Content

What is the Current Metal Injection Molding (MIM) Parts Market Size and Volume?

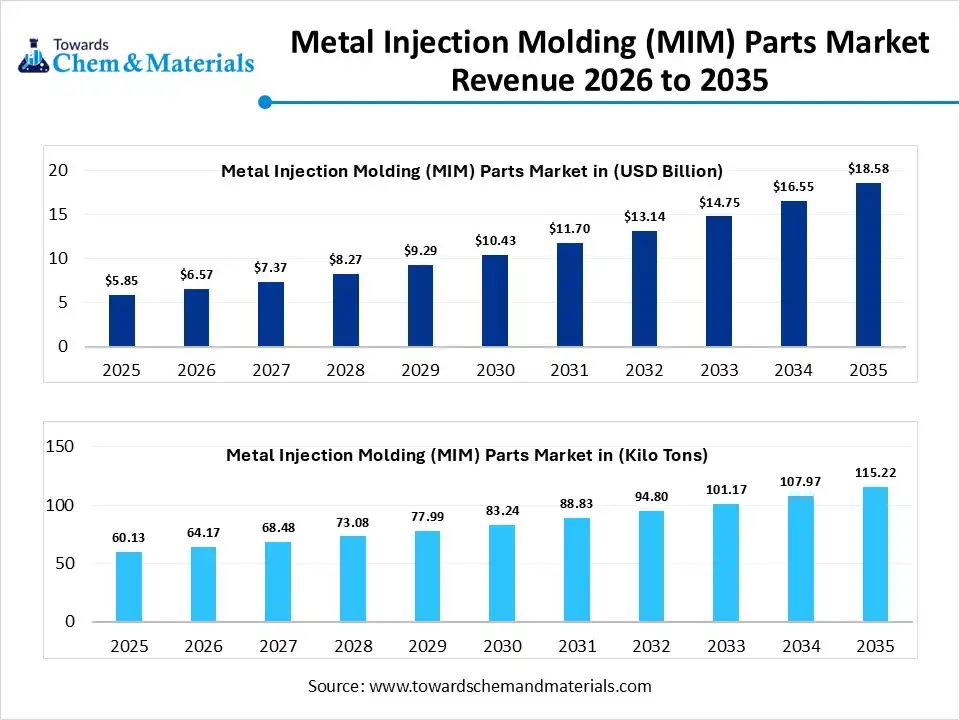

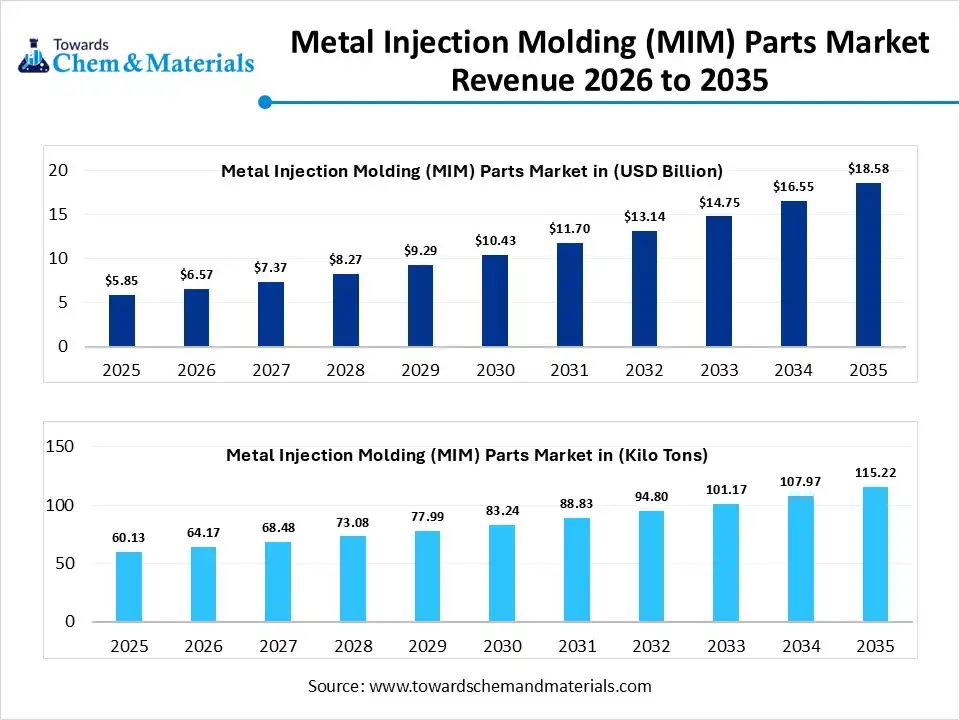

The global metal injection molding (MIM) parts market size was estimated at USD 5.85 billion in 2025 and is expected to increase from USD 6.57 billion in 2026 to USD 18.58 billion by 2035, growing at a CAGR of 12.25% from 2026 to 2035. In terms of volume, the market is projected to grow from 60.13 kilo tons in 2025 to 115.22 kilo tons by 2035. growing at a CAGR of 6.72% from 2026 to 2035. Asia Pacific dominated the metal injection molding (MIM) parts market with the largest volume share of 52.1% in 2025. The increased production of medical devices and the focus on automotive lightweighting drive the market growth.

Market Highlights

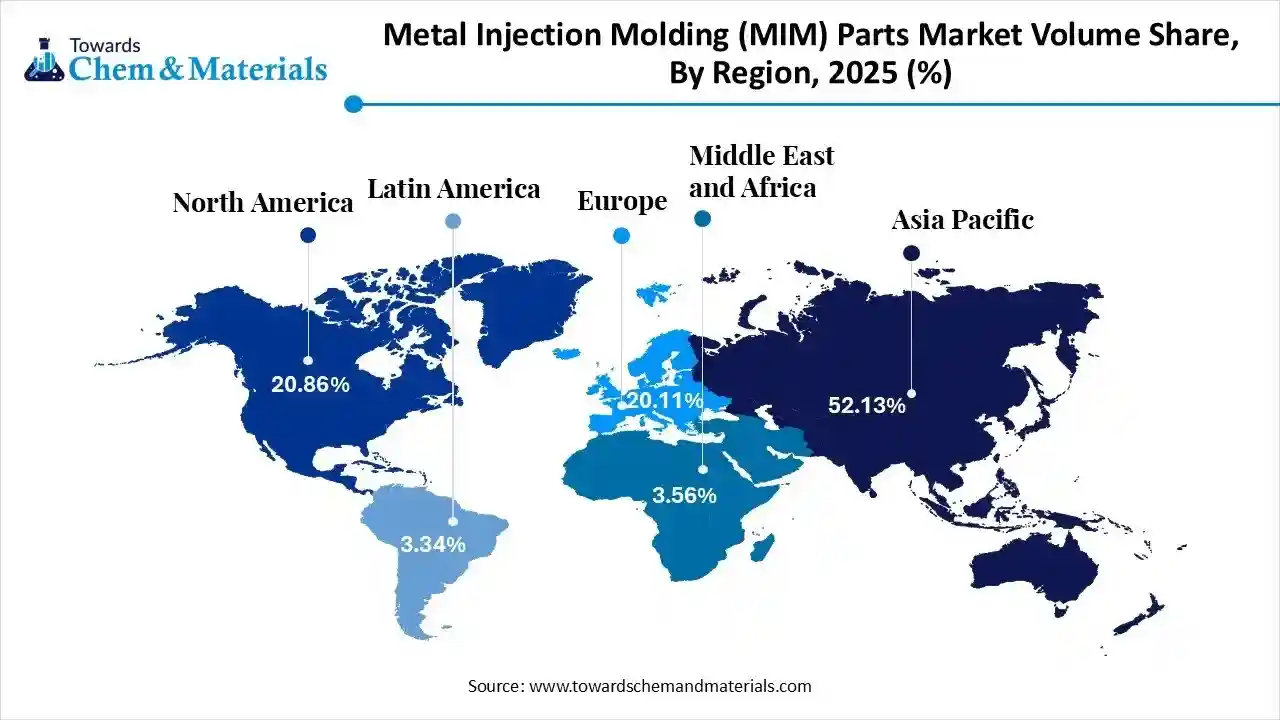

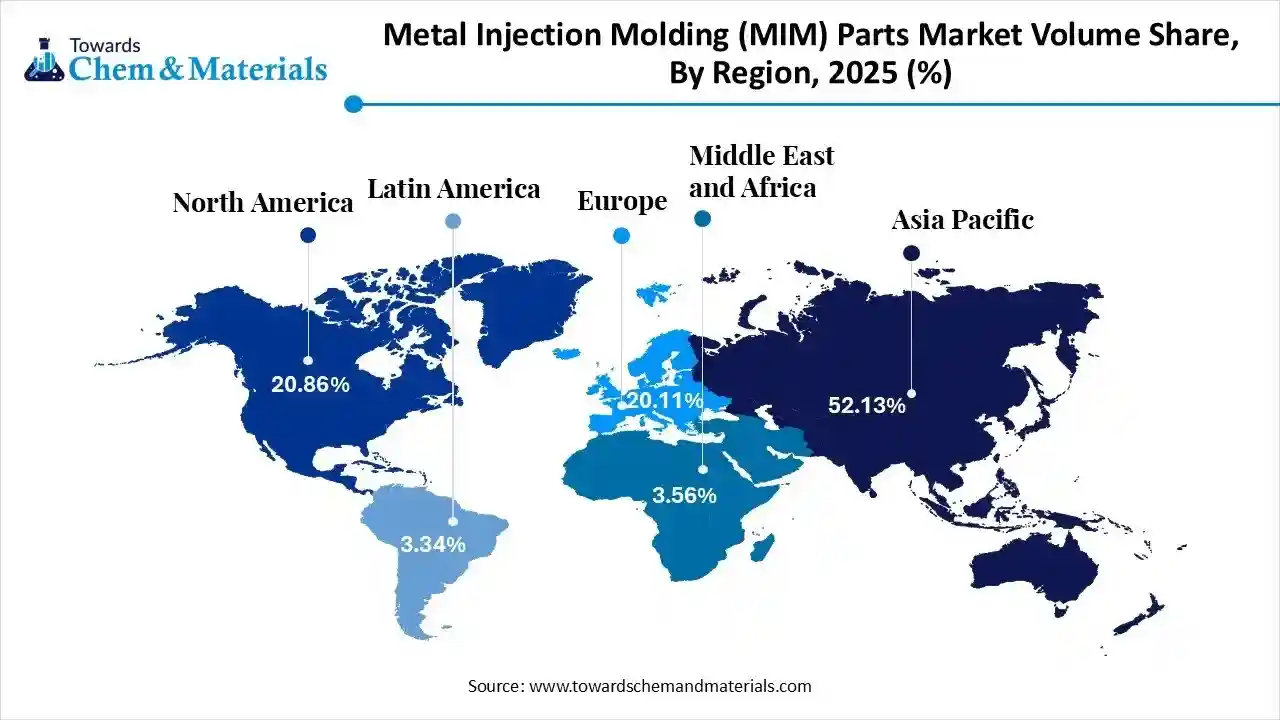

- The Asia Pacific dominated the global metal injection molding (MIM) parts market with the largest volume share of 52.1% in 2025.

- The metal injection molding (MIM) parts market in North America is expected to grow at a substantial CAGR of 8.65% from 2026 to 2035.

- The Europe metal injection molding (MIM) parts market segment accounted for the major volume share of 20.11% in 2025.

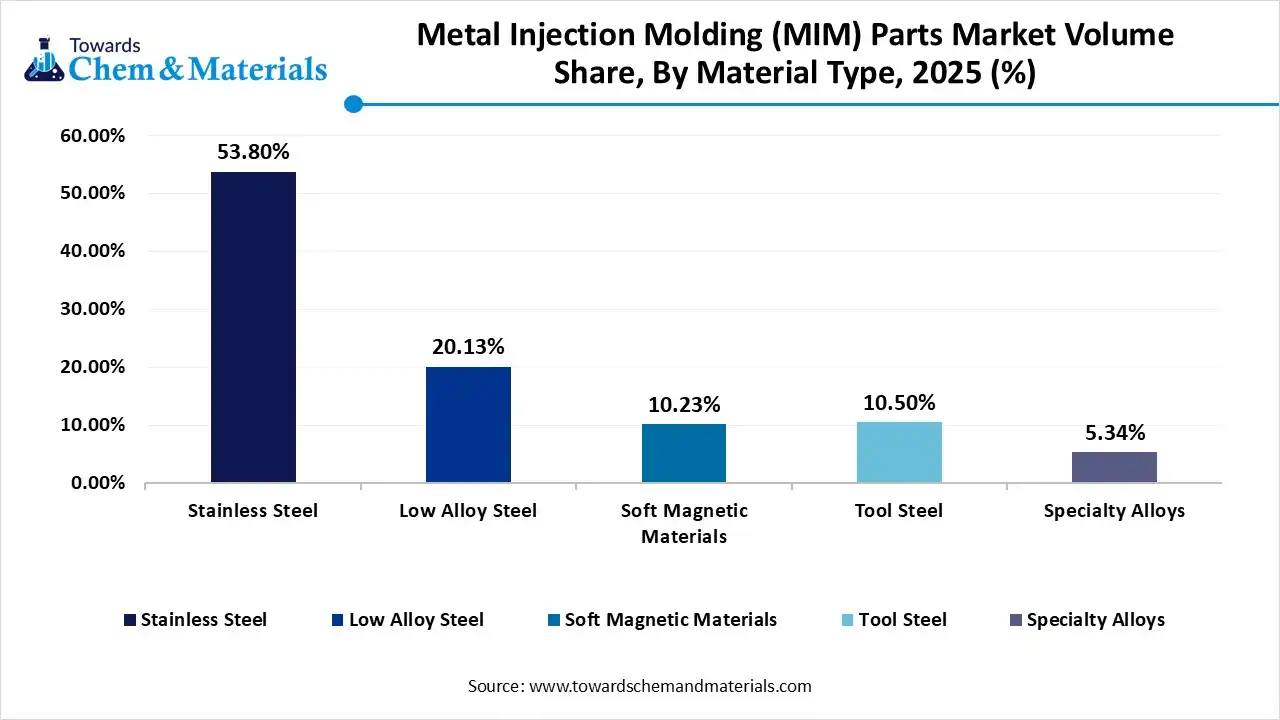

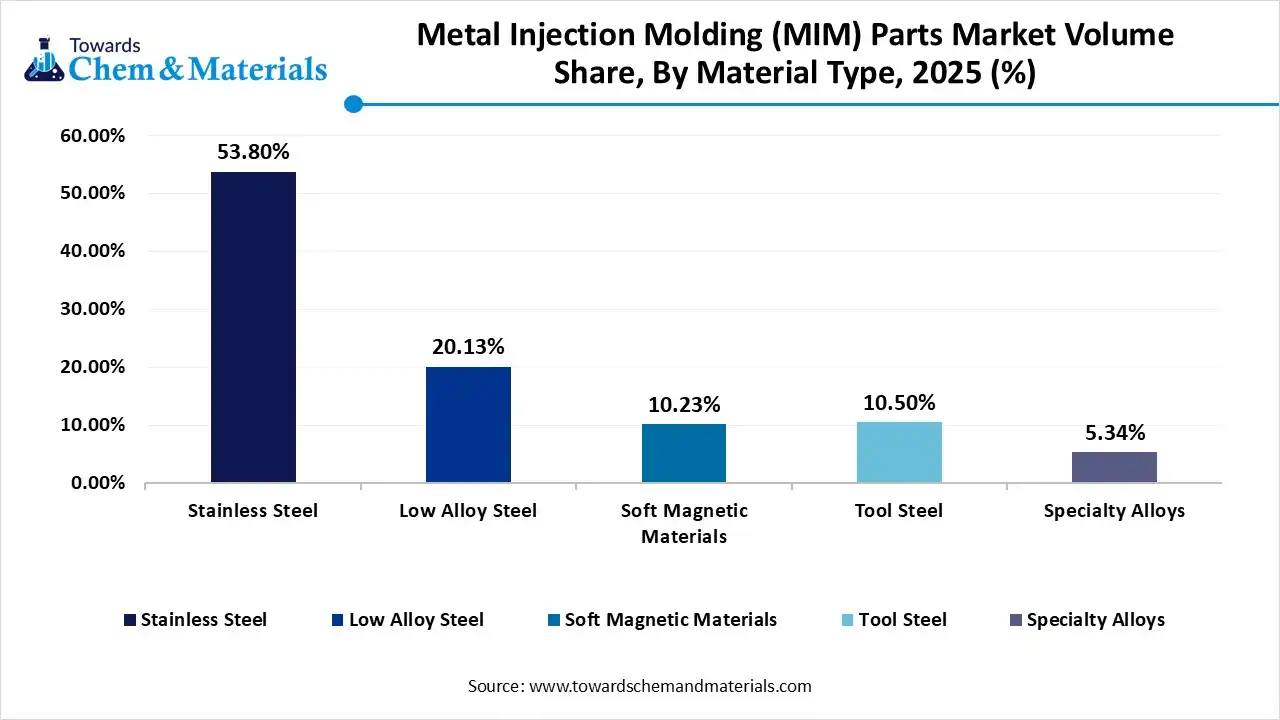

- By material type, the stainless-steel segment dominated the market and accounted for the largest volume share of 53.8% in 2025.

- By material type, the tool steel segment is expected to grow at the fastest CAGR of 10.29% from 2026 to 2035 in terms of volume.

- By end-use industry, the electrical & electronics segment led the market with the largest revenue volume share of 34.2% in 2025.

- By component weight, the small parts segment dominated the market and accounted for the largest volume share of 48.5% in 2025.

- By debinding technology, the catalytic debinding segment led the market with the largest revenue volume share of 55.00% in 2025.

What are Metal Injection Molding (MIM) Parts?

Metal injection molding parts are complex components made up using MIM technology. The technology consists of steps like feedstock creation, injection molding, debinding, and sintering for the development of MIM parts. It consists of properties like high precision, superior mechanical properties, and excellent uniformity. The MIM parts are used in applications like injector nozzles, dental parts, cameras, surgical implants, and others.

The metal injection molding (MIM) parts market growth is driven by the growing electronics miniaturization, expansion of electric vehicles, development of orthopedic components, growth in smart manufacturing, production of high-performance aerospace parts, and the increasing use of firearms.

Metal Injection Molding (MIM) Parts Market Trends:

- Growing Medical Applications:- The increasing use of micro-surgical instruments and the huge production of joint replacement parts increase demand for MIM parts to meet stricter standards.

- Expanding Firearms Use:- The increasing awareness about personal safety and the focus on military modernization increase demand for firearms. The various parts, like pistol grip safeties, trigger, and bolt carrier of firearms, require MIM.

- Surging Electronics Miniaturization:- The increasing preference for sleeker designs of electronics and the focus on the development of complex internal components increase demand for MIM parts.

- Growing Aerospace Industry:- The strong focus on improving fuel efficiency of aircraft and the stricter regulations in the aerospace industry increase demand for MIM parts. The various aerospace parts, like seatbelt buckles, satellite parts, fuel nozzles, and sensor housings, are developed using MIM.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 6.57 Billion / 64.17 Kilo Tons |

| Revenue Forecast in 2035 | USD 18.58 Billion / 115.22 Kilo Tons |

| Growth Rate | CAGR 12.25% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Coating Type, By Resin Type, By Application Area, By End-Use Sector, By Region |

| Key companies profiled | ArcelorMittal S.A, China Baowu Steel Group, Nippon Steel Corporation, POSCO Hold |

Key Technological Shifts in the Metal Injection Molding (MIM) Parts Market:

The metal injection molding (MIM) parts market is going through a key technological shift driven by the demand for sustainable parts, performance efficiency, and minimizing waste. The innovations like digital twins, smart manufacturing, advanced simulation, and robotics enhance performance and create complex parts. The major innovation is the integration of AI develops consistent quality components and supports real-time monitoring.

AI rapidly tests various parts designs and maintains consistency in the production of MIM parts. AI predicts the remaining useful life of the MIM component and streamlines the design phase. AI automatically detects defects in parts and helps in the customization of parts. AI shortens the manufacturing cycle period and maintains the structural integrity of parts. AI schedules proactive maintenance for machines and lowers the consumption of energy. Overall, AI helps in the development of advanced MIM parts.

Trade Analysis of Metal Injection Molding (MIM) Parts Market: Import & Export Statistics

- Mexico imported 736 shipments of metal injection molding parts.

- China exported 336 shipments of metal injection molding parts.

- Vietnam exported 739,620 shipments of stainless steel.

- The United States imported 102 shipments of metal injection molding parts.

Metal Injection Molding (MIM) Parts Market Value Chain Analysis

- Feedstock Procurement: The process focuses on acquiring raw materials like low-alloy steels, tungsten alloys, copper alloys, specialty metals, polyolefins, magnetic alloys, and waxes.

- Key Players:- Indo-MIM, BASF, Pollen AM, Hoganas, Epson Atmix, Plansee Group

- Chemical Synthesis and Processing: The stage includes the following steps: preparation of feedstock, injection molding, binder removal, sintering, and post-processing.

- Key Players:- GKN Powder Metallurgy, Shilpan Steelcast, MICRO, INDO-MIM, Schunk Group

- Quality Testing and Certifications: The stage focuses on evaluating properties like the actual composition of alloy, tensile strength, porosity, grain structure, yield strength, and roughness. Certifications like IATF 16949, ISO 13485, ISO 9001, and PPAP are required for MIM parts.

- Key Players:- HQTS, Bureau Veritas, Zetwerk, Smith Metal Products, SGS, TCR Engineering

Sector-by-Sector Applications of MIM Parts

| Sector | MIM Parts Used | Used Across | Key Material Used |

| Electronics |

|

|

|

| Consumer Goods |

|

|

|

| Aerospace |

|

|

|

| Automotive |

|

|

|

Segmental Insights

Material Type Insights

Why Stainless Steel Segment Dominates the Metal Injection Molding (MIM) Parts Market?

The stainless steel segment volume was valued at 32.35 Kilo Tons in 2025 and is projected to reach 57.98 Kilo Tons by 2035, expanding at a CAGR of 6.70% during the forecast period from 2025 to 2035. the stainless steel segment dominated the metal injection molding (MIM) parts market with a 53.8% share in 2025. The increased manufacturing of vehicle engine parts and the growth in the utilization of consumer electronics increase demand for stainless steel. The high hardness, cost-efficiency, excellent corrosion resistance, and aesthetic appeal of stainless steel help market expansion. The increasing need for medical implants and the development of aerospace parts requires stainless steel, driving the overall market growth.

The tool steel segment volume was valued at 6.31 Kilo Tons in 2025 and is expected to surpass around 15.24 Kilo Tons by 2035, and it is anticipated to expand to 10.29% of CAGR during 2026-2035. The tool steel materials segment is the fastest-growing in the market during the forecast period. The growing manufacturing of complex surgical implants and the increased production of EV components require tool steel. The increased miniaturization of sensors and the strong focus on lowering maintenance costs increase demand for tool steel. The excellent hardness, thermal stability, and good polishability of tool steel support the overall market growth.

Global Metal Injection Molding Parts Market Volume and Share, By Material Type, 2025-2035

| By Material Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Stainless Steel | 53.80% | 32.35 | 57.98 | 6.70% | 50.32% |

| Low Alloy Steel | 20.13% | 12.10 | 20.99 | 6.31% | 18.22% |

| Soft Magnetic Materials | 10.23% | 6.15 | 13.96 | 9.54% | 12.12% |

| Tool Steel | 10.50% | 6.31 | 15.24 | 10.29% | 13.23% |

| Specialty Alloys | 5.34% | 3.21 | 7.04 | 9.11% | 6.11% |

End-Use Industry Insights

Which End-Use Industry Segment Dominated the Metal Injection Molding (MIM) Parts Market?

The electrical & electronics segment dominated the metal injection molding (MIM) parts market with a 34.2% share in 2025. The increasing demand for smart home devices and the growth in electronics miniaturization increase the demand for MIM parts. The growing rate of smartphone utilization and the increased manufacturing of powerful gadgets increase demand for MIM parts. The expanding base of the electronic industry drives the overall market growth.

The medical & healthcare segment is experiencing the fastest growth in the market during the forecast period. The increased production of orthodontic brackets and the growing innovations in surgical instruments increase demand for MIM parts. The increasing need for diagnostic tools and the development of complex drug delivery systems require MIM parts. The transition towards minimally invasive surgeries supports the overall market growth.

Component Weight Insights

Why Small Parts Segment held the Largest Revenue Share in the Metal Injection Molding (MIM) Parts Market?

The small parts segment held the largest revenue share of 48.5% in the market in 2025. The huge production of smartphone components and the focus on minimizing the weight of vehicles increase demand for small MIM parts. The increased production of lighter components and the growing use of sensors require small MIM parts. The cost-effectiveness, uniformity, and material efficiency of small MIM parts drive the market growth.

The micro parts segment is experiencing the fastest growth in the market during the forecast period. The growing popularity of smaller devices and the increased development of micro-surgical tools require micro MIM parts. The increasing demand for lighter interior controls and ongoing modernization in devices increases the demand for micro MIM parts. The superior mechanical resistance and high complexity of micro MIM parts support the overall market growth.

Debinding Technology Insights

How did the Catalytic Debinding Segment hold the Largest Share in the Metal Injection Molding (MIM) Parts Market?

The catalytic debinding segment held the largest revenue share of 55% in the market in 2025. The strong focus on lowering cycle times and enhancing the final quality of parts increases the adoption of catalytic debinding. The growing mass production of MIM parts and the focus on lowering distortion risk increase demand for catalytic debinding. The uniform binder removal and superior shape retention ability of catalytic debinding drive the market growth.

The water-based debinding segment is experiencing the fastest growth in the market during the forecast period. The growing awareness about environmental concerns and a strong focus on enhancing workplace safety increase demand for water-based debinding. The increased production of a uniform porous structure requires water-based debinding. The cost-effectiveness, high debinding rate, and improved quality of water-based debinding support the overall market growth.

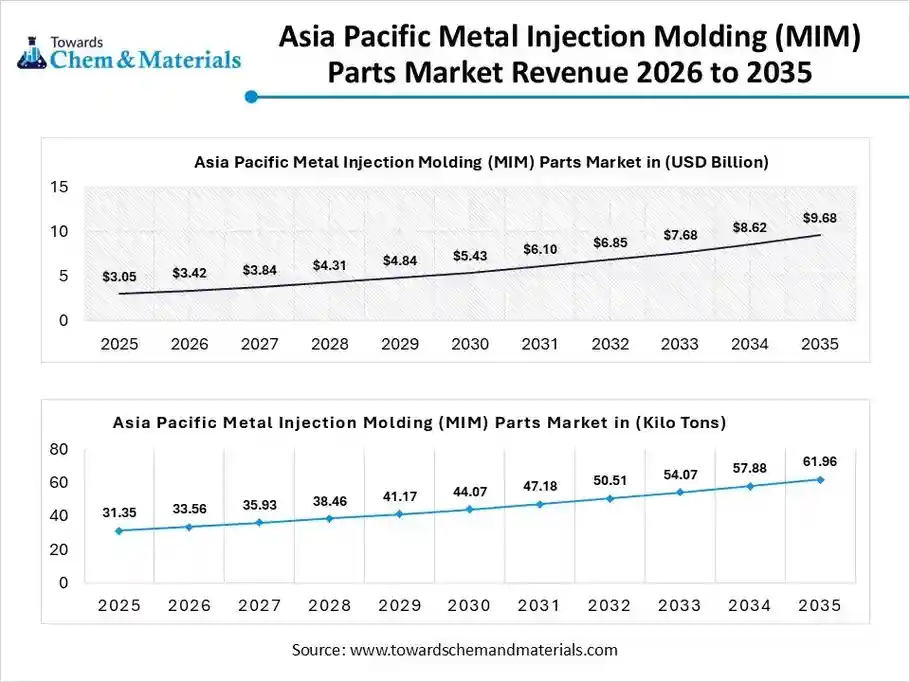

Regional Insights

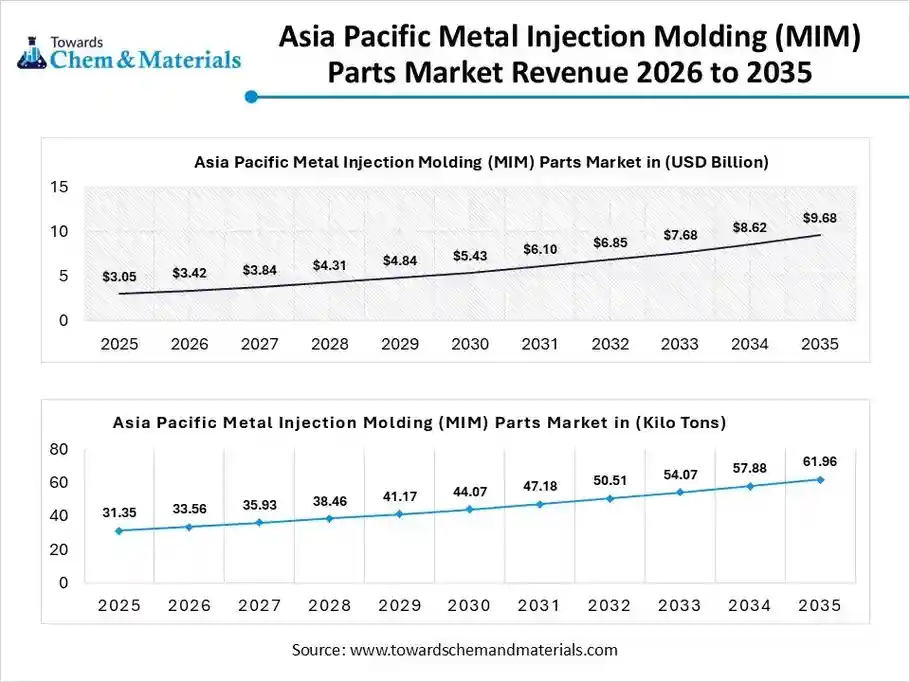

The Asia Pacific metal injection molding (MIM) parts market size was valued at USD 3.05 billion in 2025 and is expected to be worth around USD 9.68 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 12.27% over the forecast period from 2026 to 2035.

The Asia Pacific metal injection molding (MIM) parts market volume was estimated at 31.35 kilo tons in 2025 and is projected to reach 61.96 kilo tons by 2035, growing at a CAGR of 7.05% from 2026 to 2035. Asia Pacific dominated the market with a 52.1% share in 2025. The vast presence of industrial activities and the increasing use of smartphones increases demand for MIM parts. The increased production of cars and strong government backing for local manufacturing create higher demand for MIM parts. The rise in the development of intricate medical tools and the increasing need for consumer goods products require MIM parts, driving the overall market growth.

From Scale to Precision: China’s Role in MIM Parts Production

China is a major contributor to the market due to the increased production of ICT products. The government backing for advanced manufacturing activities and the well-established medical device sectors increase demand for MIM parts. The growing consumer demand for consumer goods and the increasing use of vehicles require MIM parts. The presence of large-scale factories supports the overall market growth.

North America Metal Injection Molding (MIM) Parts Market Trends

The North America metal injection molding (MIM) parts market volume was estimated at 12.54 kilo tons in 2025 and is projected to reach 26.47 kilo tons by 2035, growing at a CAGR of 8.65% from 2026 to 2035. The growing miniaturization of smart devices and the increased production of defense systems require MIM parts. The strong presence of an advanced manufacturing base and the strong focus on local production increase demand for MIM parts. The robust growth in the aerospace industry and the growing healthcare industry requires MIM parts, driving the overall market growth.

Global Metal Injection Molding Parts Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 20.86% | 12.54 | 26.47 | 8.65% | 22.97% |

| Europe | 20.11% | 12.09 | 24.35 | 8.09% | 21.13% |

| Asia Pacific | 52.13% | 31.35 | 57.86 | 7.05% | 50.22% |

| South America | 3.34% | 2.01 | 2.94 | 4.32% | 2.55% |

| Middle East & Africa | 3.56% | 2.14 | 3.61 | 5.97% | 3.13% |

Engineering Precision: United States Contribution to the MIM Parts

The United States is growing key contributor to the market. The strong focus on the development of lightweight aerospace components and the increasing use of wearables increases demand for MIM parts. The increasing investment in the production of lightweight defense components and the growing demand for everyday products increase the adoption of MIM parts. The increasing use of surgical tools and the electronic miniaturization requires MIM parts, supporting the overall market growth.

Europe Metal Injection Molding (MIM) Parts Market Trends

The metal injection molding (MIM) parts market volume was estimated at 12.09 kilo tons in 2025 and is projected to reach 24.35 kilo tons by 2035, growing at a CAGR of 8.09% from 2026 to 2035. Europe is growing at a notable rate in the market due to the growing transformation in the automotive sector. The increasing use of advanced machinery and the rising development of dental components increase demand for MIM parts. The increased manufacturing of durable components and the strong manufacturing infrastructure require MIM parts. The growing use of electric vehicles and expanding healthcare applications requires MIM parts, driving the overall market growth.

Advanced Manufacturing: Germany’s Excellence in MIM Parts

Germany is growing rapidly in the market. The strong auto manufacturing base and the growing miniaturization of medical devices increase demand for MIM parts. The development of energy-efficient furnaces and the growing industrial automation creates a huge demand for MIM parts. The increasing investment in lightweight construction materials and the popularity of miniaturization increase demand for MIM parts, supporting the overall market growth.

South America Metal Injection Molding (MIM) Parts Market Trends

The South America metal injection molding (MIM) parts market volume was estimated at 2.01 kilo tons in 2025 and is projected to reach 2.94 kilo tons by 2035, growing at a CAGR of 4.32% from 2026 to 2035. South America is growing in the market. The increased production of vehicle transmission components and the increasing use of dental devices require MIM parts. The growing domestic industrial expansion and the strong focus on lightweighting create demand for MIM parts. The growth in infrastructure development and the nearshoring popularity increases demand for MIM parts, driving the overall market growth.

Excellent Performance: Strong MIM Parts Momentum in Brazil

Brazil is growing significantly in the market due to the growth in the utilization of consumer electronics. The strong focus on enhancing EV battery range and the growing domestic manufacturing activities increase demand for MIM parts. The increasing investment in the production of electronic gadgets and the high consumption of consumer goods increase demand for MIM parts, supporting the overall market growth.

Middle East & Africa Metal Injection Molding (MIM) Parts Market Trends

The Middle East & Africa metal injection molding (MIM) parts market volume was estimated at 2.14 kilo tons in 2025 and is projected to reach 3.61 kilo tons by 2035, growing at a CAGR of 5.97% from 2026 to 2035. The Middle East & Africa are growing in the market. The increasing use of orthopedic tools and the modernization of electronics increases demand for MIM parts. The growing expansion of manufacturing activities and the development of digital infrastructure require MIM parts. The strong focus on maximizing EV range and the need for enhancing vehicle safety increase demand for MIM parts, driving the overall market growth.

Large Projects Drive MIM Parts Demand in Saudi Arabia

Saudi Arabia’s market growth is driven by the growing development of mega projects. The increased production of intricate automobile parts and the huge demand for high-strength aerospace materials require MIM parts. The expansion of construction activities and the focus on advanced manufacturing practices increase demand for MIM parts, supporting the overall market growth.

Recent Developments

- In October 2024, Biomerics launched a metal injection molding service. The MIM-manufactured components are widely used in medical device applications. The component consists of properties like excellent corrosion resistance and high density.(Source: www.surgicalroboticstechnology.com)

- In September 2024, Callaway Golf introduced Opus Platinum Chrome Wedges made with Metal Injection Molding components. The Wedges consist of tungsten elements, and MIM provides precision in the construction of the wedge. (Source: www.pim-international.com)

- In February 2025, Cobra Golf launched a new MIM golf wedge range, King and King-X. The wedges consist of tighter tolerances and a deep undercut design. (Source: www.pim-international.com)

Top Companies List

- Smith Metals:- The UK-based company manufactures complex MIM parts to serve industrial applications like telecom, medical devices, automotive, consumer electronics, firearms, and industrial automation.

Indo-MIM Pvt. Ltd.:- The company offers various MIM services like precision investment casting, advanced machining, ceramic injection molding, and additive manufacturing to support diverse industries.

Advanced Materials Technologies Pte. Ltd:- The Singapore-based company manufactures MIM parts of various materials like tungsten, superalloys, nickel-free steels, stainless steel, and copper to support diverse sectors.

Dynacast:- The company manufactures precision-engineered metal components and provides MIM operations through its brand OptiMIM.

CMG Technologies:- The UK-based company manufactures high-precision metal parts using MIM technology to support industries like aerospace, automotive, medical, and agriculture. - Phillips-Medisize (Molex)

- Parmaco Metal Injection Molding AG

- Schunk Group

- Epson Atmix

- Fine MIM

- Future High-Tech Co., Ltd.

- Sintex

- Advanced Powder Products, Inc.

- Micro-MIM

- Zoltrix Material

- Mimest S.p.A.

- Sturm, Ruger & Co. (MIM Division)

- PolyMIM GmbH

- GKN Powder Metallurgy

- PSM Industries

Segments Covered

By Material Type

- Stainless Steel

- Austenitic (316L, 304L)

- Martensitic (420, 440C)

- Precipitation Hardening (17-4PH, 15-5PH)

- Low Alloy Steels

- Fe-Ni Alloys (Fe-2Ni, Fe-7Ni)

- 4140, 4605, 8620

- Soft Magnetic Materials

- Pure Iron

- Fe-Si Alloys

- Fe-Ni Alloys

- Tool Steels

- M2, D2, H13

- Specialty Alloys

- Titanium and Titanium Alloys (Ti6Al4V)

- Cobalt-Chrome (Co-Cr) Alloys

- Tungsten Heavy Alloys

- Copper and Copper-based Alloys

- Superalloys (Inconel, Hastelloy)

By End-Use Industry

- Medical & Healthcare

- Surgical Instruments (Forceps, Scalpel Handles)

- Orthodontic Brackets and Dental Tools

- Implantable Devices

- Diagnostic Equipment Components

- Electrical & Electronics

- Smartphone Frames and Internal Brackets

- Camera Lens Mechanisms

- Wearable Device Components (Watch Cases, Sensors)

- Laptop and Tablet Hinges

- Connectors and Fiber Optic Hardware

- Automotive

- Fuel Injection System Parts

- Turbocharger Components (Vanes, Actuators)

- Interior Safety Systems (Seat Belt Parts, Airbag Components)

- Lock and Latch Mechanisms

- Sensor Housings and Small Gears

- Firearms & Defense

- Triggers and Hammers

- Sights and Rail Systems

- Safety Levers and Bolts

- Firing Pins

- Industrial Machinery & Tools

- Power Tool Components (Gears, Chucks)

- Pneumatic and Hydraulic Valve Parts

- Textile Machinery Components

- Pump Rotors and Nozzles

- Aerospace

- Engine Blade Fasteners

- Navigation System Hardware

- Lightweight Structural Brackets

- Consumer Goods

- Eyewear Hinges and Frames

- High-end Watch Straps and Cases

- Luxury Hardware (Zippers, Buckles)

- Sporting Goods (Golf Club Inserts)

By Component Weight

- Micro Parts (Less than 0.1g)

- Small Parts (0.1g to 10g)

- Medium Parts (10g to 50g)

- Large Parts (Greater than 50g)

By Debinding Technology

- Catalytic Debinding

- Thermal Debinding

- Solvent Debinding

- Water-based Debinding

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa