Content

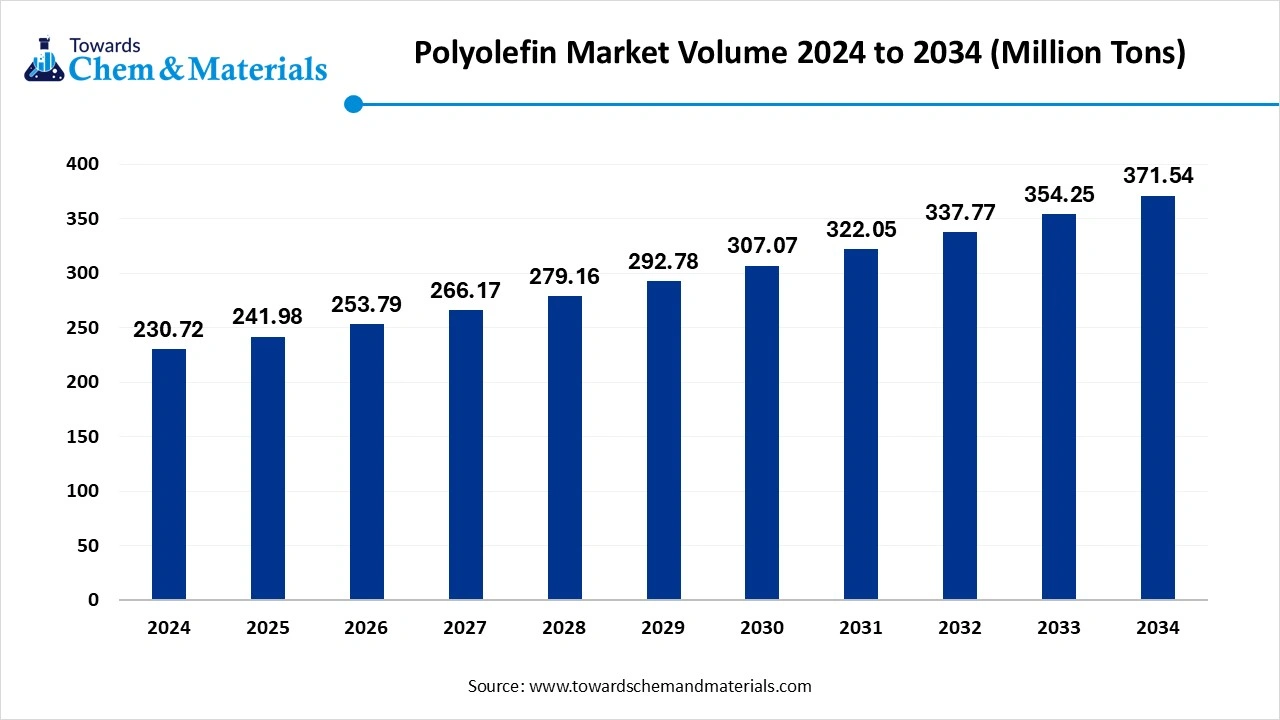

Polyolefin Market Volume and Forecast 2025 to 2034

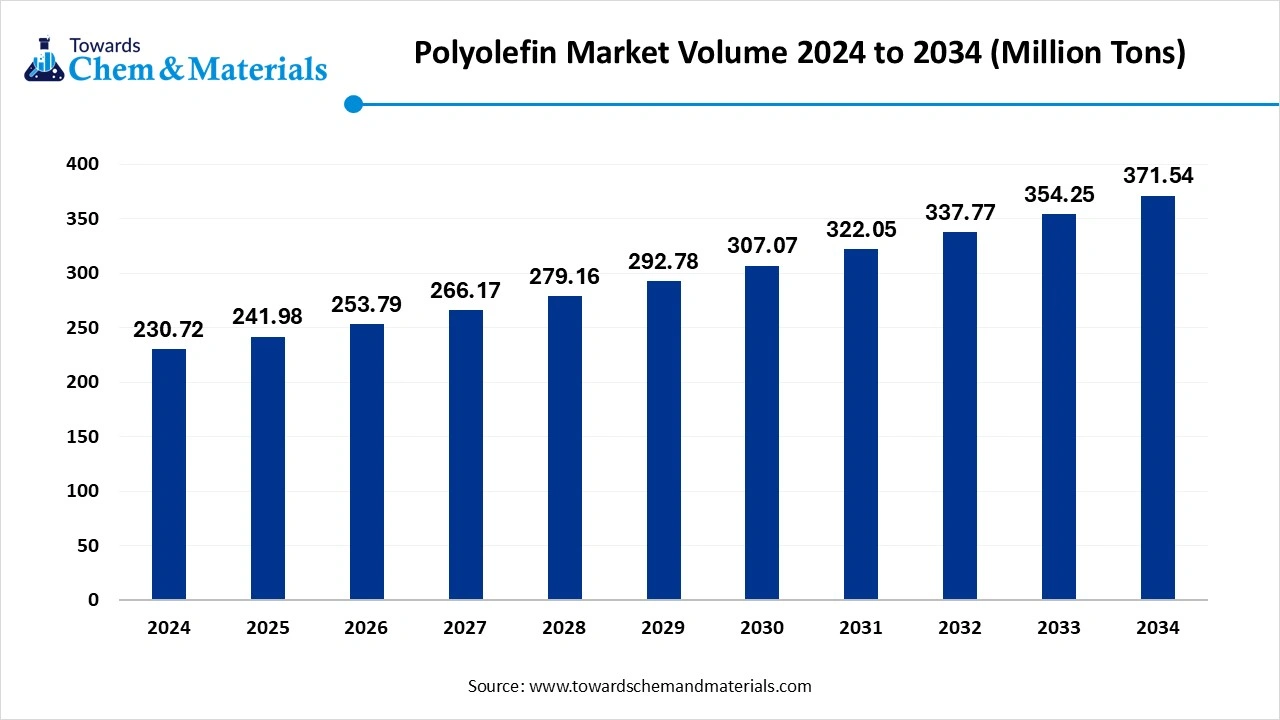

The global polyolefin market volume was valued at 230.72 million tons in 2024 and is estimated to reach around 371.54 million tons by 2034, exhibiting a compound annual growth rate (CAGR) of 4.88% during the forecast period 2025 to 2034. Growing demand for flexible and rigid packaging, increasing adoption in various industries like automotive and electronics, and a growing focus on sustainability and eco-friendly materials, boost market growth.

Key Takeaways

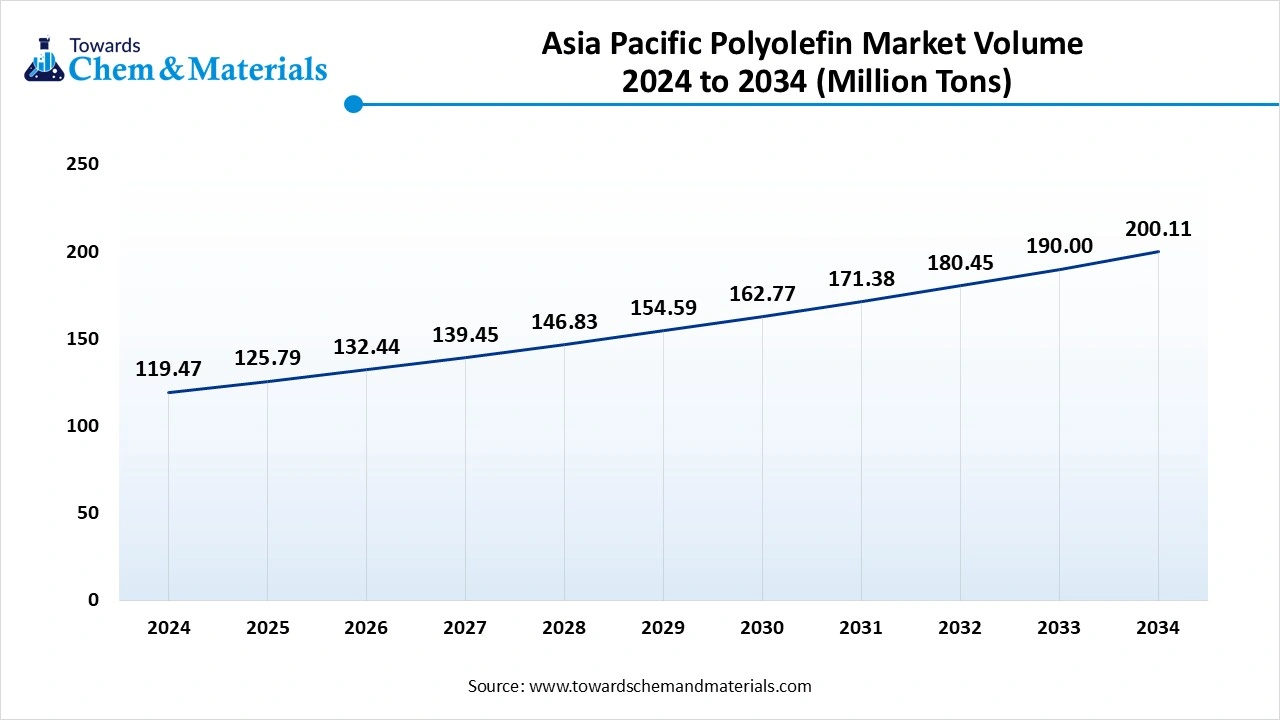

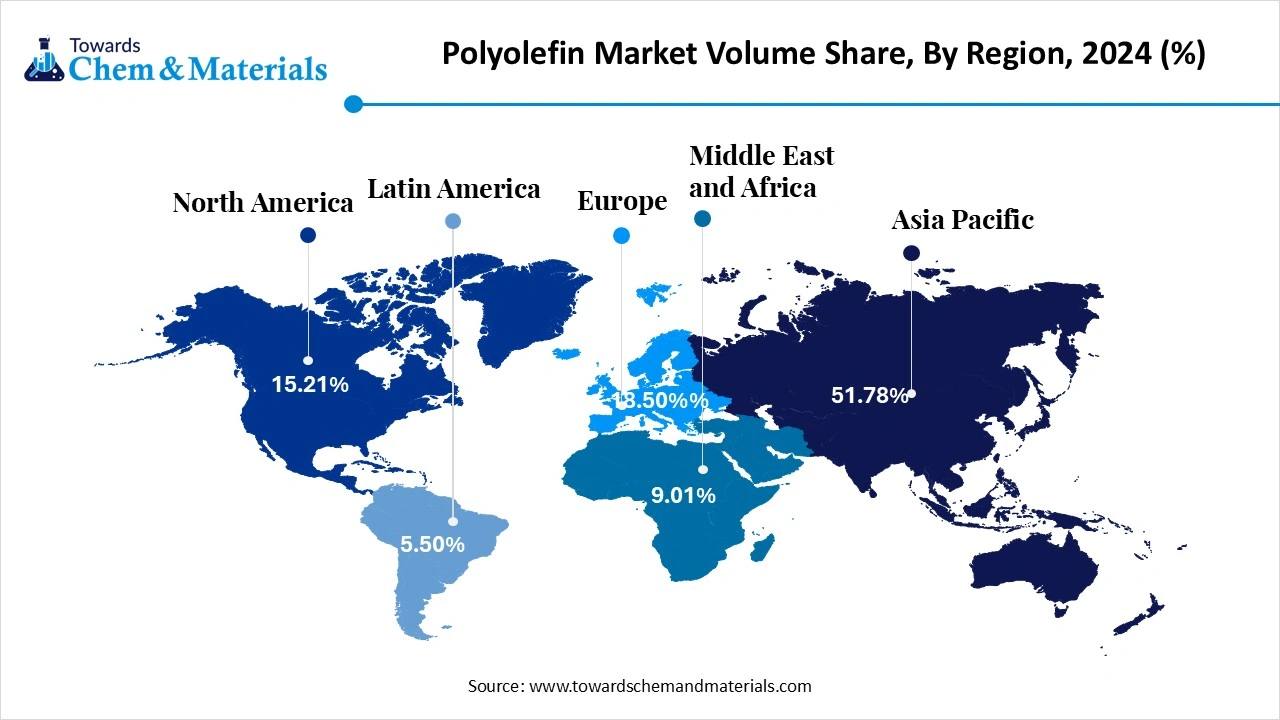

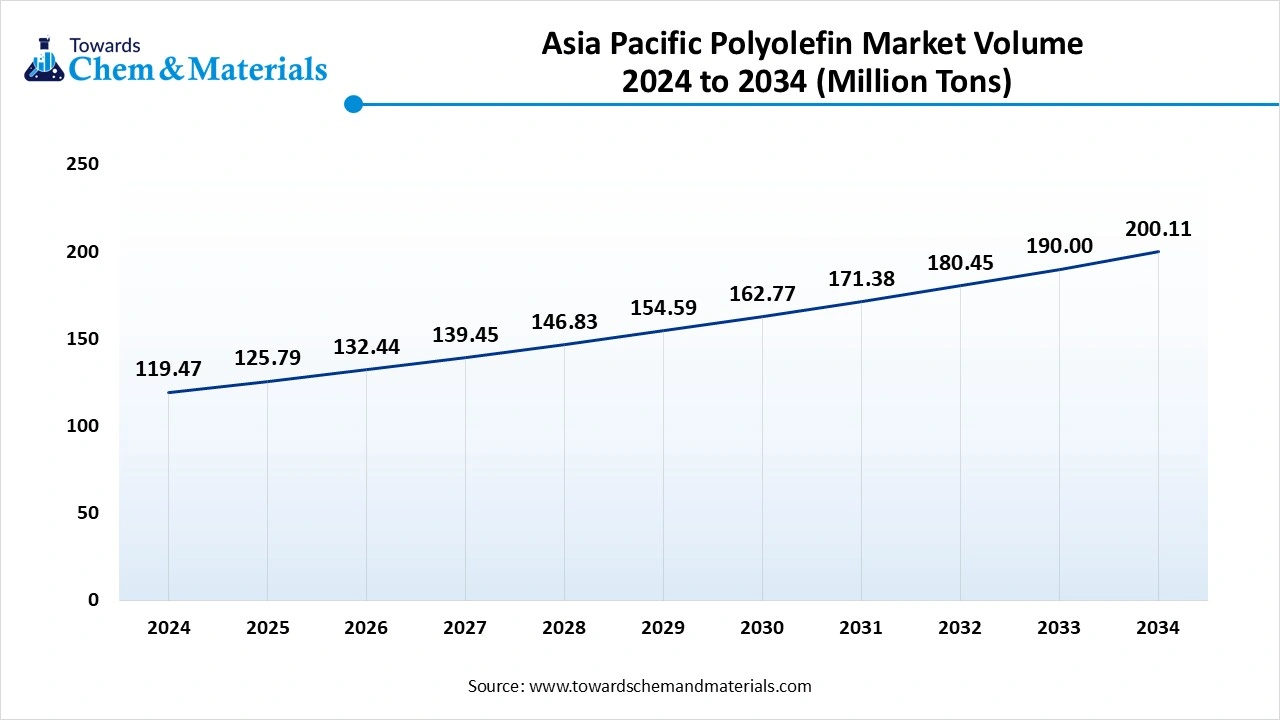

- The Asia Pacific polyolefin market size reached a volume of 119.47 million tons in 2025, the market is further projected to grow at a CAGR of 5.29% between 2025 and 2034, reaching a volume of 200.11 Million Tons by 2034.

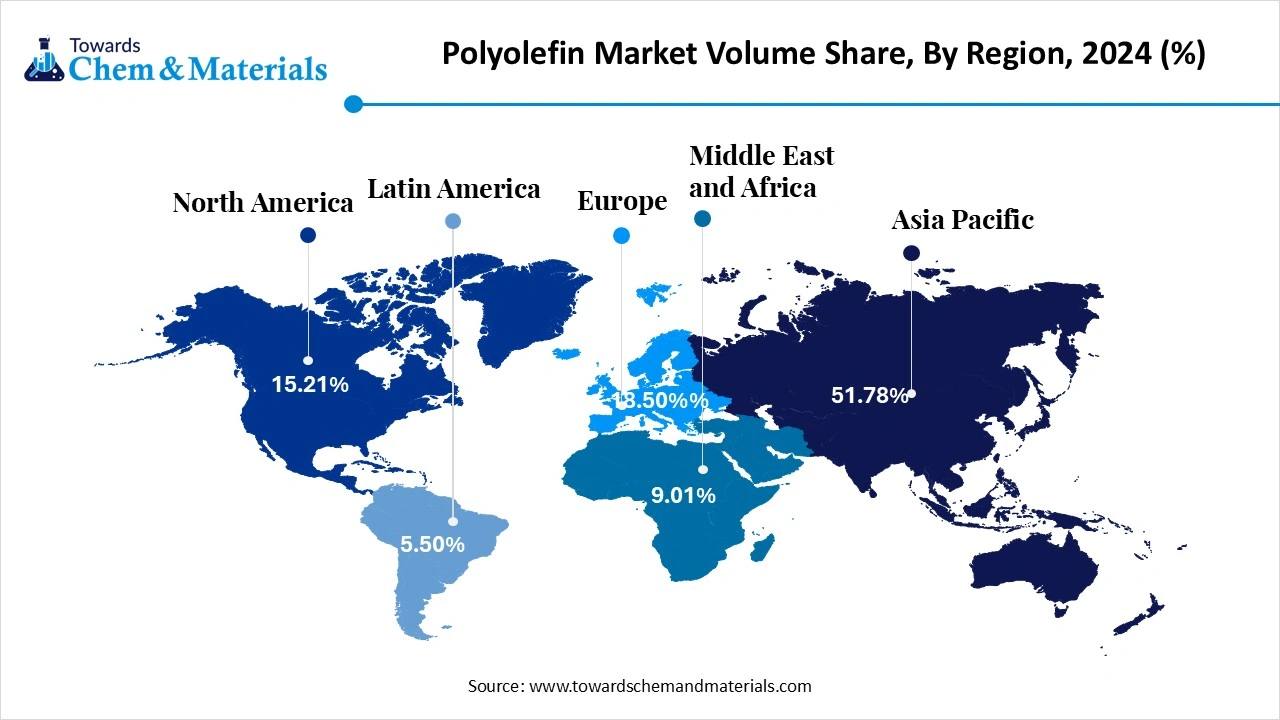

- Asia Pacific dominated the market and accounted for a largest volume share of 51.78% in 2024.

- The Europe has held volume share of around 18.50% in 2024.

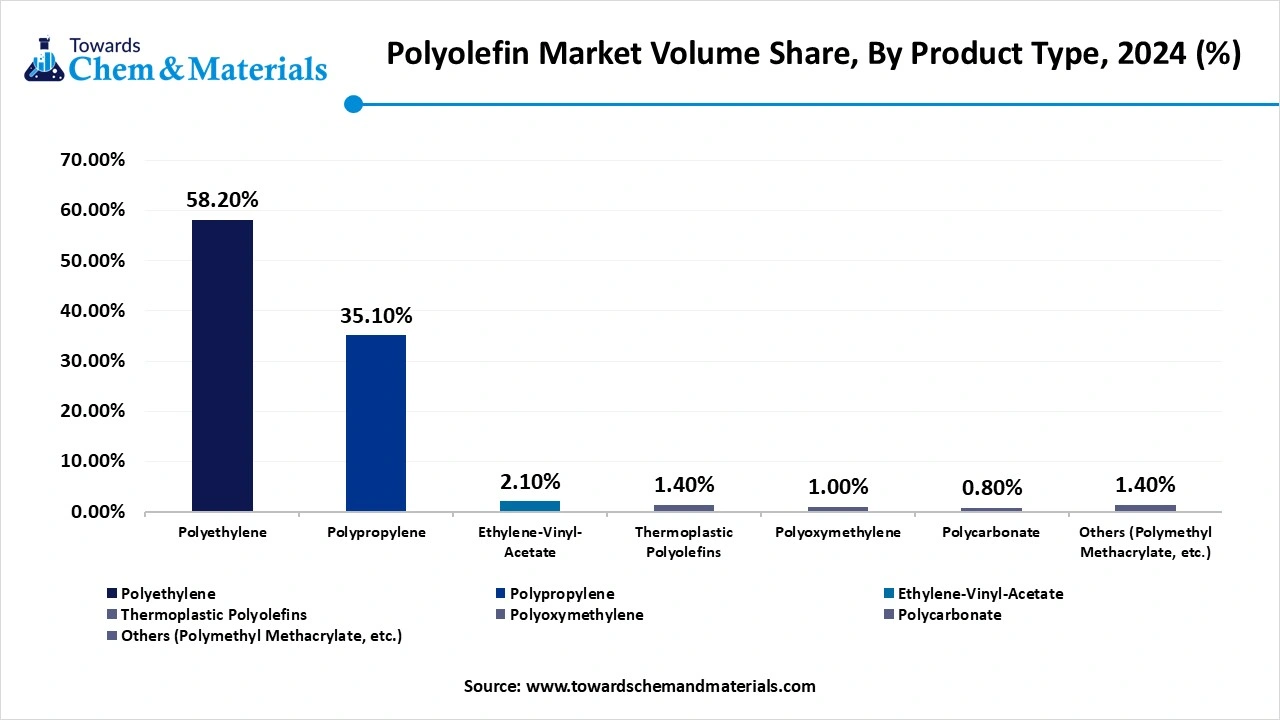

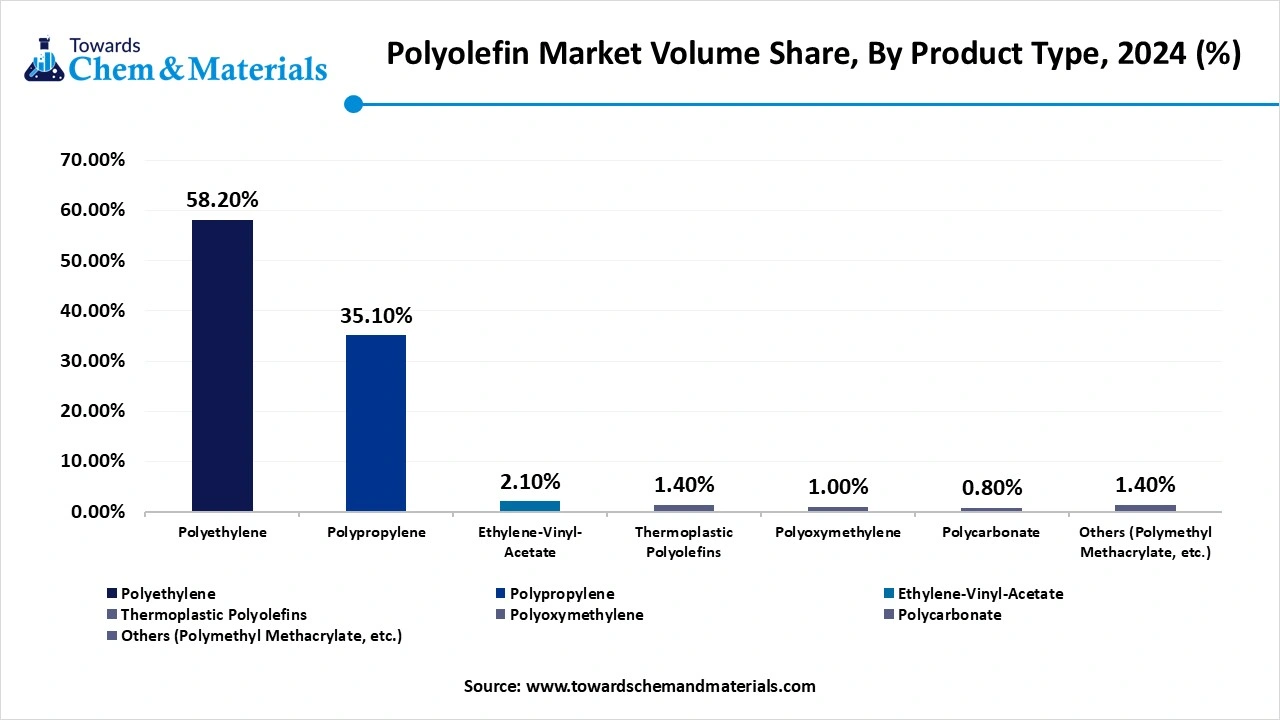

- The Polyethylene (PE) led the polyolefin market across the product segmentation and accounted for a largest volume share of 58.20% in 2024.

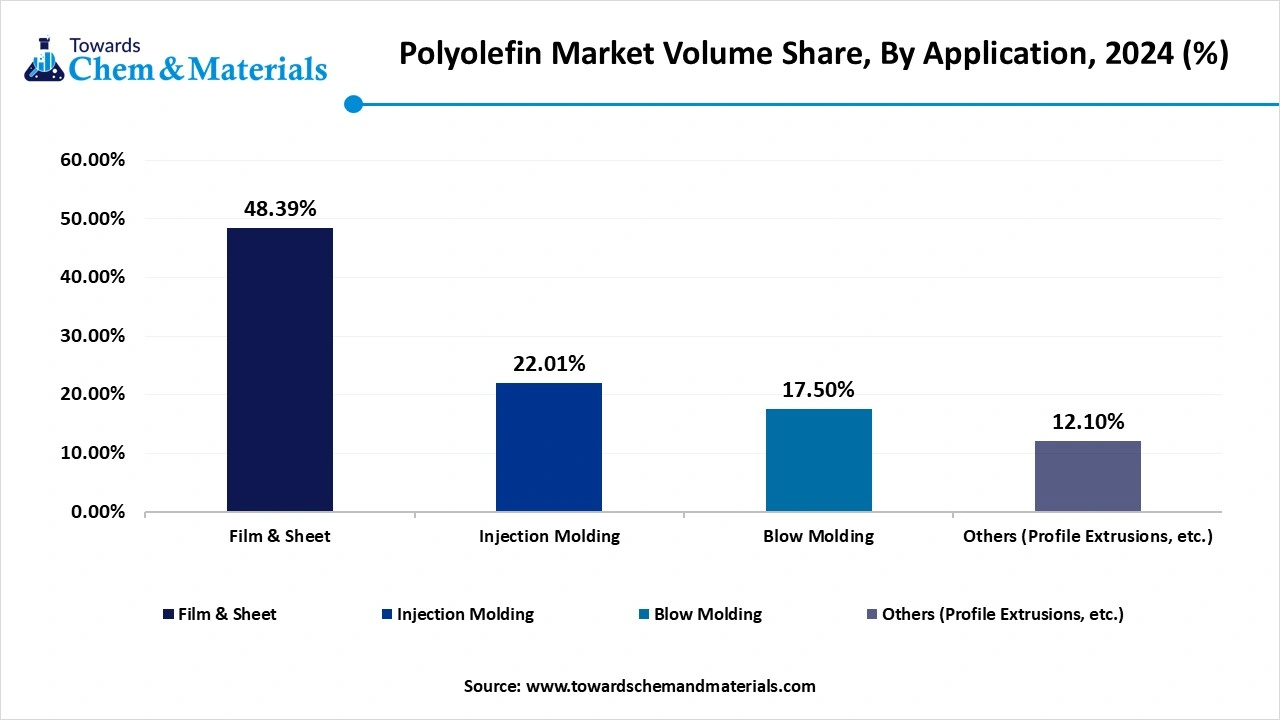

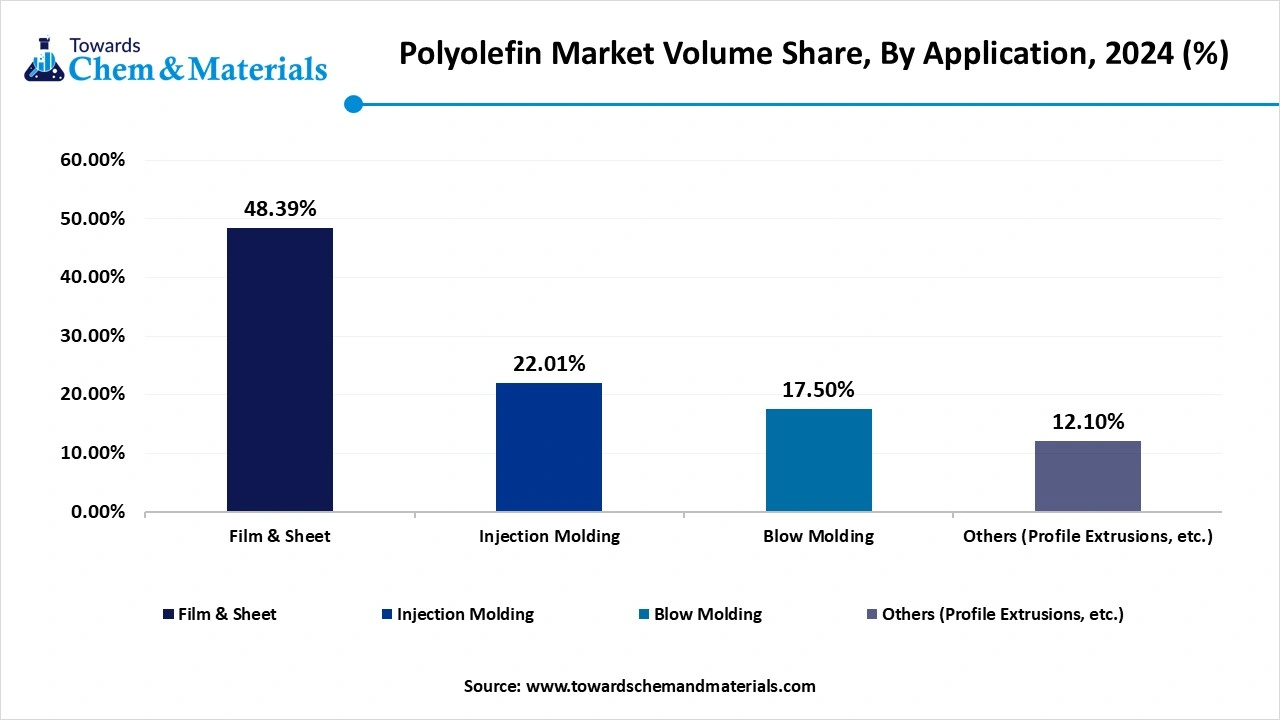

- The film & sheet led the market for polyolefin market across the application segmentation and accounted for a largest volume share of 48.39% in 2024.

Versatility of Polyolefins and Increasing Use in Various Industries, Particularly Packaging, Consumer Goods, and Construction, Accelerate Market Expansion

Polyolefins are derived from olefins, specifically ethylene and propylene. The most common polyolefins are polyethylene and polypropylene. They offer specific properties including the high chemical resistance, good durability, and flexibility. They are widely used in various industries due to their versatility, low cost, and good mechanical properties. Rising demand from the packaging industry, automotive sector and construction industry, boost the market growth.

Polyolefins are widely used in the packaging material including the films, containers, and bags. They are used in building materials like roofing, insulation, and pipes. Booming automotive industry demand the polyolefins in various applications due to their lightweight nature and resistance to harsh condition, make them suitable for vehicle manufacturing. Innovations in polymer processing technologies and the development of biodegradable and recycled-content polyolefins, further drives the polyolefin market.

Market Trends

- Booming packaging industry: Rising adoption of flexible packaging across various industries, drive the market. They are widely used in the food and beverages packaging due to their ability to protect the product from moisture. Polyolefins are also use in the industrial packaging to protect goods during storage and transportation. The rising demand from healthcare sector for medical packaging, medical devices drive the polyolefin market.

- Rising sustainability concern: Rising environmental awareness demands the polyolefins derived from renewable resources, drive the market. Incorporating recycled materials into the polyolefins products reduces plastic waste and promotes resource efficiency. Innovation in the biodegradable polyolefins is also gaining popularity due to their ability to reduce the long term environmental impact.

- Growing automotive industry: Growing automotive industry demands polyolefins in vehicle production application. They are widely used to reduce vehicle weight and improve fuel economy. It is cost effective option, making them great choice for various automotive application. Polyolefins are used to enhance vehicle safety and comfort due to their ability of impact resistance and high durability.

Report Scope

| Report Attributes | Details |

| Market Volume on 2025 | 241.98 Million Tons |

| Expected Volume by 2034 | 371.54 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 4.88% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled | China Petrochemical Corporation, LyondellBasell Industries Holdings B.V., PetroChina Company Limited, TotalEnergies, Chevron Corporation, Repsol, Dow, Inc., Exxon Mobil Corporation, Braskem, Borealis AG |

Market Opportunity

The Rising Demand From the Packaging, Healthcare, and Automotive Industries, Shows Significant Market Opportunities for Polyolefins, The expansion of e commerce and retail sectors increases demand for flexible and rigid packaging solutions shows market oppournities for polyolefins. Rising demand for safe, hygienic, and attractive packaging for food and beverages demands polyolefins in various application including bags, pouches, and containers. Healthcare sector is heavily dependent on sterile and disposable materials, demands polyolefins in application like syringes, IV bottles, and medical devices, may drive the market in the future.

Technological Advancements

Technological advancements create polyolefin market opportunities for polyolefins by enhancing production efficiency, enabling new applications, and driving sustainable solutions. Advancement in new catalyst improves the efficiency and reduces production costs. Advancement in polyolefins properties, allows their use in medical devices and drug delivery systems. Advancement in recycling, particularly chemical recycling, allow for the production of high quality polyolefins from recycled materials. Various research and development in biodegradable polyolefins offer alternative to traditional plastics, drive demand for sustainable packaging and other application, further drive the market.

Market Challenges

Environmental Concerns and Plastic Pollution

Growing public awareness of the environmental impact of plastic, may limit the market. Governments are implementing policies to reduce the plastic consumption and waste increases producer responsibility laws and stricter waste management regulation. Consumers are increasingly looking for alternative to plastics, particularly polyolefins, increases pressure o manufacturer to develop and market more sustainable products. The polyolefins industry is facing lots of pressure to reduce environmental impact through change in production processes, promoting recycling, and exploring alternative materials.

Regional Insights

The Asia Pacific polyolefin market demand stood at 119.47 million tonnes in 2024 and is forecast to reach 200.11 million tonnes by 2034, growing at a healthy CAGR of 5.29% until 2034. Asia pacific is dominated polyolefin market in 2024.

Rising population, rapid urbanization, and strong industrial growth, contributes to market growth. Increasing demand for various products including those that utilize polyolefins for packaging, construction, and other application boost the market. Large manufacturing hubs in countries like China have significant large market of global vehicle production. Rapidly growing industries including the packaging, automotive, and construction increases use of polyolefins, further boost the market. The increasing popularity of e commerce also drives the demand for flexible packaging, further boosting the demand for polyolefins. Polyolefins are relatively affordable material compared to the alternative like metal and glass, making them preferred choice for many applications. Supporting government policies and investment in petrochemical industries in countries like China, India, and Southeast Asia contribute to market growth across this region.

- For Instances, In September 2023, Petro China has launched construction of a $3 billion petrochemical complex in Xinjiang, China. This project includes 11 key facilities, includes two 450,000-tpy polyethylene units with full-density, ethylene plant of 1.2 million metric tons per year (tpy), and a 400,000-tpy polypropylene unit. (Source: reuters.com )

North America expects significant growth in polyolefin market during the forecast period due to robust economic condition, thriving consumer market, and increasing demand from various key industries like packaging and automotive. Strong economy and high disposable income in North America region increases demand of polyolefins in the packaging and consumer goods. Rapid growth of e commerce increased demand of durable and flexible packaging materials, further contribute to market growth across this region. The increasing use of polyolefins in different car parts is also driving the market. The packaging industry, especially in food and beverages, requires polyolefins for protection and shelf life expansion.

Growing need to repair aging infrastructure, especially in water and sewage system, further increase demand for polyolefins pipes. The US government plays a role in supporting the domestic polyolefins industry trough various initiatives like taxes, breaks, and R&D investments, boost the market across this region. The increasing focus on sustainability and the circular economy is influencing the polyolefin market. Companies are investing in renewable feedstocks and developing new technologies to improve the sustainability of polyolefins.

- For Instances, In September 2023, Braskem and WEAV3D Inc. are collaborating to enhance the performance of Braskem's polypropylene (PP) polymer using WEAV3D's composite lattice technology. The aim of this partnership is to create high-performance, lightweight, and sustainable materials for automotive and other structural applications. (Source: Braskem.com)

Polyolefin Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Million Tons 2024 | Volume Share, 2034 (%) | Market Volume Million Tons 2034 | CAGR(2025 - 2034) |

| North America | 15.21% | 35.09 | 14.23% | 52.87 | 4.18% |

| Europe | 18.50% | 42.68 | 17.21% | 63.94 | 4.12% |

| Asia Pacific | 51.78% | 119.47 | 53.86% | 200.11 | 5.29% |

| Latin America | 5.50% | 12.69 | 5.20% | 19.32 | 4.29% |

| Middle East & Africa | 9.01% | 20.79 | 9.50% | 35.30 | 5.44% |

| Total | 100% | 230.72 | 100% | 371.54 | 4.88% |

Segmental Insights

Product Insights

The polyethylene segment held the dominating share of polyolefin market in 2024 due to its versatility and widespread applications, polyethylene is widely used in products including packaging films, bottles, containers, and consumer goods. Polyethylene is used for application were moisture resistance is important due to its high tenacity, impact resistance, chemical resistance, and good electrical insulation. Rising shift towards flexible packaging solutions in food and beverages, consumer goods and industrial application, contribute to growth of this segment. Various industries including packaging, automotive, and consumer good increases demand of polyethylene, boost the market. The rising demand for sustainable packaging solution demands polyethylene because it is recyclable and can be use in various sustainable packaging solutions. Technological advancement in polyethylene production, further enhance the material performance, drive the market.

The polypropylene segment expected to grow at a significant rate in the polyolefin market during the forecast period due to its wide range of applications in automotive, medical, and consumer goods sectors. It is used in lightweight components, packaging, and medical, drive the market. It possesses excellent heat resistance, chemical stability, and mechanical properties, makes suitable for various applications. Due to its lightweight nature it is widely used in automotive industry to improve fuel efficiency and reduced emission. Current researches are focusing on development of new polypropylene grade with enhanced properties; widen its application in various areas. Polypropylene is widely used in the sustainable packaging solutions and recycling initiatives, further driving its demand.

Polyolefin Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Million Tons 2024 | Volume Share, 2034 (%) | Market Volume Million Tons 2034 | CAGR(2025 - 2034) |

| Polyethylene | 58.20% | 134.28 | 55.40% | 205.83 | 4.36% |

| Polypropylene | 35.10% | 80.98 | 36.80% | 136.73 | 5.38% |

| Ethylene-Vinyl-Acetate | 2.10% | 4.85 | 2.40% | 8.92 | 7.01% |

| Thermoplastic Polyolefins | 1.40% | 3.23 | 1.70% | 6.32 | 7.74% |

| Polyoxymethylene | 1.00% | 2.31 | 1.10% | 4.09 | 6.56% |

| Polycarbonate | 0.80% | 1.85 | 1.10% | 4.09 | 9.23% |

| Others (Polymethyl Methacrylate, etc.) | 1.40% | 3.23 | 1.50% | 5.57 | 6.25% |

| Total | 100% | 230.72 | 100% | 371.54 | 4.88% |

Application Insights

The film & sheet segment held the dominating share of polyolefin market in 2024 due to is broad range of applications and the material’s inherent properties. The film and sheet segment is strongly used in packaging for food, consumer goods, and pharmaceuticals due to their ability to provide moisture and durability. Polyolefins can be processed into various film sheet forms. Including shrink wrap, agriculture film to meet the specific application requirements. They are relatively less expensive compare to other plastics so become a great choice for film and sheet production. They offer good tensile strength and durability so increases their use in construction materials and industrial liners. They are highly used in packaging and storage of various products due to ther ability to resistance to many chemicals and solvents. They are derived from renewable sources like sugar cane, making them more sustainable than traditional petroleum based plastics, further drives the market.

The injection molding segment is expected to grow significantly in the polyolefin market during the forecast period. Rising demand from automotive, healthcare, and packaging industries along with advancement in technology and materials contribute to market growth of this segment. Increasing demand for lightweight materials and electric vehicle from automotive industry, rising demand for medical devices and equipment, contribute to market growth of injection molding segment. Innovation in automation and the development of new materials, such as high performance polymers and biodegradable plastics, further contribute to expansion of market growth. Injection molding offers cost effective mass production, increases their use manufacturing process for various applications. Sifting trend towards sustainable and eco friendly products, further contribute to market growth.

Polyolefin Market Volume Share, By Application, 2024-2034 (%)

| By Application | Volume Share, 2024 (%) | Market Volume Million Tons 2024 | Volume Share, 2034 (%) | Market Volume Million Tons 2034 | CAGR(2025 - 2034) |

| Film & Sheet | 48.39% | 111.65 | 46.00% | 170.91 | 4.35% |

| Injection Molding | 22.01% | 50.78 | 23.80% | 88.43 | 5.70% |

| Blow Molding | 17.50% | 40.38 | 18.20% | 67.62 | 5.90% |

| Others (Profile Extrusions, etc.) | 12.10% | 27.92 | 12.00% | 44.58 | 5.34% |

| Total | 100% | 230.72 | 100% | 371.54 | 4.88% |

Recent Developments

- In May 2023, Borealis launched a new line of sustainable polyolefins using renewable feedstock. They also introduced Stelora, known for its strength, durability, and thermal resistance. It is used in applications requiring high-temperature resistance, such as in e-mobility and renewable energy.

(Source: borealisgroup.com ) - In May 2024, Clariant launched a new product range called AddWorks PPA focused on sustainable polyolefin film extrusion, specifically addressing concerns about perfluoralkyl substances (PFAS) in the environment. (Source:clariant.com)

- In March 2025, LyondellBasell invests to expand propylene production capacity at its near Houston. This expansion will strengthen LyondellBasell ability to meet customer demand and reduce exposure to market volatility.(Source: lyondellbasell.com )

Top Companies List

- China Petrochemical Corporation

- LyondellBasell Industries Holdings B.V.

- PetroChina Company Limited

- TotalEnergies

- Chevron Corporation

- Repsol

- Dow, Inc.

- Exxon Mobil Corporation

- Braskem

- Borealis AG

Segments Covered in the Report

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Ethylene-Vinyl Acetate (EVA)

- Thermoplastic Polyolefins (TPO)

- Polyoxymethylene (POM)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Others

By Application

- Film & Sheet

- Injection Molding

- Blow Molding

- Profile Extrusion

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait