Content

Foam Market Size and Growth 2025 to 2034

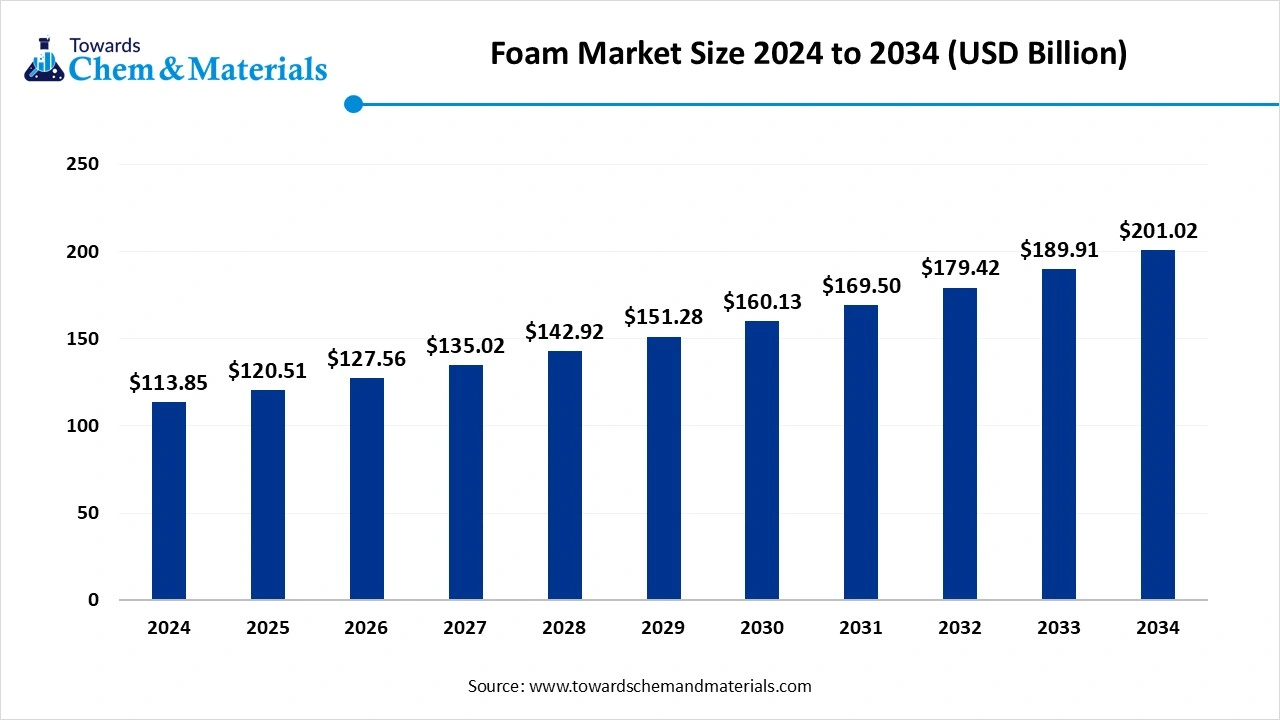

The foam market size is calculated at USD 113.85 billion in 2024, grew to USD 120.51 billion in 2025, and is projected to reach around USD 201.02 billion by 2034. The market is expanding at a CAGR of 5.85% between 2025 and 2034. The increased need for energy-efficient materials is fueling the expansion of opportunities within the sector.

Key Takeaways

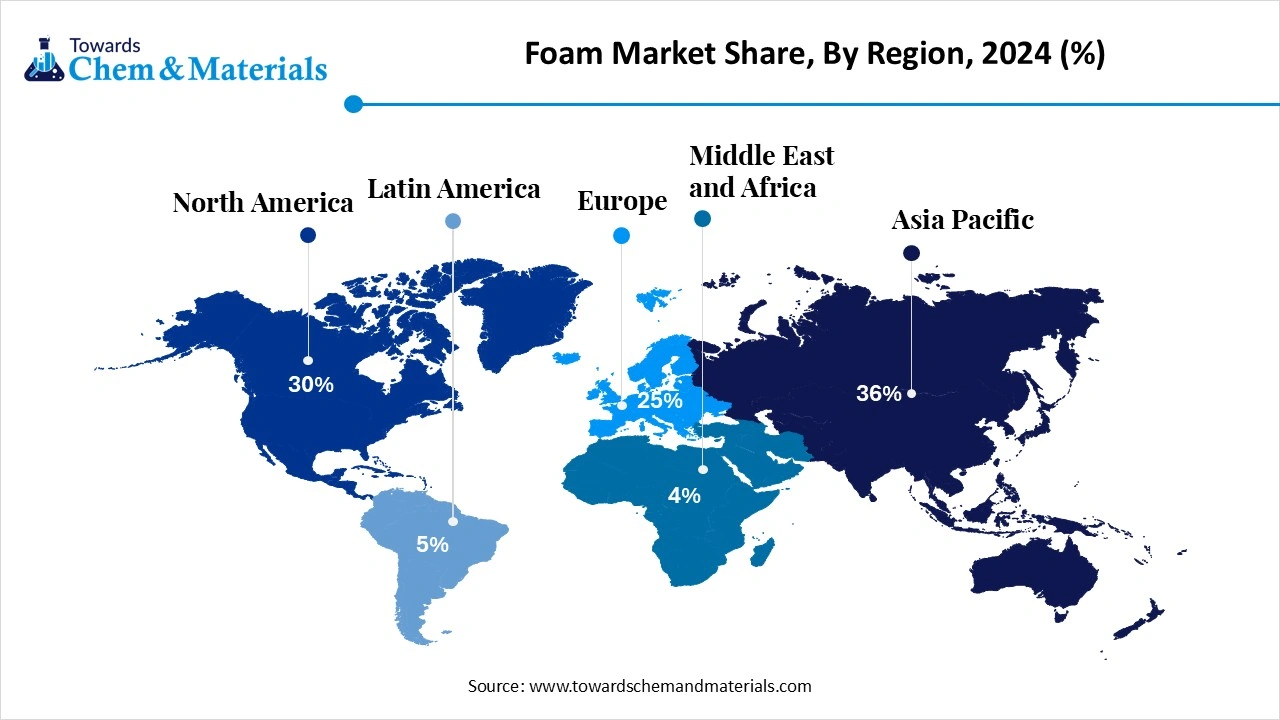

- By region, Asia Pacific dominated the foam market with approximately 36% industry share in 2024, owing to factors such as the enlarged construction activities and heavy automotive production infrastructure.

- By region, North America is expected to grow at a notable rate in the future, akin to the greater push for eco-friendly construction and advanced packaging needs.

- By polymer type, the polyurethane foams segment led the market with approximately 40% industry share in 2024, due to their lightweight properties, affordability, and better suitability for multiple industries.

- By polymer type, the specialty engineered foam segment is expected to grow at the fastest rate in the market during the forecast period, owing to the increased need for high-performance solutions and advanced materials from the major manufacturing industries.

- By physical forms, the sheets and rolls segment emerged as the top-performing segment in the market with approximately 32% industry share in 2024, because they are the most practical, cost-effective, and widely used foam forms.

- By physical forms, the spray-applied foams segment is expected fastest in the market in the coming years, because it provides seamless insulation, flexibility in application, and long-term energy savings.

- By end-use industry, the building and construction segment led the market with approximately 27% share in 2024, because of the huge demand for insulation, flooring, roofing, and cushioning materials.

- By end-use industry, the automotive and transportation segment is expected to capture the fastest growth in the market in the coming years, because of the growing demand for lightweight, fuel-efficient, and comfortable vehicles.

Market Overview

Lightweight, Strong, and Smart: The New Era of Foam

The foam market has experienced sophisticated growth in recent years. The materials (polymeric or cellular materials) are manufactured by introducing gas pockets into a solid or semi-solid matrix to produce low-density, lightweight products used for cushioning, insulation, packaging, structural cores, acoustic control, filtration, sealing, and specialty engineering applications across consumer, industrial, automotive, construction, medical, and electronics end-use sectors. Moreover, by having versatility and greater insulation properties, the foam has received heightened scrutiny and evolution in the past few years.

Driving Innovations With Energy-Efficient Foam Materials

The global push for lightweight and energy-efficient materials has significantly increased the commercial viability of the industry. Moreover, by providing excellent thermal insulation to the under-construction buildings, vehicles, and appliances, the foams are regarded as a major technological advancement in recent years. Furthermore, the versatility of the foams has positively influenced sectoral momentum in the present period, as per the recent industry survey.

For Instance, the 3A Composites Core Material unveiled its latest PET foam. Also, this foam is specifically designed for highly loaded applications, as per the company's claim.(Source: www.jeccomposites.com)

Market Trends

- The greater demand for the biobased foams is actively supporting capital growth and economic activity in the sector over the past few years, as several manufacturers are seen under the heavy investment for the sustainable foam production initiatives.

- The trend towards the functional and smart foams has emerged as a catalyst for unlocking the sector's growth in recent years. The individuals choose the foam that has fire retardancy, antimicrobial resistance, and better conductivity.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 120.51 Billion |

| Expected Size by 2034 | USD 201.02 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Polymer/Chemistry Type, By Physical Form, By End-Use Industry, By Region |

| Key Companies Profiled | BASF SE, The Dow Chemical Company , Huntsman Corporation , Covestro AG , Armacell International S.A. , Zotefoams plc , Sekisui Chemical Co., Ltd. , Recticel , Kingspan Group plc , Owens Corning , Saint-Gobain S.A. , Rogers Corporation , JSP Corporation , 3M Company , LyondellBasell Industries N.V. , Mitsui Chemicals, Inc., Carpenter Co. , FoamPartner AG , Eurofoam GmbH , Beaulieu International Group |

Market Opportunity

Sustainable Foams Paving the Way for Greener Manufacturing

The manufacturers can benefit by launching recyclable and sustainable foams during the forecast period. As the global shift towards eco-friendly manufacturing, renewable forms are likely to raise awareness among ventures and corporate backers in the coming years. Moreover, the protective packaging industry is forecasted to strengthen the bottom line for production firms in the coming period, as per future industry expectations.

- In April 2025, Useon Unite and TotalEnergies created a partnership. The motive behind the collaboration is to create sustainable PLA foam technology, as per the company's claim.(Source: www.chemanalyst.com)

Market Challenge

Petroleum-Based Foams Hit Roadblocks in Eco-Conscious Markets

The increased waste disposal challenges of the traditional foams are expected to limit market entry and scalability in the coming years. Moreover, most of the foams are produced from petroleum-based raw material, which is hard to decompose. Furthermore, a sustainability push from the regional governments could disrupt the planned expansion efforts within the sectors during the projected period.

Regional Insights

Asia Pacific Foam Market Size, Industry Report 2034

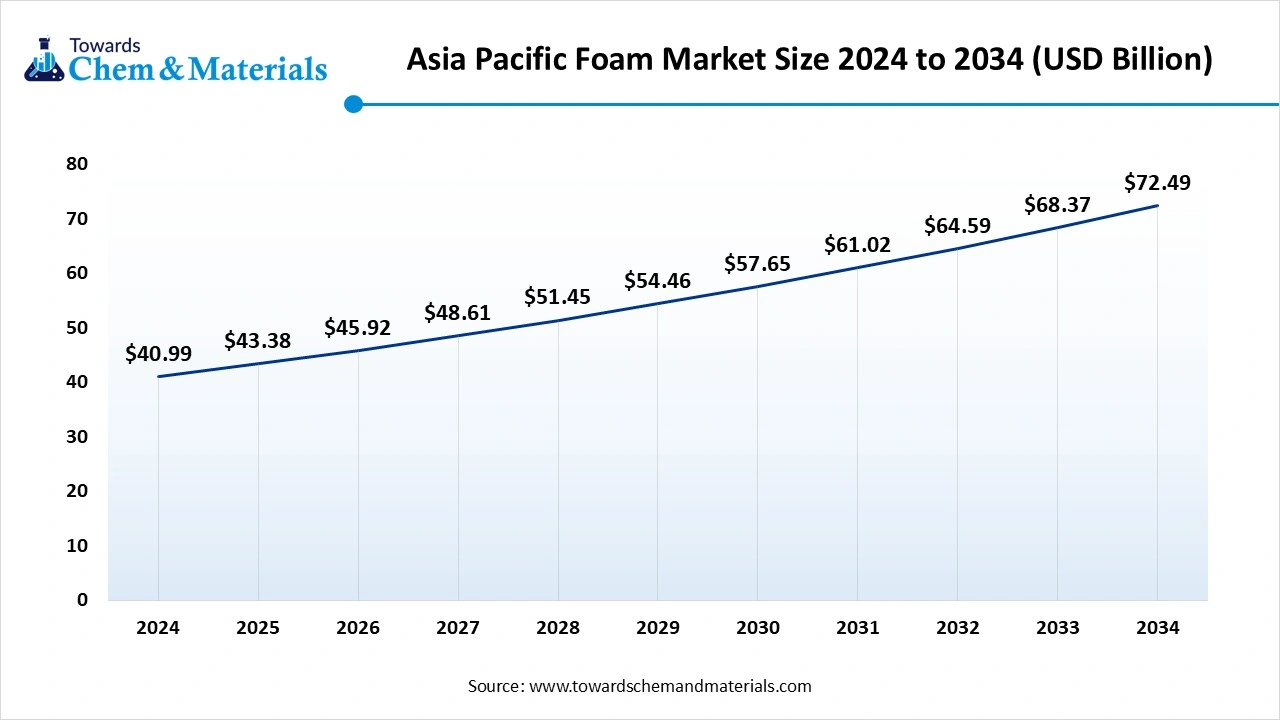

The Asia Pacific foam market size was estimated at USD 40.99 billion in 2024 and is anticipated to reach USD 72.49 billion by 2034, growing at a CAGR of 5.87% from 2025 to 2034. Asia Pacific dominated the market in 2024,

owing to factors such as the enlarged construction activities and heavy automotive production infrastructure. The foams have gained major attention in the regional countries such as India, China, and Southeast Asia for purposes like housing insulation, packaging, furniture, and transport. Also, the regional benefits like low-cost manufacturing and labor charges have boosted the overall capacity of the industry in the region.

Can China’s Infrastructure Boom Keep Boosting Foam Demand?

China maintained its dominance in the market in 2024, owing to the country being considered one of the largest producers of foam, with greater consumption. Moreover, industries like packaging, construction, and automotive have been heavily creating profitable pathways for stakeholders in recent years by demanding the heavy stick of the foams. Also, having advantages like enlarged raw material supply and ongoing infrastructure development, the foam manufacturers have gained prominence in innovation-led discussions in the past few years.

- In July 2025, Convestro introduced its latest foam in China’s EV market. Also, the newly unveiled foam has flame-retardant properties, which are designed for EV batteries as per the published report.(Source: www.indianchemicalnews.com)

North America Foam Market Trends

North America is expected to capture a significant share of the market during the forecast period, akin to the greater push for eco-friendly construction and advanced packaging needs. Moreover, the regional countries like the United States and Canada are seen under the heavy implementation of the sustainable building construction and energy codes in recent years, which is influencing financial performance and sector growth.

Segmental Insights

Polymer Type Insights

How did the Polyurethane Foams Segment Dominate the Foam Market in 2024?

The polyurethane foams segment held the largest share of the market in 2024, due to their lightweight properties, affordability, and better suitability for multiple industries. Moreover, the manufacturers of the furniture, packaging. Automotive and insulation have seen the heavy usage of polyurethane foams in recent years. Furthermore, by having durability and the ability to provide better thermal insulation, the polyurethane has gained traction with investment firms and analysts in recent years.

The specialty engineered foams segment is expected to grow at a notable rate during the predicted timeframe, owing to the increased need for high-performance solutions and advanced materials from the major manufacturing industries. Also, by having flame resistance properties, bio compatibility, and sound proofing, the specialty engineered foams are likely to receive a sophisticated consumer base from the sectors such as the aerospace, medical devices, and defense, according to the sector needs in the coming years.

- In February 2025, Glenmark Pharmaceutical Inc. introduced its latest pharmaceutical foam called Clindamycin Phosphate Foam, 1%.(Source: www.prnewswire.com)

Physical Form Insights

Why Does The Sheets And Rolls Segment Dominate The Foam Market By Form Type?

The sheets and rolls segment held the largest share of the foam market in 2024, because they are the most practical, cost-effective, and widely used foam forms. They are easy to cut, shape, and apply across industries like construction, packaging, and furniture. Sheets provide consistent thickness and flexibility, which makes them suitable for insulation panels, protective packaging, and cushioning materials. Rolls are especially popular in flooring underlays, carpet padding, and sound insulation because they cover large areas quickly.

The spray-applied foams segment is expected to grow at a notable rate during the predicted timeframe because they provide seamless insulation, flexibility in application, and long-term energy savings. In construction, spray foams fill cracks and cavities, reducing air leakage and improving building efficiency. They are gaining popularity in both residential and commercial sectors due to increasing focus on green buildings and stricter energy-efficiency regulations.

End User Industry Insights

How did the Building and Construction Segment Dominate the Foam Market in 2024?

The building and construction segment dominated the market with the largest share in 2024 because of the huge demand for insulation, flooring, roofing, and cushioning materials. As urbanization increases, foams are heavily used in housing, commercial buildings, and infrastructure projects. Polyurethane and polystyrene foams are common for thermal insulation, which improves energy efficiency in buildings. The furniture, bedding, and interior design industries also rely heavily on foams for comfort and durability.

The automotive and transportation segment is expected to grow at a significant rate during the predicted timeframe because of the growing demand for lightweight, fuel-efficient, and comfortable vehicles. Foams are key materials in car seating, headrests, dashboards, and insulation panels. With the rise of electric vehicles (EVs), foams are being used for battery insulation, noise reduction, and lightweight interiors.

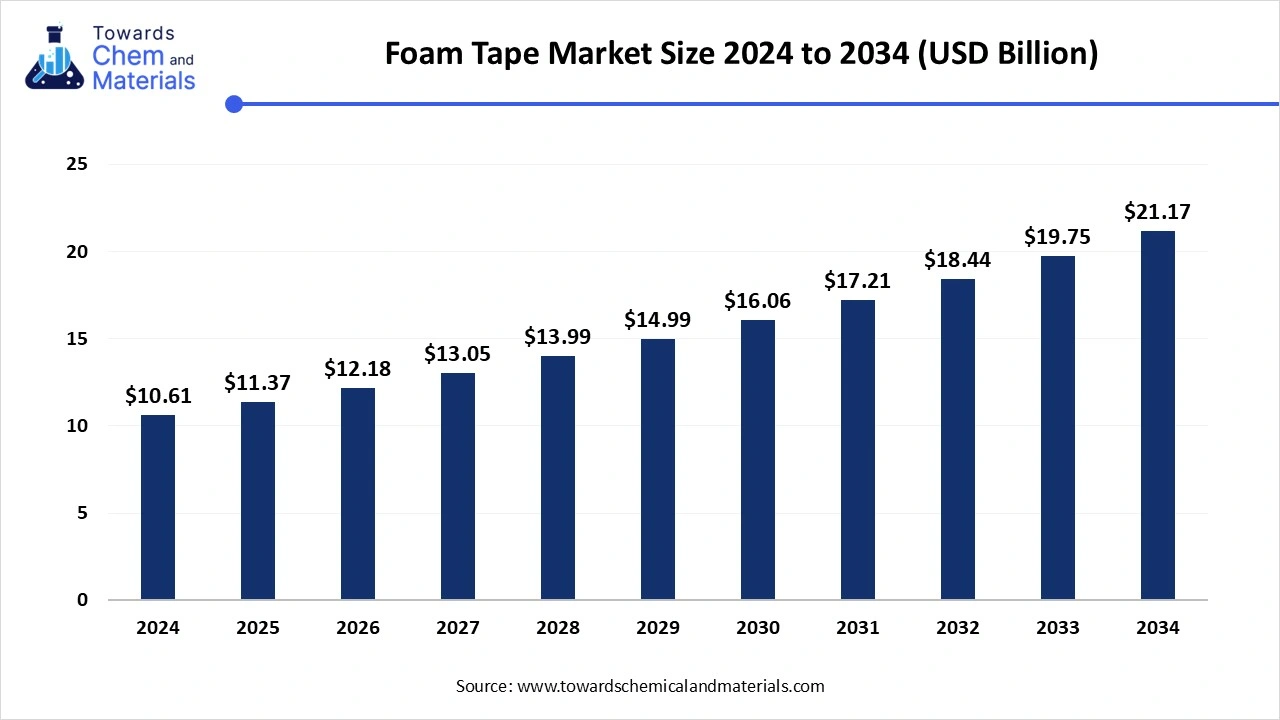

Future of Foam Tape Market Size

The global foam tape market size was valued at USD 10.61 billion in 2024 and is expected to hit around USD 21.17 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.15% over the forecast period 2025 to 2034. The growth in the electronic and semiconductor industry drives the growth of the market.

The foam tape market has witnessed steady growth in recent years. The wide applications in major industries such as electronics, construction, automotive, and packaging have contributed significantly to the growth of the market. The foam tapes offer strong adhesion, excellent vibration resistance, and greater durability, which can turn individuals' perspectives towards foam tapes in the current scenario. The foam tapes are seen in major usage in the construction industry with replacements of bolts, screws, and liquid adhesives in recent years.

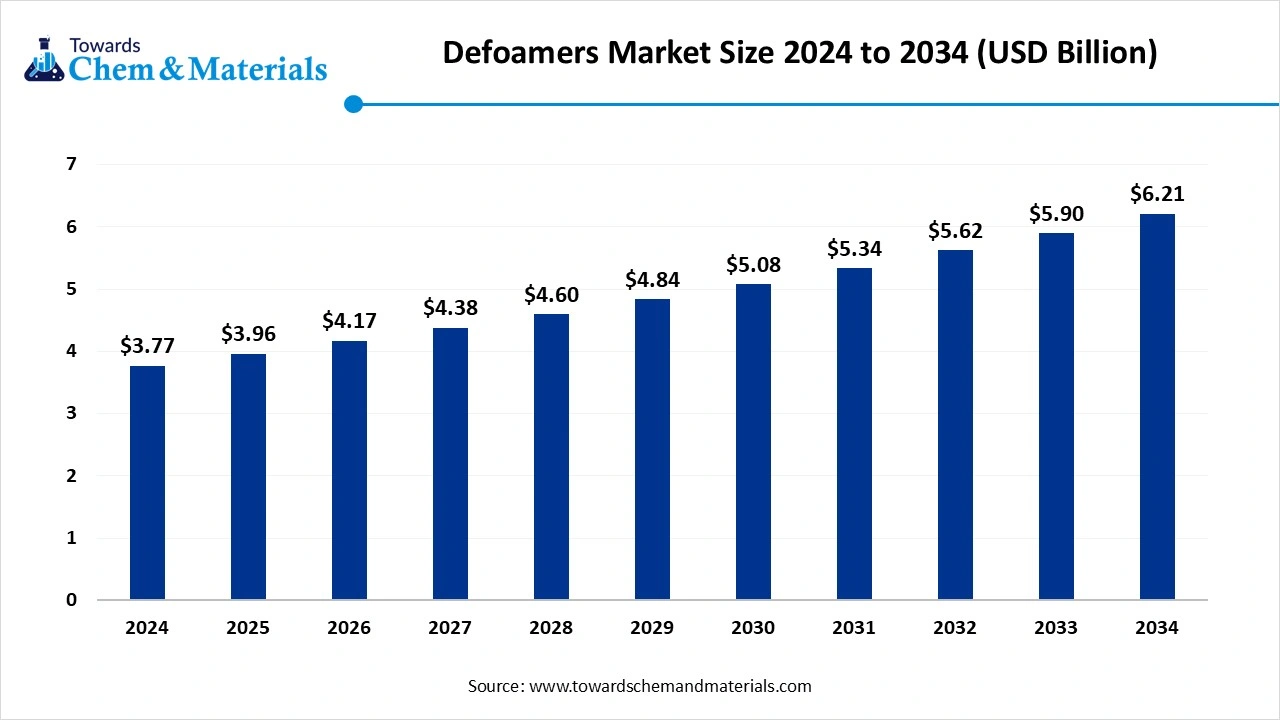

Future of Defoamers Market Size

The global defoamers market size accounted for USD 3.77 billion in 2024, grew to USD 3.96 billion in 2025, and is expected to be worth around USD 6.21 billion by 2034, poised to grow at a CAGR of 5.11% between 2025 and 2034. The increasing demand for agrochemicals globally is the key factor driving market growth. Also, a surge in the need for wastewater treatment, coupled with the rising preference for sustainable defoamers, can fuel market growth further.

Defoamers, also known as anti-foaming agents, are chemical additives that reduce and hinder the formation of foam in industrial process liquids. Foam can cause defects in surface coatings, hinder processing capacity, or result in poor product quality. Defoamers are used across multiple industries, including paints & coatings, food & beverages, water treatment, and pulp & paper, among others. Growing demand in sectors such as pulp & paper, oil & gas, paints & coatings, and pharmaceuticals is positively impacting market growth.

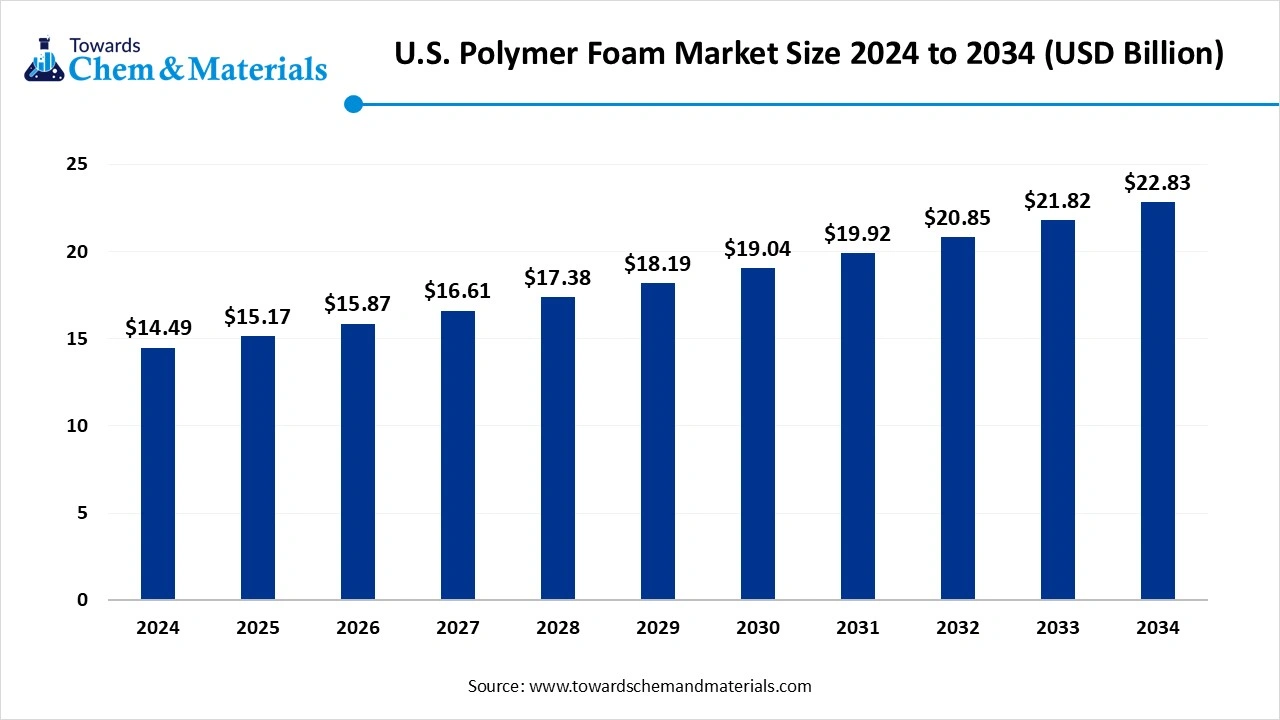

Future of U.S. Polymer Foam Market Size

The U.S. polymer foam market size was reached at USD 14.49 billion in 2024, grew to USD 15.17 billion in 2025 and is expected to be worth around USD 22.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.65% over the forecast period 2025 to 2034. The need for lightweight material is fueling the expansion of opportunities within the sector.

The U.S. polymer foam market has experienced sophisticated growth in recent years, as the region is increasingly shifting towards better lightweight material, insulation, and cushioning, which is continuously improving the financial performance and sector growth at the same time.

Moreover, by packaging fragile items to provide better energy efficiency to buildings, the polymer foams have been widely discussed in technological forums and white papers in the United States in the past few years. Also, the greater investment from the manufacturer for the development and implementation of the sustainable foam production is likely to create greater opportunities in the United States during the projected period.

Foam Market Value Chain Analysis

- Distribution to Industrial Users: The distribution and usage of foam are closely associated with sectors such as the packaging, automotive, construction, and furniture.

- Key Players: BASF, Convestro AG, and Dow Inc

- Chemical Synthesis and Processing: The chemical synthesis and production of the foam are dependent on the foam type, like polyurethane and other foams.

- Regulatory Compliance and Safety Monitoring: The safety monitoring and regulatory compliance of foam is mainly attached to internal company policies, international standards, and government regulations, as per the latest survey.

Recent Developments

- In September 2025, OrthoLite introduced the latest foam technology in Boston and Portland. The newly launched foam technology, called the SloMo which is breathable and memory foam technology.(Source: shop-eat-surf-outdoor.com)

- In July 2025, Novapor and Stora Enso established a strategic collaboration. The aim of the cooperation of the company is to develop cellulose-based foam packaging, as per the report published by the company recently.(Source: www.storaenso.com)

Foam Market Top Companies

- BASF SE

- The Dow Chemical Company

- Huntsman Corporation

- Covestro AG

- Armacell International S.A.

- Zotefoams plc

- Sekisui Chemical Co., Ltd.

- Recticel

- Kingspan Group plc

- Owens Corning

- Saint-Gobain S.A.

- Rogers Corporation

- JSP Corporation

- 3M Company

- LyondellBasell Industries N.V.

- Mitsui Chemicals, Inc.

- Carpenter Co.

- FoamPartner AG

- Eurofoam GmbH

- Beaulieu International Group

Segment Covered

By Polymer/Chemistry Type

- Polyurethane (PU) Foam

- Flexible PU (slabstock, molded)

- Rigid PU (insulation, spray, PIR variants)

- Viscoelastic / Memory PU

- Integral Skin PU

- Polyethylene (PE) Foam

- Cross-linked PE (XLPE)

- Expanded PE (EPE)

- Polystyrene (PS) Foam

- Expanded PS (EPS)

- Extruded PS (XPS)

- Polypropylene (PP) Foam

- Expanded PP (EPP)

- Molded PP Foam

- PVC Foam (rigid, structural panels, signage)

- Silicone Foam

- Melamine Foam

- Neoprene / CR Foam

- Latex / Natural Rubber Foam

- Phenolic Foam

- Specialty Engineered Foams (conductive, graphite-filled, metal-filled, EMI/thermal

- management)

By Physical Form

- Blocks / Slabs

- Sheets / Rolls

- Molded Components

- Beads / Loose-fill

- Panels / Boards

- Spray-applied Foams

- Laminates / Bonded Composites

- Foam Tapes & Gaskets

- Filtration Foams

By End-Use Industry

- Building & Construction

- Automotive & Transportation

- Furniture & Bedding

- Packaging

- Consumer Goods & Appliances

- Electronics & Electrical

- Medical & Healthcare

- Industrial & Machinery

- Aerospace & Marine

- Sports & Recreation

- Adhesives & Tapes

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait