Content

What is the Current Europe Adhesives And Sealants Market Size and Share?

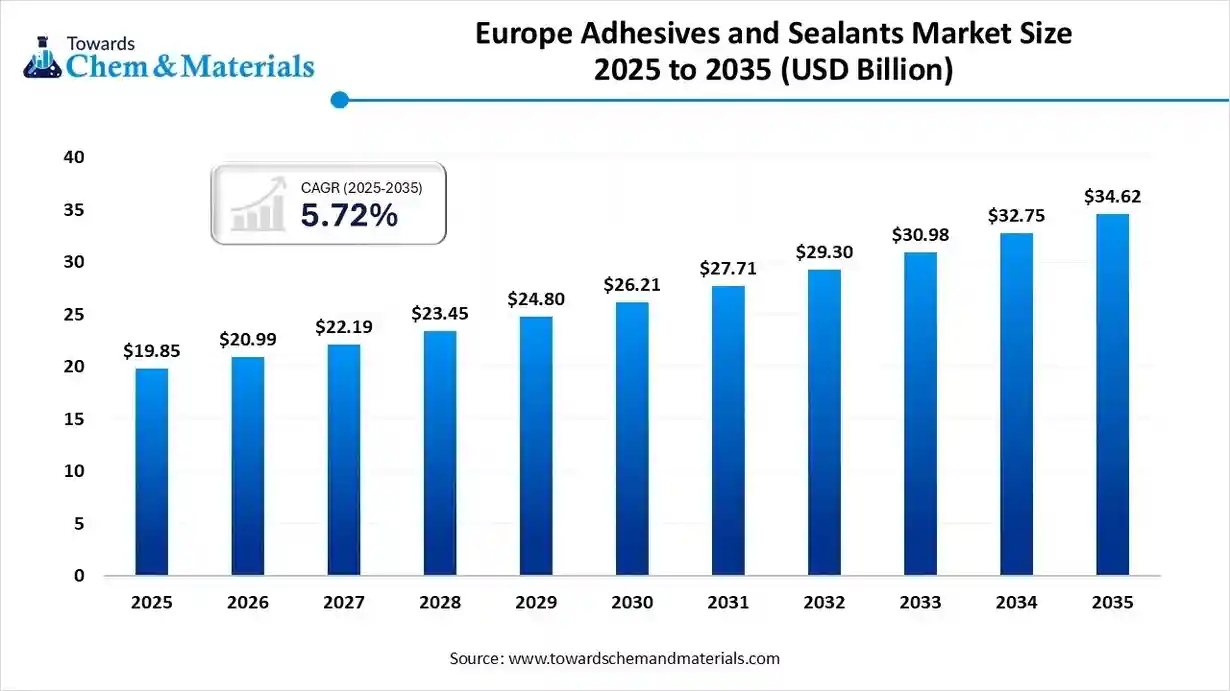

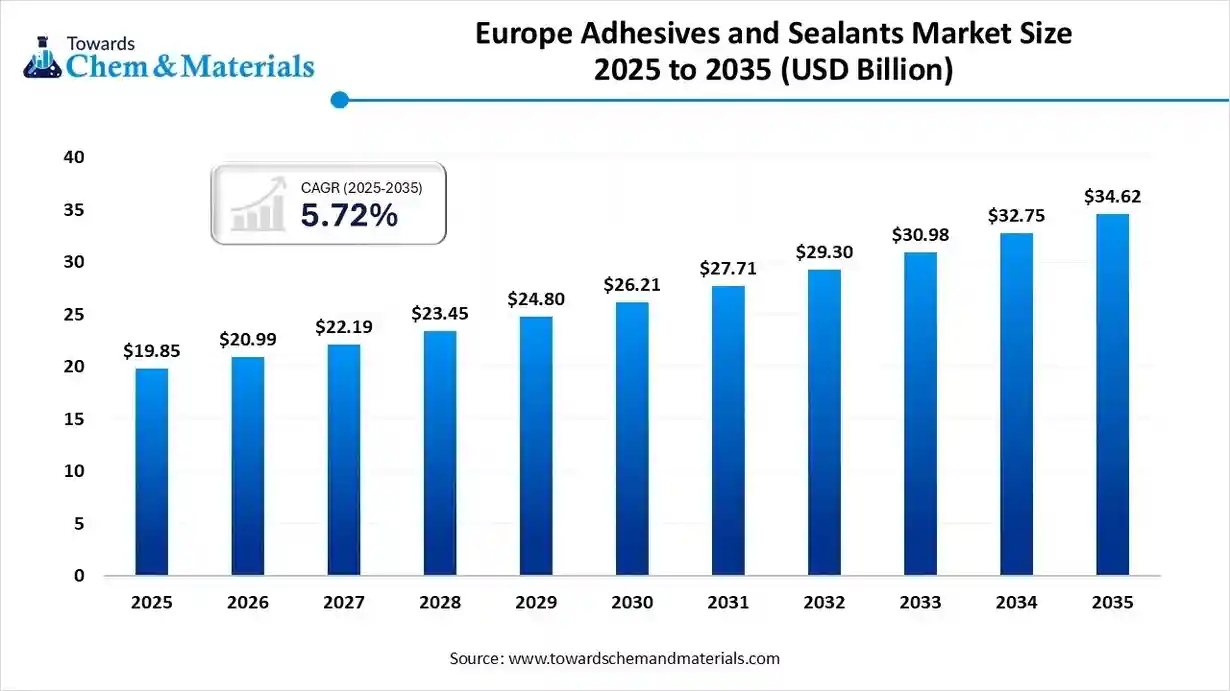

The Europe adhesives and sealants market size is calculated at USD 19.85 billion in 2025 and is predicted to increase from USD 20.99 billion in 2026 and is projected to reach around USD 34.62 billion by 2035, The market is expanding at a CAGR of 5.72% between 2026 and 2035. The growing construction industry, increased demand from the automotive sector for lightweighting, and a shift towards high-performance applications drive the growth of the market.

Key Takeaways

- By resin, the acrylic resins segment accounted for the largest revenue share of 39.19% in 2025.

- By technology, the reactive adhesives segment dominated with the largest revenue share of 44.32% in 2025.

- By end-use industry, the building and construction segment dominated with the largest revenue share of 47.22% in 2025..

Market Overview

What Is The Significance Of The Europe Adhesives And Sealants Market?

The significance of the Europe adhesives and sealants market lies in its role as a key enabler for major industries like automotive, construction, and electronics, driven by trends such as the shift to lightweight vehicles and sustainable building practices. The market is a significant economic driver, with growth fueled by demand for innovative, high-performance, and eco-friendly solutions in response to stringent EU regulations and sustainability goals.

Europe Adhesives And Sealants Market Trends:

- Technological advancement: Ongoing innovation is focused on developing advanced adhesives with properties like conductivity, flexibility, and rapid curing for electronics and other applications.

- Sustainability and environmental regulations: Stringent EU regulations are driving demand for eco-friendly, low-VOC, water-borne systems and bio-based adhesives.

- Automotive industry: The push for lightweight, fuel-efficient electric vehicles (EVs) is a major driver, as adhesives replace traditional fasteners for improved structural integrity and reduced weight.

- Aerospace: The demand for lightweight and fuel-efficient aircraft components is increasing the use of high-performance adhesives to bond parts, improve structural integrity, and reduce weight.

Electronics and renewable energy: The market is expanding to meet the needs of the electronics sector (IoT, 5G, wearables) and renewable energy technologies like solar panels and wind turbines, which require high-performance adhesives for assembly and weather resistance.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 22.09 Billion |

| Revenue Forecast in 2035 | USD 48.22 Billion |

| Growth Rate | CAGR 8.12% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Resin, By Technology, By End-User Industry, |

| Key companies profiled | Henkel AG & Co. KGaA, Arkema, H.B. Fuller Company, RPM International Inc., Soudal Group, Chemetall, 3M, Huntsman International LLC, Avery Dennison Corporation, DELO Industrial Adhesives, Dow, RPM International Inc., Soudal Group, Solvay, Bostik, Jowat, Mapei S.p.A., Wacker Chemie AG |

Key Technological Shifts In The Europe Adhesives And Sealants Market:

Key technological shifts in the Europe adhesives and sealants market include the dominance of water-based technologies, the rapid growth of hot-melt adhesives, and the rise of sustainable and bio-based solutions. Digitalisation, Artificial Intelligence, and automation are being integrated to improve operations and product development, while specialised applications are emerging, particularly in sectors like electric vehicles and renewable energy. The market is also seeing innovation in "smart adhesives" that respond to environmental changes.

Trade Analysis Of Europe Adhesives And Sealants Market: Import & Export Statistics

- According to European Union Export data, the EU exported 11 shipments of Sealant from March 2024 to February 2025 (TTM). These exports were handled by 5 EU exporters to 8 buyers. With the growth rate of 38% compared to the preceding twelve months.

- Most of the EU's Sealant exports go to Vietnam, Ukraine, and Kazakhstan.

- Globally, the top three exporters of sealants are China, the United States, and Vietnam. China leads the world in Sealant exports with 31,974 shipments, followed by the United States with 15,567 shipments, and Vietnam in third place with 5,749 shipments.

- The world exported 5,649 shipments of adhesives and sealants from June 2024 to May 2025 (TTM). These exports were made by 1,349 exporters to 1,403 buyers, marking a 5% growth compared to the previous twelve months.

- Most of the world’s adhesives and sealants exports go to Vietnam, Mexico, and India.

- Globally, the top three exporters of adhesives and sealants are the United States, China, and Japan. The United States leads with 4,762 shipments, followed by China with 4,111 shipments, and Japan in third place with 1,695 shipments.

Europe Adhesives And Sealants Market Value Chain Analysis

- Chemical Synthesis and Processing: Adhesives and sealants in Europe are manufactured using polymer chemistries such as acrylics, epoxies, polyurethanes, silicones, and hot melts through processes including polymerisation, blending, compounding, and curing. These products are tailored for applications requiring bonding, sealing, elasticity, and durability.

- Key players : Henkel AG & Co. KGaA, Sika AG, Arkema Group (Bostik), H.B. Fuller Company, Dow Inc.

- Quality Testing and Certification : Adhesives and sealants are tested for bonding strength, thermal resistance, flexibility, chemical resistance, and environmental compliance under standards such as EN 1465, ISO 9001, and REACH regulations in Europe.

- Key players: TÜV SÜD, SGS, Intertek, Bureau Veritas.

- Distribution to Industrial Users : Adhesives and sealants are distributed to construction, automotive, packaging, electronics, and furniture industries through regional distributors, OEM supply chains, and direct industrial partnerships across Europe.

- Key players: Henkel AG & Co. KGaA, Sika AG, Arkema Group (Bostik), H.B. Fuller Company.

Adhesives And Sealants Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| Europe Union (EU) | Europe Commission, ECHA (Europe Chemicals Agency) | REACH Regulation (EC No. 1907/2006), CLP Regulation (EC No. 1272/2008), Construction Products Regulation (CPR – EU 305/2011) | Chemical safety, hazard classification, product performance, labeling | REACH impacts raw materials (isocyanates, solvents, plasticizers); restrictions on hazardous substances are driving reformulation toward low-VOC and solvent-free systems. |

| Germany | Federal Environment Agency (UBA), DIBt (German Institute for Construction Technology) | AgBB Scheme for VOC emissions, German Building Code, REACH/CLP compliance | Indoor air quality, VOC emissions, and construction material safety | Germany enforces some of the strictest indoor air emission requirements in Europe, influencing adhesive formulations for flooring and construction. |

| France | ANSES, French Ministry for Ecological Transition | VOC Emission Labelling Decree, REACH/CLP, Environmental Code | VOC labelling, indoor emissions, consumer safety | Mandatory VOC emission labelling on construction adhesives helps promote low-emission and green-certified products. |

| United Kingdom | HSE (Health and Safety Executive), DEFRA | UK REACH, UK CLP Regulation, Construction Products Regulations | Chemical registration, occupational safety, and product compliance after Brexit | Post-Brexit UK REACH requires separate chemical registration for substances marketed in the UK; divergence from EU rules is increasing gradually. |

| Italy | Ministry of Ecological Transition, UNI (Italian Standards Body) | UNI Standards for construction materials, REACH/CLP | Construction quality, sustainability, and environmental protection | Strong alignment with EU laws; growing focus on green building certifications (LEED, BREEAM), influencing adhesive demand. |

Segmental Insights

Resin Insights

Which Adhesive Resin Segment Dominated The Europe Adhesives And Sealants Market In 2024?

The acrylic resins segment dominated the Europe adhesives and sealants market with a share of 39.19% in 2025. Acrylic resin–based adhesives are widely used in Europe due to their strong bonding properties, excellent weather resistance, and long-term durability.

These adhesives are extensively applied in various sectors where UV resistance and transparency are critical. Additionally, low-volatile organic compound formulations are increasing in adoption as European regulations push for environmentally friendly and sustainable adhesive solutions.

The epoxy resins segment expects significant growth in the market during the forecast period. Epoxy-based adhesives offer superior mechanical strength, chemical resistance, and thermal stability, making them ideal for structural bonding applications across aerospace, construction, and heavy industries. Their strong adhesion to metals and composites makes them critical in high-performance applications where durability and load-bearing performance are essential.

The polyurethane segment has seen notable growth in the market. Polyurethane adhesives are known for their flexibility, impact resistance, and ability to bond dissimilar materials. Their ability to absorb vibrations and withstand temperature variations supports increasing demand. Growth in green building projects and modular construction across Europe is further driving polyurethane adhesive consumption.

Technology Insights

How Did the Reactive Adhesives Segment Dominated The Europe Adhesives And Sealants Market In 2024?

The reactive adhesives segment dominated the market with a share of 44.32% in 2025. Reactive adhesives, such as moisture-curing polyurethanes and epoxies, dominate high-performance applications where strong and permanent bonding is required. Increasing use of lightweight materials and composites in transportation is pushing demand for reactive adhesives. Their superior bonding strength and long service life make them essential in modern industrial processes.

The hot melt adhesives segment expects significant growth in the Europe adhesives and sealants market during the forecast period. Hot melt adhesives are gaining popularity due to their fast setting time, solvent-free nature, and recyclability advantages. They are widely used in packaging, labelling, woodworking, and hygiene products. The rising preference for environmentally sustainable and energy-efficient manufacturing processes also boosts the adoption of hot melt technologies.

The solvent-borne adhesives segment has seen notable growth in the market. Despite tightening environmental regulations, solvent-borne adhesives continue to have strong demand in applications requiring high initial tack and strong bonding, such as automotive trims and industrial laminates. This segment remains relevant in legacy applications and in industries where performance requirements outweigh environmental concerns.

End-User Industry Insights

Which End-User Industry Segment Dominated The Europe Adhesives And Sealants Market In 2024?

The building and construction segment dominated the market with a share of 47.22% in 2025. The construction industry is the largest consumer of adhesives and sealants in Europe, driven by demand from residential renovation, commercial construction, and infrastructure projects. Growing urbanisation, energy-efficient building requirements, and increasing retrofitting activities across ageing European infrastructure are major growth drivers for this segment.

The aerospace segment expects significant growth in the Europe adhesives and sealants market during the forecast period. In the aerospace industry, adhesives and sealants are essential for bonding lightweight composites, sealing aircraft fuselage sections, and improving fuel efficiency by reducing mechanical fasteners. Increasing production of commercial aircraft and investments in defence fleets are contributing significantly to the growth of this segment.

The automotive segment has seen notable growth in the market. The automotive industry in Europe extensively uses adhesives for lightweight vehicle design, electric vehicles, and battery assembly. Growing electric vehicle adoption and sustainability mandates in European automotive manufacturing are driving higher usage of advanced adhesive and sealing solutions in OEM and aftermarket applications.

Country Insights

Germany: Europe Adhesives And Sealants Market Growth Trends

Germany is the largest adhesives and sealants market in Europe, supported by its strong automotive, construction, and industrial manufacturing sectors. The country’s leadership in electric vehicle production and green construction initiatives have significantly increased demand for advanced bonding solutions. German manufacturers focus heavily on high-performance, sustainable, and low-emission adhesives to comply with strict environmental regulations and maintain technological leadership in the European market.

United Kingdom (UK): Europe Adhesives And Sealants Market Growth Trends

The UK adhesives and sealants market is driven by infrastructure repair projects, residential construction, and aerospace manufacturing. Strong demand from aircraft production, packaging, and renovation activities supports steady growth. Post-Brexit supply chain restructuring has also encouraged domestic adhesive manufacturing, while sustainability trends and green construction policies are accelerating the transition toward eco-friendly adhesive and sealant solutions.

France: Europe Adhesives And Sealants Market Growth Trends

France’s market is supported by aerospace, automotive, and renovation-focused construction industries. Major investments in sustainable urban development, public housing, and transportation infrastructure are boosting adhesive consumption. The presence of global aerospace leaders and automotive companies further contributes to strong demand for structural adhesives, sealants, and specialised bonding materials for high-value industrial applications.

Netherlands: Europe Adhesives And Sealants Market Growth Trends

The Netherlands benefits from strong demand in construction, marine applications, and logistics packaging due to its strategic position as a European trade hub. Growth in modular housing, offshore wind projects, and sustainable packaging solutions is driving the adhesives and sealants market. The country’s commitment to circular economy initiatives is also pushing manufacturers to develop recyclable and bio-based adhesive products.

Italy: Europe Adhesives And Sealants Market Growth Trends

Italy’s market is driven by the construction renovation sector, furniture manufacturing, and automotive components production. Adhesives are extensively used in ceramics, flooring, fashion goods, and industrial manufacturing. Government incentives for energy-efficient building upgrades and increasing housing renovation activities are contributing to higher demand for advanced adhesive technologies and weather-resistant sealant solutions.

Recent Developments

- In May 2025, WACKER initiated the production of hybrid polymers at a new facility in Nünchritz, Germany, representing a double-digit million-euro investment aimed at increasing capacity and meeting demand for tin-free adhesives and sealants. This facility produces silane-terminated polymers under the GENIOSIL® STP-E brand for use in construction, assembly, and parquet adhesives, and liquid waterproofing systems.(Source: www.Europe-coatings.com)

- In September 2025, Huntsman Advanced Materials will launch a new range of ARALDITE® epoxy adhesives that are safer and more sustainable. The reformulated adhesives are free from intentionally added BPA and substances classified as CMR under the EU's CLP regulation.(Source: www.huntsman.com)

- In March 2025, at the Europe Coatings Show 2025, Clariant and Omya highlighted their AddWorks® IBC 760 stabiliser solution for SMP sealants, noting its proven performance and sustainability benefits. The solution is label-free, enhances sealant durability by up to 50%, and features a new packaging design reducing paper use by over 80%. (Source: www.clariant.com)

Top Players In The Europe Adhesives And Sealants Market & Their Offerings:

Sika AG

Corporate Information

- Full Name: Sika AG

- Type: Public Company (Aktiengesellschaft)

- Headquarters: Baar, Switzerland

- Founded: 1910 by Kaspar Winkler

- Key Business Areas: Specialty chemicals for building & construction and industrial markets including concrete admixtures, mortars, roofing, flooring, waterproofing, adhesives & sealants.

History and Background

- Origins: The company started in Switzerland in 1910.

- Core Competencies: Over the years, Sika has built strong capabilities in sealing, bonding, damping, reinforcing, and protecting these are its main value propositions.

Key Developments and Strategic Initiatives

- “Local-for-Local” Strategy: Sika emphasizes producing locally in its target markets to reduce risk from trade barriers and improve supply reliability.

- Efficiency Program “Fast Forward”: In 2025, Sika launched a structural adjustment and efficiency program aiming to generate annual savings.

- Sustainability: They introduced the Sika® Carbon Compass, a platform for calculating product carbon footprints, aligned with international standards.

Mergers & Acquisitions

- MBCC Group Acquisition: One of its largest to date significantly boosts its construction chemicals portfolio.

- Parex Acquisition (2019): Strengthened its mortar and façade systems business.

Partnerships & Collaborations

- Joint Venture w/ Sulzer: To advance plastics recycling in construction combining Sika’s polymer expertise with Sulzer’s chemical-recycling know-how.

- Strategic Investment in Giatec: Sika has taken a minority stake in Giatec Scientific, a company specializing in digital concrete technologies (sensors, AI analytics).

- BASF Collaboration: In March 2025, Sika and BASF launched a low-VOC epoxy hardener for sustainable construction.

Product Launches / Innovations

- Sustainable Flooring Hardener: The epoxy hardener with very low VOC developed with BASF.

- Digital Concrete Tools: Through Giatec, Sika is pushing smart testing of concrete, enabling real-time data on quality and durability.

- Carbon Footprint Platform: Sika® Carbon Compass lets customers calculate and manage the carbon footprint of products.

Key Technology Focus Areas

- High-performance Bonding / Sealants: Adhesives, sealants, structural bonding.

- Waterproofing & Mortars: For roofs, façades, floors.

- Concrete Admixtures / Additives: Enhancing strength, durability, workability.

R&D Organisation & Investment

- Global R&D Reach: Given its global manufacturing footprint (~400 production sites in 102 countries as of 2025), it's well-positioned for innovation regionally.

- R&D for Sustainability: Investment in low-emissions materials (e.g., low-VOC hardeners) and carbon management tools (Carbon Compass).

- Digital R&D: Through its stake in Giatec, Sika is investing in data analytics and smart infrastructure.

SWOT Analysis

Strengths

- Strong global footprint + “local-for-local” model.

- Diversified business across infrastructure, industrial, roofing, concrete, etc.

- Proven acquisition capabilities (MBCC, Elmich, others) to scale new segments.

- High operational margins and efficiency programs underway (Fast Forward).

- Sustainability leadership (Carbon Compass, net-zero goals).

Weaknesses

- Exposure to currency risk (foreign exchange impacts have hurt reported earnings)

- High complexity in integrating many acquisitions.

- Cost of restructuring: one off costs (e.g., workforce reduction) are significant.

Opportunities

- Growing demand for green construction (waterproofing, low VOC materials).

- Expansion in emerging markets leveraging local production.

- Digitalization of construction (with Giatec) opening new revenue streams.

- Circular economy: recycling joint ventures (e.g., with Sulzer) - sustainability + cost advantages.

Threats

- Weakness in key markets (e.g., Chinese construction slowdown)

- Trade policy or tariff risks, though mitigated by local production.

- Rising raw material costs, especially for specialty chemicals.

- Execution risk in achieving synergies from large M&A deals.

Recent News & Strategic Updates

- Financial Performance: In its 9-month 2025 report, Sika posted +1.1% sales growth in local currencies but anticipates one-off costs of CHF 80–100 million due to restructuring.

- Bond Issuance: In March 2025, Sika placed a CHF 500 million bond.

- Growth Investments: New factories opened in Singapore (mortars) and Xi’an (adhesives, waterproofing) to strengthen local production.

Other Top Players Are

- Henkel AG & Co. KGaA: Henkel is a market leader in adhesives, sealants, and functional coatings across Europe. Through its LOCTITE, TEROSON, and BONDERITE brands, the company serves automotive, construction, packaging, and electronics industries with high-performance bonding and sealing solutions.

- Arkema: Arkema’s Bostik brand specialises in smart adhesives for construction, packaging, and industrial assembly. The company focuses on sustainable and low-VOC solutions for flooring, insulation, and flexible packaging applications.

- H.B. Fuller Company: H.B. Fuller is a global adhesives company with strong European operations, providing solutions for packaging, hygiene, automotive, electronics, and woodworking industries, while focusing on sustainable and bio-based formulations.

- RPM International Inc.: RPM operates strongly in Europe through brands like Tremco and illbruck. It offers high-performance sealants, waterproofing, and building envelope solutions for commercial, residential, and industrial construction sectors.

- Soudal Group: Soudal is one of Europe’s largest independent manufacturers of sealants, adhesives, and PU foams. It serves DIY, professional construction, and industrial markets across Europe with a wide product portfolio.

- Chemetall

- 3M

- Huntsman International LLC

- Avery Dennison Corporation

- DELO Industrial Adhesives

- Dow

- RPM International Inc.

- Soudal Group

- Solvay

- Bostik

- Jowat

- Mapei S.p.A.

- Wacker Chemie AG

Segments Covered

By Resin

- Acrylic

- Cyanoacrylate

- Epoxy

- Polyurethane

- Silicone

- VAE / EVA

- Other Resins (Silane-Modified Polymer (SMP), Bio-based Resins, etc.)

By Technology

- Hot-Melt

- Reactive

- Solvent-Borne

- UV-Cured

- Water-Borne

By End-User Industry:

- Aerospace

- Automotive

- Building and Construction

- Footwear and Leather

- Healthcare

- Packaging

- Woodworking and Joinery

- Other End-User Industries (Renewable Energy, Electronics and Appliances, etc.)