Content

Europe Polymer Market Size and Share 2034

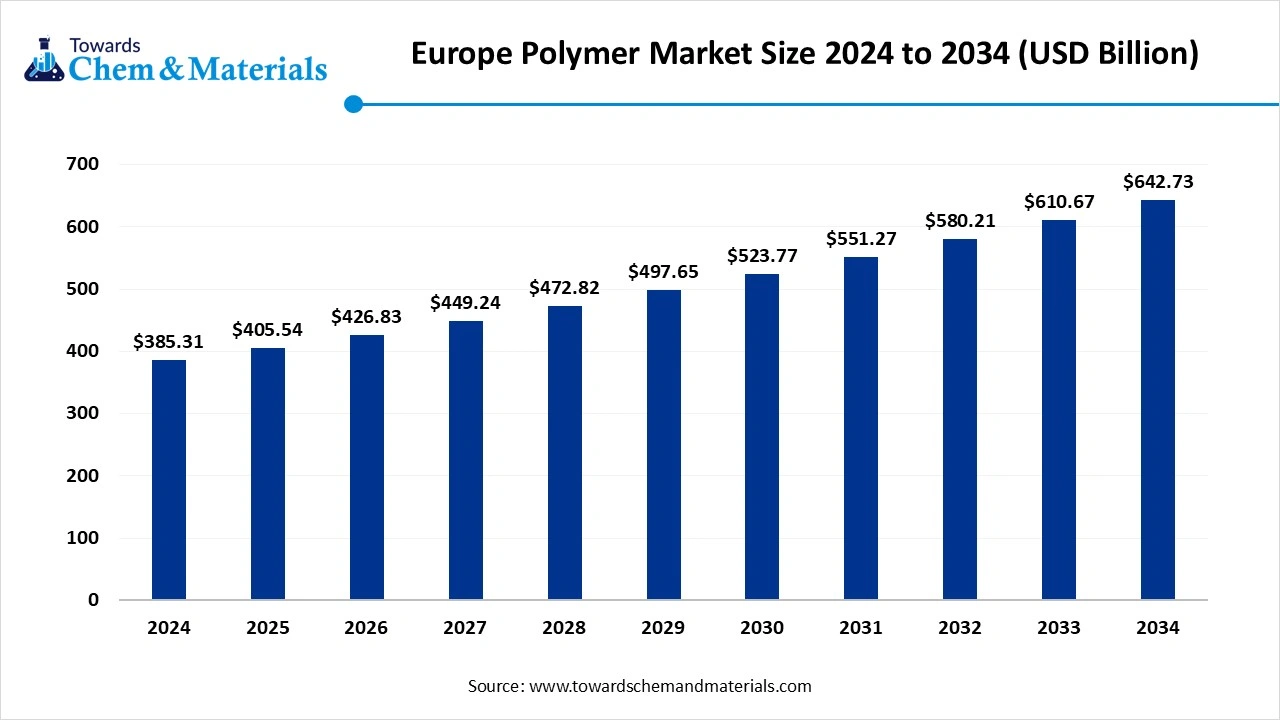

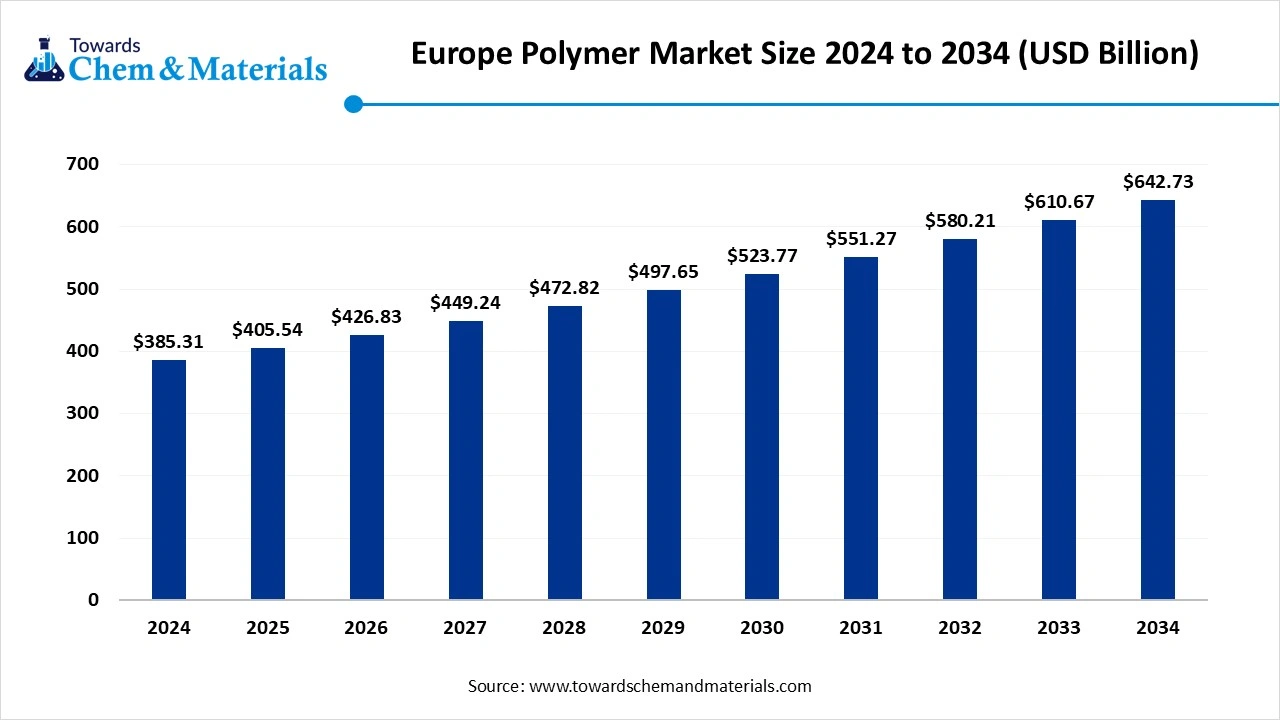

The Europe polymer market size was approximately USD 385.31 billion in 2024 and is projected to reach around USD 642.73 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 5.25% between 2025 and 2034. The increasing use of lightweight materials from various end-user industries is the key factor driving market growth. Also, the ongoing advancements in polymer chemistry and processing technologies, coupled with the growing demand for sustainable polymers, can fuel market growth further.

Key Takeaways

- By polymer type, the polyethylene (PE) segment dominated the market with a 35% share in 2024.

- By polymer type, the polyamide (PA) segment is expected to grow at the fastest CAGR over the forecast period.

- By manufacturing, the addition polymerization segment held a 40% market share in 2024.

- By manufacturing, the emulsion polymerization segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the packaging segment held a 45% market share in 2024.

- By application, the healthcare segment is expected to grow at the fastest CAGR over the projected period.

- By recycling method, the mechanical recycling segment dominated the market by holding a 60% share in 2024.

- By recycling method, the chemical recycling segment is expected to grow at the fastest CAGR over the study period.

What is Polymer?

A growing emphasis on achieving a circular economy target by 2030 is one of the major factors fuelling market growth. The market encompasses the manufacturing, sale, and application of polymers across various industries such as automotive, packaging, and electronics.

The market includes a range of polymer types, from commodities to high-grade specialty polymers. Polymers offer properties such as flexibility, clarity, and durability for different medical products.

Europe Polymer Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the market is anticipated to witness substantial growth due to rapid innovations in blending, recycling, and smart material applications, which are enabling the new uses for eco-friendly polymers. Urbanization and infrastructure development are boosting the demand for polymer-based insulation, pipes, and window frames with other building materials.

- Sustainability Trends: The ongoing inclination towards recycled and bio-based polymers is a key sustainability trend in the market, fuelled by regulatory pressure from frameworks such as REACH and the EU Green Deal and the push for a circular economy. Also, the packaging sector is a significant driver, with a focus on compostable, biodegradable, and highly recyclable polymer solutions.

- Global Expansion: Major players in the market, such as BASF SE, are heavily investing in bio-based polymers and expanding their production portfolio. Also, Dow Inc. is working on innovating the circular economy through enhanced recycling and increased use of recycled materials by expanding manufacturing capacity in Europe.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 405.54 Billion |

| Expected Size by 2034 | USD 642.73 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Polymer Type, By Manufacturing Process, By Application, By Recycling Method, |

| Key Companies Profiled | Solvay SA, Lanxess AG, LyondellBasell Industries N.V., Versalis S.p.A., SABIC, Dow Inc., Arkema S.A., Wacker Chemie AG, Celanese Corporation, Evonik Industries AG, Asahi Kasei Corporation, Clariant AG, 3M Company, Lubrizol Corporation, DIC Corporation, Sumitomo Chemical Co., Ltd., JSR Corporation |

Key Technological Shifts in the Europe Polymer Market:

Key technological shifts in the market include the extensive adoption of digitalization, with AI and IoT, along with a significant emphasis on sustainability through recyclable, biodegradable, and bio-based polymers to fulfill circular economy goals. Integration of nanotechnology and novel recycling technologies is also a major driver for enhanced material properties.

Companies such as DOW, BASF, and Mondelēz International are heavily investing in R&D and new production lines to adapt to regulatory pressures and increasing consumer demand for eco-friendly products. Companies are shifting from linear models to circular economy practices, focusing on waste reuse and recycling.

Trade Analysis of Europe Polymer Market: Import & Export Statistics

- Based on 2023 data, Europe is a net exporter of PVC, with exports exceeding 1 million tons against imports of approximately 700,000 tons.

- The United Kingdom exported 445 shipments of polymers between June 2024 and May 2025 (TTM), a 23% increase year-over-year.

- Turkey was the top exporter to Europe in 2023. European buyers are reportedly avoiding Chinese PET due to an anti-dumping investigation.

Value Chain Analysis of Europe Polymer Market

- Feedstock Procurement : It involves the acquisition of the raw materials required for polymer production, such as petrochemicals and recycled feedstock.

- Chemical Synthesis and Processing : It refers to the industrial processes that create polymer materials from chemical components and then convert them for various applications.

- Packaging and Labelling : Packaging and labelling of the polymers in the region are heavily influenced by the new Packaging Waste Regulation (PPWR), which focuses on environmental sustainability.

- Regulatory Compliance and Safety Monitoring : It refers to the adherence to established regulations, law, guidelines, standards, and specifications related to the manufacturing, use, and disposal of polymers within the EU.

Europe Polymer Market’s Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union | REACH Regulation (EC) No 1907/2006 deals with the Registration, Evaluation, Authorization, and Restriction of Chemicals. It is a cornerstone of EU chemicals regulation |

| Germany | A major player in the European market, Germany has a strong focus on innovation and sets international standards for manufacturing processes. |

| United Kingdom | Holds significant market share, with a focus on the automotive and construction industries, and has its own national recycling initiatives. |

Market Opportunity

The Growing Use of Smart Polymers

The growing use of smart polymers is the latest trend, creating lucrative opportunities in the market. These polymers are generally in demand from the health sector. Furthermore, they are used in artificial body parts and biosensors, etc. The biocompatible nature of smart polymers is going to boost their demand and overall growth in the upcoming years.

Market Challenge

Recycling Infrastructure Limitations

The lack of adequate recycling infrastructure and waste management exacerbates plastic waste concerns, which is a major factor hindering market growth. Moreover, the market is highly competitive, which leads to pricing issues in mature segments such as construction and packaging. Hence, small and mid-sized market players may find it challenging to keep pace with regulatory and technological changes.

Segmental Insights

Polymer Type Insight

Which Polymer Type Segment Dominated the Europe Polymer Market in 2024?

The polyethylene (PE) segment dominated the market with a 35% share in 2024. It is a sub-segment of the thermoplastic segment. The dominance of the segment can be attributed to the growing product demand from the automotive industry for fuel-efficient and lightweight vehicle parts. Additionally, PE's low density makes it crucial for minimizing vehicle weight by enhancing overall fuel efficiency and safety.

The polyamide (PA) segment is expected to grow at the fastest CAGR over the forecast period. It is another subsegment of the thermoplastic segment. The growth of the segment can be credited to its superior thermal and chemical resistance, strength-to-weight ratio, and electrical insulating properties. Also, polyamide is extensively used in food packaging for applications such as sausage casings and meat packaging.

Manufacturing Insight

How Much Share Did the Addition Polymerization Segment Held in 2024?

The addition polymerization segment held a 40% market share in 2024. The dominance of the segment can be linked to the growing demand for polypropylene (PP) and polyethylene (PE) in automotive, packaging, and consumer goods. In addition, market players are introducing new technologies and formulations to enhance the performance and sustainability of these polymers, driving segment growth further.

The emulsion polymerization segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing demand for high-performance and sustainable paints and coatings in the automotive and construction sectors, coupled with innovations in bio-based materials. Moreover, the EU's emphasis on sustainability and circular economy models propels the recyclable emulsion polymers.

Application Insight

Which Application Segment Dominated the Europe Polymer Market in 2024?

The packaging segment held a 45% market share in 2024. The dominance of the segment is owed to the consumer lifestyle changes, such as a preference for convenience foods and the growing e-commerce sector. The rising demand for natural, paraben-free, and cruelty-free cosmetic products is driving towards greater use of sustainable and recyclable packaging for these goods.

The healthcare segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to growing demand for medical devices along with the rise in chronic diseases, which fuels the demand for high-performance polymers. Additionally, the growing adoption of minimally invasive surgeries, which minimize recovery times and pain, increases the need for durable and biocompatible polymeric components.

Recycling Method Insight

Why Did The Mechanical Recycling Segment Dominated The Europe Polymer Market 2024?

The mechanical recycling segment dominated the market by holding a 60% share in 2024. The dominance of the segment can be attributed to the growing demand for sustainable products and ongoing investments in recycling infrastructure. Furthermore, advancements in mechanical recycling practices are driving the manufacturing of high-quality recycled plastics that meet international standards.

The chemical recycling segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the integration of recycled plastics into sectors such as automotive, packaging, and textiles. The cost-effectiveness of recyclable materials can offer incentives for companies to adopt circular practices, leading to further market expansion.

Country Insights

The Western Europe held a 50% market share in 2024. The dominance of the region can be attributed to the ongoing advancements in bioplastic and innovative recycling technologies, coupled with the consumer demand for eco-friendly products. In addition, the increasing demand for energy-efficient and durable plastic components is driving regional growth soon.

The Eastern Europe is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be credited to the favorable government initiatives, rapid industrialization, and rapid infrastructure development in this European region. Furthermore, collaboration among public and private sectors with access to EU funding facilitates a dynamic advancement in the ecosystem in Eastern Europe.

Country-level Investments & Funding Trends for the Europe Polymer Market:

- Germany: Leads in R&D, advanced manufacturing, and the commercialization of Polymer Polyol technologies.

- France: France is a leader in R&D and sustainability, with strong government backing for innovative and eco-friendly solutions.

- United Kingdom (UK): Rapid adoption of next-generation Polymer Polyol technologies is supported by favourable government policies.

Top Vendors in Europe Polymer Market & Their Offerings:

- BASF SE: BASF SE is a global leader in the chemical industry, with a significant presence in the polymer market through its Performance Materials segment, offering a broad range of engineering plastics.

- INEOS Group: INEOS is a major global player in the polymer market, with major European and North American polymer businesses, and a focus on producing olefins and polyolefins for diverse industries.

- Covestro AG: Covestro AG is a leading global company in the high-tech polymer materials market, developing innovative solutions for sectors like automotive, construction, and electronics.

Other Players

- Solvay SA

- Lanxess AG

- LyondellBasell Industries N.V.

- Versalis S.p.A.

- SABIC

- Dow Inc.

- Arkema S.A.

- Wacker Chemie AG

- Celanese Corporation

- Evonik Industries AG

- Asahi Kasei Corporation

- Clariant AG

- 3M Company

- Lubrizol Corporation

- DIC Corporation

- Sumitomo Chemical Co., Ltd.

- JSR Corporation

Recent Development

- In March 2025, Agilyx ASA introduced Plastyx in partnership with Carlos Monreal for feedstock management. Plastyx aims to be the region's major feedstock supplier to the developed plastic recycling market.(Source: www.indianchemicalnews.com)

Segment Covered

By Polymer Type

- Thermoplastics

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Rigid PVC

- Flexible PVC

- Polystyrene (PS)

- GPPS

- HIPS

- Polyamides (PA)

- PA6

- PA66

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene Terephthalate (PET)

- Polyoxymethylene (POM)

- Polymethyl Methacrylate (PMMA)

- Polyethylene (PE)

- Elastomers

- Styrene-Butadiene Rubber (SBR)

- Nitrile Rubber (NBR)

- Ethylene Propylene Diene Monomer (EPDM)

- Thermoplastic Elastomers (TPE)

- Styrenic Block Copolymers (SBC)

- Thermoplastic Polyolefins (TPO)

- Thermosets

- Epoxy Resins

- Phenolic Resins

- Unsaturated Polyester Resins (UPR)

- Melamine Formaldehyde

- Urea Formaldehyde

- Polyurethane (Thermoset)

By Manufacturing Process

- Addition Polymerization

- Condensation Polymerization

- Emulsion Polymerization

- Suspension Polymerization

- Melt Polymerization

By Application

- Packaging

- Rigid (Bottles, Containers)

- Flexible (Films, Pouches)

- Automotive

- Interior Components (Dashboard, Seats)

- Exterior Components (Bumpers, Panels)

- Construction

- Pipes & Fittings

- Insulation Materials

- Window Profiles

- Electrical & Electronics

- Insulation Materials

- Cable Sheathing

- Healthcare

- Medical Devices

- Diagnostic Equipment

- Textiles

- Fibers & Yarns

- Nonwoven Fabrics

- Renewable Energy

- Wind Turbine Blades

- Solar Panel Components

By Recycling Method

- Mechanical Recycling

- Shredding

- Pelletizing

- Chemical Recycling

- Depolymerization

- Biological Recycling

- Composting

- Enzymatic Degradation