Content

What is the Current Resin Market Size and Share?

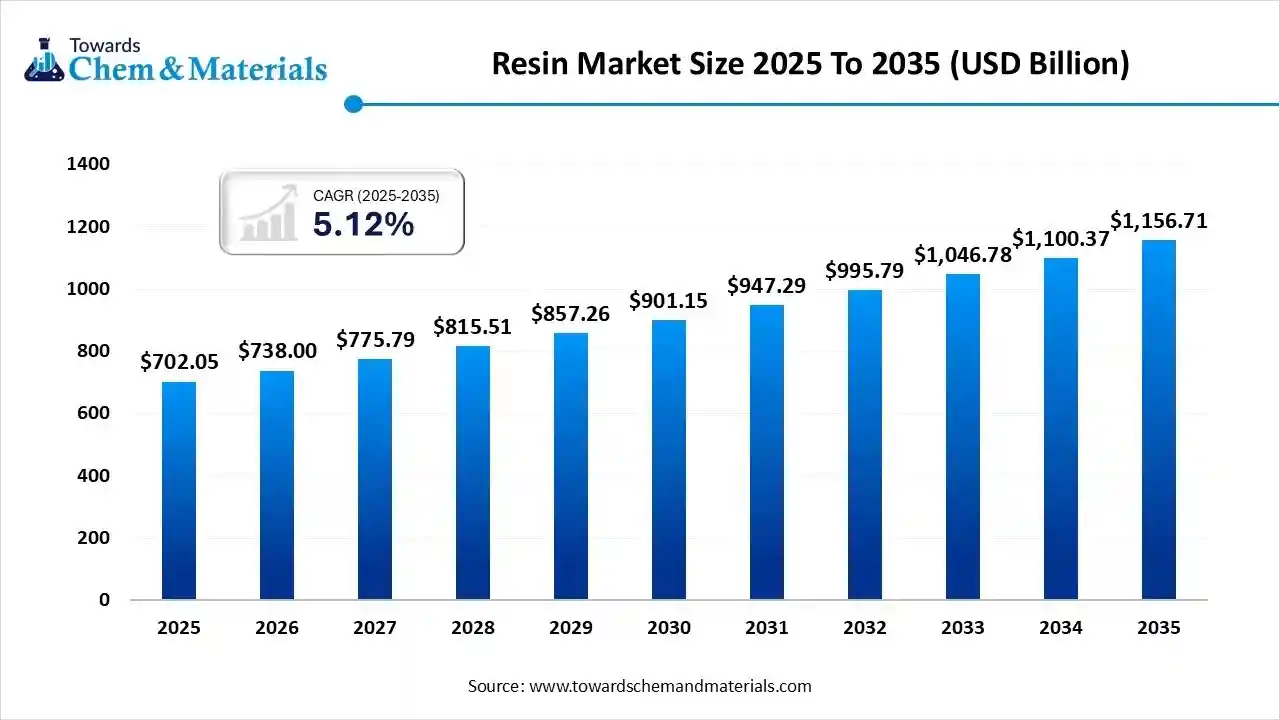

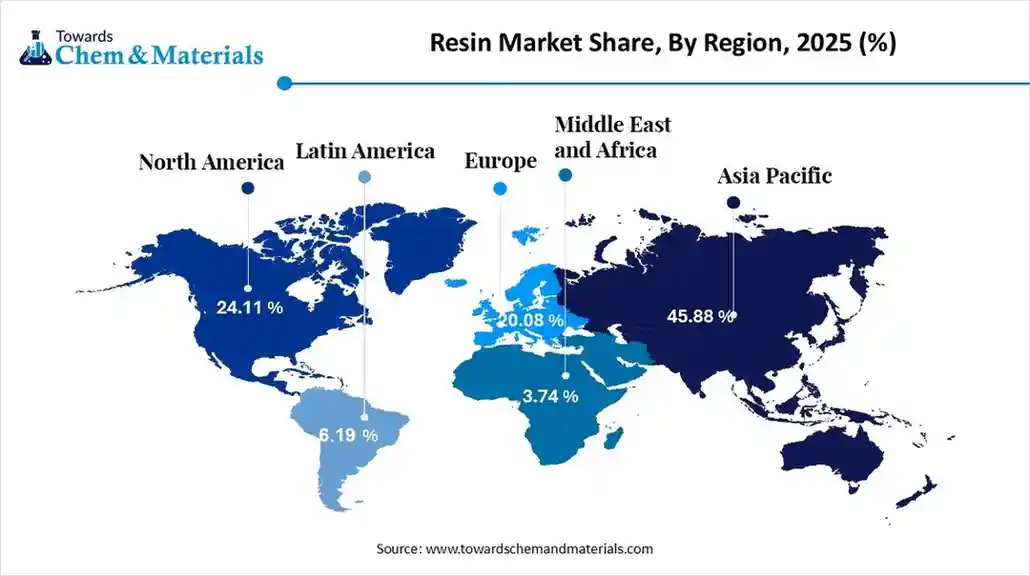

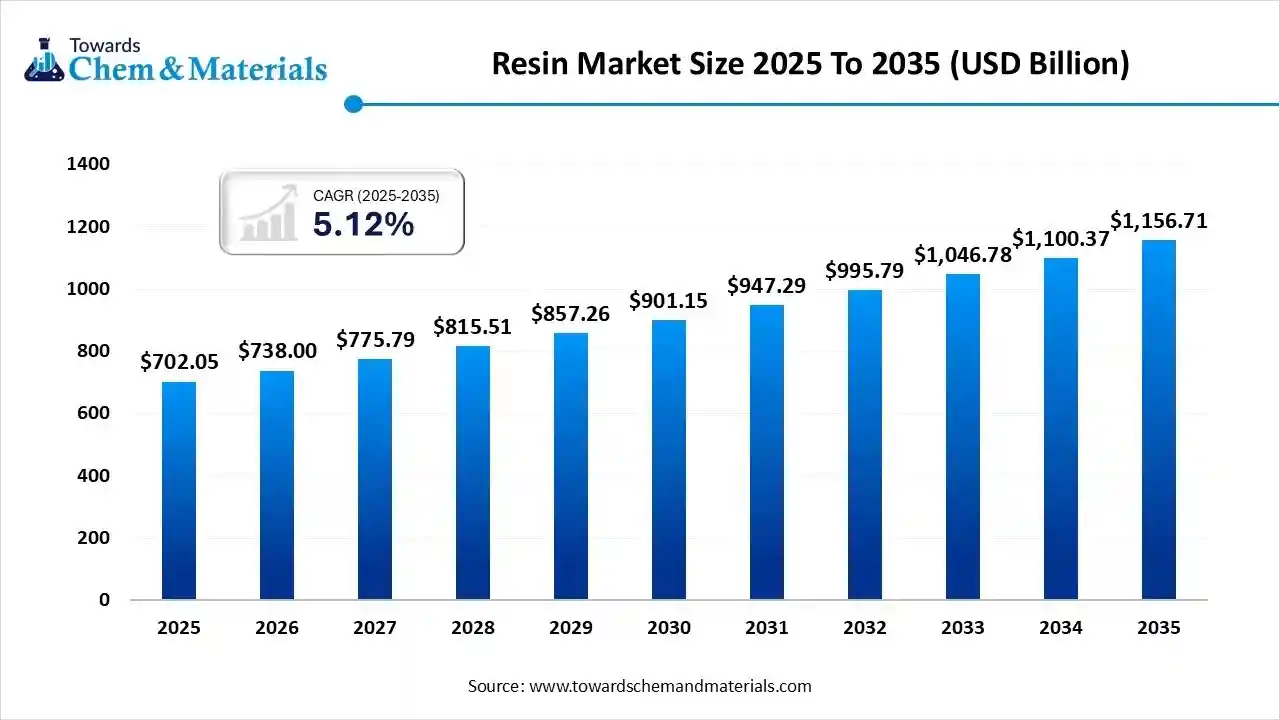

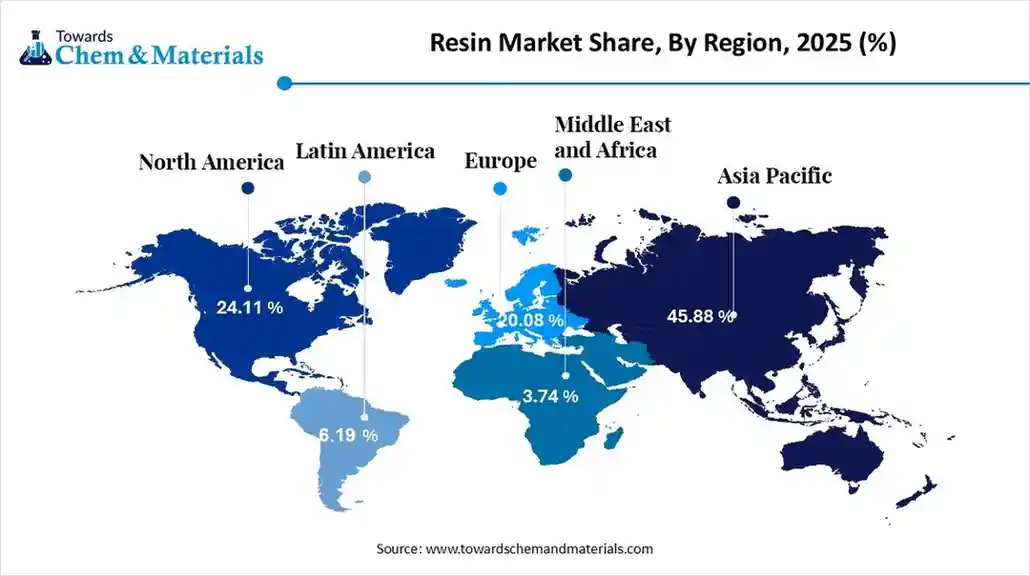

The global resin market size is calculated at USD 702.05 billion in 2025 and is predicted to increase from USD 738.00 billion in 2026 and is projected to reach around USD 1,156.71 billion by 2035, The market is expanding at a CAGR of 5.12% between 2026 and 2035. Asia Pacific dominated the Resin market with a market share of 45.88% the global market in 2025. The growing demand from end-use industries, such as automotive and construction, the expansion of e-commerce requiring more packaging, and a strong push for sustainable and bio-based materials drive the market's growth.

Key Takeaways

- Asia Pacific dominated the resin market with the largest revenue share of 45.88% in 2025.

- By type, the polyethylene segment led the market with the largest revenue share of 42.85% in 2025.

- By end-use, the packaging segment led the market with the largest revenue share of 44.38% in 2025.

Market Overview

What Is The Significance Of The Resin Market?

The significance of the resin market is its foundational role in modern manufacturing, driven by the demand for versatile materials in key sectors like packaging, automotive, construction, and electronics. Resins are essential for creating durable, lightweight, and high-performance products, with growth also spurred by sustainable alternatives and the expansion of industries like e-commerce and electric vehicles.

Resin Market Trend:

- Focus on high-performance materials: Beyond sustainability, there is ongoing innovation to develop resins with specific performance characteristics for a wide range of applications, from wind turbine blades to specialised coatings and adhesives.

- Electronics sector demand: The electronics industry's demand for high-performance resins is growing, especially materials with superior thermal and electrical properties for consumer devices and semiconductor packaging.

- Automotive industry influence: The demand for lightweight and fuel-efficient vehicles is driving resin use in automotive applications like exterior and interior components. Innovations in additives and the use of carbon-negative materials are key focus areas.

- Construction and infrastructure: Composite resins are increasingly used in construction and infrastructure projects due to their durability and cost-effectiveness compared to traditional materials like steel and concrete. Their application in retrofitting old structures is also rising.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 738.00 Billion |

| Revenue Forecast in 2035 | USD 1,156.71 Billion |

| Growth Rate | CAGR 5.12% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segments covered | By Type, By End-use Industry, Region |

| Key companies profiled | Dow Inc. (USA), BASF SE (Germany), LyondellBasell Industries (Netherlands), ExxonMobil Chemical (USA), Covestro AG (Germany), DuPont (U.S.), Arkema (France), INEOS Holdings Ltd. (U.K.), Hexion (U.S.), Invista (U.S.), Mitsubishi Engineering-Plastics Corporation (Japan), Mitsui Chemicals (Japan), Nova Chemicals (Canada), Qenos (Australia), Radici Group (Italy), Repsol (Spain), Sumitomo Chemical Co., Ltd. (Japan), Teijin Limited (Japan), Tosoh Corporation (Japan), Toray Group (Japan) |

Key Technological Shifts In The Resin Market:

The key technological shifts in the market are Innovations in resin formulations that improve performance, opening new applications in electronics, aerospace, and automotive sectors. Sustainability Initiatives: Growing emphasis on eco-friendly and bio-based epoxy resins aligns with global sustainability goals, expanding market opportunities.

Trade Analysis Of the Resin Market: Import & Export Statistics

- According to Global Export data, between June 2024 and May 2025 (TTM), the world exported 4,107 shipments of Natural Resin. These were handled by 410 exporters and bought by 517 buyers, reflecting a 14% increase over the previous twelve months.

- Most Natural Resin exports are destined for the United States, China, and Brazil.

- Globally, the top three exporters are the United States, Belgium, and Russia, with the United States leading at 7,256 shipments, followed by Belgium with 523, and Russia with 447.

- According to India Export data, India shipped 42,053 shipments. The exports handled by 1,618 Indian exporters to 4,993 buyers.

- The major resin exports from India destined to United States, Nepal, and Bangladesh.

- Globally, the top Resin exporters are the United States, China, and South Korea. The U.S. leads at 571,278 shipments, followed by China with 132,203 shipments, and South Korea with 46,253.

Resin Market Value Chain Analysis

- Chemical Synthesis and Processing: Resins are produced through polymerisation and polycondensation processes using petrochemical or bio-based feedstocks. These are processed using moulding, casting, extrusion, lamination, and coating techniques to manufacture composites, adhesives, coatings, and moulded components.

- Key players BASF SE, Dow Inc., Huntsman Corporation, Mitsubishi Chemical Group, Hexion Inc.

- Quality Testing and Certification: Resins are tested for viscosity, thermal stability, chemical resistance, curing behaviour, and mechanical strength under standards such as ISO 9001, ASTM D2471, and REACH compliance (for Europe).

- Key players: SGS, Intertek, TÜV SÜD, UL Solutions, Bureau Veritas.

- Distribution to Industrial Users: Resins are distributed to construction, automotive, electrical & electronics, marine, wind energy, and packaging industries through chemical distributors, direct manufacturer supply contracts, and regional trading networks.

- Key players: BASF SE, Dow Inc., Hexion Inc., Huntsman Corporation.

Resin Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA & Canada) | US EPA, US FDA, Environment and Climate Change Canada (ECCC) | TSCA, FDA 21 CFR (food-contact polymers), Canadian Environmental Protection Act (CEPA) | Chemical safety, toxic substance control, food-contact compliance, emissions | TSCA reform has increased scrutiny on resin monomers and additives; FDA clearance is required for packaging and food-contact applications. |

| Europe | European Commission, ECHA (European Chemicals Agency) | REACH Regulation, CLP Regulation, EU Packaging & Packaging Waste Regulation (PPWR) | Chemical registration, hazard classification, recyclability, and SVHC control | REACH impacts resin raw materials (styrene, BPA, epoxies); growing pressure for recyclable and low-VOC formulations under the Green Deal. |

| Asia Pacific | China MEE, Japan METI/MOE, India MoEFCC & BIS | China MEE Order No.12, Japan CSCL, India Draft Chemicals (Management & Safety) Rules | New chemical registration, environmental risk assessment, import/export compliance | China and Japan have REACH-like systems; India is developing a comprehensive chemicals law impacting resin importers and manufacturers. |

| South America | Brazil CONAMA & ANVISA, Mexico SEMARNAT | Brazil National Solid Waste Policy (PNRS), Mexico General Law on Waste & Chemicals | Plastic and chemical waste management, occupational safety, and resin import control | Growing regulations on plastic waste and styrene-based materials; Brazil requires strict licensing for industrial resin production. |

| Middle East & Africa | SASO (Saudi Arabia), Gulf Standardisation Organisation (GSO), South African Dept of Forestry, Fisheries & the Environment | GCC GSO chemical & polymer standards, Saudi Quality Mark (SQM), South Africa Hazardous Substances Act | Product quality, chemical conformity, and environmental protection | GCC countries increasingly require conformity certificates for imported polymer resins; sustainability compliance is gaining importance. |

Segmental Insights

Type Insights

Which Type Segment Dominated The Resin Market In 2025?

The Polyethylene segment dominated the market share of 42.85% in 2025. Polyethylene is the most widely used resin globally due to its versatility, low cost, and strong mechanical properties. It is extensively used in packaging films, containers, bottles, pipes, and insulation materials. Growth in flexible packaging, food packaging, and infrastructure development, especially in emerging economies, is significantly driving demand for polyethylene resins.

The polypropylene segment expects significant growth in the market during the forecast period. Polypropylene is a high-performance thermoplastic resin known for its lightweight nature, chemical resistance, and durability. The increasing demand for lightweight materials in the automotive sector for fuel efficiency and emission reduction is boosting polypropylene consumption. Its recyclability and suitability for food packaging also support its growing market adoption across multiple industries.

The polystyrene segment has seen notable growth in the market. Polystyrene is a rigid and transparent resin commonly used in packaging, electronics, and consumer goods. It is available in different forms such as general-purpose polystyrene (GPPS), high-impact polystyrene (HIPS), and expandable polystyrene (EPS). EPS is particularly popular in construction for insulation applications. Demand remains steady due to cost efficiency and widespread use in protective packaging and thermal insulation materials.

End Use Insights

How Did the Packaging Segment Dominated The Resin Market In 2025?

The packaging segment held the largest market share of 44.38% in 2025. Packaging is the largest end-use segment for the market, driven by the growing demand for food, beverage, pharmaceutical, and consumer goods packaging. Resins such as polyethylene, polypropylene, and polystyrene are widely used due to their lightweight, durability, and cost-effectiveness. The rise of e-commerce, increasing demand for flexible packaging, and growing urban consumer lifestyles continue to accelerate resin usage in this segment across both developed and emerging markets.

The building and construction segment expects the fastest growth in the market during the forecast period. The building and construction sector uses resins for pipes, insulation materials, roofing sheets, panels, adhesives, and coatings. The growth of infrastructure projects, smart cities, and green buildings is driving resin demand. Increasing investments in residential and commercial construction globally are expected to support the long-term growth of this segment.

The automotive and transportation segment has seen significant growth in the market. In the automotive and transportation sector, resins are used to manufacture lightweight components such as dashboards, bumpers, interior trims, fuel tanks, and under-the-hood applications. With the rise of electric vehicles and demand for lightweight materials, the consumption of advanced polymer resins is expected to increase significantly in this sector.

Regional Analysis

The Asia Pacific resin market size was valued at USD 322.10 billion in 2025 and is expected to surpass around USD 531.39 billion by 2035, expanding at a compound annual growth rate (CAGR) of 5.13% over the forecast period from 2026 to 2035. Asia Pacific dominated the resin market share of 45.88% in 2025.

The Asia Pacific resin market holds the largest global share due to strong industrial growth, rapid urbanisation, and expanding manufacturing sectors. The region benefits from low manufacturing costs, the availability of raw materials, and increasing investments in infrastructure development and housing projects. Additionally, rising demand for consumer goods and electrical appliances continues to support large-scale resin consumption.

China: Resin Market Growth Trends

China is the dominant resin producer and consumer in the Asia Pacific region due to its massive construction, automotive, and electronics manufacturing sectors. Growing government investments in infrastructure projects, electric vehicles, and renewable energy installations further boost resin demand across construction materials, insulation products, and advanced composite applications.

Europe: The Presence Of Strong Regulatory Bodies And Sustainability Practices Pushes The Resin Market

Europe is expected to have fastest growth in the market in the forecast period. The European resin market is characterised by strong regulatory control and a growing focus on sustainable materials and circular economy practices. The region shows high demand for speciality and bio-based resins, especially in packaging, automotive, and construction sectors. Strict environmental regulations are pushing manufacturers to shift towards recyclable, low-VOC, and bio-resin alternatives. Germany, France, and the UK play leading roles due to their strong industrial and manufacturing bases.

Germany: Resin Market Growth Trends

Germany is one of the largest resin markets in Europe, supported by its advanced automotive, construction, and chemical manufacturing industries. The country has a high demand for engineering and speciality resins used in electric vehicles, industrial coatings, and lightweight composite materials. Germany’s strong focus on sustainable construction and green building initiatives is driving demand for eco-friendly and low-emission resin products.

North America's Strong Market Presence And Technological Advancements Drives The Growth

North America is a mature and technologically advanced resin market, driven by strong demand from various sectors. The region benefits from easy access to petrochemical feedstocks, advanced manufacturing infrastructure, and continuous innovation in high-performance and speciality resins. There is also growing demand for sustainable and low-VOC resins, especially for coatings, adhesives, and packaging applications, due to strict environmental regulations and consumer preference for eco-friendly materials.

United States: Resin Market Growth Trends

The US dominates the North American resin market due to its large industrial base and strong demand from end-use industries. The presence of major resin manufacturers and well-established R&D facilities supports the development of advanced materials such as epoxy, polyurethane, and composite resins. Growth in renewable energy sectors like wind turbines and electric vehicles further contributes to increased demand for high-performance resins.

South America: Good Manufacturing Base Supports The Growth Of The Market

South America is an emerging market for resins, supported by growth in construction, automotive production, and consumer goods manufacturing. Countries like Brazil and Mexico drive regional demand due to expanding infrastructure projects and industrial development. The region is witnessing increasing investment in residential and commercial construction, boosting the consumption of resins in adhesives, coatings, insulation, and plastic components.

Brazil: Resin Market Growth Trends

Brazil represents the largest market in South America due to its growing construction industry, packaging sector, and automotive manufacturing. The country also has a developing plastics and petrochemical industry, supporting domestic resin production. Rapid urbanisation and infrastructure modernisation projects are expected to increase the consumption of synthetic and speciality resins for long-term applications.

Middle East & Africa (MEA): Large-Scale Construction Activities Led The Market Growth

The MEA resin market is driven by large-scale construction activities, oil and gas infrastructure projects, and industrial expansions. Countries in the Middle East benefit from easy access to petrochemical raw materials, enabling strong domestic resin production. Meanwhile, African countries are witnessing growing demand for housing, infrastructure, and renewable energy projects. The region presents high growth potential despite existing logistical and manufacturing challenges.

Saudi Arabia: Resin Market Growth Trends

Saudi Arabia plays a key role in the MEA resin market due to its strong petrochemical industry and large oil reserves. The country has several large-scale resin manufacturing facilities and exports significant volumes globally. Ongoing investments in infrastructure development, Vision 2030 industrial diversification plans, and construction projects are boosting domestic demand for various types of resins, including polyethene, epoxy, and polyurethane.

Recent Developments

- In November 2025, Cronos Group Inc. launched a new line of premium products under its Lord Jones® brand in the Canadian market. These products are designed to offer a high-quality experience.(Source: www.globenewswire.com/news)

- In November 2025, PostProcess Technologies is launching the DEMI X 5000, a next-generation automated resin cleaning solution for the 3D printing industry. This system is designed to increase productivity, safety, and sustainability for manufacturers working with large-scale SLA parts.(Source: manufactur3dmag.com)

- In July 2025, Dow launched its INNATE™ TF 220 Precision Packaging Resin, a high-density polyethene (HDPE) material designed to boost the recyclability of flexible packaging. The new resin supports the creation of high-performance, mono-material biaxially oriented polyethene (BOPE) films, addressing the need for both performance and sustainability in the packaging industry.(Source: www.chemanalyst.com)

Top Companies In The Resin Market & Their Offerings:

SABIC

Corporate Information

- SABIC is headquartered in Riyadh, Saudi Arabia, with major industrial operations in the industrial city of Al Jubail (on the Arabian Gulf) and in Yanbu (on the Red Sea).

- It is a publicly listed company (on Saudi’s Tadawul exchange), of which ~70% is owned by Saudi Aramco, while the rest is publicly traded.

- SABIC operates globally manufacturing, sales, technology & innovation facilities across Americas, Europe, Middle East, Asia Pacific.

History and Background

- SABIC was founded in 1976 by royal decree, initially to leverage Saudi Arabia’s hydrocarbon resources (oil/gas) to produce chemicals, polymers and fertilisers locally, rather than exporting raw hydrocarbons.

- Early operations were concentrated in industrial cities primarily in the then small fishing villages of Jubail and Yanbu, which were transformed into large industrial hubs as part of SABIC’s growth.

Key Developments and Strategic Initiatives

- SABIC restructured its operations in 2015: it reorganized from a site-based structure into a Strategic Business

- Unit (SBU) model grouping business into units such as Polymers, Chemicals, Specialties, Agri-nutrients, etc.

- The company emphasizes global diversification with production, manufacturing, sales and R&D presence across multiple geographies (Middle East, Europe, Americas, Asia).

Mergers & Acquisitions

- 2019–2020, A major change: state owned Saudi Aramco acquired a 70% majority stake in SABIC (from Public Investment Fund) in a deal worth ~$69.1 billion, integrating SABIC more closely with national energy & petrochemical strategy.

Partnerships & Collaborations

- SABIC works closely with Saudi Aramco beyond shareholding, the collaboration aims to funnel more crude/ hydrocarbon feedstock into production of chemicals/plastics rather than just fuel aligning with efforts to transform waste gases and oil derivatives into value added materials.

- The company also operates global technology & innovation centers collaborating across geographies to adapt materials to industries such as automotive, electronics, construction, healthcare, packaging, etc.

Product Launches / Innovations

- SABIC claims over 11,000 patents and patent applications globally, supported by a worldwide network of technology & innovation centers.

- SABIC is regarded as a global leader in a range of products: polyethylene (PE), polypropylene (PP), polycarbonate, mono-ethylene glycol (MEG), methanol, granular urea, engineering plastics and compounding.

Key Technology Focus Areas

- In 2025, at the global plastics/chemical trade show K 2025, SABIC unveiled “advanced material solutions” aimed at every day-use applications emphasizing segments “Live, Move, Work, Shop, Care,” under initiatives such as MEGAMOLDING™, BLUEHERO™ and TRUCIRCLE™ highlighting its focus on innovation, sustainability and circular economy ready materials.

R&D Organisation & Investment

- SABIC operates multiple global technology & innovation centers across key geographies (Middle East, Europe, Americas, Asia Pacific) to support product development, applications and custom solutions.

- The company reportedly introduces around 150 new products per year.

SWOT Analysis

Strengths:

- Extensive global footprint operations in many countries, manufacturing, sales, R&D presence across regions.

- Large, diversified product portfolio commodity chemicals/plastics, high-performance polymers, fertilisers, speciality products, etc.

- Strong backing and integration with Saudi energy supply chain via Saudi Aramco access to feedstock, financial strength.

Weaknesses / Challenges:

- As a large commodity chemicals/plastics producer exposed to global cyclical demand, feedstock price volatility, over-capacity risk.

- Environmental and regulatory pressures plastics industry under scrutiny; demand for sustainable/circular plastics may require additional investment.

Opportunities:

- Growth in demand for high performance, specialty plastics for industries like automotive, electronics, healthcare.

- Rising global emphasis on sustainability and circular economy SABIC’s initiatives (e.g. recycling, “TRUCIRCLE™”) could capture growing demand for eco friendly plastics.

Threats / Risks:

- Oversupply and demand slowdown in global petrochemicals markets leading to margin compression.

- Regulatory risk increasing environmental regulations, bans/restrictions on certain plastics, push for recycling and alternatives.

Recent News & Strategic Updates

- In 2025, at trade show K 2025, SABIC unveiled advanced material solutions under initiatives MEGAMOLDING™, BLUEHERO™ and TRUCIRCLE™, highlighting its push into everyday use products and circular economy materials.

- According to recent financial reports, SABIC has faced headwinds: in Q4 2024 it reported a net loss (due to weak demand, high input costs).

Companies Analysis

- Dow Inc. (USA): Dow is a global leader in synthetic resins, including polyethene, polypropylene, and speciality elastomeric resins. Its products are widely used in packaging, infrastructure, automotive, and consumer goods due to their durability, chemical resistance, and process efficiency.

- BASF SE (Germany): BASF offers a broad range of thermoset and thermoplastic resins, including epoxy, polyester, polyurethane, and engineering resins. These materials serve applications in coatings, adhesives, construction, automotive, and electronics industries worldwide.

- LyondellBasell Industries (Netherlands): LyondellBasell is a leading resin manufacturer known for its polypropylene and polyethene resins used in packaging, piping systems, medical devices, and industrial components.

- ExxonMobil Chemical (USA): ExxonMobil supplies a wide portfolio of polyethene, polypropylene, and speciality resins used for flexible packaging, automotive parts, industrial films, and consumer goods applications.

- Covestro AG (Germany): Covestro focuses on high-performance polymer resins like polycarbonate, polyurethane, and speciality coatings resins. These materials are used in automotive, construction, electronics, and healthcare industries.

- DuPont (U.S.)

- Arkema (France)

- INEOS Holdings Ltd. (U.K.)

- Hexion (U.S.)

- Invista (U.S.)

- Mitsubishi Engineering-Plastics Corporation (Japan)

- Mitsui Chemicals (Japan)

- Nova Chemicals (Canada)

- Qenos (Australia)

- Radici Group (Italy)

- Repsol (Spain)

- Sumitomo Chemical Co., Ltd. (Japan)

- Teijin Limited (Japan)

- Tosoh Corporation (Japan)

- Toray Group (Japan)

Top Companies in the Resin Market

- Dow Inc. (USA)

- BASF SE (Germany)

- LyondellBasell Industries (Netherlands)

- ExxonMobil Chemical (USA)

- Covestro AG (Germany)

- DuPont (U.S.)

- Arkema (France)

- INEOS Holdings Ltd. (U.K.)

- Hexion (U.S.)

- Invista (U.S.)

- Mitsubishi Engineering-Plastics Corporation (Japan)

- Mitsui Chemicals (Japan)

- Nova Chemicals (Canada)

- Qenos (Australia)

- Radici Group (Italy)

- Repsol (Spain)

- Sumitomo Chemical Co., Ltd. (Japan)

- Teijin Limited (Japan)

- Tosoh Corporation (Japan)

- Toray Group (Japan)

Segments Covered:

By Type

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Polyvinyl Chloride

- Acrylonitrile Butadiene Styrene

- Polyamide

- Polycarbonate

- Polyurethane

- Polystyrene

- Others

By End-use Industry

- Packaging

- Automotive & Transportation

- Building & Construction

- Consumer Goods/Lifestyle

- Electrical & Electronics

- Agriculture

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa