Content

Low-VOC Coatings Market Size and Growth 2025 to 2034

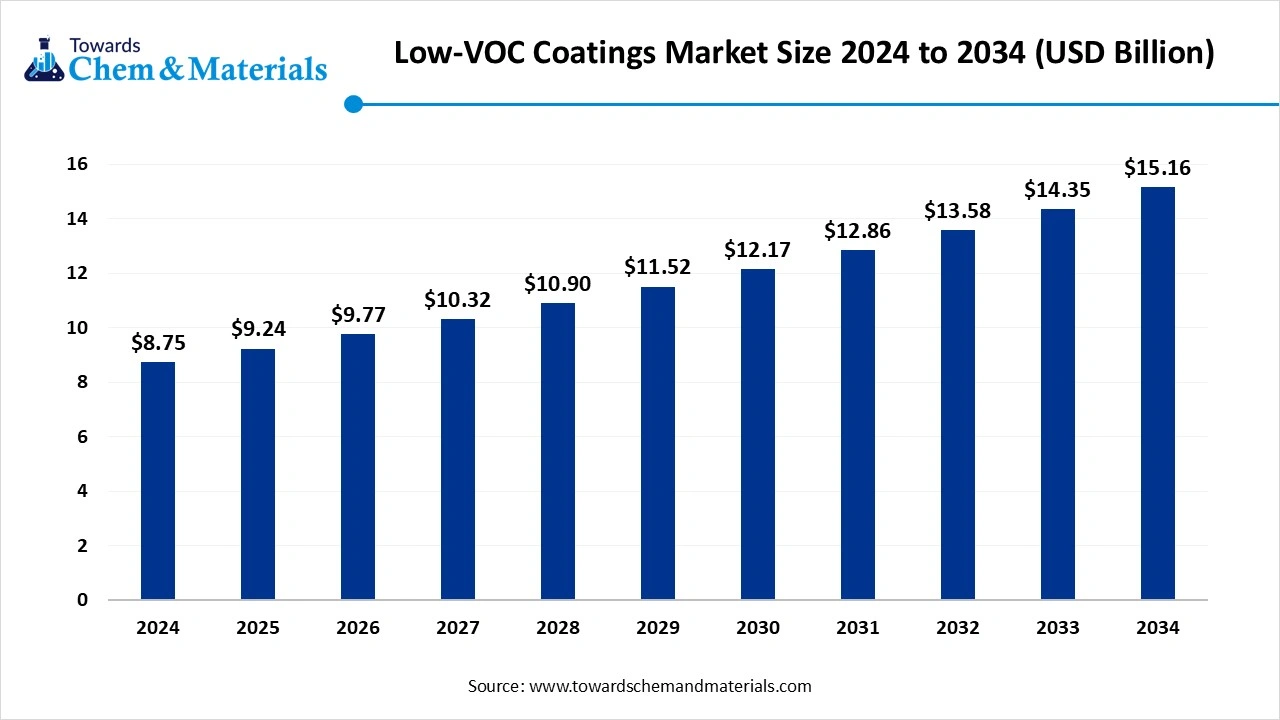

The global low-VOC coatings market size was reached at USD 8.75 billion in 2024 and is expected to be worth around USD 15.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period 2025 to 2034. Increasing environmental awareness is the key factor driving market growth. Also, advancements in product development coupled with the rise in demand for safety and health regulations can fuel market growth further.

Key Takeaways

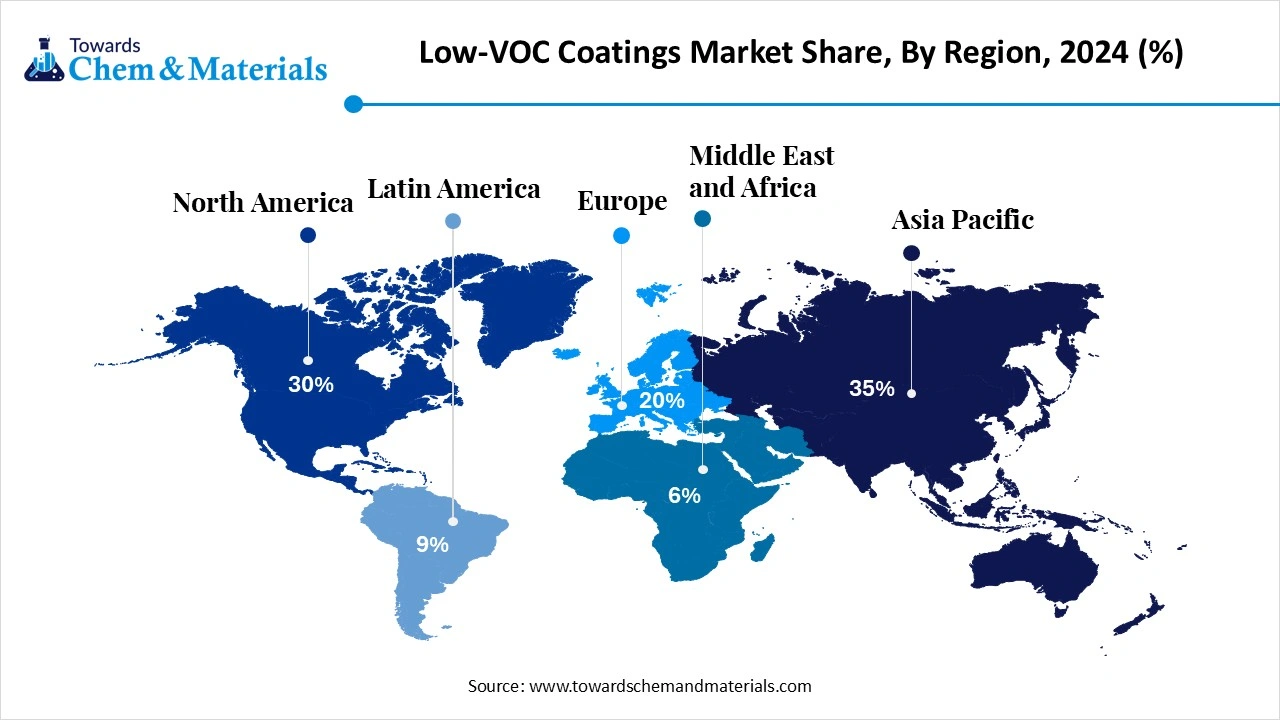

- By region, Asia Pacific dominated the market with a 35% low-VOC coatings market share in 2024. The dominance of the segment can be attributed to the increasing environmental awareness.

- By region, Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing consumer awareness regarding the environmental and health benefits of these products.

- By resin type, the acrylic-based segment dominated the market with 32% market share in 2024. The dominance of the segment can be attributed to the increasing demand for low-VOC paints in industrial and architectural applications.

- By resin type, the polyurethane-based segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising demand for sustainable coatings.

- By application, the automotive (OEM) segment led the market by holding 40% market share in 2024. The dominance of the segment can be linked to the surge in automotive manufacturing across the globe.

- By application, the furniture & wood coatings segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by expanding furniture and construction sectors.

- By end user, the construction & infrastructure segment held a 45% market share in 2024. The dominance of the segment is due to the surge in construction and infrastructure activities across the globe.

- By end user, the automotive & transportation segment expects the fastest growth during the projected period. The growth of the segment is owing to the innovations in coating formulations.

- By formulation, the waterborne coatings segment dominated the market by holding 50% market share in 2024. The dominance of the segment can be attributed to the strict environmental regulations.

- By formulation, the powder coatings segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the rising demand for sustainable and durable coating materials across different industries.

- By technology, the spray coating segment held a 60% market share in 2024. The dominance of the segment can be linked to the expansion of green building practices and innovations in low-VOC coating technologies.

- By technology, the electrostatic coating segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its benefits over conventional solvent-based options.

Advancements in Product Development are Expanding Market Growth

Lov-Voc (Low-Volatile Organic Compounds) coatings are eco-friendly coatings with reduced volatile organic compound emissions. These coatings are used in various applications, including automotive, industrial, architectural, and furniture finishes, with a focus on reducing the impact on air quality and contributing to environmental sustainability. Lov-Voc coatings meet the increasing demand for environmental regulations while still offering high-performance properties like durability, resistance, and ease of application.

They are gaining traction across industries due to their compliance with stringent environmental policies and their role in reducing harmful emissions. The ongoing advancements in product development are impacting positive market growth.

What Are the Key Trends Influencing the Low-VOC Coatings Market?

- The surge in concern over environmental sustainability is the latest trend in the market. With the consistent surge in environmental degradation, industries and consumers are increasingly becoming aware of the products they use, especially those that can have an adverse effect on health.

- The rapid advancements in product development in the market are playing a crucial role in market expansion. Researchers are focusing on creating advanced formulations that can minimize VOC content and enhance performance characteristics, including finish quality, drying time, and durability. The ongoing changes of these products are boosting market growth soon.

- The expansion of the automotive industry has substantially increased the need for low-VOC coatings. With the growing number of vehicles being fabricated across the globe, there is a growing demand for high-performance coatings that provide exceptional aesthetics and protection.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 9.24 Billion |

| Expected Size by 2034 | USD 15.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Resin Type, By Application Type, By End-User Industry, By Formulation, By Technology, By Region |

| Key Companies Profiled | PPG Industries, AkzoNobel N.V., Sherwin-Williams, BASF SE, RPM International Inc., Axalta Coating Systems, Valspar Corporation (Acquired by Sherwin-Williams), Jotun Group, Tikkurila Oyj, Hempel A/S, Kansai Paint Co., Ltd., Benjamin Moore & Co., Asian Paints Ltd., Nippon Paint Holdings Co., Ltd., Sika AG, Dow Chemical Company, Covestro AG, 3M Company, H.B. Fuller Company, Clariant International Ltd. |

Market Opportunity

Rising Use of Digital Technologies in Coating Applications

Increasing utilisation of digital technologies for coating applications is the major factor creating lucrative opportunities in the market, because these technologies offer improved efficiencies, better performance, and less wastage. Furthermore, the digital twin technology is rapidly being incorporated, which can boost the coating performance in various environments.

- In July 2025, Nouryon unveiled a cutting-edge multifunctional additive, called Ethylan EF-60, which allows manufacturers to fix the minimum temperature storage stability of VOC-free coating and paint products.(Source: www.coatingsworld.com)

Market Challenges

Environmental and Sustainability Regulations

The concerns associated with the sustainability regulations are a major factor hindering market growth. The market players in the coating sector are witnessing challenges with respect to hazardous air pollutants (HAPs) and minimizing volatile organic compounds (VOCs). Moreover, low VOC coatings can include chemicals like biocides, formaldehyde, and ammonia, which are dangerous to health.

Regional Insights

Asia Pacific Low-VOC Coatings Market Trends

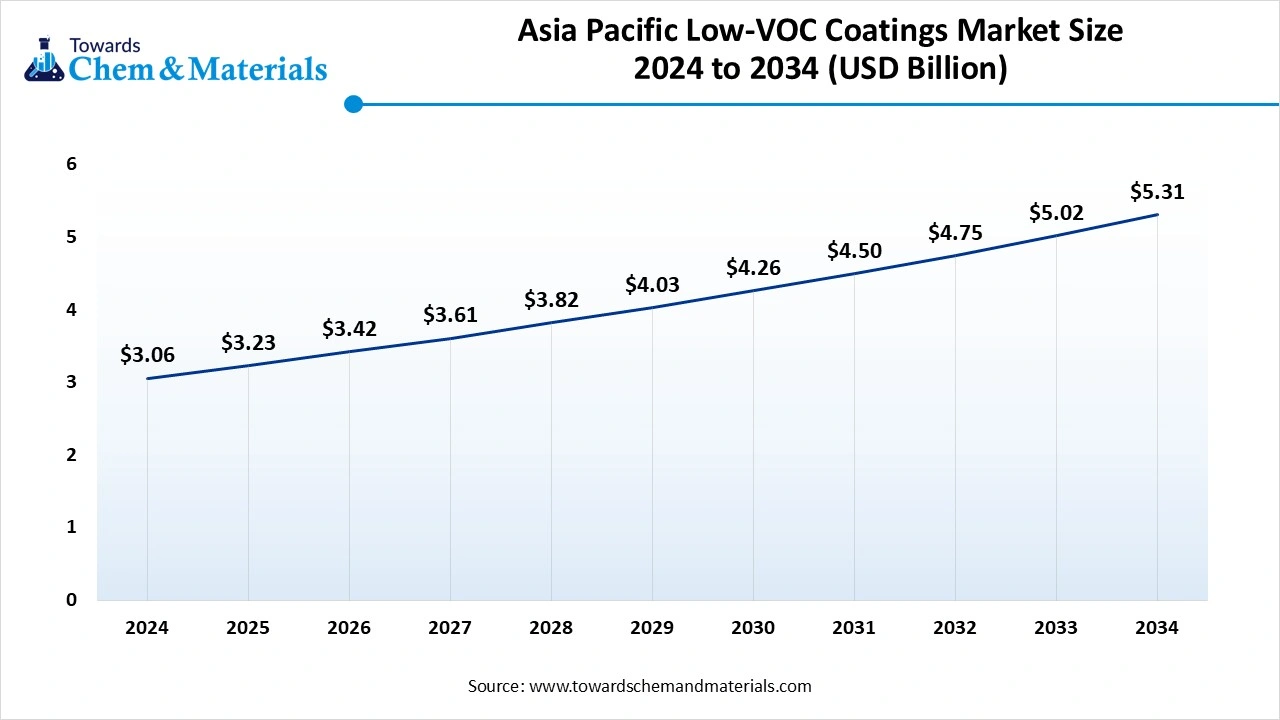

The Asia Pacific low-VOC coatings market size was estimated at USD 3.06 billion in 2024 and is anticipated to reach USD 5.31 billion by 2034, growing at a CAGR of 5.67% from 2025 to 2034. Asia Pacific dominated the market with a 35% of market share in 2024.

The dominance of the segment can be attributed to the increasing environmental awareness, surge in construction activities, and the stringent regulations. In addition, rising awareness regarding the health hazards linked with VOC emissions is allowing consumers and businesses to opt for sustainable alternatives.

China Low-VOC Coatings Market Trends

In the Asia Pacific, China led the market due to the increasing preference for eco-friendly products along with the rise in environmental regulations. Also, China's expanding automotive industry, construction sector, and increasing industrialization in the country are all impacting the positive market growth soon.

Europe Low-VOC Coatings Market Trends

Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing consumer awareness regarding the environmental and health benefits of these products. Major countries such as Germany, France, and the UK are increasingly adopting low-VOC paints because of efficient government policies and a better focus on green building practices.

Germany Low-VOC Coatings Market Trends

In Europe, Germany dominated the market by holding the largest market share due to ongoing advancements in smart coatings methods and AI-powered analytics, which are improving the performance and efficiency of low-VOC coatings. Moreover, Western and Southern Germany are emerging as major innovation hubs in R&D activities.

Who is the Top Paint Exporting Countries in 2023?

| Country | Exports in Billions |

| Germany | $3.9 billion |

| United States | $2.9 billion |

| Italy | $1.9 billion |

| Japan | $1.6 billion |

| Netherlands | $1.5 billion |

Segmental Insight

Resin Type Insight

Which Resin Type Segment Dominated the Low-VOC Coatings Market in 2024?

The acrylic-based segment dominated the market with a 32% market share in 2024. The dominance of the segment can be attributed to the increasing demand for low-VOC paints in industrial and architectural applications, coupled with the high-performance characteristics of acrylic coatings. Also, advancements in acrylic resin technology have optimised the development of low-VOC acrylic coatings with enhanced performance.

The polyurethane-based segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising demand for sustainable coatings and the expansion of the aerospace and automotive sectors. Additionally, the application of polyurethane coatings is emerging into new sectors such as healthcare facilities and medical devices, creating lucrative opportunities in the market.

Application Type Insight

Why Did the Automotive Segment Held the Largest Low-VOC Coatings Market Share in 2024?

The automotive (OEM) segment dominated the market by holding 40% market share in 2024. The dominance of the segment can be linked to the surge in automotive manufacturing across the globe, along with the rising environmental regulations. Moreover, technological innovations such as high-solid formulations and nanocoating's are playing a crucial role in propelling the adoption of low-VOC and waterborne coatings.

The furniture & wood coatings segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by expanding furniture and construction sectors, coupled with the rise in consumer awareness across the globe. Furthermore, homeowners are rapidly investing in remodelling and renovation projects, which involve the refinishing of furniture and wood surfaces.

End-User Industry Insight

How Much Share Did The Construction & Infrastructure Segment Held In 2024?

The construction & infrastructure segment held a 45% market share in 2024. The dominance of the segment is due to the surge in construction and infrastructure activities across the globe. The increasing emphasis on creating healthier indoor environments in commercial and residential buildings is also contributing to the growing use of low-VOC coatings, leading to further segment growth.

The automotive & transportation segment expects the fastest CAGR during the forecast period. The growth of the segment is owing to the innovations in coating formulations, such as powder and waterborne coatings, which are enhancing durability, performance, and aesthetic appeal, making them more convenient to manufacturers and consumers.

Formulation Insight

Which Formulation Type Segment Dominated the Low-VOC Coatings Market in 2024?

The waterborne coatings segment dominated the market by holding 50% market share in 2024. The dominance of the segment can be attributed to the strict environmental regulations and the superior performance properties of this coating. Additionally, waterborne coatings offer improved safety profiles, excellent performance with less environmental impact as compared to conventional solvent-based coatings.

The powder coatings segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the rising demand for sustainable and durable coating materials across different industries. Powder coatings are very low in VOCs and favoured for their durability, sustainability, and cost-effectiveness, which will impact positive market expansion soon.

Technology Insight

Why Did the Spray Coating Segment Dominated the Low-VOC Coatings Market in 2024?

The spray coating segment held the largest market share of 60% in 2024. The dominance of the segment can be linked to the expansion of green building practices and innovations in low-VOC coating technologies. The development of eco-friendly raw material sources, like renewable and bio-based additives, is further enhancing the environmental impact of low-VOC spray coatings.

The electrostatic coating segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its benefits over conventional solvent-based options. Furthermore, Electrostatic coatings offer an extensive range of colors and textures, enabling product customization to a wide range of consumer preferences, leading to segment growth.

Recent Developments

- In July 2025, Evonik introduced Grind Aid to fulfil regulatory and VOC compliance in inks and coatings. The product name Carbowet GA-200 offers various benefits in an extensive range of water formulations that meet EH&S considerations.(Source: www.coatingsworld.com)

Low-VOC Coatings Market Top Companies

- PPG Industries

- AkzoNobel N.V.

- Sherwin-Williams

- BASF SE

- RPM International Inc.

- Axalta Coating Systems

- Valspar Corporation (Acquired by Sherwin-Williams)

- Jotun Group

- Tikkurila Oyj

- Hempel A/S

- Kansai Paint Co., Ltd.

- Benjamin Moore & Co.

- Asian Paints Ltd.

- Nippon Paint Holdings Co., Ltd.

- Sika AG

- Dow Chemical Company

- Covestro AG

- 3M Company

- H.B. Fuller Company

- Clariant International Ltd.

Segments Covered

By Resin Type

- Acrylic-based

- Epoxy-based

- Polyurethane-based

- Alkyd-based

- Polyester-based

- Silicone-based

By Application Type

- Automotive

- OEM

- Aftermarket

- Industrial

- Machinery & Equipment

- Aerospace

- Oil & Gas

- Architectural

- Residential

- Commercial

- Furniture & Wood Coatings

- Marine

- Packaging

- Others (Including Electrical, Sports Goods, etc.)

By End-User Industry

- Construction & Infrastructure

- Commercial Buildings

- Residential Buildings

- Industrial Infrastructure

- Automotive & Transportation

- Consumer Goods & Electronics

- Furniture & Wood

- Marine & Shipbuilding

- Oil & Gas

- Aerospace

- Packaging

- Others (Textiles, Sporting Goods, etc.)

By Formulation

- Waterborne Coatings

- Solvent-based Coatings

- Powder Coatings

- UV-curable Coatings

By Technology

- Spray Coating

- Roller Coating

- Dip Coating

- Brush Coating

- Electrostatic Coating

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait