Content

What is the Current Blue Hydrogen Market Size and Volume?

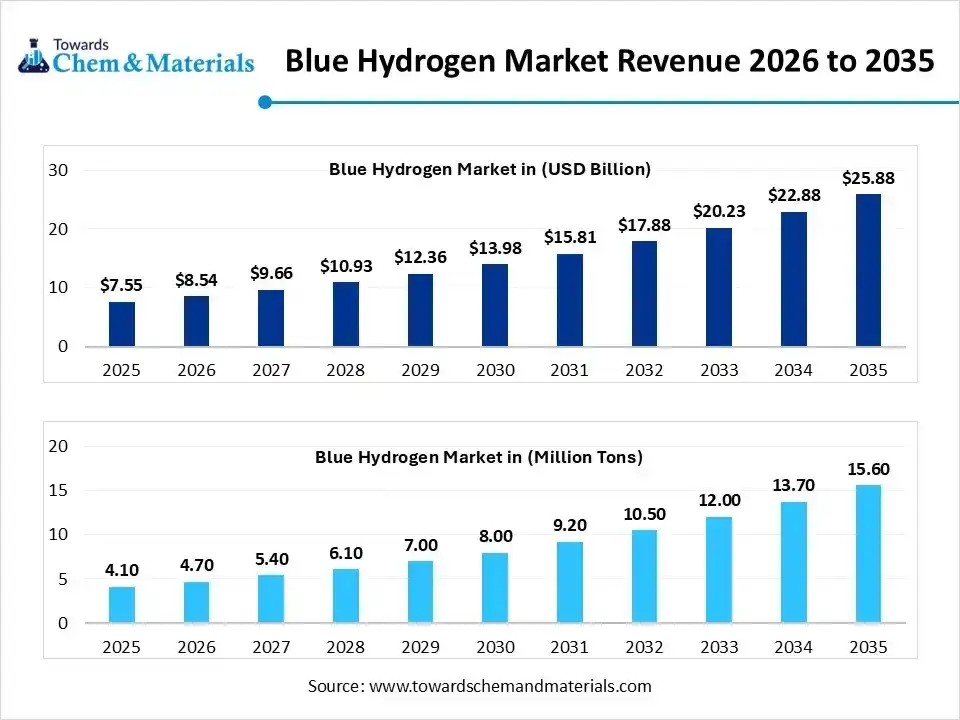

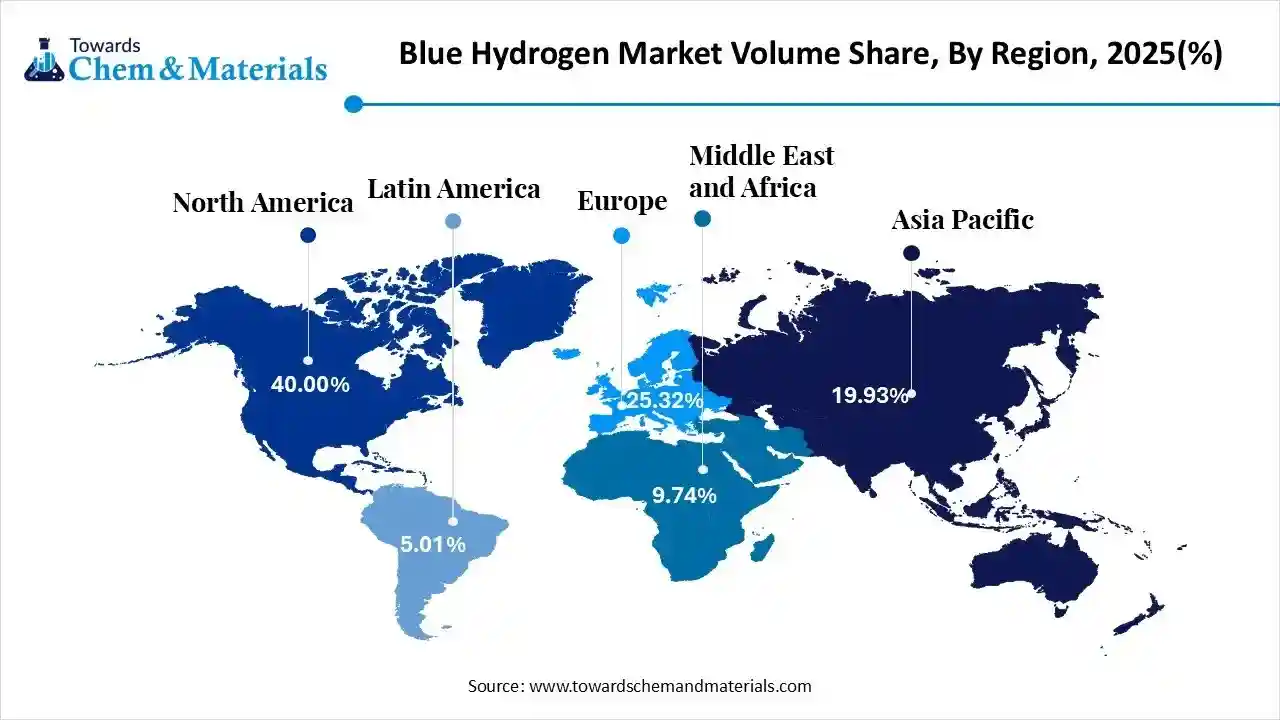

The global blue hydrogen market size was estimated at USD 7.55 billion in 2025 and is expected to increase from USD 8.54 billion in 2026 to USD 25.88 billion by 2035, growing at a CAGR of 13.11% from 2026 to 2035. In terms of volume, the market is projected to grow from 4.10 million tons in 2025 to 15.60 million tons by 2035. growing at a CAGR of 14.30% from 2026 to 2035. North America dominated the blue hydrogen market with the largest volume share of 40% in 2025. The growth of the market is driven by global decarbonization goals, government net-zero targets, and the need for cleaner energy alternatives.

The global blue hydrogen market consists of hydrogen produced primarily from natural gas via Steam Methane Reforming or Auto Thermal Reforming, combined with Carbon Capture and Storage technology. Demand is driven by the global transition toward Net-Zero emissions, where blue hydrogen serves as a critical "bridge fuel" until green hydrogen becomes cost-competitive at scale. It is essential for decarbonizing "hard-to-abate" sectors such as heavy industry, long-haul shipping, and chemical manufacturing.

Key Takeaways

- By region, North America led the blue hydrogen market held the volume share of around 40% in 2025. The region's large-scale investments drive the growth of the market.

- By region, Asia Pacific is expected to have fastest growth in the market in the forecast period between 2026 and 2035. The growth of the market in the region is driven by rapid industrialization.

- By technology, the steam methane reforming segment led the market with the largest volume share of 75% in 2025.The growth of infrastructure development and production technology drives the growth.

- By technology, the auto thermal reforming segment is projected to grow at a CAGR between 2026 and 2035. The improved carbon capture integration drives the growth.

- By end use, the petroleum refineries segment led the market with the largest volume share of 45% in 2025. The regulatory pressure and other advanced processing drive the growth of the market.

- By end use, the chemical industry segment is projected to grow at a CAGR between 2026 and 2035. Rising demand for low-carbon chemicals increases the demand.

- By transportation, the pipeline segment accounted for the largest volume share of 55% in 2025. Cost-effectiveness and a scalable method increase the demand.

- By transportation, the cryogenic liquid tankers segment is projected to grow at a CAGR between 2026 and 2035. The flexibility and support of cross-border support the growth of the market.

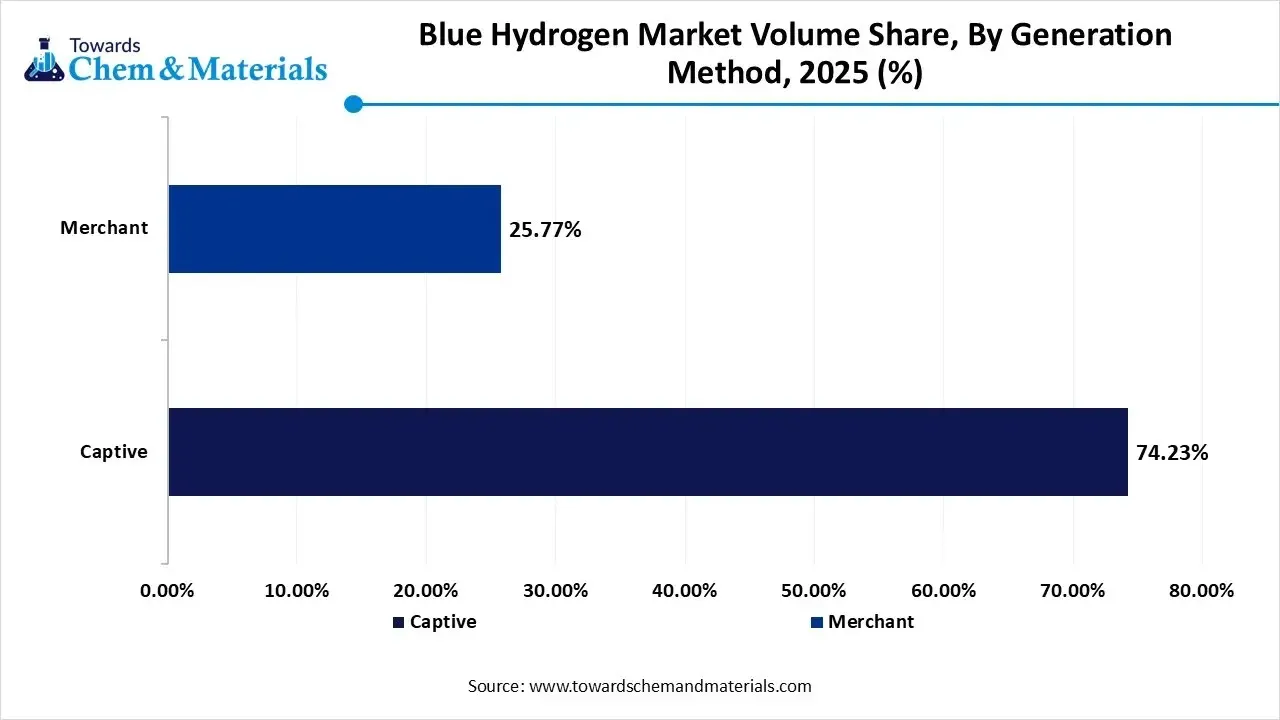

- By generation, the captive segment dominated with the largest volume share of 60% in 2025. Reduced transportation cost and better integration fuels the growth of the market.

- By generation, the merchant segment is projected to grow at a CAGR between 2026 and 2035. Long-term agreements and government initiatives drive the growth of the market.

What Is The Significance Of The Blue Hydrogen Market?

The significance of the blue hydrogen market lies in its role as a bridge fuel for decarbonization, providing a low-carbon energy source from natural gas using Carbon Capture & Storage to meet urgent net-zero goals, especially in heavy industries like refining, steel, and power generation, offering immediate scale and cost-effectiveness while infrastructure for green hydrogen develops, supporting fuel cell vehicles, and driving innovation in sustainable energy systems.

Blue Hydrogen Market Growth Trends:

- Technology Shift: Moving from Steam Methane Reforming retrofits to larger Autothermal Reforming plants for better CO2 capture, especially for export-focused blue ammonia/methanol.

- CCUS Integration: Heavy investment in Carbon Capture, Utilization, and Storage is crucial, with significant demand.

- Strategic Partnerships: Energy giants are forming JVs and supply agreements to build large-scale projects, often co-located with carbon transport/storage.

- Shifting Investor Sentiment: Speculative investment has cooled; investors now prioritize revenue, off-take agreements, and realistic financial models, pushing for phased development.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 8.54 Billion / 4.70 Million Tons |

| Revenue Forecast in 2035 | USD 25.88 Billion / 15.60 Million Tons |

| Growth Rate | CAGR 13.11% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Technology (Production Method), By Generation Method, By Transportation & Storage Mode, By End-Use Application, By Region |

| Key companies profiled | Air Products and Chemicals, Inc. (USA), Linde plc (Ireland/USA), Shell plc (UK/Netherlands), BP plc (UK), Air Liquide (France), ExxonMobil Corporation , Saudi Aramco , Equinor ASA , TotalEnergies SE , Technip Energies N.V. , Siemens Energy AG , Mitsubishi Heavy Industries, Ltd. , Topsoe A/S , Engie S.A. , Uniper SE , Suncor Energy Inc. , Woodside Energy Group , Chevron Corporation , Reliance Industries Limited , Iwatani Corporation |

Key Technological Shifts In The Blue Hydrogen Market:

Key tech shifts in blue hydrogen focus on upgrading existing Steam Methane Reforming with better Carbon Capture, moving towards more efficient Autothermal Reforming for large-scale projects, integrating advanced catalysts/materials for higher yields, and exploring novel feedstocks like biogenic methane to reduce fossil fuel reliance, all aimed at lowering costs and increasing CCUS effectiveness for truly low-carbon hydrogen.

Trade Analysis Of the Blue Hydrogen Market: Import & Export Statistics

- According to India Export data, India has shipped 839 shipments of Compressed Gas Hydrogen, exported by 6 Indian exporters to 133 buyers. The main destinations include the United Arab Emirates, Brazil, and Egypt.

- Globally, the leading exporters are India, the United States, and Vietnam, with India accounting for 837 shipments, followed by the United States with 552, and Vietnam with 272 shipments.

- Additionally, from January 2023 to December 2024, India exported 4 shipments of Hydrogen Generators, by 2 Indian exporters to 2 buyers.

- The majority of the exports from India destined to Bahrain, the United States, and Russia.

- Worldwide, China, the United States, and South Korea are the top exporters of Hydrogen Generators, with China leading at 253 shipments, the United States at 106, and South Korea at 66 shipments.

Blue Hydrogen Market Value Chain Analysis

- Production and Processing: Blue hydrogen is produced through processes such as steam methane reforming or autothermal reforming combined with carbon capture, utilization, and storage. Processing includes hydrogen purification, CO₂ separation, compression, transport, and storage to reduce lifecycle carbon emissions.

- Key players: Air Products and Chemicals Inc., Shell plc, Linde plc, Air Liquide, ExxonMobil

- Quality Testing and Certification: Blue hydrogen requires certifications for hydrogen purity, carbon intensity, safety, and environmental compliance. Key certifications include ISO hydrogen standards, low-carbon hydrogen certification schemes, carbon capture verification, and compliance with national clean energy regulations.

- Key players: ISO (International Organization for Standardization), CertifHy, TÜV SÜD, UL Solutions.

- Distribution to Industrial Users: Blue hydrogen is distributed to refineries, chemical manufacturers, power generation facilities, industrial heating applications, and hydrogen fueling infrastructure as a transitional low-carbon energy source.

- Key players: Air Liquide, Linde plc, Air Products, Shell plc.

Blue Hydrogen Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA & Canada) | U.S. Department of Energy (DOE) U.S. Environmental Protection Agency (EPA) Internal Revenue Service (IRS) / Treasury |

Inflation Reduction Act (IRA) — Clean Hydrogen Production Tax Credit (45V) EPA Clean Air Act (GHG reporting, emissions) DOE hydrogen & clean energy funding programs Canada: Clean Fuel Regulations (CFR), Clean Electricity Regulations (CER) |

Low-carbon hydrogen certification & tax incentives Methane emissions/ flaring control Carbon capture, utilization & storage (CCUS) regulation |

The IRA in the U.S. provides powerful tax credits for low-carbon hydrogen, especially with strong methane/CO₂ controls. Canada’s CFR/CER frameworks create demand for low-CI hydrogen, including blue hydrogen. |

| Europe | European Commission EU Member State Energy & Environment Agencies |

EU Hydrogen Strategy & Renewable/Low-Carbon Fuel Standards (part of RED III/IV) EU Emissions Trading System (EU ETS) National CCUS and hydrogen roadmaps (Germany, Netherlands, etc.) |

Lifecycle carbon intensity standards CCUS permitting & transport pipelines Integration into transport and industrial sectors |

Europe is integrating hydrogen into key decarbonization plans; blue hydrogen must demonstrate low lifecycle emissions and often pair with CCUS to meet RED certification. |

| Asia Pacific | China NDRC/NEA/MEE Japan METI / MOE South Korea MoE / MOTIE India Ministry of Power/Ministry of New & Renewable Energy (MNRE) |

National hydrogen strategies Clean energy & industrial policy directives CCUS development policies |

Support for hydrogen production (blue & green) Carbon capture deployment Infrastructure & industrial integration |

Many APAC nations include hydrogen in long-term energy plans; China & Japan support CCUS and low-carbon hydrogen production pilots; South Korea’s Hydrogen Economy Roadmap includes incentives. |

| South America | Brazil Ministry of Mines & Energy Chile Ministry of Energy Argentina Ministry of Energy |

National hydrogen strategies (emerging) Clean energy and renewable integration laws |

Blue hydrogen pilots Combined blue/green hydrogen incentives Export industry potential (Chile, Brazil) |

South America is emerging with national plans for hydrogen hubs; blue hydrogen is part of broader clean hydrogen discussions with a focus on export markets and CCUS. |

| Middle East & Africa | UAE Ministry of Energy & Infrastructure Saudi Ministry of Energy South African Department of Mineral Resources & Energy |

National decarbonization strategies (Vision 2030, Net Zero by 2070) Emerging hydrogen policies CCUS and industrial decarbonization frameworks |

Hydrogen exports CCUS deployment Industrial sector decarbonization |

Gulf states are positioning to be clean hydrogen (blue + green) exporters; CCUS investment is a key part of enabling blue hydrogen economics, especially in oil & gas sectors. |

Segmental Insights

Technology Insights

Which Technology Segment Dominated The Blue Hydrogen Market In 2025?

The steam methane reforming segment dominated the market, accounting for approximately 75% of the market volume share in 2025. Steam methane reforming is the most established technology for blue hydrogen production, leveraging natural gas as a feedstock while integrating carbon capture and storage systems to reduce emissions. Its commercial maturity, existing infrastructure compatibility, and relatively lower production costs make SMR the dominant choice for large-scale blue hydrogen projects, particularly in regions with strong natural gas availability and CCS capabilities.

The auto thermal reforming segment is projected to grow at a CAGR between 2026 and 2035 in the market. Auto thermal reforming combines partial oxidation and steam reforming in a single reactor, enabling higher CO₂ capture rates compared to SMR. ATR is increasingly preferred for next-generation blue hydrogen facilities due to its efficiency, compact plant design, and improved carbon capture integration. This technology is gaining traction in industrial decarbonization projects and government-backed hydrogen hubs aiming for near-zero carbon intensity.

Transportation Insights

Which Transportation Segment Dominated The Blue Hydrogen Market In 2025

The pipeline segment dominated the market, accounting for approximately 55% of the market volume share share in 2025. Pipeline transportation is the most cost-effective and scalable method for distributing blue hydrogen over long distances. Existing natural gas pipeline infrastructure can often be repurposed or blended with hydrogen, reducing capital expenditure. Pipeline-based transport supports stable supply to industrial clusters, refineries, and power plants, making it a preferred option in regions developing integrated hydrogen ecosystems.

The cryogenic liquid tankers segment is projected to grow at a CAGR between 2026 and 2035 in the market. Cryogenic liquid tankers are used for transporting blue hydrogen where pipeline infrastructure is unavailable or uneconomical. This mode offers flexibility and supports cross-border or remote distribution but involves higher costs due to liquefaction and specialized storage requirements. It is commonly adopted for pilot projects, niche industrial demand, and early-stage hydrogen markets before pipeline networks are established.

Generation Insights

How Did Captive Segment Dominated The Blue Hydrogen Market In 2025

The captive segment dominated the market, accounting for approximately 74.23% of the market volume share in 2025. Captive blue hydrogen generation involves on-site production for internal consumption by refineries, chemical plants, or industrial facilities. This model ensures supply security, reduces transportation costs, and enables better integration with CCS systems. Captive generation is particularly attractive for large hydrogen consumers seeking predictable operating costs and direct control over carbon reduction strategies.

The merchant segment is projected to grow at a CAGR between 2026 and 2035 in the market. Merchant blue hydrogen generation focuses on producing hydrogen for sale to third-party customers across multiple industries. This model supports the development of regional hydrogen markets and centralized production hubs. Merchant facilities benefit from economies of scale and are increasingly supported by long-term offtake agreements, government incentives, and infrastructure investments aimed at expanding low-carbon hydrogen supply.

Blue Hydrogen Market Volume and Share, By Generation Method, 2025 (%)

| By Generation Method | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Captive | 74.23% | 3.1 | 11.3 | 15.67% | 72.32% |

| Merchant | 25.77% | 1.1 | 4.3 | 16.94% | 27.68% |

End-Use Insights

How Did the Petroleum Refineries Segment Dominated The Blue Hydrogen Market In 2025

The petroleum refineries segment dominated the market, accounting for approximately 45% of the market volume share in 2025. Petroleum refineries represent a major end-use segment for blue hydrogen, utilizing it for hydrocracking, desulfurization, and other refining processes. The transition from grey to blue hydrogen allows refineries to significantly reduce Scope 1 emissions without major operational changes. Regulatory pressure, carbon pricing mechanisms, and sustainability targets are accelerating blue hydrogen adoption across refining operations globally.

The chemical industry segment is projected to grow at a CAGR between 2026 and 2035 in the market. The chemical industry uses blue hydrogen as a feedstock for ammonia, methanol, and specialty chemical production. Integrating blue hydrogen enables chemical manufacturers to decarbonize hydrogen-intensive processes while maintaining production efficiency. Rising demand for low-carbon chemicals, along with ESG-driven procurement strategies, is driving strong interest in blue hydrogen across fertilizer, petrochemical, and specialty chemical value chains.

Regional Insights

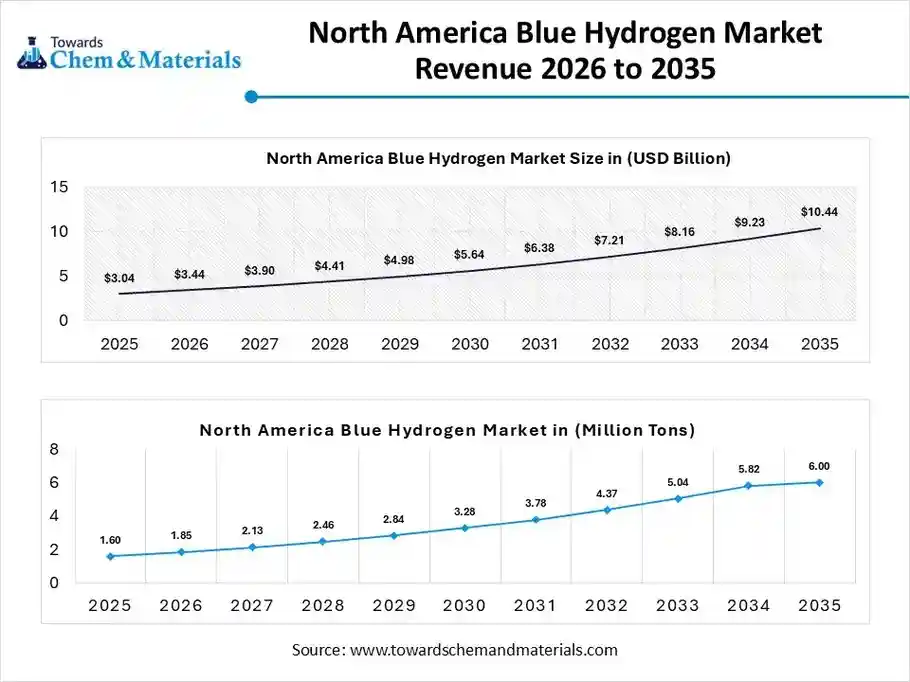

The North America blue hydrogen market size was valued at USD 3.04 billion in 2025 and is expected to be worth around USD 10.44 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 13.13% over the forecast period from 2026 to 2035.

The North America blue hydrogen market volume was estimated at 1.60 million tons in 2025 and is projected to reach 6.00 million tons by 2035, growing at a CAGR of 14.42% from 2026 to 2035. North America dominated the market with a Volume share of approximately 40% in 2025. North America represents a leading market for blue hydrogen due to strong natural gas availability, established carbon capture and storage infrastructure, and supportive decarbonization policies. The region benefits from large-scale industrial hydrogen demand across refining, chemicals, and power generation, alongside increasing investments in low-carbon hydrogen hubs and public–private partnerships.

U.S. Blue Hydrogen Market Growth Trends

The U.S. blue hydrogen market is driven by abundant shale gas reserves, advanced CCS projects, and federal incentives such as tax credits for carbon capture. Industrial clusters along the Gulf Coast and Midwest are key demand centers, with blue hydrogen adoption accelerating in ammonia production, refineries, and emerging clean power and heavy transport applications.

Blue Hydrogen Market Volume and Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 40.00% | 1.6 | 6.0 | 15.42% | 38.20% |

| Europe | 25.32% | 1.0 | 4.1 | 16.37% | 26.04% |

| Asia Pacific | 19.93% | 0.8 | 3.5 | 17.47% | 22.30% |

| Latin America | 5.01% | 0.2 | 0.8 | 16.54% | 5.22% |

| Middle East & Africa | 9.74% | 0.4 | 1.3 | 13.87% | 8.24% |

Asia Pacific Growth In The Market Is Driven By Rapid Industrialization

Asia Pacific is expected to have fastest growth in the market in the forecast period between 2026 and 2035. Asia Pacific is emerging as a high-growth region for blue hydrogen due to rapid industrialization, rising energy demand, and increasing focus on emission reduction. Countries in the region are exploring blue hydrogen as a transitional solution to decarbonize heavy industries while leveraging existing fossil fuel assets and infrastructure.

Japan Blue Hydrogen Market Growth Trends

Japan’s blue hydrogen market is shaped by energy security concerns and strong government support for hydrogen-based energy systems. The country invests in overseas blue hydrogen supply chains, CCS-linked production, and hydrogen import infrastructure, with applications spanning power generation, industrial energy use, and hydrogen fuel development.

Europe's Growth In The Market Is Driven By A Strong Focus On Production

Europe is expected to experience notable growth in the blue hydrogen market. Europe is a significant market, supported by aggressive climate targets, carbon pricing mechanisms, and a strong focus on transitioning existing hydrogen production to low-carbon alternatives. The region leverages existing gas infrastructure and cross-border hydrogen strategies to balance blue hydrogen deployment with long-term green hydrogen goals.

UK Blue Hydrogen Market Growth Trends

The UK is a frontrunner in blue hydrogen adoption, driven by its North Sea gas resources and CCS capabilities. Government-backed hydrogen strategies and industrial decarbonization programs support blue hydrogen use in power generation, heating trials, and industrial clusters, particularly in steel, chemicals, and refinery applications.

South America's Growth In The Market Is Driven By The Growing Adoption

South America is gradually entering the market, supported by natural gas resources and growing interest in industrial decarbonization. While still at an early stage, regional governments and energy companies are evaluating blue hydrogen as a bridge technology alongside a renewable-based hydrogen initiative.

Brazil Blue Hydrogen Market Growth Trends

Brazil’s blue hydrogen market is developing around its expanding natural gas infrastructure and industrial base. Interest is growing in deploying blue hydrogen for refining, fertilizer production, and chemicals, particularly where CCS potential exists, while aligning with national energy transition and emissions reduction objectives.

MEA Growth In The Market Is Driven By The Increased Investments

The MEA region holds strong potential for blue hydrogen due to vast hydrocarbon reserves, low-cost natural gas, and large-scale industrial demand. Regional strategies increasingly position blue hydrogen as a key export-oriented and domestic decarbonization solution, supported by investments in CCS and hydrogen infrastructure.

Saudi Arabia Blue Hydrogen Market Growth Trends

Saudi Arabia is a prominent player in the market, leveraging its natural gas resources and large industrial complexes. National energy diversification plans support blue hydrogen production for ammonia exports, power generation, and industrial use, with CCS projects enabling reduced carbon intensity and global competitiveness.

Recent Developments

- In December 2025, Japan's first integrated blue hydrogen and ammonia facility, known as the Kashiwazaki Hydrogen Park, was inaugurated in Niigata Prefecture.(Source : www.hydrogeninsight.com)

- In July 2025, CF Industries launched a new carbon capture and sequestration (CCS) facility at its Donaldsonville Complex in Louisiana, marking a milestone in blue hydrogen and ammonia production.(Source: fuelcellsworks.com)

- In November 2025, Japan and Hungary initiated a strategic partnership aimed at developing and testing hydrogen internal combustion engines (H2 ICE). (Source: www.qcintel.com)

- In September 2025, Teledyne Energy Systems successfully launched its Hydrogen Electrical Power System (HEPS) fuel cell on Blue Origin's New Shepard rocket during the NS-35 mission.(Source: www.businesswire.com)

Top Players in the Blue Hydrogen Market & Their Offerings:

- Air Products and Chemicals, Inc. (USA): Air Products is a global leader in hydrogen production and supply. The company develops large-scale blue hydrogen plants using steam methane reforming (SMR) coupled with carbon capture and storage (CCS). Its offerings support industrial hydrogen supply, refining, and clean energy transition initiatives.

- Linde plc (Ireland/USA): Linde supplies industrial gas solutions, including blue hydrogen production systems, SMR technology, and integrated CCS infrastructure. Its hydrogen production and delivery networks serve refining, petrochemicals, and heavy industry while reducing carbon intensity.

- Air Liquide (France): Air Liquide is a major provider of hydrogen production, purification, and storage solutions. The company deploys blue hydrogen facilities that integrate SMR with carbon capture technologies to support decarbonized industrial and energy applications across Europe, North America, and Asia.

- Shell plc (UK/Netherlands): Shell develops blue hydrogen projects integrated with its existing natural gas and refining assets, leveraging CCS and low-carbon fuel technologies. Its solutions aim to decarbonize mobility, chemicals, and power sectors by providing low-carbon hydrogen feedstock.

- BP plc (UK): BP is investing in blue hydrogen production with CCS integration to support industrial decarbonization and hydrogen economy development. The company’s offerings include SMR-based hydrogen plants and infrastructure for blending hydrogen into gas networks and industrial systems.

Top Companies in the Blue Hydrogen Market

- Air Products and Chemicals, Inc. (USA)

- Linde plc (Ireland/USA)

- Shell plc (UK/Netherlands)

- BP plc (UK)

- Air Liquide (France)

- ExxonMobil Corporation

- Saudi Aramco

- Equinor ASA

- TotalEnergies SE

- Technip Energies N.V.

- Siemens Energy AG

- Mitsubishi Heavy Industries, Ltd.

- Topsoe A/S

- Engie S.A.

- Uniper SE

- Suncor Energy Inc.

- Woodside Energy Group

- Chevron Corporation

- Reliance Industries Limited

- Iwatani Corporation

Segments Covered

By Technology (Production Method)

- Steam Methane Reforming (SMR) + CCS

- Auto Thermal Reforming (ATR) + CCS

- Gas Partial Oxidation (POX) + CCS

- Methane Pyrolysis (Turquoise Hydrogen)

By Generation Method

- Captive

- Merchant

By Transportation & Storage Mode

- Pipeline

- Cryogenic Liquid Tankers

- Compressed Gas Cylinders

- Geological Storage

By End-Use Application

- Petroleum Refineries

- Chemical Industry

- Power Generation

- Transportation

- Industrial Manufacturing

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa