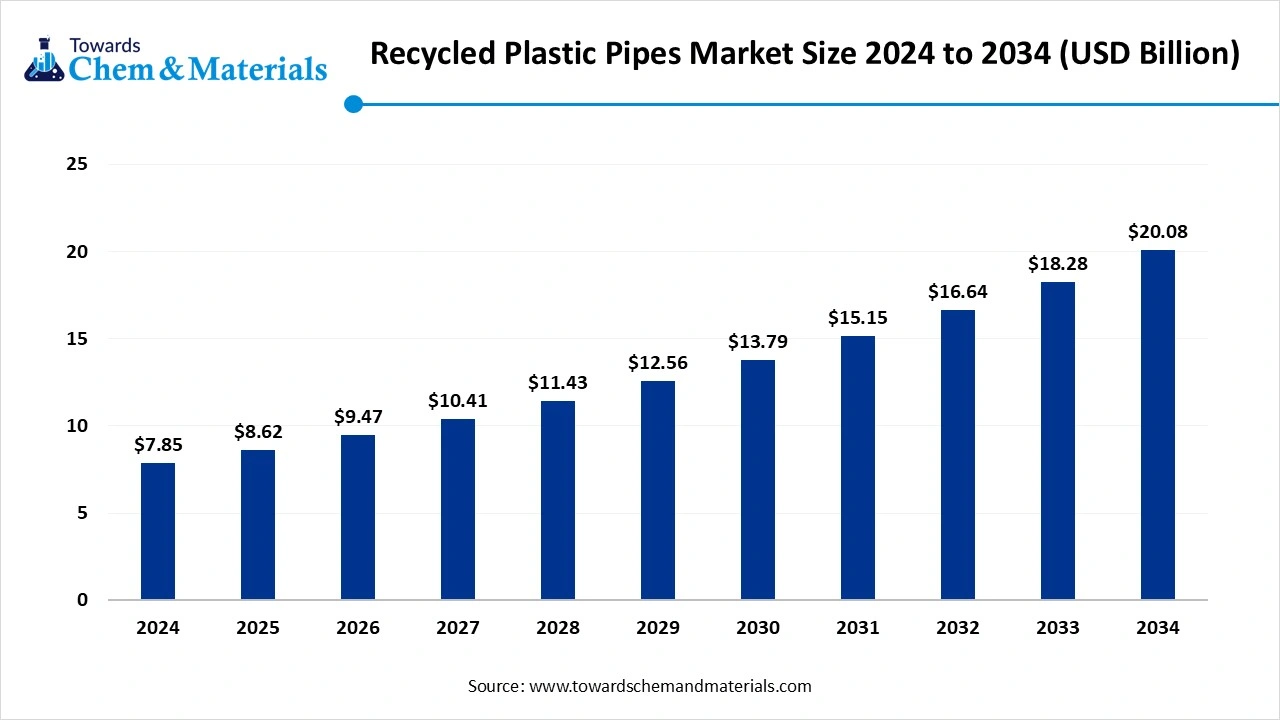

The global recycled plastic pipes market size was approximately USD 7.85 billion in 2024 and is projected to reach around USD 20.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.85% between 2025 and 2034. The growing modernization of infrastructure and increasing development of water supply & sewage pipeline drive the market growth.

Key Takeaways

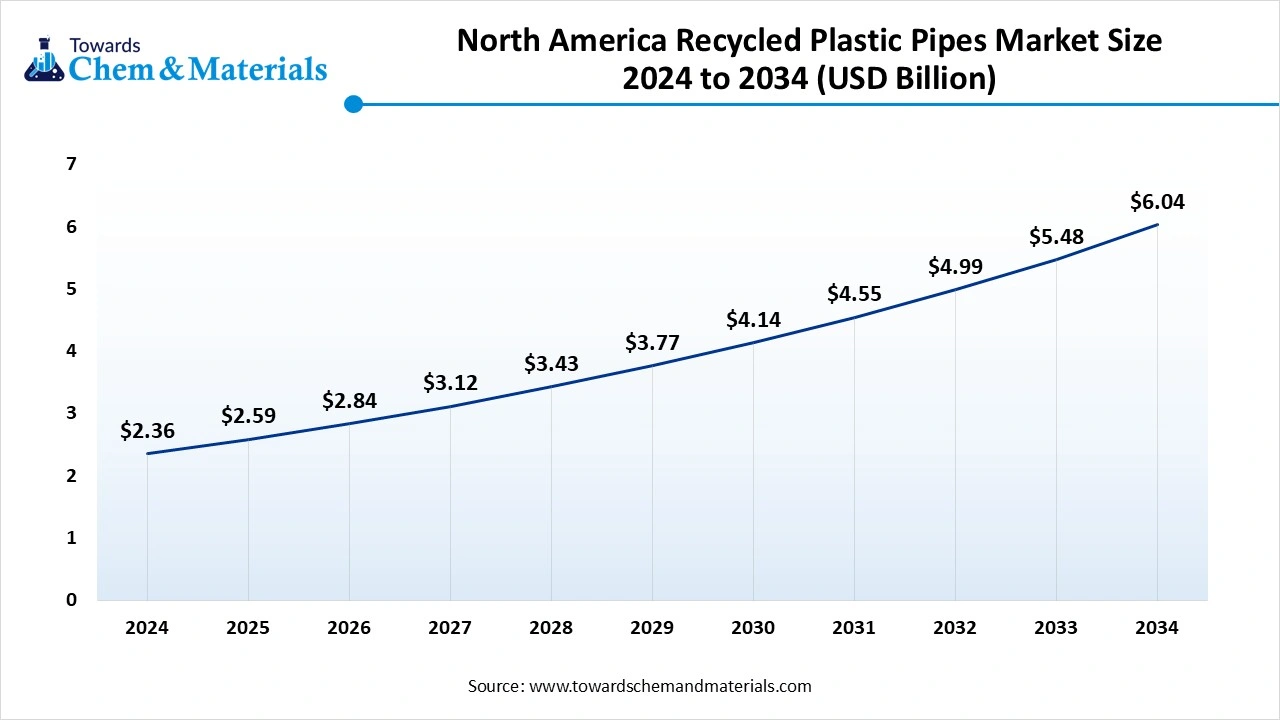

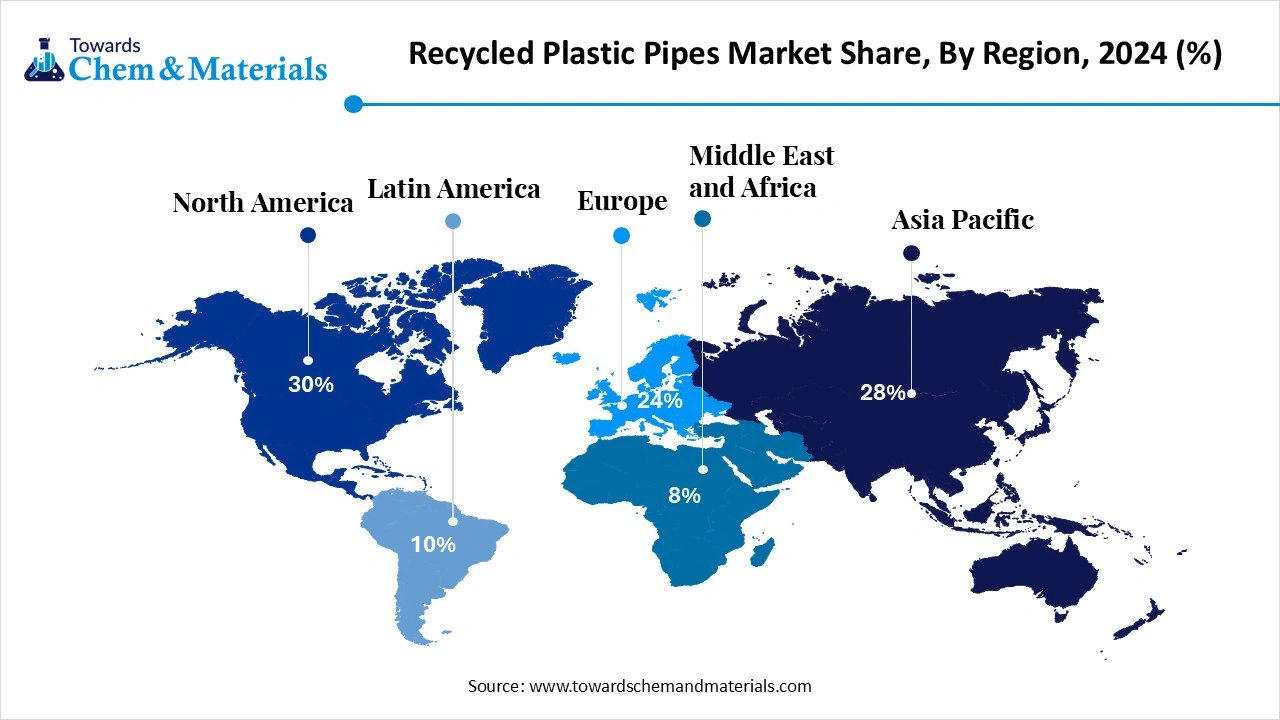

- By region, North America held a 30% share in the market in 2024.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period.

- By material type, the HDPE segment held a 45% share in the market in 2024.

- By material type, the PVC segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the sewage & drainage segment held a 40% share in the market in 2024.

- By application, the water supply segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By pipe diameter, the large diameter pipes segment held a 50% share in the market in 2024.

- By pipe diameter, the small diameter pipes segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By product type, the solid wall pipes segment held a 55% share in the market in 2024.

- By product type, the corrugated pipes segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By distribution channel, the direct sales segment held a 60% share in the market in 2024.

- By distribution channel, the online sales segment is expected to grow at the fastest CAGR in the market during the forecast period.

What are the Recycled Plastic Pipes?

The recycled plastic pipes market growth is driven by the development of smart cities projects, increasing awareness about sustainability, increasing need for sewage systems, and the modernization of water supply systems. Recycled plastic pipes are a process of manufacturing plastic pipes from post-industrial and post-consumer plastic waste. The chemical recycling and mechanical recycling processes are widely used for the production of recycled plastic pipes.

The process involves steps like the collection of plastic, sorting, recycling, and manufacturing pipes. The materials used for manufacturing pipes are HDPE, PP, PVC, and ABS. It offers benefits like minimizing landfill waste, saving energy, and reducing greenhouse gas emissions.

Recycled Plastic Pipes Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, there is growth in the development of infrastructure projects, such as sewage, water supply, and drainage systems. Growth is being reinforced by stringent environmental regulations and sustainability goals in the Asia-Pacific and North America.

- Sustainability Trends: Sustainability is reshaping the recycled plastic pipe landscape, with advancements in recycling technology and production of high-grade recycled content to lower landfill waste, minimize carbon footprint, and extend the life of the product.

- Global Expansion: Leading players are expanding geographically to support government regulations and promote sustainability, particularly in the Asia

- Pacific, North America, the Middle East & Europe. Aliaxis Group, for example, announced the development of manufacturing facilities of water tanks, pipes, & fittings in Chennai and Hyderabad.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 8.62 Billion |

| Expected Size by 2034 | USD 20.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Material Type, By Application, By Pipe Diameter, |

| Key Companies Profiled | National Pipe and Plastics, SABIC, JM Eagle, PVC Pipe Industries, Charlotte Pipe and Foundry, Georg Fischer Piping Systems, Thermoplastic Pipes Ltd., Plastech Group, North American Pipe Corporation, Chevron Phillips Chemical, Sekisui Chemical Co., Ltd., Advanced Drainage Systems, Pipelife International, Molecor, Amiantit |

Key Technological Shifts in the Recycled Plastic Pipes Market:

The recycled plastic pipes market is undergoing key technological advancements driven by the demand for energy efficiency, performance efficiency, and sustainability. One of the most significant advancements is the adoption of chemical recycling technology.

It uses technologies like solvent dissolution, pyrolysis, and depolymerization to support stricter regulations. The innovations, like hydrothermal treatment and enzymatic recycling, produce high-quality materials and enhance the purity of the material. For instance, Pipelife company uses Borealis’s Borcycle chemical recycling technology for the development of pressure-resistant drinking water pipes.

What are the Common Types of Recycled Plastic Pipes?

| Pipe Type | Features | Applications |

| High-Density Polyethylene (HDPE) |

|

|

| Polypropylene (PP) |

|

|

| Polyvinyl Chloride (PVC) |

|

|

Trade Analysis of Recycled Plastic Pipes: Import & Export Statistics

- Germany exported $4.79B of plastic pipes in 2023.(Source: oec.world)

- India exported $318M of plastic pipes in 2023.(Source: oec.world)

- Vietnam exported 141,149 shipments of PVC pipe.(Source: www.volza.com)

- China exported 10,572 shipments of HDPE pipe.(Source: www.volza.com)

- Vietnam exported 32,499 shipments of PP pipe.(Source: www.volza.com)

Recycled Plastic Pipes Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement for recycled plastic pipes involves post-industrial & post-consumer waste like plastic bottles, crates, and caps.

- Chemical Synthesis and Processing: The chemical synthesis and processing involve methods like depolymerization, hydrothermal liquefaction, pyrolysis, hydrolysis, and gasification.

- Quality Testing and Certification : The quality testing involves ESCR testing, hydrostatic pressure testing, ring stiffness testing, RCP testing, physical & chemical properties testing, and certifications like GRS & EN15343 Standard.

Market Opportunity

Growing Infrastructure Development Unlocks Market Opportunity

The rapid urbanization and growing development of large-scale infrastructure projects like sewage systems, drainage systems, and water supply systems increase demand for recycled plastic pipe. The high government investment in the irrigation, water management, and sanitation systems increases demand for recycled plastic pipe.

The aging infrastructure and increasing adoption of sustainable solutions require recycled plastic pipe. The strong focus on ease of installation and the increasing need for industrial fluid handling increase the adoption of recycled plastic pipe. The strong focus on minimizing waste and expansion of water supply networks increases demand for recycled plastic pipe. The growing infrastructure development creates an opportunity for the growth of the recycled plastic pipes market.

Market Challenge

High Recycling Cost Creates Hurdles for Market Growth

Despite several benefits of the recycled plastic pipes in various applications, the high recycling cost restricts the market growth. Factors like the need for shredding equipment, complex sorting processes, use of hazardous additives, degradation of material quality, and collection of dense pipe are responsible for high recycling costs.

The extensive need for labor and the need for heavy-duty shredding & processing equipment increase the cost. The hazardous additives like stabilizers & plasticizers, and the utilization of mixed materials increase the cost. The high recycling cost hampers the growth of the recycled plastic pipes market.

Regional Insights

North America Recycled Plastic Pipes Market Size, Industry Report 2034

The North America recycled plastic pipes market size was estimated at USD 2.36 billion in 2024 and is projected to reach USD 6.04 billion by 2034, growing at a CAGR of 9.87% from 2025 to 2034. North America dominated the market with a 30% share in 2024.

The growing modernization of sewage and water supply systems increases demand for recycled plastic pipes. The supportive government policies and the presence of advanced recycling technologies help the market growth. The growing investment in infrastructure development and increasing awareness about environmental issues increase demand for recycled plastic pipes. The growing demand for efficient sanitation & water supply systems increases the adoption of recycled plastic pipes, driving the market growth.

United States Recycled Plastic Pipes Market Trends

The United States is a major contributor to the recycled plastic pipes market. The growing development of infrastructure and construction projects increases demand for recycled plastic pipes. The aging water supply systems and a strong focus on the modernization of the sewage & water systems increase the adoption of recycled plastic pipes. The increasing investment in advanced recycling technology and preference for sustainable building practices support the overall market growth.

- The United States exported $3.97B of plastic pipes in 2023. (Source: oec.world)

Asia Pacific Recycled Plastic Pipes Market Trends

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The growing demand for drainage, water, and sewage in urban areas increases the demand for recycled plastic pipes. The growing telecommunication networks and increasing investment in large-scale water projects increase demand for recycled plastic pipes.

The growing adoption of sustainable construction practices and corporate sustainability goals increases demand for recycled plastic pipes. The growing industrial activities and growth in the chemical sector increase demand for recycled plastic pipes, driving the overall market growth.

China Recycled Plastic Pipes Market Trends

China is a key contributor to the recycled plastic pipes market. The growing development of large-scale industrial and sanitation projects increases demand for recycled plastic pipes. The growing expansion of cities and the government's focus on environmental sustainability increase the adoption of recycled plastic pipes. The strong presence of domestic recycling capacity and the high development of infrastructure projects support the overall market growth.

- China exported $3.93B of plastic pipes in 2023.(Source: oec.world)

- China exported $4.61B of plastic pipes in 2024.(Source: oec.world)

Segmental Insights

Material Type Insights

Why the HDPE Segment Dominates the Recycled Plastic Pipes Market?

The HDPE segment dominated the recycled plastic pipes market with a 45% share in 2024. The easy installation and excellent resistance to environmental stress, corrosion, and chemicals increase the adoption of HDPE. The smooth inner surface and low cost of maintenance increase demand for HDPE. The longer service life and high recyclability increase the adoption of HDPE. The growing development of sewage, water, and gas systems increases demand for HDPE, driving the overall market growth.

The PVC segment is the fastest-growing in the market during the forecast period. The energy-efficient production and high recyclability increase the adoption of PVC. The strong focus on longevity and growing environmental awareness increases demand for PVC pipes. The growing development of infrastructure projects and cost-effectiveness increases the adoption of PVC. The development of smart city projects and superior material properties increases demand for PVC, supporting the overall market growth.

Application Insights

Which Application Held the Largest Share in the Recycled Plastic Pipes Market?

The sewage & drainage segment held the largest revenue share of 40% in the market in 2024. The growing investment in drainage and sewage systems increases demand for recycled plastic pipes. The growing commercial and residential construction activities increase demand for recycled plastic pipes for the development of sewage & drainage systems. The rapid urbanization and growing modernization of infrastructure projects drive the overall market growth.

The water supply segment is experiencing the fastest growth in the market during the forecast period. The rapid urbanization and growing expansion of industrial activities increase the demand for a water supply system. The strong focus on minimizing water loss and increasing investment in infrastructure projects increases demand for the water supply system. The strong government support for the water supply system and the increasing need for a leak-reduction water system support the overall growth of the market.

Pipe Diameter Insights

Why is the Large Diameter Pipes Segment Dominating the Recycled Plastic Pipes Market?

The large diameter pipes segment dominated the market with a 50% share in 2024. The rapid urbanization and growing development of infrastructure projects increase the adoption of large diameter pipes. The growing demand for efficient irrigation systems and high investment in the sewage & water systems increases the adoption of large diameter pipes. The development of urban stormwater management & irrigation systems increases demand for large diameter pipes, supporting the overall market growth.

The small diameter pipes segment is the fastest-growing in the market during the forecast period. The growing adoption of precision farming and the development of rainwater harvesting projects increase the demand for small diameter pipes.

The increasing development of plumbing and the expansion of smart city projects increase the adoption of small diameter pipes. The growing expansion of agricultural irrigation networks and the growth in industrial fluid transport increase demand for small diameter pipes, supporting the overall market growth.

Product Type Insights

How the Solid Wall Pipes Segment Held the Largest Share in the Recycled Plastic Pipes Market?

The solid wall pipes segment held the largest revenue share of 55% in the market in 2024. The growing development of the drainage system and water supply system increases demand for solid wall pipes. The longer lifespan and lower production cost increase the adoption of solid wall pipes. The development of agricultural irrigation and wastewater infrastructure increases the demand for solid wall pipes. The strong focus on sustainability and simplicity of design drives the overall growth of the market.

The corrugated pipes segment is experiencing the fastest growth in the market during the forecast period. The growing environmental awareness and growth in industrial activities increase demand for corrugated pipes. The increasing development of water management and drainage systems increases the adoption of corrugated pipes. The easy installation and growing road construction increase demand for corrugated pipes. The development of transportation networks like railways, highways, and airports increases demand for corrugated pipes, supporting the overall market growth.

Distribution Channel Insights

Why did the Direct Sales Segment Dominate the Recycled Plastic Pipes Market?

The direct sales segment dominated the recycled plastic pipes market with a 60% share in 2024. The transparency and focus on handling complexity increase the adoption of direct sales. The focus on bridging the gap between manufacturers & customers and an extensive range of products increases demand for direct sales. The development of large-scale projects and complexities in the supply chain management increases the adoption of direct sales, supporting the overall market growth.

The online sales segment is the fastest-growing in the market during the forecast period. The growing shift towards online purchasing and the ease of browsing products increases demand for online sales. The broader customer base and the need for timely delivery increase the adoption of online sales. The availability of a wide range of products and easy access to technical information increase demand for online sales, supporting the overall growth of the market.

Recent Developments

- In April 2025, Prayag Polymers launched a range of PVC-O pipes for water applications. The pipe is useful in applications like industrial, high-pressure water distribution, and irrigation systems. The range of pipes is PN16, PN25, PN12.5, & PN20 and consists of 40% higher hydraulic capacity. The diameter ranges from 90mm to 400mm and is useful in commercial & residential applications. (Source: www.indianchemicalnews.com )

- In March 2025, REHAU launched the first 100% climate-neutral plastic sewer system. The system is made up of polypropylene and lowers CO2 emissions. The system saves 360 tonnes of CO2 and offers a range of nevoPP products. The range includes AWACHCHT nevoPP DN 1000 & AWADUKT nevoPP SN10.(Source: www.watermagazine.co.uk )

- In June 2025, Rollepaal streamlines PVC-O pipe production. The pipe meets stringent AWWA & ISO standards and offers various sizes of pipes. The pipe is useful in applications like infrastructure projects, water distribution, and irrigation systems.(Source: www.k-online.com )

Top Companies List

- ADS Pipe: The leading manufacturer of products like triple, single, and double-wall corrugated polypropylene & polyethylene pipes.

- Polypipe: The UK-based company that supports the sale, design, and manufacture of various plastic piping systems like drainage, underfloor heating, ventilation, plumbing, and others.

- Wavin: The global manufacturer of plastic pipe that provides solutions like drainage, water supply, and others in building & infrastructure projects.

- Aliaxis Group: The global company manufactures and designs fittings, drainage systems, pipes, and valves for applications like gas distribution, rainwater management, water supply, and energy distribution.

- Ipex Inc: The leading manufacturer of an integrated thermoplastic piping system to support sectors like commercial, industrial, residential, and municipal.

Other Top Companies

- National Pipe and Plastics

- SABIC

- JM Eagle

- PVC Pipe Industries

- Charlotte Pipe and Foundry

- Georg Fischer Piping Systems

- Thermoplastic Pipes Ltd.

- Plastech Group

- North American Pipe Corporation

- Chevron Phillips Chemical

- Sekisui Chemical Co., Ltd.

- Advanced Drainage Systems

- Pipelife International

- Molecor

- Amiantit

Segments Covered

By Material Type

- High-Density Polyethylene (HDPE)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Other Recycled Plastics (ABS, PE, etc.)

By Application

- Water Supply

- Potable Water Systems

- Non-potable Water Systems

- Sewage & Drainage

- Municipal Sewerage Systems

- Industrial Drainage Systems

- Agricultural Irrigation

- Oil & Gas

- Telecommunications

- Construction & Infrastructure

By Pipe Diameter

- Small Diameter Pipes (Up to 4 inches)

- Medium Diameter Pipes (4-8 inches)

- Large Diameter Pipes (Above 8 inches)

By Product Type

- Solid Wall Pipes

- Corrugated Pipes

- Perforated Pipes

By Distribution Channel

- Direct Sales

- Online Sales

- Retail

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait