Content

U.S. Industrial Coatings Market Size and Growth 2025 to 2034

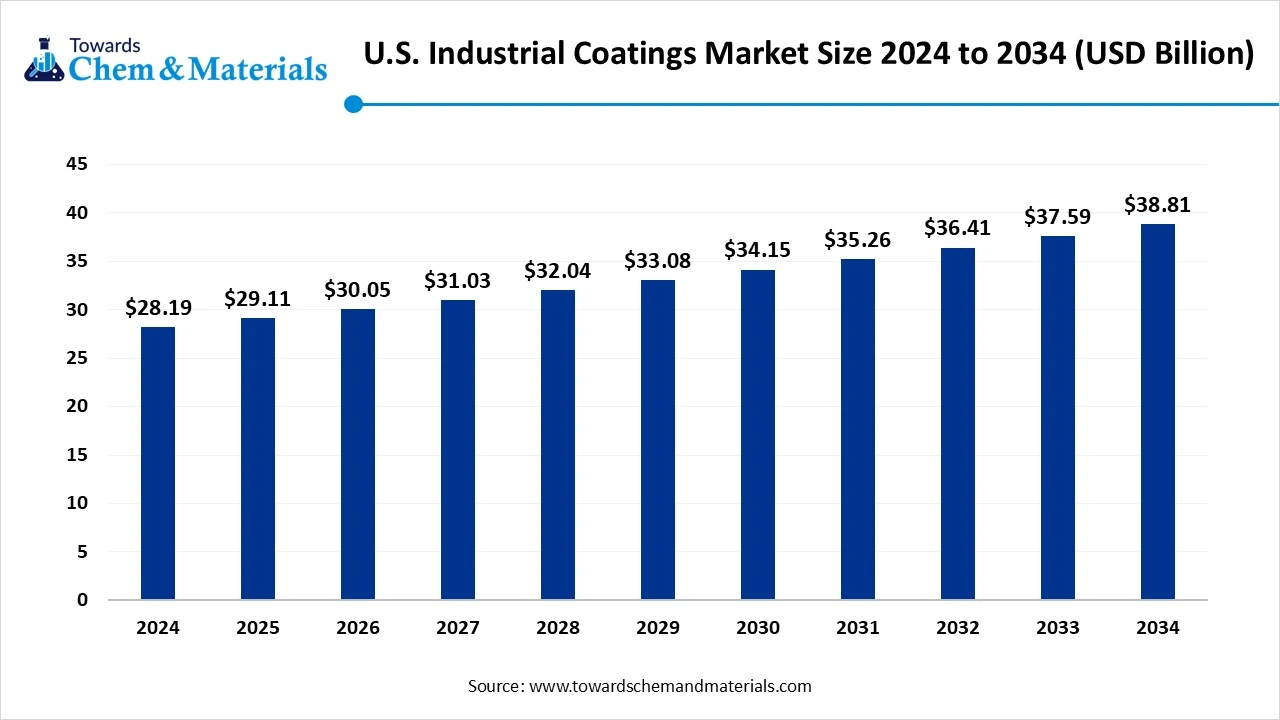

The U.S. industrial coatings market size accounted for USD 28.19 billion in 2024 and is predicted to increase from USD 29.11 billion in 2025 to approximately USD 38.81 billion by 2034, expanding at a CAGR of 3.25% from 2025 to 2034. The growth of the market is driven by the growing demand for the industrial sector, environmental regulations, and eco-friendly demand due to its benefits and properties offered, which increases the growth of the market.

Key Takeaways

- By technology, the waterborne segment dominated the market in 2024. The waterborne segment held approximately 45% share in the market in 2024. They are widely used in various industries.

- By technology, the UV / EB cure segment is expected to grow significantly in the market during the forecast period. Widely applied in electronics, packaging, and specialty industrial products.

- By product form, the liquid segment dominated the market in 2024. The liquid segment held approximately 65% share in the market in 2024. They are especially common in machinery.

- By product form, the solid concentrates & dispersions segment is expected to grow in the forecast period. Demand in high-volume industrial applications drives growth.

- By application, the protective & maintenance segment dominated the market in 2024. The protective & maintenance segment held approximately 35% share in the market in 2024. They are used extensively in infrastructure.

- By application, the renewable energy coatings segment is expected to grow in the forecast period. The shift towards sustainability drives the market.

- By performance, the corrosion-resistant segment dominated the market in 2024. The corrosion-resistant segment held approximately 40% share in the market in 2024. The reduced maintenance cost drives the growth.

- By performance, the low VOC / environmental compliance segment is expected to grow in the forecast period. Stringent environmental regulation increases adoption.

- By end-use industry, the metal fabrication & machinery segment dominated the market in 2024. The metal fabrication & machinery segment held approximately 25% share in the market in 2024. Coatings provide wear resistance, anti-rust properties, and improved durability, which increases the adoption of the market.

- By end-use industry, the renewable energy & EV components segment is expected to grow in the forecast period. The ongoing energy transition influences and propel the growth of the market.

Market Overview

Rising Demand For Durable Materials: U.S. Industrial Coatings Market To Expand

Industrial coatings are functional and protective coatings formulated for non-architectural applications across industrial end-use sectors. They provide protection (corrosion, chemical, heat, abrasion), performance (electrical insulation, anti-fouling, fire-retardant), and regulatory/environmental compliance (low VOC, waterborne, powder).

What Are The Key Growth Drivers That Support The Growth Of the U.S. Industrial Coatings Market?

The U.S. industrial coatings market growth is driven by the growing industrial base, which increases the demand, especially in automotive, aerospace, and general industrial sectors, which demand coating materials that are specialized and require protective and performance coatings.

The environmental regulations and eco-friendly demand due to the shift towards eco-friendly and sustainable solutions also encourage the adoption, research, and development in these areas, driving the growth of the market. Technological advancements like self-cleaning and self-healing coatings, which increase durability and also lower maintenance costs, also contribute to large adoption, fueling the growth and expansion of the market.

Market Trends

- Environmental Regulations and Waterborne Coatings: As environmental concerns grow and regulations become stricter, the demand for waterborne coatings is rising. These coatings have lower VOC emissions than traditional solvent-borne coatings.

- Advances in Technology: The market is witnessing breakthroughs in coating technologies, including self-cleaning, self-healing, and high-performance coatings that cut maintenance costs and boost durability.

- Developments in Resins: Epoxy coatings remain a major player in the market, but there's increasing interest in polyurethane coatings. Acrylic-based coatings continue to be a top product type.

- Powder Coatings: The demand for powder coatings is on the rise, particularly for shipbuilding, pipelines, and other industrial uses, as they provide an eco-friendlier solution.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 29.11 Billion |

| Expected Size by 2034 | USD 38.81 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | Technology / Delivery System, Product Form / Physical Formulation,Application / Use Case, Performance / Functionality, End-User Industry |

| Key Companies Profiled | PPG Industries, The Sherwin-Williams Company , Axalta Coating Systems , AkzoNobel N.V. , BASF Corporation , RPM International Inc. , Kansai Paint Co., Ltd. , Nippon Paint Holdings Co., Ltd. , Jotun A/S , Hempel A/S , Carboline Company , Tnemec Company, Inc. , Benjamin Moore & Co. , The Dow Chemical Company , Eastman Chemical Company, Covestro AG , Ferro Corporation , Behr Process Corporation , Rust-Oleum Corporation , Asian Paints Limited |

Market Opportunity

The Growing Industrial Sector

The key growth opportunities that influence the growth of the market are the growing industrial base, especially automotive, aerospace, construction, and electronics, which increases the demand for smart coating materials, driving the growth of the market. The shift towards the use of electric vehicles and the shift towards luxury demand for advanced coating materials from the automotive industry.

The demand for high-performance coating materials for aircraft components, with skilled labor and manufacturers like Boeing Inc., is increasing. Increasing infrastructure and building development also demand protective and functional industrial coatings, creating an opportunity for growth and expansion of the market.

Market Challenge

Raw Material Process And Supply Chain Management

The key growth challenges that hinder the growth of the market are the raw material price fluctuation due to geopolitical tension, which makes cost estimation and production planning difficult for manufacturers, restricting the growth of the market in the country. The other key challenges are the stringent environmental regulations, competition from substitute materials, the need for innovation and technological advancements, supply chain disruption, production disruptions, and sustainability concerns, which limit the growth and expansion of the market.

Segmental Insights

Technology Insights

How Did The Waterborne Segment Dominate The U.S. Industrial Coatings Market In 2024?

The waterborne segment dominated the market in 2024. Waterborne coatings dominate the US industrial coatings landscape due to their lower environmental footprint and compliance with stringent EPA regulations. These coatings are widely used in metal finishing, automotive, and construction applications where reduced VOC emissions and worker safety are priorities. Their versatility, coupled with steady innovation in performance enhancement, continues to drive adoption.

The UV/EB cure segment expects significant growth in the U.S. industrial coatings market during the forecast period. UV/EB cure coatings are gaining traction owing to their fast curing times, energy efficiency, and ability to provide superior finishes. Widely applied in electronics, packaging, and specialty industrial products, they enable high-quality surface protection while aligning with sustainability goals. Increasing adoption in advanced manufacturing is reinforcing their growth.

Product Form Insights

Which Product Form Segment Dominates The U.S. Industrial Coatings Market In 2024?

The liquid segment dominated the market in 2024. Liquid coatings remain the preferred form in the US market due to ease of application, adaptability across substrates, and widespread usage in protective and decorative applications. They are especially common in machinery, infrastructure, and automotive maintenance, where reliable coverage is needed.

The solid concentrates and dispersions segment is expected to experience significant growth in the market during the forecast period. Solid concentrates and dispersions are emerging as sustainable alternatives, offering higher material efficiency and reduced waste. They are gaining demand in high-volume industrial applications where performance, durability, and lower environmental impact are key considerations.

Application Insights

How Did The Protective & Maintenance Segment Dominate The U.S. Industrial Coatings Market In 2024?

The protective & maintenance segment dominated the market in 2024. Protective and maintenance coatings form the largest application area in the US industrial coatings market. They are used extensively in infrastructure, machinery, and transportation to safeguard against wear, corrosion, and harsh environmental conditions. Long service life and cost savings from reduced downtime drive their adoption.

The renewable energy coatings segment expects significant growth in the market during the forecast period. Renewable energy coatings are expanding rapidly, particularly in wind and solar energy components. Specialized coatings for blades, panels, and EV charging infrastructure enhance durability and efficiency. As the US transitions toward renewable energy, this segment is expected to remain a high-growth area.

Performance Insights

Which Performance Segment Dominated The U.S. Industrial Coatings Market In 2024?

The corrosion-resistant segment dominated the market in 2024. Corrosion resistance is a key performance feature in industrial coatings, especially in sectors such as oil & gas, marine, and heavy machinery. Coatings with advanced anti-corrosion properties extend equipment life, reduce maintenance costs, and ensure reliability in demanding environments.

The low VOC / environmental compliance segment expects significant growth in the market during the forecast period. Low VOC/environmental compliance coatings are growing in importance as sustainability becomes central to industrial strategies. With strict US environmental regulations, manufacturers are innovating coatings that balance performance with minimal ecological impact, driving adoption across multiple industries.

End-Use Industry Insights

How Did The Metal Fabrication & Machinery Segment Dominate The U.S. Industrial Coatings Market In 2024?

The metal fabrication & machinery segment dominated the market in 2024. Metal fabrication and machinery account for a significant demand for industrial coatings in the US. Coatings provide wear resistance, anti-rust properties, and improved durability, critical for machinery, fabricated parts, and industrial equipment. This ensures longer life cycles and cost efficiency.

The renewable energy & EV components segment expects significant growth in the market during the forecast period. Renewable energy and EV components represent a dynamic growth area. Coatings for solar panels, wind turbine blades, EV batteries, and charging systems play a crucial role in enhancing performance and sustainability. The ongoing energy transition in the US is expected to propel this segment further.

U.S. Industrial Coatings Market Value Chain Analysis

- Chemical Synthesis and Processing: The industrial coatings are synthesised and processed through liquid coating, powder coating, and milling and shifting.

- Key players: Sherwin-Williams Company, PPG Industries, and Axalta Coating Systems

- Quality Testing and Certification: The industrial coatings require standards like ISO 12944 along with adhesion testing, hardness testing, and corrosion resistance.

- Key players: ASTM International and UL Solutions

- Distribution to Industrial Users: The industrial coatings are distributed to the automotive, aerospace, construction, energy, marine, and manufacturing industries.

- Key players: Sherwin-Williams, PPG Industries, and AkzoNobel.

Recent Developments

- In September 2025, AkzoNobel’s protective coatings brand, International, rolled out its flagship epoxy passive fire protection (PFP) product, Chartek ONE, worldwide. Chartek ONE is a single-coat, mesh-free solution that streamlines PFP application for energy sector assets, providing a single solution for complete protection.(Source: www.coatingsworld.com)

U.S. Industrial Coatings Market Top Companies

- PPG Industries

- The Sherwin-Williams Company

- Axalta Coating Systems

- AkzoNobel N.V.

- BASF Corporation

- RPM International Inc.

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Jotun A/S

- Hempel A/S

- Carboline Company

- Tnemec Company, Inc.

- Benjamin Moore & Co.

- The Dow Chemical Company

- Eastman Chemical Company

- Covestro AG

- Ferro Corporation

- Behr Process Corporation

- Rust-Oleum Corporation

- Asian Paints Limited

Segments Covered

Technology / Delivery System

- Waterborne coatings

- Solvent-borne coatings

- Powder coatings

- UV / Electron beam curable coatings

- High-solids coatings

- Electrocoat (E-coat)

Product Form / Physical Formulation

- Liquid

- Two-component kits (2K)

- Aerosol / spray can

- Paste / mastic / adhesive

- Solid concentrates / dispersions

- Pre-applied films / laminates

Application / Use Case

- Protective & maintenance coatings

- OEM industrial coatings

- Coil coatings

- Can & food packaging coatings

- Automotive refinish coatings

- Marine coatings

- Aerospace coatings

- Oil & gas / petrochemical protective systems

- Rail & rolling stock coatings

- Renewable energy coatings (wind/solar)

- Electrical & electronics coatings

- Appliance & white goods coatings

- Metal fabrication coatings

- Flooring & industrial concrete coatings

- Wood industrial coatings

- Specialty industrial coatings (fire-retardant, anti-graffiti)

Performance / Functionality

- Corrosion-resistant

- Chemical / solvent-resistant

- Heat / high-temperature resistant

- Abrasion / wear-resistant

- Anti-fouling / anti-biofouling

- Fire-retardant / intumescent

- Electrical insulation / conductive

- Decorative / color & gloss stabilization

- Low VOC / environmental compliance

End-User Industry

- Oil & Gas / Petrochemical

- Automotive

- Aerospace & Defense

- Marine & Shipbuilding

- Metal Fabrication & Machinery

- Building & Construction (infrastructure)

- Appliances & White Goods

- Electrical & Electronics Manufacturing

- Packaging (metal cans, closures)

- Renewable Energy

- Rail & Transit

- Food & Beverage Processing Equipment

- Heavy Equipment & Mining