Content

What is the Current Standard Modulus Carbon Fiber Market Size and Volume?

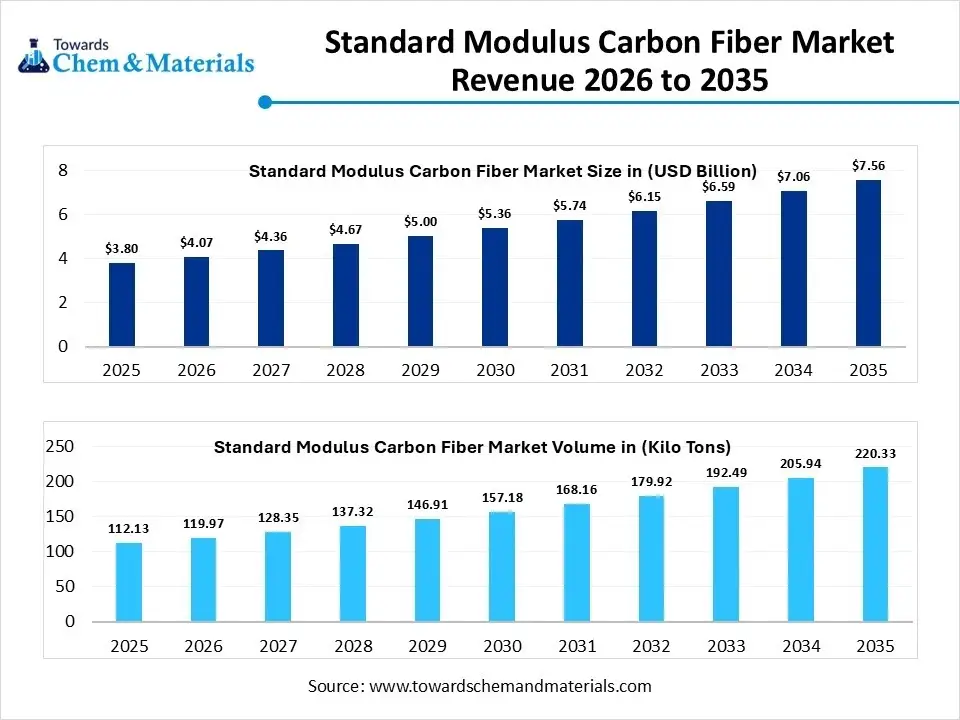

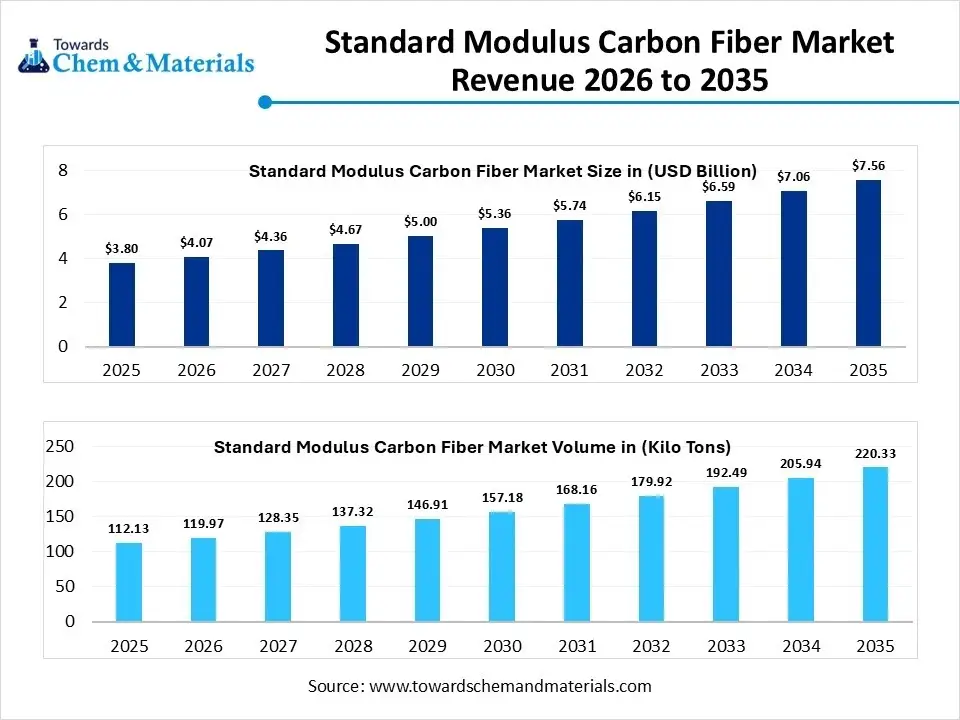

The global standard modulus carbon fiber market size was estimated at USD 3.80 billion in 2025 and is expected to increase from USD 4.07 billion in 2026 to USD 7.56 billion by 2035, growing at a CAGR of 7.11% from 2026 to 2035. In terms of volume, the market is projected to grow from 112.13 million tons in 2025 to 220.33 million tons by 2035. growing at a CAGR of 6.99% from 2026 to 2035. Asia Pacific dominated the standard modulus carbon fiber market with the largest volume share of 45.12% in 2025. The rapid renewable energy expansion and focus on vehicle lightweighting drive the market growth.

Market Highlights

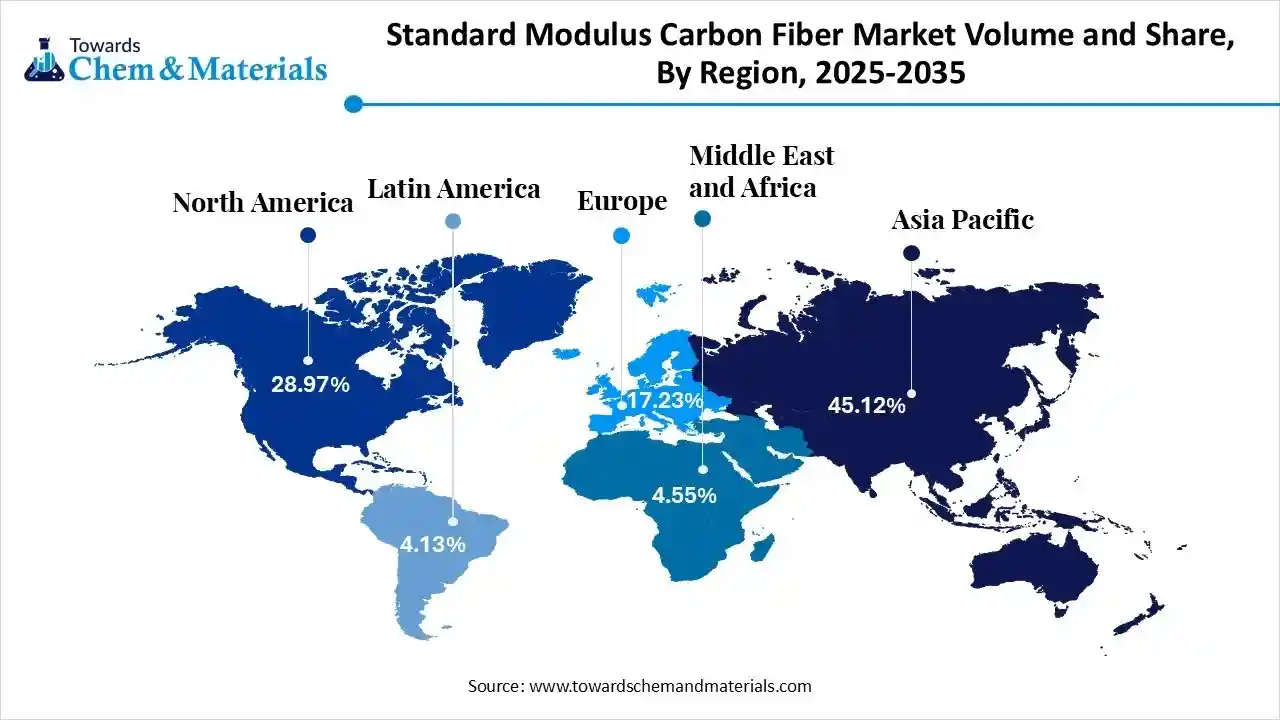

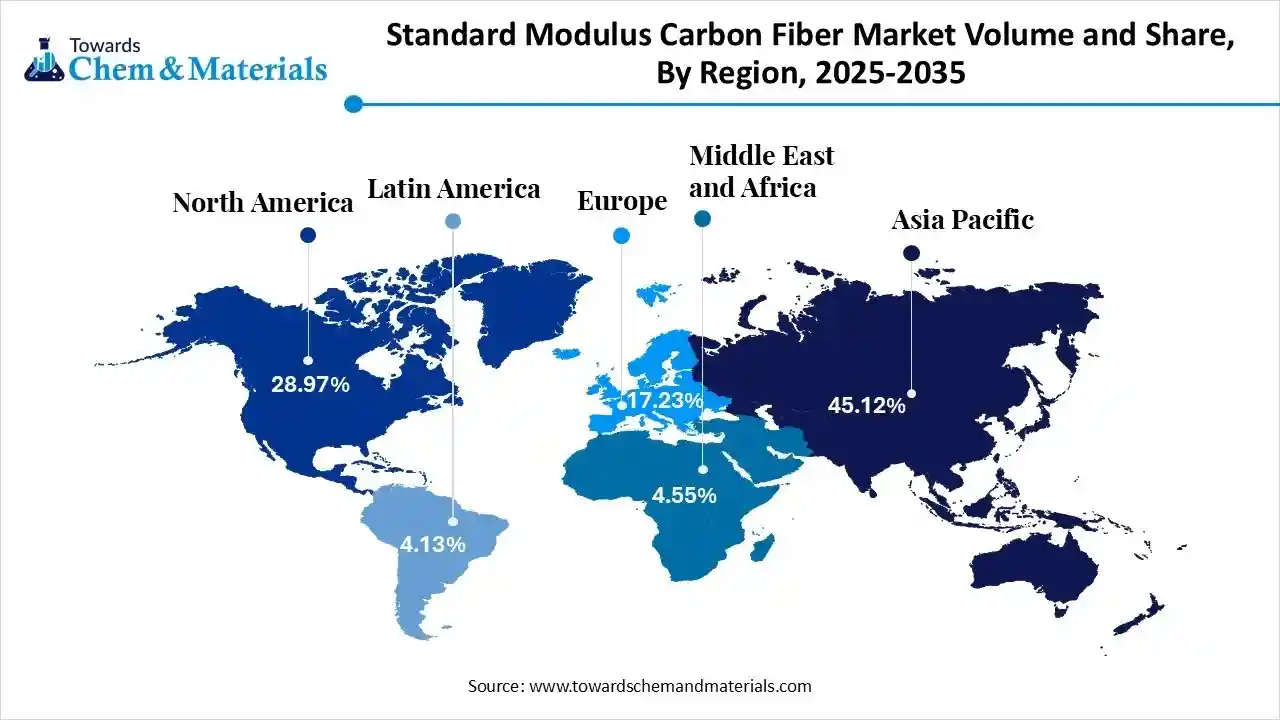

- The Asia Pacific dominated the global standard modulus carbon fiber market with the largest volume share of 45.12% in 2025.

- The standard modulus carbon fiber market in North America is expected to grow at a substantial CAGR of 6.43% from 2026 to 2035.

- The Europe standard modulus carbon fiber market segment accounted for the major volume share of 17.23% in 2025.

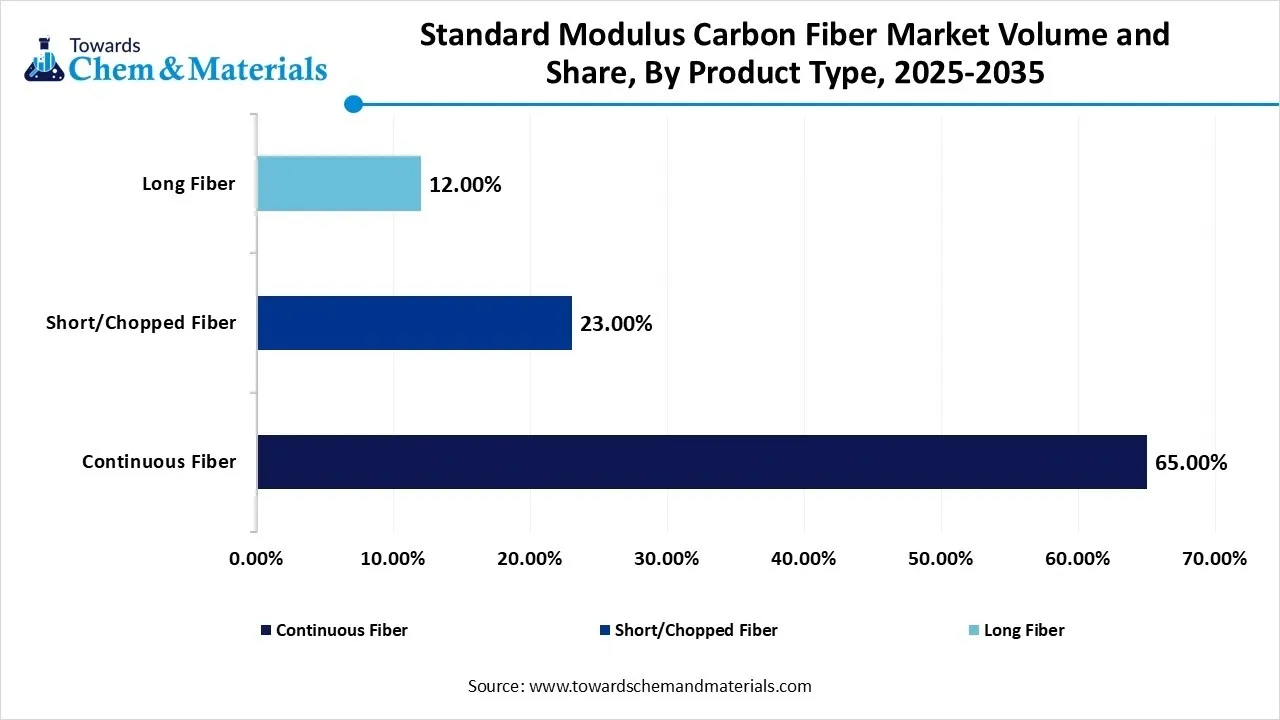

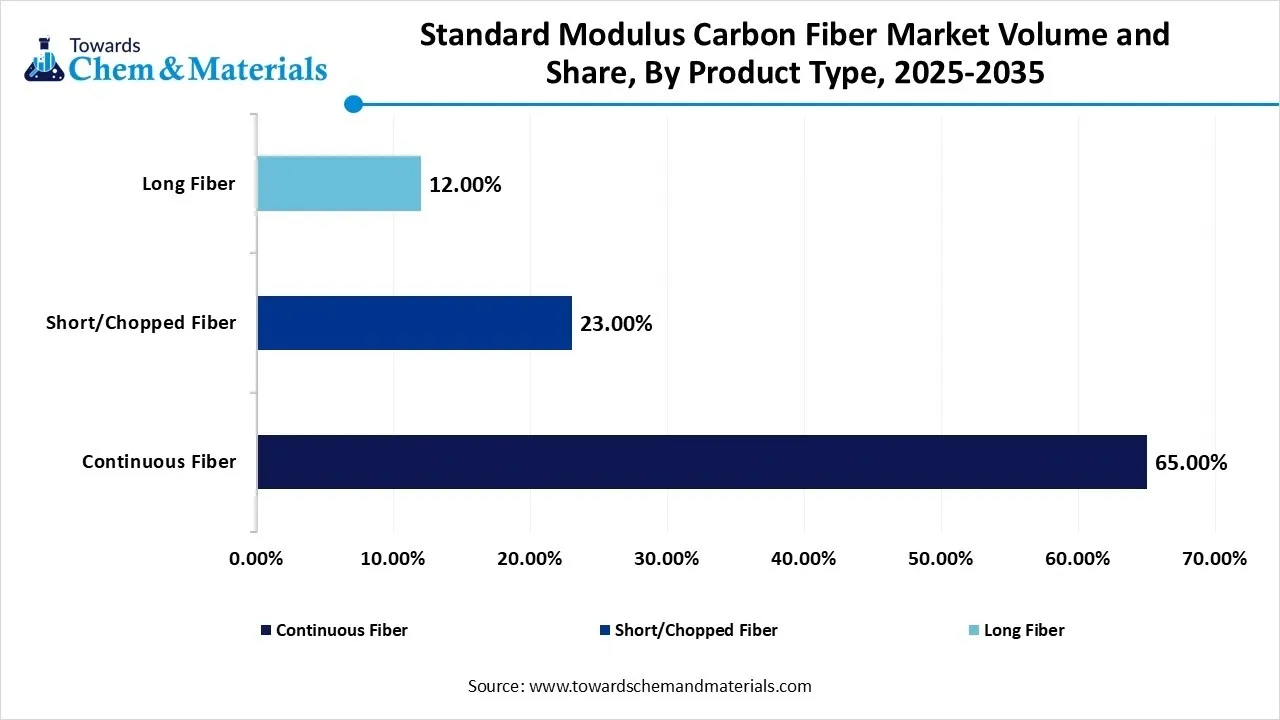

- By product type, the continuous fiber segment dominated the market and accounted for the largest volume share of 65% in 2025.

- By product type, the short/chopped fiber segment is expected to grow at the fastest CAGR of 9.53% from 2026 to 2035 in terms of volume.

- By precursor type, the PAN-based segment led the market with the largest revenue volume share of 94% in 2025.

- By application, the composite materials segment dominated the market and accounted for the largest volume share of 80% in 2025.

- By end-use industry, the aerospace & defense segment led the market with the largest revenue volume share of 31% in 2025.

What is Standard Modulus Carbon Fiber?

Standard modulus carbon fiber is a type of carbon fiber that has a fiber modulus of 33-36 Msi. It consists of 3500-5000 MPa tensile strength and good fatigue resistance. It is widely used across industrial applications and is the most common grade. The standard modulus carbon fiber production cost is low, and it offers moderate stiffness. The common uses of standard modulus carbon fiber are brake pads, performance-critical aircraft parts, bicycle frames, wind turbine blades, high-pressure tanks, and drive shafts.

The standard modulus carbon fiber market growth is driven by the development of durable satellite parts, focus on enhancing fuel efficiency of vehicles, increasing use of wind turbines, growing need for high-performance storage, increased utilization of sporting goods, stringent emission regulations, and expanding carbon fiber recycling.

Standard Modulus Carbon Fiber Market Trends:

- Growing Consumer Goods Demand:- The increasing use of various sporting goods and the increasing development of lighter sporting equipment increase demand for standard modulus carbon fiber. The growing utilization of luxury goods requires standard modulus carbon fiber.

- Increasing Use of Industrial Machinery:- The growing development of lighter machine parts and increasing use of machinery in industrial activities increases demand for standard modulus carbon fiber. The development of industrial rollers, AGVs, jigs, and other industrial machinery creates a higher demand for standard modulus carbon fiber.

- Push For Wind Energy:- The growing expansion of wind farm installation and the increased construction of large-scale turbine blades increases demand for standard modulus carbon fiber to enhance structural integrity and energy capture.

- Growing Pipes and Tanks Sector:- The increasing need for pressure vessels to store industrial gases and the strong focus on lowering the weight of large-diameter pipes increase demand for standard modulus carbon fiber.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 4.07 Billion / 119.97 Kilo Tons |

| Revenue Forecast in 2035 | USD 7.56 Billion / 220.33 Kilo Tons |

| Growth Rate | CAGR 7.11% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Precursor Type, By Application, By End-Use Industry, By Region |

| Key companies profiled | Toray Industries, Inc., Hexcel Corporation, Mitsubishi Chemical Group, Teijin Limited, SGL Carbon SE, Zoltek Companies, Inc. (Toray Group), Solvay S.A., DowAksa, Hyosung Advanced Materials, Zhongfu Shenying Carbon Fiber Co., Ltd., Formosa Plastics Corporation, Jiangsu Hengshen Co., Ltd., Weihai Guangwei Composites Co., Ltd., Taekwang Industrial Co., Ltd., A&P Technology, Inc. |

Key Technological Shifts in the Standard Modulus Carbon Fiber Market:

The standard modulus carbon fiber market is undergoing key technological shifts driven by the demand for lighter material, sustainability, and cost reduction. The technological shifts, like additive manufacturing, IoT, manufacturing automation, and digitalization, enhance efficiency and improve quality control. The major technological innovation is the integration of AI improves performance and develops better composites.

AI accelerates the speed of the production process and predicts the scrap rates. AI easily discovers new precursors and lowers the waste of materials. AI predicts automated fiber placement and monitors the health of equipment. AI designs composites with specific properties and schedules the maintenance of equipment. AI easily develops complex composites and minimizes the consumption of energy. Overall, AI speeds up the innovation process and enhances reliability.

Standard Modulus Carbon Fiber Market Value Chain Analysis

- Feedstock Procurement: The stage focuses on sourcing raw materials like polyacrylonitrile and sustainable feedstocks like recycled carbon fiber, lignin, & bio-based ACN.

- Key Players:- Teijin Limited, Hexcel Corporation, Hyosung Advanced Materials, Toray Industries, Mitsubishi Chemical Corporation

- Chemical Synthesis and Processing: The stage performs steps like polymerization of CAN, spinning, oxidative stabilization, carbonization, surface treatment, and sizing.

- Key Players:- Mitsubishi Chemical Corporation, SGL Carbon SE, Hyosung Advanced Materials, Syensqo, Toray Industries

- Quality Testing and Certifications: The stage focuses on evaluating attributes like bond strength, specific gravity, tensile modulus, compressive load capacity, and filament diameter. Certifications include ISO 9001, ISCC PLUS, EN 9100, ASTM International, and CEMILAC.

- Key Players:- Intertek Group plc, WMT&R, Applus+Laboratories, TUV SUD, SGS S.A.

Mapping Country-Wise Applications of Standard Modulus Carbon Fiber

| Country | Key Applications | Companies |

| China |

|

|

| United States |

|

|

| Germany |

|

|

| Brazil |

|

|

Segmental Insights

Product Type Insights

Why the Continuous Fiber Segment Dominates the Standard Modulus Carbon Fiber Market?

The continuous fiber segment volume was valued at 72.88 million tons in 2025 and is projected to reach 132.73 million tons by 2035, expanding at a CAGR of 6.89% during the forecast period from 2025 to 2035. The continuous fiber segment dominated the standard modulus carbon fiber market with a 65% share in 2025. The growing manufacturing of aircraft wings and the increasing use of high-end sports cars increase demand for continuous fiber. The development of high-pressure tanks and huge vehicle production requires continuous fiber. The superior strength, cost-effectiveness, and design flexibility of continuous fiber drives the overall market growth.

The short/chopped fiber segment volume was valued at 25.79 million tons in 2025 and is expected to surpass around 58.50 million tons by 2035, and it is anticipated to expand to 9.53% of CAGR during 2026 to 2035. The short/chopped fiber segment is the fastest-growing in the market during the forecast period. The integration with automated processes and the compatibility with high-volume manufacturing of short fibers help market expansion.The increased development of EV battery enclosures and the growing use of lightweight housing increase demand for short/chopped fiber. The development of high-performance parts and the sustainability focus increases the adoption of short/chopped fiber, supporting the overall market growth.

Standard Modulus Carbon Fiber Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Continuous Fiber | 65.00% | 72.88 | 132.73 | 6.89% | 60.24% |

| Short/Chopped Fiber | 23.00% | 25.79 | 58.50 | 9.53% | 26.55% |

| Long Fiber | 12.00% | 13.46 | 29.11 | 8.95% | 13.21% |

Precursor Type Insights

How did the PAN-Based Segment hold the Largest Share in the Standard Modulus Carbon Fiber Market?

The PAN-based segment held the largest revenue share of 94% in the standard modulus carbon fiber market in 2025. The growing development of car parts and focus on enhancing energy capture capacity in renewables increases demand for PAN-based carbon fiber. The increasing use of various sports equipment and the expanded production of consumer goods require PAN-based carbon fiber. The high processability, excellent tensile strength, and the versatility of PAN-based carbon fiber drive the overall market growth.

The rayon & bio-based segment is experiencing the fastest growth in the market during the forecast period. The growing environmental issues and increasing adoption of sustainable practices increase demand for rayon & bio-based carbon fiber. The sustainability targets in the corporate environment and the higher need to lower carbon footprint increase demand for rayon & bio-based carbon fiber. The industrial shift towards sustainable options supports the overall market growth.

Application Insights

Which Application Segment Dominated the Standard Modulus Carbon Fiber Market?

The composite materials segment dominated the standard modulus carbon fiber market with an 80% share in 2025. The development of lighter aircraft and innovations in manufacturing technologies increases demand for composite materials. The acceleration in the EV production and development of performance-critical components in military aircraft increases demand for composite materials. The exceptional rigidity, excellent corrosion resistance, and affordability of composite materials drive the market growth.

The non-composite materials segment is the fastest-growing in the market during the forecast period. The increased production of fuel cells and the advanced tanks for storage increases demand for non-composite materials. The development of imaging equipment and the increasing use of specialized textiles require non-composite materials. The excellent electrical conductivity, sustainability, and biocompatibility of non-composite materials support the overall market growth.

End-Use Industry Insights

How did the Aerospace & Defense hold the Largest Share in the Standard Modulus Carbon Fiber Market?

The aerospace & defense segment held the largest revenue share of 31% in the standard modulus carbon fiber market in 2025. The strong focus on enhancing flight performance and the increasing use of advanced weaponry increase demand for standard modulus carbon fiber. The growing expansion of drones and the stricter safety standards in the aerospace industry create a higher demand for standard modulus carbon fiber. The development of lightweight armor and the growth in commercial aviation require standard modulus carbon fiber, driving the overall market growth.

The pipes & tanks segment is experiencing the fastest growth in the market during the forecast period. The higher need for composite pressure vessels and the increased installations of large-diameter pipes increase demand for standard modulus carbon fiber. The push for cleaner energy and the expansion of industrial storage increase demand for standard modulus carbon fiber. The growth in storing hydrogen and the focus on lower pipe maintenance create demand for standard modulus carbon fiber, supporting the overall growth of the market.

Regional Insights

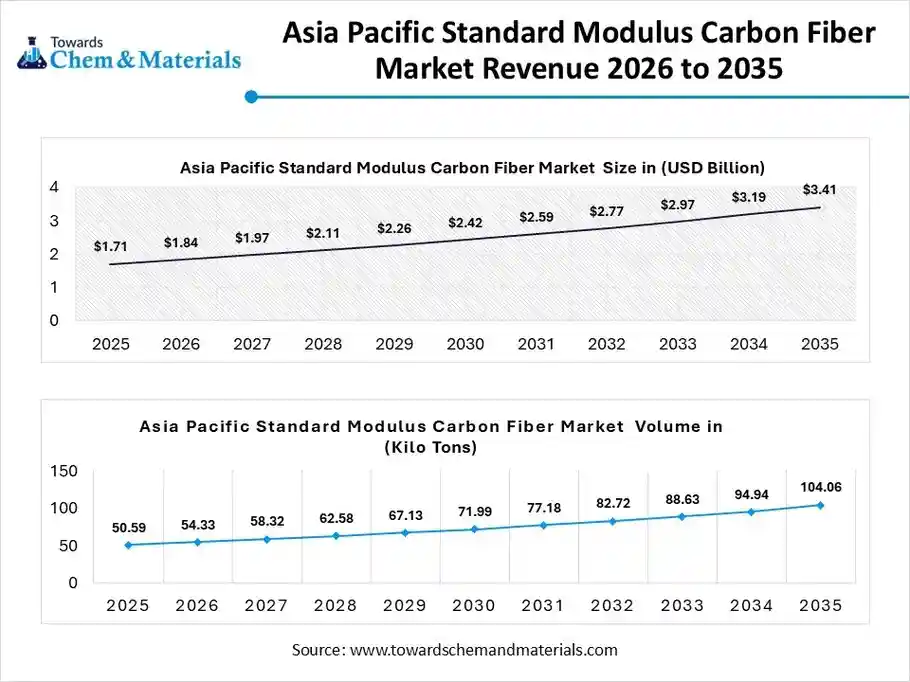

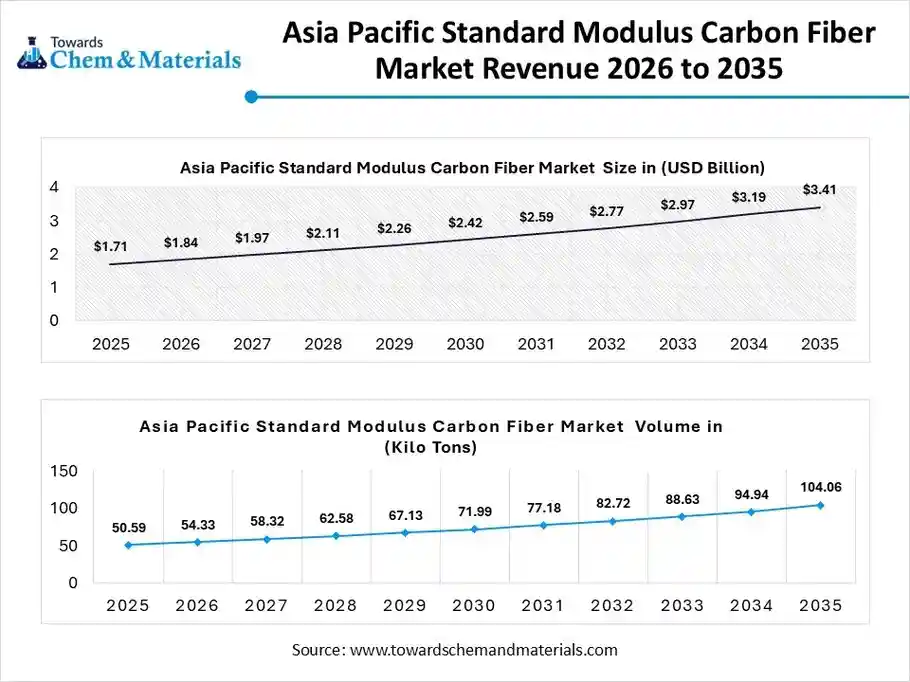

The Asia Pacific standard modulus carbon fiber market size was valued at USD 1.71 billion in 2025 and is expected to be worth around USD 3.41 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.13% over the forecast period from 2026 to 2035.

The Asia Pacific standard modulus carbon fiber market volume was estimated at 50.59 million tons in 2025 and is projected to reach 104.06 million tons by 2035, growing at a CAGR of 8.34% from 2026 to 2035. Asia Pacific dominated the standard modulus carbon fiber market in 2025. The strong presence of industrial sectors and the well-established electric vehicle base increases demand for standard modulus carbon fiber.

The surging renewable energy industry and the increasing use of automated manufacturing processes increase demand for standard modulus carbon fiber. The strong focus on aerospace programs and the booming use of sporting goods increases demand for standard modulus carbon fiber. The expanding construction projects and the government investment in local production drive the overall market growth.

Power of Fibers: China’s Role in Standard Modulus Carbon Fiber

China is a major contributor to the market. The huge electric vehicle production and the growth in the development of infrastructure projects increase demand for standard modulus carbon fiber. The shift towards sustainable transportation solutions and the presence of the large-scale manufacturing sector increase demand for standard modulus carbon fiber. The government's focus on industrial self-reliance supports the overall market growth.

North America Standard Modulus Carbon Fiber Market Trends

North America is experiencing the fastest growth in the market during the forecast period. The strong presence of aerospace manufacturers and the development of longer-range EVs increase demand for standard modulus carbon fiber. The strong focus on energy generation and the increasing development of high-pressure carbon fiber tanks increase demand for standard modulus carbon fiber. The growing satellite manufacturing activities and increased production of defense hardware create demand for standard modulus carbon fiber, driving the overall growth of the market.

Industrial Growth Shaping Standard Modulus Carbon Fiber in the U.S.

The United States is a key contributor to the market. The strong presence of the automotive industry and the increasing production of industrial components create a higher demand for standard modulus carbon fiber. The surging sporting goods industry and the increasing need for high-pressure hydrogen tanks increase demand for standard modulus carbon fiber. The ongoing automotive electrification and the expanding space industry increase demand for standard modulus carbon fiber. The presence of companies like Toray, Alfa Chemistry, Hexcel Corporation, and Mitsubishi Chemical supports the overall market growth.

Standard Modulus Carbon Fiber Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 28.97% | 32.48 | 56.91 | 6.43% | 25.83% |

| Europe | 17.23% | 19.32 | 39.90 | 8.39% | 18.11% |

| Asia Pacific | 45.12% | 50.59 | 104.06 | 8.34% | 47.23% |

| South America | 4.13% | 4.63 | 7.93 | 6.16% | 3.60% |

| Middle East & Africa | 4.55% | 5.10 | 11.52 | 9.48% | 5.23% |

Europe Standard Modulus Carbon Fiber Market Trends

Europe is growing at a notable rate in the market. The strong presence of the aerospace base and the increasing use of corrosion-resistant pipes increase demand for standard modulus carbon fiber. The expansion of chemical processing and the increasing use of electric vehicles increase demand for standard modulus carbon fiber. The stringent environmental regulations and the major manufacturing base increase demand for standard modulus carbon fiber, driving the overall market growth.

Germany’s Standard Modulus Carbon Fiber Landscape

Germany is growing rapidly in the market. The stringent automotive emission targets and the presence of a robust industrial base increase demand for standard modulus carbon fiber. The expansion of hydrogen infrastructure and the presence of advanced manufacturing increase demand for standard modulus carbon fiber. The growing aircraft manufacturing and the national decarbonization goals require standard modulus carbon fiber, supporting the overall market growth.

Middle East & Africa Standard Modulus Carbon Fiber Market Trends

The Middle East & Africa are growing at a substantial rate in the market. The focus on lowering the weight of aircraft and the development of stronger vehicles increases demand for standard modulus carbon fiber. The growth in the development of wind energy projects and the presence of the oil & gas industry increase demand for standard modulus carbon fiber for the development of turbine blades and pressure vessels. The increasing use of sustainable materials across industries drives the overall market growth.

Forging Strength: South Africa Rise in Standard Modulus Carbon Fiber

South Africa is growing significantly in the market. The growing development of the EV battery range and the strong focus on fuel-efficient vehicles increase demand for standard modulus carbon fiber. The renewable energy goals and the focus on the development of durable satellite components increase demand for standard modulus carbon fiber. The expanding automotive manufacturing supports the overall market growth.

South America Standard Modulus Carbon Fiber Market Trends

South America is growing in the market due to the rapid growth in wind farms. The strong focus on lowering the weight of vehicles and the ongoing modernization in the aerospace industry increase demand for standard modulus carbon fiber. The need for enhancing vehicle performance and the growth in the development of civil engineering projects require standard modulus carbon fiber. The expanding 3D printing drives the overall market growth.

Brazil Standard Modulus Carbon Fiber Ambition

Brazil is substantially growing in the market. The Brazilian automotive manufacturers focus on improving fuel economy, and the transition towards renewables increases demand for standard modulus carbon fiber. The growing recreation activities and the manufacturing of massive wind turbines increase demand for standard modulus carbon fiber. The development of aircraft structures and advanced manufacturing activities creates demand for standard modulus carbon fiber, supporting the overall market growth.

Recent Developments

- In May 2025, Hexcel and Specialty Materials launched boron fiber-infused high modulus carbon fiber, Hy-Bor. The material is useful across applications like defense, commercial aviation, and space. The material consists of design flexibility and enhanced compression strength.(Source: www.compositesworld.com)

- In January 2024, Toray launched carbon fiber, TORAYCA M46X, with enhanced strength and high tensile modulus. The carbon fiber minimizes the environmental impact and increases the design flexibility.(Source: www.specialchem.com)

- In June 2024, Hexcel launched intermediate modulus carbon fiber, HexTow IM9 24K. The carbon fiber consists of a 298 gigapascals modulus and supports the development of high-performance materials. Carbon fiber is widely used across aerospace applications and supports high-rate manufacturing.(Source: www.compositesworld.com)

Top Companies List

- Toray Industries, Inc.:- The Japan-based company manufactures carbon fiber composite materials and PAN-based carbon fiber for the development of high-end sports equipment, wind blades, and pressure vessels.

- Hexcel Corporation:- The company manufactures carbon fiber & reinforcement materials under the HexTow brand to serve applications like rotorcraft, automotive parts, aircraft structures, sporting goods, and wind turbine blades development.

- Mitsubishi Chemical Group:- The Japanese company manufactures pitch-based and PAN-based carbon fibers to support industries like sporting goods, automotive, and aerospace.

- Teijin Limited:- The company manufactures premium carbon fibers and produces pitch-based fine carbon fibers to serve industries like aerospace, sports goods, automotive, and renewable energy.

- SGL Carbon SE:- The German-based company is a key producer of short and continuous carbon fiber to support multiple industrial applications.

- Zoltek Companies, Inc. (Toray Group)

- Solvay S.A.

- DowAksa

- Hyosung Advanced Materials

- Zhongfu Shenying Carbon Fiber Co., Ltd.

- Formosa Plastics Corporation

- Jiangsu Hengshen Co., Ltd.

- Weihai Guangwei Composites Co., Ltd.

- Taekwang Industrial Co., Ltd.

- A&P Technology, Inc.

Segments Covered

By Product Type

- Continuous Fiber

- Short/Chopped Fiber

- Long Fiber

By Precursor Type

- PAN-based (Polyacrylonitrile)

- Pitch-based

- Rayon & Bio-based

By Application

- Composite Materials

- Non-Composite (Textiles/Electrodes)

By End-Use Industry

- Aerospace & Defense

- Wind Energy

- Automotive & Transportation

- Sporting Goods

- Pipes & Tanks (Pressure Vessels)

- Construction & Infrastructure

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa