Content

What is the North America Building Thermal Insulation Market Size?

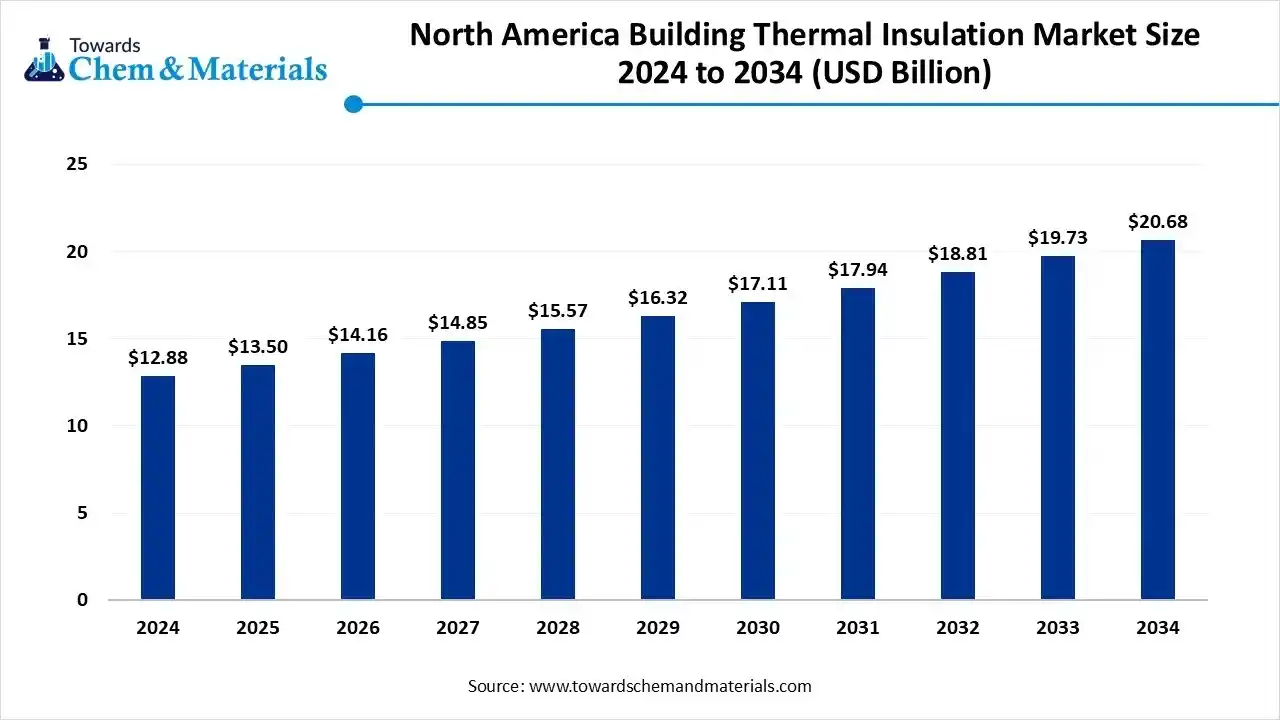

The North America building thermal insulation market size was valued at USD 12.88 billion in 2024 and is expected to hit around USD 20.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.85% over the forecast period from 2025 to 2034. U.S building thermal insulation market dominated with the largest revenue share of 75% in 2024. The infrastructure updation and green development are strengthening the foundation for future sector growth.

Key Takeaways

Key Takeaways

- United States dominated the North America building thermal insulation market with approximately 75% industry share in 2024.

- By material type, the fiberglass segment led the market with approximately 35% industry share in 2024.

- By material type, the polyeurathane segment is expected to grow at the fastest rate in the market during the forecast period.

- By form type, the batts and rolls segment emerged as the top-performing segment in the market with approximately 40% industry share in 2024.

- By form type, the spray foam segment is expected to lead the market in the coming years.

- By application type, the wall segment led the market with approximately 40% share in 2024.

- By application type, the roof segment is expected to capture the biggest portion of the market in the coming years.

- By end-use type, the residential control segment led North America building thermal insulation market with approximately 50% industry share in 2024.

- By end-use type, the commercial segment is expected to grow at the fastest rate in the market during the forecast period.

Market Overview

How North America Building Thermal Material Market Evolved?

The North America building thermal insulation market refers to materials and solutions that reduce heat transfer in buildings, thereby improving energy efficiency and reducing operational costs. Widely used in residential, commercial, and industrial structures, these insulation materials include fiberglass, mineral wool, polystyrene, polyurethane foams, and cellulose. Growth is driven by stringent building codes, green building adoption, energy-saving initiatives, and sustainability goals.

- In January 2025, the Ontario Government introduced its latest energy efficiency programs. This program has included energy efficiency infrastructure rebuilding, such as home and office renovations, as per the information. (Source: news.ontario.ca)

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 14.16 Billion |

| Expected Size by 2034 | USD 20.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material, By Form, By Application, By End-Use Industry |

| Key Companies Profiled | GAF Material Corporation, Huntsman International LLC, Johns Manville Corporation, Knauf Insulation, Owens Corning, ROCKWOOL Insulation A/S, Dow Inc., DuPont, Kingspan Group |

North America Building Thermal Insulation Market Outlook :

- Industry Growth Overview: Between 2025 and 2034, the greater push for net-zero buildings has contributed to favorable market economies for the industry in recent time. Also, the government in North America has seen the implementation of the carbon reduction goals, where insulation has become the key element in regulatory discussions in North America in the past few years.

- Sustainability Trends: The usage of recycled waste in insulation production has enabled the sector to explore untapped potential in the past years. Moreover, the manufacturers are observed as using PET bottles and even agricultural waste in making high-performance insulation boards.

- Global Expansion: The regional update and renovation of old infrastructure is likely to help producers capture a greater portion of the industry’s potential during the forecast period. Moreover, the government is actively supporting these education initiatives by releasing greater subsidies and beneficial policies for the consumers in North America these days. Also, the manufacturers can gain a competitive advantage in the market by offering attractive and easy solutions for insulation in the upcoming period.

Key Technological Shifts in the North America Building Thermal Insulation

The technology upgrade has actively impacted the industry dynamics in recent years. The emergence of smart insulation has actively powered the industry's potential in recent years, where manufacturers are integrating with smart sensors. Also, several manufacturers are seen in installing high-end technologies in their manufacturing plants to reduce human error and minimize production times.

Trade Analysis of the North America Building Thermal Insulation Market:

- Import, Export, Consumption, and Production Statistics

- China has recorded 7 shipments of thermal insulation foam from Jun 2024 to May 2025.(Source: www.volza.com)

- Russia has seen under a heavy export of thermal insulation material with 170 shipments in 2024.(Source: www.volza.com)

North America Building Thermal Insulation Market Value Chain Analysis

- Distribution to Industrial Users : The distribution and industrial use of thermal insulation in North America mainly relies on factors, suppliers, manufacturers, and installers, as per the recent information.

- Chemical Synthesis and Processing: The thermal insulation is mainly processed by materials such as mineral wood, polyurethane foam, aerogels, and others.

- Regulatory Compliance and Safety Monitoring: The regulatory compliance of building thermal insulation in North America is held by regional standards like the International Energy Conservation Code and others.

North America Building Thermal Insulation Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Department of Energy (DOE) | ASHRAE 90.1 | Energy efficiency | The DOE promotes energy efficiency in buildings and provides tools, like its ZIP code insulation calculator |

| Canada | National Research Council Canada (NRC) | National Building Code of Canada (NBCC) | Climate resilience | The NRC oversees the Canadian Commission on Building and Fire Codes (CCBFC), which develops Canada's national model building codes. |

Segmental Insights

Material Type Insights

How did the Fiberglass Segment Dominate the North America Building Thermal Insulation Market in 2024

The fiberglass segment held the largest share of the market in 2024, due to factors such as cost-effectiveness, easy installation, and greater availability. Moreover, the major building firms have been actively seen in preferring these fiberglass batts and rolls for construction in recent years. Also, by having excellent fire resistance and greater thermal performance, the fiberglass segment is set to create a competitive advantage in production spaces.

The polyurethane segment is expected to grow at a notable rate during the predicted timeframe, consistent with its characteristics, such as the greater thermal efficiency and ability to provide air-tight sealing. Moreover, by reducing the heat loss more efficiently, the polyurethane may remain in enhanced brand positioning and product offerings in the coming years.

Form Type Insights

Why does the Batts and Rolls Segment Dominate the North America Building Thermal Insulation Market?

The batts and rolls segment held the largest share of the market in 2024, because they are the most affordable and commonly used form in residential construction. They can be easily cut to fit walls, floors, and ceilings, making them popular with contractors and DIY homeowners. Fiberglass batts are widely available at local hardware stores, which increases accessibility.

The spray foam segment is expected to grow at a notable rate due to having superior energy-saving properties as compared to batts and rolls. Moreover, the spray foam has the capacity to fill minor gaps and cracks, spreading the market potential in the current period. This makes buildings more efficient and lowers utility bills. Spray foam also adds structural strength and resists moisture, preventing mold issues.

Application Type Insights

How did the Wall Segment Dominate the North America Building Thermal Insulation Market in 2024?

The wall segment dominated the market with the largest share in 2024 because walls are the largest surface area of most buildings and the primary source of heat loss. Insulating walls provides the greatest impact on energy efficiency, making it a priority in both residential and commercial construction. Materials like fiberglass batts are specifically designed for wall cavities, making them convenient and cost-effective.

The roof segment is expected to grow at a significant rate because heat rises, and poorly insulated roofs cause major energy losses in buildings. With climate change causing hotter summers and colder winters, roofs are now seen as critical for energy savings. Advanced insulation materials like spray foam and polyurethane are increasingly used in roofing applications to improve thermal resistance and prevent leaks.

End Use Industry Insights

Can insulation Really Cut Down Energy Bills This Much?

The residential segment held the largest share of the market in 2024 because of massive housing demand and frequent retrofitting of older homes in the U.S. Families want lower energy bills, and insulation is one of the easiest upgrades to achieve that. Government programs and tax credits also encourage homeowners to insulate attics, walls, and basements. Fiberglass batts and rolls are widely used in residential projects, keeping costs affordable while improving comfort.

The commercial segment is expected to grow at a notable rate during the predicted timeframe because large office buildings, schools, hospitals, and shopping centers consume far more energy than homes. Rising energy costs and stricter building codes push businesses to invest heavily in high-performance insulation. Green building certifications like LEED also drive demand for advanced insulation in commercial projects.

United States Building Thermal Insulation Market Trends

The United States dominated the North America building thermal insulation market in 2024, akin to the advanced construction infrastructure and sustainability implementation. Moreover, the stricter energy efficiency standards are positioning industry for long-term expansion. Also, consumers are accepting the standards of thermal insulation that undergo the regulation of firms like LEED and federal energy codes in the current period. Moreover, the heavy push of the infrastructure updation is actively strengthening the foundation for future sector growth.

Recent Developments

- In January 2025, the Panasonic Corporation introduced its own OASYS residential central air conditioning system in the United States. Also, it’s the first central air conditioning system that includes various elements like ventilation fans, mini split AC, and others.(Source: news.panasonic.com)

- In April 2025, Kingspan introduced its latest vacuum insulation panel in North America. The newly launched product is named OPTIM-R E, as per the information provided by the company recently.(Source: www.roofingcontractor.com)

Top Vendors in the North America Building Thermal Insulation Market & Their Offerings:

- Anco Products, Inc.: An ISO 9001-certified manufacturer and subsidiary of APi Group that specializes in producing fiberglass insulation products, flexible air duct systems, and pre-engineered metal building insulation.

- Atlas Roofing Corporation: An innovative manufacturer of residential and commercial building materials.

- Cellofoam North America Inc: multi-line manufacturer of expanded polystyrene (EPS) foam products used for thermal insulation in residential and commercial construction.

- CertainTeed Corporation: A major North American manufacturer of building materials.

Other Top Companies list

- GAF Material Corporation

- Huntsman International LLC

- Johns Manville Corporation

- Knauf Insulation

- Owens Corning

- ROCKWOOL Insulation A/S

- Dow Inc.

- DuPont

- Kingspan Group

Segment Covered

By Material

- Fiberglass

- Mineral Wool

- Polystyrene (EPS, XPS)

- Polyurethane (PUR/PIR)

- Cellulose

- Others

By Form

- Batts & Rolls

- Rigid Boards

- Sprayed Foam

- Loose-Fill

- Others

By Application

- Roof

- Wall

- Floor

- Others

By End-Use Industry

- Residential

- Commercial

- Industrial