Content

What is the Current Polyethylene Furanoate (PEF) Market Size and Volume?

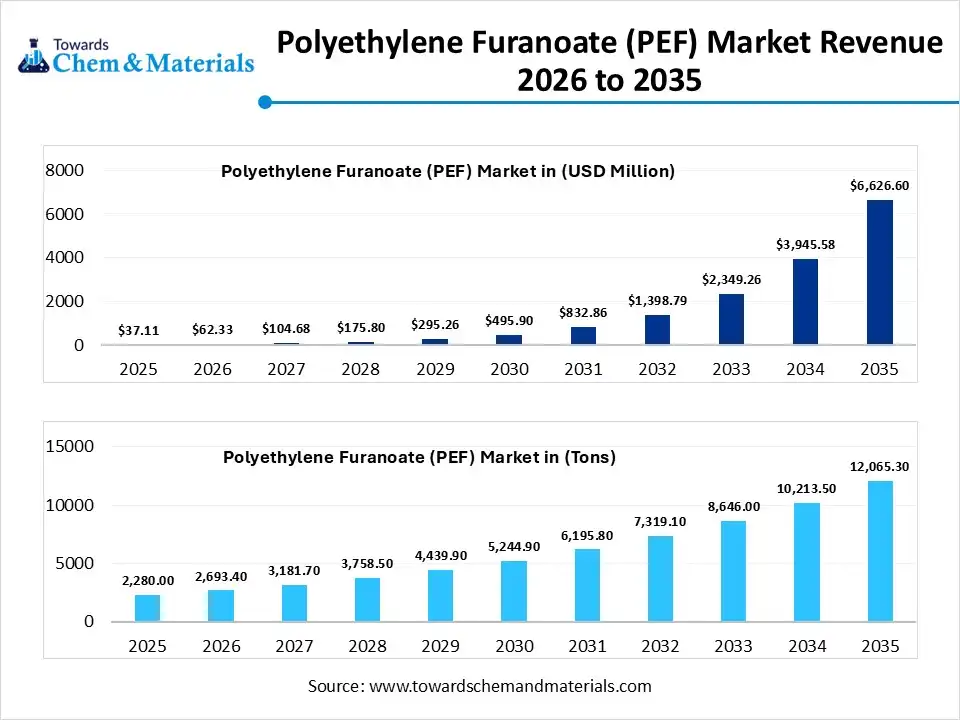

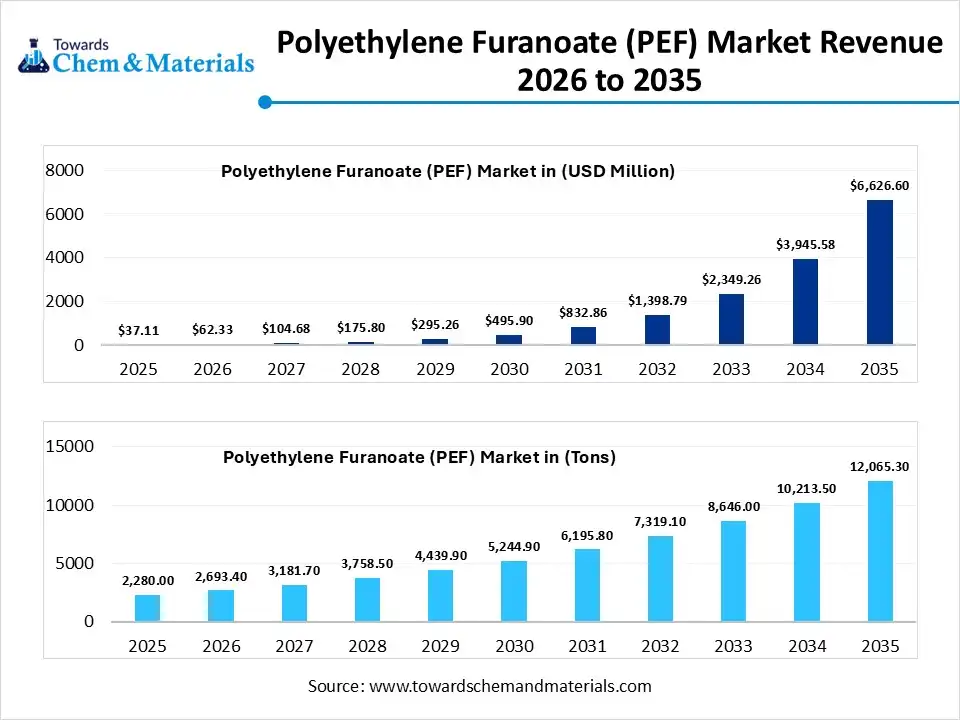

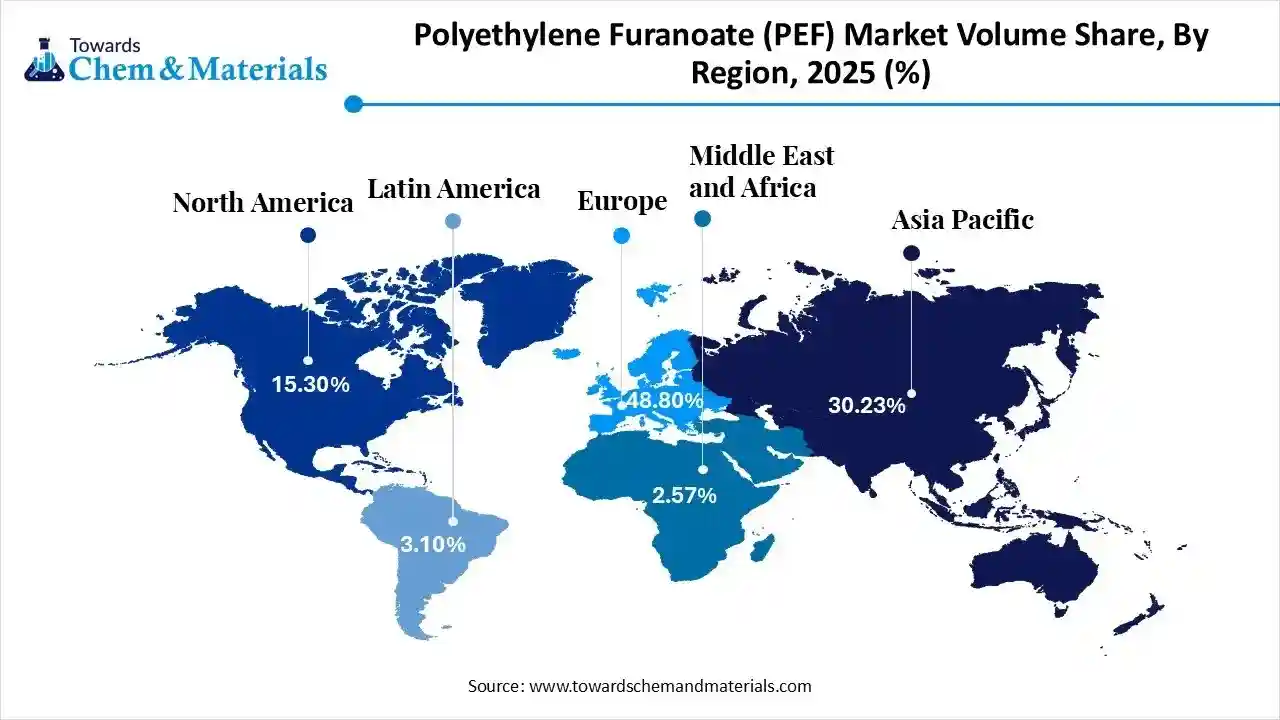

The global polyethylene furanoate (PEF) market size was estimated at USD 37.11 million in 2025 and is expected to increase from USD 62.33 million in 2026 to USD 6,626.60 million by 2035, growing at a CAGR of 67.95% from 2026 to 2035. In terms of volume, the market is projected to grow from 2,280.0 tons in 2025 to 12,065.3 tons by 2035. growing at a CAGR of 18.13% from 2026 to 2035. Europe dominated the polyethylene furanoate (PEF) market with the largest volume share of 48.80% in 2025.The growing investment in bio-based materials is the key factor driving market growth. Also, growing investments in renewable plastics, coupled with the rapid urbanisation across the globe, can fuel market growth further.

The polyethylene furanoate (PEF) market involves the production and supply of a 100% bio-based, recyclable polyester derived from renewable plant sugars (such as fructose and glucose). PEF is a sustainable alternative to petroleum-based Polyethylene Terephthalate (PET), offering superior barrier properties against oxygen and carbon dioxide, higher mechanical strength, and better heat resistance.

Market Highlights

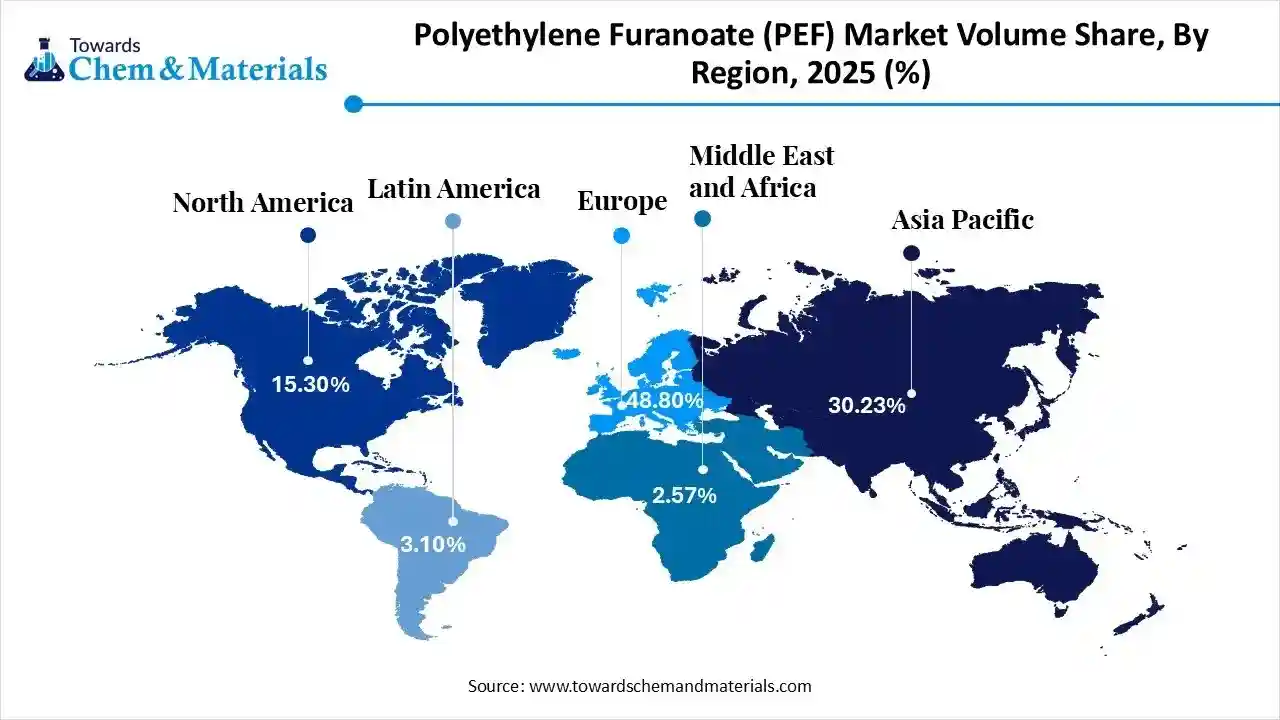

- The Europe dominated the global polyethylene furanoate (PEF) market with the largest volume share of 48.80% in 2025.

- The polyethylene furanoate (PEF) market in Asia Pacific is expected to grow at a substantial CAGR of 21.56% from 2026 to 2035.

- The North America polyethylene furanoate (PEF) market segment accounted for the major volume share of 15.30% in 2025.

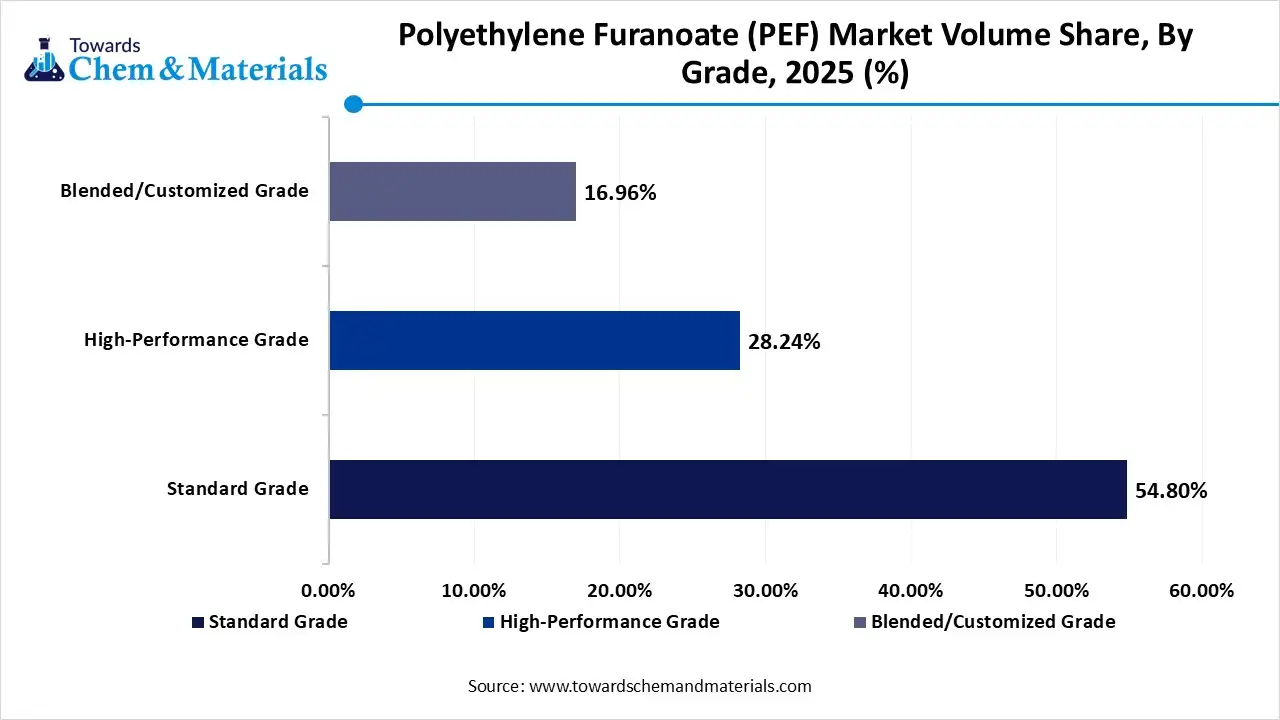

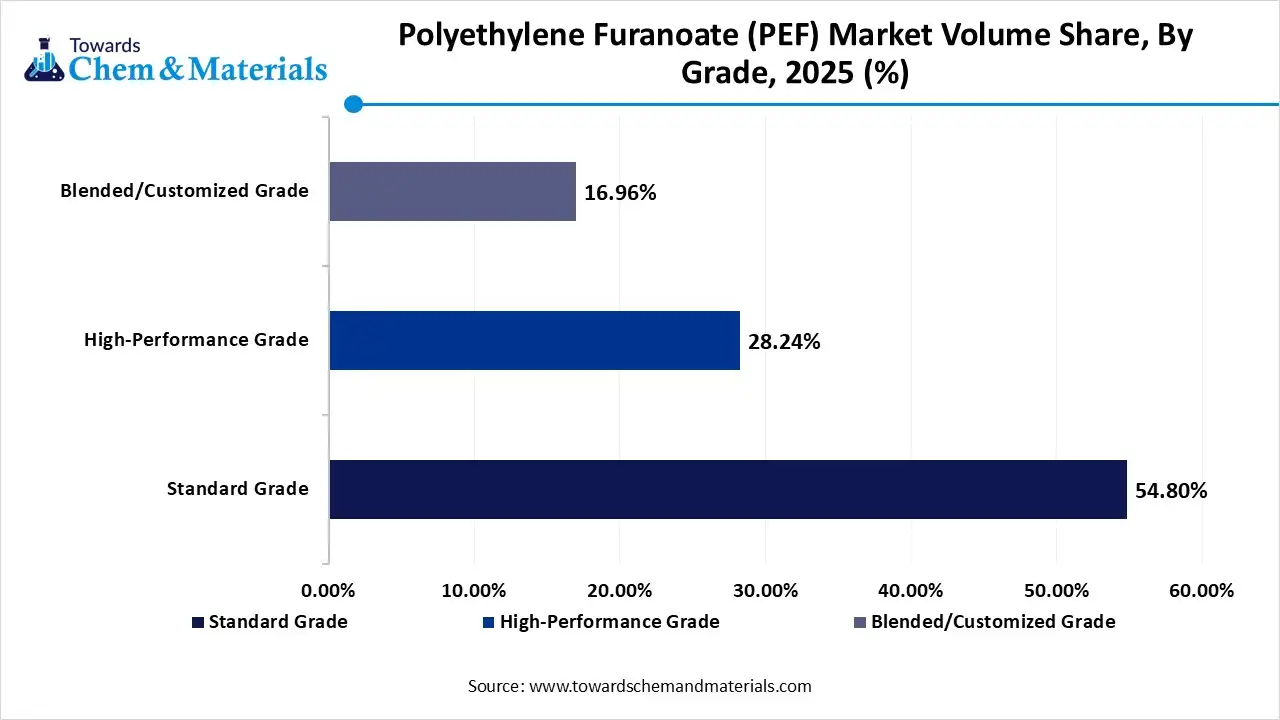

- By grade, the standard grade segment dominated the market and accounted for the largest volume share of 54.80% in 2025.

- By grade, the high-performance grade segment is expected to grow at the fastest CAGR of 21.34% from 2026 to 2035 in terms of volume.

- By application, the bottles segment led the market with the largest revenue volume share of 67.4% in 2025.

- By end-use industry, the packaging segment dominated the market and accounted for the largest volume share of 59.1% in 2025.

- By source, the plant-based segment led the market with the largest revenue volume share of 42.4% in 2025.

Polyethylene Furanoate (PEF) Market Trends

- This market is primarily driven by the global transition toward a circular economy, stringent regulations on single-use plastics, and the food and beverage industry's demand for high-performance, eco-friendly packaging solutions.

- Governments across the globe are increasingly enforcing stringent regulations and policies that support the use of sustainable materials like polyethylene in different sectors. Governments are also giving financial subsidies and incentives to various companies that adopt sustainable practices.

- The increasing need for governments is the latest trend boosting market expansion.PEF addresses this demand by providing a plant-based and recyclable solution that substantially lowers the overall carbon footprint of packaging.

- The rising consumer awareness regarding environmental concerns is another major trend shaping positive market growth. This surge in awareness is supporting market players to explore substitutes such as polyethylene furanoate, which is compatible with consumer preferences for sustainable solutions.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 62.33 Million / 2,693.4 Tons |

| Revenue Forecast in 2035 | USD 6,626.60 Million / 12,065.3 Tons |

| Growth Rate | CAGR 67.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Tons) |

| Dominant Region | Europe |

| Segment Covered | By Source, By Grade, By Application Area, By End-Use Industry, By Region |

| Key companies profiled | Avantium N.V., Sulzer Ltd., AVA Biochem AG, Origin Materials, TOYOBO CO., LTD., BASF SE, Mitsui & Co., Ltd., Corbion, Danone, ALPLA Group, Swicofil AG, Zhejiang Sugar Energy Technology Co., Ltd., Eastman Chemical Company, DuPont de Nemours, Inc., Toray Industries, Inc. , Gevo, Inc., Stora Enso, Sukano AG , ADM (Archer Daniels Midland), WIFAG-Polytype Holding AG |

How Cutting-Edge Technologies Are Revolutionizing the Polyethylene Furanoate (PEF) Market?

Advanced technologies are transforming the market mainly by improving its manufacturing efficiency, minimizing costs, and extending its adoption scope in high-performance industries. Furthermore, the integration of robotics, automation and Internet of Things (IoT) technologies in production optimises production workflows, facilitating predictive maintenance and ensuring real-time quality control.

Trade Analysis of Polyethylene Furanoate (PEF) Market: Import & Export Statistics

- The U.S. exported 9.1 million tons of polyethylene (all grades combined) through July 2025, increase of 5% from the same period in 2024.

- Year-to-date through July 2025, China exported 1.2 million tons of polyethylene, up 17% (all grades); 1.9 million tons of polypropylene, up 29%; 0.7 million tons of styrenic polymers, up 40%; 4.6 million tons of PET, up 19% and 2.7 million tons of PVC, up 51%.

- In May 2025, India imported 3,027 polyethylene shipments, which represents a 20.7% year-on-year increase compared to May 2024 and a 23% sequential growth from April 2025.

Polyethylene Furanoate (PEF) Market Value Chain Analysis

- Feedstock Procurement: It is the sourcing of plant-based and renewable materials, mainly plant sugars or fructose, which are converted into ethylene glycol (EG) and 2,5-furandicarboxylic acid (FDCA).

- Major Players: Avantium N.V., AVA Biochem AG.

- Chemical Synthesis and Processing: It refers to the specialised methods used to convert bio-based feedstocks into a high-performance EF, a recyclable alternative to conventional PET plastic.

- Major Players: Origin Materials, ALPLA Group.

- Packaging and Labelling: In this stage, the bio-based polymer is used for its better environmental and barrier properties. PEF offers chemical resistance and high gloss for products such as skin creams and shampoos.

- Major Players: Sukano, Swicofil AG

- Regulatory Compliance and Safety Monitoring : It is the crucial process of navigating complex and constantly changing legal landscapes to ensure material safety for its intended uses, particularly food contact.

- Major Players: Danone, Toyobo Co., Ltd.

Polyethylene Furanoate (PEF) Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | The U.S. Food and Drug Administration (FDA) granted Food Contact Notification approval for Avantium's PEF in October 2024. This allows its use as a packaging material for all food types. |

| European Union | The EU's new Packaging and Packaging Waste Regulation (effective January 2025) also encourages the use of bio-based plastics like PEF. PEF has received interim recycling endorsement from the European PET Bottle Platform (EPBP). |

| Japan | As of June 2025, Japan's "Positive List" system for food contact plastics includes FDCA as an approved monomer, making PEF eligible for use in food packaging applications. |

Segmental Insights

Grade Insights

How Much Share Did the Standard Grade Segment Held in 2025?

The standard grade segment volume was valued at 1,249.4 tons in 2025 and is projected to reach 6,372.9 tons by 2035, expanding at a CAGR of 19.85% during the forecast period from 2025 to 2035. The standard grade segment dominated the market with 54.80% share in 2025. The dominance of the segment can be attributed to the growing emphasis on advancements for cost reduction and manufacturing, fuelled by increasing consumer demand for bio-based materials. In addition, its superior mechanical strength and moisture barrier properties, as compared to PET, drive its use in other applications.

The high-performance grade segment volume was valued at 643.9 tons in 2025 and is expected to surpass around 3,672.7 tons by 2035, and it is anticipated to expand to 21.34% of CAGR during 2026 to 2035. the growth of the segment can be credited to the strict environmental regulations and strategic partnerships among major market players. It also provides an excellent carbon dioxide, oxygen, and water vapor barrier, lengthening shelf life for delicate products such as food or drinks.

Polyethylene Furanoate (PEF) Market Volume and Share, By Grade, 2025 - 2035

| By Grade | Market Volume Share (%), 2025 | Market Volume ( Tons)2025 | Market Volume (Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Standard Grade | 54.80% | 1,249.4 | 6,372.9 | 19.85% | 52.82% |

| High-Performance Grade | 28.24% | 643.9 | 3,672.7 | 21.34% | 30.44% |

| Blended/Customized Grade | 16.96% | 386.7 | 2,019.7 | 20.16% | 16.74% |

Application Insights

Which Application Type Segment Dominated Polyethylene Furanoate (PEF) Market in 2025?

The bottles segment held a 67.4% market share in 2025. The dominance of the segment can be linked to the rapid surge in FMCG packaging and the ongoing adoption of sustainability targets by brand owners. PEF gives excellent CO2 and oxygen barrier, which makes it crucial for sensitive and carbonated beverages, allowing for much extended freshness and lighter bottles.

The films & sheets segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by ongoing R&D initiatives for cost-efficient manufacturing and the growth of electronics and e-commerce sectors. Furthermore, advancements in polymerization and bio-refining are enhancing efficiency and overall PEF's performance, such as thermal stability and strength.

End-Use Industry Insights

How Much Share Did the Packaging Segment Held in 2025?

The packaging segment dominated the market with 59.1% share in 2025. The dominance of the segment is owing to the growing need for bio-based, sustainable solutions with better barrier properties, coupled with the rise in environmental awareness among most consumers. Moreover, major players are rapidly collaborating and extending their capacity to boost PEF commercialization.

The fiber & textile segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to a rise in government initiatives supporting sustainable materials and rapid industrialization across the globe. PEF fibers give better properties as compared to conventional polyester fibers, such as high durability, tensile strength, and moisture resistance.

Source Insights

How Much Share Did the Plant-Based Segment Held in 2025?

The plant-based segment held a 42.4% market share in 2025. The dominance of the segment can be attributed to the growing demand for PEF blends in industrial fabrics for apparel for improved moisture management and strength. In addition, governments across the globe are enforcing strict policies to minimize plastic waste, which fuels the adoption of plant-based materials.

The bio-based segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be credited to the surge in consumer awareness regarding sustainable products and technological innovations in production processes. The major players, such as Danone and Carlsberg, are using PEF to fulfil their net-zero carbon goals, leading to segment growth.

Regional Insights

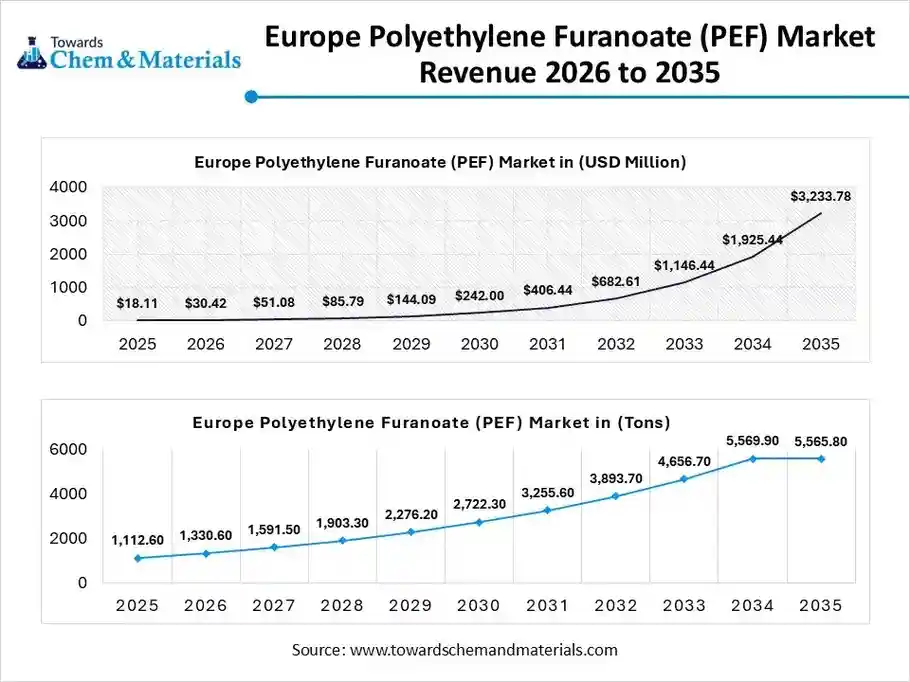

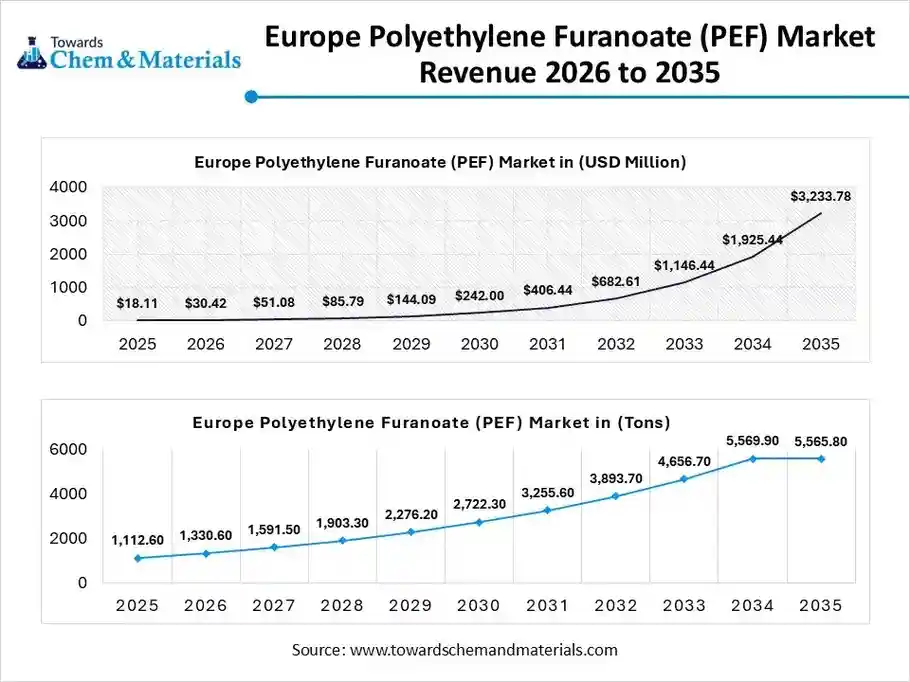

The Europe polyethylene furanoate (PEF) market size was valued at USD 18.11 billion in 2025 and is expected to be worth around USD 3,233.78 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 67.95% over the forecast period from 2026 to 2035.

The Europe polyethylene furanoate (PEF) market volume was estimated at 1,112.6 tons in 2025 and is projected to reach 5,565.8 tons by 2035, growing at a CAGR of 19.59% from 2026 to 2035. Europe dominated the market with the 48.80% share in 2025. The dominance of the region can be attributed to the increasing consumer demand for eco-friendly packaging and its superior properties, which make it ideal for food/beverage bottles. In addition, R&D is increasingly emphasising combining PEF into current PET recycling streams, leading to regional expansion in the upcoming years.

Germany Polyethylene Furanoate (PEF) Market Trends

In Europe, Germany dominated the market owing to stringent EU policies emphasizing reduced plastic waste and circular economy principles. Also, major market players in the country are heavily investing in PEF as a sustainable solution, which aligns with corporate commitments to sustainability initiatives and policies.

Asia Pacific The polyethylene furanoate (PEF) market volume was estimated at 689.2 tons in 2025 and is projected to reach 3,996.0 tons by 2035, growing at a CAGR of 21.56% from 2026 to 2035. The growth of the region can be credited to the ongoing industrialization and supportive government initiatives in emerging economies such as China and India. Moreover, the growth of processed food and e-commerce sectors in the region boosts demand for sustainable and advanced packaging solutions, with bottles being a major application.

Polyethylene Furanoate (PEF) Market Volume and Share, By Region, 2025 - 2035

| By Region | Market Volume Share (%), 2025 | Market Volume ( Tons)2025 | Market Volume (Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 15.30% | 348.8 | 1,931.6 | 20.95% | 16.01% |

| Europe | 48.80% | 1,112.6 | 5,565.8 | 19.59% | 46.13% |

| Asia Pacific | 30.23% | 689.2 | 3,996.0 | 21.56% | 33.12% |

| Latin America | 3.10% | 70.7 | 346.3 | 19.31% | 2.87% |

| Middle East & Africa | 2.57% | 58.6 | 225.5 | 16.15% | 1.87% |

China Polyethylene Furanoate (PEF) Market Trends

In the Asia Pacific, China led the market due to rapid advancements in cost-effective and efficient PEF production methods, along with the surge in e-commerce and processed foods sectors. The Chinese market boasts the strong presence of domestic manufacturers and international firms, emphasizing process efficiency and cost optimization.

North America Polyethylene Furanoate (PEF) Market Trends

The North America polyethylene furanoate market volume was estimated at 348.8 tons in 2025 and is projected to reach 1,931.6 tons by 2035, growing at a CAGR of 20.95% from 2026 to 2035.The growth of the region can be linked to the ongoing investment in PEF manufacturing, coupled with the growing adoption of films and bottles. Furthermore, major players such as Coca-Cola and Danone are adding PEF into their packaging process. Consumers in the region are also demanding fossil fuel-based plastics alternatives.

U.S. Polyethylene Furanoate (PEF) Market Trends

The growth of the market in the country can be driven by rapid investments in pilot plants and biorefineries by major players such as Avantium and Origin Materials, which are propelling PEF's cost-competitiveness and scalability. The research institutions in the U.S. are fuelling commercialization and R&D efforts for PEF products, leading to market growth in the country shortly.

Latin America Polyethylene Furanoate (PEF) Market Trends

The Latin America polyethylene furanoate (PEF) market volume was estimated at 70.7 tons in 2025 and is projected to reach 346.3 tons by 2035, growing at a CAGR of 19.31% from 2026 to 2035. The growth of the region can be boosted by increasing the adoption of fibers, bottles, and niche industrial uses with an emphasis on replacing PET. Additionally, the rapid development of pilot plants and new formulations with enhanced manufacturing processes aims to expand PEF's properties, such as barrier and strength, offering lower costs.

Brazil Polyethylene Furanoate (PEF) Market Trends

The growth of the market in the country can be fuelled by growing awareness regarding plastic waste and bio-based solution PET. Brazil's status as a leading bioethanol manufacturer makes it a crucial location for future PEF production, as it offers renewable sugars for FDCA. Also, the country's existing infrastructure positions it for upcoming joint ventures, contributing to market expansion.

Middle East & Africa Polyethylene Furanoate (PEF) Market Trends

The Middle East & Africa polyethylene furanoate (PEF) market volume was estimated at 58.6 tons in 2025 and is projected to reach 225.5 tons by 2035, growing at a CAGR of 16.15% from 2026 to 2035.The growth of the market in the Middle East & Africa can be propelled by rising consumer demand for green packaging and increasing total investments in production processes. In addition, the increasing emphasis on startups, R&D, and NGO support for bio-based polymers in food packaging and agriculture also promotes the regional growth further in the market.

Saudi Arabia Polyethylene Furanoate (PEF) Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be credited to the growing emphasis on minimizing plastic waste in hotels or other places, coupled with the strong industrial sector in the country. Furthermore, major market players such as Aramco and SABIC are increasingly emphasizing circular economy projects, which can optimize future local PEF production.

Recent Developments

- In May 2025, Avantium N.V., a major company in renewable and circular polymer materials, announced a collaboration with the Bottle Collective. This partnership focuses on developing fiber bottles using Dry Molded Fiber (DMF) technology. The technology creates fiber-based packaging with lower CO2 footprints.(Source : worldbiomarketinsights.com)

Polyethylene Furanoate (PEF) Market Companies

- Avantium N.V.: Avantium N.V. is the leading pioneer in the polyethylene furanoate (PEF) market, driving the transition from fossil-based PET to 100% plant-based, circular alternatives.

- Sulzer Ltd: Sulzer Ltd (primarily through its Sulzer Chemtech division) is a key technology provider and licensing partner in the global polyethylene furanoate (PEF) market.

- AVA Biochem AG

- Origin Materials

- TOYOBO CO., LTD.

- BASF SE

- Mitsui & Co., Ltd.

- Corbion

- Danone

- ALPLA Group

- Swicofil AG

- Zhejiang Sugar Energy Technology Co., Ltd.

- Eastman Chemical Company

- DuPont de Nemours, Inc.

- Toray Industries, Inc.

- Gevo, Inc.

- Stora Enso

- Sukano AG

- ADM (Archer Daniels Midland)

- WIFAG-Polytype Holding AG

Segments Covered in the Report

By Source

- Plant-based

- Bio-based

By Grade

- Standard Grade

- High-Performance Grade

- Blended/Customized Grade

By Application Area

- Bottles (Beverages, Personal Care)

- Films & Sheets (Food Packaging, Industrial)

- Fibers (Textiles, Industrial Apparel)

- Molded Components (Automotive, Electronics)

- Extruded Components

By End-Use Industry

- Food & Beverage Packaging

- Fiber & Textiles

- Automotive & Transportation

- Electrical & Electronics

- Pharmaceuticals & Medical

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa