Content

Plasticizers Market Size and Growth 2025 to 2034

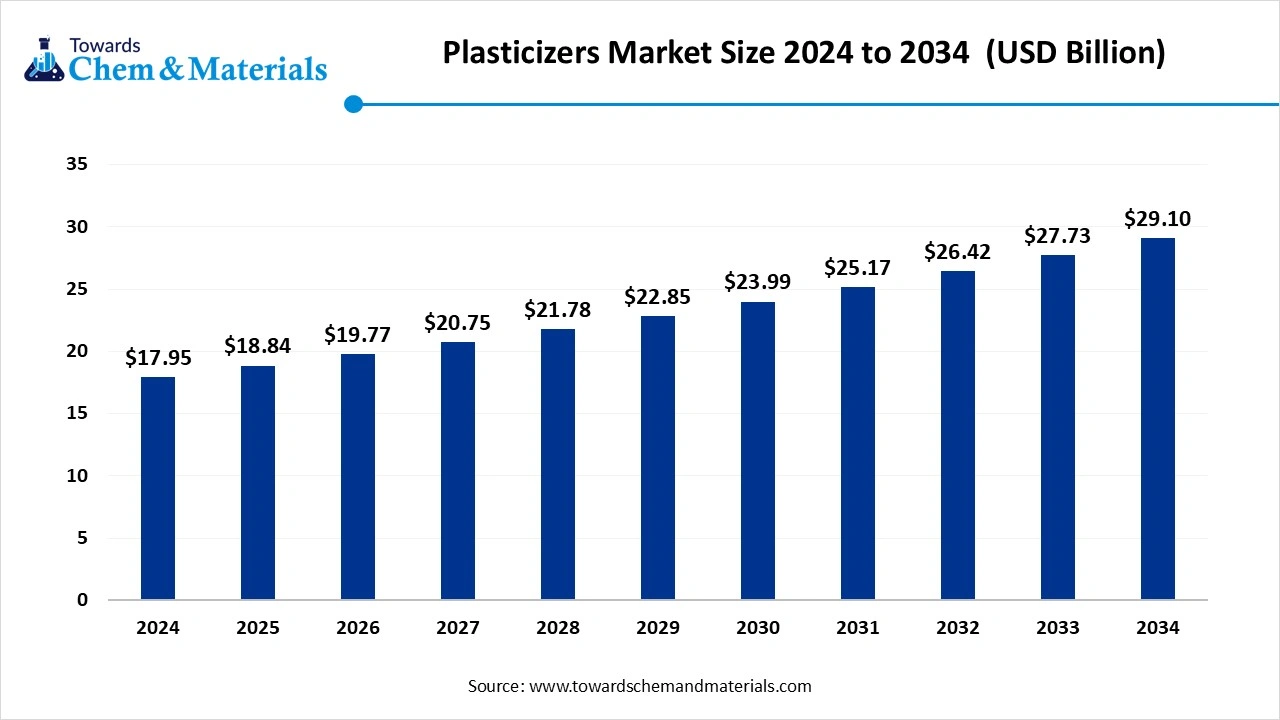

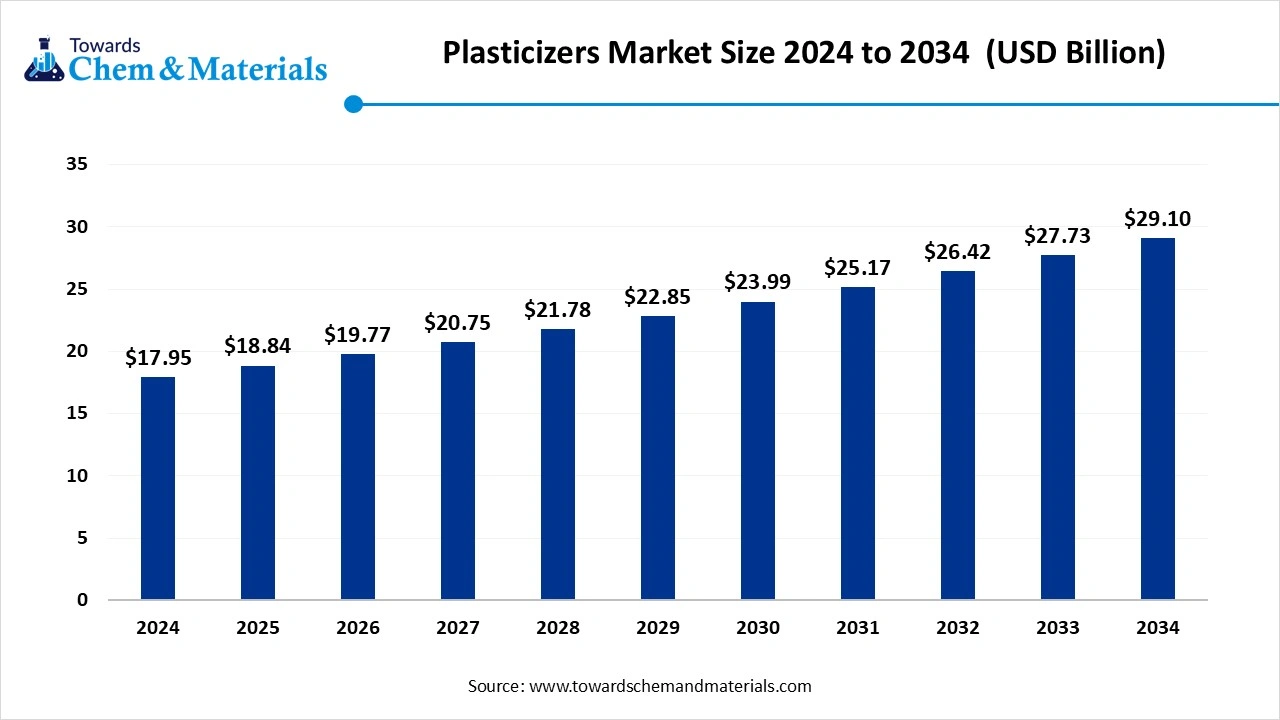

The global plasticizers market size was reached at USD 17.95 billion in 2024 and is expected to be worth around USD 29.10 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.95% over the forecast period 2025 to 2034. The growth of the market is driven by the rising construction activities due to rapid urbanization and industrialization, which influences the growth of the market.

Key Takeaways

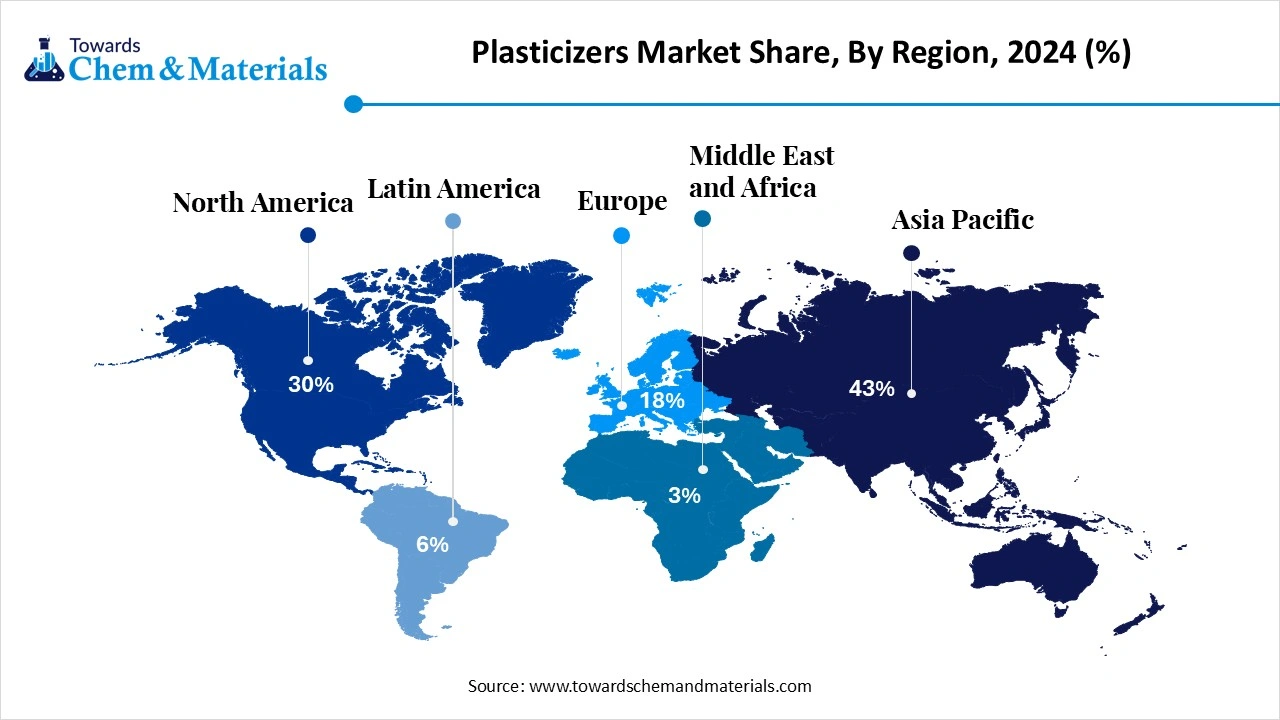

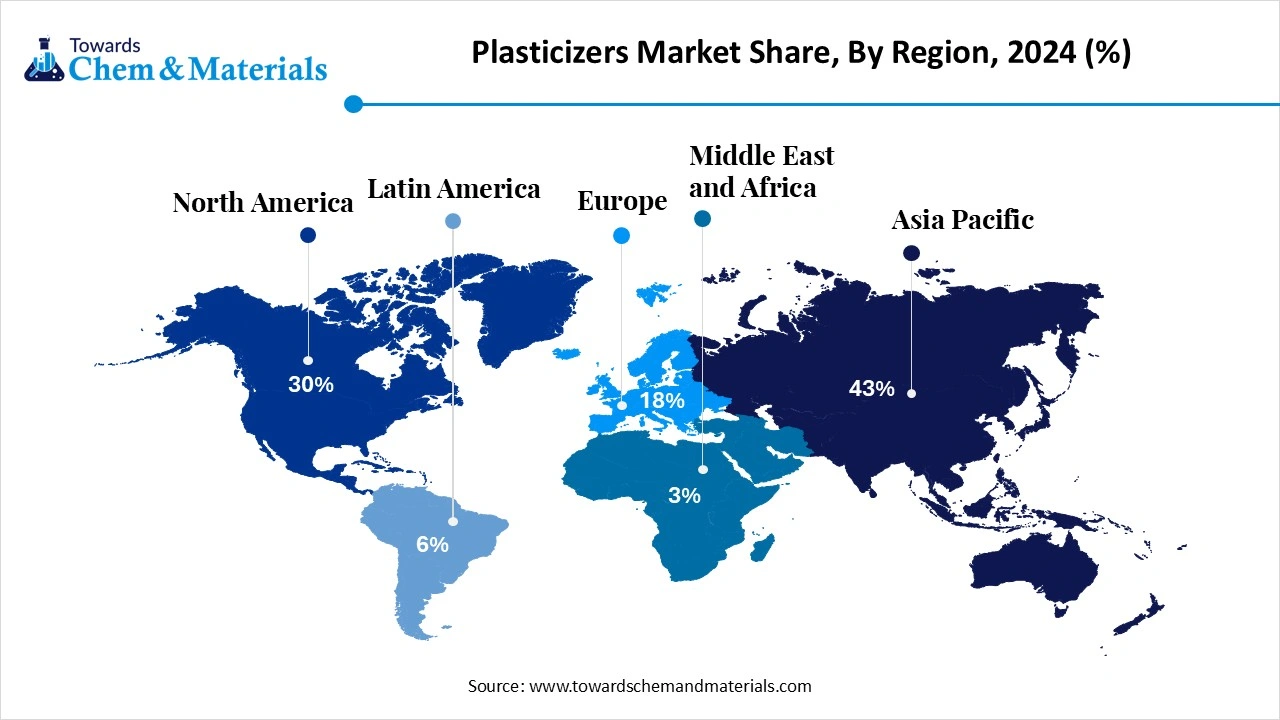

- By region, Asia Pacific dominated the market in 2024 and is expected to maintain the same position in the forecasted period. The plastic segment held a 43% share in the market in 2024. The government initiatives in the region support the growth of the market.

- By region, North America is expected to experience notable growth in the market. The growth of the market is driven by the focus on sustainability.

- By type, the phthalate plasticizers segment dominated the market in 2024. The phthalate plasticizers segment held a 57% share in the market in 2024. Demand from various sectors influences the growth of the market.

- By type, the bio-based & non-phthalate plasticizers segment is expected to grow significantly in the market during the forecast period. The Growing shift towards sustainability boosts the growth.

- By polymer type, the PVC segment dominated the market in 2024. The PVC segment held a 72% share in the market in 2024. The key properties offered fuel the growth of the market.

- By polymer type, the polyurethanes & rubber segment is expected to grow in the forecast period. Enhanced flexibility makes it a preferred choice, influencing the growth.

- By application, the wires & cables segment dominated the market in 2024. The wires & cables segment held a 31% share in the market in 2024. The bending and flexibility offered drive the demand.

- By application, the medical devices & automotive upholstery segment is expected to grow in the forecast period. The growing adoption due to the benefits offered drives the growth.

- By end use, the construction segment dominated the market in 2024. The construction segment held a 39% share in the market in 2024. The growing sector and material demand fuel the growth.

- By end use, the healthcare & electronics segment is expected to grow in the forecast period. Demand for biobased alternatives influences the growth.

Market Overview

Rising Demand For Durable Materials: Plasticizers Market To Expand

The plasticizers Market includes the production, distribution, and application of chemical additives used to increase the flexibility, workability, and durability of plastics, particularly polyvinyl chloride (PVC). Plasticizers are essential for making rigid polymers softer and easier to process, and they are widely used in construction materials, automotive interiors, wires and cables, packaging, medical devices, and flooring. The market is shaped by environmental and regulatory pressures, growing demand in Asia-Pacific, innovation in bio-based alternatives, and a global push toward safer, non-phthalate formulations.

What Are The Key Growth Drivers That Support The Growth Of The Plasticizers Market?

The growth of the market is driven by the growing industrialization and urbanization, the growing construction industry, which leads to increased demand for flexible PVC materials used in construction for pipes, wall covering, flooring, and roofing, which influences the growth. Other key drivers are expanding automotive industries, flexible packaging demand, shift towards non-phthalate plasticizers, and wire and cable applications, which drive the growth of the market. The government initiatives for infrastructure development, like the development of smart cities and green buildings, fuel the growth of the market.

Market Trends

- The growing demand for bio-plasticizers is due to the increasing demand from various industries fuels the growth of the market.

- The increasing demand for the construction and automotive industries increased the demand and production, fueling the growth of the market.

- Shift to non-phthalate and bio-based plasticizers due to growing awareness fuels the growth of the market.

- Growing in the packaging sector to enhance flexibility, resilience, and strength fuels the growth of the market.

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Plasticizers Market?

The key growth opportunities that support the growth of the market are the growing and rapid industrialization, like growth in the automotive, packaging, and construction industries, driving the growth of the market. The automotive sector demand for PVC and other plasticizers for manufacturing various components like dashboard, door panels, and interiors, which increases the growth of the market. The packaging industry demand for bio-based packaging materials amid growing environmental concerns which driving the demand. These factors increase the growth and expansion of the market.

Market Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 18.84 Billion |

| Expected Size by 2034 | USD 29.1Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Polymer/Application Type, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | Weyerhaeuser, Dewitt Products LLC, Arauco, Gemini Particleboard Pvt Ltd, Norbord, Pine Wood Canada, Wood Resources International LLC, Finsa, Shannon Wood Products, Sukup Manufacturing Co Kronospan Biesse SpA Veneer Products Ltd, Panel Processing Inc |

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The Market?

The key challenge that hinders the growth of the market is the regulatory and environmental concerns, phthalate restrictions, and compliance complexity, are the factors which limit the growth of the market. The price volatility, high cost of eco-friendly options, and supply chain disruption are some of the key factors that hinder the growth and expansion of the market.

Regional Insights

How Did Asia Pacific Dominate The Plasticizers Market In 2024?

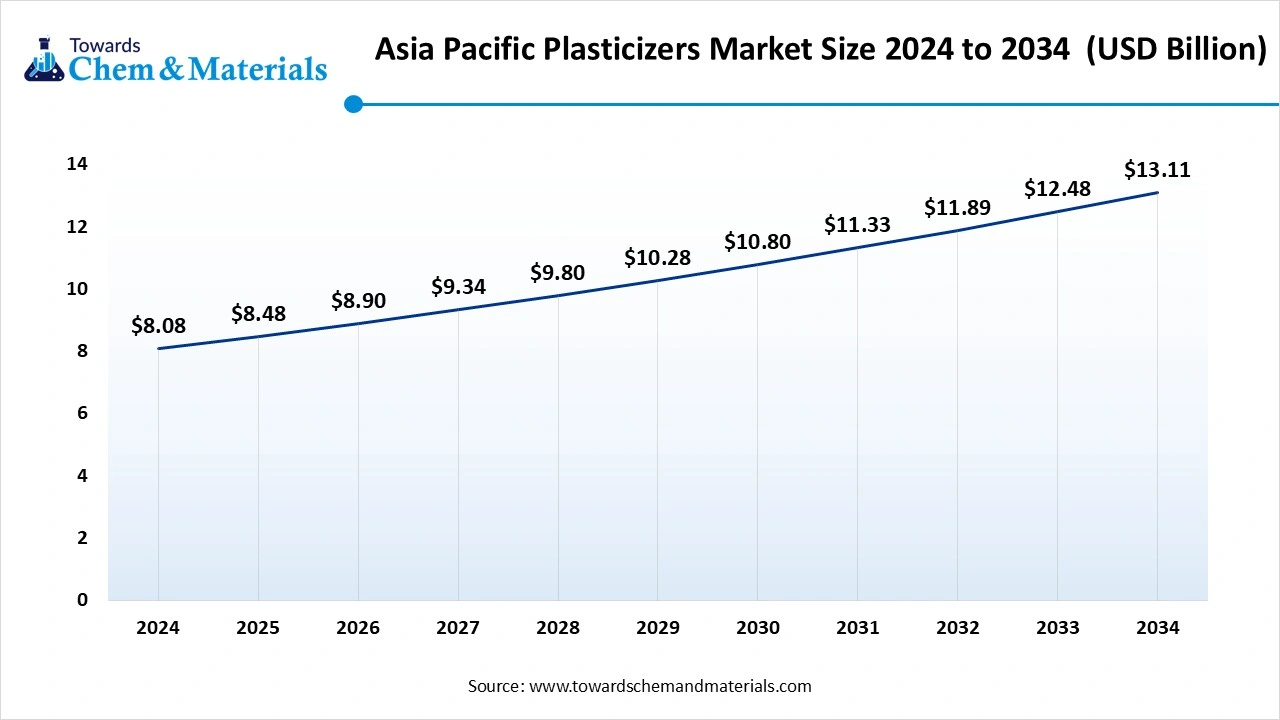

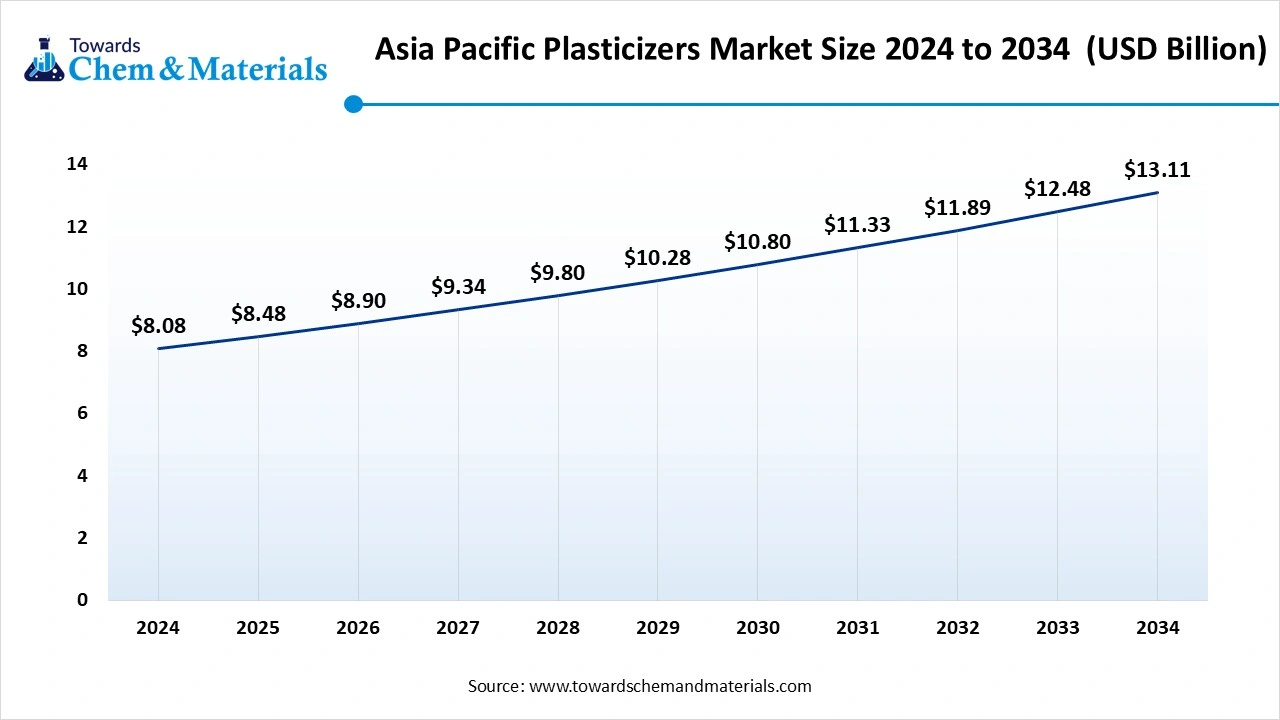

The Asia Pacific plasticizers market size was estimated at USD 8.08 billion in 2024 and is anticipated to reach USD 13.11 billion by 2034, growing at a CAGR of 4.96% from 2025 to 2034. Asia Pacific dominated the plasticizers market in 2024 and is expected to maintain the same position in the forecast period.

The growth of the market is driven by the growing government initiatives like Made in China 2025, Make in India Initiatives, which influence the growth of the market in the region. The growth in the region is seen due to an increasing shift towards the use of bio-plasticizers, due to the growing adoption of eco-friendly alternatives, which supports the growth of the market. The strong demand for flexible PVC due to rapid industrialization and growing sectors in the region, like automotive, construction, electronics, and packaging, which are the major consumers of the plasticizers, supports the growth and expansion of the market in the region.

India Has Seen Significant Growth, Driven By Infrastructure Development Projects.

The growth of the market is driven by the growing infrastructure development projects in the country by the government for smart and green initiatives in the country, which demand plasticizers in construction, which drives the growth of the market. The key applications are wires and cables, flooring and wall coverings, films and sheets, and coatings. The key players like Aarti Industries Limited, KLJ Group, OXEA Chemicals, and BASF India also play a major role in the growth of the market in the country and support expansion.

North America Has Seen Growth In The Market Due To An Increasing Focus On Sustainability

North America is expected to experience notable growth in the market during the forecast period. The growth of the market is driven by the growing demand and focus on sustainability, like the use of bio-based plasticizers and non-phthalate alternatives, due to rising environmental concerns and rising environmental awareness in the region, which supports the growth of the market. The key players like BASF SE, Eastman Chemical Co, and Exxon Mobil Corp play a major role in the growth by developing and manufacturing innovative and eco-friendly products, which increases the demand.

The U.S. Has Seen A Steady Growth In The Market, Driven By The Growing Sectors In The Country

The growth of the market in the US is driven by the increasing demand from various sectors for materials like construction, automotive, and electronics, as they are the major consumers of the plasticizers, especially packaging, which fuels the growth of the market in the country. The stringent environmental regulations increase the focus on sustainable and eco-friendly alternatives and increase demand for non-phthalate and bio-based plasticizers due to growing environmental awareness and regulatory pressure, fueling the growth and expansion of the market in the country. Other key drivers that support growth in the country are advancements in green chemistry and biotechnology, infrastructure development, and a strong industrial base.

- The world shipped out 1,119,208 Plasticizers shipments from November 2023 to October 2024 (TTM). These exports were done by 92,573 global exporters to 501,658 buyers, showing a growth rate of 73% over the last year.(Source: www.volza.com )

- Globally, China, the United States, and Vietnam are the top three exporters of Plasticizers. China is the global leader in Plasticizers exports with 1,620,875 shipments, followed closely by the United States with 231,695 shipments, and Vietnam in third place with 162,337 shipments.(Source: www.volza.com)

Segmental Insights

Type Insights

Which Type Segment Dominated The Plasticizers Market In 2024?

The phthalate plasticizers segment dominated the market in 2024. Phthalate plasticizers have traditionally dominated the market due to their cost-effectiveness, high performance, and compatibility with PVC. Widely used in construction, automotive, and consumer goods, they offer excellent flexibility and durability. Demand persists in industrial sectors, where performance requirements often outweigh regulatory limitations.

The bio-based & non-phthalate plasticizers segment expects significant growth in the plasticizers market during the forecast period. Biobased and non-phthalate plasticizers are gaining traction as safer, sustainable alternatives to traditional phthalates. Derived from renewable sources like soybean oil or citrates, these plasticizers offer comparable flexibility and performance while meeting stringent environmental and health regulations. Demand is rising across healthcare, food packaging, and children’s products due to increasing consumer awareness and regulatory pressure. Their adoption is also supported by global sustainability initiatives and green building certifications.

Polymer Type Insights

How Did PVC Segment Dominated The Plasticizers Market In 2024?

The PVC segment dominated the market in 2024. The growth of the market is driven by the growing use and properties of materials like flexibility, processing, and durability, which increases the growth of the market due to rising demand. The safety regulations and alternatives also support the growth. It makes PVC more flexible, reduces melt viscosity, lowers glass transition temperature, which makes it an ideal material for manufacturers which supporting the growth and expansion of the market.

The polyurethanes & rubber segment expects significant growth in the plasticizers market during the forecast period. The growth of the market is driven by the properties that are enhanced by the plasticizers, like enhanced flexibility, reduced hardness, low temperature performance, and processability. The growing application in automotive and medical makes it a preferred choice by many, which influences the growth and expansion of the market.

Application Insights

Which Application Segment Dominated The Plasticizers Market In 2024?

The wires & cables segment dominated the market in 2024. The key factors like increased flexibility, improved processing, enhanced durability, temperature rating, flexibility needs, and resistance to environmental factors boost the growth of the market due to increasing demand. The ability to bend without breaking makes it suitable for various applications like electrical insulation and sheathing, increasing the demand and influencing the growth and expansion of the market.

The medical devices & automotive upholstery segment expects significant growth in the plasticizers market during the forecast period. The flexibility, softness, performance factors like low fogging, viscosity are important considerations when selecting plasticizers for automotive applications, which increases the demand, supporting the growth. IV bags, tubing, catheters, feeding tubes, blood bags, and some types of medical gloves often utilize plasticizers. This application boosts the growth of the market.

End-Use Industry Insights

How Did the Construction Segment Dominate the Plasticizers Market In 2024?

The construction segment dominated the market in 2024. The construction industry is a major consumer of plasticizers, primarily in PVC-based products such as roofing membranes, cables, pipes, flooring, and wall coverings. Plasticizers rising the durability, flexibility, and workability of materials, makes it suitable for diverse construction applications. Growing urbanization, infrastructure development, and demand for energy-efficient buildings are driving the use of advanced and eco-friendly plasticizers that comply with regulatory norms and support long-lasting structural performance.

The healthcare & electronics segment expects significant growth in the plasticizers market during the forecast period. Plasticizers play a crucial role in healthcare and electronics by enhancing the flexibility and performance of materials used in medical devices, cables, connectors, and insulation. In healthcare, they are vital for blood bags, tubing, and IV containers, requiring biocompatibility and safety. In electronics, plasticizers improve the heat resistance and durability of wire coatings. The shift toward non-phthalate and bio-based plasticizers is gaining momentum amid rising safety and regulatory concerns.

Recent Developments

- In October 2024, a study was published in the journal Chem. Researchers have developed more durable and sustainable PVC products. They developed a novel method for strengthening PVC products, aligning with the goal.(Source : news.osu.edu)

- In June 2025, German firm Covestro launched production of its new Desmopan® Rx medical-grade Thermoplastic Polyurethane (TPU) at its Changhua site in Taiwan, which has recently been qualified for medical-grade TPU manufacturing.(Source: www.chemanalyst.com)

Top Companies List

- Weyerhaeuser

- Dewitt Products LLC

- Arauco

- Gemini Particleboard Pvt Ltd

- Norbord

- Pine Wood Canada

- Wood Resources International LLC

- Finsa

- Shannon Wood Products

- Sukup Manufacturing Co

- Kronospan

- Biesse SpA

- Veneer Products Ltd

- Panel Processing Inc

Segments Covered

By Type

- Phthalate Plasticizers

- Di(2-ethylhexyl) phthalate (DEHP/DOP)

- Diisononyl phthalate (DINP)

- Diisodecyl phthalate (DIDP)

- Non-Phthalate Plasticizers

- Di-isononyl cyclohexane-1,2-dicarboxylate (DINCH)

- Adipates (e.g., DOA, DINA)

- Sebacates

- Trimellitates (TOTM, TINTM)

- Bio-Based & Green Plasticizers

- Epoxidized soybean oil (ESBO)

- Citrates

- Succinates

- Castor oil derivatives

By Polymer/Application Type

- Polyvinyl Chloride (PVC)

- Rubber

- Acrylics

- Polyurethanes

- Cellulose Acetate

By Application

- Wires & Cables

- Flooring & Wall Coverings

- Automotive Interiors & Upholstery

- Medical Devices

- Consumer Goods

- Adhesives & Sealants

- Packaging

- Construction Materials

By End-Use Industry

- Construction & Infrastructure

- Automotive & Transportation

- Medical & Healthcare

- Electrical & Electronics

- Consumer Goods

- Packaging

- Industrial Manufacturing

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait