Content

What is the Current GCC Natural Gas Market Size and Volume?

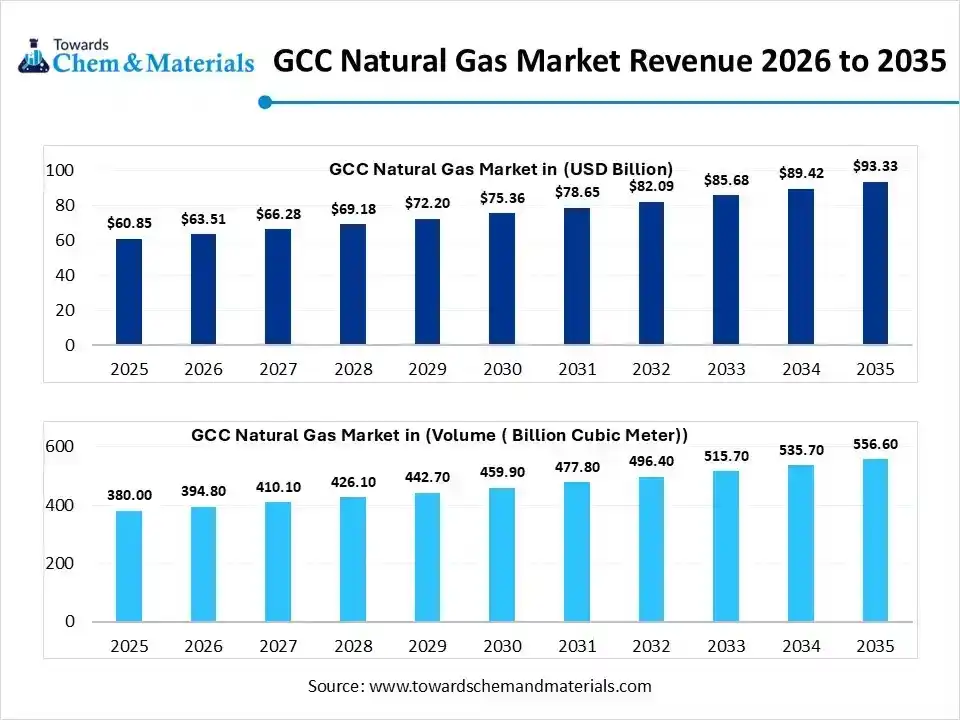

The GCC natural gas market size was estimated at USD 60.85 billion in 2025 and is expected to increase from USD 63.51 billion in 2026 to USD 93.33 billion by 2035, growing at a CAGR of 4.37% from 2026 to 2035. In terms of volume, the market is projected to grow from 380 billion cubic meter in 2025 to 556.6 billion cubic meter by 2035. growing at a CAGR of 3.89% from 2026 to 2035. Qatar dominated the GCC natural gas market with the largest volume share of 40.70% in 2025. The shift towards the minimization of dependence on oil has accelerated the industry growth in these regions nowadays.

Key Takeaways

- The, Qatar led the GCC natural gas market held the volume share of around 40.70% in 2025.

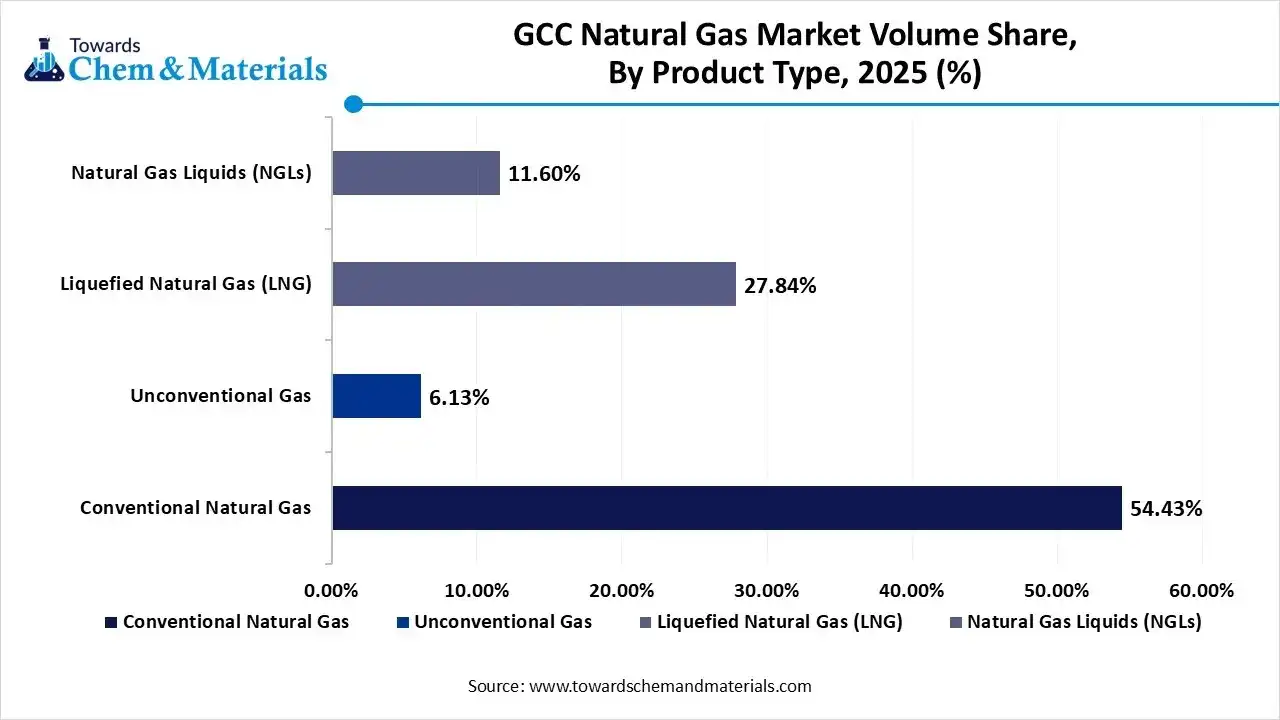

- By product type, the conventional natural gas segment led the market with the largest volume share of 54.43% in 2025. due to factors like easy extraction, greater availability, and reliability.

- By product type, the unconventional gas segment is expected to grow during the forecast period, owing to the reduction of easy gas and the rising demand.

- By form, the pipeline natural gas segment led the market with the largest volume share of 55.10% in 2025, owing to its strong integration with domestic energy systems.

- By form, the liquefied natural gas (LNG) segment is expected to grow at a rapid CAGR during the forecast period, akin to its strategic importance in global energy trade.

- By end use, the power generation segment accounted for the largest volume share of 55.32% in 2025.

- By end use, the industrial feedstock segment is expected to grow during the forecast period, akin to expanding manufacturing activities.

Natural Gas: Powering Modern Energy with Cleaner, Smarter, and Efficient Solutions

The clean-burning fossil fuel which is located deep under the earth kwon as natural gas. Moreover, this gas is primarily made up of methane and some other gases in smaller amounts. Furthermore, the natural gas has seen under the heavy demand from sectors such as heating, electricity, and industrial processes. Also, the natural gas is seen as reducing emission than regular oil or coal, which strengthen foundation of the market earlier.

GCC Natural Gas Market Trends:

- The greater focus towards the export-oriented markets instead of local supply is positioning the industry for long term expansion. Also, earlier in GCC countries, natural gas was used only for powering homes and factories.

- Also, these countries are observed under the development of a large LNG export terminal while collaborating with Europe, Asia, and Africa these days.

- Establishment of industrial clusters around natural feedstock is actively enhancing the industry readiness and future industry capabilities. Moreover, the countries have using natural gas to make fertilizers, plastic, and chemicals in large industrial zones where the higher economic returns.

- The integration with cleaner energy sources, the natural gas manufacturers are generating value-added opportunities in the industry nowadays. Moreover, several countries have been using natural gas plants with wind, solar, and energy storage for the stable supply and lower carbon power generation in the current period, as per the latest regional survey.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 63.51 Billion / 394.8 Volume ( Billion Cubic Meter) |

| Revenue Forecast in 2035 | USD 93.33 Billion / 556.6 Volume ( Billion Cubic Meter) |

| Growth Rate | CAGR 4.37% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume ( Billion Cubic Meter) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Fuel Type, By Aircraft Type, By Application, By Region |

| Key companies profiled | BP p.l.c., ExxonMobil Corporation, TotalEnergies SE, Shell plc, Chevron Corporation , Valero Energy Corporation , Neste Corporation , Phillips 66, Marathon Petroleum Corporation, Reliance Industries Limited , PetroChina Company Limited , Sinopec (China Petro |

Smart Monitoring and AI Support Efficient Gas Flow and Lower Emissions

The market is experiencing a greater technological shift with artificial intelligence. The adoption of smart digital platforms and carbon-reducing innovations is forecasted to support the reshaping of supply and dynamics in the coming years. Real-time digital monitoring systems and artificial intelligence are enabling operators to predict maintenance needs, optimize gas flows, and minimize operational waste. Moreover, carbon capture and utilization technologies are increasingly integrated into gas plants to lower emissions.

Trade Analysis of the GCC Natural Gas Market: Import, Export, Consumption, and Production Statistics

- Qatar has exported a significant amount of natural gas to China in 2024, and the estimated trade value is around 10,595,100.46 USD as per the published report.

- Saudi Arabia has exported 2,810,020,000 Kg of natural gas globally in 2024, as per the latest survey.

Value Chain Analysis of the GCC Natural Gas Market:

- Distribution to Industrial Users: The distribution of natural gas to industrial users in the Gulf Cooperation Council (GCC) remains a cornerstone of the region's economic diversification and industrialization strategy.

- Key Players: Saudi Aramco and QatarEnergy

- Chemical Synthesis and Processing: The chemical synthesis and processing market in the Gulf Cooperation Council (GCC) is centered on transforming natural gas constituents, primarily methane, ethane, and propane, into high-value petrochemicals, fertilizers, and industrial gases.

- Key Players: SABIC (Saudi Arabia) and ADNOC (UAE)

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring in the GCC natural gas market are characterized by a shift toward mandatory greenhouse gas (GHG) reporting, digitizing enforcement through AI and IoT, and strictly aligning with international ISO standards.

- Key Agencies: Ministry of Energy (Saudi Arabia) and High Commission for Industrial Security (HCIS) (UAE)

GCC Natural Gas Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| Saudi Arabia | Ministry of Energy | SAES-A-102 for emissions standards | Aims for a 50% renewables/50% gas energy mix for power generation to free up crude oil for export |

| Qatar | QatarEnergy | Governed by QatarEnergy's internal sustainability strategy | Sustainability Strategy |

| UAE | Supreme Council for Financial and Economic Affairs (SCFEA) | UAE Climate Decree 2025 (Federal Decree-Law No. 11 of 2024) | Achieving net-zero emissions by 2050 |

Segmental Insights

Product Insights

How did the Conventional Natural Gas Segment Dominate the GCC Natural Gas Market in 2025?

The conventional natural gas segment dominated the market with approximately 54.43% share in 2025, due to factors like easy extraction, greater availability, and reliability. Moreover, having a lower production cost with limited risk, the conventional natural gas segment has gained major industry attention in recent years in the market.

The unconventional gas segment is expected to grow with a rapid CAGR, owing to the reduction of easy gas and the rising demand. Moreover, the GCC countries have seen in shifting towards shale gas and deep has to future security. Also, the technology shift has played a major role in the segment growth while minimizing the cost and risk of production in the past few years.

GCC Natural Gas Market Volume and Share, By Product Type, 2025 (%)

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Conventional Natural Gas | 54.43% | 206.8 | 291.2 | 3.87% | 52.32% |

| Unconventional Gas | 6.13% | 23.3 | 38.2 | 5.66% | 6.87% |

| Liquefied Natural Gas (LNG) | 27.84% | 105.8 | 156.5 | 4.45% | 28.12% |

| Natural Gas Liquids (NGLs) | 11.60% | 44.1 | 70.6 | 5.38% | 12.69% |

Form Insights

Why does the Pipeline Natural Gas Segment Dominate the GCC Natural Gas Market?

The pipeline natural gas segment dominated the market with approximately 55% share in 2025, owing to its strong integration with domestic energy systems. Power generation, water desalination, and industrial operations rely heavily on pipeline gas for an uninterrupted supply. Long-term infrastructure investment has strengthened the pipeline network in recent years.

The liquefied natural gas (LNG) segment is expected to grow at a rapid CAGR akin to its strategic importance in global energy trade. LNG provides supply flexibility and supports energy security for importing countries. GCC producers benefit from LNG by expanding exports beyond pipeline-connected regions. This makes LNG a key growth driver in the natural gas market.

End Use Insights

How did the Power Generation Segment Dominate the GCC Natural Gas Market in 2025?

The power generation segment dominated the market with approximately 55% share in 2025, akin to ongoing electricity demand. Natural gas offers efficient and cleaner power generation compared to oil. Gas-based power plants support grid stability and a continuous electricity supply. This made power generation the largest consumer of natural gas across the GCC region.

The industrial feedstock segment is expected to grow with a rapid CAGR, due to expanding manufacturing activities. Natural gas is used to produce chemicals, fertilizers, and hydrogen. These applications create higher economic value than power generation. As industries expand, gas demand for feedstock will increase steadily.

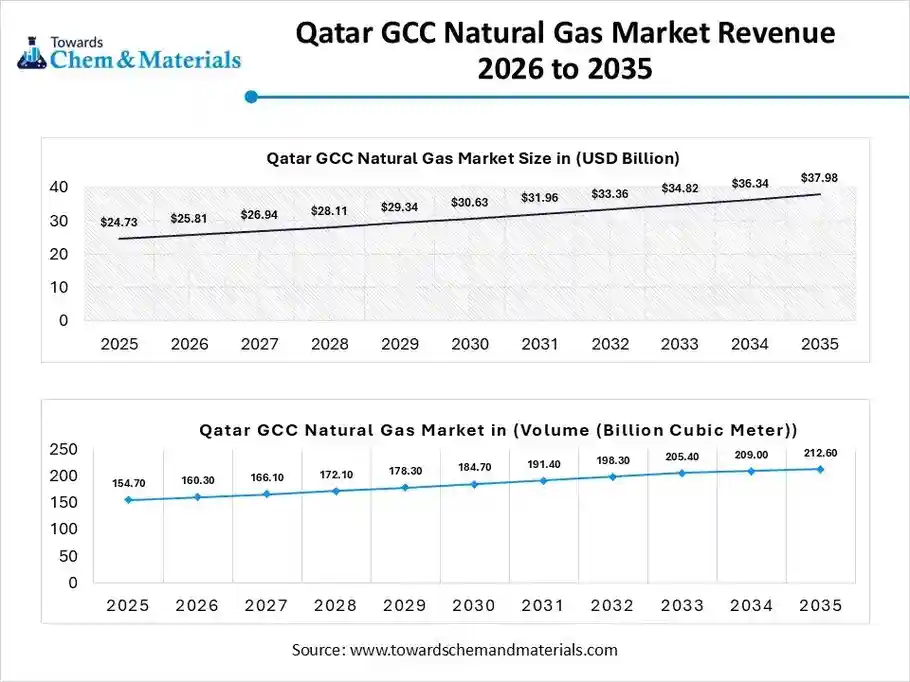

Country Insights

The Qatar GCC natural gas market size was valued at USD 24.73 billion in 2025 and is expected to be worth around USD 37.98 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.39% over the forecast period from 2026 to 2035.

The Qatar GCC natural gas market volume was estimated at 154.7 Billion Cubic Meter in 2025 and is projected to reach 212.6 Billion Cubic Meter by 2035, growing at a CAGR of 3.60% from 2026 to 2035. Qatar dominated with 40.70% share in the market in 2025, owing to the greater focus on export readiness and scale. Moreover, when other GCC countries are using natural gas locally, where the Qatar has seen the development of LNG export terminals. Moreover, with the heavy investments towards the advanced liquefaction plants and enlarged gas field, the country has allowed stakeholders to capitalize on growth opportunities in recent years.

Saudi Arabia’s Diversification Drive Fuels Rapid Growth

Saudi Arabia is expected to capture a major share of the market with a rapid CAGR, akin to the country’s focus on diversification and industrial expansion. Also, the country is developing gas resources to support petrochemicals, manufacturing, and clean energy projects. Moreover, growing domestic demand ensures stable gas consumption, encouraging continuous investment.

GCC Natural Gas Market Volume and Share, By Region, 2025-2035 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Qatar | 40.70% | 154.7 | 212.6 | 3.60% | 38.20% |

| Saudi Arabia | 28.40% | 107.9 | 169.3 | 5.13% | 30.41% |

| United Arab Emirates | 13.50% | 51.3 | 75.4 | 4.37% | 13.55% |

| Rest of MEA | 17.40% | 66.1 | 99.3 | 4.62% | 17.84% |

Recent Developments

- In December 2025, Saudi Arabia started heavy production of natural gas in their giant Jafurah project. Also, Saudi Aramco has invested in the construction of this giant plant as per the published report.(Source: oilprice.com)

Top Vendors in the GCC Natural Gas Market & Their Offerings:

- QatarEnergy: The state-owned energy giant of Qatar and the world’s leading LNG producer, currently executing the North Field expansion to maintain its status as a top global exporter of natural gas.

- Saudi Aramco: As the world's largest integrated energy and chemicals company, Aramco manages Saudi Arabia's vast hydrocarbon reserves and is aggressively expanding its domestic gas production to diversify the national energy mix.

- ADNOC Gas: A majority-owned subsidiary of the Abu Dhabi National Oil Company, it operates one of the largest gas processing systems in the world, providing a critical energy supply to industrial and residential users across the UAE.

- Oman LNG: A joint venture company based in Sur, Oman, that specializes in the liquefaction and export of natural gas, playing a vital role in the Sultanate's economy and its strategic energy partnerships.

Top Companies in the GCC Natural Gas Market

- Oman LNG

- ADNOC Gas

- QatarEnergy

- Saudi Aramco

- Kuwait Petroleum Corporation (KPC)

- Bapco Energies

- Dolphin Energy

- Shell plc

- ExxonMobil

- TotalEnergies

- Eni S.p.A.

- BP p.l.c.

- Dana Gas

- Crescent Petroleum

- TAQA

Segments Covered in the Report

By Product Type (Resource Type)

- Conventional Natural Gas

- Unconventional Gas

- Liquefied Natural Gas (LNG)

- Natural Gas Liquids (NGLs)

By Form

- Pipeline Gas

- Liquefied (LNG)

- Compressed (CNG)

By End-Use Application

- Power Generation

- Industrial Feedstock

- Industrial Fuel

- Residential & Commercial

- Transportation

By Country

- Qatar

- Saudi Arabia

- United Arab Emirates (UAE)

- Rest of MEA