Content

North America Foam Market Size and Forecast 2025 to 2034

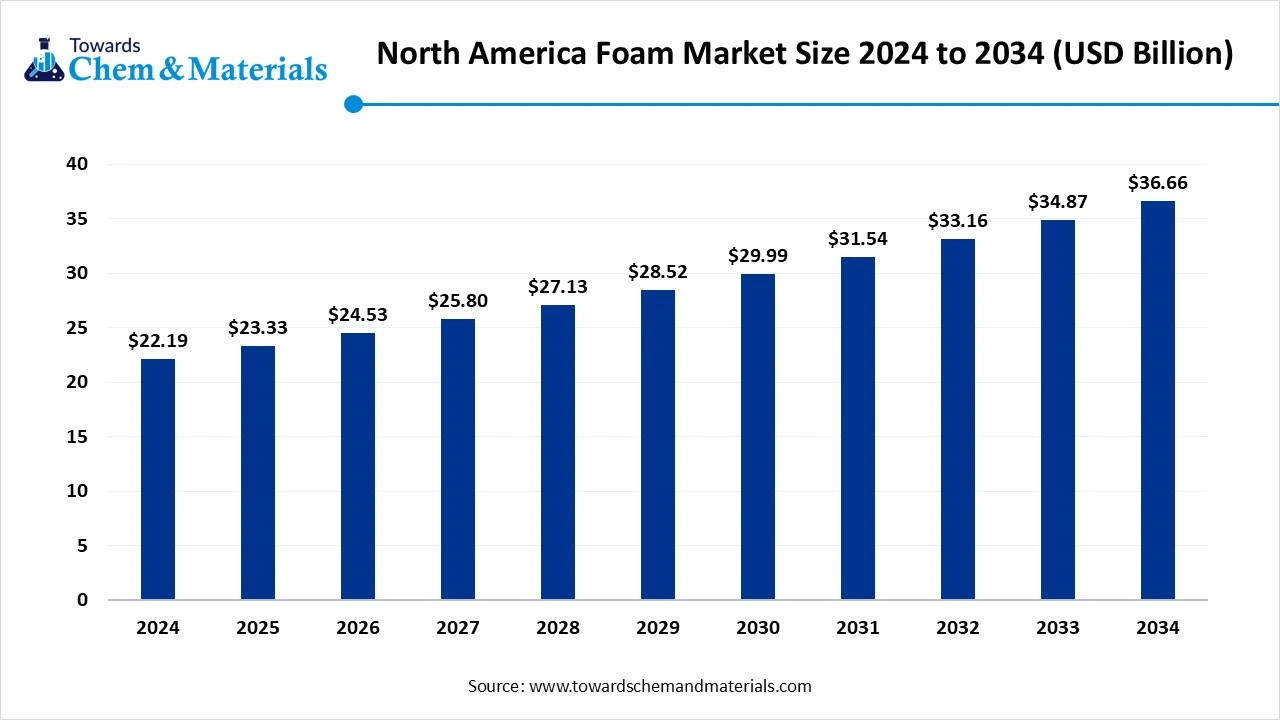

The North America foam market size was valued at USD 22.19 billion in 2024, grew to USD 23.33 billion in 2025, and is expected to hit around USD 36.66 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period from 2025 to 2034. Updation of construction and expansion of the automotive industry are driving the industry potential.

Key Takeaways

- By foam type, the polyurethane foam segment led the North America foam market with approximately 40% industry share in 2024, due to specialized characteristics like versatility and wide application in construction.

- By foam type, the biobased and sustainable segment is expected to grow at the fastest rate in the market during the forecast period, owing to a heavy push for sustainability from the government and local awareness about the eco-friendly nature.

- By application, the building and construction segment emerged as the top-performing segment in the market with approximately 35% industry share in 2024, because foams provide exceptional insulation, soundproofing, and lightweight structural support.

- By application, the automotive and packaging segment is expected to lead the market in the coming years, as automakers are replacing heavier materials with lightweight foams to improve fuel efficiency.

- By property type, the flexible foam segment led the North America foam market with approximately 45% share in 2024, because of its extensive use in furniture, bedding, automotive seating, and cushioning products.

- By property type, the spray foam and specialty foams segment is expected to capture the biggest portion of the market in the coming years, because of advanced applications in insulation, aerospace, medical, and high-performance packaging.

How Is the Foam Industry Evolving Across North America?

The North America foam industry has experienced sophisticated growth in recent years. Also, the industry refers to the production, distribution, and application of polymer foams across industries such as construction, automotive, packaging, furniture & bedding, and appliances.

Foams are lightweight, durable, and versatile materials used for insulation, cushioning, sealing, and structural support. The market includes polyurethane, polystyrene, polyolefin, phenolic, and specialty foams. Growth is driven by rising demand for energy-efficient buildings, increased packaging needs from e-commerce, lightweight materials in vehicles, and advancements in sustainable/recyclable foam solutions.

Smart Foam Solutions Driving Energy Savings

The increased adoption of high-performance insulation material for commercial and residential places is heavily driving the sectoral scalability and strategic transformation of the industry. Also, the regional countries like the United States and Canada have energy codes where the foam is increasingly used for various applications, which has been actively seen in reducing heating and cooling costs. Moreover, initiatives like energy-efficient buildings and sustainable manufacturing are boosting the overall capacity of the industry in the current period.

- OneClickDIY has seen under the expansion of customer support and availability of DIY foam insulation. Also, the company is likely to offer a wide product line of spray foam kits, adhesives, and sealants in the United States for the upcoming years, as per the company's claim.(Source: www.shreveporttimes.com)

Market Trends

- The sudden shift towards the multifunctional foams has allowed major manufacturers to capitalize on growth opportunities in recent years. Also, sectors like defense, aerospace, and electronics are increasingly demanding these types of films.

- The implementation of the sustainability standards, where the manufacturers are seen under heavy pressure to develop eco-friendly foams in the region nowadays.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 23.33 Billion |

| Expected Size by 2034 | USD 36.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Foam Type, By Application, By Property / Functionality, |

| Key Companies Profiled | BASF SE, Covestro AG , Huntsman Corporation , Dow Inc. , Recticel Group , Carpenter Co. , Sealed Air Corporation , Rogers Corporation , Armacell International S.A., FXI Holdings, Inc. , UFP Technologies, Inc. , Zotefoams Plc , Kaneka North America LLC , INOAC Corporation, JSP Corporation |

Market Opportunity

A Greener Tomorrow Through Bio-Based Foam Innovation

The production of the foam by using agricultural waste like corn husk, soybean oil, and sugarcane bagasse will likely aid in business diversification for producers during the forecast period. Also, the greater push for sustainable manufacturing by the regional government is likely to majorly contribute to the future industry growth. Moreover, the manufacturers can establish a partnership with major sectors like automotive construction, which are actively looking for the minimization of their carbon footprint in recent years.

- In January 2025, the United States had over 600 million kg of plastic waste trade and set an example of environmental responsibility for nations.(Source: www.circularise.com)

Market Challenge

Rising Raw Material Costs Threaten Industry Margins

The price volatility of raw materials, such as the TDI and MDI, is likely to suppress profit margins and deter investment in the sector during the forecast period. Moreover, these raw materials are mainly derived from the petrochemical which is continuously seen under high price fluctuations due to factors like trade wars and geopolitical tensions in recent years. Also, these price fluctuations can delay product launch and increase product costing.

Country Insights

Why is Foam Becoming Essential in United States Insulation Projects?

United States dominated the North America foam market in 2024, owing to having an enlarged and advanced manufacturing base and greater automotive infrastructure. Also, the country has observed the heavy construction upgradation, where the foam is considered a crucial element for insulation works in the United States nowadays. Also, the foam manufacturers are heavily investing in R&D for innovative material development, which is likely to create profitable pathways for sector participants in the coming years.

Segmental Insights

Foam Type Insights

How Did The Polyurethane Foam Segment Dominate The North America Foam Market In 2024?

The polyurethane foam segment held the largest share of the market in 2024, due to specialized characteristics like versatility and wide application in construction. Moreover, sectors like automotive and furniture have contributed to the growth of the segment by using these polyurethane foams as the ideal insulation in recent years. Furthermore, the durability and cost effectiveness of the polyurethane foams have maintained their dominance in the North America region over the past few years.

The bio-based and sustainable segment is expected to grow at a notable rate during the predicted timeframe, owing to a heavy push for sustainability from the government and local awareness about the eco-friendly nature. Moreover, the major companies in the region are actively replacing their petrochemical foams with eco-friendly materials like PHA and PLA-based foams in recent years. Also, several manufacturers are seen under the heavy promotion of their sustainable manufacturing practices on social media platforms and websites in North America.

Application Type Insights

Why Does The Building And Construction Segment Dominate The North America Foam Market?

The building and construction segment held the largest share of the market in 2024 because foams provide exceptional insulation, soundproofing, and lightweight structural support. In North America, strict building codes and high heating/cooling costs make foams a practical choice for walls, roofs, and flooring systems. Urbanization and green building programs like LEED certification further push contractors to adopt polyurethane and spray foams over traditional insulation materials.

The automotive and packaging segment is expected to grow at a notable rate. Automakers are replacing heavier materials with lightweight foams to improve fuel efficiency and meet EV design needs. Seating, interiors, and vibration control applications are increasingly foam-dependent. Meanwhile, the surge in e-commerce has transformed packaging into a critical end-use sector.

Property Type Insights

How Did The Flexible Foam Segment Dominate The North America Foam Market In 2024?

The flexible foam segment dominated the market with the largest share in 2024 because of its extensive use in furniture, bedding, automotive seating, and cushioning products. The U.S. consumer market strongly values comfort, ergonomics, and design versatility-all of which flexible foams deliver. Their softness, lightweight properties, and cost-effectiveness make them the preferred choice for both household and industrial cushioning needs

The spray foam and specialty foams segment is expected to grow at a significant rate because of advanced applications in insulation, aerospace, medical, and high-performance packaging. Spray foams offer superior air-sealing and thermal efficiency, making them highly demanded for retrofitting older U.S. buildings. Specialty foams, such as vibration-damping and fire-resistant foams, are crucial in aerospace, defense, and electronics industries.

North America Foam Market Value Chain Analysis

- Distribution to Industrial Users: The foam is mainly distributed in the packaging and automotive sectors in North America, as per the recent survey.

- Chemical Synthesis and Processing: The chemical synthesis of the foams according to their foam type, like polyurethane foam, can undergo gelling reactions and others in the region.

- Regulatory Compliance and Safety Monitoring: North America has a specialized regulatory body for the safety and regulatory compliance of the foam, called the EPA, and others.

Recent Developments

- In July 2025, Huntsman introduced their digital tool for the United States spray foam contractors. The newly launched digital tool can offer job site tracking for contractors as per the report published by the company recently.(Source: www.sprayfoammagazine.com)

- In February 2025, the Smithers Oasis unveiled their latest plant-based floral foam. Also, this foam does not contain colorants and dyes and is expected to launch initially in the United States as per the company's claim.(Source: thursd.com)

North America Foam Market Top Companies

- BASF SE

- Covestro AG

- Huntsman Corporation

- Dow Inc.

- Recticel Group

- Carpenter Co.

- Sealed Air Corporation

- Rogers Corporation

- Armacell International S.A.

- FXI Holdings, Inc.

- UFP Technologies, Inc.

- Zotefoams Plc

- Kaneka North America LLC

- INOAC Corporation

- JSP Corporation

Segment Covered

By Foam Type

- Polyurethane (Flexible & Rigid)

- Polystyrene (EPS, XPS)

- Polyolefin Foams (PE, PP, EVA)

- Phenolic Foams

- PVC Foams

- Melamine & Specialty Foams

- Bio-based & Sustainable Foams

By Application

- Building & Construction (insulation, roofing, flooring, sealing)

- Automotive & Transportation (seating, interior, lightweighting)

- Packaging (protective, thermal, cushioning)

- Furniture & Bedding (mattresses, cushions, upholstery)

- Appliances & Consumer Goods (refrigerators, HVAC, electronics)

- Sports, Leisure & Footwear

- Industrial & Other Uses

By Property / Functionality

- Flexible Foam

- Rigid Foam

- Spray Foam

- Structural & Specialty Foam