Content

Polystyrene Market Volume and Forecast 2025 to 2034

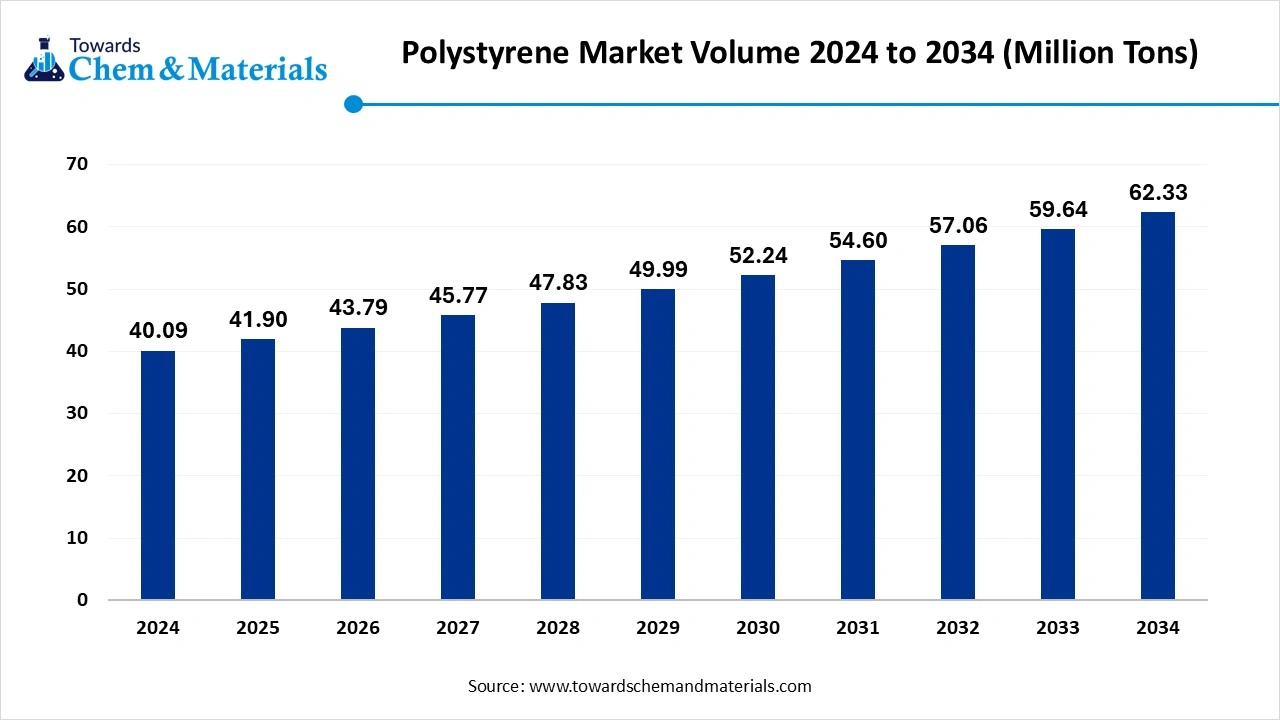

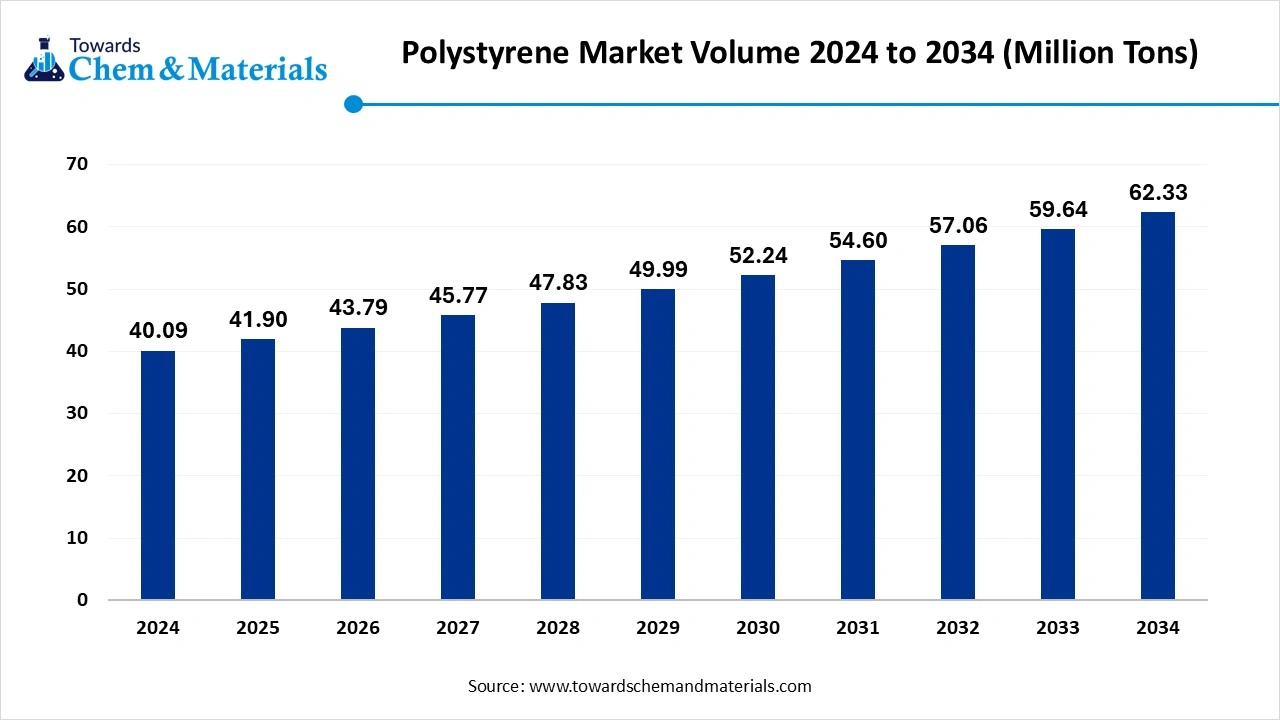

The global polystyrene market volume was reached at 40.09 million tons in 2024 and is estimated to surpass around 62.33 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.51% during the forecast period 2025 to 2034. The heavy expansion of the packaging industry is accelerating the industrial growth.

Key Takeaways

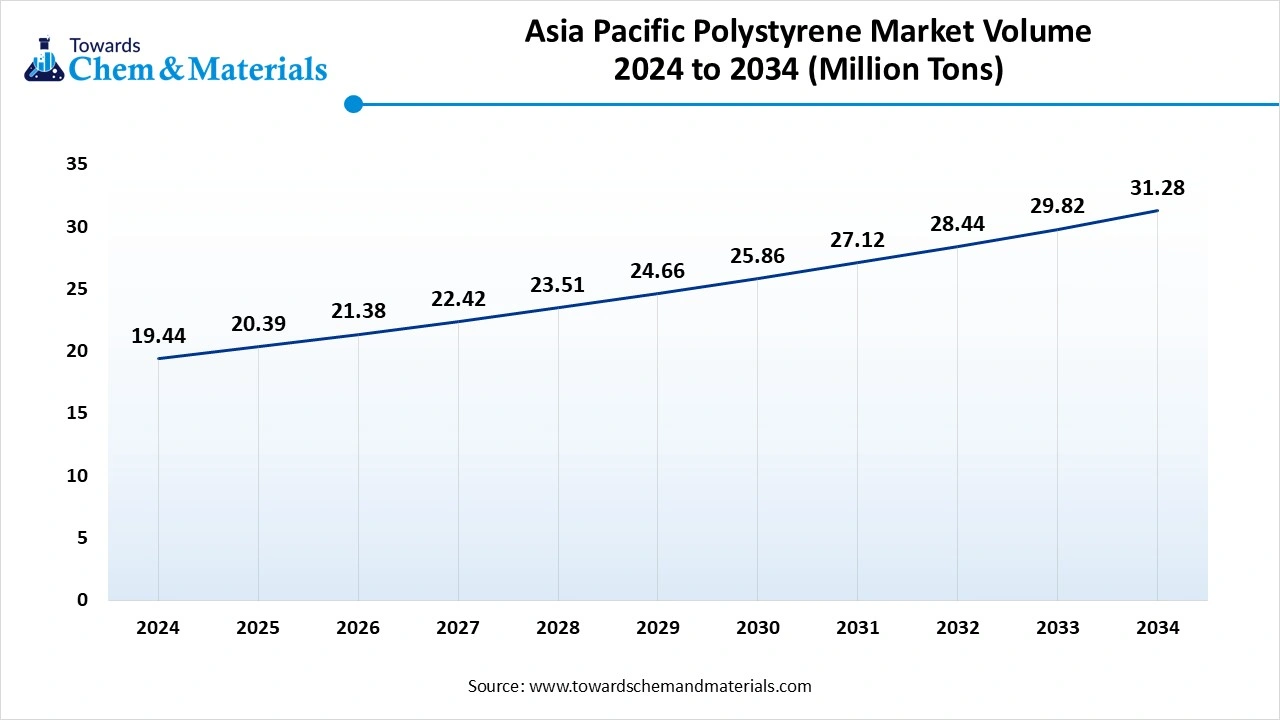

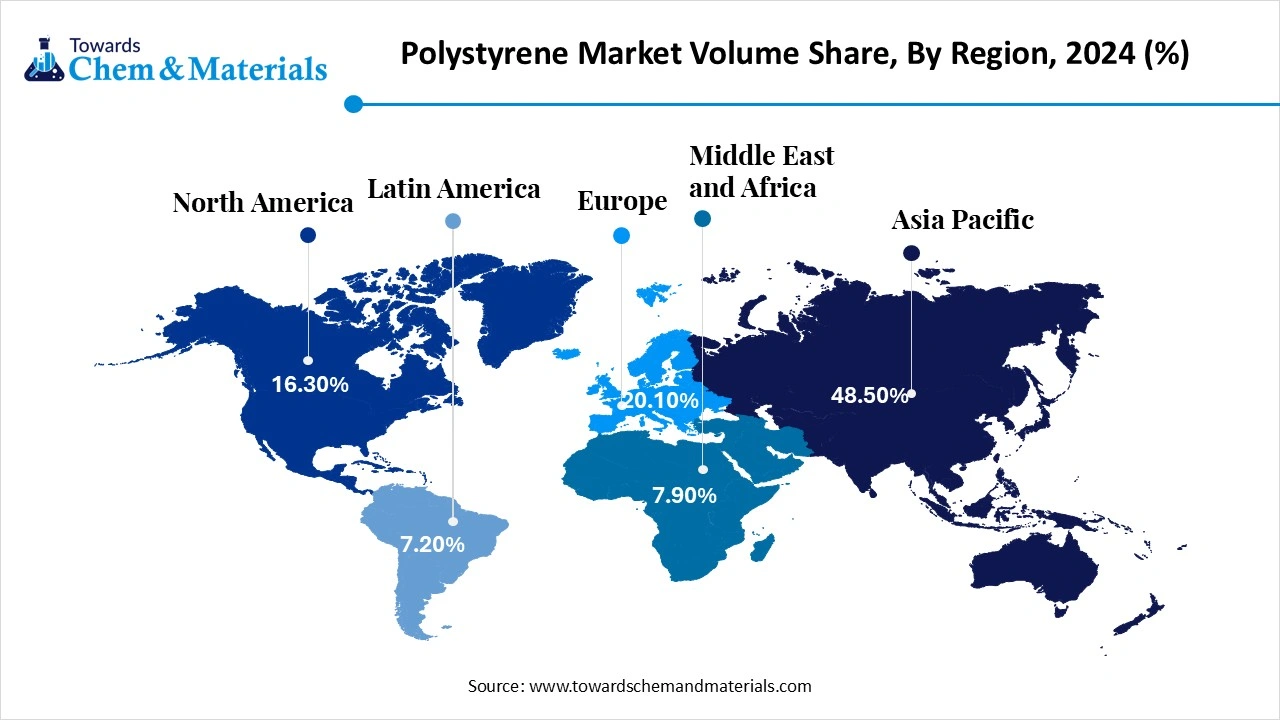

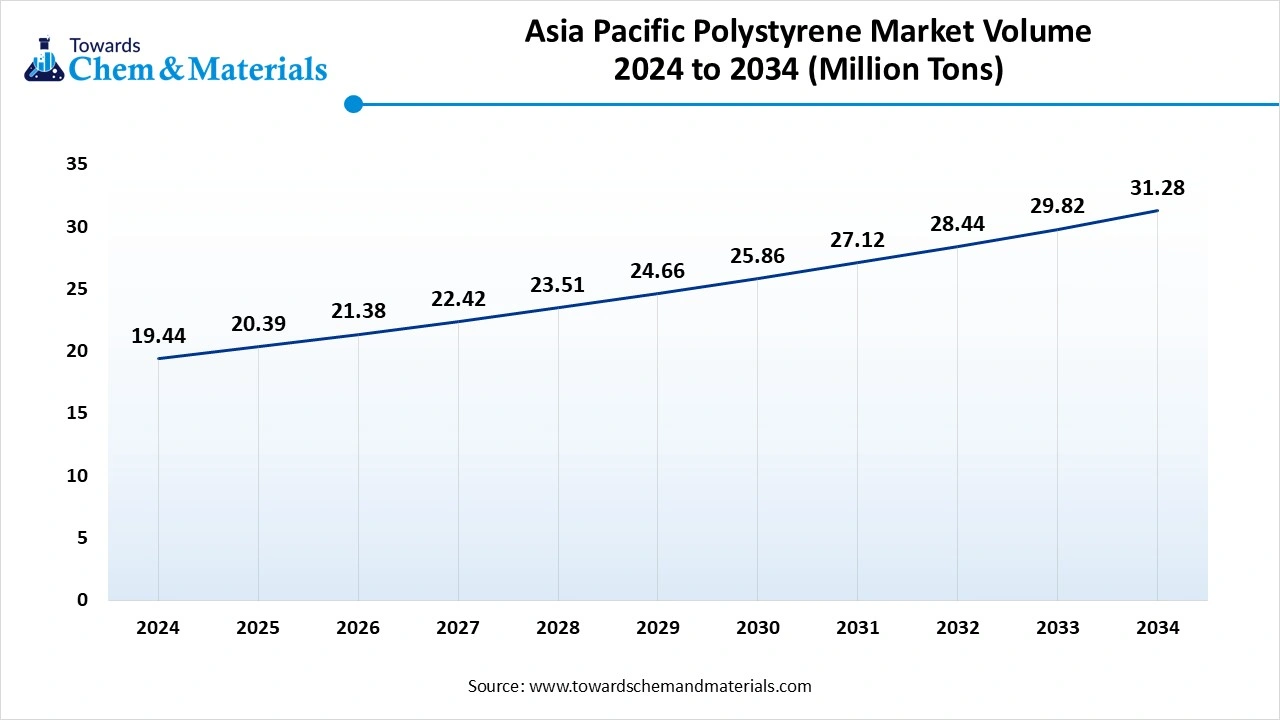

- The Asia pacific polystyrene industry volume is estimated at 20.39 million tons in 2025, and is expected to reach 31.28 million tons by 2034, at a CAGR of 4.87% during the forecast period 2025-2034

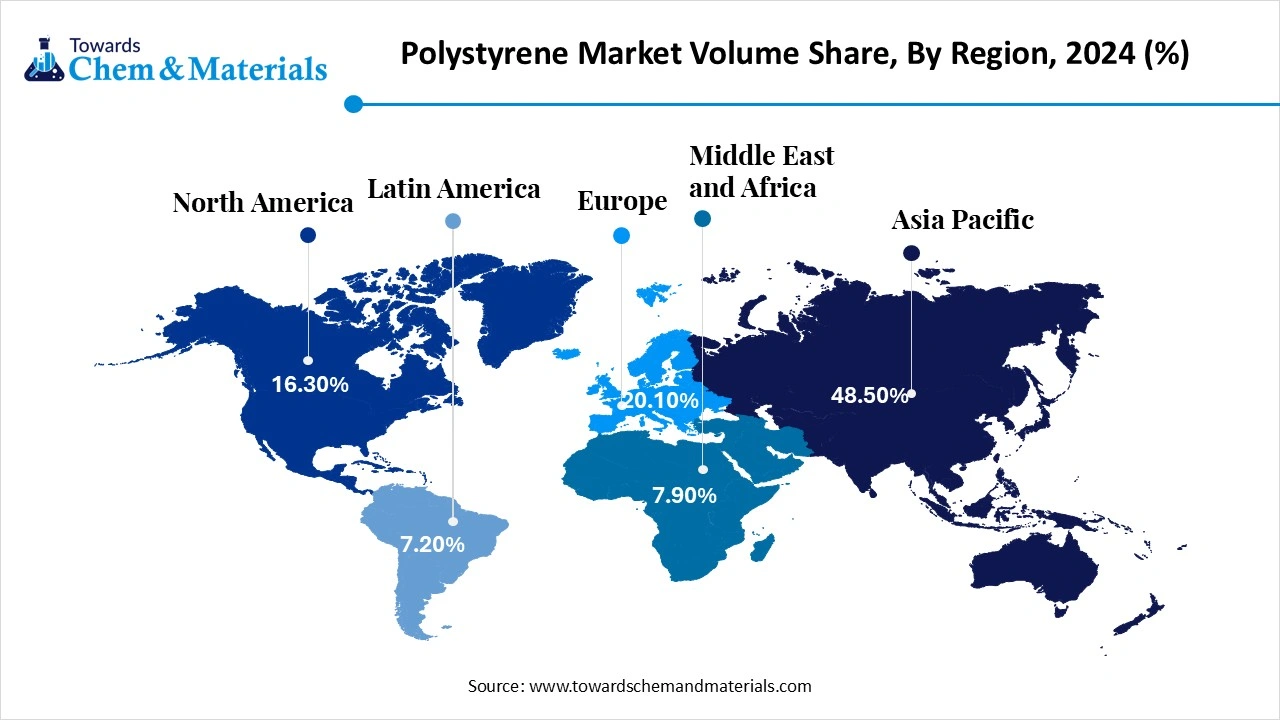

- Asia Pacific is the dominating region of the global polystyrene industry and accounted for more than 48.50% Volume share of the overall Volume in 2024.

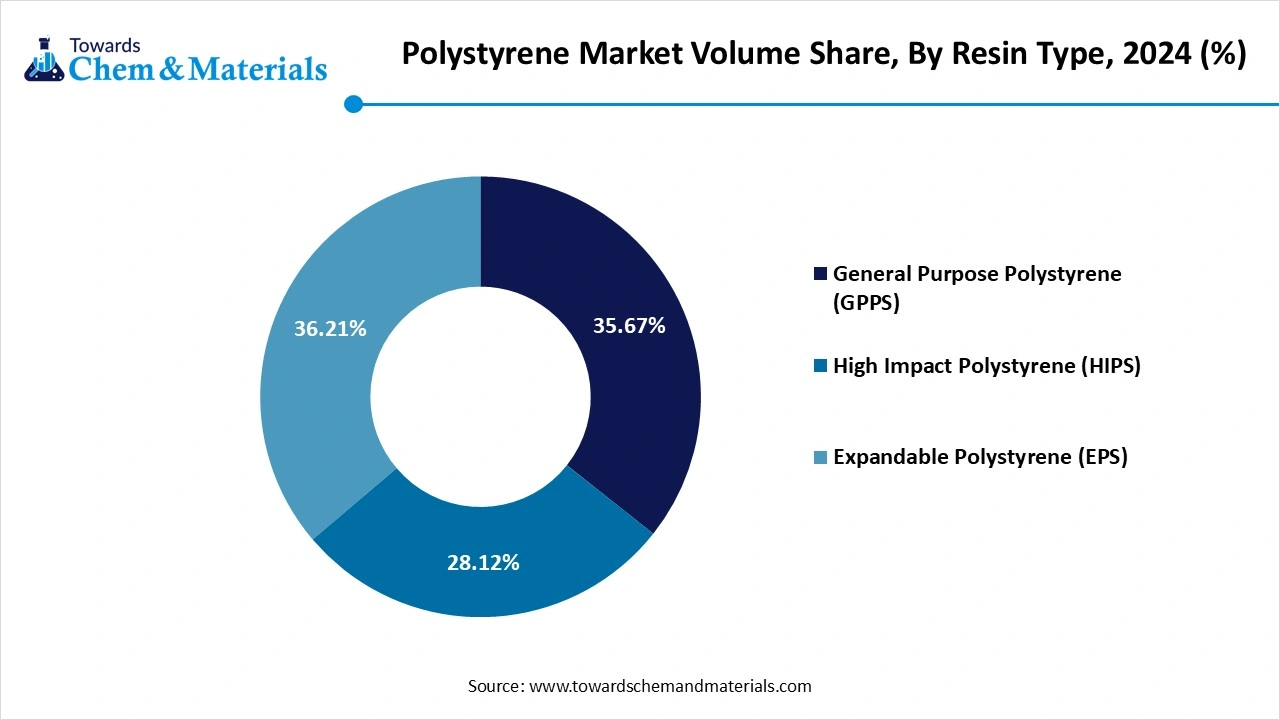

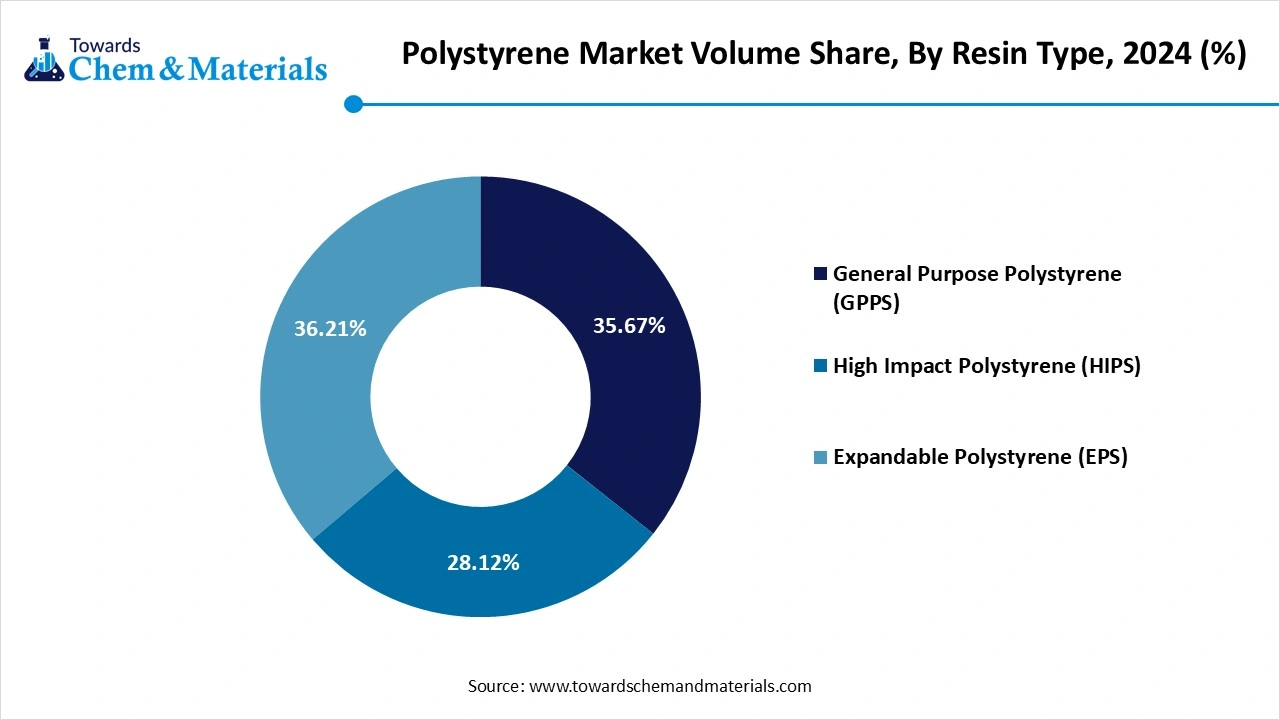

- By Resin Type, the general-purpose polystyrene segment accounted for the largest market Volume share of 35.67% in 2024

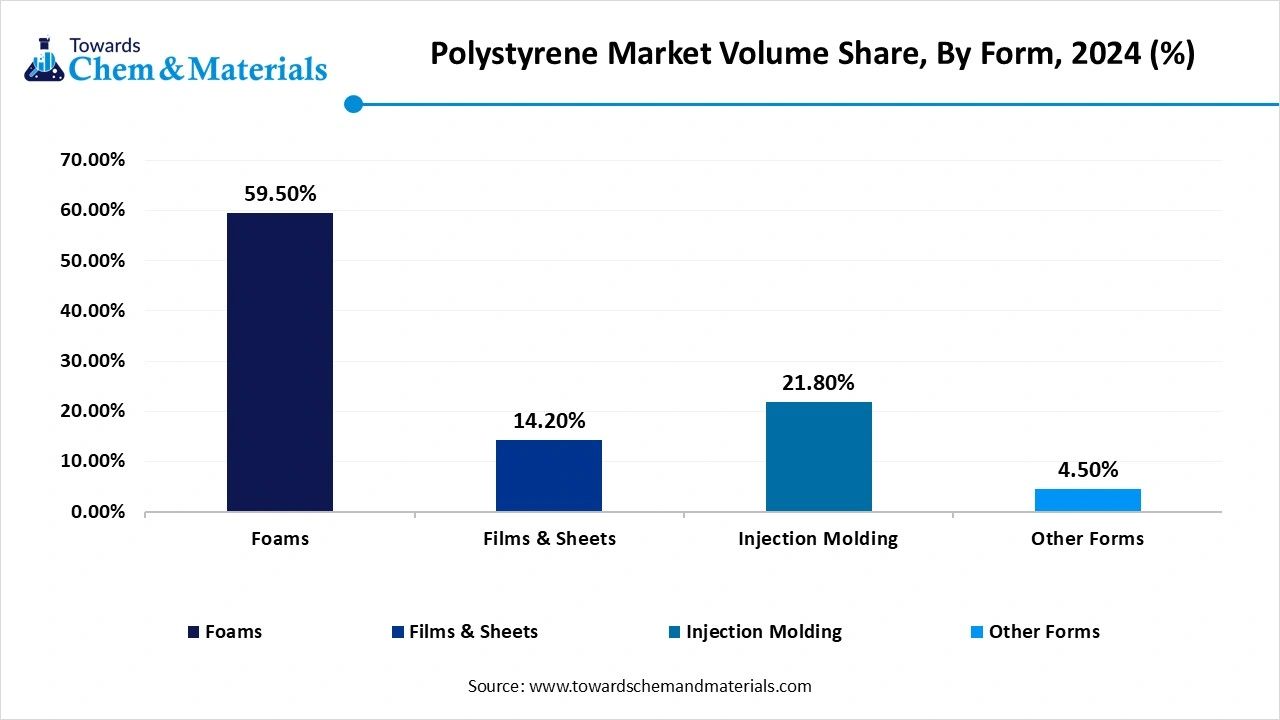

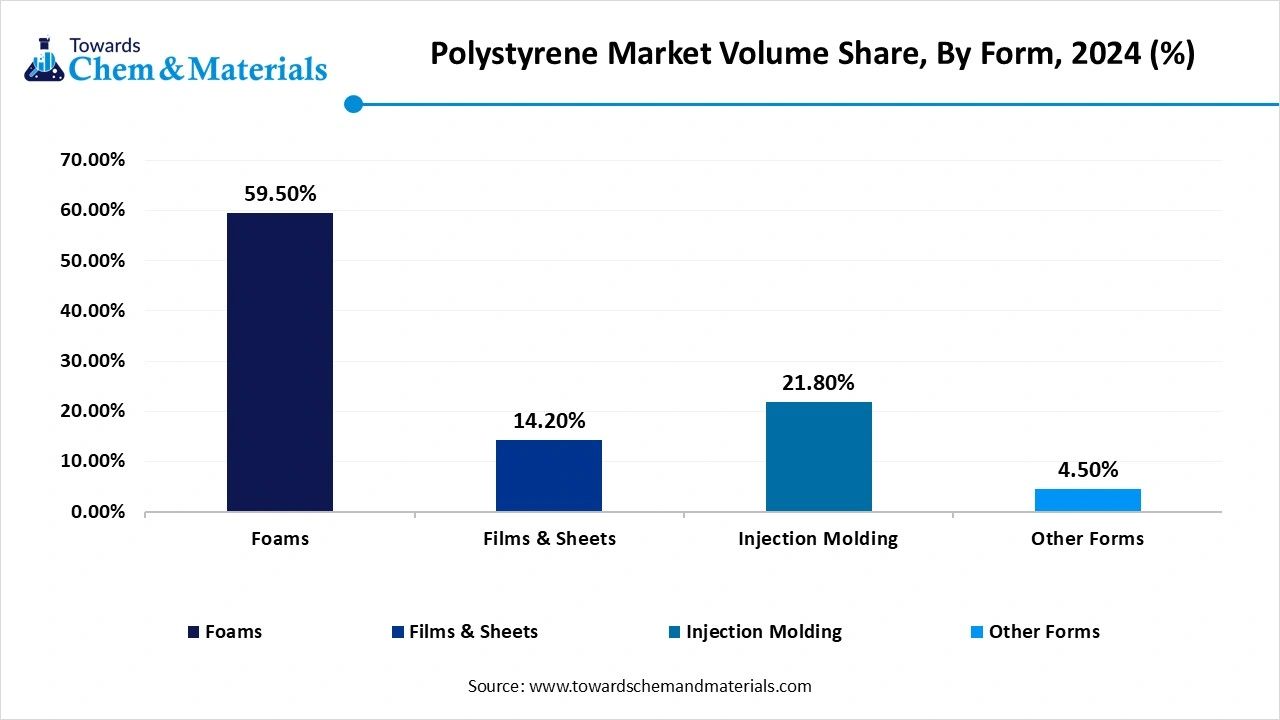

- By Form , the Foams is the dominating form type segment of the global polystyrene market and accounted for more than 59.50% Volume share of the overall Volume in 2024

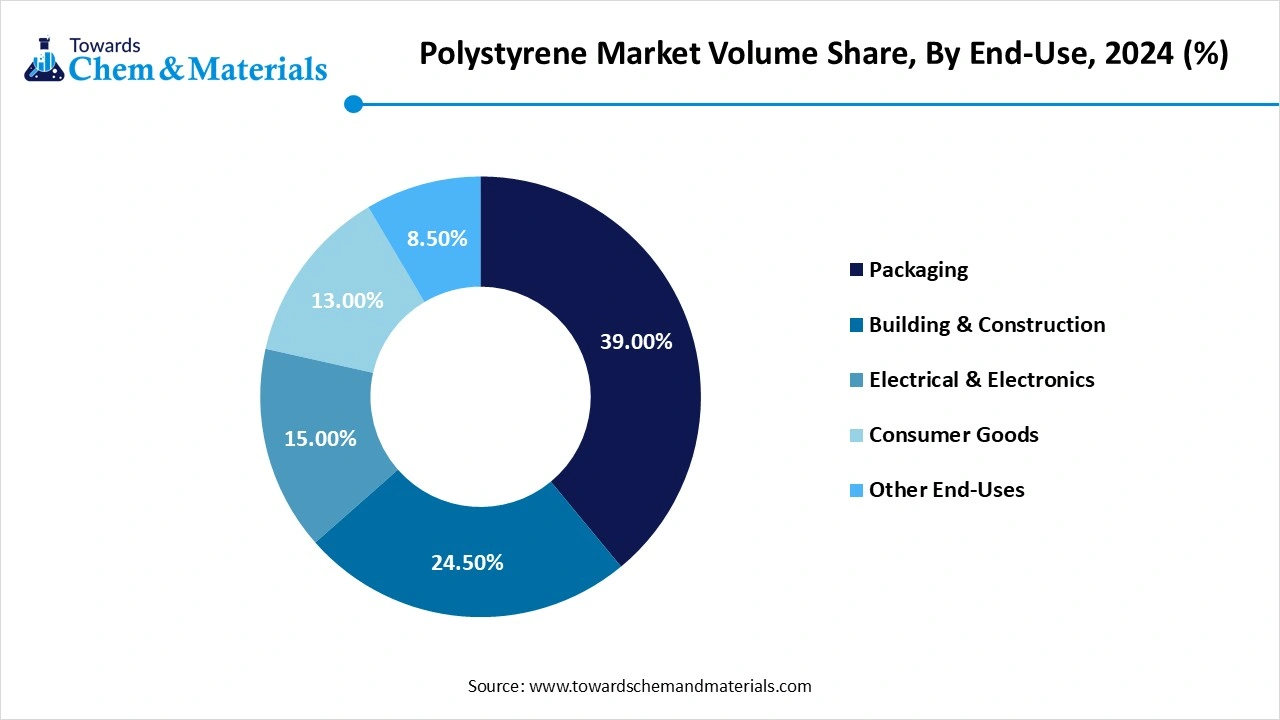

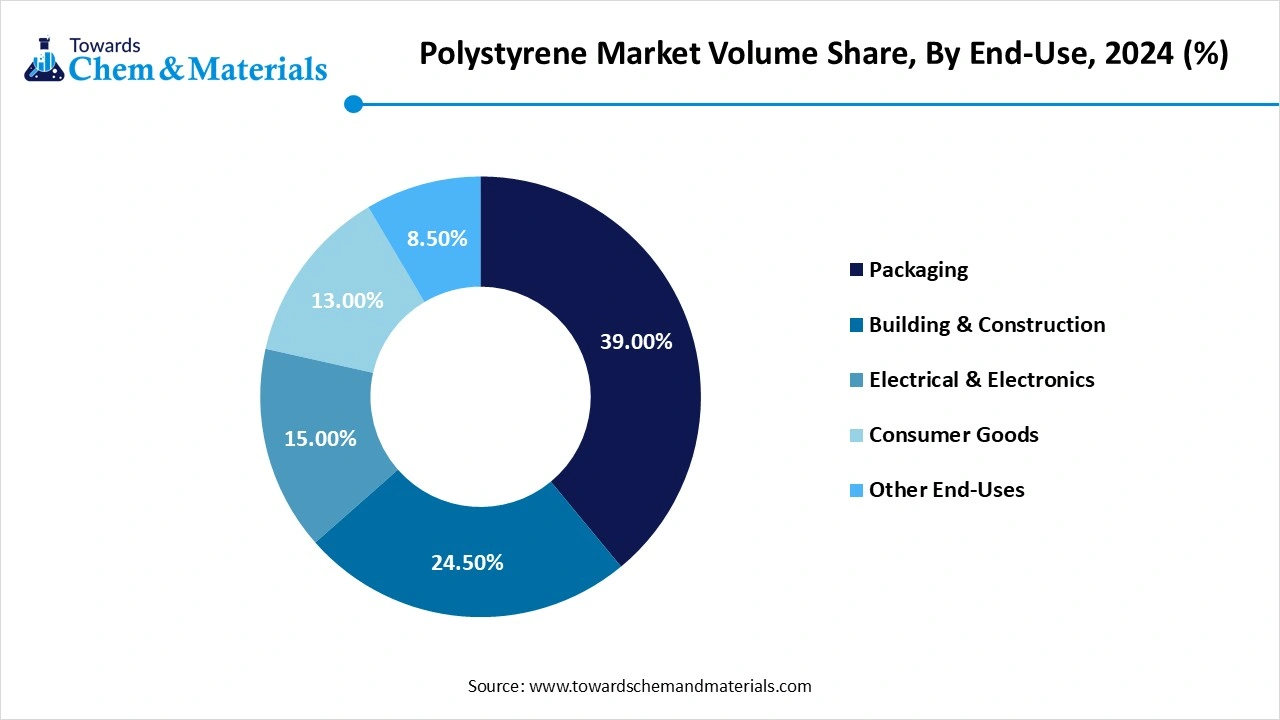

- By End-use , the Packaging is the dominating end-use segment of the global polystyrene market and accounted for more than 39% Volume share of the overall Volume in 2024

Lightweight and Insulated: The Rise of Polystyrene in Modern Industries

The polystyrene market is expected to seen in rapid growth owing to its widespread application in industries such as packaging, construction, and consumer electronics in the current period. Moreover, the demand for lightweight, molding, and insulation is severely contributing to the industry's growth in recent years. Also, these properties make polystyrene a preferred material across the heavy industries. Moreover, the expansion of construction projects has led to a major consumer base for the industry in the past few years, as construction developers are increasingly using polystyrene in their activities. Also, the rising environmental concerns are leading to the development of bio-based alternatives and encouraging the use of recycled plastic in the current period, as per observation.

Can Polystyrene Sustain Its Role Amid Expanding Packaging Demand ?

The enlarged expansion of the packaging industry is driving the polystyrene market growth in the industry environment. As sectors like food and electronics have increasingly provided a huge consumer base to the market in recent years. Having properties such as moisture resistance, cushioning, and insulation has led to the growth of polystyrene in heavy industries and make it ideal component for the protective and thermal packaging solutions in recent years. as need for the cost effective and lightweight materials, the polystyrene has gained popularity in the

Polystyrene Market Trends

- The sudden rise of e-commerce is spearheading market growth in the current period. This e-commerce industry has seen in demand for protective and thermal packaging in recent years. Moreover, as individuals buy products online, the use of polystyrene in packaging increase in the coming years.

- The increasing use of polystyrene in cold logistics is driving up industry potential in the current period. The cold logistics industries, such as pharmaceutical and perishable food, have been seen using polystyrene as the packaging material for sensitive materials such as vaccines, fresh produce, and frozen meals in the past few years.

- The increasing need for lightweight construction material is severely contributing to the growth of the market in the present period, as initiatives such as green building and energy efficient building development are actively providing the heavy consumer base for the polystyrene nowadays. Also, the polystyrene is preferred for their excellent thermal resistance and lower weight.

Report Scope

| Report Attributes | Details |

| Market Volune in 2025 | 41.90 Million Tons |

| Expected Volume by 2034 | 62.33 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 4.51% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Type, By Application, By Region |

| Key Companies Profiled | INEOS Styrolution, TotalEnergies, Dow Chemical Company, SABIC, BASF SE, LG Chem, Chevron Phillips Chemical Company, Synthos S.A., Versalis S.p.A., Formosa, Chemicals & Fibre Corp., Trinseo, Nova Chemicals Corporation, Chi Mei Corporation, Supreme Petrochem Ltd., Americas Styrenics LLC |

Polystyrene Market Opportunity

Recycled and Renewable: The Future of Polystyrene Manufacturing

The investment in advanced recycling processing is expected to create lucrative opportunities polystyrene market in the coming years. Several governments across the world are increasingly implementing sustainable initiatives and offering some benefits to manufacturers who prefer eco-friendly production initiatives in the current period. Moreover, the manufacturers can use the biobased alternative to follow the ongoing sustainability trend. Several packaging companies have been actively seen in promoting bio-based packaging for their product in recent years.

Market Challenge

Polystyrene’s Durability Raises Environmental Red Flags

Having limited biodegradability is expected to hamper the polystyrene market growth during the forecast period. This original polystyrene can take many years to decompose, which can create a harmful barrier for the environment in the coming years. Also, this lower biodegradability can hamper the polystyrene adoption in heavy industries such as food packaging and retail, akin to increased awareness of sustainability in the current period, as per the expectation.

Regional Insights

The Asia-Pacific Polystyrene market volume was valued at 19.44 volume million tons in 2024 and is expected to be worth around 31.28 volume million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.87% over the forecast period 2025 to 2034. Asia Pacific dominated the polystyrene market in 2024, akin by high industrialization and a reliable manufacturing base in the current period. Also, the increasing demand for packaging, consumer electronics, and construction activities is heavily contributing to the growth of the industry in the region in recent years. Moreover, the region is considered a heavy exporter of polystyrene in the past few years due to the prominent manufacturing giant countries such as China, India, and others, Moreover, the wide availability of raw materials is increasingly driving the polystyrene manufacturing in the region, as per the observation.

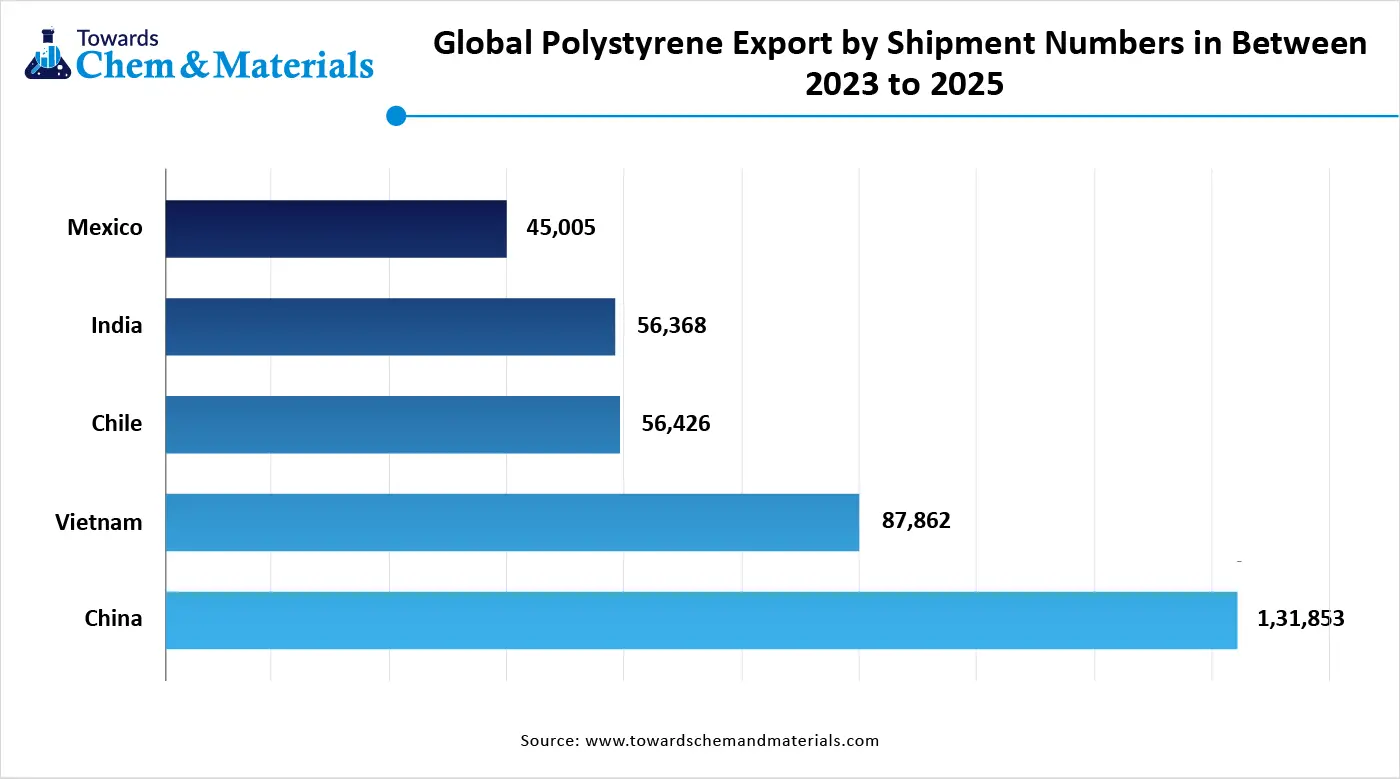

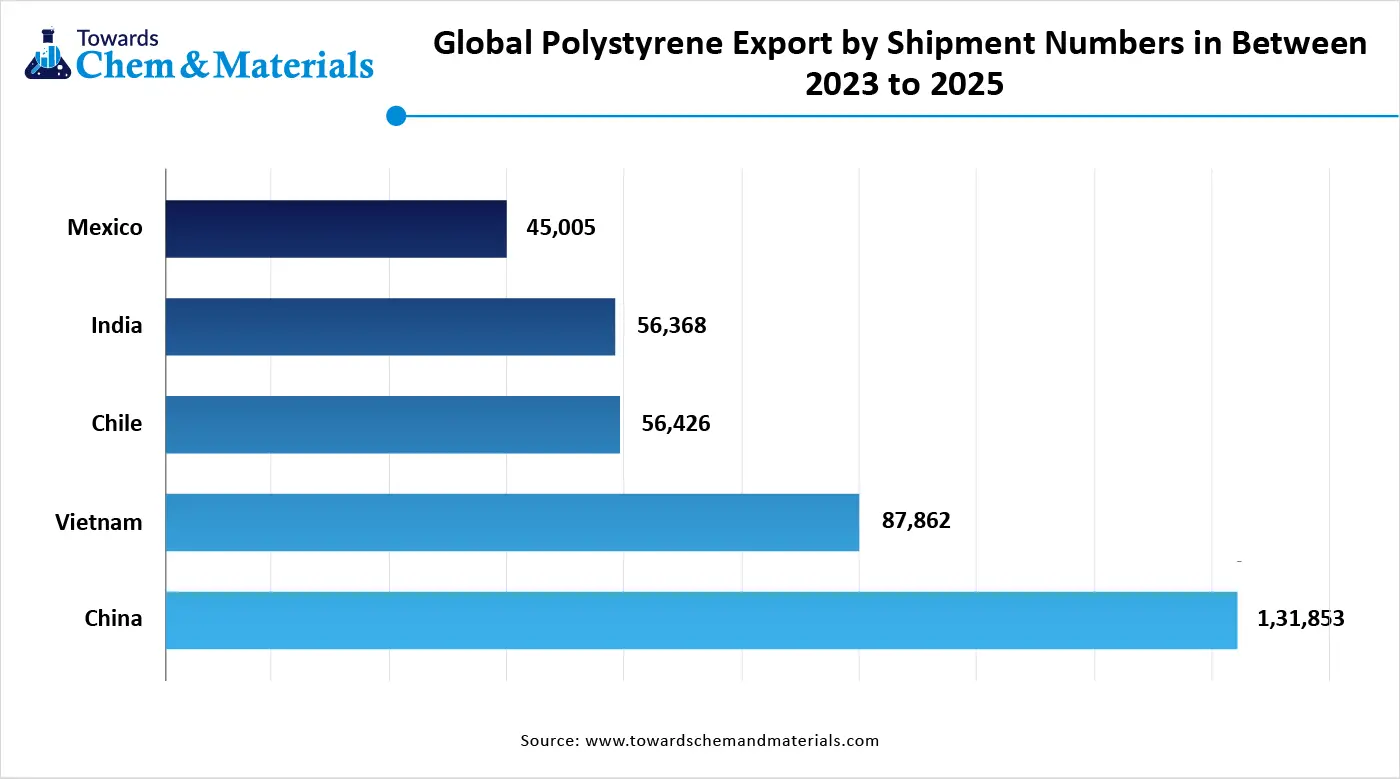

How are Government Policies supporting Polystyrene Growth in China? China maintained its dominance in the polystyrene market owing to the enlarged manufacturing sector. Moreover, China has seen a high demand for consumer products in recent years. Also, the favorable government initiatives and manufacturing facilities are driving industry growth in the country nowadays. Furthermore, China has a heavy domestic demand for polystyrene, which is leading the heavy consumer based in the current period in the country. The ongoing technological innovation can lead to the industry's potential during the forecast period in China, as per the country observation.

- Product Export: According to the report published by Observatory of Economic Complexity, the China exported Polystyrene worth $507 million in the years of 2023. Also, all exports of general enzymes fall under the plastic and rubbers section as per the report. (Source : oecworld )

North America expects significant growth in the polystyrene market during the forecast period, owing to technological innovation in recycling practices in the current period. As the country is seen under the heavy sustainable product demand, which can lead the industry growth in the coming years. Moreover, favorable government initiatives towards manufacturing sectors have increasingly encouraged polystyrene developers in recent years in the region. Also, the heavy construction sighting, modern construction practices are expected to severely contribute to industry growth in the upcoming period, as per the regional observation.

Polystyrene Market Volume & Share, By Region, 2024 - 2034 (%)

| By Region | Volume Shares, 2024 (% ) | Volume Million Tons - 2024 | Volume Share, 2034 (%) | Volume Million Tons 2034 | CAGR (2025 - 2034) |

| North America | 16.30% | 6.53 | 15.40% | 9.60 | 3.92% |

| Europe | 20.10% | 8.06 | 18.50% | 11.53 | 3.65% |

| Asia Pacific | 48.50% | 19.44 | 50.20% | 31.29 | 4.87% |

| Latin America | 7.20% | 2.89 | 7.50% | 4.67 | 4.94% |

| Middle East & Africa | 7.90% | 3.17 | 8.40% | 5.24 | 5.16% |

| Total | 100% | 40.09 | 100% | 62.33 | 4.51% |

How Will the United States' Recycling Infrastructure Shape Polystyrene Growth? The United States is expected to rise as a dominant country in the North American region in the coming years. The United States has an organized and technologically advanced recycling infrastructure in the current period. This infrastructure can lead the industry growth in the upcoming period, akin to several nations adopting the United States' strategy of recycling in recent years. Moreover, the heavy need for insulated packaging in e-commerce and pharmaceutical sectors can lead to heavy profit margins in the coming years, as per the expectation.

Segmental Insights

By Resin Type

The general-purpose polystyrene segment held the largest share of the market in 2024, akin to its clarity, rigidity, and ease of molding. It is widely used in products like food containers, CD cases, and disposable cutlery. GPPS is cost-effective and easy to process, making it a popular choice for many manufacturers. Its lightweight and transparent nature make it ideal for packaging and consumer goods. Because it meets everyday product needs at a low cost, it continues to lead the market. Its versatility and wide range of uses make GPPS the preferred type for companies in the food, retail, and electronics industries.

The high-impact polystyrene segment expects significant growth in the market during timeframe owing to its strength, flexibility, and better impact resistance compared to GPPS. HIPS is used in products that need more durability, such as appliance housings, toys, and automotive parts. It also works well with printing, making it great for promotional packaging and displays. As industries shift toward tougher, long-lasting materials, HIPS offers more value. Its ability to handle wear and tear makes it attractive for sectors like electronics and automotive. As demand grows for strong, recyclable plastics, HIPS will gain a larger share in the polystyrene market.

Polystyrene Market Volume & Share, By Resin Type, 2024 - 2034 (%)

| By Resin Type | Volume Share, 2024 (%) | Volume Million Tons 2024 | Volume Share, 2034 (%) | Volume Million Tons 2034 | CAGR (2025 - 2034 ) |

| General Purpose Polystyrene (GPPS) | 35.67% | 14.30 | 25.99% | 16.20 | 1.25% |

| High Impact Polystyrene (HIPS) | 28.12% | 11.27 | 36.80% | 22.94 | 7.36% |

| Expandable Polystyrene (EPS) | 36.21% | 14.52 | 37.21% | 23.19 | 5.34% |

| Total | 100% | 40.09 | 100% | 62.33 | 4.51% |

By Form

The foams segment led the polystyrene market in 2024. Polystyrene foam, particularly in the form of expanded polystyrene (EPS) and extruded polystyrene (XPS), is widely used in packaging, construction, and insulation due to its lightweight, cushioning properties, and thermal insulation capabilities. The surge in demand for protective packaging solutions in e-commerce, coupled with the growing need for energy-efficient insulation materials in the construction sector, significantly contributed to the dominance of the foams segment.

The moulding injection segments is seen to grow at the fastest rate during the forecast period. This growth is primarily driven by the increasing demand for precision-molded polystyrene components across industries such as consumer electronics, automotive, medical devices, and household goods. Injection molding enables the production of complex and lightweight parts with high dimensional accuracy and repeatability, making it ideal for mass production. The rising preference for cost-efficient and scalable manufacturing methods, combined with the adaptability of polystyrene to various design requirements, is accelerating the adoption of injection molding processes.

Polystyrene Market Volume Share, By Form, 2024 - 2034 (%)

| By Form | Volume Share, 2024 (%) | Volume Million Tons 2024 | Volume Share, 2034 (%) | Volume Million Tons2034 | CAGR (2025 - 2034) |

| Foams | 59.50% | 23.85 | 56.00% | 34.90 | 3.88% |

| Films & Sheets | 14.20% | 5.69 | 15.60% | 9.72 | 5.50% |

| Injection Molding | 21.80% | 8.74 | 23.40% | 14.59 | 5.86% |

| Other Forms | 4.50% | 1.80 | 5.00% | 3.12 | 6.26% |

| Total | 100% | 40.09 | 100% | 62.33 | 4.51% |

By End Use

The packaging segment held the dominating share of the polystyrene market in 2024 due to its lightweight, protective, and insulating properties. In the current period, industries like food, electronics, and healthcare rely heavily on polystyrene for safe and efficient packaging. Expanded polystyrene (EPS) keeps products secure during transport, while GPPS is used for clear food containers and trays. It is also cost-effective and easy to produce. With growing online shopping and food delivery, the need for protective and thermal packaging continues to rise. These factors make packaging the most dominant segment in the market, especially in regions with strong retail and logistics growth.

The automotive segment is seen to grow at a notable rate in the polystyrene market during the predicted timeframe. High impact polystyrene (HIPS) is used in car interiors, trims, and electronic housings due to its strength and easy moldability. As automakers focus on reducing vehicle weight to improve fuel efficiency and meet emission standards, materials like polystyrene become more valuable. It also helps in lowering production costs. Moreover, the rise of electric vehicles increases the need for light, insulation materials. These trends are pushing the automotive sector to adopt more polystyrene parts in both structural and decorative applications.

Polystyrene Market Volume & Share, By End-Use, 2024 - 2034 (%)

| By End-Use |

Volume Share, 2024(%) |

Volume Million Tons 2024 | Volume Share, 2034 (%) | Volume Million Tons 2034 | CAGR (2025 - 2034) |

| Packaging | 39.00% | 15.64 | 36.50% | 22.75 | 3.82% |

| Building & Construction | 24.50% | 9.82 | 25.80% | 16.08 | 5.05% |

| Electrical & Electronics | 15.00% | 6.01 | 15.40% | 9.60 | 4.79% |

| Consumer Goods | 13.00% | 5.21 | 13.70% | 8.54 | 5.06% |

| Other End-Uses | 8.50% | 3.41 | 8.60% | 5.36 | 4.63% |

| Total | 100% | 40.09 | 100% | 62.33 | 4.51% |

Polystyrene Market Recent Developments

- In 2025, the Plastic Industry Association created the Polystyrene Recycling Alliance recently. The reason behind this launch is to improve polystyrene recycling in the United States, as per the published report. (Source : plasticindustry.org )

- In January 2025, INEOS Styrolution introduced recycled polystyrene. Also, this polystyrene is specifically launched for food applications. Also, for the development of this recycled polystyrene, the company made multiple collaborations with multiple partners, as per the report published by the company. (Source : sustainableplastics.com)

- In February 2025, Trinseo unveiled its latest recycled polystyrene. Also, this recycled polystyrene is specifically made for the direct food contact application, as per the company's claim recently. Moreover, this is the transparent dissolution of recycled polystyrene. (Source : trinseo.com )

Top Companies list

- INEOS Styrolution

- TotalEnergies

- Dow Chemical Company

- SABIC

- BASF SE

- LG Chem

- Chevron Phillips Chemical Company

- Synthos S.A.

- Versalis S.p.A.

- Formosa Chemicals & Fibre Corp.

- Trinseo

- Nova Chemicals Corporation

- Chi Mei Corporation

- Supreme Petrochem Ltd.

- Americas Styrenics LLC

Segment Covered in the Report

By Resin Type

- General Purpose Polystyrene (GPPS)

- High Impact Polystyrene (HIPS)

- Expandable Polystyrene (EPS)

By Form

- Foams

- Films & Sheets

- Injection Molding

- Other Forms

By End-User

- Packaging

- Building & Construction

- Electrical & Electronics

- Consumer Goods

- Other End-Uses

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait