Content

What is the Thermoplastics In Construction Films Market Size 2025 And Growth Rate?

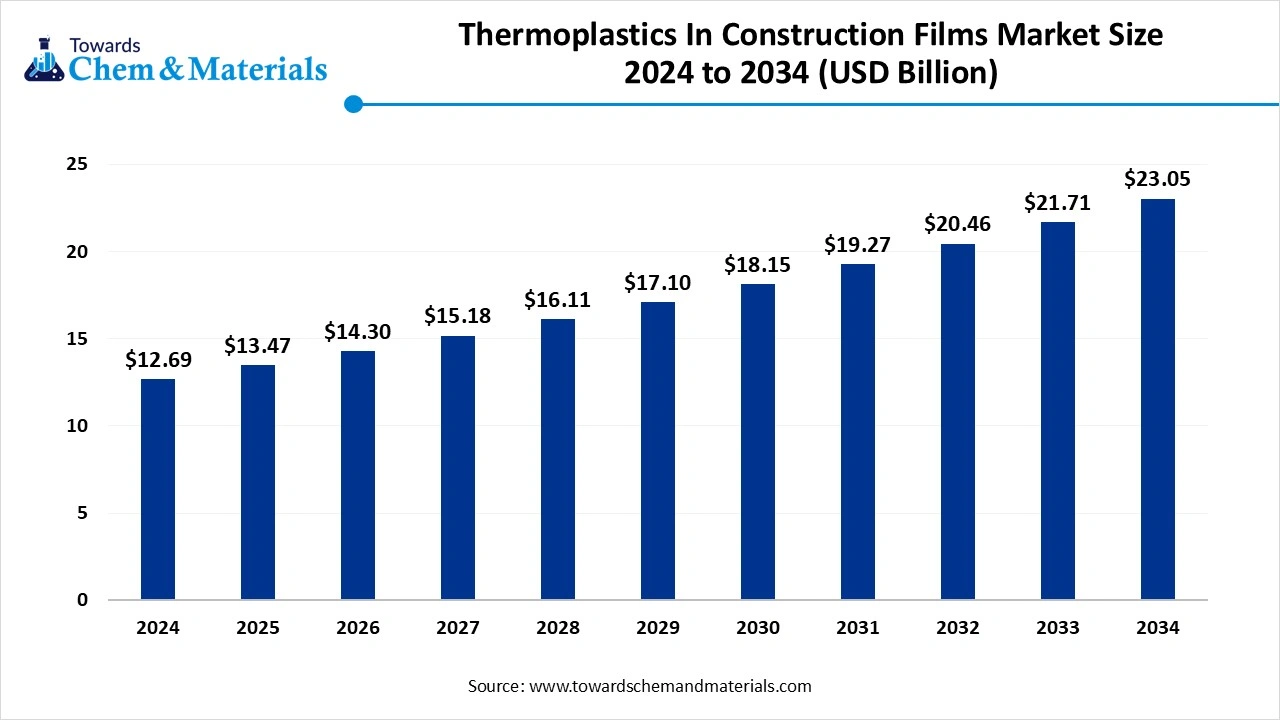

The global thermoplastics in construction films market size is calculated at USD 12.69 billion in 2024, grew to USD 13.47 billion in 2025, and is projected to reach around USD 23.05 billion by 2034. The market is expanding at a CAGR of 6.15% between 2025 and 2034. the growing demand for residential & commercial construction and a strong focus on green building drive the growth of the market.

Key Takeaways

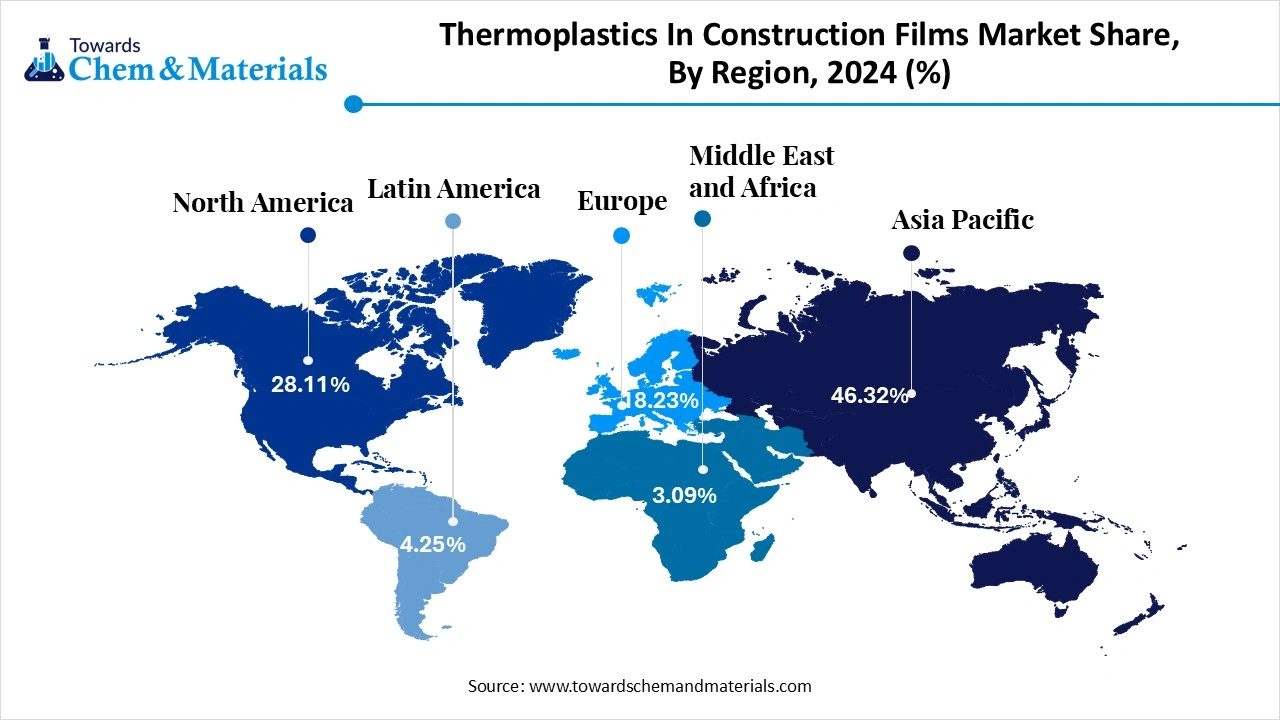

- Asia Pacific dominated the thermoplastics construction films industry and accounted for the largest revenue share of 46.32% in 2024 and is anticipated to grow at a significant CAGR of 6.75% over the forecast period.

- By material, the Low-Density Polyethylene segment recorded the largest revenue share of over 39.11%, in 2024.

- By material, the Linear Low-Density Polyethylene segment is projected to grow at the fastest CAGR of 9.95% during the forecast period.

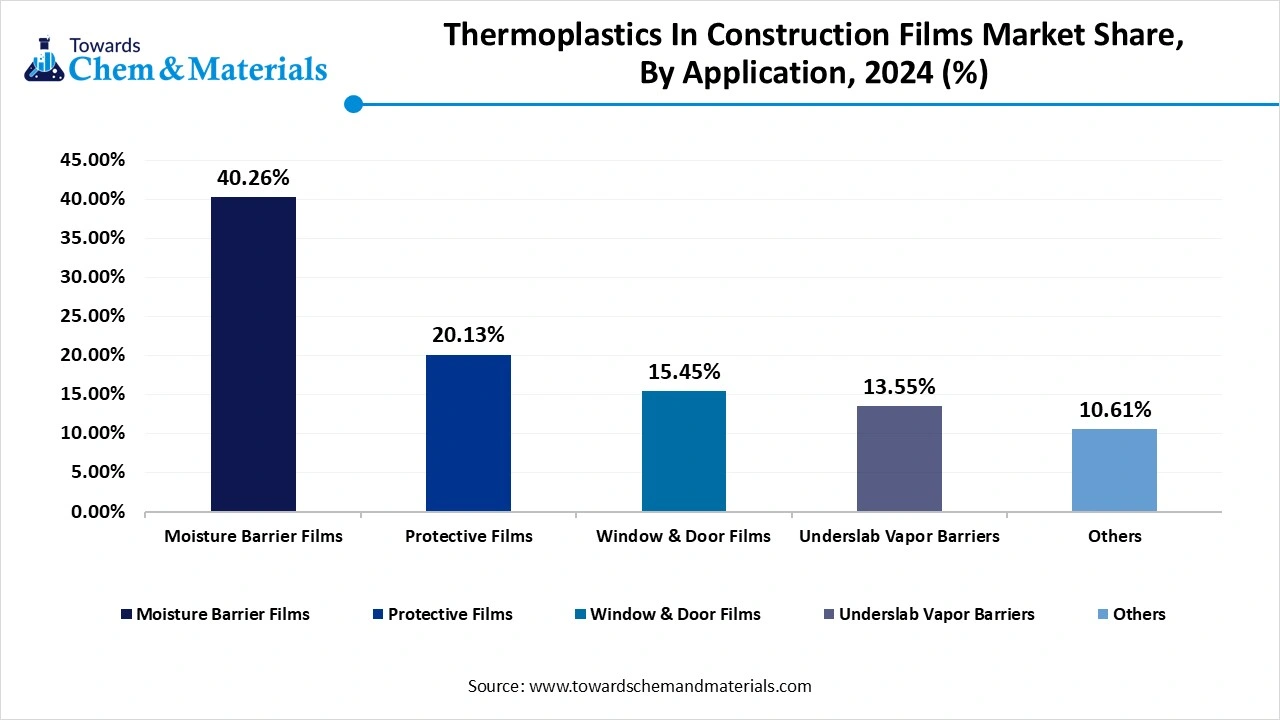

- By application, the moisture barrier films segment recorded the largest market share of 40.26% in 2024.

- By application, the protective films segment is projected to grow at a significant CAGR of 6.25% during the forecast period.

The Magic of Thermoplastics in Construction Films in Modern Construction

Thermoplastic films are plastic-based materials that are applied to construction substrates for diverse purposes. They are used in construction for various purposes, like protective films, moisture barriers, and insulation. Thermoplastic films protect building interiors from damage. It creates insulation that helps in energy efficiency and regulates temperature in construction buildings. Thermoplastic films used in construction are polypropylene, LDPE, LLDPE, and HDPE.

Thermoplastic films offer versatility, durability, recyclability, and cost-effectiveness in construction. The growing technological advancements in thermoplastic films to enhance recyclability and durability help in the market growth. The growing construction in commercial, infrastructural, residential, and industrial construction increases demand for thermoplastic films. The growing demand for energy-efficient buildings fuels demand for thermoplastic films for various applications like energy-efficient windows, insulation, and moisture barrier. The growing adoption of green buildings helps in the market growth. Factors like the growing demand for sustainable construction material, urbanization, and increasing construction activities in developing nations contribute to the overall growth of the thermoplastics in construction films market.

- Vietnam exported 79391 shipments of thermoplastic polyurethane film.(Source:Volza)

- The United States exported 20400 shipments of low-density polyethylene. (Source:Volza)

- Qatar exported 19439 shipments of low-density polyethylene.(Source:volza)

- The United States exported 40009 shipments of Polyethylene Lldpe. (Source:Volza)

- TEMPE S A is a leading supplier of thermoplastic in the world, constituting 37% of the total.(Source: Volza)

The Growing Residential & Commercial Construction Drives Market Growth

The growing commercial & residential construction due to urbanization and population growth increases demand for thermoplastics construction films. The growing investment in residential construction directly increases demand for thermoplastic construction films. It is used as a moisture barrier to prevent water damage in roofs, walls, and foundations. The growing demand for commercial construction in various developing nations fuels demand for thermoplastic construction films to create an effective barrier against weather & moisture. The growing focus on sustainability increases demand for environment-friendly construction materials like thermoplastic films. The growing demand for flooring, protective coatings, roofing, and membranes in commercial construction increases demand for thermoplastic films. The growing need for moisture-barrier, vapor barrier, and insulation in residential construction increases demand for thermoplastic films. It enhances building performance and lowers sound transmission between buildings & rooms. The growing residential & commercial construction is a key driver for the growth of the thermoplastics in construction films market.

Market Trends

- The Growing Demand for Protective Films & Moisture Barrier: The rapid growth in the construction activities in various regions increases demand for protective films & moisture barrier. They help to maintain the longevity and integrity of the building. Thermoplastics are made up of LLDPE and LDPE material is best for protective films and moisture barrier applications.

- The Rising Focus on Sustainability: The growing environmental concerns and strict regulations increase demand for eco-friendly materials. The growing focus on sustainability increases demand for recyclable thermoplastic films made up of LLDPE and LDPE. The growing focus on the development of biodegradable films lowers environmental impact.

- Growing Infrastructure Development: The growing infrastructure development boom globally increases demand for thermoplastic films for various applications. The growing investment in infrastructure projects like public facilities, roads, and bridges increases demand for high-quality thermoplastic films for high performance.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 13.47 Billion |

| Expected Market Size by 2034 | USD 23.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Material, By Application, By Region |

| Key Companies Profiled | RKW Group, Polifilm Group, 3M Company, Ginegar Plastic Products Ltd, Cosmoplast, Berry Global Inc., Saint-Gobain, Interplast Group, Toray Industries, Qenos Pty Ltd. |

Market Opportunity

The Green Building Initiatives Surge Demand for Thermoplastic Films

The growing adoption of green buildings is due to factors like growing energy costs and rising environmental awareness, fueling demand for thermoplastic films for diverse purposes. The growing environmental concerns increase demand for sustainable construction materials to lower environmental impact. Green buildings lower consumption of energy through various techniques like smart building technologies, insulation, and energy-efficient windows.

Thermoplastic films enhance the overall energy efficiency of construction projects by offering insulation and energy-efficient windows. The focus of green building is to reduce waste and conserve natural resources. Thermoplastic films support the aim of green building. It is reusable, recyclable, and minimizes the overall weight of buildings. It reduces environmental impact by lowering construction and transportation costs. The growing environmental problems help in the development of biodegradable thermoplastic materials. The green building initiative creates an opportunity for thermoplastics in the construction films market.

Market Challenge

Fluctuating Raw Materials Prices Limit the Expansion of the Market

Despite several benefits of thermoplastics in construction films in various construction activities, fluctuating raw material prices restrict the growth of the market. Factors like environmental regulations, supply & demand dynamics, and geopolitical tensions increase the cost of raw materials. Supply chain disruptions due to pandemics, natural disasters, and international conflicts increase the cost of raw materials. Crude oil is a key raw material used for the production of thermoplastic films. The fluctuation in crude oil prices increases the raw material costs. Situations like trade wars and tariffs fuel the cost of raw materials. The growing demand from the construction industry leads to cost fluctuations of raw materials. The fluctuations in the price of raw materials like PP, LDPE, and LLDPE affect the cost of thermoplastic films. The fluctuating raw material prices hamper the growth of the thermoplastics in construction films market.

Regional Insights

How Asia Pacific Dominated the Thermoplastics in Construction Films Market?

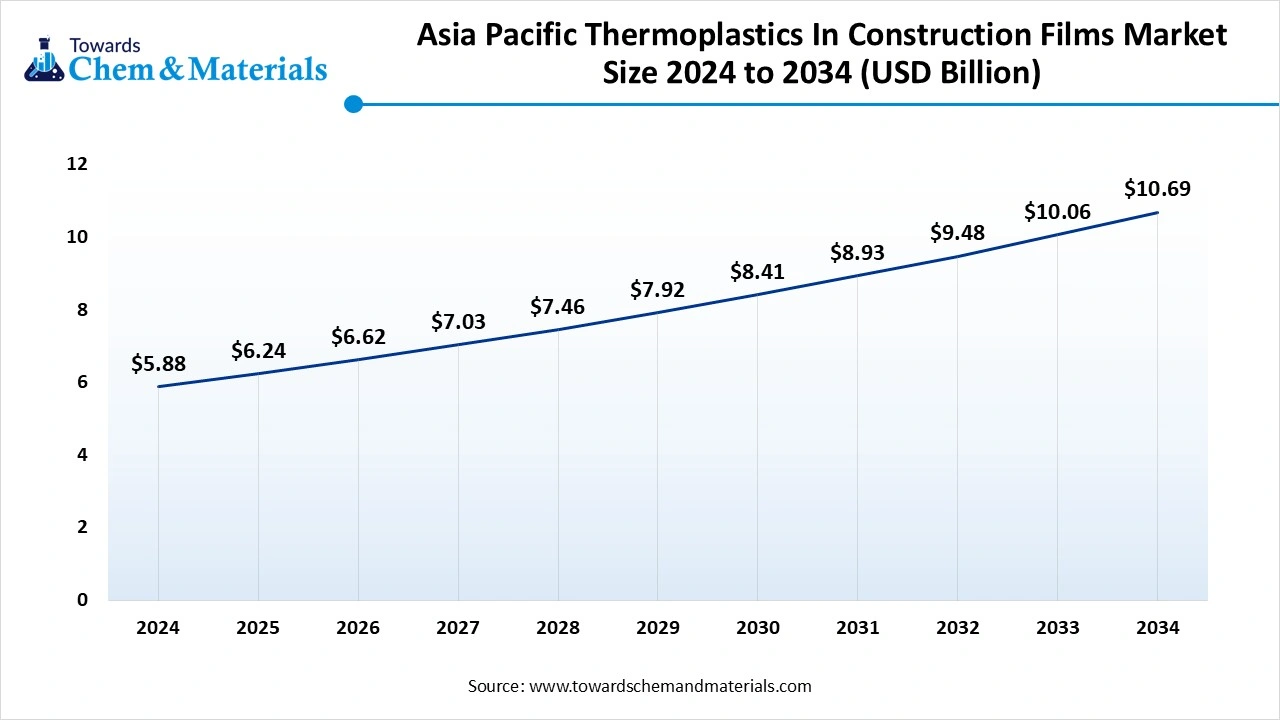

The Asia Pacific pthermoplastics in construction films market is expected to increase from USD 6.24 billion in 2025 to USD 10.69 billion by 2034, growing at a CAGR of 6.16% throughout the forecast period from 2025 to 2034.

Asia Pacific dominated the thermoplastics in construction films market in 2024. The rapid growth in infrastructure development and growing urbanization increases demand for construction, fueling demand for construction films. The strong focus on energy-efficient and sustainable thermoplastics construction helps in the market growth. The growing disposable incomes and rising middle-class peoples increases demand for construction and housing materials, which fuels demand for thermoplastic construction films. The strong government support for green building practices and sustainable construction is driving demand for thermoplastics construction films. The presence of a well-established manufacturing base and distribution of thermoplastic films drives market growth. Additionally, rapid growth in the construction sector in countries like India, Vietnam, China, and Indonesia contributes to the overall growth of the market.

What are the Thermoplastics in Construction Films Market Trends in China?

China is a major contributor to the thermoplastics in construction films market. The rapid urbanization and rising demand for residential and commercial construction fuel the adoption of thermoplastics construction films. The strong government support for infrastructure development and sustainable energy helps in the growth of the market. The growing demand for moisture barrier films to prevent mold formation and water damage drives market growth. The strong investment in the development of infrastructure projects increases demand for thermoplastics construction films, supporting the overall market growth.

- China exported 457376 shipments of thermoplastics.(Source: Volza)

India’s Thermoplastics in Construction Films Market Trends

India is significantly growing in the thermoplastics in construction films market. The growing expansion of the construction sector in industrial, residential, and commercial buildings increases demand for thermoplastics construction films. The growing demand for sustainable construction materials and focus on green building initiatives help in the market growth. The government initiatives, like Make in India, increase the domestic production of thermoplastic films, driving the overall growth of the market.

- India exported 105695 shipments of thermoplastics.(Source: Volza)

- India exported 32009 shipments of linear low-density polyethylene.(Source: Volza)

Which Region is the Fastest Growing in the Thermoplastics in Construction Films Market?

Europe is experiencing the fastest growth in the market during the forecast period. The European countries' strong focus on improving building energy efficiency increases demand for thermoplastics construction films. The growing modernization of infrastructure projects like waterproofing & roofing helps in the market growth. The rapid growth in new construction, like industrial, residential, and commercial projects, fuels demand for thermoplastic construction films for energy-efficient windows, insulation, and moisture barrier. The rapid urbanization and growing preference for sustainable construction materials drive the overall growth of the market.

Thermoplastics in Construction Films Market Trends in Germany

Germany is significantly growing in the thermoplastics in construction films market. The strong investment in energy-efficient building and green building initiatives increases demand for thermoplastics construction films. The rapid urban development and the growing construction industry help in the market growth. Additionally, growing refurbishment of older buildings and growth in infrastructure projects development increase demand for thermoplastics construction films for insulation and roofing, supporting the overall growth of the market.

Segmental Insights

Material Insights

Why did the Low-Density Polyethylene Segment Dominate the Thermoplastics in Construction Films Market?

The low-density polyethylene segment led the thermoplastics in construction films market in 2024. The growing demand for various construction applications, like protective sheeting, vapor barriers, and moisture barriers, increases demand for low-density polyethylene. It is a cost-effective thermoplastic and flexible for various construction applications. It consists of good weatherproof qualities and chemical resistance. LDPE is easily molded & processed and suitable for various environments. It provides a barrier against damage & moisture and possesses good resistance to cracking.

Additionally, the growing demand for sustainable materials in the construction sector increases demand for LDPE, driving the overall growth of the market.

The linear-low-density polyethylene segment is the fastest-growing in the market during the forecast period. The growing demand for protective coverings from underground tunnels and basements in construction projects increases demand for LLDPE. The strong focus on green building initiatives increases demand for LLDPE for energy efficiency, helping in the market growth. It offers higher puncture resistance and tensile strength. The contractors and manufacturers give preference to LLDPE due to its versatility. The growing demand for insulation materials, moisture barrier films, and protective covering increases the adoption of LLDPE. It is recyclable, cost-effective, and offers better flexibility. The growing population and rising demand for durable and flexible construction materials fuel demand for LLDPE, which drives the overall growth of the market.

Application Insights

Which Application Segment Dominated Thermoplastics in Construction Films Market in 2024?

The moisture barrier films segment dominated the market in 2024. The rising awareness about building longevity and moisture management increases demand for moisture barrier films. These films prevent structural damage, mold, and mildew. Moisture barrier films enhance the durability and lifespan of buildings. It helps to minimize energy waste and maintain building envelopes. The growing demand for durable and energy-efficient buildings increases demand for moisture barrier films. The growing demand from various construction applications like roofing, under slab, and wall helps in the market growth. The strong focus on green building practices and rising renovation projects increases demand for moisture barrier films to enhance sustainability and improve air quality, driving the overall growth of the market.

The protective films segment is the fastest growing in the market during the forecast period. The growing demand from diverse applications like floors, structural profiles, glazed panels, and window profiles helps in the market growth. Protective films prevent damage from spills, scuffs, and various hazards. It offers protection for various construction surfaces like metal panels, glass, and flooring. It is a cost-effective solution and minimizes material damage. The growing expansion of the construction and renovation industry in developing nations fuels demand for protective films, supporting the overall growth of the market.

Recent Developments

- In February 2025, Avient launched thermoplastic composite panels for simplified construction at the NAHB International Builders Show. Thermoplastic panels consist of flame-retardant Hammerhead FR eliminates the requirements for additional FR coatings and sheets. It is used in ceilings, construction walls, and floorings. The panels help to prevent degradation and rot from chemicals, corrosion, moisture, and light. The hammerhead FR minimizes installation cost & time and has nearly unlimited lengths & is 10 feet wide.(Source: avient)

- In September 2024, Covestro is to construct a TPU application development center in South China. The company launched innovative solutions in key applications like specialty cables, footwear, films, consumer electronics, and extrusion applications. The production center is present in Zhuhai and focuses on utilizing raw materials like biomass or waste feedstocks.(Source: chemengonline)

Top Companies List

- RKW Group

- Polifilm Group

- 3M Company

- Ginegar Plastic Products Ltd

- Cosmoplast

- Berry Global Inc.

- Saint-Gobain

- Interplast Group

- Toray Industries

- Qenos Pty Ltd.

Segments Covered

By Material

- Low-Density Polyethylene (LDPE)

- Linear-Low-Density Polyethylene (LLDPE)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Others

By Application

- Moisture Barrier Films

- Protective Films

- Window & Door Films

- Underslab Vapor Barriers

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

_Artboard-1.webp)