Content

Stabilizers Market Size and Growth 2025 to 2034

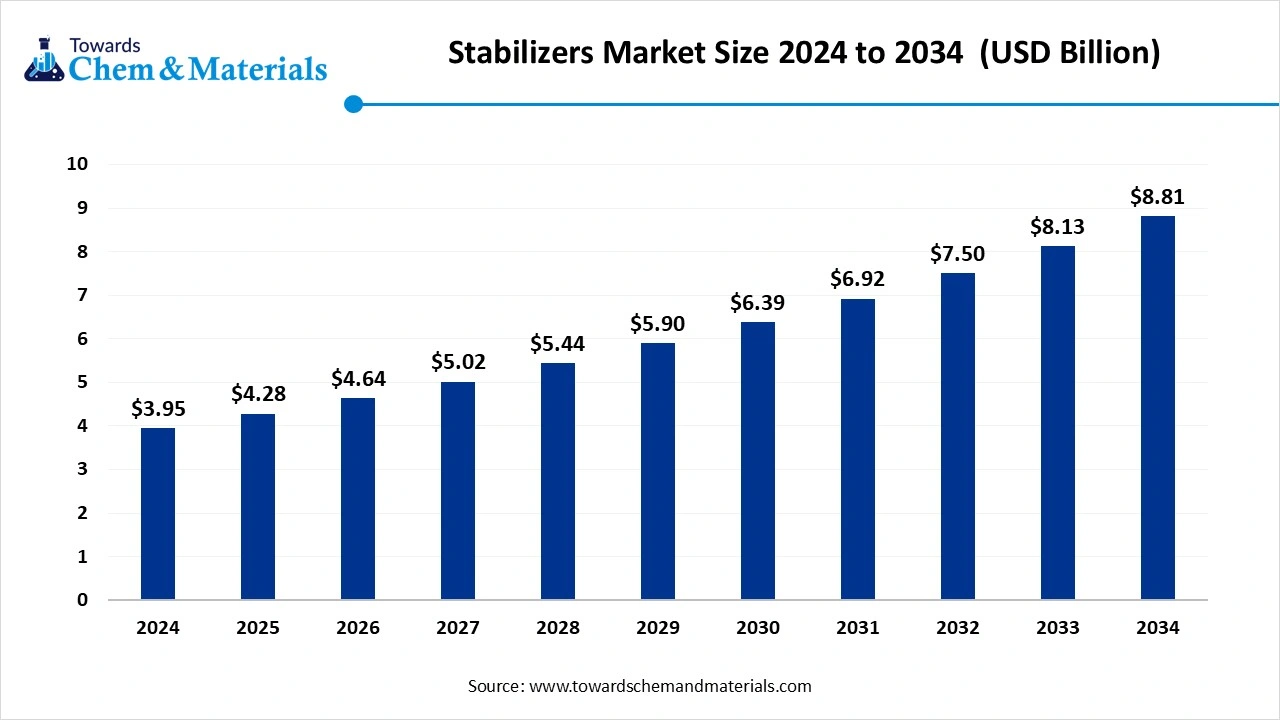

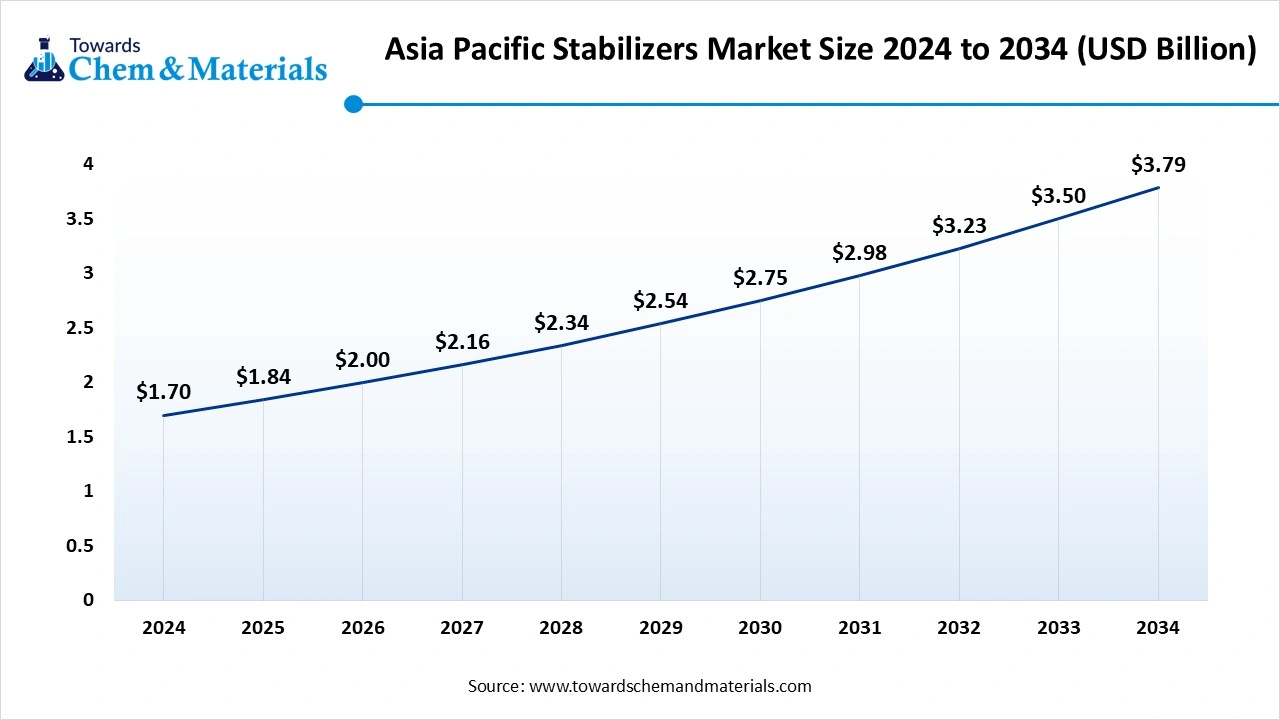

The global stabilizers market size was reached at USD 3.95 billion in 2024 and is expected to be worth around USD 8.81 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.35% over the forecast period 2025 to 2034. The growing demand for processed foods, growth in infrastructure development, and rising industrialization drive the market growth.

Key Takeaways

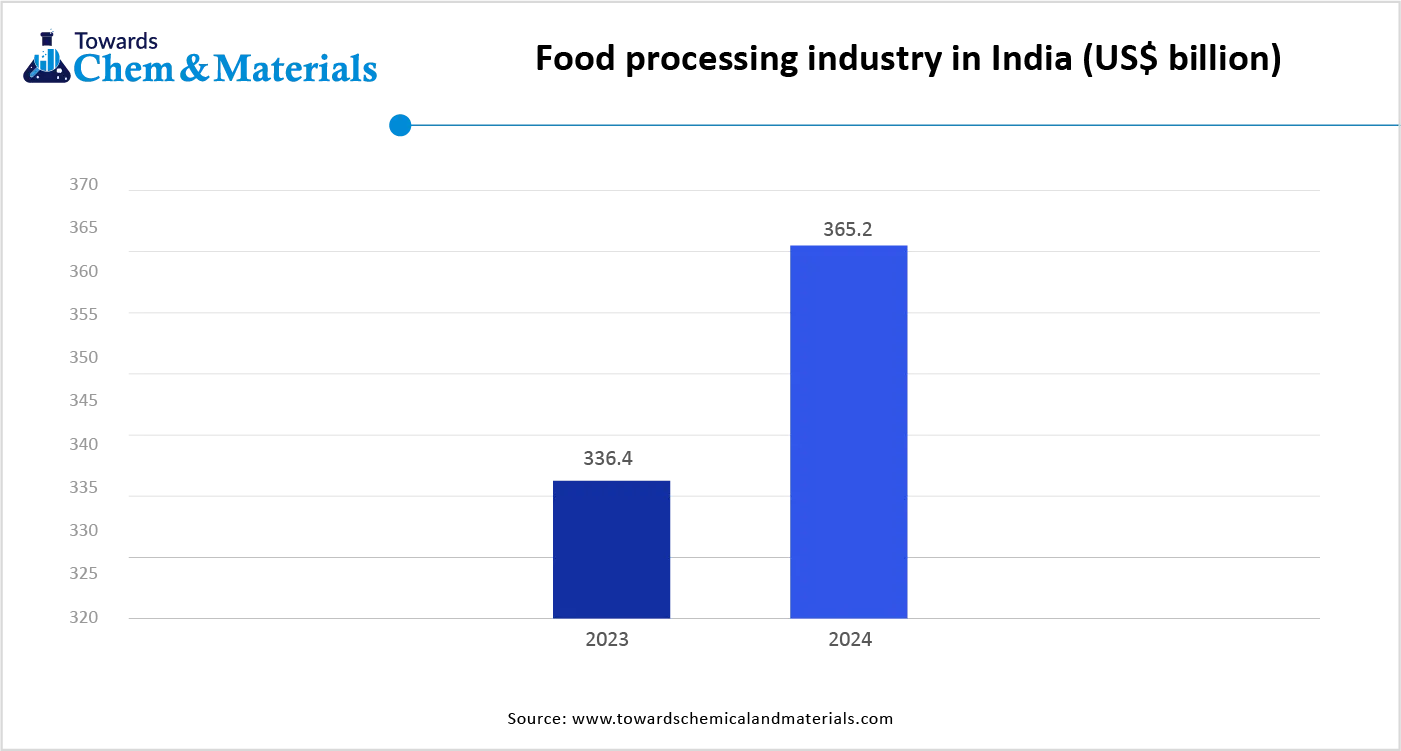

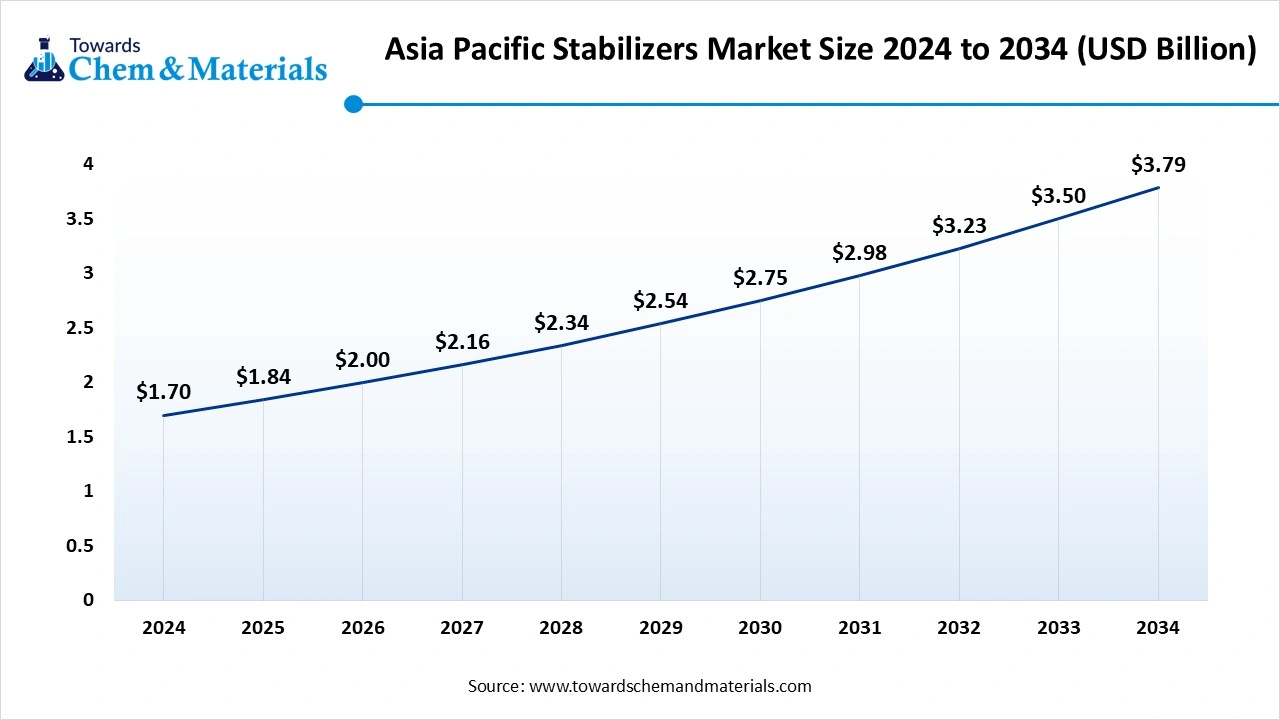

- By region, Asia Pacific held a 43% share in the stabilizers market in 2024 due to the increasing demand for convenience foods.

- By region, North America is growing at a significant CAGR in the market during the forecast period due to its well-established industrial base.

- By type, the heat stabilizers segment held a 48% share in the market in 2024 due to the growing construction activities.

- By type, the UV stabilizers segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing production of agricultural products.

- By polymer type, the PVC segment held a 56% share in the market in 2024 due to the growing infrastructure development.

- By polymer type, the polyolefins & engineering plastics segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing manufacturing of automotive components.

- By application, the pipes & fittings segment held a 32% share in the market in 2024 due to the longer lifespan and good performance.

- By application, the automotive interiors & agricultural films segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing production of agricultural films.

Stabilizers: The Science Behind Stability & Consistency in Modern Industry

A stabilizer is a substance used to prevent degradation and preserve the chemical & physical properties of various materials. Stabilizers avoid the separation of substances like water & oil and control the viscosity of the product. They enhance the weathering, thermal, and UV resistance of polymers & plastics throughout service life & processing. Stabilizers prevent discoloration, mechanical property loss, degradation, and embrittlement.

They are widely used in polyolefins, rubber, PVC, coatings, and engineering plastics. The growing expansion of commercial sectors like healthcare facilities, data centers, and many more increases demand for stabilizers. The increasing development of infrastructure projects like affordable housing and smart cities increases demand for stabilizers. The increasing demand for various appliances like TVs, air conditioners, and refrigerators fuels demand for stabilizers to avoid damage. Factors like growing demand for appliances, growth in industrial sectors, and increasing demand for processed foods contribute to the growth of the stabilizers market.

- India exported 2214 shipments of PVC stabilizer.(Source: https://www.volza.com)

- India exported 72 shipments of UV stabilizer.(Source: https://www.volza.com )

- The World exported 497 shipments of UV absorber.(Source: https://www.volza.com)

- Turkey exported 335 shipments of lead stabilizer.(Source: https://www.volza.com)

Who are the Leading Suppliers of UV Stabilizer in the World?

| Company | Constituent(%) | Shipments |

| SUQIAN UNITECOMMERCE CO LTD | 47% | 487 Shipments |

| YANTAI SUNSHOW CHEMICAL TECHNOLOGY CO | 28% | 285 Shipments |

| BASF SE | 5% | 47 Shipments |

Growing Food & Beverage Industry Drives Stabilizers Market Growth

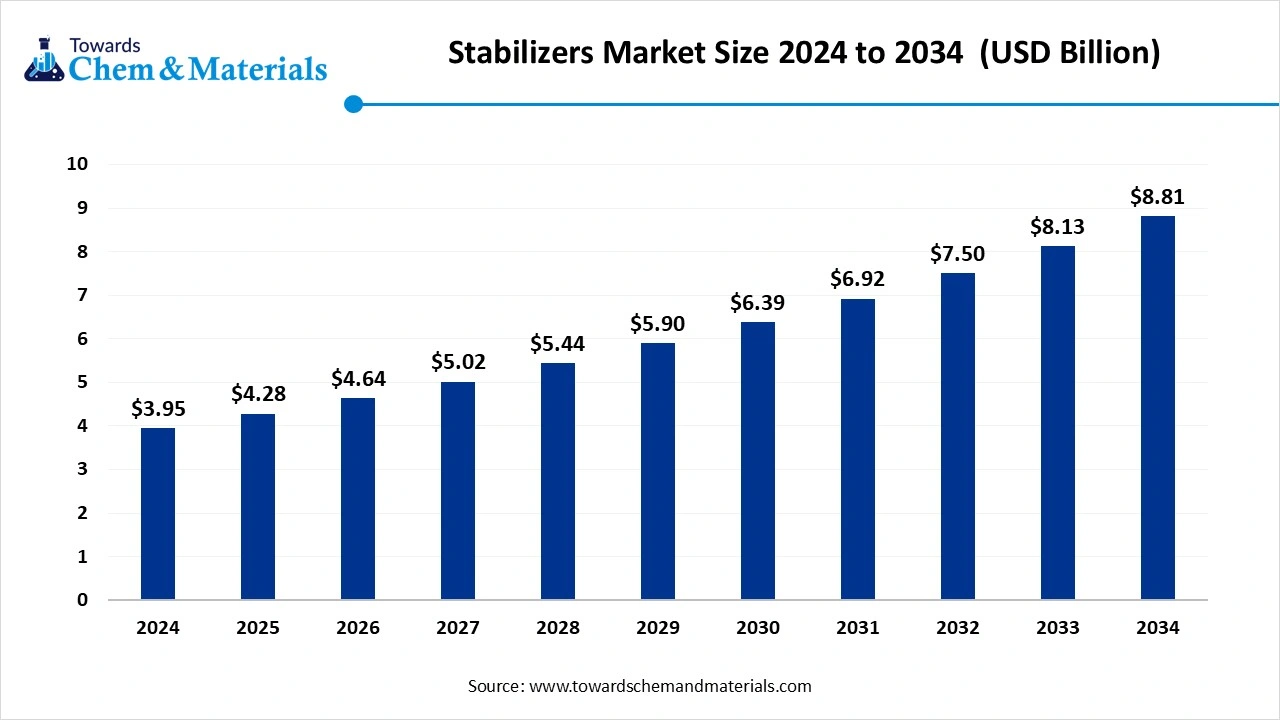

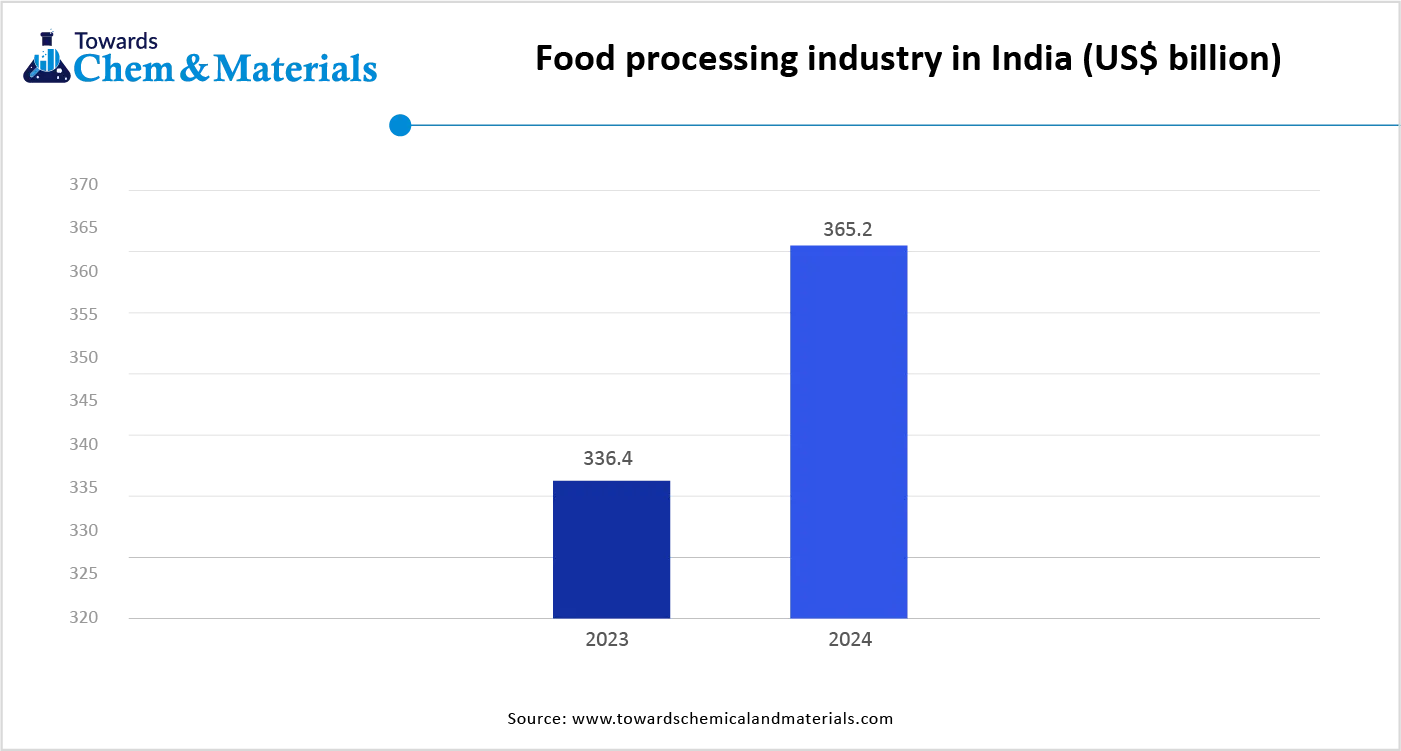

The growing food & beverage industry in various regions increases demand for stabilizers to enhance shelf life and maintain texture. The consumers' busy lifestyles increase demand for ready-to-drink beverages, ready-to-eat meals, and snacks increases demand for stabilizers to enhance shelf life and prevent spoilage. The increasing consumption of various bakery products like cakes & breads increases demand for stabilizers to improve texture and retain moisture.

The growing demand for various beverages like dairy products, fruit juice, and other products increases demand for stabilizers to enhance mouthfeel, avoid separation, and maintain consistency. The food products, like sauces and salad dressing, require stabilizers to avoid oil & water separation. The focus on minimizing food waste and maintaining the quality of food products requires stabilizers. The growing food & beverage industry is a key driver for the growth of the market.

Market Trends

- Growing Demand for Renewable Energy: The growing adoption of renewable energy like wind power & solar in various regions increases demand for stabilizers for improving grid stability and managing distribution of power.

- Increasing Adoption of Electronic Devices: The growing demand for various electronic devices like smartphones, laptops, computers, and many more increases the demand for stabilizers to prevent damage and maintain stable voltage.

- Growing Demand for PVC: The increasing demand for PVC in various industries like consumer goods, construction, automotive, and packaging increases demand for stabilizers to ensure product quality.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 4.28 Billion |

| Expected Size by 2034 | USD 8.81 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Polymer Type, By Application, By Region |

| Key Companies Profiled | Baerlocher GmbH, ADEKA Corporation, Songwon Industrial Co., Ltd., BASF SE, Clariant AG, Evonik Industries AG, Norac Additives, Valtris Specialty Chemicals, Arkema S.A., PMC Group, Reagens S.p.A., Solvay S.A., MOMCPL (Metal Organics), Akdeniz Chemson, Vikas Ecotech Ltd. |

Market Opportunity

Growing Construction Activities Unlocks Opportunity for Stabilizers Market

The rapid urbanization increases construction activities and infrastructure development in various regions, which fuels demand for stabilizers. The growing development of infrastructure projects like roads, transportation systems, and new buildings requires a stable power supply that increases demand for stabilizers. The growing development of commercial and residential construction increases demand for stabilizers for various applications roofing, wiring, pipelines, and many more.

The focus on the development of affordable housing and smart cities increases demand for stabilizers for manufacturing wires, window profiles, pipes, and cables. The increasing demand for building materials like roofing membranes, flooring, and siding increases the adoption of stabilizers to enhance performance and durability. The increasing popularity of green buildings increases demand for sustainable stabilizers. The growing construction activities create an opportunity for the stabilizers market.

Market Challenge

High Production Cost Limits Expansion of the Stabilizers Market

Despite several benefits of the stabilizers in various industries, the high production cost restricts the market growth. Factors like the need for advanced technologies, fluctuating costs of raw materials, and complex manufacturing processes are responsible for high production costs. The fluctuating prices of raw materials like steel, copper, and aluminium increase the production cost.

The naturally derived stabilizers require raw materials like seaweed, which are expensive. The complex manufacturing steps, like the production of transformers and multi-step processes, require high cost. The development of advanced features like overload protection, automatic voltage adjustment, and digital displays requires a high cost. The heavy investments in infrastructure increase the manufacturing cost. The high production cost hampers the growth of the stabilizers market.

Regional Insights

Which Region Dominated the Stabilizers Market?

Asia Pacific dominated the market in 2024, and the region is observed to sustain the position during the forecast period. The rapid urbanization and growing industrialization in the area increase demand for stabilizers for various applications. The increasing adoption of electronics and appliances fuels demand for stabilizers for protection. The rising food processing industry and growing demand for convenience foods increase demand for stabilizers to maintain shelf life, quality, and texture. The expansion of the packaging sector and the rise in e-commerce increase the adoption of stabilizers to enhance shelf life and durability. The strong government support for infrastructure development and industrial growth fuels demand for stabilizers. The growing demand across sectors like packaging, automotive, and construction drives the market growth.

China Stabilizers Market Trends

China is a major contributor to the stabilizers market. The rapid urbanization and growing industrial production increase demand for stabilizers. The increasing demand for consumer goods & processed foods fuels the adoption of stabilizers. The growing expansion of the construction industry, like real estate & infrastructure development, increases demand for stabilizers like PVC stabilizers. The increasing consumption of meat fuels demand for stabilizers to extend shelf life and maintain quality. The growing manufacturing in industries like construction, electronics, and automotive increases demand for stabilizers, supporting the overall market growth.

- China exported 11622 shipments of stabilizer.(Source: https://www.volza.com )

- China exported 5075 shipments of PVC stabilizer.(Source: https://www.volza.com)

- China exported 1609 shipments of heat stabilizer(Source: https://www.volza.com )

- China exported 268 shipments of lead stabilizer.(Source: https://www.volza.com)

- China exported 1174 shipments of static stabilizer.(Source: https://www.volza.com)

Why is North America Significantly Growing in the Stabilizers Market?

North America expects the significant growth in the market during the forecast period. The strong industrial base, such as technology sectors and manufacturing, increases the adoption of stabilizers. The strong presence of data centers increases demand for stabilizers like voltage stabilizers to avoid data loss and equipment failures. The increasing manufacturing of automotive components increases demand for stabilizers. The growing demand for functional foods, processed foods, and natural products fuels demand for stabilizers. The favorable government policies and focus on the development of new stabilizers drive the market growth.

United States Stabilizers Market Trends

The United States is growing in the stabilizers market. The strong commercial establishments, data centers, and manufacturing facilities increase demand for stabilizers. The growing utilization of plastic in various construction projects increases the adoption of stabilizers. The growing demand for various stabilizers across sectors like oil & gas, automotive, and construction supports the market growth.

- The United States exported 13453 shipments of stabilizer.(Source: https://www.volza.com)

Segmental Insights

Type Insights

Why did the Heat Stabilizers Segment Dominate the Stabilizers Market?

The heat stabilizers segment dominated the stabilizers market in 2024. The increasing consumption of PVC in construction activities like fittings, roofing, pipes, and window profiles increases demand for heat stabilizers. The growing manufacturing of automotive components like underbody coatings, interior trim, and cable & wire insulation fuels demand for heat stabilization. The ongoing advancements in heat stabilizers like chromatography analysis & TGA help the market growth. The growing demand for PVC in various industries like packaging, construction, and automotive increases the adoption of heat stabilizers, driving the overall market growth.

The UV stabilizers segment is the fastest-growing in the market during the forecast period. The growing construction activities increase demand for UV stabilizers to protect building materials from UV damage. The increasing demand for preserving beverages, food, and other fuels demand for UV stabilizers to maintain quality. The focus on protecting vehicle parts from sun damage and enhancing durability increases the adoption of UV stabilizers. The increasing demand for agricultural products like mulch films, greenhouse films, and nets requires a UV stabilizer. The increasing demand for hindered amine light stabilizers and rising sustainability awareness support the market growth.

Polymer Type Insights

How the PVC Segment Held the Largest Share in the Stabilizers Market?

The PVC segment held the largest revenue share in the stabilizers market in 2024. The growing development of infrastructure projects like wiring & pipelines increases demand for PVC. The increasing utilization of PVC in construction activities like window profiles, roofing, pipes, and flooring helps the market growth. The growing manufacturing of exterior and interior automotive components like door panels & dashboards increases demand for PVC. The ongoing advancements in PVC stabilizer technology and focus on maintaining the appearance of packaging materials drive the market growth.

The polyolefins & engineering plastics segment is experiencing the fastest growth in the market during the forecast period. The growing development of automotive components like interior trim, bumpers, and dashboards increases demand for polyolefins and engineering plastics. The growing adoption of electronic devices increases demand for plastics to withstand electrical stress & heat. The growing demand for polyolefins and engineering plastics in sectors like packaging, automotive, and construction supports the market growth.

Application Insights

The pipes & fittings segment dominated the stabilizers market in 2024. The growing demand for water supply systems, plumbing, and drainage in construction increases the adoption of pipes & fittings. The increasing infrastructure development in various regions increases demand for pipes & fittings. They offer high chemical resistance and a long lifespan. They offer good performance and are cost-effective. The growing demand for pipes & fittings in infrastructure development and construction activities drives the market growth.

The automotive interiors & agricultural films segment is the fastest-growing in the market during the forecast period. The growing causes like discoloration, material degradation, fading, and cracking in automotive interiors increase demand for stabilizers. The increasing demand for lightweight materials in vehicles and the rising production of cars increases demand for stabilizers. The increasing production of various agricultural films, like mulch films, greenhouse films, and others, increases demand for stabilizers. The focus on improving crop yields and growing adoption of sustainable practices increases demand for stabilizers. The increasing manufacturing of various automotive interiors like seat covers, dashboards, and door panels supports the market growth.

Recent Developments

- In November 2023, Baerlocher India launched a PVC stabilizer manufacturing facility in Madhya Pradesh. The facility is a platinum-rated green factory and reduces 698 tons of carbon dioxide emissions. (Source: www.indianchemicalnews.com)

- In July 2024, BASF launched a heat & light stabilizer, Tinuvin NOR 211 AR, for sustainable farming. The stabilizer is effective against chemicals, UV radiation, and heat. The stabilizer addresses challenges like increased chemical exposure, downgauging trends, sustainability requirements, and long use durations.(Source: www.indianchemicalnews.com)

- In November 2023, Sigrid Therapeutics launched a Glucose Stabilizer in the U.S. The stabilizer minimizes bloating, curve appetite, lowers blood sugar, helps in weight loss, and keeps you full longer & is made up of micron-sized silica particles.(Source: www.prnewswire.com)

Stabilizers Market Top Companies

- Baerlocher GmbH

- ADEKA Corporation

- Songwon Industrial Co., Ltd.

- BASF SE

- Clariant AG

- Evonik Industries AG

- Norac Additives

- Valtris Specialty Chemicals

- Arkema S.A.

- PMC Group

- Reagens S.p.A.

- Solvay S.A.

- MOMCPL (Metal Organics)

- Akdeniz Chemson

- Vikas Ecotech Ltd.

Segments Covered

By Type

- Heat Stabilizers

- Calcium-Zinc (Ca-Zn)

- Barium-Zinc (Ba-Zn)

- Tin-Based Stabilizers

- Lead-Based Stabilizers (being phased out globally)

- UV Stabilizers

- Hindered Amine Light Stabilizers (HALS)

- UV Absorbers (e.g., benzotriazoles, benzophenones)

- Antioxidants

- Light Stabilizers

By Polymer Type

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polyethylene (PE)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyesters (PET, PBT)

- Engineering Plastics

- Rubber & Elastomers

By Application

- Pipes & Fittings

- Wires & Cables

- Profiles & Window Frames

- Packaging Films

- Agricultural Films & Greenhouses

- Automotive Parts

- Consumer Goods

- Coatings & Adhesives

- Furniture & Flooring

- Medical Tubing & Devices

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait