Content

Engineering Plastics Market Size and Growth 2025 to 2034

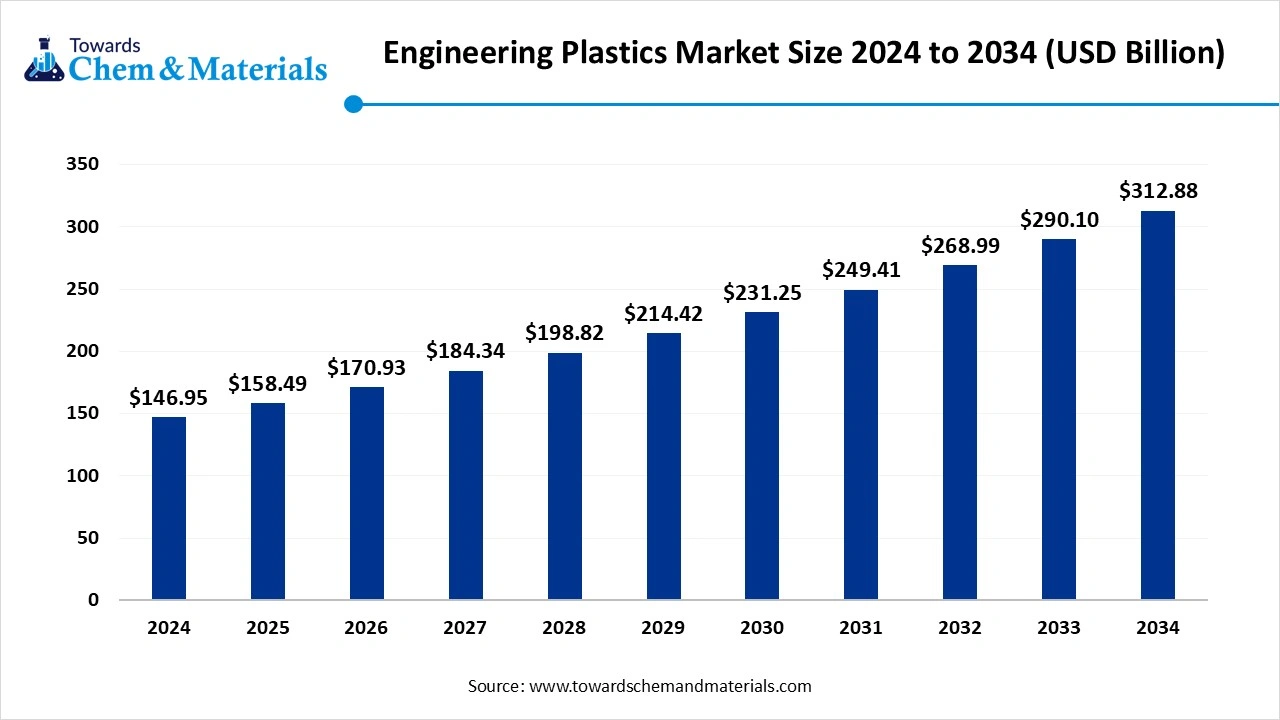

The global engineering plastics market size was reached at USD 146.95 billion in 2024 and is expected to be worth around USD 312.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.85% over the forecast period 2025 to 2034. Increasing demand for engineering plastics across various industries is the key factor driving market growth. Also, rising global demand for electronic devices coupled with the growing environmental awareness is fuelling market growth further.

Key Takeaways

- By region, Asia Pacific dominated the engineering plastics market in 2024 by holding 45% market share. The dominance of the region can be attributed to the high availability of skilled labor at very low cost.

- By region, North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rising exploration activities.

- By resin type, the ABS Segment held a 35% market share in 2024. The dominance of the segment can be attributed to the increasing application of these compounds in the automotive and electrical & electronics industry.

- By resin type, the fluoropolymers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing demand for fluoropolymers from electronics and semiconductor sectors.

- By end use industry, the automotive & transportation segment dominated the market with 36% market share in 2024. The dominance of the segment can be linked to the rising product utilisation in automotive components like interior trims, bumpers, and dashboards.

- By end use industry, the electrical &AB electronics segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing need for housing electrical & electronics like cables, wires, circuit breakers, and sockets.

- By application, the injection moulding segment led the market with 43% market share in 2024. The dominance of the segment is owed to its cost-effective way to create parts in large volumes with high precision and minimal material waste.

- By application, the extrusion segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to innovations in extrusion technologies along with the ongoing shift towards sustainable practices.

Technological Advancements are Expanding Market Growth

The engineering plastics market refers to a specialized segment of the plastics industry focused on high-performance polymer materials that offer superior mechanical, thermal, chemical, and electrical properties compared to commodity plastics. These plastics are engineered to withstand demanding environments and provide exceptional functionality, making them indispensable in various critical applications where traditional materials (like metals or glass) fall short or are less efficient. Key drivers for this market include the increasing demand for lightweight materials in automotive and aerospace for fuel efficiency, miniaturization trends in electronics, stringent performance requirements in industrial applications, and the growing emphasis on durability and longevity across various sectors.

Challenges include fluctuating raw material prices, intense competition from other polymers (including commodity plastics in certain applications), and growing environmental concerns pushing for more sustainable alternatives. Advancements in digital technologies like IoT, AI, and automation are improving product capabilities, boosting market growth soon.

What Are the Key Trends Influencing the Engineering Plastics Market?

- The growing use of engineering plastics in various end-user industries is the latest trend in the market. The industries such as transportation, automotive, and electrical and electronics continuously require engineering plastics because of their superior electrical and physical properties like chemical resistance, stability, and heat resistance.

- The increasing demand for lightweight substitutes in the automotive sector is positively impacting market expansion. The engineering plastics become crucial in modern automotive production because of their high-performance abilities. Their capability to replace heavier traditional materials such as metal allowed for substantial reductions in vehicle weight, enabling better fuel efficiency.

- The integration of functional and smart materials is emerging as a revolutionary trend in the market, changing the role of plastic among different industries like electronics, automotive, and healthcare. This shift is driving the advancements in product functionality and design, enabling market players to develop more adaptive and smarter solutions.

How the Government is Supporting the Engineering Plastics Market?

The Governments across the globe are actively promoting the market through several initiatives aimed at propelling domestic production, supporting sustainability, and focusing on innovations. The efforts, such as supporting research and development, establishing Plastic Parks, and incentivizing the utilisation of sustainable materials, are driving the adoption of engineering plastics globally. The government, through initiatives such as PLI schemes for electronics production, is fuelling domestic manufacturing by creating lucrative opportunities.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 158.49 Billion |

| Expected Size by 2034 | USD 312.88 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.85%% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Resin Type, By End-Use Industry, By Application, By Region |

| Key Companies Profiled | BASF SE, Dow Inc., DuPont de Nemours, Inc., Covestro AG, SABIC (Saudi Basic Industries Corporation), Lanxess AG, LG Chem, Mitsubishi Chemical Corporation, Solvay S.A., Celanese Corporation, Evonik Industries AG, Arkema S.A., Toray Industries, Inc., Sumitomo Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd., Formosa Plastics Corporation, DSM Engineering Materials (now part of Envalior), Teijin Limited, Victrex Plc, Mitsui Chemicals Inc. |

Market Opportunity

Surge of Bio-Based Plastics

The increasing focus on sustainability is creating lucrative opportunities for the global market. Rising public health and environmental awareness among most consumers, coupled with the ongoing regulatory pressure from various governments, is fuelling a shift away from traditional polycarbonates. Furthermore, bio-based engineering plastics exhibit a current generation of high-performance plastics that integrate thermal stability, strong mechanical properties, and optical clarity.

- In April 2025, Germany's Covestro introduces a latest line of post-consumer recycled (PCR) polycarbonates created from automotive headlamps, marking a major milestone in the automotive sector. Covestro has also partnered with firms such as Chinese recycler Ausell, a top automaker in the country.(Source: www.alchempro.com)

Market Challenges

Adverse Impact on Environment

Although engineering plastics have some benefits over other material types due to innovative design and recycling properties, a certain formulation can have a negative impact on the environment, potentially hindering market growth. Moreover, high production costs associated with manufacturing of engineering plastics raise the expenses for different certificates of compliance in many countries in terms of safety and regulations, which can hamper market growth shortly.

Regional Insights

Asia Pacific dominated the engineering plastics market in 2024 by holding 45% market share. The dominance of the region can be attributed to the high availability of skilled labor at very low cost along with the easy accessibility of land in emerging economies such as China and India. In addition, the ongoing infrastructure investments in these countries are anticipated to promote economic progression, boosting market expansion further in the region.

Engineering Plastics Market in China

In Asia Pacific, China led the market owing to the rising engineering plastic demand from electronics, automotive, and construction sectors in the country, along with the government initiatives supporting industrial upgrading. Also, raised consumer spending power and the rapid urbanisation in China are propelling demand for engineered plastic soon in the country.

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the

region can be credited to the rising exploration activities and growth in production using shale gas, which has allowed consumers and market players to obtain a high level of cost-effectiveness. Furthermore, increasing adoption of electric vehicles (EVs) and innovations in medical and electronics technologies are creating a rise in demand for engineering plastics with improved properties, driving regional market growth soon.

Who are the Top Countries Responsible for Most Exported Plastic Waste in 2024?

| Country | Plastic Waste in Tonnes |

| Germany | 688,067 tonnes |

| Japan | 606,374 tonnes |

| United Kingdom | 600,000 tonnes |

| Netherlands | 576,702 tonnes |

| United States | 431,841 tonnes |

Segmental Insight

Resin Type Insight

Which Resin Type Segment Dominated the Engineering Plastics Market in 2024?

The ABS Segment held a 35% market share in 2024. The dominance of the segment can be attributed to the increasing application of these compounds in the automotive and electrical & electronics industry. In addition, the products used in interior components, bumpers, and automotive trims, because of their usage range, are anticipated to increase in upcoming years. ABS offers balanced costs and properties, which makes it a convenient choice for electronics manufacturers.

The fluoropolymers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing demand for fluoropolymer from electronics and semiconductor sectors, coupled with the innovations in renewable energy and medical device applications. In addition, fluoropolymers are increasingly finding application in the construction sector, such as sealants and coatings, due to their weather resistance, durability, and chemical resistance.

End-Use Industry Insight

Why Did the Automotive & Transportation Segment Dominated the Engineering Plastics Market in 2024?

The automotive & transportation segment dominated the market with 36% market share in 2024. The dominance of the segment can be linked to the rising product utilisation in automotive components like interior trims, bumpers, and dashboards, and the ongoing surge in automotive production globally. Additionally, the growing demand for hybrid and electric vehicles requires the use of lightweight materials to strengthen battery performance and range.

The electrical &AB electronics segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing need for housing electrical & electronics like cables, wires, circuit breakers, and sockets. The rise in demand for 5G, IoT, and AI technologies is propelling the need for engineered plastics with superior properties, including high dielectric strength, flame retardancy, and mechanical strength in electronic devices.

Application Insights

Why Did the Injection Moulding Segment Held the Largest Engineering Plastics Market Share in 2024?

The injection moulding segment led the market with 43% market share in 2024. The dominance of the segment is owed to its cost-effective way to create parts in large volumes with high precision and minimal material waste. Moreover, the increasing consumer base and rapid industrialization in emerging economies such as China and India are boosting the demand for injection-molded products across different sectors, leading to market expansion further.

The extrusion segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to innovations in extrusion technologies along with the ongoing shift towards sustainable practices. Advancements such as multi-layer tubing production and innovations in polymer processing improve production efficiency and capabilities, driving segment growth shortly.

Recent Developments

- In March 2025, Resynergi, a California-based plastic recycling company, announced the latest offering of its proprietary Resynergi Modules, which are supplied and warrantied by its partner Lummus Technology, based in Houston.(Source: www.recyclingtoday.com)

- In September 2024, CSIRO and Murdoch University introduced the bioplastic innovation initiative, an $8 million partnership that will, alongside industry partners, design a new generation of 100% compostable plastic. These advancements aim to transform the plastic packaging industry.(Source: www.csiro.au)

Top Companies List

- BASF SE

- Dow Inc.

- DuPont de Nemours, Inc.

- Covestro AG

- SABIC (Saudi Basic Industries Corporation)

- Lanxess AG

- LG Chem

- Mitsubishi Chemical Corporation

- Solvay S.A.

- Celanese Corporation

- Evonik Industries AG

- Arkema S.A.

- Toray Industries, Inc.

- Sumitomo Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Formosa Plastics Corporation

- DSM Engineering Materials (now part of Envalior)

- Teijin Limited

- Victrex Plc

- Mitsui Chemicals Inc.

Segments Covered

By Resin Type

- Polyamide (PA)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyoxymethylene (POM) / Acetal

- Fluoropolymers

- Polyphenylene Sulfide (PPS)

- Polyether Ether Ketone (PEEK)

- Liquid Crystal Polymer (LCP)

- Polymethyl Methacrylate (PMMA)

- Styrene Acrylonitrile (SAN)

- Other High-Performance Polymers

By End-Use Industry

- Automotive & Transportation

- Electrical & Electronics

- Building & Construction

- Industrial & Machinery

- Consumer Goods & Appliances

- Aerospace & Defense

- Medical & Healthcare

- Packaging

- Others

By Application

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Compression Molding

- Other Processing Methods

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait