Content

Bio-Based Polyurethane Market Size & Share Report, 2034

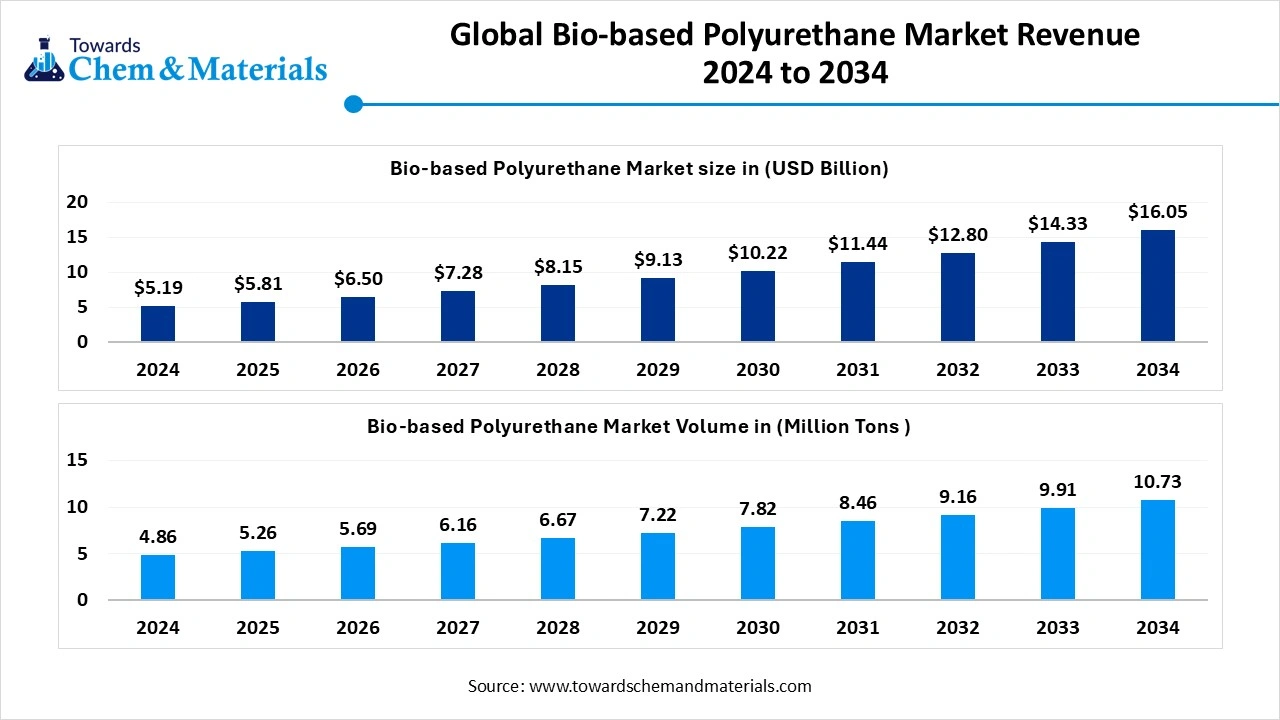

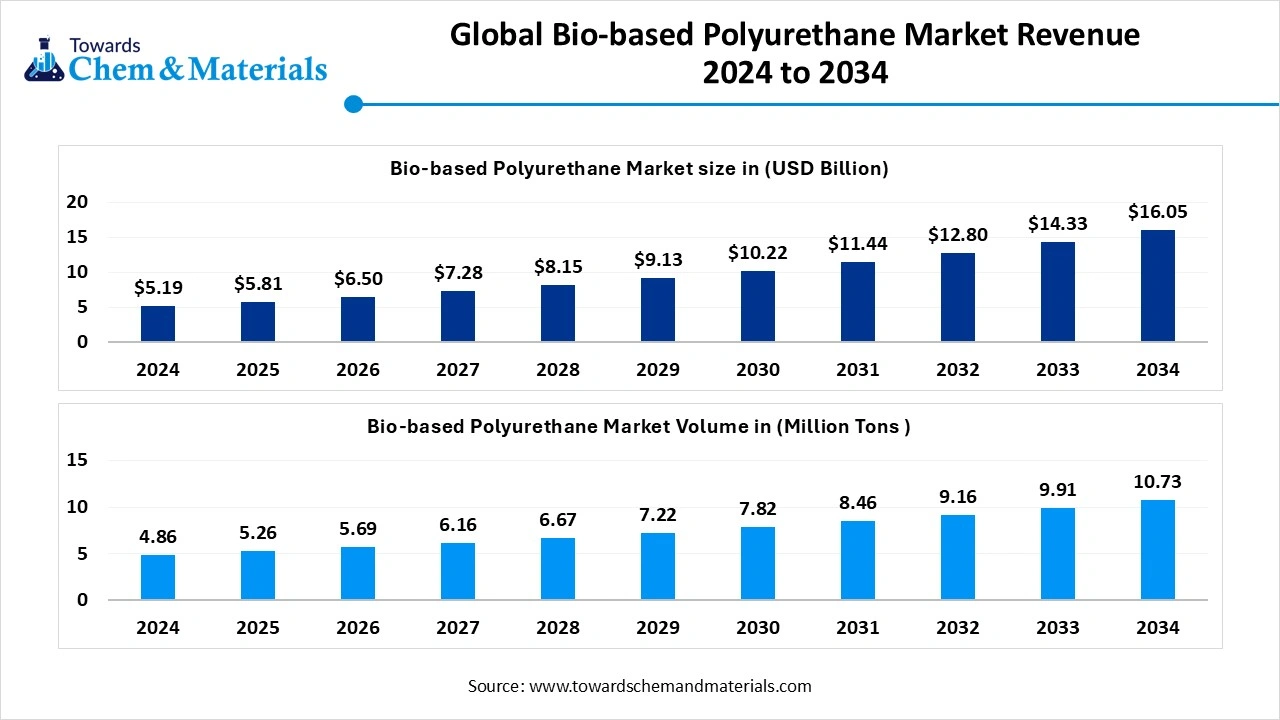

The global bio-based polyurethane market size was reached at 4.86 million tons in 2024 and is expected to be worth around 10.73 million tons by 2034, growing at a compound annual growth rate (CAGR) of 8.24% over the forecast period 2025 to 2034. The growing demand across key end-user industries like construction, footwear, automotive, and packaging drives the growth of the market.

Key Takeaways

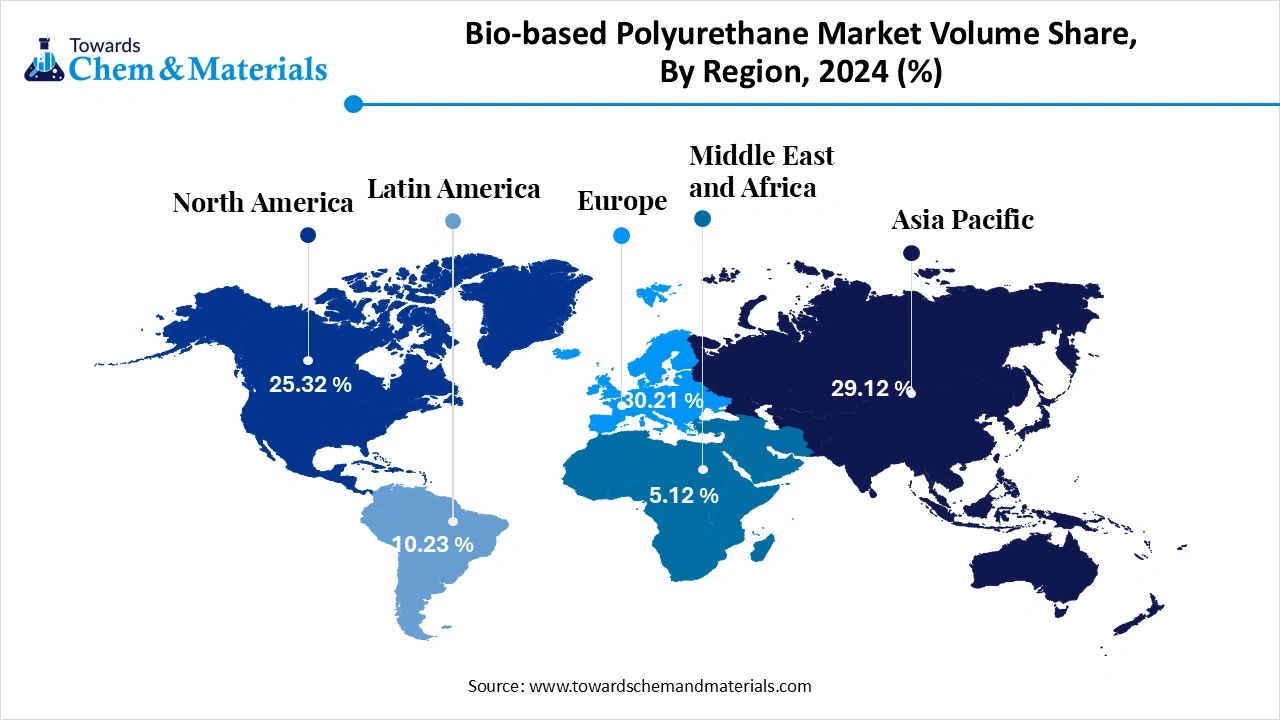

- By region, North America held a 35% share in the bio-based polyurethane market in 2024 due to the well-established manufacturing base.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the rapid growth in infrastructure development.

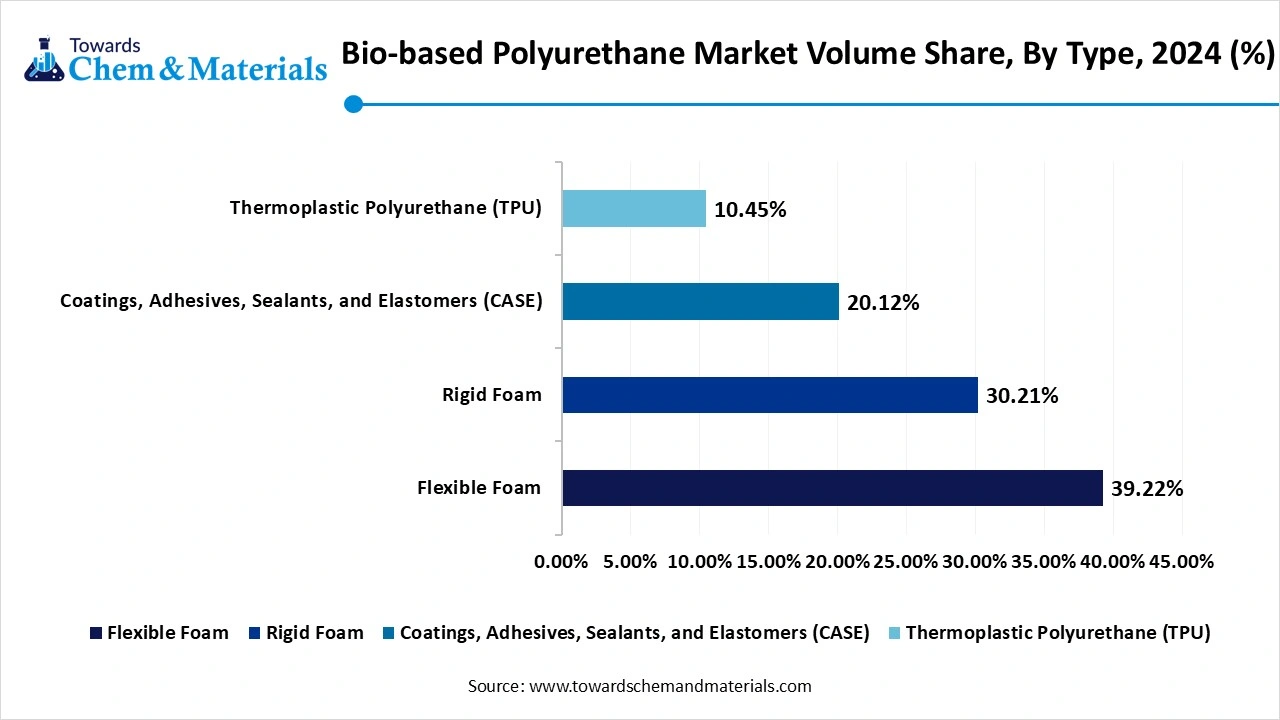

- By type, the flexible foam segment held a 40% share in the market in 2024 due to the growing demand across furniture applications.

- By type, the rigid foam segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand across construction applications.

- By raw material, the vegetable oils segment held a 55% share in the market in 2024 due to the increasing focus on reducing carbon emissions.

- By raw material, the bio-based polyols segment is expected to grow at the fastest CAGR in the market during the forecast period due to the stringent environmental regulations.

- By end-use industry, the automotive segment held a 30% share in the bio-based polyurethane market in 2024 due to the growing adoption of electric vehicles.

- By end-use industry, the building & construction segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rapid growth in construction activities.

Role of Bio-Based PU in a Cleaner Tomorrow and Modern Industry

Bio-based polyurethane, or bio-based PU, is polyurethane derived from renewable sources like lignocellulosic biomass, vegetable oils including soybean oil & castor oil, and carbohydrates. Bio-based PU is a sustainable material and minimizes reliance on fossil fuels. It consists of properties like good mechanical strength, biodegradability, and excellent chemical resistance. It is suitable for various applications like foams, biomedical materials, coatings, and adhesives.

Their key benefits include the use of renewable resources, reducing environmental impact, and a lower carbon footprint. The focus on lowering the carbon footprint and greenhouse gas emissions increases demand for bio-based PU. The increasing production of footwear, like insoles and soles, fuels demand for bio-based PU. The growing demand across industries like automotive, packaging, construction, electronics, and furniture & bedding contributes to the bio-based polyurethane market growth.

- The World exported 72K shipments of vegetable oil.(Source: www.volza.com )

- South Korea exported 12534 shipments of polyol.(Source: www.volza.com)

- India exported 35140 shipments of castor oil.(Source: www.volza.com)

- Ukraine exported 12264 shipments of soybean oil.(Source: www.volza.com)

Who are the Leading Exporters of Polyurethanes in 2023?

| Country | Shipments |

| Germany | $1.62B |

| China | $944M |

| United States | $781M |

Growing Packaging Demand Propels Bio-Based Polyurethane Market Growth

The rise in e-commerce and growing online shopping increases demand for packaging. The growing packaging industry increases demand for bio-based polyurethane. The growing environmental concerns and focus on sustainability increase demand for bio-based PU for packaging applications. The increasing need for adhesives, foams, and coatings in packaging requires bio-based PU. The growing demand for protective packaging, flexible films, and rigid containers increases the adoption of bio-based PU.

The increased online ordering of food fuels demand for sustainable food packaging. The growing consumer awareness about traditional packaging increases demand for bio-based PU packaging. The manufacturing of single-use packaging like food containers, shopping bags, and disposable cutlery increases demand for bio-based PU. The growing demand for general packaging, food packaging, and electronics packaging increases the demand for bio-based PU. The growing demand for packaging is a key driver for the bio-based polyurethane market.

Market Trends

- Growing Demand for Furniture: The growing furniture manufacturing, including adhesives, cushioning, coatings, and customization of furniture, increases demand for bio-based PU for properties like comfort, durability, and flexibility.

- Increasing Demand for Electronic Devices: The increasing demand for electronic devices like wearable devices, smartphones, laptops, and computers increases demand for bio-based PU for superior performance. Bio-based PU offers insulating, encapsulating, and sealing properties to electronics components.

- Growing Environmental Concerns: The growing environmental concerns increase demand for bio-based PU to lower carbon footprint and greenhouse gas emissions. The focus on reducing reliance on fossil fuels and landfill waste increases the adoption of bio-based PU.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 5.26 Million Tons |

| Expected Volume by 2034 | 10.73 Million Tons |

| Growth Rate from 2025 to 2034 | 8.24% CAGR |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Type, By Raw Material, By End-Use Industry, By Region |

| Key Companies Profiled | BASF SE, Covestro AG, Huntsman International LLC, Dow Inc., Wanhua Chemical Group Co., Ltd., Mitsui Chemicals, Inc., DSM Engineering Plastics, Sika AG,, ARLANXEO, Lanxess AG, Covestro AG, Foamex Innovations, Emerald Performance Materials, Perstorp Group, Urethane Soy Systems, Cargill Inc., Rampf Group, BioBased Technologies LLC, Covestro AG, Green Dot Bioplastics |

Market Opportunity

Growing Construction Activities Unlocks Opportunity for Market Growth

The rapid urbanization and growing construction activities in various regions increase demand for bio-based PU. The focus on sustainable building practices and energy efficiency increases the adoption of bio-based PU. The growth in residential and commercial construction increases demand for bio-based PU for various applications like coatings, insulation, and sealants. The increasing need for insulation in floors, walls, and roofs requires bio-based PU to minimize cooling & heating costs and lowering heat transfer.

The growing need for flexible foams in construction applications like industrial roof insulation, waterproof barriers, windows & doors, and sound insulation requires bio-based PU. The growing development of infrastructure projects like roads, bridges, new buildings, and others increases demand for bio-based PU. The rising adoption of green building practices fuels the adoption of bio-based PU. The need for construction components like structural elements, pipes, and cladding increases demand for bio-based PU. The growing construction activities create an opportunity for the bio-based polyurethane market.

Market Challenge

High Production Cost Limits Expansion of Bio-Based Polyurethane Market

Despite several benefits of the bio-based polyurethane in various industries, the high production cost restricts the market growth. Factors like high-cost raw materials, need for specialized equipment, and complex processes are responsible for high production costs. The need for raw materials like agricultural feedstocks and plant-based oils like soy, castor oil, and others costs fluctuate. The limited availability of feedstocks leads to higher production costs. The need for existing production facilities and specialized equipment requires a high initial cost. The complex production processes and the need for specialized catalysts increase the production cost. The development of reliable supply chains requires a high initial cost. The high production cost hampers the growth of the market.

Regional Insights

Which Region Dominated the Bio-Based Polyurethane Market?

North America dominated the bio-based polyurethane market in 2024. The well-developed manufacturing infrastructure increases the production of bio-based polyurethane. The strong government support for sustainable material use and growing adoption of bio-based polyurethane in various sectors help the market growth. The strong focus on energy efficiency and increasing consumer preference for eco-friendly products increases demand for bio-based polyurethane. The stringent environmental regulations and growing demand across applications like furniture production, automotive manufacturing, and construction insulation drive the market growth.

United States Bio-Based Polyurethane Market Trends

The United States is a major contributor to the bio-based polyurethane market. The well-developed manufacturing base in the construction and automotive sectors increases demand for bio-based polyurethane. The well-established industrial infrastructure and stringent environmental regulations for carbon emissions increase the adoption of polyurethane. The shift towards green building and growing demand across industries like construction, manufacturing, and healthcare drive the market growth.

- The United States exported 5255 shipments of vegetable oil. (Source: www.volza.com)

- The United States exported 22902 shipments of polyol.(Source: www.volza.com)

Why is the Asia Pacific Experiencing the Fastest Growth in the Bio-Based Polyurethane Market?

Asia Pacific experiencing the fastest growth in the market during the forecast period. The rapid urbanization and growing infrastructure development increase demand for bio-based polyurethane for structural components, insulation, and coatings. The growing environmental concerns and stricter regulations on carbon emissions increase demand for bio-based polyurethane. The growing automotive applications like interior components, seat cushions, and dashboards increase demand for bio-based polyurethane. The growing demand across sectors like electronics, construction, and packaging supports the overall growth of the market.

China Bio-Based Polyurethane Market Trends

China is a key contributor to the market. The well-established industrial infrastructure and strong manufacturing capacity increase the production of bio-based polyurethane. The extensive investment in R&D for bio-based polyurethane and easy access to raw materials help the market growth. The growing demand across end-user industries like electronics, construction, and automotive support the overall market growth.

- China exported 43230 shipments of polyol. (Source: www.volza.com)

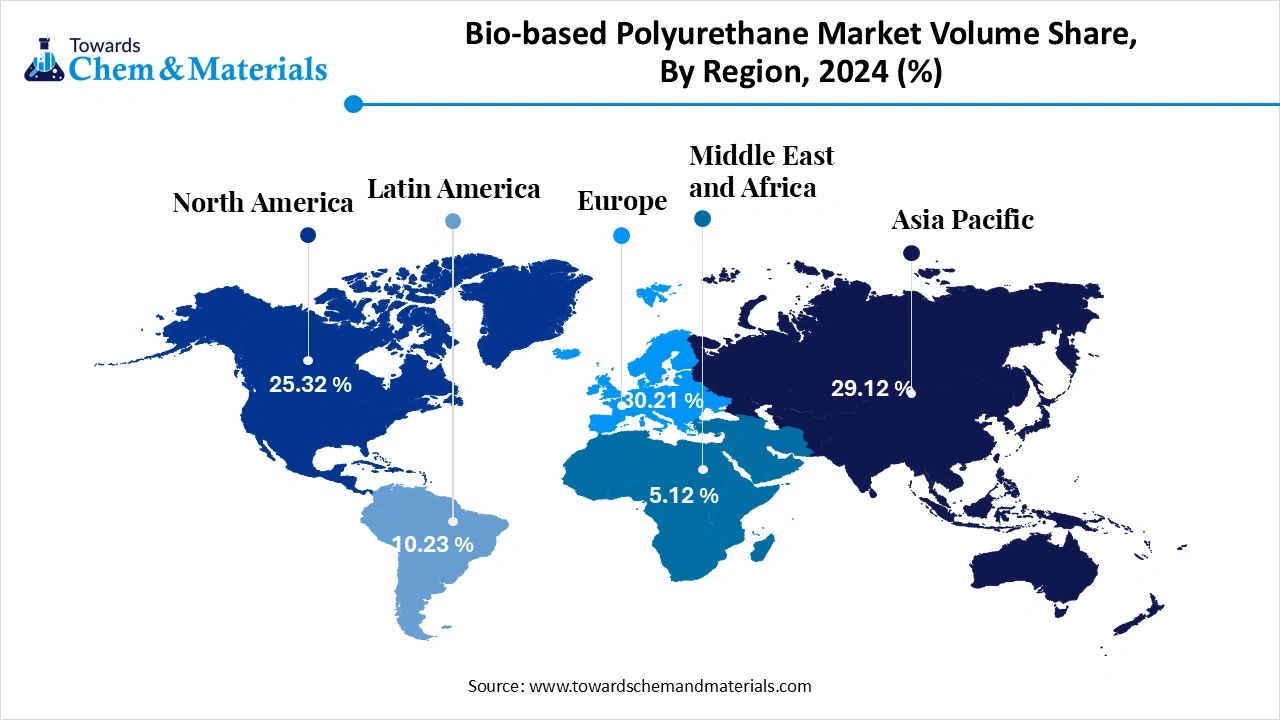

Bio-Based Polyurethane Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume - 2024( Million Tons) | Volume Share, 2034 (%) | Market Volume - 2034( Million Tons) | CAGR (2025 - 2034) |

| North America | 25.32% | 1.23 | 28.32% | 3.04 | 10.57% |

| Europe | 30.21% | 1.47 | 32.12% | 3.45 | 9.95% |

| Asia Pacific | 29.12% | 1.42 | 26.32% | 2.82 | 7.98% |

| South America | 10.23% | 0.50 | 8.12% | 0.87 | 6.43% |

| Middle East & Africa | 5.12% | 0.25 | 5.12% | 0.55 | 9.20% |

| Total | 100% | 4.86 | 100% | 10.73 | 8.24% |

Segmental Insights

Type Insights

Why did Flexible Foam Segment Dominate the Bio-Based Polyurethane Market?

The flexible foam segment dominated the bio-based polyurethane market in 2024. The growing consumer demand for sustainable and comfortable products increases demand for flexible foam. The increasing manufacturing of interior automotive components, car seats, and headrests increases demand for flexible foam. The growing demand for furniture like cushions & mattresses fuels demand for flexible foam to offer insulation and comfort. Flexible foam provides excellent resilience, cushioning, and insulation. The growing demand across applications like furniture, automotive interiors, and packaging drives the overall growth of the market.

The rigid foam segment is the fastest-growing in the market during the forecast period. The growing demand across the construction industry for roofs, walls, and floor insulation increases demand for rigid foam. The increasing focus on sustainable packaging solutions and growth in e-commerce increases demand for rigid foams, helping market growth. Rigid foams minimize energy consumption and offer excellent insulation. The growing demand across applications like refrigerators, solar & household water heaters, and furniture supports the market growth.

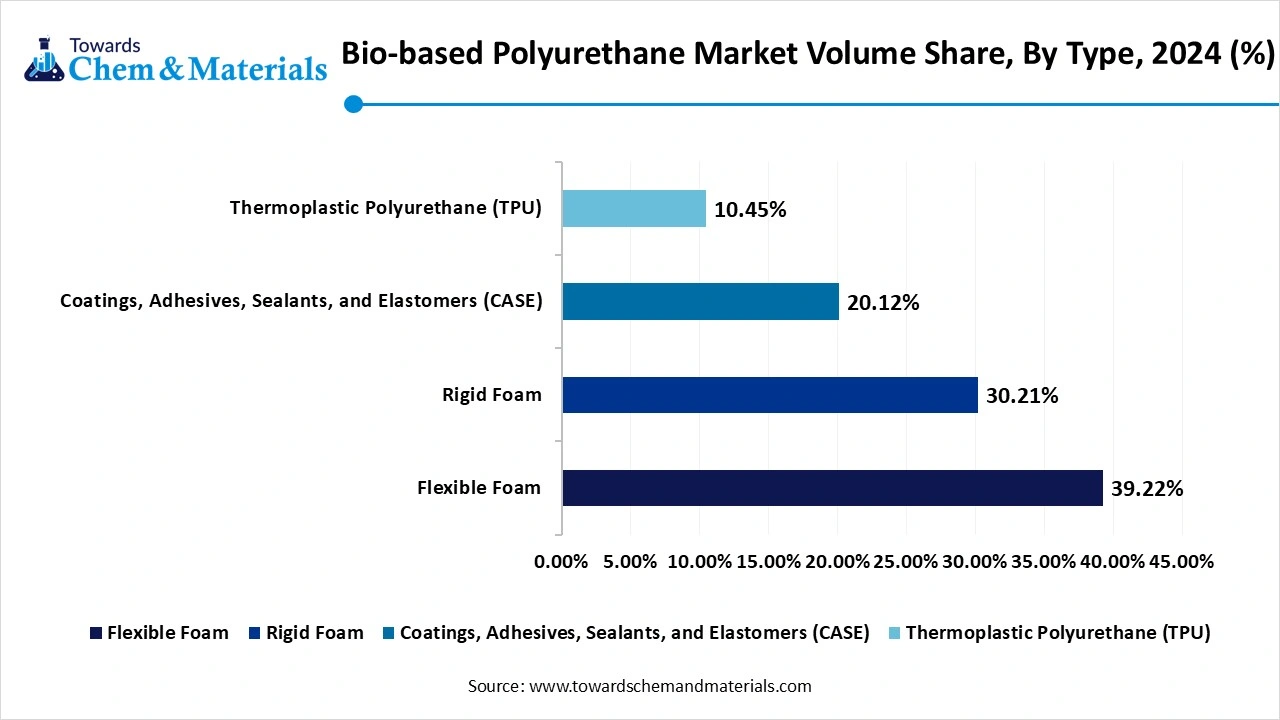

Bio-Based Polyurethane Market Volume Share, By Type, 2024-2034 (%)

| By Type | Volume Share, 2024 (%) | Market Volume - 2024( Million Tons) | Volume Share, 2034 (%) | Market Volume - 2034( Million Tons) | CAGR (2025 - 2034) |

| Flexible Foam | 39.22% | 1.91 | 38.64% | 4.15 | 9.02% |

| Rigid Foam | 30.21% | 1.47 | 32.12% | 3.45 | 9.95% |

| Coatings, Adhesives, Sealants, and Elastomers (CASE) | 20.12% | 0.98 | 18.34% | 1.97 | 8.08% |

| Thermoplastic Polyurethane (TPU) | 10.45% | 0.51 | 10.90% | 1.17 | 9.71% |

| Total | 100% | 4.86 | 100% | 10.73 | 8.24% |

Raw Material Insights

How Vegetable Oils Segment Held the Largest Share in the Bio-Based Polyurethane Market?

The vegetable oils segment held the largest revenue share in the bio-based polyurethane market in 2024. The growing production of sustainable polyurethane products increases demand for vegetable oils. The focus on chemical versatility and reactive sites increases the adoption of vegetable oils. The focus on reducing carbon footprint and reliance on non-renewable resources fuels demand for vegetable oils, helping the market growth. Vegetable oil is easily available and lowers environmental impact. The wide range of vegetable oils, like sunflower, palm oil, soybean, castor oil, and rapeseed, is used in the production of bio-based polyurethane. The growing demand across applications like packaging, automotive, and construction drives the market growth.

The bio-based polyols segment is experiencing the fastest growth in the market during the forecast period. The focus on meeting stricter environmental regulations and lowering carbon footprint increases demand for bio-based polyols. The ongoing technological advancements, like chemical processes and biotechnology, to lower VOC emissions and reduce viscosity in bio-based polyols, help the market growth. Bio-based polyols improve dimensional stability, minimize density, and reduce water uptake. The growing demand from various applications like construction, furniture, automotive, packaging, and many more supports the market growth.

End-Use Industry Insights

Which End-Use Industry Dominated the Bio-Based Polyurethane Market?

The automotive segment dominated the bio-based polyurethane market in 2024. The need for improving fuel efficiency and minimizing vehicle weight increases demand for bio-based polyurethane. The growing manufacturing of various automotive parts like dashboards, interior components, car seats, and door panels fuels demand for bio-based polyurethane. The automakers' focus on meeting stringent environmental regulations and lowering carbon emissions increases demand for bio-based polyurethane. The rise in electric vehicles fuels the adoption of bio-based polyurethane for lightweight interiors, battery closures, and others. The focus on enhancing passenger comfort and growing automotive industry drives the overall market growth.

The building & construction segment is the fastest-growing in the market during the forecast period. The rapid urbanization and growing construction industry increase demand for bio-based polyurethane for various applications. The growing need for coatings, structural components, insulation, and adhesives in construction & building increases the adoption of bio-based polyurethanes. The increasing demand for insulation in floors, walls, and roofs fuels demand for bio-based polyurethane to enhance energy efficiency. The growing focus on green building practices and government support for eco-friendly products increases demand for bio-based polyurethane. The growing applications in pipes, structural components, door & window profiles, and flooring increase demand for bio-based polyurethane, supporting the overall growth of the market.

Recent Developments

- In May 2024, Lubrizol launched bio-based thermoplastic polyurethane, Pearlbond ECO 590 HMS TPU for HMAs. This polyurethane is applicable for edge banding, hot-melt films, seam tape, transportation, furniture, electronics, textile lamination, and footwear. The polyurethane solution consists of good adhesion and wide wettability.(Source: www.specialchem.com)

- In September 2023, Covestro and Salena launched bio-attributed PU foams, Ultra-Fast 70 for thermal insulation. The foam reduces 60% carbon footprint and minimizes the time required for installing windows & doors. The curing time for foam is 90 minutes, and it easily integrates with existing operations.(Source: www.sustainableplastics.com)

- In April 2025, Huntsman launched bio-based polyurethane resins for wood composites. The polyurethane resins include I-BOND OSB BIO 1025 & I-BOND PB BIO 1025. The foam reduces the carbon footprint by 30% and easily integrates with existing manufacturing processes. The foam is widely used in the construction and furniture industry and offers high moisture resistance, strength, and durability. (Source: https://news.ialconsultants.com)

Bio-Based Polyurethane Market Top Companies

- BASF SE

- Covestro AG

- Huntsman International LLC

- Dow Inc.

- Wanhua Chemical Group Co., Ltd.

- Mitsui Chemicals, Inc.

- DSM Engineering Plastics

- Sika AG

- ARLANXEO

- Lanxess AG

- Covestro AG

- Foamex Innovations

- Emerald Performance Materials

- Perstorp Group

- Urethane Soy Systems

- Cargill Inc.

- Rampf Group

- BioBased Technologies LLC

- Covestro AG

- Green Dot Bioplastics

Segments Covered

By Type

- Flexible Foam

- Bedding

- Furniture

- Automotive Seating

- Rigid Foam

- Insulation Materials

- Refrigeration

- HVAC Systems

- Coatings, Adhesives, Sealants, and Elastomers (CASE)

- Bio-based Coatings

- Bio-based Adhesives

- Bio-based Sealants

- Bio-based Elastomers

- Thermoplastic Polyurethane (TPU)

- Automotive

- Electronics

- Medical Devices

- Other Applications (Sports Equipment, etc.)

By Raw Material

- Vegetable Oils

- Castor Oil

- Soy-Based Oils

- Other Plant Oils

- Bio-based Polyols

- Sucrose-based Polyols

- Glucose-based Polyols

- Other Bio-based Polyols

- Other Bio-based Feedstocks

- Starch-based Polyols

- Lignin-based Polyols

By End-Use Industry

- Furniture and Bedding

- Mattresses

- Cushions

- Furniture Upholstery

- Automotive

- Seats

- Interior Components

- Insulation

- Building and Construction

- Insulation Materials

- Sealants

- Footwear

- Soles

- Footbeds

- Packaging

- Foam Packaging

- Cushioning Packaging

- Electronics

- Insulating Materials

- Cushioning Materials

- Medical

- Medical Devices

- Surgical Products

- Other Industries

- Sports Equipment

- Textiles

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait