Content

What is the Current Lead Acid Battery Recycling Market Size and Volume?

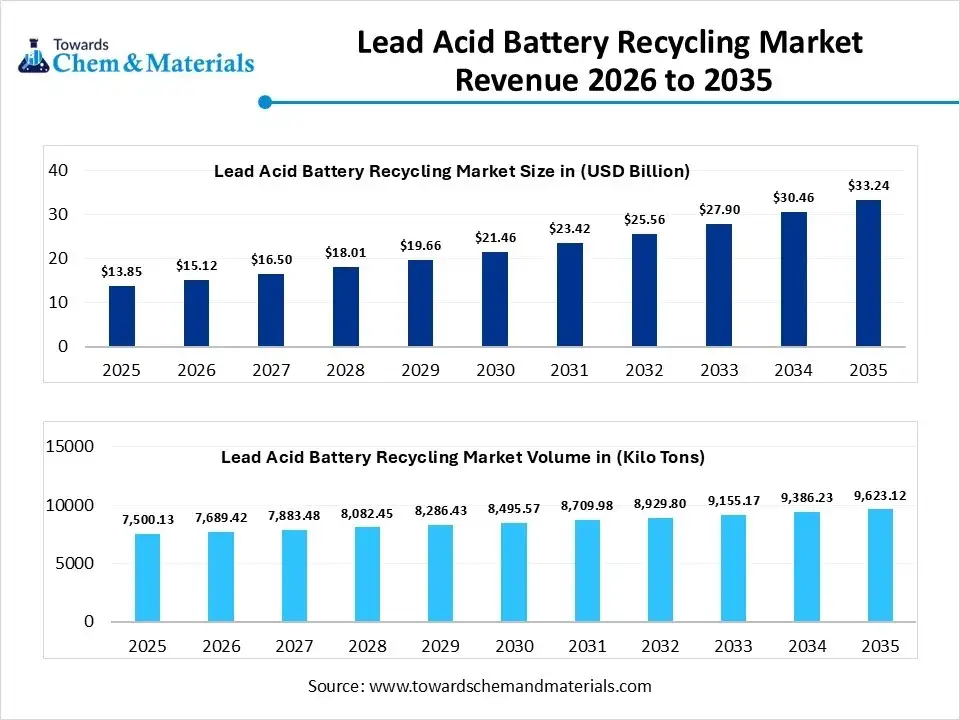

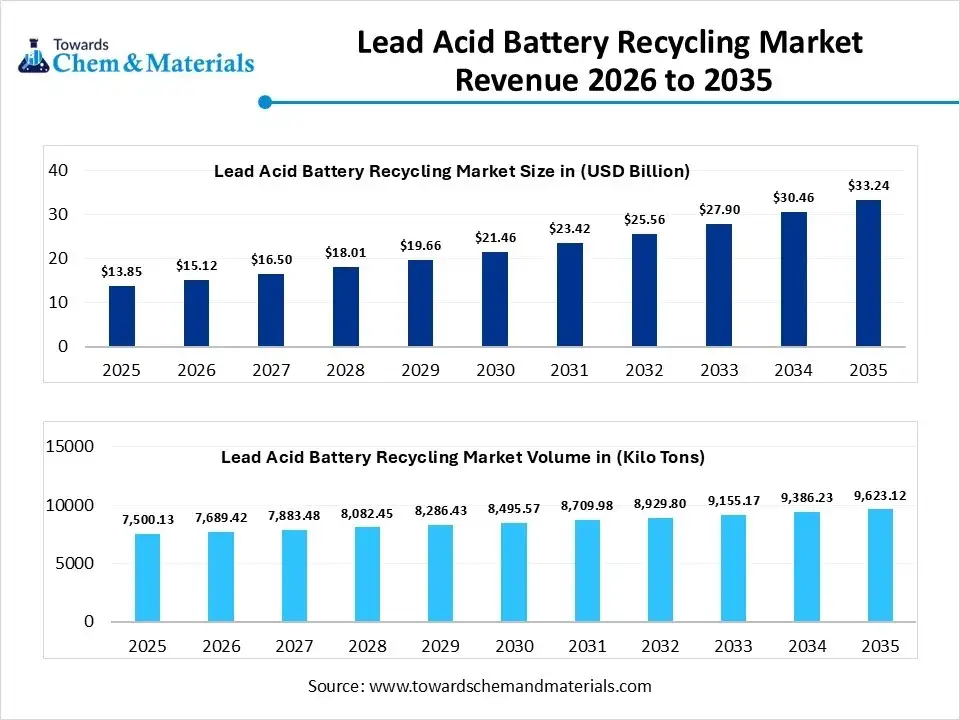

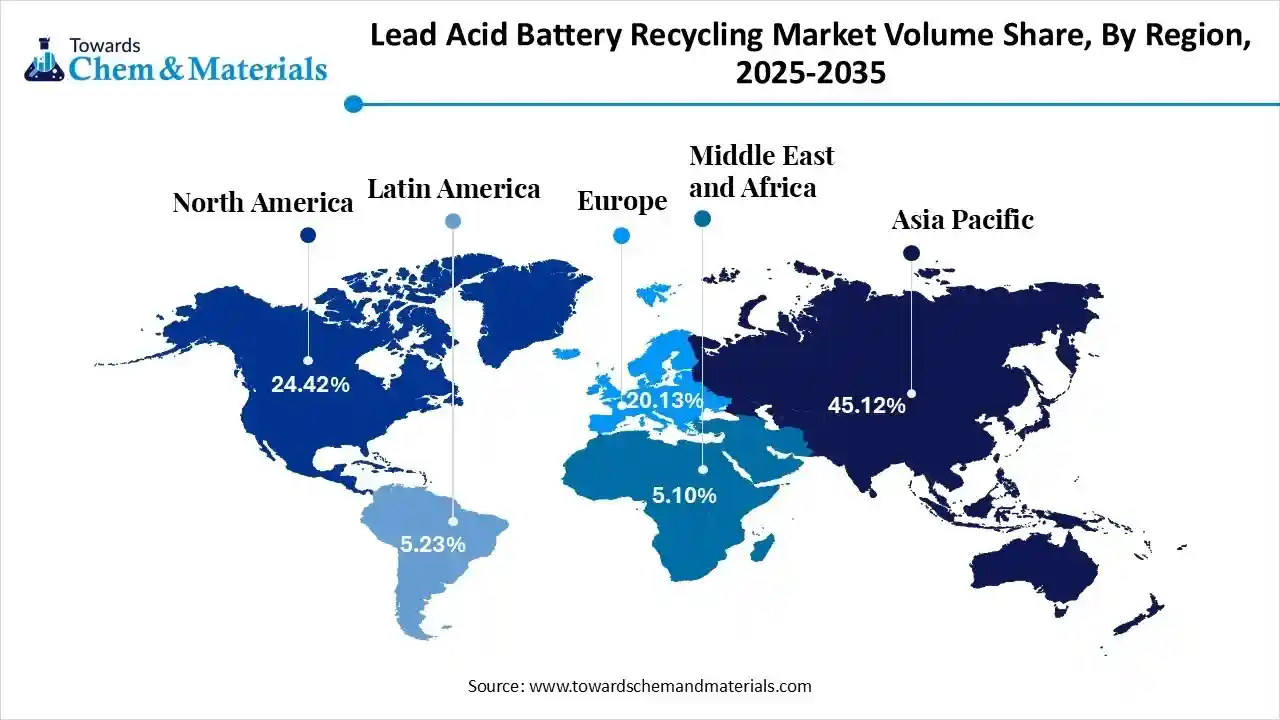

The global lead acid battery recycling market size was estimated at USD 13.85 billion in 2025 and is expected to increase from USD 15.12 billion in 2026 to USD 33.24 billion by 2035, growing at a CAGR of 9.15% from 2026 to 2035. In terms of volume, the market is projected to grow from 7500.13 kilo tons in 2025 to 9623.12 kilo tons by 2035. growing at a CAGR of 2.52% from 2026 to 2035. Asia Pacific dominated the lead acid battery recycling market with the largest volume share of 45.12% in 2025. The shift towards sustainable manufacturing and cost efficiency has accelerated the industry's growth in recent years.

Market Highlights

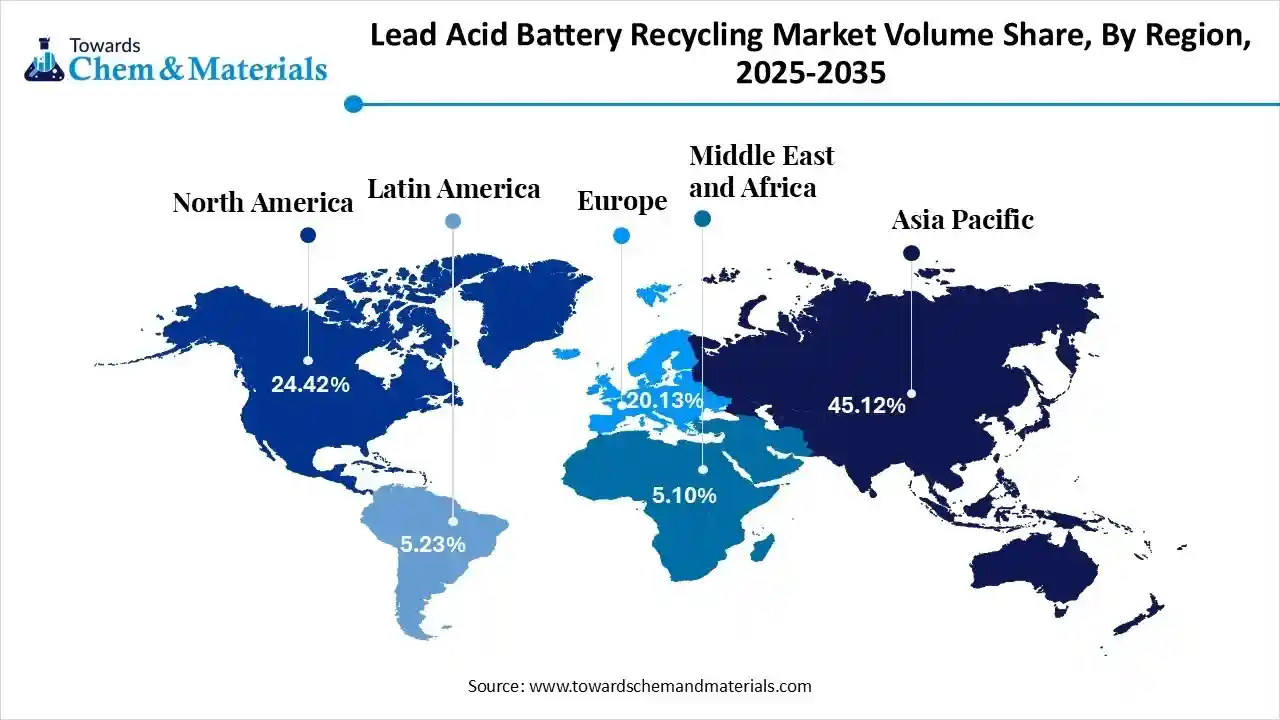

- The Asia Pacific dominated the global lead acid battery recycling market with the largest volume share of 45.12% in 2025.

- The lead acid battery recycling market in North America is expected to grow at a substantial CAGR of 1.60% from 2026 to 2035.

- The Europe lead acid battery recycling market segment accounted for the major volume share of 20.13% in 2025.

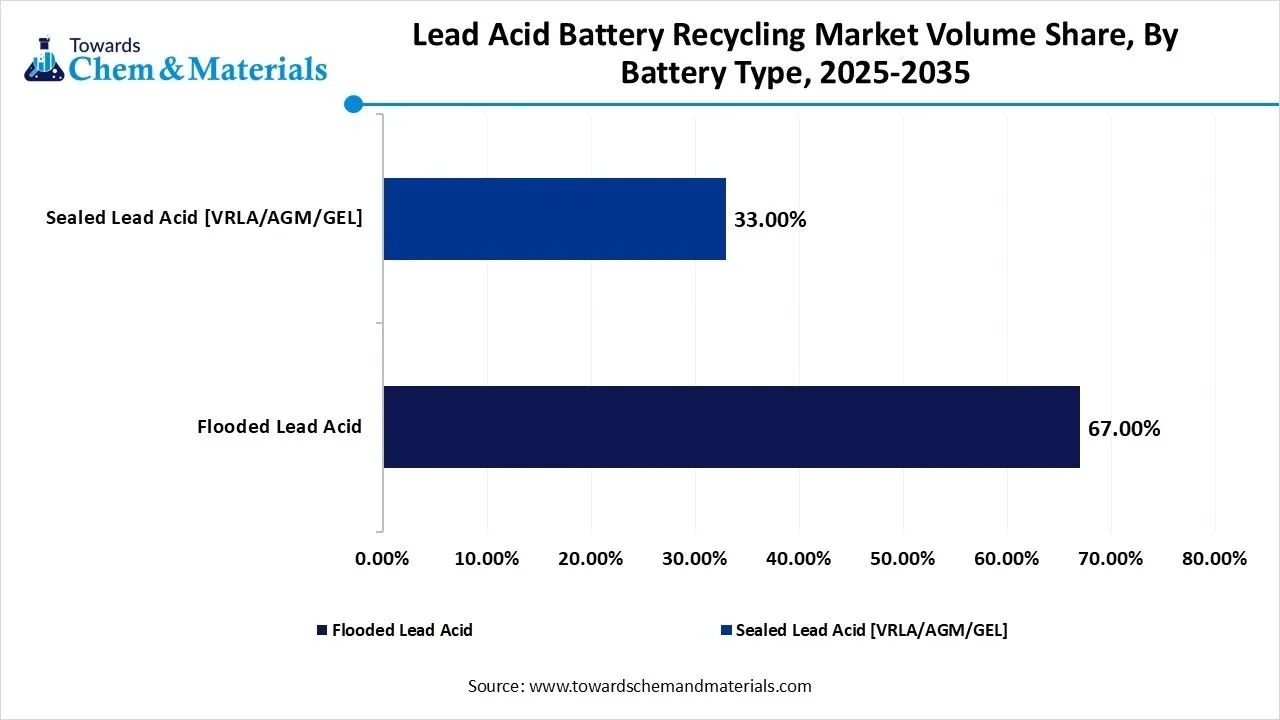

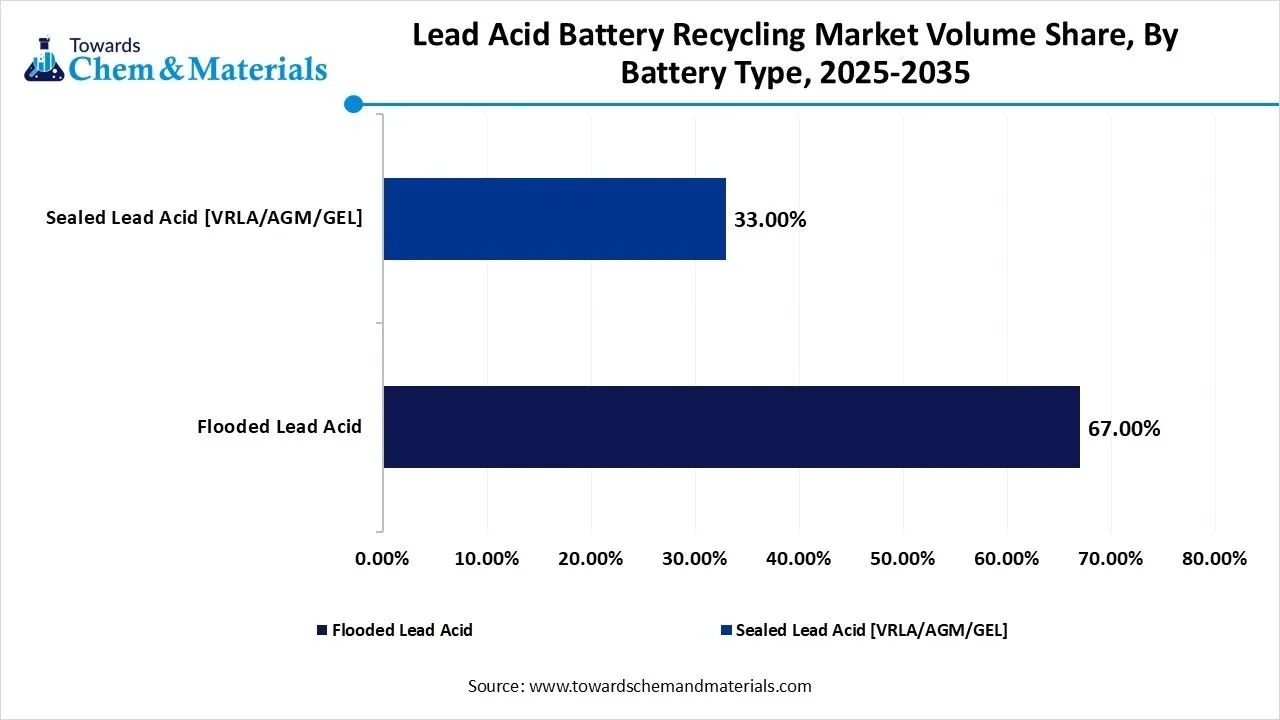

- By battery type insights, the flooded lead acid segment dominated the market and accounted for the largest volume share of 67.00% in 2025.

- By battery type insights, the sealed lead acid (VRLA) segment is expected to grow at the fastest CAGR of 3.91% from 2026 to 2035 in terms of volume.

- By technology type, the pyrometallurgical (smelting) segment led the market with the largest revenue volume share of 62% in 2025.

- By source type, the automotive segment dominated the market and accounted for the largest volume share of 58% in 2025.

Recycling Lead Acid Batteries: Cleaner Growth, Higher Profits

The processing of safely collecting lead acid batteries and turn into reusable raw materials is called lead acid battery recycling. Also, the sudden surge in eco-friendly manufacturing and minimisation of carbon emissions has immensely improved the financial performance and sector scalability in recent years. Also, having greater reusability without losing quality, the lead acid battery recycling is likely to create lucrative opportunities in the industry during the forecast period.

Lead Acid Battery Recycling Market Trends:

- The shift towards the consistency of the recycling plant by manufacturers has created profitable pathways for the sector participants in the past few years. Also, the increasing need for recycled lead, which behaves the same way every time during production, can lead to industry growth in the coming years

- The establishment of the local recycling plants is actively supporting the capital growth and the economic activity in the sector. Also, the specific group of manufacturers is seen under the establishment of the smaller recycling plants near battery collection instead of relying on large recycling zones in recent years.

- The lead acid battery recycling emerges as a secure raw material supply, which is expected to positively impact revenue potential during the forecast period. Also, by giving better control over materials and planning to the companies, the recycling of lead-acid batteries is anticipated to gain major industry share in the coming years.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 15.12 Billion / 7689.42 Kilo Tons |

| Revenue Forecast in 2035 | USD 33.24 Billion / 9623.12 Kilo Tons |

| Growth Rate | CAGR 9.15% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Technology, By Source, By Region |

| Key companies profiled | Ecobat, Clarios, East Penn Manufacturing Co., Exide Technologies, Gravita India Ltd., The Doe Run Company, EnerSys, Umicore, Glencore plc, Cirba Solutions, Aqua Metals, Inc., Gopher Resource, Call2Recycle, Inc. 1, Johnson Controls International, Terrapure Environmental |

Tracking Batteries, Eliminating Toxic Waste

The market is increasingly moving from heavy, polluting recycling methods to cleaner, smarter, and more controlled processes. Also, new recycling plants now use low-temperature lead recovery, better air filters, and closed systems that stop toxic dust from escaping. Another major shift is digital battery tracking, where batteries are tagged and followed from use to recycling, reducing illegal dumping.

Trade Analysis of the Lead Acid Battery Recycling Market:

Import, Export, Consumption, and Production Statistics

- China has observed in various types of battery exports where the unit count is around 37.895 billion, as per the reports.(Source: www.webull.com)

- The United States has seen in between sophisticated export of electric batteries, which is around $8.78 billion in 2024, where other countries like Mexico, with 3.74 billion, and the United Kingdom, with $222 million, as per the latest survey.(Source: oec.world)

Value Chain Analysis of the Lead Acid Battery Recycling Market:

- Distribution to Industrial Users: The industrial segment of the lead-acid battery recycling market is characterized by a strong shift toward closed-loop circular economies, where recycled lead is directly reintegrated into new industrial battery production.

- Key Players: Exide Technologies and Ecobat

- Chemical Synthesis and Processing: The chemical synthesis and processing segment of the lead-acid battery (LAB) recycling market is increasingly dominated by advanced hydrometallurgical techniques, which utilize aqueous chemistry to offer high-purity material recovery and lower environmental emissions compared to traditional smelting.

- Key Players: Aqua Metals Inc and Clarios

- Regulatory Compliance and Safety Monitoring: The regulatory compliance and safety monitoring segment of the lead-acid battery (LAB) recycling market is driven by the global enforcement of Extended Producer Responsibility (EPR) and the implementation of advanced digital tracking technologies.

- Safety Standards- EU Battery Regulation and Battery Waste Management Rules (2022)(India)

Lead Acid Battery Recycling Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | RCRA Subtitle C | Ensuring high worker safety to prevent lead poisoning |

| European Union | European Chemicals Agency (ECHA) | Batteries Regulation (EU) 2023/1542 | Shifting toward a full circular economy model |

| China | Ministry of Ecology and Environment (MEE) | Law on the Prevention and Control of Environmental Pollution by Solid Waste (Solid Waste Law) (revised 2020) | Eliminating unlicensed and polluting recycling operations |

Segmental Insights

Battery Type Insights

How did the Flooded Lead Acid Segment Dominate the Lead Acid Battery Recycling Market in 2025?

The flooded lead acid segment volume was valued at 5025.09 kilo tons in 2025 and is projected to reach 6128.00 kilo tons by 2035, expanding at a CAGR of 2.23% during the forecast period from 2025 to 2035. The flooded lead acid segment dominated the market with 67% industry share in 2025, as these batteries are widely used in traditional vehicles, power stations, and large backup systems due to their strong performance and lower upfront cost. Their simple design makes them easy to collect and dismantle, which feeds recycling systems with a continuous supply.

The sealed lead acid (VRLA) segment volume was valued at 2475.04 kilo tons in 2025 and is expected to surpass around 3495.12 kilo tons by 2035, and it is anticipated to expand to 3.91% of CAGR during 2026 to 2035. The sealed lead acid (VRLA) segment is expected to grow due to its safety, compactness, and increasing use in mobile and high-tech applications. SLAs require less maintenance, reducing handling risks and increasing collection consistency. Their sealed design minimizes leakage, which helps recyclers manage materials more predictably.

Lead Acid Battery Recycling Market Volume and Share, By Battery Type, 2025-2035

| By Battery Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Flooded Lead Acid | 67.00% | 5025.09 | 6128.00 | 2.23% | 63.68% |

| Sealed Lead Acid [VRLA/AGM/GEL] | 33.00% | 2475.04 | 3495.12 | 3.91% | 36.32% |

Technology Type Insights,

How did the Pyrometallurgical (Smelting) Segment Dominate the Lead-Acid Battery Recycling Market in 2025?

The pyrometallurgical (smelting) segment dominated the market with 62% industry share in 2025, due to it known as a simple and well-understood technology in the industry nowadays. Also, several manufacturers with furnaces are leading the pyrometallurgy process with cost-effectivity in the current period as per the recent survey.

The hydrometallurgical process segment is expected to grow with a rapid CAGR, owing to its usage of less energy and production of pure lead. Moreover, by dissolving the liquids and enabling the finer control over impurities, the hydrometallurgical process is expected to create profitable pathways for sector participants while reducing heat usage during the projected period, as per the industry expectations.

Source Insights

How did the Automotive (SLI) Segment Dominate the Lead Acid Battery Recycling Market in 2025?

The automotive (SLI) segment dominated the market with 58% industry share in 2025, akin to vehicles contributing the largest share of used lead-acid batteries. The consistent demand for starter, lighting, and ignition batteries throughout the automotive lifecycle ensures a high and predictable supply of end-of-life units. Moreover, automotive service centers and dealerships often act as collection points, boosting recycling participation levels.

The industrial (UPS/data centers) segment is expected to grow due to power storage needs expand in factories, data centers, solar farms, and remote energy infrastructures in recent years. Also, industrial lead-acid batteries are larger and more standardized than automotive ones, making their post-use handling and recycling more predictable.

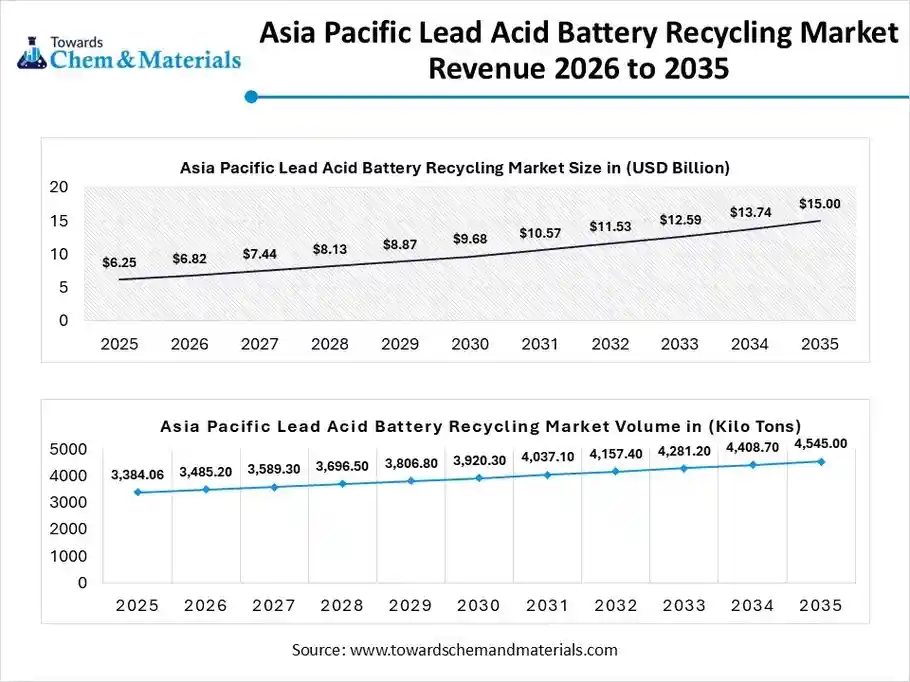

Regional Analysis:

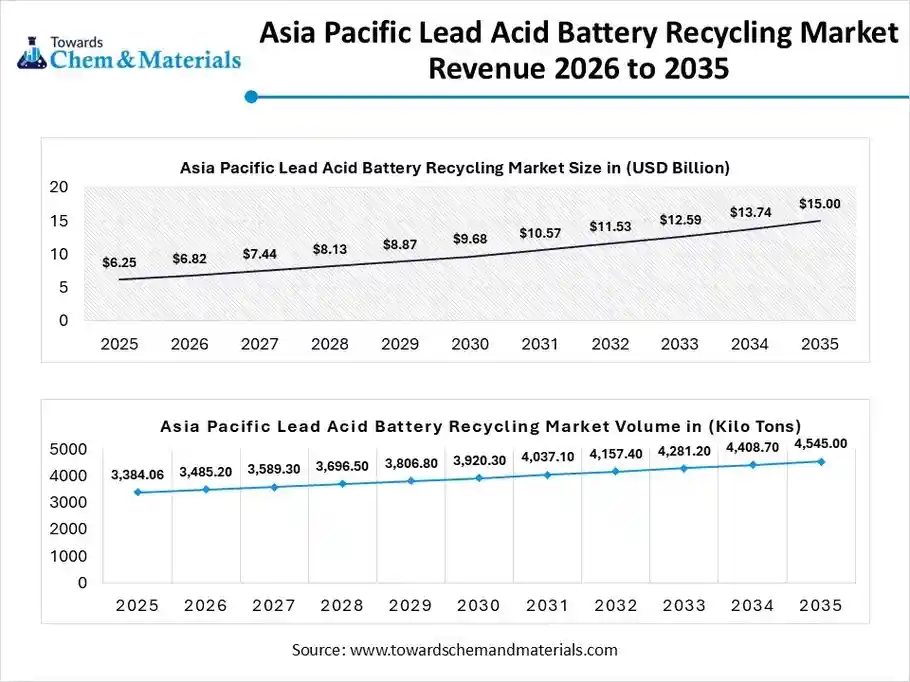

The Asia Pacific lead acid battery recycling market size was valued at USD 6.25 billion in 2025 and is expected to be worth around USD 15.00 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.17% over the forecast period from 2026 to 2035.

The Asia Pacific lead acid battery recycling market volume was estimated at 3384.06 kilo tons in 2025 and is projected to reach 4545.00 kilo tons by 2035, growing at a CAGR of 3.33% from 2026 to 2035. Asia Pacific dominated the lead acid battery recycling market in 2025, due to the heavy battery usage and faster replacement cycles observed in the region. moreover, the factors such as the large number of vehicle owners and the huge infrastructure of the backup power systems are expected to lead the industry's potential in the coming years in the region.

China Sets Pace in Battery Recycling

China maintained its dominance in the market, owing to the tightly controlled material reuse policies and systems in the country. Moreover, the country has shifted its focus to the internal recycling infrastructure with the goal to the minimization of imports in recent years. Also, the heavy investment in electric vehicles and components is expected to drive the industry growth in the coming years.

North America Lead Acid Battery Recycling Market Examination

The North America lead acid battery recycling market volume was estimated at 1831.53 million tons in 2025 and is projected to reach 2113.24 million tons by 2035, growing at a CAGR of 1.60% from 2026 to 2035. North America is expected to capture a major share of the lead acid battery recycling market with a rapid CAGR, owing to the increased regional focus on safety, consistency, and long-term material reliability in recent years. Moreover, factors such as the stronger and advanced infrastructure, reliable logistics, and controlled handling systems have increased the commercial viability of the regional industry in recent years.

Heavy Investment Strengthens Recycling Ecosystems in the United States.

The United States is expected to emerge as a prominent country for the lead acid battery recycling market in the coming years, akin to the greater move towards sustainability in manufacturing infrastructure. Also, the participants of the recycling industry have seen under the heavy investment in advanced recycling with affordability, which is likely to create significant opportunities in the United States market ecosystems during the forecast period.

Lead Acid Battery Recycling Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 24.42% | 1831.53 | 2113.24 | 1.60% | 21.96% |

| Europe | 20.13% | 1509.78 | 1848.60 | 2.28% | 19.21% |

| Asia Pacific | 45.12% | 3384.06 | 4545.00 | 3.33% | 47.23% |

| South America | 5.23% | 392.26 | 587.01 | 4.58% | 6.10% |

| Middle East & Africa | 5.10% | 382.51 | 529.27 | 3.67% | 5.50% |

Europe Lead Acid Battery Recycling Market Evaluation

The Europe lead acid battery recycling market volume was estimated at 1509.78 million tons in 2025 and is projected to reach 1848.60 million tons by 2035, growing at a CAGR of 2.28% from 2026 to 2035. Europe is a notably growing region, owing to the fact that recycling is now treated as a normal daily activity in the region. Also, Old car batteries, industrial batteries, and backup power batteries are collected through organized systems, so very few are wasted. Companies prefer recycled lead because it is cheaper and more stable in price than mined lead in the region.

Strong Systems Drive Germany’s Recycling Success

Germany is expected to gain a major industry share, as people and businesses follow systems carefully in the country. Batteries are returned on time, stored safely, and sent to proper recycling units. Germany has many vehicles, factories, and backup power systems, so used batteries are always available.

South America Lead Acid Battery Recycling Market Evaluation

The South America lead acid battery recycling market volume was estimated at 392.26 million tons in 2025 and is projected to reach 587.01 million tons by 2035, growing at a CAGR of 4.58% from 2026 to 2035. South America is a notably growing region due to the transportation, industry, and telecom services, which are growing steadily. Many people rely on vehicles and small businesses that use lead-acid batteries daily. Governments are improving recycling rules, but community-level collection plays a big role. Recycling is becoming a source of local income in the region nowadays. Moreover, small collectors and cooperatives gather used batteries and supply them to formal recyclers

Used Batteries Power Brazil’s Future

Brazil is expected to gain a major industry share, akin to its large vehicle population and strong local manufacturing base. Moreover, used batteries are easy to find and collect. Recycling systems work closely with repair shops, transport operators, and small industries in the country, which is expected to create lucrative opportunities in the coming years.

Lead Acid Battery Recycling Market Study in the Middle East and Africa

The Middle East and Africa lead acid battery recycling market volume was estimated at 382.51 million tons in 2025 and is projected to reach 529.27 million tons by 2035, growing at a CAGR of 3.67% from 2026 to 2035. The Middle East and Africa are expected to capture a notable share of the industry, as power backup is essential in the region nowadays. Moreover, many areas face power instability, so lead-acid batteries are widely used in telecom towers, homes, and hospitals. and businesses. As these batteries wear out, recycling becomes necessary.

Saudi Arabia’s Battery Recycling Momentum

Saudi Arabia is expected to emerge as a prominent country, akin to large-scale infrastructure, energy projects, and sustainability goals. Batteries are heavily used in construction sites and oil facilities. data centers, and backup power systems. Moreover, the hot weather shortens battery life, which increases recycling volume in the country.

Recent Developments

- In March 2025, Nafees Batteries installed the lead-acid battery recycling plant in Qatar. Also, the main motive behind the establishment of this advanced recycling plant is to boost sustainability in the state, as per the published report.(Source: www.batteriesinternational.com)

Top Vendors in the Lead Acid Battery Recycling Market & Their Offerings:

- Ecobat: As the world's largest recycler of lead-acid batteries and a leader in lead production, Ecobat operates high-tech smelters across Europe and the U.S. to ensure nearly 100% of battery materials are recovered and reused.

- Clarios: A global leader in advanced energy storage solutions, Clarios operates a massive circular supply chain where they collect and recycle approximately 8,000 batteries every hour to produce new automotive batteries.

- East Penn Manufacturing Co.: This family-owned American company operates one of the world's largest single-site lead-acid battery manufacturing and recycling facilities, maintaining a 99% recycling rate for all battery components.

- Exide Technologies: A major global provider of stored electrical energy solutions, Exide utilizes a sophisticated "Total Battery Management" program to integrate battery production with specialized smelting and recycling operations.

- Gravita India Ltd.

- The Doe Run Company

- EnerSys

- Umicore

- Glencore plc

- Cirba Solutions

- Aqua Metals, Inc.

- Gopher Resource

- Call2Recycle, Inc. 1

- Johnson Controls International

- Terrapure Environmental

Segments Covered in the Report

By Technology

- Pyrometallurgical (Smelting)

- Hydrometallurgical (Aqueous Chemistry)

- Physical/Mechanical (Crushing & Separation)

By Battery Type

- Flooded Lead Acid

- Sealed Lead Acid (VRLA/AGM/GEL)

By Source

- Automotive (SLI Batteries)

- Industrial (Telecom/UPS/Energy Storage)

- Consumer Electronics & Appliances

- Others (Marine/Motive Power)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa