Content

What is the Current North America Water and Wastewater Treatment Market Size and Share?

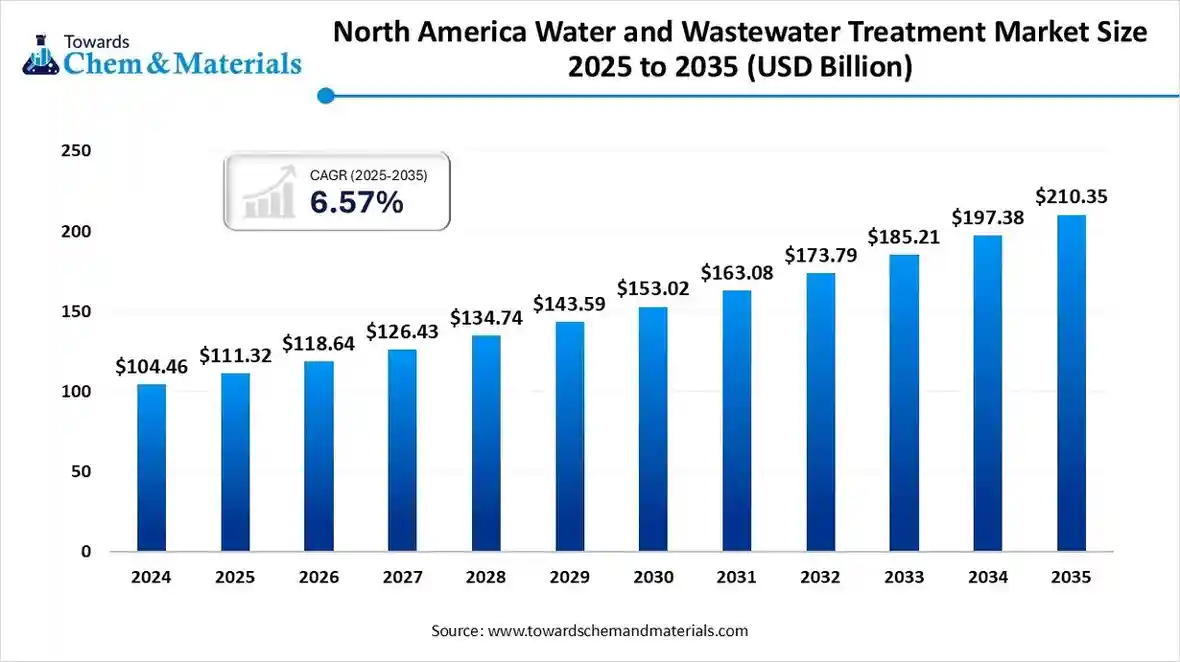

The North America water and wastewater treatment market size is estimated at USD 111.32 billion in 2025 it is predicted to increase from USD 118.64 billion in 2026 and is projected to reach USD 210.35 billion by 2035, growing at a CAGR of 6.57% from 2025 to 2035. The demand to upgrade aging infrastructure is the key factor driving market growth. Also, growing investments in water reuse, coupled with the integration of advanced solutions, can fuel market growth further.

Key Takeaways

- By type, the wastewater treatment segment dominated the market with a 72.4% share in 2024.

- By type, the water treatment segment is expected to grow at the fastest CAGR of 5.3% over the forecast period.

- By technology, the membrane separation segment held a 38.5% market share in 2024.

- By technology, the biological treatment segment is expected to grow at the fastest CAGR of 5.0% over the forecast period.

- By application, the municipal segment dominated the market with a 68.5% share in 2024.

- By application, the industrial segment is expected to grow at the fastest CAGR of 5.1% during the projected period.

- By end-use industry, the power generation segment held 40.2% market share in 2024.

- By end-use industry, the pharmaceutical segment is expected to grow at the fastest CAGR of 5.2% over the study period.

What is Water and Wastewater Treatment?

The market is driven by stringent environmental regulations, aging water infrastructure, and growing industrialization. The North American water and wastewater treatment market involves processes and technologies designed to purify water for industrial, municipal, and residential use while ensuring environmentally safe wastewater discharge. Increasing investments in smart water management, desalination, and membrane filtration systems are enhancing efficiency. Rising demand for clean water across urban areas and industries like power generation and pharmaceuticals further supports market growth across the region.

North America Water and Wastewater Treatment Market Outlook

- Industry Growth Overview: The market benefits from the development and adoption of cutting-edge and energy-efficient solutions such as digital monitoring, membrane technologies, and AI-driven process optimization. Also, both government and private sector investments in this sector are offering a major boost to the market.

- Sustainability Trends: This trend in the market includes a rapid shift towards a circular economy via growing water reuse and recycling with the energy-efficient technologies, such as smart systems and membrane bioreactors, with an emphasis on resource recovery.

- Major Investors: Major players in the market, such as Veolia, Xylem, and Ecolab, are actively investing through R&D, strategic acquisitions, and technology advancements with emphasis on innovative solutions such as membrane filtration and digital water management.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 118.64 Billion |

| Expected Size by 2034 | USD 210.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.57% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Technology, By Application, By End-Use Industry |

| Key Companies Profiled | Ecolab Inc., Veolia North America, SUEZ Water Technologies & Solutions,Pentair plc, Evoqua Water Technologies (now part of Xylem), 3M Company,DuPont Water Solutions, Aquatech International LLC, A. O. Smith Corporation, BASF SE, Kurita Water Industries Ltd., Trojan Technologies,WABAG Water Technology, Lenntech B.V. |

How State-of-the-Art Technologies are Revolutionising the North America Water and Wastewater Treatment Market?

Cutting-edge technologies are transforming the market by fuelling driving efficiency, sustainability, and real-time operational control. Major advancements like the Internet of Things (IoT), Artificial Intelligence (AI), and advanced membrane filtration are reducing costs, optimizing processes, and enabling compliance with stringent environmental regulations.

Trade Analysis of North America Water and Wastewater Treatment Market: Import & Export Statistics:

- In 2024, the United States exported $243B of Chemical Products, being the 4th most exported product in the United States.

- In 2024, the main destinations of the United States' Chemical Products exports were: Canada ($30.5B), Mexico ($21.6B), China ($21.2B), Japan ($15.6B), and Germany ($14.4B).

- In 2024, Canada exported C$46.3B of Chemical Products, being the 5th most exported product in Canada.

- In 2024, the main destinations of Canada's Chemical Products exports were: the United States (C$32.8B), China (C$1.87B), Brazil (C$1.19B), the Netherlands (C$976M), and the United Kingdom (C$952M).

North America Water and Wastewater Treatment Market Value Chain Analysis

- Feedstock Procurement : It refers to the sourcing and acquisition of the essential raw materials, particularly bio-based materials, which are necessary inputs for the various treatment processes.

- Chemical Synthesis and Processing : It mainly refers to the manufacturing and use of specialized chemicals important for treating and purifying water and wastewater.

- Packaging and Labelling : This stage involves safety standards, strict regulations, and growing trends toward sustainability. These factors are crucial for ensuring the safe handling of hazardous products.

- Regulatory Compliance and Safety Monitoring : It involves the compulsory adherence to a complex framework of state/provincial, federal, and local laws and standards created to safeguard public health and the environment.

North America Water and Wastewater Treatment Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | The Clean Water Act (CWA) regulates pollutant discharges into U.S. surface waters by requiring permits for all point source discharges into navigable waters. Industrial and municipal facilities must obtain a National Pollutant Discharge Elimination System (NPDES) permit to legally discharge pollutants. |

| Canada | Environment and Climate Change Canada develop federal legislation, such as the Fisheries Act, which prohibits the deposit of deleterious substances into water frequented by fish. The federal government also has regulations regarding the interprovincial transport of waste |

| Mexico | NOM-001-SEMARNAT-2021 is a critical standard that sets stricter limits for pollutants in wastewater discharged into national bodies of water (rivers, lakes, marine zones, and soils). |

Segment Insights

Type Insight

How Much Share Did the Wastewater Treatment Segment Held in 2024?

- The wastewater treatment segment dominated the market with a 72.4% share in 2024. The dominance of the segment can be attributed to the growing awareness of water scarcity and the expansion of various sectors such as manufacturing, food processing, and pharmaceuticals. Advancements in smart water management systems are enhancing overall treatment effectiveness.

- The water treatment segment is expected to grow at the fastest CAGR of 5.3% over the forecast period. The growth of the segment can be credited to the increasing water treatment demand from industrial sectors for innovative treatment solutions. Federal and state governments are also heavily investing in water infrastructure projects.

Technology Insights

Which Technology Type Segment Dominated the North America Water and Wastewater Treatment Market in 2024?

- The membrane separation segment held a 38.5% market share in 2024. The dominance of the segment can be linked to the growing need for sustainable practices and rapid investments in water infrastructure. Membrane processes are more energy efficient than conventional methods, facilitating much lower operating costs for various municipalities and industries.

- The biological treatment segment is expected to grow at the fastest CAGR of 5.0% over the forecast period. The growth of the segment can be driven by ongoing advancements in biological treatment processes, which are leading to more effective systems. Government programs and investments are promoting sustainable water practices in the region.

- The growth of the disinfection segment is driven by the ongoing demand to upgrade aging infrastructure and rising water scarcity. Advancements in disinfection technologies like advanced oxidation processes and UV disinfection offer more efficient and effective ways to remove pathogens, leading to market expansion.

- The sludge treatment is one of the major segments in the market. The growth of the segment is fuelled by the growing volume of sludge requiring treatment, along with an increasing emphasis on sustainable sludge management practices such as energy recovery from biosolids and water reuse.

Application Insights

Which Application Type Segment Dominated the North America Water and Wastewater Treatment Market in 2024?

- The municipal segment dominated the market with a 68.5% share in 2024. The dominance of the segment is owed to the growing adoption of modern technologies such as smart water management systems and membrane filtration, which are enhancing the cost-effectiveness and efficiency of overall processes.

- The industrial segment is expected to grow at the fastest CAGR of 5.1% during the projected period. The growth of the segment is due to the increasing need for specialized treatment solutions from industrial sectors, along with substantial investments in infrastructure upgrades. Expansion in industrial sectors such as pharmaceuticals, power generation, and mining needs more sustainable wastewater treatment solutions.

End-Use Industry

How Much Share Did the Power Generation Segment Held in 2024?

- The power generation segment held 40.2% market share in 2024. The dominance of the segment can be attributed to the growing need for treated water for cooling and operational processes. Power plants depend on high-grade water for efficient operations, which leads to further segment expansion.

- The pharmaceutical segment is expected to grow at the fastest CAGR of 5.2% over the study period. The growth of the segment can be credited to the ongoing infrastructure modernization in the region, along with the growing demand for innovative treatment technologies like ultrafiltration.

- The food & beverage is one of the major segments in the market. This industry is a major water consumer, creating a large volume of wastewater that needs treatment. Rising awareness of water scarcity is impelling the sector more towards sustainable practices like water reuse and reclamation.

- The growth of the chemical industry is propelled by the rising need for clean water from population growth and industrialization, coupled with the demand for water sustainability and reuse initiatives. The chemicals are crucial for sedimentation processes in wastewater treatment.

Country Insights

How did U.S. Thrived in the North America Water and Wastewater Treatment Market in 2024?

The U.S. dominated the market with an 85.4% share in 2024. The dominance of the country can be attributed to the stringent environmental regulations, along with the rising water scarcity. In addition, a surge in population and expanding industrial sectors, particularly the food and beverage industry, increases the demand for drinking water and treated wastewater in the country.

Which is the Fastest Growing Country in the Region?

Canada is expected to grow at the fastest CAGR of 5.8% over the forecast period. The growth of the country can be credited to the growing demand to upgrade aging infrastructure, coupled with the growing public awareness of waterborne diseases. Furthermore, government and corporate policies are promoting the development of sustainable water management initiatives, which can impact positive market growth in the country.

Recent Developments

- In September 2025, Veolia introduced its cutting-edge Hubgrade Center in Scottsdale, Arizona, revolutionizing wastewater treatment services across the U.S..The facility integrates human expertise with artificial intelligence to boost water and wastewater treatment for municipalities.(Source: www.indianchemicalnews.com)

- In February 2025, Turing, a leader in AI-driven water management solutions, completed $14 million funding round led by Safar Partners. This will boost Turing's global expansion and improve its flagship AI-powered platforms, TOP Clear.(Source: www.businesswire.com)

Top North America Water and Wastewater Treatment Market Companies

Xylem Inc.

Corporate Information

- Xylem Inc. is a publicly traded water technology company (ticker: XYL) based in the U.S., operating globally in more than 150 countries.

- The company serves the full water cycle: transport, treatment, testing, and efficient use of water across public utilities, industrial, commercial, residential and agricultural markets.

History and Background

- Xylem was formed via a spin off: On Jan 12, 2011 the parent company ITT Corporation announced that its water businesses would be separated into a standalone company, which became Xylem.

- The name “Xylem” is derived from the Greek term for the plant tissue that transports water reflecting the company’s water transport and treatment mission.

- In its early years the company built on legacy brands (such as Flygt, Goulds Water Technology, YSI) and focused on combining pump and instrumentation heritage with analytics and services.

Key Developments and Strategic Initiatives

- Xylem has emphasized sustainability and impact: for example, it announced having enabled the reuse of over 18.1 billion m³ of water since 2019 and reduced non revenue water by 3.7 billion m³.

- The company has been named the Dow Jones Sustainability Index North America and FTSE4Good indices for its sustainability efforts.

Mergers & Acquisitions

Notable acquisitions:

- The majority stake in Idrica (2024) to expand digital analytics of water networks.

Earlier acquisition of smart metering company Sensus (~2016). - The significant acquisition of Evoqua Water Technologies (May 2023) which added water & wastewater treatment services, making Xylem a larger pure play water tech entity.

- Divestitures: The company has also divested non core businesses (e.g., international metering business) as part of portfolio simplification.

Partnerships & Collaborations

- Example: Xylem has collaborated with city utilities and major technology firms (for instance, leak detection with utilities in Mexico City and Monterrey) to deploy advanced solutions.

- Also partnership with industrial/municipal clients on nanobubble technology for wastewater.

Product Launches / Innovations

- Xylem’s portfolio covers many product lines: pumps, controls, filtration, disinfection, instrumentation, analytics platforms (via Sensus, YSI, Xylem Vue) and wastewater treatment systems.

- Innovation focus includes smart metering, digital analytics (IoT for water networks), advanced wastewater treatment methods (e.g., nanobubbles) and condition based services.

Key Technology Focus Areas

- Water Infrastructure: pumps, valves, dewatering, transport of water & wastewater.

- Applied Water: building services, commercial/residential water treatment, industrial processing.

- Measurement & Control / Digital: smart meters, network communication devices, sensors, software, analytics.

R&D Organisation & Investment

- While explicit R&D spend amounts aren’t widely publicly broken out in the sources I reviewed, the company emphasises digital innovation, analytics and services.

- The acquisition of analytics companies (e.g., Idrica) shows investment into software/R&D capability rather than just hardware.

- Their sustainability targets and technology deployment (e.g., nanobubble, leak detection) reflect dedicated innovation activity.

SWOT Analysis

Strengths

- Broad, global footprint with strong brand portfolios (Flygt, Goulds, YSI, Sensus).

- Diverse offering covering full water cycle (equipment, analytics, services) which gives end to‐end value.

- Strong growth tailwinds: water scarcity, aging infrastructure, digitalization of utilities.

- Disciplined management: margin expansion, cost productivity, strategic M&A.

Weaknesses

- Integration risk from large acquisitions (e.g., Evoqua, Idrica) and potential complexity of combining hardware + software + services.

- Exposure to macro & infrastructure cycles - utility spending may be subject to regulation, political cycles, budget constraints.

- Foreign currency and geopolitics risks given global operations.

- R&D intensity and innovation requirement: must keep ahead of technological change.

Opportunities

- Growing demand for digital water solutions, smart metering, leak detection and data analytics in utilities.

- Water reuse, non revenue water reduction, sustainability mandates across regions.

- Emerging markets infrastructure build out, especially in water stressed regions.

- Service & maintenance models (recurring revenue) and condition based services.

Threats

- Competitive pressure from other major water tech companies, chemicals companies, services firms.

- Regulatory risk (water utilities heavily regulated; environmental standards change).

- Commodity/inflation pressures (materials, energy) which may squeeze margins.

- Integration failures or under performing acquisitions could hurt growth.

- Technological disruption (new entrants, alternative treatment technologies) may challenge legacy hardware offerings.

Recent News & Strategic Updates

- In Q2 2025: Xylem reported ~$2.3 billion revenue, up ~6% year over year; EPS up ~16%; raised full year guidance.

- In October 2024: acquired majority stake in Idrica to strengthen digital water analytics and the Xylem Vue platform.

- The company is also focusing on margin improvement via productivity gains and strategic portfolio optimization (divesting non core assets).

Other Companies in the Market

- Ecolab Inc.: Ecolab is a major player in North America's water and wastewater treatment market, operating primarily through its subsidiary, Nalco Water. The company provides a wide range of solutions, including chemicals, equipment, and services, to both industrial and municipal customers.

- Veolia North America: Veolia North America provides water and wastewater treatment solutions, including operation, maintenance, and consulting services for industrial and municipal clients.

- SUEZ Water Technologies & Solutions

- Pentair plc

- Evoqua Water Technologies (now part of Xylem)

- 3M Company

- DuPont Water Solutions

- Aquatech International LLC

- A. O. Smith Corporation

- BASF SE

- Kurita Water Industries Ltd.

- Trojan Technologies

- WABAG Water Technology

- Lenntech B.V.

Segments Covered in the Report

By Type

- Water Treatment

- Wastewater Treatment

By Technology

- Membrane Separation

- Biological Treatment

- Disinfection

- Sludge Treatment

- Filtration

- Others

By Application

- Municipal

- Industrial

By End-Use Industry

- Power Generation

- Food & Beverage

- Chemical

- Pharmaceutical

- Oil & Gas

- Pulp & Paper

- Others