Content

What is the Current PET Film-Coated Steel Coil Market Size ?

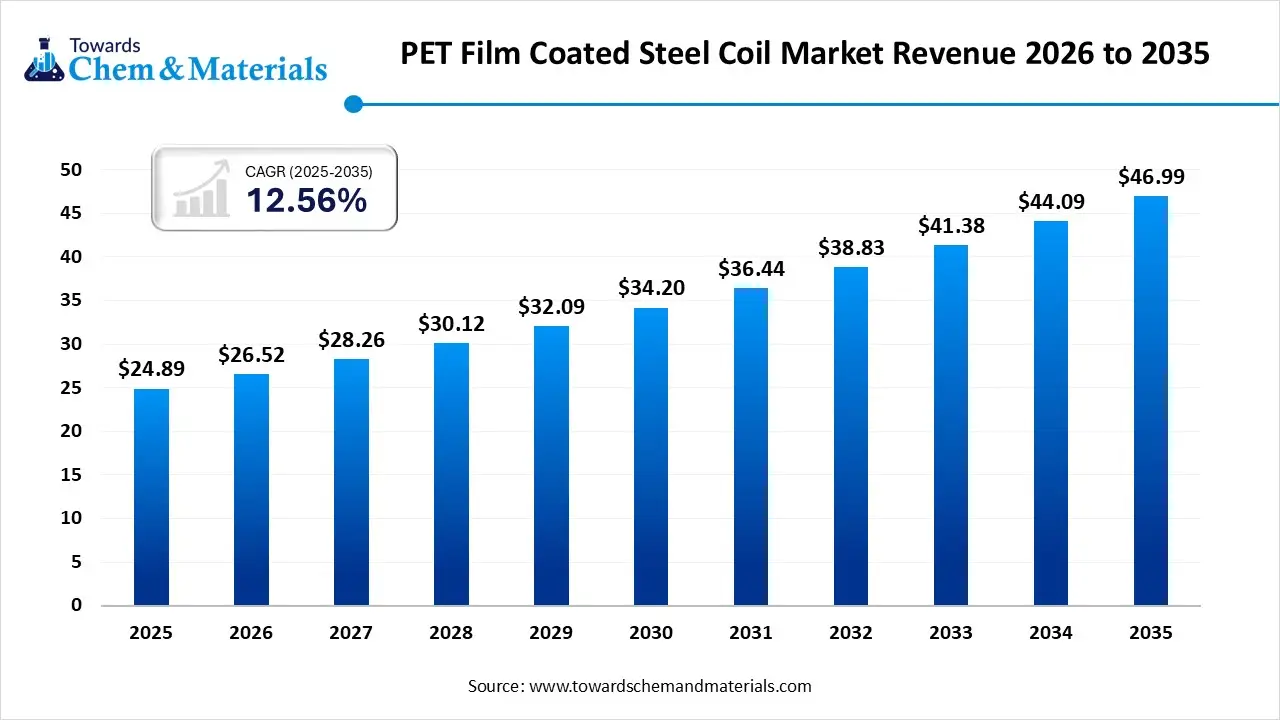

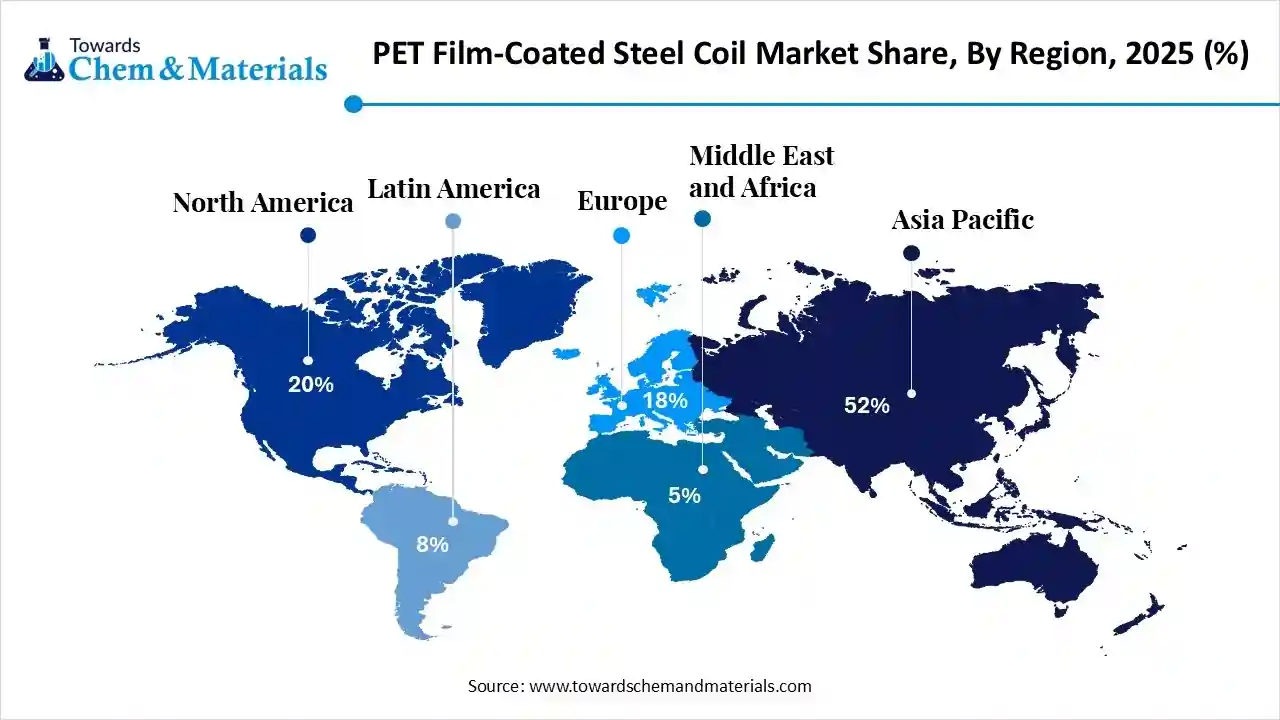

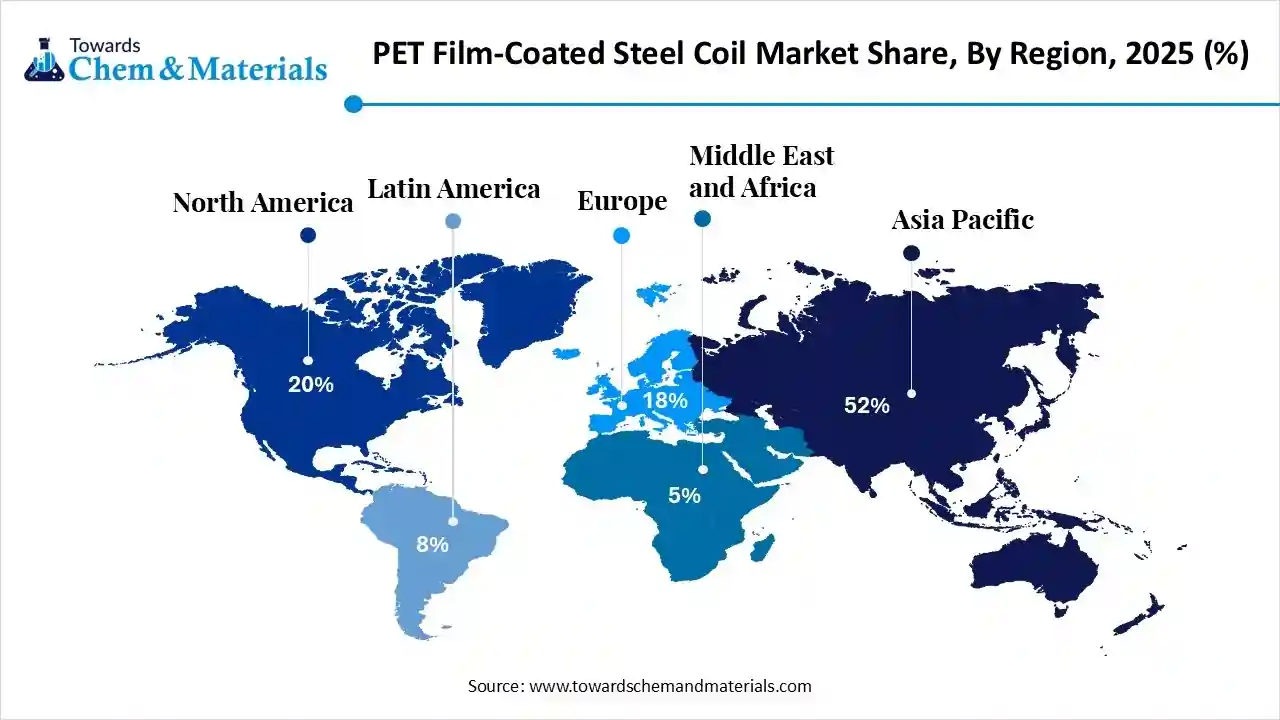

The global PET film-coated steel coil market size was estimated at USD 24.89 billion in 2025 and is expected to increase from USD 26.52 billion in 2026 to USD 46.99 billion by 2035, growing at a CAGR of 12.56% from 2026 to 2035. Asia Pacific dominated the pet film-coated steel coil market with the largest share of 52% in 2025. The growth of the market is driven by technological advances, supportive government policies, growing emerging markets, and the shift from PVC to PET for sustainability and better performance, boosting innovation and efficiency in production. The significance of the PET film-coated steel coil market lies in its unique combination of steel's strength with PET film's durability, corrosion resistance, aesthetic appeal, and lightweight properties, driving growth in appliances, construction, and automotive sectors for higher performance, eco-friendly, and visually appealing products, reducing costs while enhancing longevity and design flexibility.

Market Highlights

- By region, Asia Pacific led the PET film-coated steel coil market held the share of around 52% in 2025.

- By substrate type, the galvanized sheet segment led the market with the largest share of 53% in 2025.

- By coating type, the single-side PET film coating segment led the market with the largest share of 63% in 2025.

- By application, the home applications segment accounted for the largest share of 41% in 2025.

- By end-use industry, the consumer appliances segment dominated with the largest share of 43% in 2025.

PET Film-Coated Steel Coil Market Growth Trends:

- Sustainability Push: Growing environmental regulations favor PET over PVC, with a focus on lower embodied carbon and recyclability.

- Enhanced Aesthetics & Durability: Offers vibrant finishes, superior corrosion resistance, and visual appeal for appliances and construction.

- Lightweighting: Meets demand for lighter, high-performance materials in various industries.

- Technological Advances: AI in design, better coating processes, and automation boost efficiency and customization

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 26.52 Billion |

| Revenue Forecast in 2035 | USD 46.99 Billion |

| Growth Rate | CAGR 12.56% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Substrate Type, By Coating Type, By Application, By End-user Industry, By Regions |

| Key companies profiled | JSW Steel Ltd. (India), Jiangyin Everest Import and Export Co., Ltd. (China), American Nickeloid Company Inc. (USA), Kolor Metal A/S (Denmark), Uttam Galva Steels Limited (India), Acerinox S.A, Nippon Steel Corporation, YIEH Corp., Jiangyin Everest Import and Export Co., Ltd., Chongqing Youngson Metal, Jiangyin Wofeng Metallic Material Co., Ltd., Boxing County Fuhong New Materials Co., Ltd. |

Key Technological Shifts In The PET Film-Coated Steel Coil Market:

Key technological shifts in the PET film-coated steel coil market reflect a move toward higher performance, sustainability, and digitally enhanced manufacturing. Innovations in coating technologies such as advanced application techniques that improve adhesion, UV resistance, scratch resistance, corrosion protection, and color stability are expanding the material’s usability in demanding sectors like construction, automotive, and appliances. These improvements also support broader customization options (e.g., specialized finishes and functional coatings) tailored to specific end-use requirements.

Trade Analysis Of PET Film-Coated Steel Coil Market: Import & Export Statistics

- According to Global Export data, the world exported 61,090 shipments of Coated Coil from June 2024 to May 2025 (TTM). These exports involved 1,478 exporters and 2,683 buyers, showing a 21% increase compared to the previous twelve months.

- The majority of Coated Coil exports from the World are shipped to Indonesia, the United States, and Vietnam.

- The top three global exporters of Coated Coil are India, China, and Vietnam. India leads with 48,390 shipments, followed by China with 35,293 shipments and Vietnam with 30,804 shipments.

- World exported 12,380 shipments of Color Coated Steel Coil, involving 451 exporters and 912 buyers.

- Most exports of Color Coated Steel Coil from the World go to Indonesia, Malaysia, and Cambodia.

- The leading exporters of Color Coated Steel Coil are Vietnam, China, and India. Vietnam exports the most with 6,819 shipments, then China with 3,864, and India with 1,329 shipments

PET Film-Coated Steel Coil Market Value Chain Analysis

- Material Processing & Coating: PET film-coated steel coils are manufactured through processes such as cold-rolled steel preparation, surface cleaning, primer application, PET film lamination, heat bonding, and coil finishing to enhance corrosion resistance, durability, and aesthetic performance.

- Key players : NSSMC (Nippon Steel Corporation), ArcelorMittal, Tata Steel, ThyssenKrupp AG

- Quality Testing and Certification : PET film-coated steel coils require certifications for coating adhesion, corrosion resistance, mechanical strength, food-contact safety, and environmental compliance. Key certifications include ISO 9001, ISO 14001, ASTM coating standards, RoHS compliance, and food-grade certifications where applicable.

- Key players: ISO (International Organization for Standardization), ASTM International, TÜV SÜD, UL Solutions

- Distribution to Industrial Users: PET film-coated steel coils are supplied to appliance manufacturers, building & construction companies, automotive interior component producers, packaging manufacturers, and consumer durable OEMs.

- Key players: JFE Steel Corporation, BlueScope Steel, POSCO.

PET Film-Coated Steel Coil Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA & Canada) | U.S. EPA (Environmental Protection Agency) OSHA (Occupational Safety and Health Administration) U.S. DOT (Department of Transportation) Environment and Climate Change Canada (ECCC) |

Clean Air Act (CAA) – VOC & particulate limits Clean Water Act (CWA) – NPDES permits OSHA 29 CFR (worker safety) Hazardous Materials Regulations (49 CFR) Canadian Environmental Protection Act (CEPA) |

Emissions from coating lines Wastewater discharge & stormwater control Worker safety and hazard communication Transport of coating chemicals & rolls |

Coating operations must control VOCs and particulates; wastewater from coating/pretreatment requires permits. OSHA/WHMIS ensures SDS and hazard communication. DOT/Transport Canada governs the shipment of hazardous coating chemicals. |

| Europe | European Commission European Chemicals Agency (ECHA) National Environment & Workplace Safety Agencies |

REACH Regulation (EC 1907/2006) CLP Regulation (EC 1272/2008) Industrial Emissions Directive (IED) EU Packaging & Waste Directives |

Chemical registration & hazard classification Emission & effluent controls Workplace health & safety End-of-life management |

Raw materials and coatings must be REACH registered; restrictions on certain substances (e.g., chromium, PFAS) drive reformulation. IED/BAT requirements affect large coating operations. |

| Asia Pacific | China MEE (Ministry of Ecology & Environment) Japan METI/MOE India MoEFCC / CPCB Korea Ministry of Environment (MoE) |

China Air & Water Pollution Prevention Laws Japan CSCL & PRTR Law India PWM Rules & Air/Water Acts Korea K-REACH & Waste Control Act |

Local chemical registration Emission & discharge limits Worker safety & chemical use restrictions Reporting of pollutant releases |

China and Korea require chemical registration and hazard labeling. India’s Plastic Waste Management (PWM) rules influence packaging and coating waste. Japan’s PRTR mandates pollutant release reporting. |

| South America | Brazil IBAMA/ANTT Mexico SEMARNAT/PROFEPA Argentina Ministry of Environment |

National Air & Water Quality Regulations Solid Waste Rules Chemical handling and transport laws |

Emission controls Waste management Import/export compliance |

Regulations vary by country, but most require air emissions permits and waste control for coating operations. Brazil’s IBAMA regulates major plants. |

| Middle East & Africa | UAE Ministry of Climate Change & Environment (MOCCAE) Saudi SASO South Africa DMRE |

National environmental protection laws Hazardous chemical handling & workplace safety rules |

Environmental compliance for coatings Worker safety Import conformity |

Regulatory frameworks are emerging, often aligned with international norms (e.g., GHS). Focus is on environmental protection and safe chemical handling in industrial facilities. |

Segmental Insights

Substrate Type Insights

Which Substrate Type Segment Dominated The PET Film-Coated Steel Coil Market In 2025?

The galvanized sheet segment dominated the market with a share of 53% in 2025. PET film-coated steel coils based on galvanized sheets are widely used due to their strong corrosion resistance, mechanical durability, and cost-effectiveness. The zinc coating provides base-level protection, while the PET film enhances surface aesthetics, chemical resistance, and scratch protection. These substrates are preferred in consumer appliances and electrical enclosures requiring long service life and visual appeal.

The galvalume/aluzinc sheet segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Galvalume or aluzinc-based PET film-coated steel coils offer superior corrosion resistance through aluminum-zinc alloy coatings, making them suitable for humid and high-temperature environments. The PET film further improves weatherability and surface protection, supporting applications in premium electrical cabinets and home appliances. Demand is driven by infrastructure modernization and higher durability requirements.

Coating Type Insights

How Did the Single-Sided PET Film Coatings Segment Dominated The PET Film-Coated Steel Coil Market In 2025?

The single-sided PET film coating segment dominated the PET film-coated steel coil market with a share of 63% in 2025. Single-sided PET film-coated steel coils are commonly used where only the exposed surface requires protection and aesthetics, while the reverse side remains functional. It is widely adopted in appliances, panels, and enclosures where internal surfaces face minimal environmental stress.

The antibacterial and functional PET segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Antibacterial and functional PET film coatings are gaining traction due to rising hygiene, safety, and regulatory requirements. They are increasingly used in consumer appliances and electrical equipment, particularly in healthcare-adjacent and high-touch environments, supporting premium product differentiation.

Application Insights

Which Application Segment Dominated The PET Film-Coated Steel Coil Market In 2025?

The home applications segment dominated the market with a share of 41% in 2025. In-home applications, PET film-coated steel coils are used in refrigerators, washing machines, air conditioners, and decorative panels. Growth is supported by rising consumer demand for durable, visually appealing, and low-maintenance household appliances.

The electrical cabinets and enclosures segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Electrical cabinets and enclosures utilize PET film-coated steel coils for insulation compatibility, corrosion protection, and long-term surface integrity. Increasing investments in power infrastructure, automation, and smart grids are driving demand in this application segment.

End-Use Industry Insights

How Did the Consumer Appliances Segment Dominated The PET Film-Coated Steel Coil Market In 2025?

The consumer appliances segment dominated the market with a share of 43% in 2025. The consumer appliances industry is a major end user of PET film-coated steel coils, leveraging their superior finish, color consistency, and durability. Growing appliance manufacturing, especially in emerging economies, continues to support steady market expansion.

The electrical and electronics segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. In the electrical and electronics industry, PET film-coated steel coils are used for panels, housings, and structural components. Rising production of electrical equipment, data centers, and industrial electronics is accelerating adoption across this end-use segment.

Regional Insights

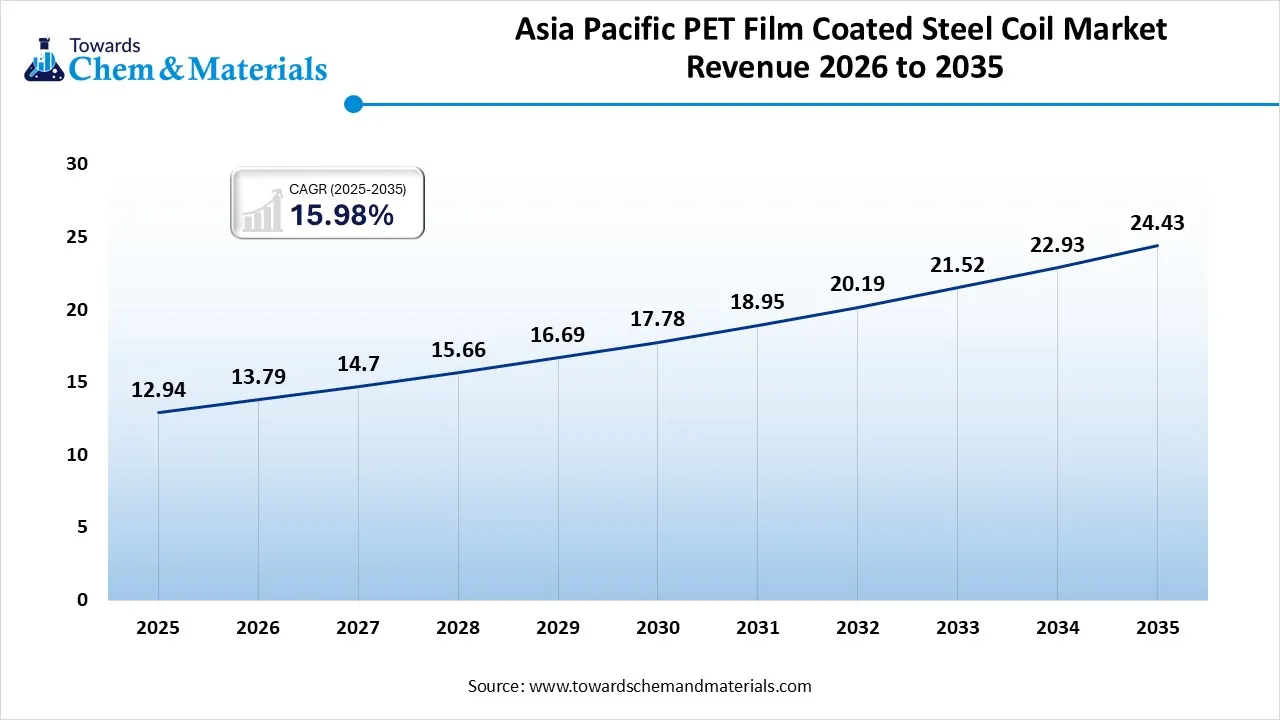

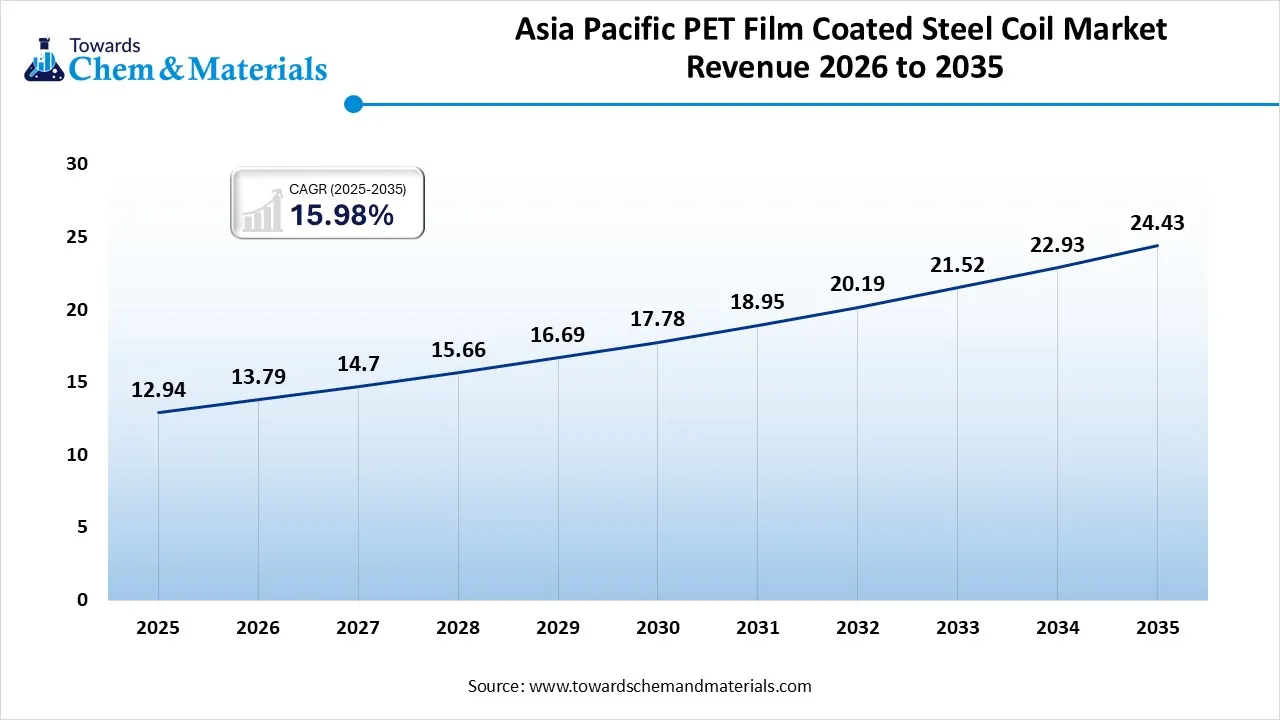

The Asia Pacific PET film-coated steel coil market size was valued at USD 12.94 billion in 2025 and is expected to be worth around USD 24.43 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 15.98% over the forecast period from 2026 to 2035.

Asia Pacific dominated the market with a share of 52% in 2025. Asia Pacific represents the largest and fastest-growing market for PET film-coated steel coils, driven by rapid industrialization, large-scale infrastructure development, and expanding appliance and construction sectors. Cost-effective manufacturing, abundant raw material availability, and increasing adoption of corrosion-resistant and aesthetically enhanced steel products further strengthen the region’s market position.

China: PET Film-Coated Steel Coil Market Growth Trends

China dominates the Asia Pacific PET film-coated steel coil market due to its massive steel production capacity and extensive use in construction, appliances, and automotive applications. Government-backed infrastructure projects, urban housing development, and high demand for pre-coated steel in consumer durables continue to support steady consumption. Additionally, domestic manufacturers are increasingly focusing on quality enhancement and export-oriented production.

North America's Growth Is Driven By Growing Environmental Regulations

North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035. The North American market is driven by demand for high-performance, durable, and environmentally compliant building materials. Strict environmental regulations promoting solvent-free and low-VOC coating alternatives have accelerated the shift toward film-coated steel solutions across industrial and architectural applications.

U.S.: PET Film-Coated Steel Coil Market Growth Trends

The U.S. market benefits from strong residential renovation activity, commercial construction, and demand from appliance manufacturers. PET film-coated steel coils are increasingly preferred for their superior corrosion resistance, long service life, and design flexibility. Technological innovation established distribution networks, and the presence of advanced steel processors further support market growth in the country.

Europe's Efficient Energy Construction Practices Drive The Growth Of The Market.

Europe’s PET film-coated steel coil market is shaped by sustainability initiatives, energy-efficient construction practices, and stringent environmental standards. Growing emphasis on recyclable materials, long-lasting coatings, and reduced lifecycle costs supports adoption across construction, transportation, and industrial sectors. The region also benefits from advanced coating technologies and strong demand for premium architectural finishes.

Germany: PET Film-Coated Steel Coil Market Growth Trends

Germany plays a central role in the European market, driven by its strong manufacturing base and advanced construction sector. High demand from automotive components, industrial panels, and energy-efficient buildings supports consistent consumption. German manufacturers emphasize high-quality coatings, precision engineering, and compliance with EU environmental regulations, reinforcing the country’s leadership position.

South America: PET Film-Coated Steel Coil Market Manufacturing And Increased Awareness

South America shows moderate but steadily growing demand for PET film-coated steel coils, supported by infrastructure modernization, residential construction, and appliance manufacturing. Increasing awareness of corrosion protection and maintenance cost reduction is encouraging adoption. However, market growth is influenced by economic stability, investment cycles, and fluctuating raw material prices across the region.

Brazil: PET Film-Coated Steel Coil Market Growth Trends

Brazil is the leading market in South America due to its expanding construction sector and domestic steel production capabilities. PET film-coated steel coils are increasingly used in roofing, cladding, and consumer appliances. Government infrastructure initiatives and gradual industrial recovery are expected to create long-term growth opportunities for coated steel products.

Middle East & Africa (MEA): PET Film-Coated Steel Coil Market, Domestic Steel Production Growth

The MEA market is driven by large-scale infrastructure projects, commercial construction, and demand for durable materials suitable for harsh climatic conditions. PET film-coated steel coils are valued for their resistance to corrosion, UV exposure, and extreme temperatures. Growth is supported by urban development, industrial expansion, and rising investments in non-oil sectors.

GCC Countries: PET Film-Coated Steel Coil Market Growth Trends

GCC countries represent the largest share within MEA, supported by megaprojects, smart city developments, and high demand for premium construction materials. PET film-coated steel coils are widely adopted in architectural panels, industrial buildings, and transportation infrastructure. The region’s focus on sustainability and long-life building materials further boosts market adoption.

Recent Developments

- In April 2024, at the American Coatings Show, Arkema highlighted an expansion of its sustainable product range. The company's focus was on three main areas: speeding up sustainable options for buildings, improving performance to boost the use of eco-friendly choices in the industry, and building partnerships throughout the supply chain. (Source :www.arkema.com)

- In April 2025, Jindal (India) Limited, part of the B.C. Jindal Group has entered the renewable energy sector with the launch of Jindalume, a line of aluminum-zinc (Al-Zn) coated steel coils.(Source:www.pv-magazine-india.com )

- In January 2025, the Government of India launched PLI Scheme 1.1, an updated second phase of the Production Linked Incentive (PLI) scheme for the specialty steel sector. This phase utilizes ₹4,000 crore in remaining funds from the initial PLI 1.0 allocation to attract further investment and boost domestic production(Source: www.newindianexpress.com )

- In December 2024, Sumitomo Electric Industries, Ltd. introduced new ultra-thin insulated powder magnetic cores specifically developed for high-performance axial flux motors. These cores are intended to enhance motor efficiency and decrease size and weight, addressing crucial needs in applications such as electric vehicles and robotics.(Source: www.metal-am.com)

Top players in the PET Film-Coated Steel Coil Market & Their Offerings:

- Uttam Galva Steels Limited (India): Uttam Galva offers PET film-coated steel products with strong corrosion resistance and tailored performance for construction, roofing, and consumer durables. The company emphasizes cost-effective solutions for emerging market demand.

- Kolor Metal A/S (Denmark): Kolor Metal supplies PET film-coated steel coils with eco-friendly laminates and extensive warranty coverage, catering to premium architectural, industrial, and appliance applications that require design flexibility and compliance with stringent standards.

- American Nickeloid Company Inc. (USA): American Nickeloid produces decorative PET film-coated steel coils with a focus on versatile designs and high finish quality for interior appliances, wall panels, and specialty industrial applications across North America.

- Jiangyin Everest Import and Export Co., Ltd. (China): This company offers competitively priced PET film-coated steel coils with diverse texture and color options, serving construction, appliances, and general industrial markets with strong supply capacity.

- JSW Steel Ltd. (India): JSW Steel supplies PET film-coated steel coils, leveraging its large mill capacities, targeting appliance and building applications with a focus on sustainable and performance-oriented coated solutions.

Other Top Players Are

- JSW Steel Ltd. (India)

- Jiangyin Everest Import and Export Co., Ltd. (China)

- American Nickeloid Company Inc. (USA)

- Kolor Metal A/S (Denmark)

- Uttam Galva Steels Limited (India)

- Acerinox S.A

- Nippon Steel Corporation

- YIEH Corp.

- Jiangyin Everest Import and Export Co., Ltd.

- Chongqing Youngson Metal

- Jiangyin Wofeng Metallic Material Co., Ltd.

- Boxing County Fuhong New Materials Co., Ltd.

Segments Covered

By Substrate Type

- Cold-Rolled Steel (CR Steel)

- Galvanized Steel

- Galvalume / Aluzinc Steel

- Other Substrate Types

By Coating Type

- Single-side PET Film Coating

- Double-sided PET Film Coating

- UV / Matte / Glossy PET Film Coatings

- Antibacterial and Functional PET Films

By Application

- Home Appliances

- Wall Panels and Roofing Sheets

- Doors and Partition Panels

- Electrical Cabinets and Enclosures

- Shipping Containers and Industrial Shelters

- Other Applications (Elevators, Cladding, Signage)

By End-user Industry

- Construction and Infrastructure

- Consumer Appliances

- Industrial Equipment

- Transportation and Automotive

- Electrical and Electronics

- Other End-user Industries (Retail, Furniture, Interior Décor)

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa