Content

What is the Current Adhesives and Sealants Market Size and Share?

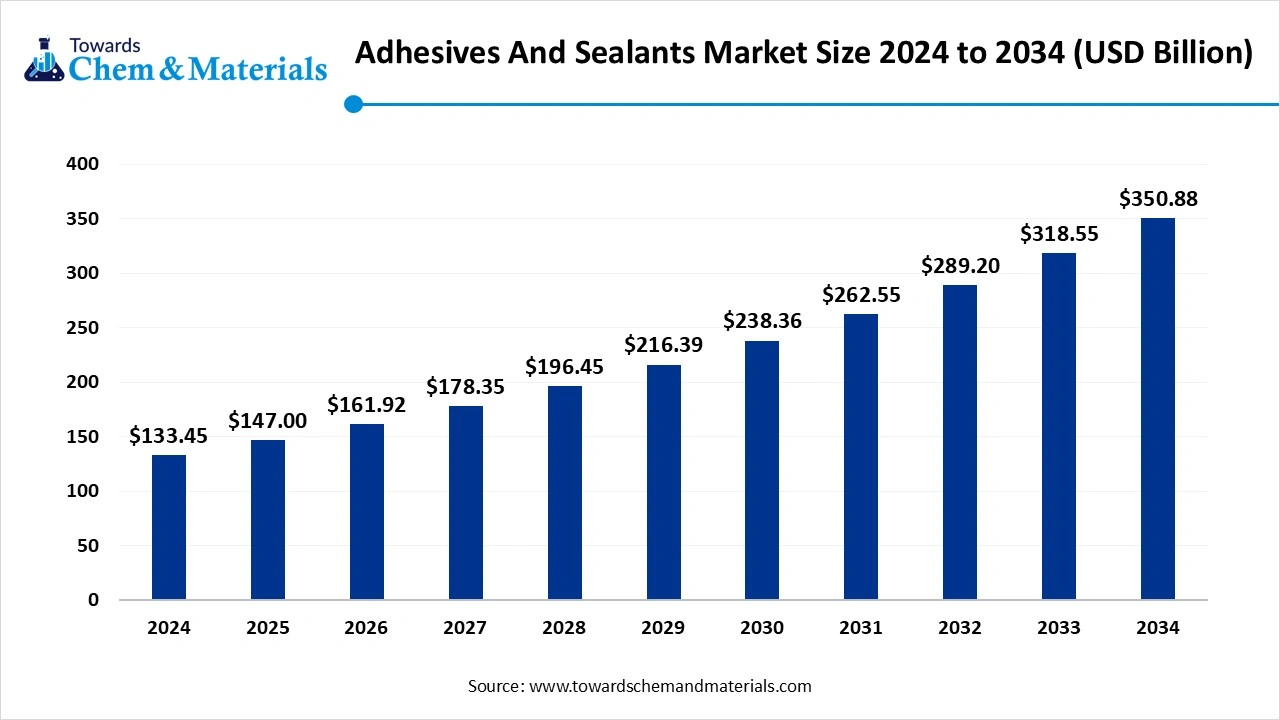

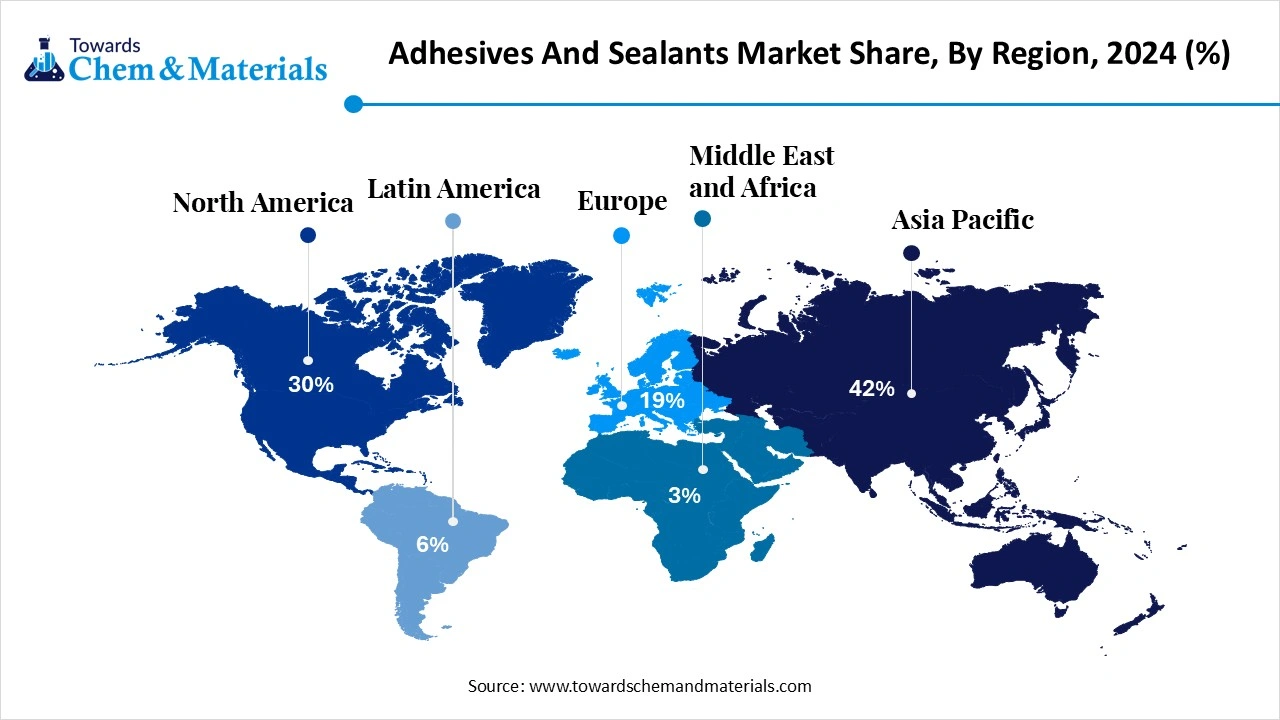

The global adhesives and sealants market size is calculated at USD 77.25 billion in 2025 and is predicted to increase from USD 81.97 billion in 2026 and is projected to reach around USD 139.79 billion by 2035, The market is expanding at a CAGR of 6.11% between 2026 and 2035. Asia Pacific dominated the adhesives and sealants market with a market share of 38.12% the global market in 2025. The growing infrastructure development and expansion of the packaging sector drive market growth.

Key Takeaways

- Asia Pacific dominated the global adhesives and sealants market with the largest revenue share of 38.12% in 2025.

- The China adhesives and sealants market is projected to grow during the forecast period.

- By adhesives technology, the water-based segment accounted for the largest revenue share of 25.7% in 2025.

- By adhesives product, the acrylic segment dominated with the largest revenue share of 38.7% in 2025.

- By adhesives application, the paper & packaging segment dominated with the largest revenue share of 31.4% in 2025.

- By sealants product, the silicone segment led the market and accounted for 35.19% of the global revenue share in 2025.

- By sealants application, the construction segment accounted for the largest revenue share of 46.7% in 2025.

Key Factors Driving the Adhesives and Sealants Industry Growth

The adhesives and sealants market growth is driven by growing construction activities, innovation in agriculture practices, the rise in adoption of electric vehicles, rapid expansion of e-commerce, increasing use of consumer electronics, and the shift from mechanical fasteners. The increasing development of large-scale infrastructure projects like roads, highways, airports, bridges, and others increases demand for adhesives & sealants.

The growing environmental concerns and increasing consumer awareness about eco-friendly products increase the development of sustainable sealants & adhesives. The innovations, like high-strength hybrid resins and sustainable water-based systems, support the expansion of the adhesives & sealants industry.

What are Adhesives and Sealants?

Adhesives are materials used to join two or more surfaces together, whereas sealants are substances that are used to fill cracks, gaps, & joints to prevent leaks. Adhesives offer excellent durability, high strength, clean appearance, and rigidity. Sealant offers excellent chemical resistance, barrier properties, flexibility, and temperature resistance.

Adhesives and sealants are widely used in applications like weatherproofing, structural joint securing, bonding components, furniture assembly, aircraft construction, sealing glass, and interior tiling.

The examples of adhesives are polyvinyl acetate, contact cement, hot melt, epoxy, & cyanoacrylate, whereas sealant examples are polyurethane, latex caulk, polysulfide, silicone, & butyl rubber.

Adhesives and Sealants Market Trends:

- Growing Construction Projects:- The rapid urbanization and growing development of infrastructure, commercial, & residential construction increases demand for adhesives & sealants. The faster project timelines and expanding green building projects require adhesives & sealants for diverse applications like roofing, glazing, flooring, & insulation.

- Development of Bio-Based Adhesives:- The strong focus on lowering reliance on fossil fuels and increasing adoption of sustainable products increases demand for the development of bio-based adhesives. The growing consumer awareness about sustainable products increases the use of bio-based adhesives across industries like healthcare, packaging, & construction.

- Increasing Demand for Mechanical Fasteners Alternative:- The strong focus on lowering failure, fatigue, and cracking in materials increases demand for alternative mechanical fasteners. Adhesives are widely used as an alternative across diverse applications like lighter assemblies, automotive manufacturing, and the creation of durable products.

- Growing Electronic Industry:- The growing utilization of consumer electronics like wearables, smartphones, laptops, computers, and tablets increases demand for adhesives & sealants for the development of bonding in smaller components and creation of water-resistant devices. The ongoing miniaturization of devices requires sealants for purposes like heat management, assembly, and display bonding.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 9.63 Billion |

| Revenue Forecast in 2035 | USD 20.82 Billion |

| Growth Rate | CAGR 8.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Product, By End Use, By Region |

| Key companies profiled | 3M Company, Ashland Inc., Avery Denison Corporation, H.B. Fuller, Henkel AG, Sika AG, Pidilite Industries, Huntsman, Wacker Chemie AG, RPM International Inc., Dow, Kuraray Co., Ltd. |

Key Technological Shifts in the Adhesives and Sealants Market:

The adhesives and sealants market is undergoing a technological transformation driven by demand for sustainable products and high-performance materials. The ongoing technological innovations, like the development of biodegradable products, UV-curable adhesives, precision dispensing, solvent-free options, and fast-curing formulations, support market expansion. The key transformation is the development of smart adhesives and sealants enhances durability, improves product quality, and sustainability.

Smart adhesives and sealants change their properties in response to external stimuli like pH, electric currents, temperature, and humidity. They extend the lifespan of the product and automatically repair minor damage or cracks. They enhance properties like resistance, strength, and durability. Smart sealants monitor real-time conditions like temperature or pressure. Overall, smart adhesives and sealants improve modern products' lifespan, overall function, and safety.

Trade Analysis of Adhesives and Sealants Market: Import & Export Statistics

- China exported 258390 shipments of adhesive.

- South Korea exported 6761 shipments of acrylic adhesive.

- China exported 1507 shipments of water-based adhesive.

- Vietnam exported 18151 shipments of polyurethane adhesive.

- China exported 31974 shipments of sealant.

- South Korea exported 6636 shipments of silicone sealant.

Adhesives and Sealants Market Value Chain Analysis

- Feedstock Procurement : Feedstock procurement is the sourcing of feedstocks like petrochemical-derived, including propylene, polyurethanes, ethylene, & propylene and bio-based, like pine trees, glycerol, and sugar.

- Key Players: Evonik Industries, Dow, Covestro, BASF, Huntsman Corporation, ExxonMobil

Chemical Synthesis and Processing :The chemical synthesis and processing involve steps like selection of raw materials, mixing & blending, polymerization, curing, testing & quality control, and packaging. - Key Players: H.B. Fuller, Arkema Group, Huntsman Corporation, Henkel AG, Sika AG, 3M

- Quality Testing and Certifications :Quality testing involves the evaluation of properties like adhesion, stress-durability, elongation, volume shrinkage, strength, & performance, and certifications like ISCC PLUS, RoHS, Green Seal, ASTM, and USP Class VI.

- Key Players: Intertek Group plc, TUV SUD, SGS SA, Bureau Veritas, Kiwa

Industry-Wise Use of Adhesives and Sealants

| Industry | Adhesives Purpose | Adhesives Used | Sealants Purpose | Sealants Used |

| Electrical & Electronics |

|

|

|

|

| Renewable Energy |

|

|

|

|

| Healthcare |

|

|

|

|

Segmental Insights

Adhesives Technology Insights

Why the Water-Based Segment Dominates the Adhesives and Sealants Market?

The water-based segment dominated the adhesives and sealants market with a 25.7% share in 2025. The growing expansion of the woodworking industry and the booming packaging sector require water-based adhesives. The strong focus on minimizing volatile organic compound emissions and stringent government regulations increases the adoption of water-based technology. The increasing development of automotive interiors and growing construction activities require water-based technology, driving the overall market growth.

The solvent-based adhesives segment is growing at the fastest CAGR of 5.2% in the market during the forecast period. The growing expansion of industries like automotive and construction increases demand for solvent-based adhesives. The rising packaging applications, like sealing & lamination, and the development of medical devices require solvent-based adhesives. The faster curing time and superior bonding properties of solvent-based adhesives support the overall market growth.

The hot melt segment is growing substantially in the market. The growing assembly of consumer electronics products like laptops & smartphones increases demand for hot melt adhesives. The development of reliable packaging solutions and the expansion of e-commerce require hot melt adhesives. The increasing shift towards green products increases the adoption of hot melt, supporting the overall market growth.

Adhesives Product Insights

How did the Acrylic Segment hold the Largest Share in the Adhesives and Sealants Industry?

The acrylic segment held the largest revenue share of 38.7% in the adhesives and sealants industry in 2025. The growing construction applications, like structural elements, flooring, and tiling, increase demand for acrylic adhesives. The increasing bonding of acrylic with various materials like plastics, ceramics, metals, wood, and glass helps market growth. The quick curing time, high durability, cost-effectiveness, and customizable formulations of acrylics drive the overall market growth.

The EVA segment is growing at a 6.5% CAGR in the market during the forecast period. The growing bonding of EVA with substrates like plastics, textiles, paper, and metals helps market growth. The growing expansion of the packaging industry and the rise in electric vehicle manufacturing increase demand for EVA. The increasing development of the paneling system and flooring requires EVA, supporting the overall market growth.

The PVA segment is growing at a significant rate in the market. The rise in paper-based packaging and growing woodworking applications increases demand for PVA. The growing construction application, like insulation, bonding wood, and flooring, requires PVA. The quick setting time, strong bonding properties, and cost-effectiveness of PVA support the overall market growth.

Adhesives Application Insights

Which Adhesives Application Segment Dominated the Adhesives and Sealants Market?

The paper & packaging segment dominated the adhesives and sealants market with a 31.4% share in 2025. The growing online shopping and increasing consumption of consumer packaged goods increase demand for adhesives. The growing production of boxes, corrugated cardboard, cartons, and other packaging requires adhesives. The growing packaging in sectors like consumer electronics, food & beverage, and cosmetics increases the adoption of adhesives, driving the overall market growth.

The furniture & woodworking segment is growing at the fastest CAGR of 7.4% in the market during the forecast period. The increasing spending on decorative & luxury furniture and high preference for engineered wood increases demand for adhesives. The increasing use of wood products in commercial and residential construction requires adhesives, supporting the overall market growth.

The medical segment is growing significantly in the market. The increasing development of wound and surgical closures increases the adoption of adhesives for minimizing scarring. The manufacturing of medical devices like single-use products, catheters, and biosensors requires adhesives. The increasing use of wearable devices like insulin delivery systems & ECG patches requires adhesives, supporting the overall market growth.

Sealants Product Insights

Why did the Silicone Sealants Segment hold the Largest Share in the Adhesives and Sealants Industry?

The silicone sealants segment held the largest revenue share of 35.19% in the adhesives and sealants industry in 2025. The growing development of infrastructure projects and increased vehicle manufacturing increases demand for silicone sealants. The strong bonding of silicone sealants with materials like plastics, fiberglass, glass, and metals helps market expansion. The properties like weatherproofing, flexibility over a wide temperature range, and thermal insulation drive the overall market growth.

The acrylic sealants segment is growing at a 6.3% CAGR in the market during the forecast period. The growing applications like joint sealing, flooring, & tiling in renovation projects & new construction increase demand for acrylic sealants. The bonding of acrylic sealants with metals, glass, plastics, and wood helps market growth. The rise in popularity of DIY projects and the expansion of e-commerce require acrylic sealants, supporting the overall market growth.

The polyurethane sealant segment is growing at a significant rate in the market during the forecast period. The growing demand for weather-tight seals in facades, windows, and doors requires polyurethane sealant. The increased manufacturing of vehicle interiors and the rise in electric vehicles require polyurethane sealant. The high performance and excellent sustainability of polyurethane sealant support the overall market growth.

Sealants Application Insights

Which Sealant Application Dominated the Adhesives and Sealants Market?

The construction segment dominated the adhesives and sealants market with a 46.7% share in 2025. The development of large-scale infrastructure projects like bridges, highways, and metro lines increases demand for sealants. The rise in commercial & residential construction activities and the renovation of existing buildings requires sealants. The growing construction applications like flooring, exterior insulation systems, tiling, structural glazing, and roofing require sealants, driving the overall market growth.

The packaging segment is growing at the fastest CAGR of 6.4% in the market during the forecast period. The growing online shopping and rapid growth in e-commerce platforms increase demand for sealants for the development of packaging. The strong focus on preserving product quality and increasing the use of sustainable packaging requires sealants. The growing development of paper envelopes, heat-sealable packaging, and corrugated boxes requires sealants, supporting the overall market growth.

The automotive segment is growing significantly in the market. The rise in electric vehicles increases demand for sealant for manufacturing structural bonding, battery pack assembly, and thermal management systems. The stringent vehicle emission regulations and the production of lightweight vehicle materials require sealants, supporting the overall market growth.

Regional Insights

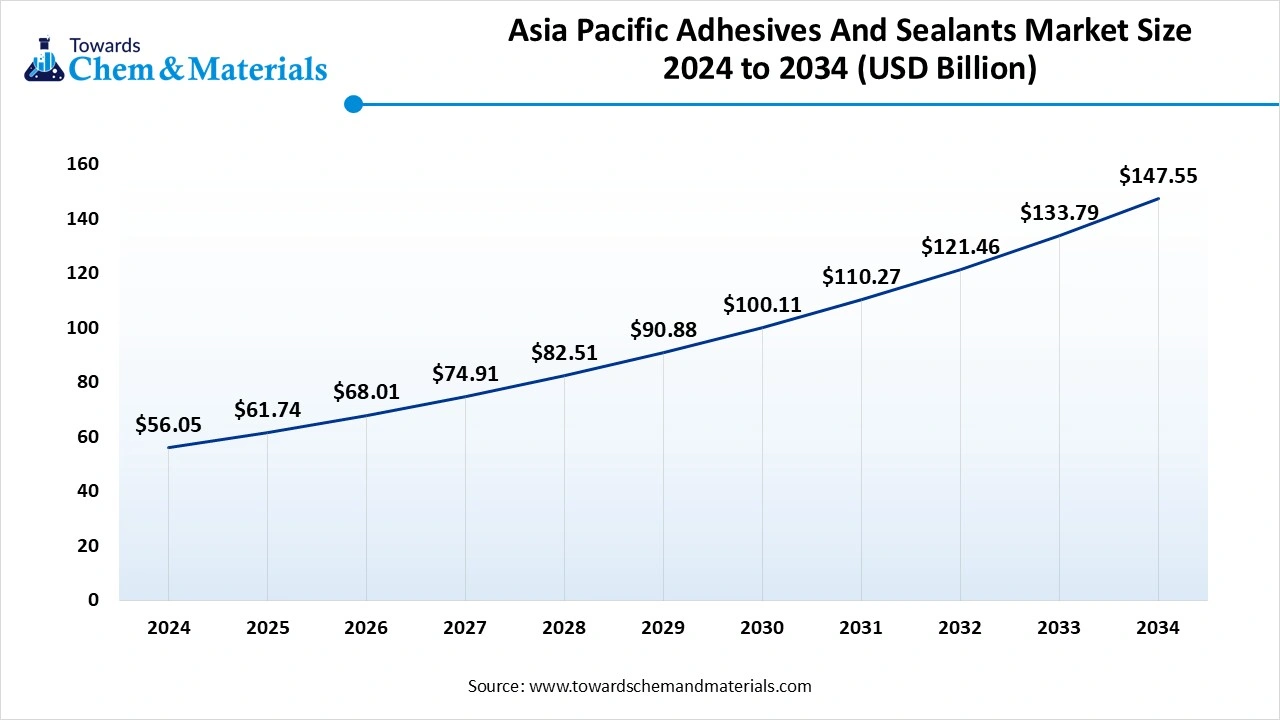

The Asia Pacific adhesives and sealants market size was valued at USD 29.45 billion in 2025 and is expected to reach USD 53.37 billion by 2035, growing at a CAGR of 6.13% from 2026 to 2035. Asia Pacific dominated the adhesives and sealants market with a 38.12% share in 2025.

The well-established automobile production hub and the rise in electric vehicles increase demand for adhesives and sealants. The growing development of infrastructure, residential, and commercial construction requires adhesives & sealants. The increasing expansion of the packaging sector, particularly in Southeast Asia and China, and growing manufacturing activities, increase demand for adhesives & sealants, driving the overall market growth.

Sticking Power: India at the Center of Adhesives and Sealants Revolution

India is a key contributor to the market. The development infrastructure projects, like smart cities, metro rails, and highways, require adhesives & sealants. The increasing consumption of packaged food and rapid e-commerce growth require adhesives & sealants. The growing EV production and development of lightweight vehicle materials require adhesives & sealants. The increasing use of low-VOC adhesives and water-based adhesives across diverse industries supports the overall market growth.

- From October 2023 to September 2024, India exported 543 shipments of sealant. (Source: www.volza.com )

North America Adhesives and Sealants Market Trends

North America is experiencing the fastest growth in the market during the forecast period. The rapid urbanization and growing development of infrastructure projects increase demand for adhesives & sealants. The popularity of home improvement projects and the development of lightweight vehicle parts require adhesives & sealants. The growing expansion of e-commerce and increased consumption of packaged goods requires adhesives & sealants, supporting the overall market growth.

Bonded United States: How Adhesives and Sealants are Shaping the Future

The United States is a major contributor to the adhesives and sealants market. The increasing private & public sector investment in construction & infrastructure projects increases demand for adhesives & sealants. The rise in electric vehicles and the increasing demand for traditional mechanical fastener alternatives require adhesives & sealants. The government initiatives, like the INFRA programs and the growing electronic industry, require adhesives & sealants, supporting the overall market growth.

- The United States exported 185489 shipments of adhesive. (Source: www.volza.com)

Europe Adhesives and Sealants Market Trends

Europe is growing at a notable rate in the market. The growing development infrastructure and construction projects require adhesives & sealants for waterproofing, structural bonding, and insulation. The growing manufacturing of vehicles and the rapid growth in electric vehicles require adhesives & sealants. The growing end-user industries like healthcare, packaging, and electronics require adhesives & sealants, driving the overall market growth.

Industrial Grip: High-Tech Adhesives and Sealants Supremacy

Germany is growing notably in the market. The growing manufacturing of diverse automotive components like structural parts, headlights, and bumpers requires adhesives and sealants. The shift towards electric vehicles and government support for infrastructure development increases demand for adhesives & sealants. The growing expansion of the packaging industry supports the overall market growth.

Germany exported 134 shipments of PU sealants.(Source: www.volza.com)

South America Adhesives and Sealants Market Trends

South America is growing significantly in the market. The growing demand for construction materials in countries like Chile, Brazil, and Argentina increases demand for adhesives and sealants. The increasing demand for furniture in urban housing and the increasing need for lightweight vehicles require adhesives & sealants. The expansion of solar & wind energy and booming e-commerce requires adhesives & sealants, driving the overall market growth.

From Tropics to Technology: Rise of Adhesives and Sealants in Brazil

Brazil is growing substantially in the market. The strong consumer preference for sustainable packaging and growing construction activities requires adhesives & sealants. The development of infrastructure projects and a rebound in vehicle manufacturing require adhesives & sealants. The strong government focus on green technologies increases the production of eco-friendly and bio-based adhesives, supporting the overall market growth.

Middle East & Africa Adhesives and Sealants Market Trends

The Middle East & Africa are growing in the market. The rapid urbanization and growing development of infrastructure projects in countries like the UAE and Saudi Arabia increase demand for adhesives & sealants. The rising manufacturing across sectors like electronics & automotive requires adhesives & sealants. The increasing investment in the renewable energy sector and rapid growth in e-commerce require adhesives & sealants, supporting the overall market growth.

Saudi Arabia: Kingdom of Stronger Bonds and Seals

Saudi Arabia is significantly growing in the market. The government's Vision 2030 includes projects like Qiddiya, NEOM, and the Red Sea project increase demand for adhesives and sealants. The abundance of raw materials like petrochemicals increases the production of adhesives. The growing manufacturing of automotive products and the development of consumer electronics products require adhesives and sealants, driving the overall market growth.

Recent Developments

- In June 2025, Gurit launched BondPro epoxy adhesives. BondPro is widely used across industries like transportation, construction, automotive, and agriculture. The adhesive offers a high level of adhesion, chemical resistance, filling properties, and thermal resistance. (Source: www.jeccomposites.com)

- In May 2025, Bio4Life launched home-compostable pressure-sensitive adhesive. The adhesive supports environmental sustainability and lowers landfill waste. The adhesive is used in food packaging applications like fruit labels, packaging labels, and others. (Source: www.labelsandlabeling.com )

- In February 2025, Lactips launched a new biobased and compostable sealant grade, CareTips PFP344MAX, for dry food product packaging. The sealant offers food safety and minimizes environmental footprint.(Source: www.biofuelsdigest.com )

- In November 2025, Bostik launched professional-grade adhesive and sealant on Amazon. The sealants range includes Pure Silicone, PWC-Painter’s White Caulk, & Duo-Sil Ultra, and the adhesives range includes HDCA, Grip n Grab, & Climb.(Source: www.bostik.com )

Top Companies List

- 3M Company: The American multinational company produces hot melt adhesives, fire barrier sealants, spray adhesives, and instant adhesives to support diverse industries like healthcare, electronics, automotive, and consumer goods.

- Ashland Inc.: The company produces structural adhesives, flexible packaging adhesives, pressure-sensitive adhesives, and UV/EB adhesives to support diverse industries.

- Avery Denison Corporation: The company manufactures products like labels, fasteners, pressure-sensitive materials, RFID solutions, and tags to support industries like e-commerce, food & beverage, automotive, logistics, and pharmaceuticals.

- H.B. Fuller: The company manufactures tapes, adhesives, sealants, and other chemical products to serve industries like automotive, electronics, construction, and packaging.

- Henkel AG: The company is the leading producer of sealants and adhesives to serve diverse sectors like electronics, construction, automotive, packaging, and medical.

Other Companies List

- Sika AG

- Pidilite Industries

- Huntsman

- Wacker Chemie AG

- RPM International Inc.

- Dow

- Kuraray Co., Ltd.

Segments Covered

By Adhesives Technology

- Water-Based

- Solvent-Based

- Hot Melt

- Reactive & Others

By Adhesives Product

- Acrylic

- PVA

- Polyurethane

- Styrenic block

- Epoxy

- EVA

- Other Products

By Adhesives Application

- Paper & Packaging

- Consumer & DIY

- Building & Construction

- Furniture & Woodworking

- Footwear & Leather

- Automotive & Transportation

- Medical

- Other Applications

By Sealants Product

- Silicones

- Polyurethanes

- Acrylic

- Polyvinyl Acetate

- Others

By Sealants Application

- Construction

- Automotive

- Packaging

- Assembly

- Consumers

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa