Content

What is the Current Performance Chemicals Market Size and Volume?

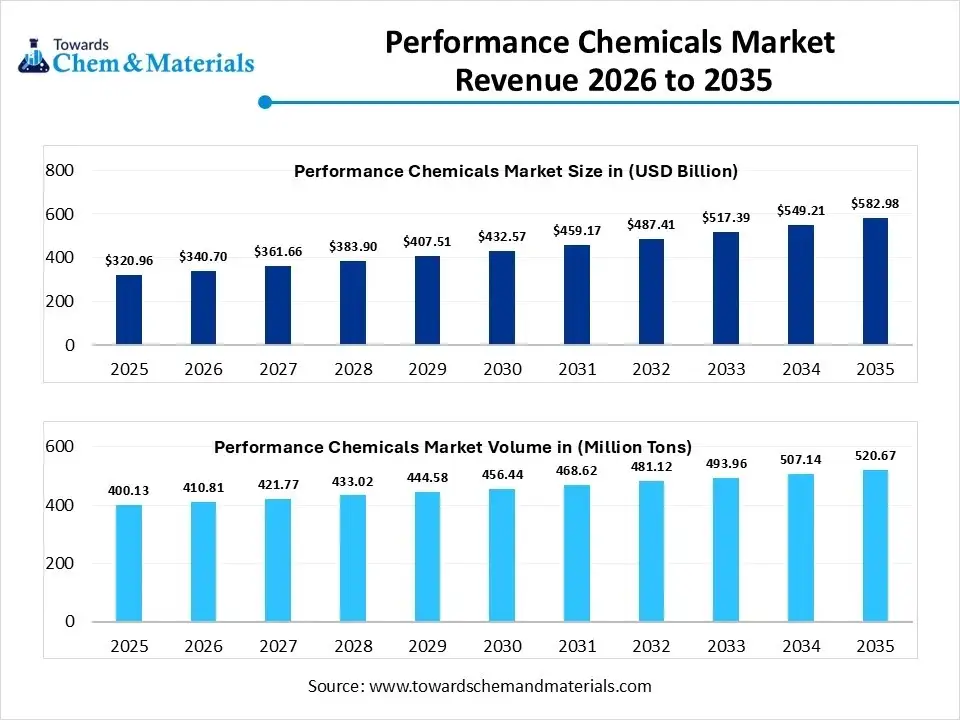

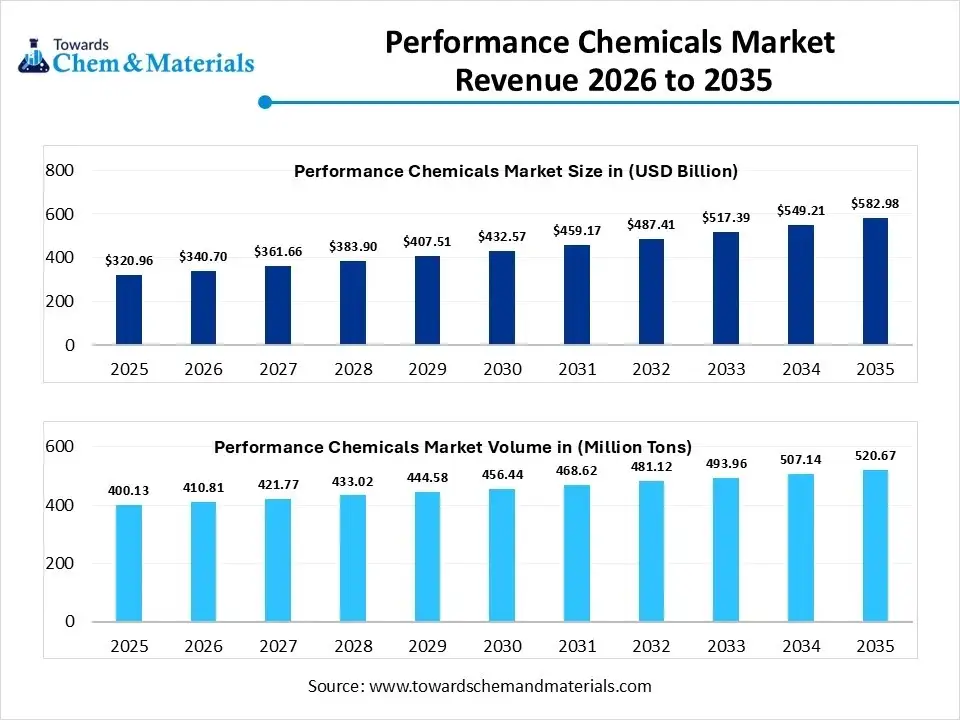

The global performance chemicals market size was estimated at USD 320.96 billion in 2025 and is expected to increase from USD 340.70 billion in 2026 to USD 582.98 billion by 2035, growing at a CAGR of 6.15% from 2026 to 2035. In terms of volume, the market is projected to grow from 400.13 million tons in 2025 to 520.67 million tons by 2035. growing at a CAGR of 2.57% from 2026 to 2035. Asia Pacific dominated the performance chemicals market with the largest volume share of 45.13% in 2025. The growth of the market is driven by growing demand for enhanced product functionality in automotive, electronics, construction, and personal care.

Performance chemicals, also known as specialty chemicals, are high-value substances manufactured for their specific functional effects rather than their chemical composition. They provide essential characteristics to end-products, such as durability, stability, and efficiency, across diverse industries, including electronics, automotive, construction, and agriculture, typically produced in smaller volumes.

Market Highlights

- The Asia Pacific dominated the global performance chemicals market with the largest volume share of 45.13% in 2025.

- The performance chemicals market in North America is expected to grow at a substantial CAGR of 2.29% from 2026 to 2035.

- The Europe performance chemicals market segment accounted for the major volume share of 25.12% in 2025.

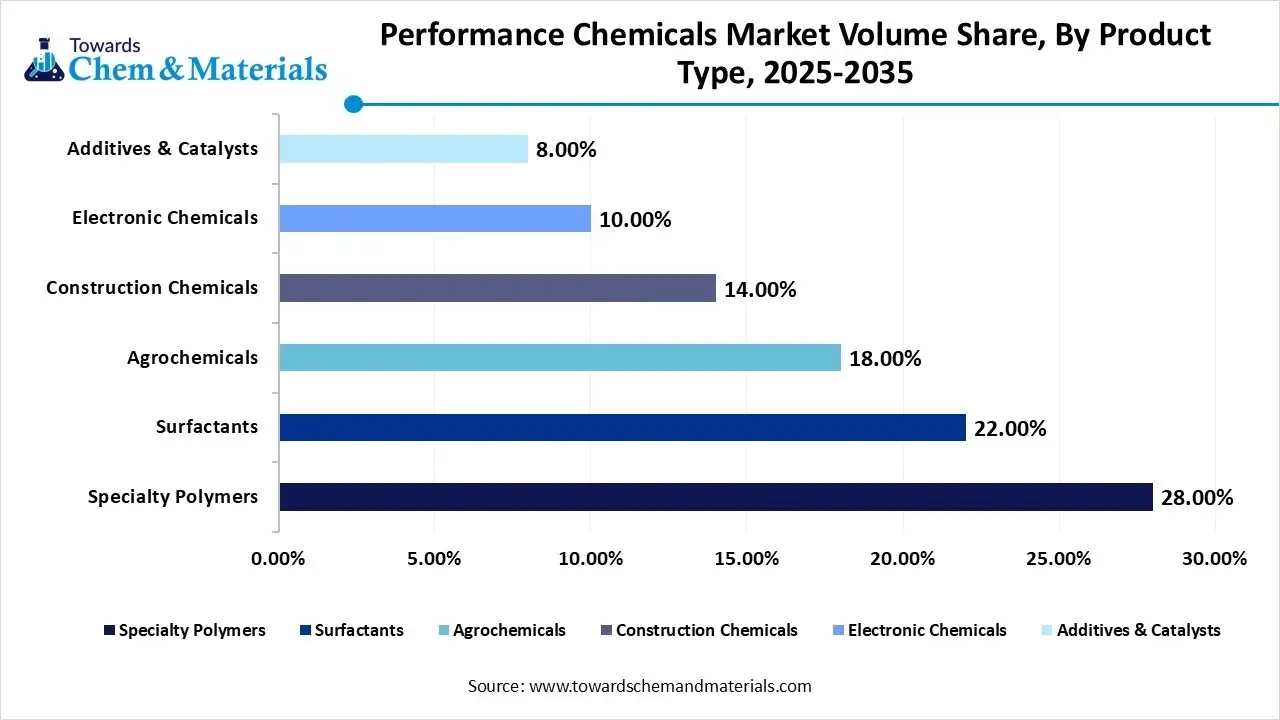

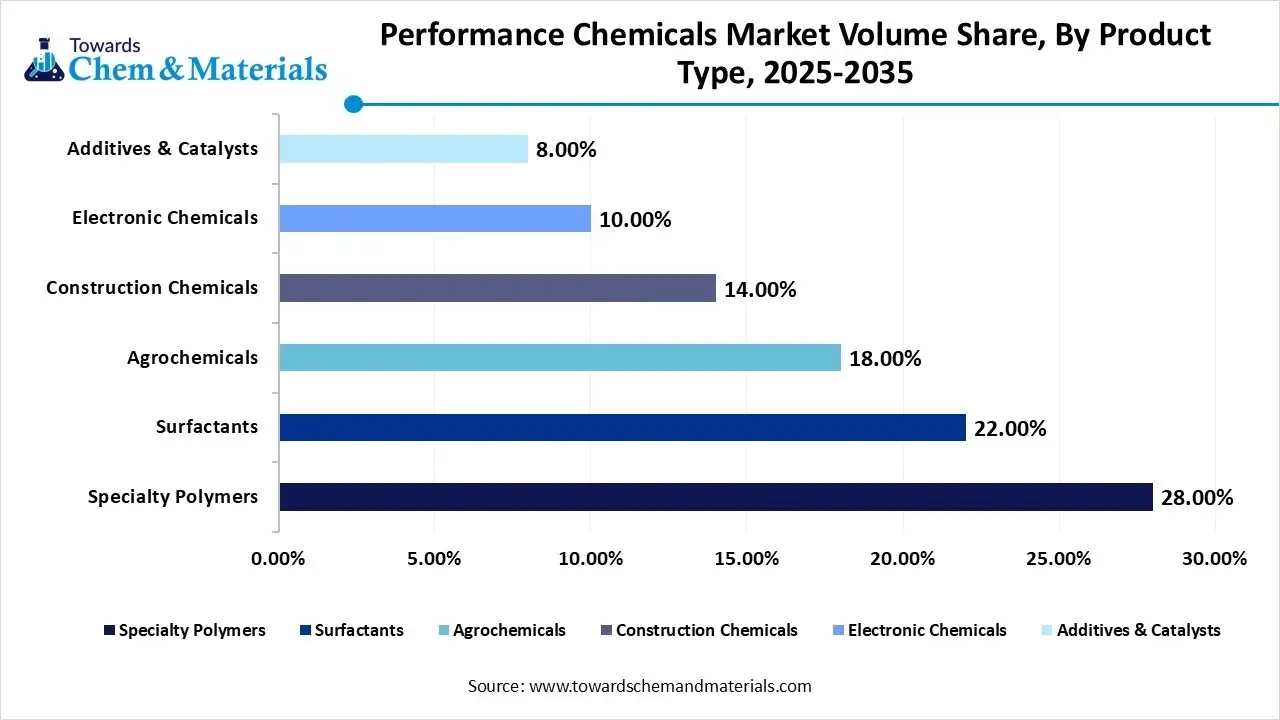

- By product type, the specialty polymers segment dominated the market and accounted for the largest volume share of 28.00% in 2025.

- By product type, the electronic chemicals segment is expected to grow at the fastest CAGR of 6.30% from 2026 to 2035 in terms of volume.

- By precursor type, the PAN-based segment led the market with the largest revenue volume share of 94% in 2025.

- By function, the antioxidants & stabilizers segment dominated the market and accounted for the largest volume share of 25% in 2025.

- By end user industry, the automotive & transportation segment led the market with the largest revenue volume share of 24% in 2025.

What Is The Significance Of The Performance Chemicals?

The significance of the performance chemicals market lies in its role as an innovation driver, providing tailored solutions that boost product quality, efficiency, and functionality across key industries. These chemicals offer advanced properties, meet specific performance needs, enable sustainability, and support economic growth, making them crucial for developing high-performance materials and advanced applications in a rapidly evolving industrial landscape.

Market Recent Growth Trends:

- Sustainability & Green Chemistry: Shift towards bio-based, recyclable, and low-VOC (Volatile Organic Compound) performance chemicals to meet environmental regulations and consumer preferences.

- Customization & Specialization: Development of tailored solutions for niche applications, from personal care ingredients to oilfield chemicals.

- Digital Transformation: Adoption of smart manufacturing, data analytics, and automation for better supply chain management and R&D.

- Focus on High-Value Segments: Growth in areas like electronic chemicals, water treatment chemicals, and advanced polymer additives.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 340.70 Billion / 410.81 MillionTons |

| Revenue Forecast in 2035 | USD 582.98 Billion / 520.67 Million Tons |

| Growth Rate | CAGR 6.15% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Function, By End-User Industry, By Regions |

| Key companies profiled | BASF SE (Germany), Dow Inc., Evonik Industries AG, Ashland Global Holdings Inc, Albemarle Corporation, DuPont de Nemours, Inc., SABIC, Arkema S.A., Solvay S.A., Clariant AG , LANXESS, AkzoNobel N.V. , Wacker Chemie AG , Eastman Chemical Company, Huntsman Corporation, Sumitomo Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd. |

Key Technological Shifts In The Performance Chemicals Market:

The performance chemicals market is undergoing significant technological shifts driven by twin imperatives like digital transformation and a profound move toward sustainability and green chemistry. AI and Machine Learning are extensively used in R&D to accelerate molecule discovery, simulate chemical reactions, and predict material properties. In operations, AI optimizes processes, predicts equipment failure, and improves quality control. These changes are reshaping everything from R&D to supply chain management and product formulation.

Trade Analysis of Performance Chemicals Market: Import & Export Statistics

- According to Volza's Global Export data, the world shipped 4,938 shipments of Specialty Chemicals from June 2024 to May 2025 (TTM). These were sent by 174 exporters to 129 buyers. Most exports of Specialty Chemicals go to Russia, the United States, and Turkey.

- The top three global exporters are Bangladesh, Germany, and China. Bangladesh leads with 3,489 shipments, followed by Germany with 2,970, and China with 2,734.(Source: www.volza.com)

- Based on Volza's India Export data, India exported 654 shipments of Specialty Chemicals via 35 exporters to 75 buyers. Most of India's Chemical exports go to the United States and Russia.

- Globally, Bangladesh, Germany, and China remain the top exporters, with Bangladesh leading at 3,489 shipments, Germany with 2,970, and China with 2,734.(Source: www.volza.com)

Performance Chemicals Market Value Chain Analysis

- Chemical Development and Processing: Performance chemicals are developed through processes such as specialty chemical synthesis, formulation, blending, functionalization, purification, and application-specific modification to enhance performance characteristics.

- Key players: BASF SE, Dow Inc., Evonik Industries, Solvay S.A

- Quality Testing and Certification: Performance chemicals require certifications ensuring product consistency, safety, environmental compliance, and application performance. Key certifications include ISO 9001 quality management, REACH compliance, ASTM and industry-specific testing standards, and occupational safety certifications.

- Key players: ISO (International Organization for Standardization), ECHA (REACH), ASTM International, UL Solutions

- Distribution to Industrial Users: Performance chemicals are supplied to automotive, construction, electronics, oil & gas, agriculture, personal care, and industrial manufacturing sectors through specialty chemical distributors and direct supplier partnerships.

- Key players: Clariant AG, Arkema S.A., Lanxess AG.

Performance Chemicals Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA & Canada) | U.S. EPA (Environmental Protection Agency) OSHA (Occupational Safety & Health Administration) Environment and Climate Change Canada (ECCC) |

TSCA (Toxic Substances Control Act) Clean Air Act (CAA) Clean Water Act (CWA) OSHA 29 CFR (Hazard Communication, Process Safety) Canada CEPA (Canadian Environmental Protection Act) |

Chemical registration & risk evaluation Emissions & effluent control Worker safety & hazard communication Waste management |

TSCA requires inventory status and risk data for chemical substances; EPA air/water rules affect facilities producing or using performance chemicals. OSHA enforces hazard communication and industry safety standards. |

| European Union | European Commission European Chemicals Agency (ECHA) |

REACH Regulation (EC 1907/2006) CLP Regulation (EC 1272/2008) Industrial Emissions Directive (IED) |

Registration & hazard classification Emission control & Best Available Techniques (BAT) Chemical safety & labeling |

Europe’s REACH is one of the most stringent frameworks globally; performance chemicals (additives, intermediates) must be registered and evaluated; CLP mandates hazard communication. |

| Asia Pacific | China MEE (Ministry of Ecology & Environment) SAMR / AQSIQ Japan METI / MOE India MoEFCC / CPCB South Korea MoE |

China MEE Order No. 12 (New Chemical Substance Registration) Cleaner Production Promotion Law Japan Chemical Substances Control Law (CSCL) India Chemical (Management & Safety) Rules (proposed) Korea K-REACH |

New chemical registration Environmental compliance Hazard labeling & reporting Worker protection |

APAC chemical regulators are progressively aligning with REACH-style inventories and hazard communication; local standards (GB, JIS, BIS) influence product compliance. |

| Latin America | Brazil IBAMA / ANVISA / MAPA Argentina Ministry of Environment Mexico SEMARNAT / COFEPRIS |

National chemical control & environmental laws Hazardous waste regulations Worker safety norms |

Emissions & effluent compliance Chemical storage & handling Product import controls |

Regulatory frameworks vary by country; many align with EU/US standards in registration, hazard labeling, and environmental protection. |

| Middle East & Africa | UAE MOCCAE (Ministry of Climate Change & Environment) Saudi SASO South African DFFE / DMRE |

National environmental protection laws Industrial safety and hazardous material controls |

Environmental compliance Worker safety Import conformity |

Frameworks often reference international GHS and chemical management norms; many countries are adopting updated hazard communication standards. |

Segmental Insights

Product Type Insight

Which Product Type Segment Dominated the Performance Chemicals Market In 2025?

The specialty polymers segment volume was valued at 112.04 million tons in 2025 and is projected to reach 122.98 million tons by 2035, expanding at a CAGR of 1.04% during the forecast period from 2025 to 2035. The specialty polymers segment dominated the performance chemicals market with a share of 28% in 2025. Specialty polymers represent a high-value segment of the performance chemicals market, driven by their tailored properties such as enhanced durability, chemical resistance, thermal stability, and lightweight characteristics. Growing demand for high-performance, application-specific materials across advanced manufacturing industries continues to support the steady growth of this segment globally.

The electronic chemicals segment volume was valued at 40.01 million tons in 2025 and is expected to surpass around 69.35 million tons by 2035, and it is anticipated to expand to 6.30% of CAGR during 2026 to 2035. Electronic chemicals are critical materials used in semiconductor manufacturing, printed circuit boards, flat panel displays, and advanced electronics. Rising semiconductor fabrication investments, expansion of consumer electronics, and growth of electric vehicles and 5G infrastructure are significantly strengthening demand for high-purity electronic chemicals.

Performance Chemicals Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Mn. Tons)2025 | Market Volume (Mn. Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Specialty Polymers | 28.00% | 112.04 | 122.98 | 1.04% | 23.62% |

| Surfactants | 22.00% | 88.03 | 104.76 | 1.95% | 20.12% |

| Agrochemicals | 18.00% | 72.02 | 94.92 | 3.11% | 18.23% |

| Construction Chemicals | 14.00% | 56.02 | 84.40 | 4.66% | 16.21% |

| Electronic Chemicals | 10.00% | 40.01 | 69.35 | 6.30% | 13.32% |

| Additives & Catalysts | 8.00% | 32.01 | 44.26 | 3.67% | 8.50% |

Function Insight

How Did Antioxidants and Stabilizers Segment Dominated the Performance Chemicals Market In 2025?

The antioxidants & stabilizers segment dominated the performance chemicals market with a share of 25% in 2025. Antioxidants and stabilizers play a crucial role in extending the lifespan and performance of polymers, plastics, lubricants, and coatings by preventing degradation caused by heat, oxygen, and UV exposure. Increasing focus on material durability, recyclability, and long-term performance is driving sustained demand across multiple industrial applications.

The biocides & disinfectants segment is projected to grow at the fastest CAGR between 2026 and 2035 in the performance chemicals market. Biocides and disinfectants are essential performance chemicals used to control microbial growth in industrial processes, water treatment systems, paints, coatings, and healthcare environments. Industrial manufacturing, healthcare facilities, and infrastructure maintenance are major end-use sectors fueling growth.

End-User Industry Insight

Which End Use Industry Segment Dominated the Performance Chemicals Market In 2025?

The automotive & transportation segment dominated the performance chemicals market with a share of 24% in 2025. The automotive and transportation sector is a major consumer of performance chemicals, utilizing them in lightweight materials, coatings, lubricants, fuel additives, and interior components. The transition toward electric vehicles, emission reduction standards, and advanced mobility solutions continues to create strong demand for high-performance chemical formulations.

The electronics & semiconductors segment is projected to grow at the fastest CAGR between 2026 and 2035 in the performance chemicals market. Electronics and semiconductor manufacturing rely heavily on performance chemicals for precision processing, component protection, and reliability enhancement. Rapid growth in digitalization, artificial intelligence, IoT devices, and advanced computing technologies is accelerating investments in semiconductor production, thereby strengthening this segment’s growth outlook.

Regional Analysis

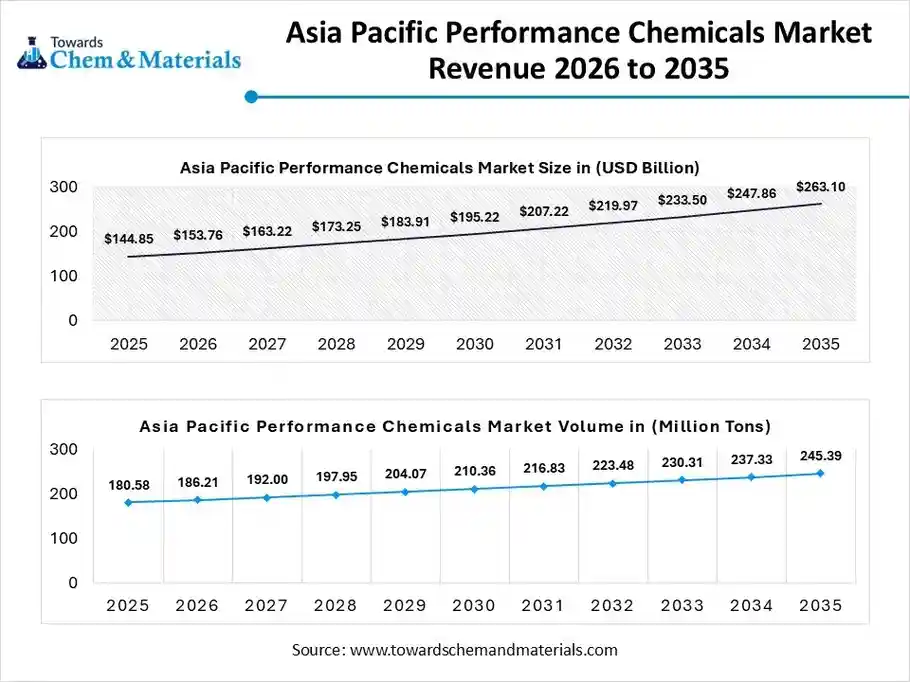

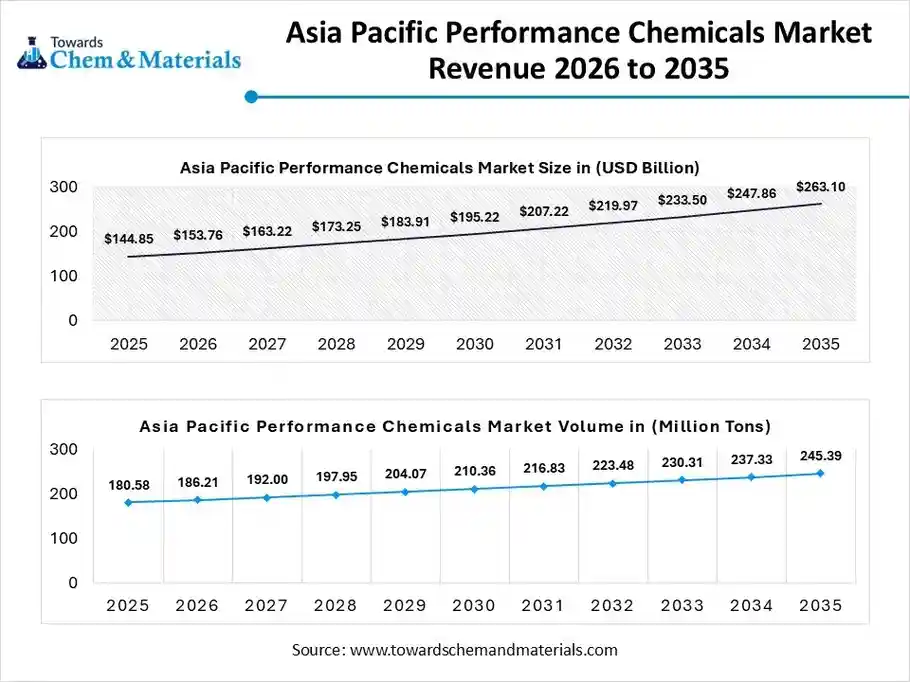

The Asia Pacific performance chemicals market size was valued at USD 144.85 billion in 2025 and is expected to be worth around USD 263.10 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.17% over the forecast period from 2026 to 2035.

The Asia Pacific performance chemicals market volume was estimated at 180.58 million tons in 2025 and is projected to reach 245.39 million tons by 2035, growing at a CAGR of 3.47% from 2026 to 2035. Asia Pacific dominates the performance chemicals market in 2025. The growth of the market is driven by rapid industrialization, strong manufacturing output, and expanding end-use sectors. Rising demand for specialty coatings, adhesives, surfactants, and high-performance polymers is supported by large-scale infrastructure development and growing export-oriented manufacturing hubs. Increasing focus on sustainability, lightweight materials, and functional additives further strengthens regional market expansion.

China: Performance Chemicals Market Growth Trends

China dominates the Asia Pacific performance chemicals market due to its extensive chemical manufacturing base and strong downstream industries. The country benefits from great domestic demand, cost-efficient production, and government support for advanced materials and specialty chemicals. Increasing investments in high-performance coatings, electronic chemicals, and environmentally compliant formulations are reshaping China’s performance chemicals landscape.

North America Performance Chemicals Market Growth Is Driven By The Strong Demand From Consumers

The North America performance chemicals market volume was estimated at 89.59 million tons in 2025 and is projected to reach 109.81 million tons by 2035, growing at a CAGR of 2.29% from 2026 to 2035. North America is expected to have significant growth in the market in the forecast period between 2026 and 2035. North America holds a significant share of the global performance chemicals market, supported by advanced industrial infrastructure, high R&D spending, and strong demand from industries. Growing adoption of high-performance additives, specialty polymers, and functional coatings for premium applications continues to drive steady market growth.

United States: Performance Chemicals Market Growth Trends

The United States is the key contributor to the North American performance chemicals market, led by the strong presence of multinational chemical companies and advanced research capabilities. Demand is driven by automotive lightweighting, construction durability solutions, and high-value applications in electronics and healthcare. Increasing regulatory focus on environmentally friendly formulations and bio-based performance chemicals is influencing product development strategies.

Global Performance Chemicals Market Volume and Share, By Region, 2025 -2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Mn. Tons)2025 | Market Volume (Mn. Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 22.39% | 89.59 | 109.81 | 2.29% | 21.09% |

| Europe | 25.12% | 100.51 | 125.64 | 2.51% | 24.13% |

| Asia Pacific | 45.13% | 180.58 | 245.39 | 3.47% | 47.13% |

| South America | 4.13% | 16.53 | 18.48 | 1.25% | 3.55% |

| Middle East & Africa | 3.23% | 12.92 | 21.35 | 5.73% | 4.10% |

The Europe Performance Chemicals Market Is Driven By The Strict Environmental Regulations

The Europe performance chemicals market volume was estimated at 100.51 million tons in 2025 and is projected to reach 125.64 million tons by 2035, growing at a CAGR of 2.51% from 2026 to 2035. Europe represents a mature yet innovation-driven market for performance chemicals, characterized by strict environmental regulations and high demand for sustainable, high-efficiency chemical solutions. Growth is supported by automotive electrification, renewable energy infrastructure, and advanced manufacturing. European manufacturers increasingly focus on specialty additives, functional coatings, and performance materials that meet circular economy and low-emission standards.

Germany: Performance Chemicals Market Growth Trends

Germany plays a central role in the European performance chemicals market due to its strong automotive, industrial machinery, and advanced manufacturing sectors. The country emphasizes high-performance materials, precision chemicals, and sustainable production technologies. Demand for specialty coatings, engineering additives, and high-temperature resistant chemicals is supported by Germany’s focus on innovation, quality, and export-driven industrial output.

Latin America Performance Chemicals Market Growth Is Driven By The Expansion Of Industries

The Latin America performance chemicals market volume was estimated at 16.53 million tons in 2025 and is projected to reach 18.48 million tons by 2035, growing at a CAGR of 1.25% from 2026 to 2035. Latin America shows moderate but steady growth in the performance chemicals market, supported by expanding construction, automotive assembly, agriculture, and packaging industries. Increasing industrial development and infrastructure investments are creating demand for specialty coatings, adhesives, and functional chemicals. However, market growth is influenced by economic fluctuations and varying regulatory environments across the region.

Brazil: Performance Chemicals Market Growth Trends

Brazil leads the South American performance chemicals market due to its large industrial base and growing demand from construction, automotive, and consumer goods sectors. The country benefits from local production capabilities and the rising use of performance additives and specialty formulations. Increasing focus on bio-based chemicals and sustainable raw materials aligns well with Brazil’s strong agricultural resources.

Middle East & Africa (MEA) Performance Chemicals Market Growth Is Driven By Infrastructure Development

The Middle East & Africa (MEA) performance chemicals market volume was estimated at 12.92 million tons in 2025 and is projected to reach 21.35 million tons by 2035, growing at a CAGR of 5.73% from 2026 to 2035. The Middle East & Africa region is emerging in the performance chemicals market, driven by infrastructure development, oil & gas diversification, and growing construction activities. Demand for corrosion-resistant coatings, specialty additives, and performance materials is increasing, particularly in harsh environmental conditions. Government-led industrial diversification initiatives are gradually expanding the specialty chemicals footprint.

Saudi Arabia: Performance Chemicals Market Growth Trends

Saudi Arabia is a key contributor to the MEA performance chemicals market, supported by strong petrochemical integration and industrial diversification under Vision 2030. The country’s access to feedstock advantages enables cost-effective production of performance chemicals for construction, automotive, and industrial applications. Investments in downstream specialty chemical manufacturing are enhancing domestic value addition and export potential.

Recent Developments:

- In February 2025, Cosmo Specialty Chemicals, a subsidiary of Cosmo First, introduced a new range of water-based Oil and Grease Resistant (OGR) barrier coatings. These coatings are designed to replace traditional polyethylene (PE) coatings in packaging, supporting sustainability goals and regulations against single-use plastics. (Source: www.indianchemicalnews.com)

- In May 2025, Pilot Chemical Company partnered with Novvi LLC in May 2025 to introduce biobased alpha olefin sulfonates (AOS) to the North American market through an exclusive agreement. This collaboration aims to provide sustainable surfactant solutions in the region.(Source: www.chemanalyst.com)

- In June 2025, Perstorp launched its Synthetic-EF portfolio, a new range of saturated synthetic polyol esters designed for the high-performance lubricant market. These products are engineered for high thermal and oxidative stability, catering specifically to industrial and automotive applications.(Source: www.alchempro.com)

Top players in the Performance Chemicals Market & Their Offerings:

- BASF SE (Germany): BASF is a global leader in performance chemicals, offering surfactants, polymer additives, catalysts, pigments, and specialty inorganic chemicals used in automotive, construction, oil & gas, electronics, and consumer products. The company emphasizes innovation in sustainable and high-efficiency formulations across diversified applications.

- Dow Inc.: Dow provides a comprehensive portfolio of performance chemical solutions, including specialty polymers, additives, surfactants, and catalysts. Its products enhance product performance in coatings, plastics, adhesives, and industrial applications, supported by strategic R&D and sustainability initiatives.

- Evonik Industries AG: Evonik develops high-performance specialty chemicals such as advanced polymers, additives, and functional materials tailored for demanding applications in automotive, healthcare, electronics, and industrial sectors. The company focuses on innovation and sustainable product development.

- Ashland Global Holdings Inc:Ashland supplies performance chemical products such as industrial polymers, surfactants, and specialty additives for coatings, personal care, and industrial segments. Focused on technical support and custom solutions for formulators.

- Albemarle Corporation: Albemarle is a key provider of performance additives and specialty chemicals, including catalysts and fine chemical intermediates, serving petroleum refining, plastics, and energy markets with engineered performance solutions.

- DuPont de Nemours, Inc.

- SABIC

- Arkema S.A.

- Solvay S.A.

- Clariant AG

- LANXESS AG

- AkzoNobel N.V.

- Wacker Chemie AG

- Eastman Chemical Company

- Huntsman Corporation

- Sumitomo Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

Segments Covered:

By Product Type

- Specialty Polymers

- Surfactants

- Agrochemicals

- Construction Chemicals

- Electronic Chemicals

- Additives & Catalysts

By Function

- Antioxidants & Stabilizers

- Biocides & Disinfectants

- Pigments & Colorants

- Specialty Coatings & Sealants

- Emulsifiers & Solvents

- Other Functional Agents

By End-User Industry

- Automotive & Transportation

- Construction & Infrastructure

- Agriculture & Agrochemicals

- Electronics & Semiconductors

- Consumer Goods & Personal Care

- Oil & Gas / Industrial Mining

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa