Content

What is the Current Polyurethane Market Size and Share?

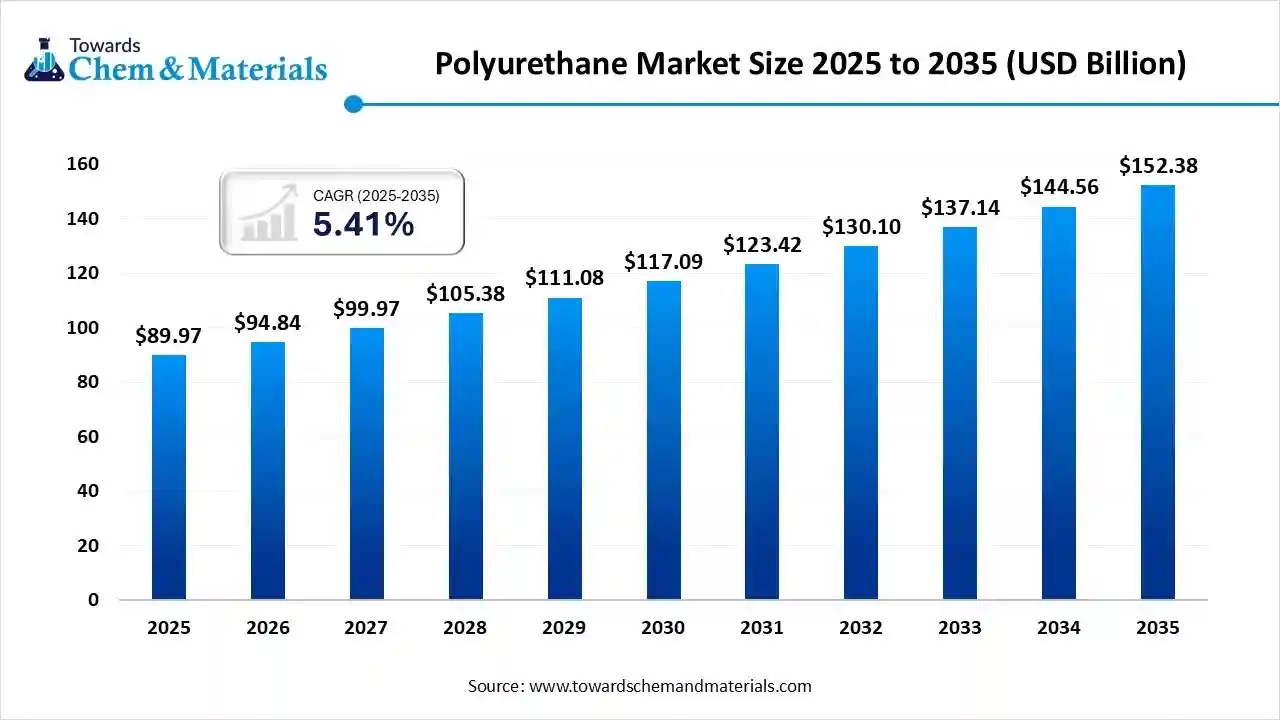

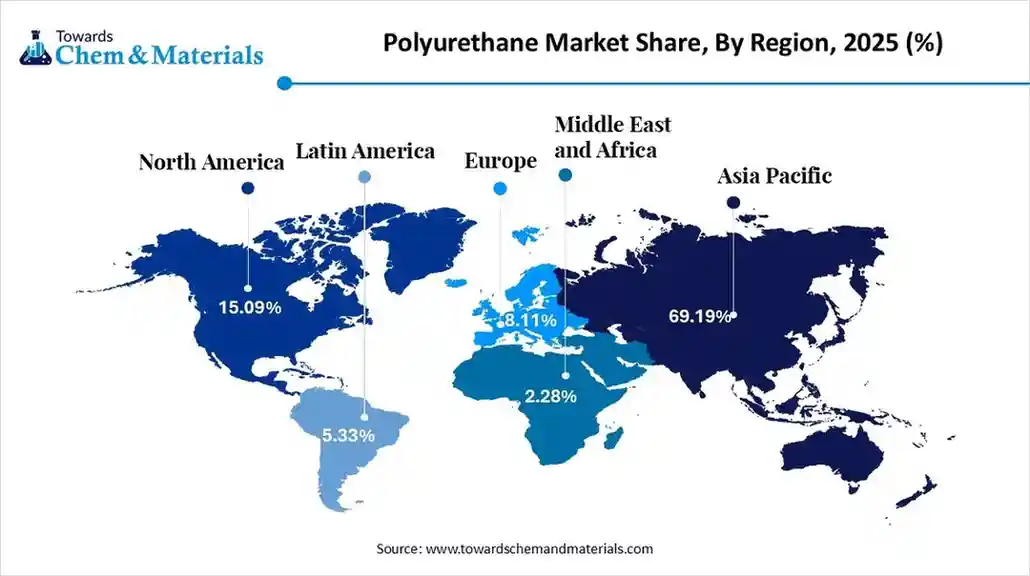

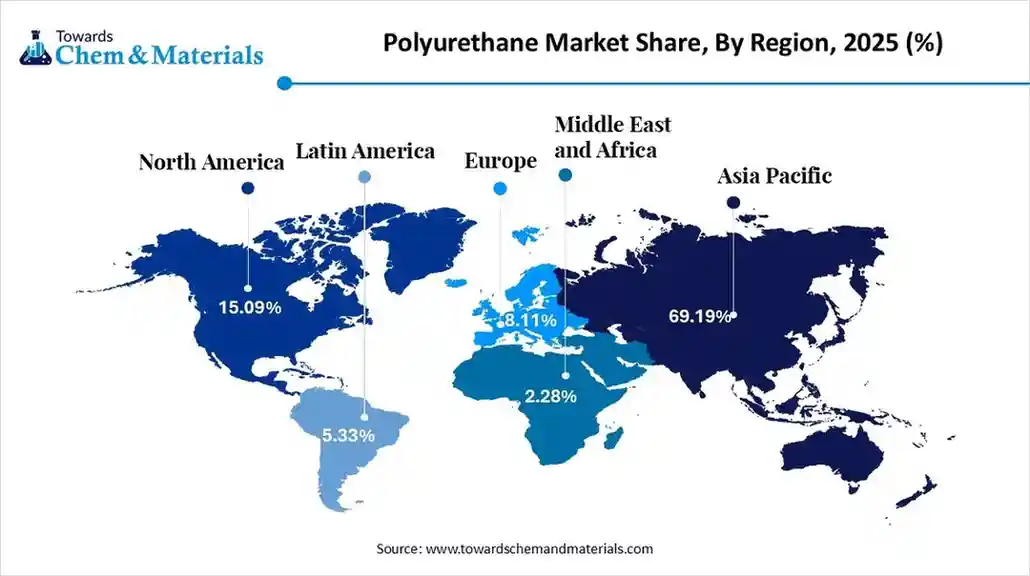

The global polyurethane market size is calculated at USD 89.97 billion in 2025 and is predicted to increase from USD 94.84 billion in 2026 and is projected to reach around USD 152.38 billion by 2035, The market is expanding at a CAGR of 5.41% between 2026 and 2035. Asia Pacific dominated the polyurethane market with a market share of 69.19% the global market in 2025.The growth of the market is driven by rising demand across the construction, automotive, and furniture industries for durable, lightweight, and versatile materials.

Key Takeaways

- Asia Pacific dominated the polyurethane market with the largest revenue share of over 69.19% in 2025.

- By region, Europe is expected to rise at a notable CAGR between 2025 and 2034.

- By raw material, the polyols segment has contributed the largest market share in 2025.

- By raw material, the methylene diphenyl di-isocyanate segment will grow at a notable CAGR between 2025 and 2034.

- By product, the rigid foam segment contributed the largest share in 2025.

- By product, the flexibility foam segment will grow at a notable CAGR between 2025 and 2034.

- By application, the construction segment contributed the largest share in 2025

- By application, the furniture and interiors segment will grow at a notable CAGR between 2025 and 2034.

Market Overview

Why is the Polyurethane market experiencing rapid growth?

The polyurethane market is experiencing rapid growth, motivated by its numerous uses in electronics, automobiles, furniture, and construction because of its adaptability and strength. Lightweight polyurethane is a material of choice in many industries. Demand in the market is being further increased by growing infrastructure and urbanization. Innovation in bio-based and eco-friendly polyurethanes is also creating new avenues for growth.

Market Trends

| Trend | Key Insight | Application/Impact |

| Sustainable & Bio-Based PU | Eco-friendly and bio-based polyurethanes are gaining traction due to environmental regulations. | Automotive interiors, packaging, construction, and insulation; lower carbon footprint. |

| Lightweight & high-performance materials | Lightweight foams and elastomers improve fuel efficiency and durability. | Automotive panels, aerospace components, EV battery casings. |

| Advanced Coatings & Adhesives | Rising use for corrosion resistance, weatherproofing, and chemical durability. | Industrial machinery, construction, protective coatings, and sealants. |

| Technological Innovations | Specialty foams, self-healing materials, flame-retardant formulations, expanding market. | Medical devices, electronics, smart textiles, specialty industrial applications. |

| Urbanization & Construction Growth | Insulation, flooring, and roofing solutions in modern infrastructure projects. | Residential and commercial buildings, soundproofing, energy-efficient solutions. |

| Durability & Long Lifecycle Products | High resistance to abrasion, chemicals, and temperature extends product lifespan. | Heavy-use industrial parts, consumer goods, and long-term construction materials. |

Trade Analysis of the Polyurethane Market

- According to recent global export statistics, the world recorded 366,210 shipments of Polyurethane. These shipments were made by 23,533 exporters supplying 30,813 buyers.

- Globally, the top three exporters of Polyurethane are China, South Korea, and United States. China leads the category with 92,151 shipments, followed by United States with 33,492 shipments and South Korea with 22,764 shipments, showcasing their dominance in advanced polymer production and distribution capabilities.

Value Chain Analysis

- Chemical Synthesis and Processing: Involves the production of raw polyurethane chemicals and formulation of PU resins. Advanced synthesis methods improve efficiency, reduce emissions, and enable specialty products.

- Key Players: Covestro AG, BASF SE, Huntsman Corporation, Dow Inc., Wanhua Chemical Group

- Quality Testing & Certification : Ensures polyurethanes meet industry standards for safety, durability, and performance. Includes mechanical, thermal, chemical resistance, and environmental compliance tests.

- Key Players: SGS, Bureau Veritas, Intertek, TÜV SÜD, UL LLC

- Distribution to Industrial Owners : Focuses on supplying PU products to the automotive, construction, furniture, and electronics sectors. Includes logistics, warehousing, and supply chain management.

- Key Players: Arkema, Lanxess, Mitsui Chemicals, Lubrizol Corporation, Recticel Group

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 94.84 Billion |

| Revenue Forecast in 2035 | USD 152.38 Billion |

| Growth Rate | CAGR 5.41% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segments covered | By Raw Material, By Product, By Application, By Region |

| Key companies profiled | Covestro AG, The Dow Chemical Company, Huntsman Corporation, Wanhua Chemical Group Co., Ltd., Mitsui Chemicals Inc., TOSOH CORPORATION, LANXESS AG, Recticel NV/SA, Sekisui Chemical Co., Ltd., The Lubrizol Corporation, Woodbridge Foam Corporation, DIC Corporation |

Segmental Insights

Raw Material Insights

What Made The Polyols Segment Dominate The Polyurethane Market In 2025?

The polyols material segment dominates the market because they are crucial for creating the rigid and flexible foams used in the packaging, automotive, furniture, and construction industries. They remain the best option for manufacturers due to their affordability and adaptability. The dominance of bio-based polyols is being strengthened by their increasing development.

Methylene diphenyl di-isocyanate segment is the fastest-growing segment because of the growing need for high-performance rigid foams for green building and insulation applications. It is perfect for energy-saving materials due to its exceptional thermal efficiency. MDI consumption is increasing as cold chains and refrigeration infrastructure expand.

Toluene Di-isocyanate segment expects notable growth in the market. Toluene Di-isocyanate is a key raw material for flexible foams used in furniture, bedding, and automotive seating. Growing demands for lightweight materials and comfort are driving demand. Stricter environmental regulations are making w emission TDI variants more important.

Product Insights

What Made The Rigid Foam Segment Dominate The Polyurethane Market In 2025?

Rigid foam segment dominates the market in 2025, because of its superior mechanical strength insulation capabilities and application in cold chain systems, appliances, and construction. It is highly compatible with international emission reduction and energy efficiency standards. Its dominance is supported by growing use in prefabricated and modular buildings. This market is growing due to the increased demand for high-performance insulation boards.

Flexible foam segment is the fastest-growing product driven by the explosive growth in demand for car seats, couches, pillows, and mattresses. For applications that prioritize comfort, its softness, cushioning, and light weight make it indispensable. Flexible foam consumption is rising dramatically due to e-commerce-driven furniture sales. Growth is also being accelerated by the emergence of orthopedic and premium mattress categories.

Coatings segment expects notable growth in the market. Coatings are seeing a notable increase in industries, and architectural and marine applications are used to create long-lasting corrosion-resistant surfaces. The use of solvent-free and waterborne coatings is increasing to lower VOC emissions. This market is a crucial growth area due to its suitability and excellent performance.

Application Insights

What Made The Construction Segment Dominate The Polyurethane Market In 2025?

The construction segment dominates the market in 2025, because PU insulation, sealants, adhesives, and coatings that increase building energy efficiency are frequently used. Its leadership is supported by rapid infrastructure development and urbanization. Government incentives for environmentally friendly construction bolster dominance even more. The market is being further expanded by the use of PU in environmentally friendly wall and roofing systems.

Furniture and Interiors segment is growing rapidly as the market for high-end bedding, modular furniture, and foam products with high resilience grows. Most of this growth is driven by flexible PU foam, which provides exceptional comfort and durability. Rising home renovation and interior design trends add to market expansion. This market is expanding due to the rising demand for luxurious and ergonomic seating options.

The automotive segment is seeing a notable increase due to increasingly increasing use of interiors, seating, and coatings for durability and comfort. Lightweight PU materials improve fuel efficiency and vehicle performance. The EV trend is driving innovative and higher adoption of PU products.

Regional Analysis

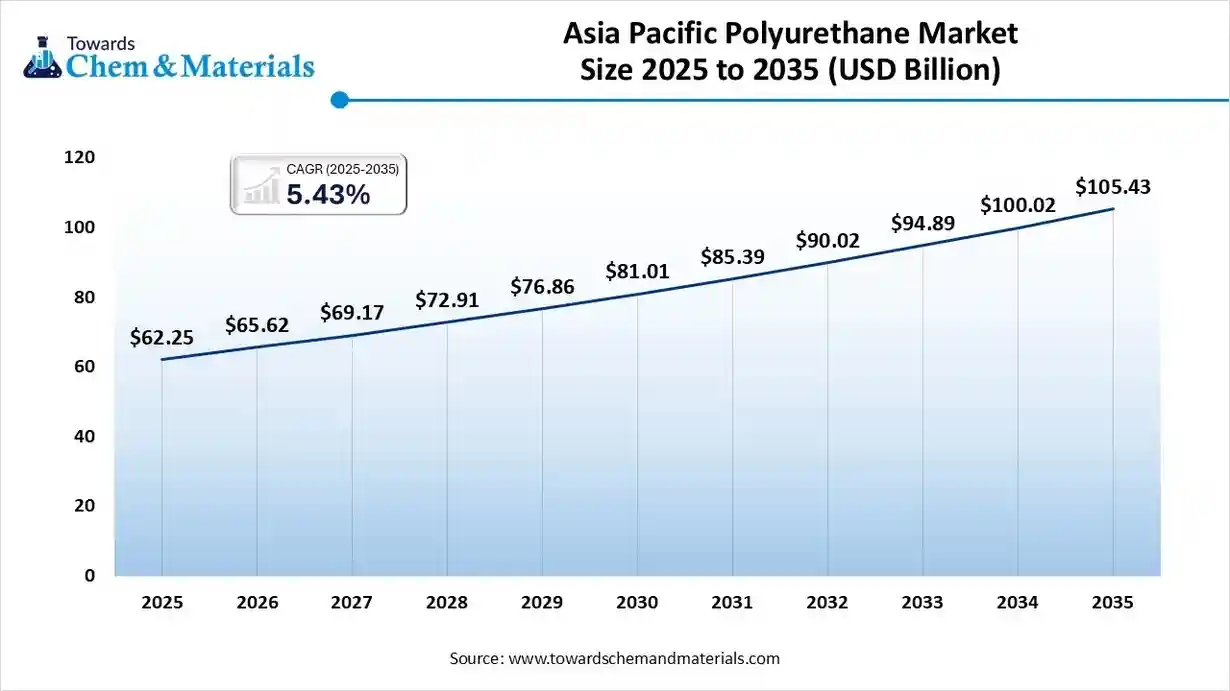

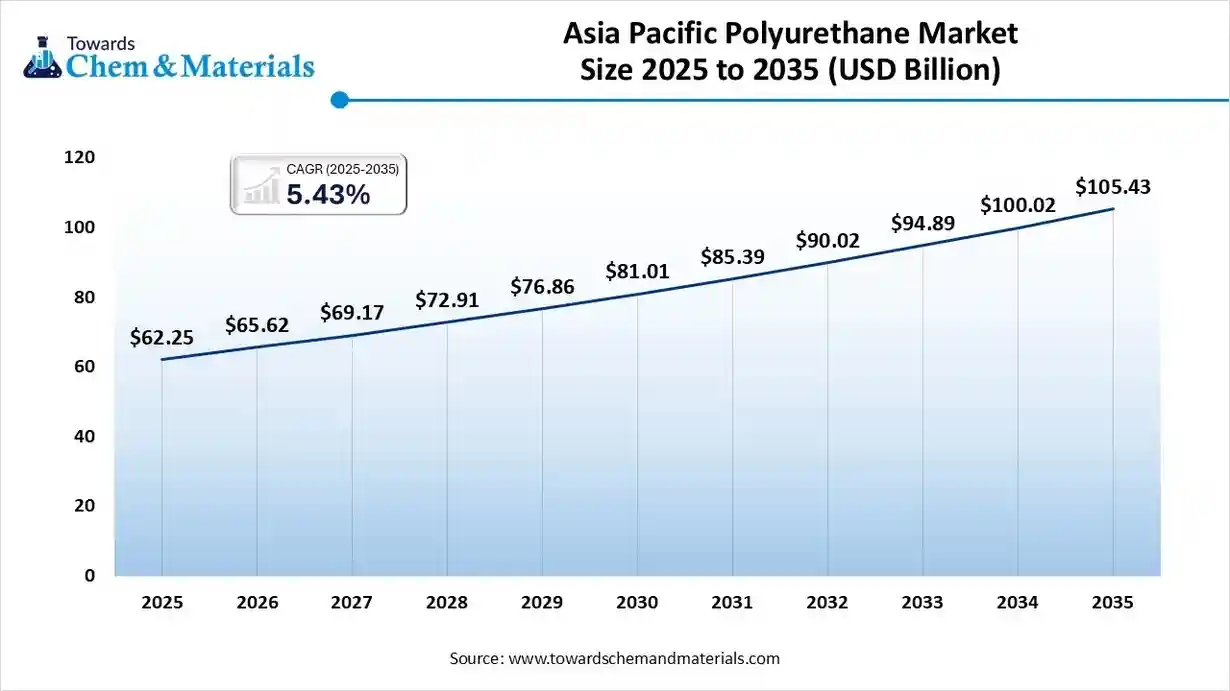

The Asia Pacific polyurethane market size was valued at USD 62.25 billion in 2025 and is expected to surpass around USD 105.43 billion by 2035, expanding at a compound annual growth rate (CAGR) of 5.43% over the forecast period from 2026 to 2035.

Asia Pacific is dominating the market in 2025, because of the furniture, automotive, and consumer goods industries growing demand, robust manufacturing activity, and quick construction expansion. Regional leadership is further reinforced by low production costs and growing industrial capacity. The use of polyurethane in various applications is still increasing due to rapid urbanization. Long-term dominance is also being boosted by extensive housing and infrastructure projects.

China Polyurethane Market Trends

China leads consumption and production due to a robust appliance manufacturing sector, a well-established chemical industry, and enormous construction activity. Demand for PU is driven by rising investments in cold chain facilities and insulation materials. Consistent growth in consumption is supported by a strong government focus on industrial modernization. PU usage is further increased by a significant OEM presence in electronics and automotive

Europe is growing fastest in the market due to strong emphasis on environmentally friendly polyurethane solutions, high adoption of energy-efficient materials, and stringent sustainability regulations. The area is a leader in advanced insulation systems, recycling technologies, and bio-based PU research. Companies are being pushed toward greener formulations by frameworks for the circular economy. Rapid expansion is further supported by growing investments in lightweight materials and clean technologies.

Germany Polyurethane Market Trends

Germany leads the region with strong automotive production, high construction efficiency standards, and growing demand for sustainable insulation. Its cutting-edge chemical sector fosters ongoing PU innovation. Specialty PU grades are consumed more frequently when lightweight vehicle components are used. PU applications are increased by manufacturing improvements and industrial automation. The demand for flexible foam is also influenced by robust bedding and furniture industries.

North America expects the significant growth in the market driven by robust demand in the furniture, automotive, and construction industries. PU adoption has increased due to consumers growing desire for materials that are strong, lightweight, and energy-efficient. In keeping with stringent environmental laws and sustainable trends, the area also prioritizes low-VOC and eco-friendly polyurethane solutions.

U.S. Polyurethane Market Trends

The U.S. dominates the market, backed by a thriving automobile sector and expanding infrastructure initiatives. The market is expanding due to the strong demand for flexible foam coatings and adhesives. Manufacturers are spending more money on cutting-edge PU technologies to satisfy performance and sustainability standards.

The Middle East and Africa polyurethane market is expanding due to increasing construction activities and industrial growth. Rising demand for insulation, coatings, and automotive applications is driving PU consumption. Investment in petrochemical production in the region is also facilitating local PU manufacturing and reducing dependency on imports.

UAE Polyurethane Market Trends

The UAE’s polyurethane market especially PU foam is expanding rapidly, driven by booming construction, real estate, furniture, automotive, packaging, and cold storage demand. Flexible foam dominates consumer oriented segments (furniture, bedding, automotive interiors), while rigid foam is widely used for insulation in buildings, refrigeration systems, and cold chain infrastructure.

The South America polyurethane market is growing steadily. Demand is driven especially by sectors like construction (insulation, building materials), furniture/interiors (foam for mattresses, upholstery), automotive, and appliances, with rigid and flexible polyurethane foams as leading product segments. Overall, South America represents a promising but developing market, with rising infrastructure investment and growing construction/furniture demand underpinning future expansion.

Brazil Polyurethane Market Trends

Brazil's polyurethane market is witnessing steady growth, backed by the growing furniture, construction, and automobile sectors. The adoption of PU is being driven by the need for materials that are affordable, strong, and lightweight. Market opportunities are further increased by government initiatives that support infrastructure development and industrial growth.

Recent Developments

- In March 2025, BASF SE announced the expansion of its PU recycling portfolio with its “Loop” technology, which chemically recycles polyurethane waste into high-quality PU materials for footwear, automotive, and synthetic leather.(Source: www.basf.com)

- In May 2025, PU industry is accelerating its green transformation, with rapid commercialization of bio-based polyols, CO₂‑based polyols, and both chemical and mechanical recycling technologies(Source: www.pudaily.com)

Top Players In The Polyurethane Market

BASF SE

Corporate Information

- BASF SE is a German multinational chemical company headquartered in Ludwigshafen am Rhein, Germany.

It is the largest chemical producer worldwide (by revenue). - As of end 2023, BASF employed around 112,000 people globally.

- The company operates across multiple business segments: Chemicals; Materials; Industrial Solutions; Nutrition & Care; and standalone businesses bundled under Surface Technologies and Agricultural Solutions.

History and Background

- The company was founded on 6 April 1865, originally under the name “Badische Anilin & Soda Fabrik” (Baden Aniline & Soda Factory), with business roots in coal tar dyes.

- Initially based in Mannheim, the manufacturing plant was moved across the Rhine to Ludwigshafen shortly after mainly because of concerns about pollution near residential areas.

Key Developments and Strategic Initiatives

Under a strategy called Winning Ways (announced earlier), BASF is re shaping its portfolio and how it manages its businesses distinguishing between “core” and “standalone” businesses to optimize focus, capital allocation, and operational efficiency.

Mergers & Acquisitions

- In the 2000s, BASF acquired major chemical businesses: for example, it acquired Engelhard Corporation (2006), and later the construction chemicals business of Degussa AG.

- In 2008–2009, BASF acquired Ciba (formerly part of Ciba Geigy), expanding its chemical & materials portfolio.

- More recently (completed January 31, 2024), BASF took over one of the two MDI plants from a joint venture in China (previously shared with Huntsman Corporation), gaining production capacity for isocyanates and precursors.

Partnerships & Collaborations

- BASF collaborates globally with many customers and industrial partners to co develop solutions especially in sustainability oriented materials and chemical processes.

- In Asia, BASF invests heavily in regional R&D and innovation for instance, its Innovation Campus Shanghai plays a central role, serving as BASF’s largest R&D site in Asia and collaborating with local institutions for materials, catalysis, specialty chemicals, process and digitalization research.

Product Launches / Innovations

- Development of sustainable polyurethane (PU) solutions: At the 2025 industry event PU TECH 2025 (Greater Noida, India), BASF showcased high performance PU solutions designed for lower environmental footprint e.g., synthetic leather for automotive seating with reduced greenhouse gas emissions, and PU composites for building insulation and PV frame applications.

- Expansion into electric vehicle battery materials and adhesives: BASF is enhancing materials for next generation batteries including “Debonding on Demand” adhesives, battery potting systems, and advanced surface treatments/coatings for battery packs to support performance, safety, and recyclability.

Key Technology Focus Areas

- Innovations in catalysis and chemical process technology: In 2025, BASF unveiled a new advanced facility in Ludwigshafen dedicated to process catalysts R&D, aimed at bringing lab developed catalysts rapidly into production and strengthening its catalyst technology leadership.

R&D Organisation & Investment

- In 2024, BASF spent around €2,061 million on R&D globally.

- Around 10,000 employees worldwide work in R&D.

- Over the past five years (to 2024), innovations newly launched have generated about €11 billion in sales, underlining the commercial impact of BASF’s R&D.

SWOT Analysis

Strengths

- Global scale and leadership: world’s largest chemical company with diversified product portfolio and presence in many segments.

- Strong integration across value chains (“Verbund” model) leading to cost efficiency, scale advantages, and operational excellence.

- Robust R&D capabilities, with substantial investment and global innovation footprint enabling advanced materials, sustainability solutions, battery materials, catalysts, etc.

Weaknesses

- Complexity due to wide portfolio: managing many diverse segments globally can dilute focus, make operations complex, and require frequent portfolio pruning.

- Exposure to raw material price volatility, energy costs, and regulatory/policy risks (given chemicals business and global footprint).

Opportunities

- Growth in sustainability and circular economy rising global demand for low carbon, recycled, and environmentally friendly chemical solutions, coatings, adhesives, battery materials, etc.

- Growing demand for materials in electric vehicles (batteries, lightweight plastics, coatings), renewable energy infrastructure, sustainable construction areas where BASF is already focusing.

Threats

- Global economic uncertainty, especially in Europe and major markets could depress demand for industrial chemicals, automotive, construction materials, etc.

- Regulatory pressure and environmental concerns as chemical production is increasingly under scrutiny for emissions, waste, and environmental impact.

Recent News & Strategic Updates

- In 2025, BASF presented progress under its “Winning Ways” strategy confirming financial targets for 2028 and reaffirming its focus on integrated core businesses plus selective standalone units.

- As part of that, BASF decided to retain the standalone business BASF Environmental Catalyst and Metal Solutions (ECMS), which generated €7.0 billion in sales in 2024 i.e. it concluded it is best positioned to operate this unit rather than divest.

Other Players

- Covestro AG: A top producer of high-performance polymer materials, including MDI and TDI, serving the insulation and automotive industries.

- The Dow Chemical Company: A leading global supplier of polyurethane ingredients used widely in insulation, automotive seating, and furniture.

- Huntsman Corporation: A major global supplier of MDI-based polyurethanes with a strong focus on insulation, construction, packaging, and automotive.

- Wanhua Chemical Group Co., Ltd.: A significant and growing player in the global market, known for its large production capacity of MDI.

- Mitsui Chemicals Inc.: A key market player providing various chemical products, including those for the polyurethane market.

- TOSOH CORPORATION: A major Japanese chemical company active in the polyurethane sector.

- LANXESS AG

- Recticel NV/SA

- Sekisui Chemical Co., Ltd.

- The Lubrizol Corporation

- Woodbridge Foam Corporation

- DIC Corporation

Segments Covered in the Report

By Raw Material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

By Application

- Furniture and Interiors

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa