Content

What is Current Liquid Hydrogen Market Size and Volume?

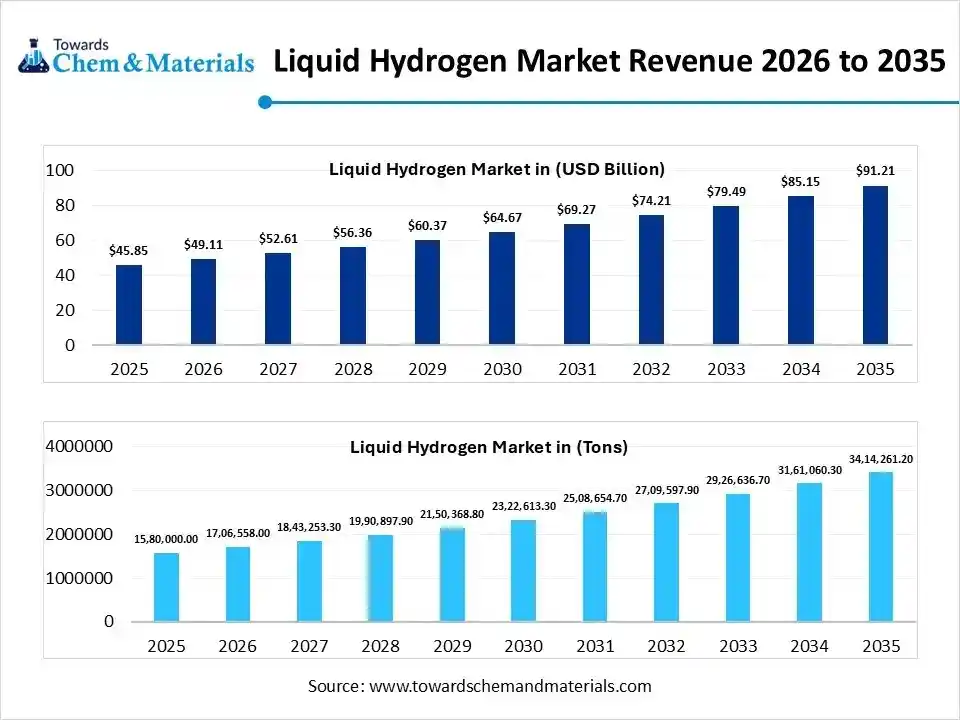

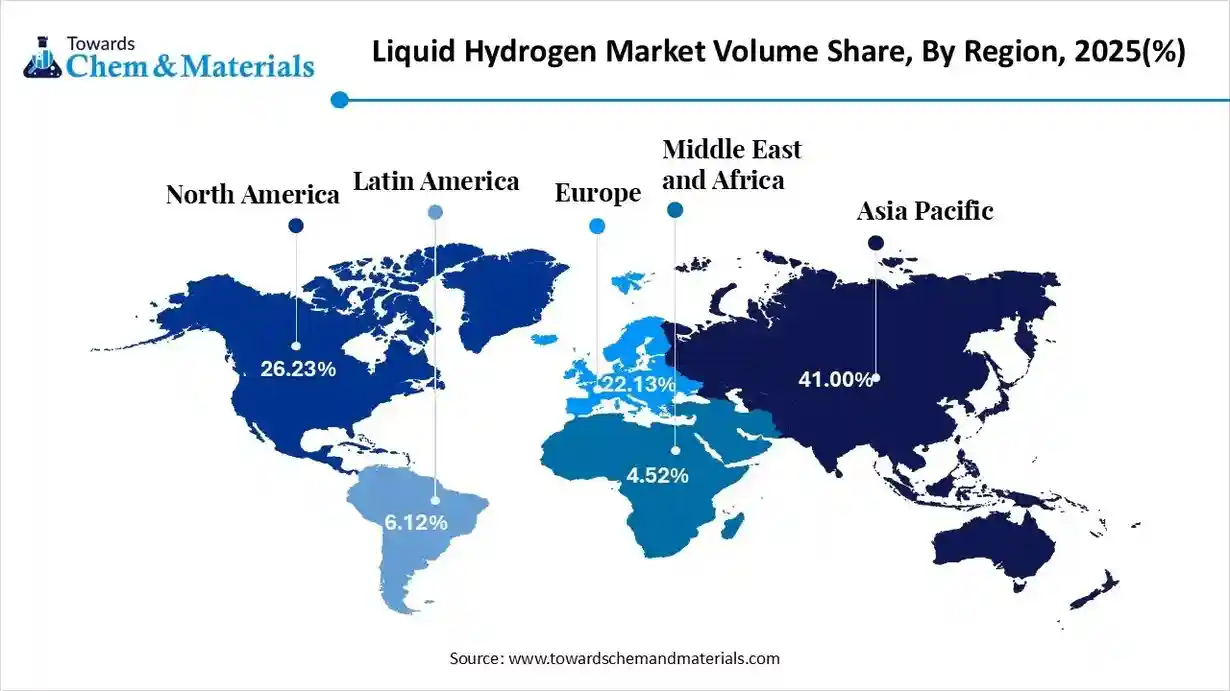

The global liquid hydrogen market size was estimated at USD 45.85 billion in 2025 and is expected to increase from USD 49.11 billion in 2026 to USD 91.21 billion by 2035, growing at a CAGR of 7.12% from 2026 to 2035. In terms of volume, the market is projected to grow from 1,580,000.0 tons in 2025 to 3,414,261.2 tons by 2035. growing at a CAGR of 8.01% from 2026 to 2035. Asia Pacific dominated the liquid hydrogen market with the largest volume share of 41% in 2025. the Increasing demand for clean energy across the globe is the key factor driving market growth. Also, supportive government policies along with the expanding hydrogen infrastructure can fuel market growth further.

The Liquid hydrogen is hydrogen that has been cooled to an extremely low temperature (about −253 °C) so it becomes a liquid, allowing it to be stored and transported in a much smaller volume than hydrogen gas. It is valued for its clean energy potential and high energy density, as it produces only water when used in fuel cells or combustion. The liquid hydrogen market is expanding steadily due to the global push for decarbonization, growing demand for clean energy in sectors such as aerospace, heavy transportation, energy storage power generation, and strong government support through hydrogen investments and policies.

Key Takeaways

- By region, Asia Pacific led the liquid hydrogen market held the volume share of around 41% in 2025.The dominance of the region can be attributed to the strong government support for clean energy.

- By region, North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the increasing product demand from the aerospace industry.

- By region, Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by the increasing use of renewable electricity.

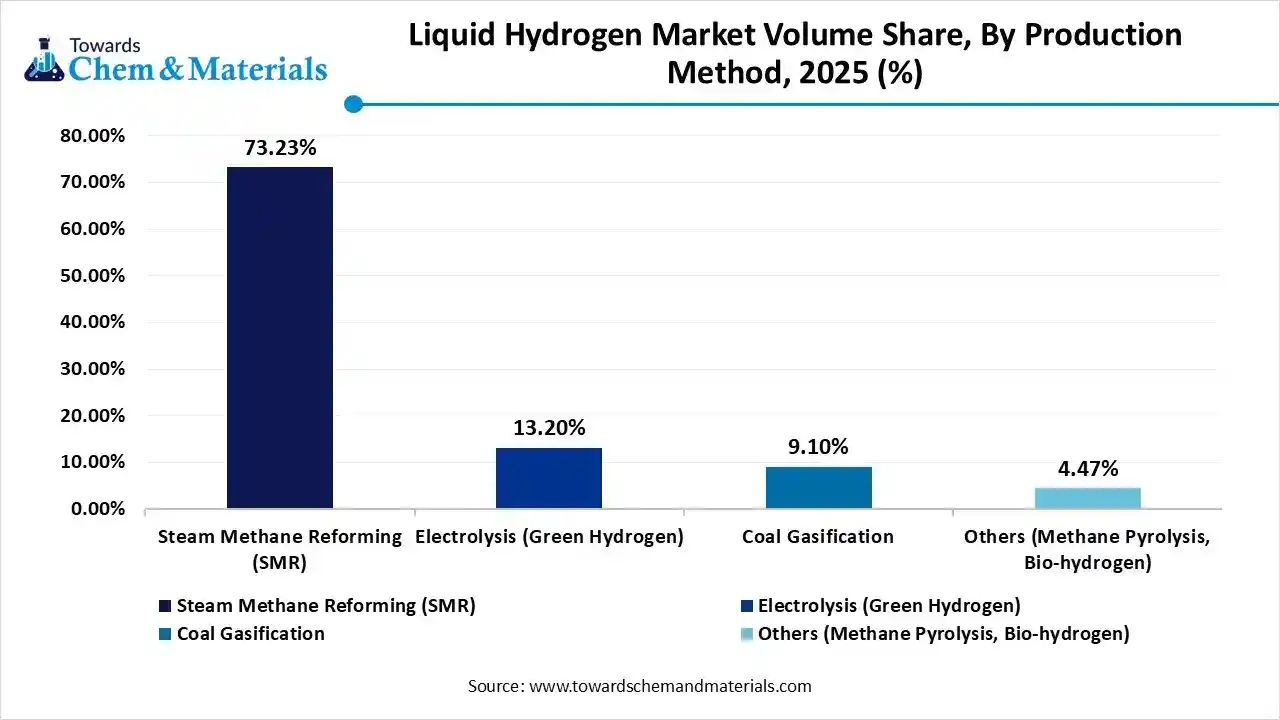

- By production, the steam methane reforming segment led the market with the largest volume share of 65% in 2025. The dominance of the segment can be attributed to its cost-effectiveness.

- By production, the electrolysis (green LH2) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid technological innovations in manufacturing.

- By distribution, the cryogenic tankers segment accounted for the largest volume share of 70% in 2025. The dominance of the segment can be linked to the high demand for nitrogen (LIN) and liquid oxygen.

- By distribution, the maritime carriers (shipping) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by strong government investment.

- By end use, the aerospace segment dominated with the largest volume share of 40% in 2025. The dominance of the segment is owed to the growing need for space exploration.

- By end use, the automotive & transportation segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to ongoing innovations in fuel cell technology.

- By storage, the fixed storage tanks segment dominated the market and accounted for the largest volume share of 55% in 2025. The dominance of the segment can be attributed to the significant financial incentives.

- By storage, the mobile/portable dewars segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the growth of the hydrogen refueling infrastructure.

Liquid Hydrogen Market Trends

- As the global energy transition accelerates, liquid hydrogen is becoming the preferred medium for international energy trade and large-scale industrial decarbonization due to its superior energy density compared to compressed gas.

- The increasing liquid hydrogen demand from the aerospace industry for rocket propulsion, with the expanding hydrogen mobility sector, such as maritime, aviation, and heavy-duty trucks, is the latest trend in the market, shaping positive market growth.

- Governments in major regions are implementing strict emission reduction regulations and incentives for the use of hydrogen in transportation, industrial, and power sectors, which directly impact the technology adoption and market expansion.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 49.11 Billion / 1,706,558.0 Tons |

| Revenue Forecast in 2035 | USD 91.21 Billion / 3,414,261.2 Tons |

| Growth Rate | CAGR 7.12% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Production Method, By Distribution Method, Application, By Storage Solution Type, By Region |

| Key companies profiled | Air Products and Chemicals, Inc., Linde plc, Air Liquide S.A., Iwatani Corporation, Plug Power Inc. Kawasaki Heavy Industries, Ltd., Chart Industries, Inc., Shell plc, Messer Group GmbH, Cummins Inc. (Hydrogenics), Ballard Power Systems Inc., INOX India Limited (INOXCVA), Taiyo Nippon Sanso Corporation, Siemens Energy AG, Hy-Line (Cryomech), Demaco Holland B.V., GenH2, Hylium Industries, Inc., Cryolor, Engie S.A. |

How Cutting Edge Technologies are Revolutionizing the Liquid Hydrogen Market

The market is experiencing a major transformation, driven by advanced technologies such as advanced materials, Artificial Intelligence (AI), and trending energy-efficient liquefaction techniques. Furthermore, ML algorithms can monitor liquefaction plants in real time, automatically adjusting flow and pressure to reduce downtime and increase overall efficiency.

Trade Analysis of Liquid Hydrogen Market: Import & Export Statistics

Exports

- In 2024, the United States exported $1.81B of Hydrogen, being the 174th most exported product in the United States.

- In 2024, the main destinations of the United States' Hydrogen exports were: Japan ($482M), Vietnam ($372M), South Korea ($157M), Belgium ($89.2M), and Mexico ($89.2M).

Imports

- In 2024, the United States imported $873M of Hydrogen, being the 407th most imported product in the United States.

- In 2024, the main origins of the United States' Hydrogen imports were: Canada ($305M), Brazil ($193M), Germany ($62.3M), Australia ($44.3M), and Norway ($43.8M).

- As of 2024, over 2000 enterprises are active in the hydrogen sector in China, double the amount in 2020, including 48 SOEs and 88 listed companies.

- The fastest growing markets for Hydrogen exports in China between 2023 and 2024 were: Thailand ($256M), Malaysia ($118M), and the Netherlands ($35.4M).

Liquid Hydrogen Market Value Chain Analysis

- Feedstock Procurement: It refers to the strategic sourcing of raw materials to produce hydrogen gas, before it is cryogenically liquefied.

- Major Players: Linde plc, Air Products and Chemicals, Inc

- Chemical Synthesis and Processing : It involves the artificial execution of chemical reactions to generate necessary products. Liquid hydrogen is preferred in these high-volume industrial settings.

- Major Players: Linde PLC, Air Liquide.

- Packaging and Labelling: It refers to the specialized form used for delivery and the safety details marked on a storage vessel, and compliance with "green" certification.

- Major Players: Demaco, Cryostar.

- Regulatory Compliance and Safety Monitoring: It refers to the detailed framework of national laws, international standards, and advanced technological solutions created to mitigate the unique risks related to cryogenic hydrogen storage and transport.

Liquid Hydrogen Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union (EU) | The "Fit for 55" Package: This legislative suite includes mandates for liquid hydrogen refuelling infrastructure at major ports and airports across the Trans-European Transport Network (TEN-T). |

| United States | The U.S. relies heavily on the NFPA 2 (Hydrogen Technologies Code), which provides the baseline for liquid hydrogen storage distances and safety protocols at refuelling stations. |

| China | In 2025, China has introduced new technical guidelines for large-scale liquid hydrogen storage tanks and transport trailers to support its "Hydrogen Corridors". |

Segmental Insights

By Production Method Insights

How Much Share Did the Steam Methane Reforming Segment Held in 2025?

The steam methane reforming segment dominated the market with nearly 65% share in 2025. The dominance of the segment can be attributed to its cost-effectiveness and increasing demand from the transport industry. In addition, the government initiatives supporting clean fuels can drive hydrogen infrastructure development and propel investment in SMR-based manufacturing.

The electrolysis (green LH2) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid technological innovations in the manufacturing and application of renewable hydrogen. Increasing investment in on-site liquefaction units enables the industry to create and liquefy its own green hydrogen.

Liquid Hydrogen Market Volume and Share, By Production Method, 2025(%)

| By Production Method | Market Volume Share (%), 2025 | Market Volume (Tons)2025 | Market Volume (Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Steam Methane Reforming (SMR) | 73.23% | 1,157,034.0 | 2,400,908.5 | 8.45% | 70.32% |

| Electrolysis (Green Hydrogen) | 13.20% | 208,560.0 | 515,553.4 | 10.58% | 15.10% |

| Coal Gasification | 9.10% | 143,780.0 | 332,890.5 | 9.78% | 9.75% |

| Others (Methane Pyrolysis, Bio-hydrogen) | 4.47% | 70,626.0 | 164,908.8 | 9.88% | 4.83% |

Distribution Insights

Which Distribution Type Segment Dominated Liquid Hydrogen Market in 2025?

The cryogenic tankers segment held an approximately 70% market share in 2025. The dominance of the segment can be linked to the high demand for nitrogen (LIN), liquid oxygen (LOX), and LNG in food processing, production, and healthcare. Additionally, the use of cutting-edge materials such as composite materials and certain aluminium alloys is making tanks lighter, which is necessary for mobility applications.

The maritime carriers (shipping) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by strong government investment and support in the required infrastructure and technological innovations in cryogenic handling. Major market players are rapidly forming strategic alliances to create the entire value chain.

End-Use Insights

How Much Share Did the Aerospace Segment Held in 2025?

The aerospace segment dominated the market with nearly 40% share in 2025. The dominance of the segment is owing to the growing need for space exploration and government support for sustainable energy initiatives. Moreover, the aerospace sector focuses on LH2 to decrease soot and other harmful emissions.

The automotive & transportation segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to ongoing innovations in fuel cell technology, which lead to more convenient hydrogen vehicles. Furthermore, partnerships between major market players and infrastructure companies fuel advances and deployment.

Storage Type Insights

How Much Share Did the Fixed Storage Tanks Segment Held in 2025?

The fixed storage tanks segment held a nearly 55% market share in 2025. The dominance of the segment can be attributed to the significant financial incentives and favourable government policies, along with the growing demand for high-capacity, efficient, and safe storage solutions. This tank plays a necessary role in the integration of different renewable energy sources.

The mobile/portable dewars segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the growth of the hydrogen refuelling infrastructure and the ongoing transition towards a hydrogen economy. These storage solutions are vital enablers, providing flexibility and accessibility in a developing infrastructure.

Regional Insights

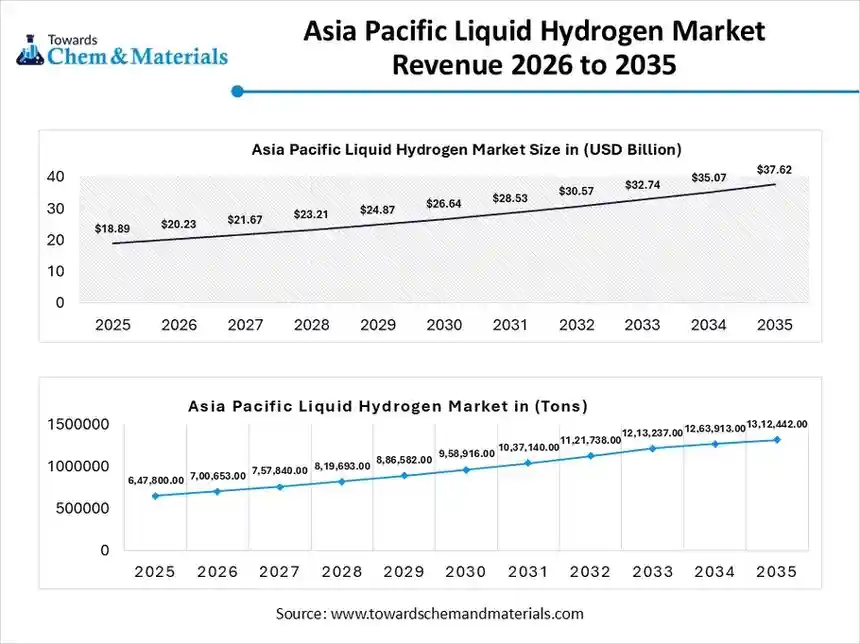

The Asia Pacific liquid hydrogen market size was valued at USD 45.85 billion in 2025 and is expected to be worth around USD 91.21 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.12% over the forecast period from 2026 to 2035.

The Asia Pacific liquid hydrogen market volume was estimated at 1,580,000.0 tons in 2025 and is projected to reach 3,414,261.2 tons by 2035, growing at a CAGR of 8.01% from 2026 to 2035. Asia Pacific dominated the market with nearly 41% share in 2025. The dominance of the region can be attributed to the strong government support for clean energy and extensive product demand from the transportation sector. In addition, industries such as ammonia production, steelmaking, and petroleum refining are the leading consumers of hydrogen.

China Liquid Hydrogen Market Trends

China dominated the market owing to a government commitment to energy security and decarbonization efforts, along with the substantial investments in hydrogen infrastructure. Also, substantial investments are targeting breakthroughs in storage and transport, impacting positive market growth further.

Liquid Hydrogen Market Volume and Share, By Region, 2025-2035 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 26.23% | 414,434.0 | 956,334.6 | 9.74% | 28.01% |

| Europe | 22.13% | 349,654.0 | 788,694.3 | 9.46% | 23.10% |

| Asia Pacific | 41.00% | 647,800.0 | 1,312,442.0 | 8.16% | 38.44% |

| Latin America | 6.12% | 96,696.0 | 211,684.2 | 9.10% | 6.20% |

| Middle East & Africa | 4.52% | 71,416.0 | 145,106.1 | 8.20% | 4.25% |

North America Market Trends

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the increasing product demand from the aerospace, fuel cell, and heavy transport industries, promoted by extensive investments in clean hydrogen hubs. Ongoing missions by organisations such as NASA and SpaceX continue to consist of liquid hydrogen in the upcoming years.

U.S. Liquid Hydrogen Market Trends

In North America, the U.S. led the market due to rising investments in manufacturing facilities and storage hubs, along with substantial investment in energy infrastructure. Also, advanced U.S firms are now using g liquid hydrogen to power drones, impacting positive market growth soon.

Europe Hydrogen Market Trends

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by increasing use of renewable electricity to manufacture green hydrogen via electrolysis and rapid investments in liquefaction plants. Furthermore, Liquid hydrogen is rapidly seen as the only viable zero-emission solution for shipping, long-haul trucking, and even short-to-medium haul aviation.

Germany Liquid Hydrogen Market Trends

The growth of the market in the country can be driven by growing product demand from hard-to-abate industries for decarbonization. Germany is heavily investing in a hydrogen pipeline network, designed to transport approximately 10 million tons of hydrogen annually.

South America Liquid Hydrogen Market Trends

South America held a major market share in 2025. The growth of the region can be fuelled by its excellent wind, solar, and hydropower potential, which enables cost-effective green hydrogen manufacturing via electrolysis. Furthermore, the major regional countries, including Uruguay, Colombia, and Costa Rica, have a clear blueprint that includes tax incentives and efficient carbon pricing methods.

Brazil Liquid Hydrogen Market Trends

The growth of the market in the country can be propelled by robust industrial demand from the petrochemical and refinery sectors, along with its commitment to green hydrogen production and export. Brazil is well-established to supply the significant demands of Asian and European markets, leading to the country's growth in the near future.

Middle East & Africa Liquid Hydrogen Market Trends

The growth of the market in the Middle East & Africa can be propelled by its geographical benefits, extensive investment in infrastructure development, and stringent decarbonization policies. In addition, there is a well-developed and existing oil and gas industry infrastructure, which can be used for hydrogen applications.

Saudi Arbia Liquid Hydrogen Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be credited to the extensive infrastructure investments and strategic national visions. Hydrogen is seen as a major medium for achieving these goals while keeping the country's status as a leading exporter.

Recent Developments

- In October 2025, HHLA, Daimler truck, and Kawasaki Heavy Industries launched a strategic collaboration to establish a liquid hydrogen supply chain for Europe. The collaboration also aims to explore the development of a cost-effective and reliable supply chain for green liquid hydrogen.(Source: www.daimlertruck.com)

- In February 2025, Plug Power introduced the industry's first spot pricing for green hydrogen. Hydrogen buyers can now choose to purchase liquid green hydrogen from Plug's manufacturing plants on demand without any limitations. (Source: www.offshore-energy.biz )

Liquid Hydrogen Market Companies

- Linde plc: Linde plc maintains its position as the global leader in the liquid hydrogen (LH2) market, controlling the world's largest liquid hydrogen capacity and distribution system. The company operates a fully integrated model that spans the entire value chain.

- Air Products and Chemicals, Inc.: Air Products is a global leader in the liquid hydrogen market, leveraging decades of experience in supply, distribution, and fueling technology to serve industrial, mobility (especially zero-emission transport), and space sectors (like NASA).

Top Companies in the Liquid Hydrogen Market

- Air Products and Chemicals, Inc.

- Linde plc

- Air Liquide S.A.

- Iwatani Corporation

- Plug Power Inc.

- Kawasaki Heavy Industries, Ltd.

- Chart Industries, Inc.

- Shell plc

- Messer Group GmbH

- Cummins Inc. (Hydrogenics)

- Ballard Power Systems Inc.

- INOX India Limited (INOXCVA)

- Taiyo Nippon Sanso Corporation

- Siemens Energy AG

- Hy-Line (Cryomech)

- Demaco Holland B.V.

- GenH2

- Hylium Industries, Inc.

- Cryolor

- Engie S.A.

Segments Covered

By Production Method

- Steam Methane Reforming (SMR)

- Electrolysis (Green Hydrogen)

- Coal Gasification

- Others (Methane Pyrolysis, Bio-hydrogen)

By Distribution Method

- Cryogenic Tankers/Trucks

- Cryogenic Pipelines

- Maritime Liquid Hydrogen Carriers

By End-Use Application

- Aerospace

- Automotive & Transportation

- Industrial Processes

- Chemical & Petrochemical

- Energy Storage & Power

By Storage Solution Type

- Fixed Storage Tanks

- Mobile/Portable Dewars

- Vacuum Insulated Transfer Lines

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa