Content

What is the Current Polymer Nanocomposites Market Size and Volume?

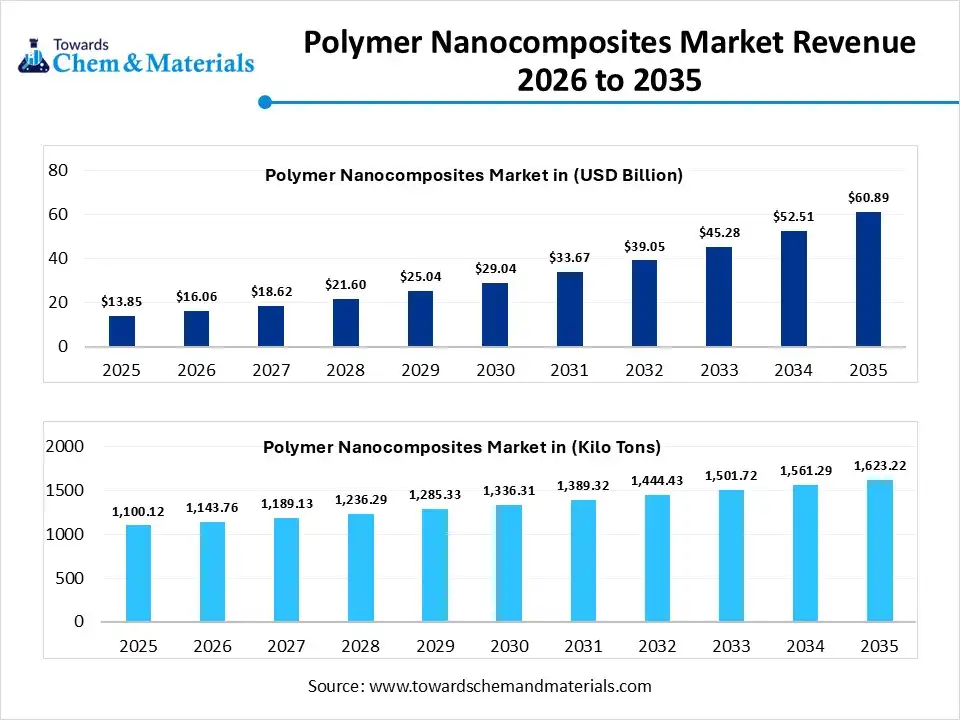

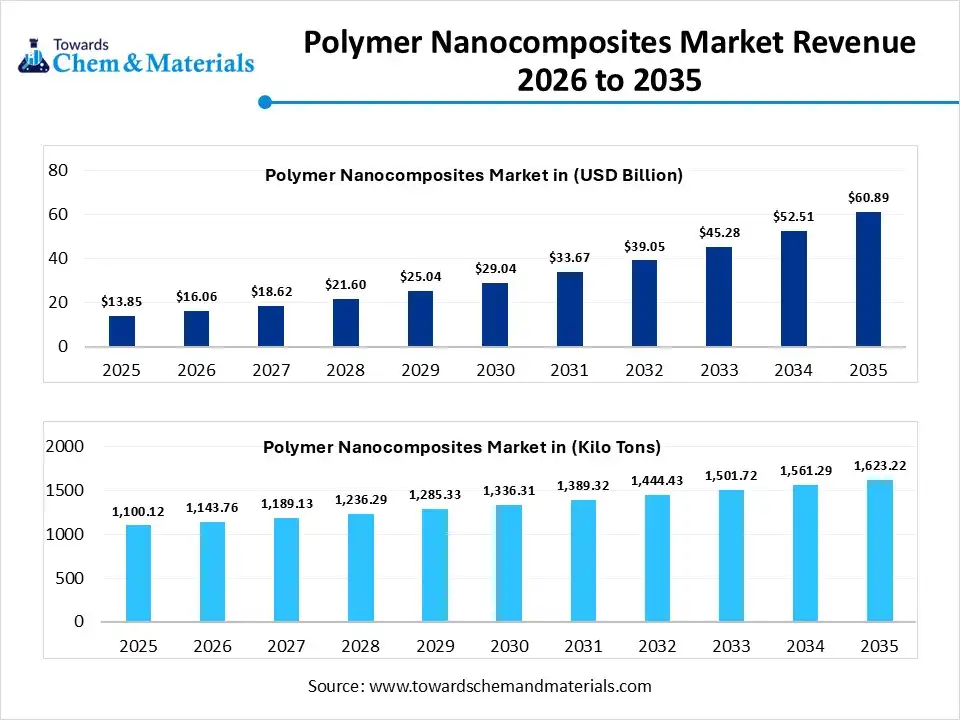

The global polymer nanocomposites market size was estimated at USD 13.85 billion in 2025 and is expected to increase from USD 16.06 billion in 2026 to USD 60.89 billion by 2035, growing at a CAGR of 15.96% from 2026 to 2035. In terms of volume, the market is projected to grow from 1,100.12 kilo tons in 2025 to 1,623.22 kilo tons by 2035. growing at a CAGR of 3.97% from 2026 to 2035. Asia Pacific dominated the polymer nanocomposites market with the largest volume share of 48.23% in 2025. The adoption of sustainable manufacturing practices has fueled the industry’s potential in recent years.the material, which is made by mixing tiny particles into plastics called the polymer nanocomposites. Also, having properties like strongness, greater heat resistance, and lightweight, the polymer nanocomposites have gained major industry share in the plastic industry in recent years. Also, the better the conductivity of electricity has supported the reshaping of supply and demand dynamics in recent years.

Market Highlights

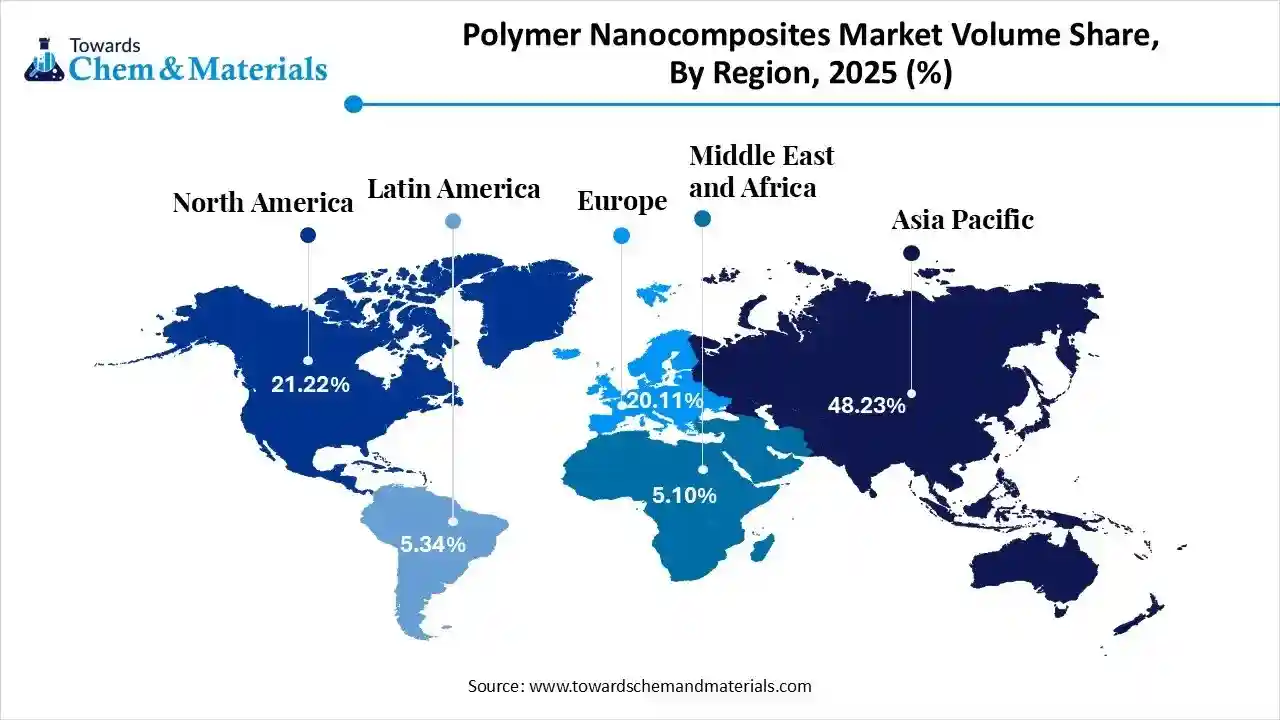

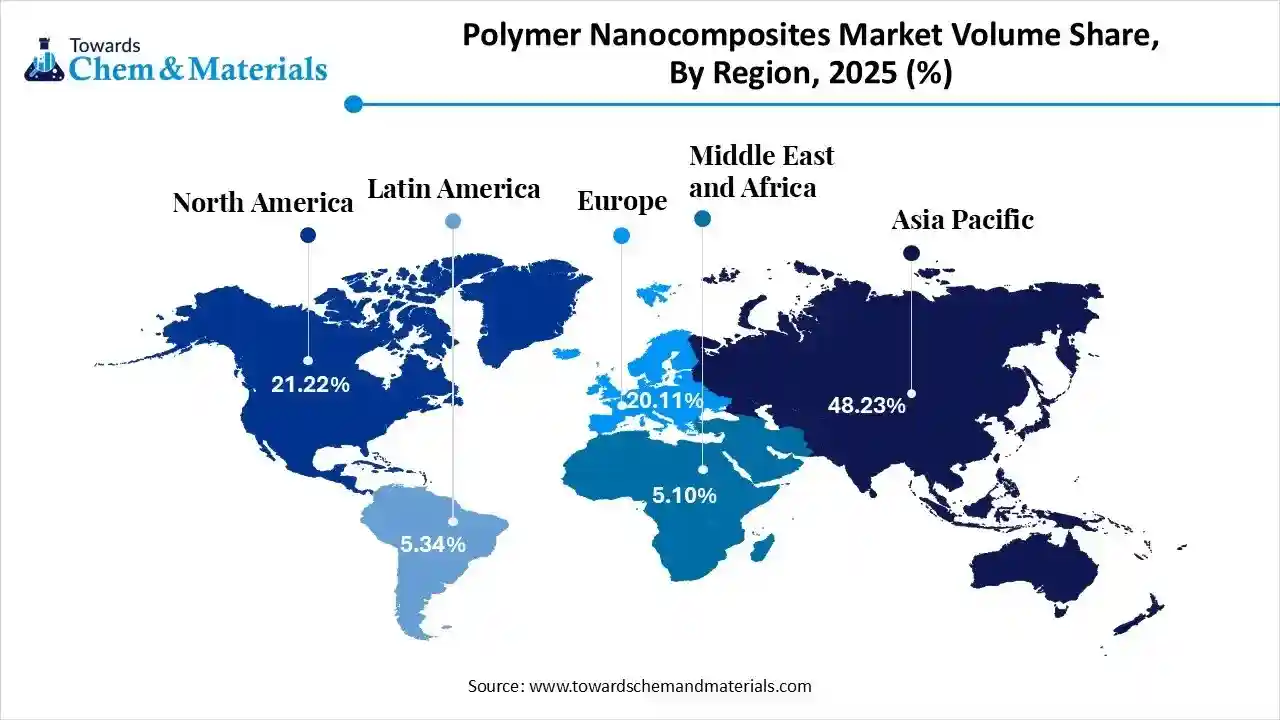

- The Asia Pacific dominated the global polymer nanocomposites market with the largest volume share of 48.23% in 2025.

- The polymer nanocomposites market in North America is expected to grow at a substantial CAGR of 5.91% from 2026 to 2035.

- The Europe polymer nanocomposites market segment accounted for the major volume share of 20.11% in 2025.

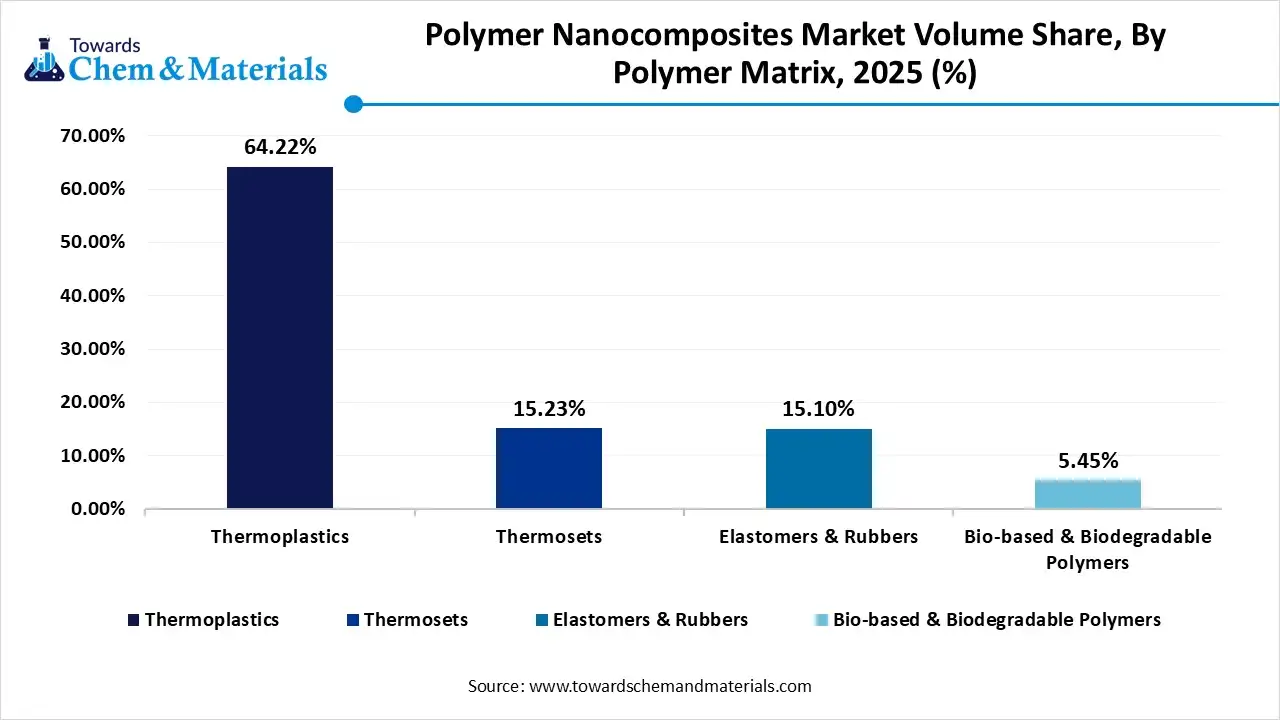

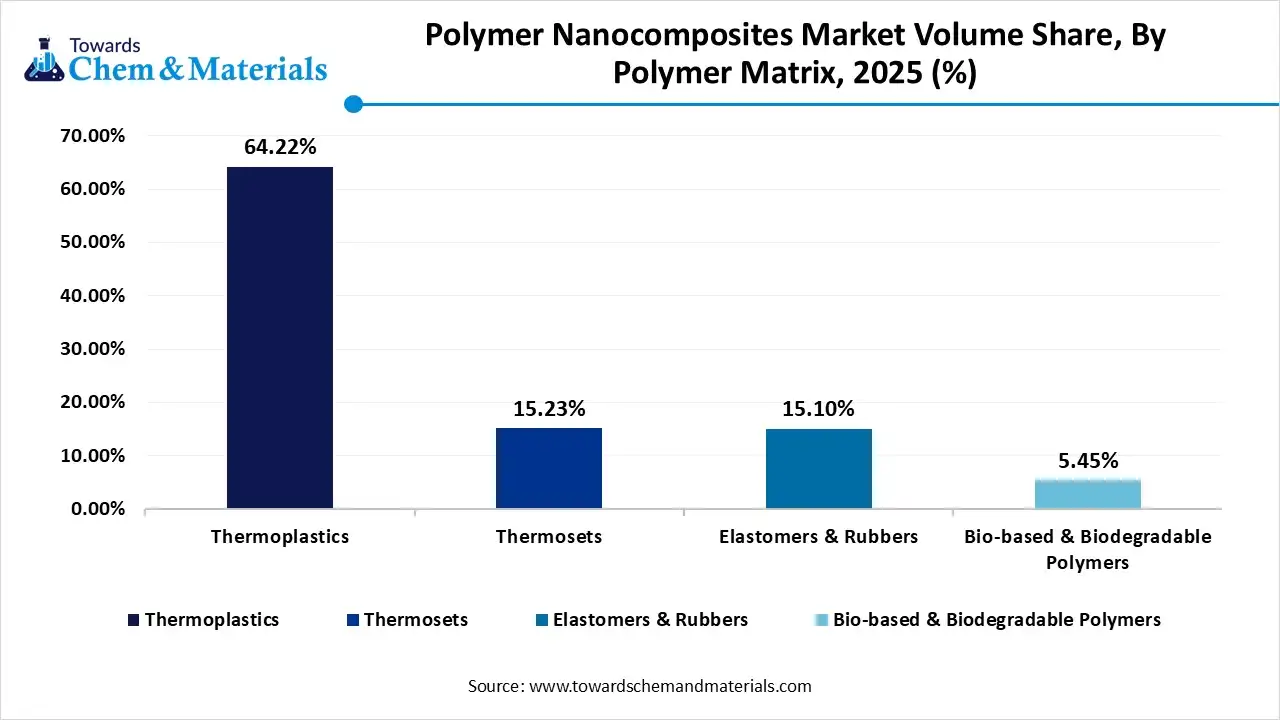

- By polymer matrix, the thermoplastic segment dominated the market and accounted for the largest volume share of 64.2% in 2025.

- By polymer matrix, the bio-based and biodegradable segment is expected to grow at the fastest CAGR of 7.58% from 2026 to 2035 in terms of volume.

- By nanomaterial type, the nanoclays segment led the market with the largest revenue volume share of 39.5% in 2025.

- By end use, the packaging segment dominated the market and accounted for the largest volume share of 32.2% in 2025.

Polymer Nanocomposites Market Trends:

- The emergence of less material usage in the making of the polymer nanoparticles, such as using smaller amounts of nanoparticles while achieving greater performance, is aligned with evolving consumer preferences and offering fresh prospects in recent years.

- The sudden surge in the demand for sustainable and eco-friendly nanocomposites is driving the regional manufacturing expansion through local sourcing trends in the current period. Also, the major brands are actively promoting their sustainable product line through various platforms like social media and online websites.

- The development of multifunctional polymer nanocomposites is anticipated to stimulate demand-led growth in the manufacturing sector in the coming years. Also, by sensing pressure, temperature, and electrical changes has provided a wider consumer base from the versatile domains in recent years, as per the observation.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 16.06 Billion / 1143.76Kilo Tons |

| Revenue Forecast in 2035 | USD 60.89 Billion / 1623.22 Kilo Tons |

| Growth Rate | CAGR 15.96% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Nanomaterial Type, By Polymer Matrix, By End-Use Industry, By Region |

| Key companies profiled | BASF SE, Dow Chemical Company, DuPont de Nemours, Inc, Evonik Industries AG, Arkema S.A., Cabot Corporation, Mitsubishi Chemical Group Corporation, Nanocyl SA, Nanocor, Inc. (Minerals Technologies Inc.), Nanophase Technologies Corporation, 3M Company, RTP Company, Avient Corporation, Clariant AG, LyondellBasell Industries N.V., Mitsui Chemicals, Inc., Toray Industries, Inc., Solvay S.A., Huntsman International LLC, Unitika Ltd. |

The Future of Materials is Precisely Engineered

The industry has seen in moving from basic mixing to controlled design at the nano level. Earlier methods mixed nanoparticles randomly into polymers, which gave uneven results. Moreover, the new techniques allow better control of particle size, spacing, and direction inside the polymer, as this helps engineers design materials with predictable strength, heat control, and electrical behavior. This shift is important because it reduces trial and error and improves product reliability, which is likely to provide closer attention to the industry.

Value Chain Analysis of the Polymer Nanocomposites Market:

- Distribution to Industrial Users: The distribution of polymer nanocomposites to industrial users is characterized by a mix of direct supply partnerships and specialized B2B digital platforms aimed at critical sectors like automotive, aerospace, and electronics.

- Key Players: DuPont and BASF

- Chemical Synthesis and Processing: The chemical synthesis and processing of polymer nanocomposites (PNCs) are dominated by advanced dispersion techniques and the integration of functional nanomaterials like carbon nanotubes, graphene, and nanoclays.

- Key Players: Arkema S.A and Evonik Industries AG

- Regulatory Compliance and Safety Monitoring: The regulatory compliance and safety monitoring of the polymer nanocomposites market is characterized by stringent reporting requirements and standardized safety assessments for nanomaterials. Major chemical producers are increasingly required to provide detailed environmental and health data to navigate evolving frameworks in the EU and the United States.

- Safety Standards- EU REACH and US TSCA

Polymer Nanocomposites Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) | Assessing potential environmental and health risks of nanoscale materials |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC) No 1907/2006 | Ensuring safety and transparency by requiring specific nanoform registration under REACH |

| China | National Medical Products Administration (NMPA) | NMPA Technical Guidelines | Developing clear standards for terminology and safety |

Segmental Insights

Polymer Matrix Insights

Why does the Thermoplastics Segment Dominate the Polymer Nanocomposites Market?

The thermoplastics segment volume was valued at 706.50 Kilo Tons in 2025 and is projected to reach 965 Kilo Tons by 2035, expanding at a CAGR of 3.53% during the forecast period from 2025 to 2035. the thermoplastics segment dominated the market with 64.2% share in 2025, owing to their easy-to-process, recyclable, and widely used properties. These polymers can be melted and reshaped many times, which makes manufacturing flexible and cost-effective. Moreover, industries prefer thermoplastics because they work well with existing machines and large-scale production.

The bio-based & biodegradable polymers segment volume was valued at 59.96 Kilo Tons in 2025 and is expected to surpass around 115.74 Kilo Tons by 2035, and it is anticipated to expand to 7.58% of CAGR during 2026-2035, akin to increasing demand for materials that do not harm the environment. Governments, companies, and consumers are pushing for greener products. These polymers naturally break down and minimize plastic waste. When nanomaterials are added, their strength and usability improve a lot, which drives growth.

Polymer Nanocomposites Market Volume and Share, By Polymer Matrix, 2025-2035

| By Polymer Matrix | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Thermoplastics | 64.22% | 706.50 | 965.00 | 3.53% | 59.45% |

| Thermosets | 15.23% | 167.55 | 295.75 | 6.52% | 18.22% |

| Elastomers & Rubbers | 15.10% | 166.12 | 246.73 | 4.49% | 15.20% |

| Bio-based & Biodegradable Polymers | 5.45% | 59.96 | 115.74 | 7.58% | 7.13% |

Nanomaterial Type Insights

How did the Nanoclays Segment Dominate the Polymer Nanocomposites Market in 2025?

The nanoclays segment dominated the market with 39.5% share in 2025, due to its unique characteristics and advantages like low cost, easy usage, and sustainability with other plastics. Moreover, by improving the heat resistance, strength, and barrier properties, the nanoclays has elevated the earning potential for producers in recent years, as per the observation.

The carbon nanotubes (CNTs) segment is expected to grow with a rapid CAGR, owing to the increasing demand for the high performance and smart materials instead of normal plastics. Also, with the shift towards the smaller and smarter designs in electronics or many industries, carbon nanotubes are seen as the high margin opportunity for manufacturers for the coming years.

End Use Insights

How did the Packaging Segment Dominate the Polymer Nanocomposites Market in 2025?

The packaging segment dominated the market with 32.2% share in 2025, akin to it need lightweight, strong, and protective materials. Nanocomposites improve barrier properties, keeping food and products fresh for a longer time. They also reduce material thickness while maintaining strength, which lowers cost and waste. Packaging companies quickly adopt new materials that improve shelf life and appearance.

The electrical and electronics segment is expected to grow due to the modern devices' need light, strong, and smart materials. Polymer nanocomposites help control heat, electricity, and strength in small spaces. Electronics are becoming thinner and more powerful, so materials must work better without adding weight.

Regional Insights

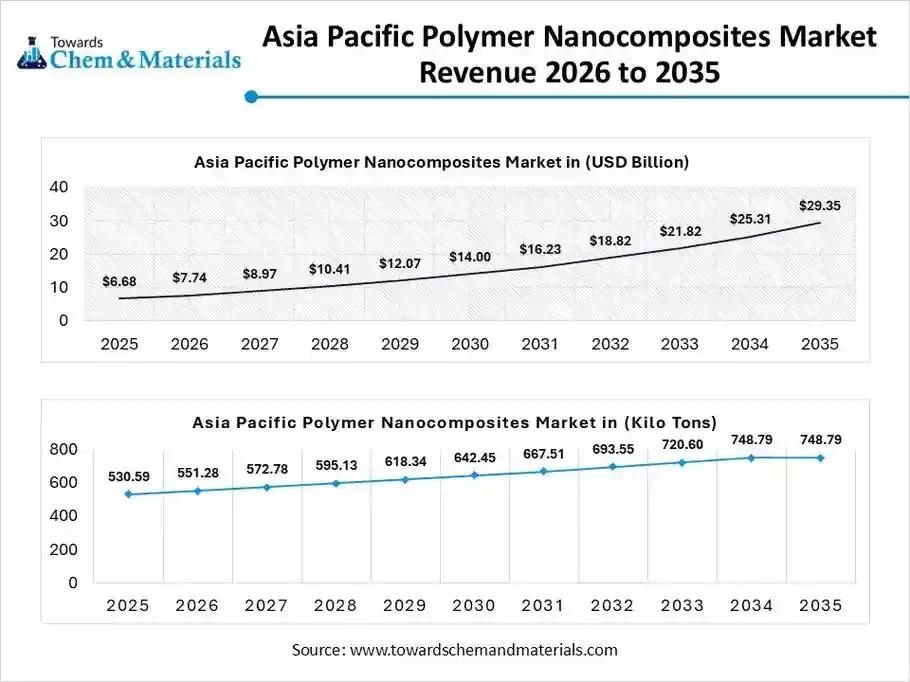

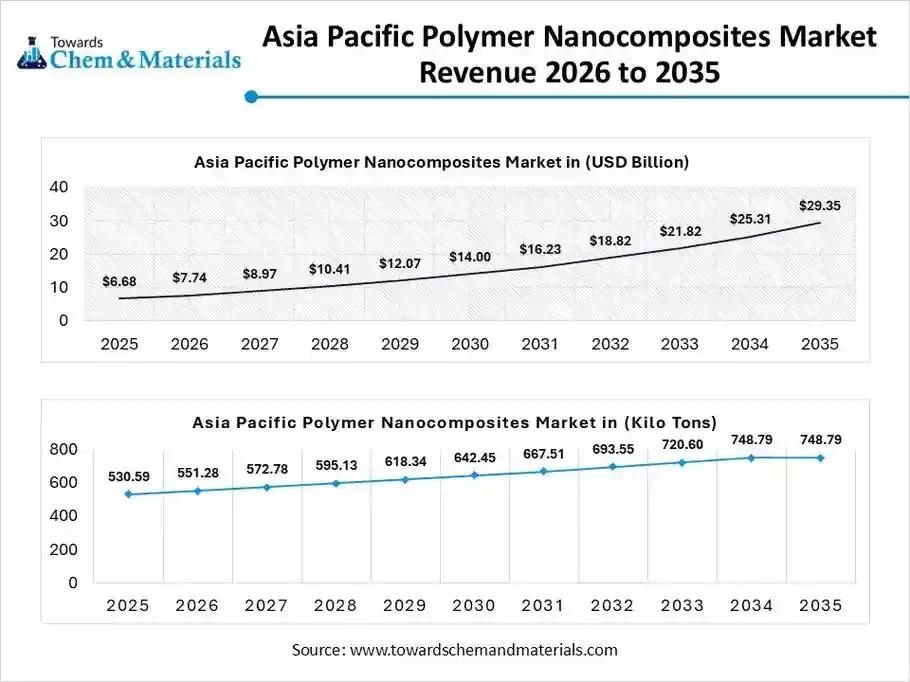

The Asia Pacific polymer nanocomposites market size is valued at USD 7.74 billion in 2026 and is expected to be worth around USD 29.35 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 15.98% over the forecast period from 2026 to 2035.

The Asia Pacific polymer nanocomposites market volume was estimated at 530.59 kilo tons in 2025 and is projected to reach 748.79 kilo tons by 2035, growing at a CAGR of 3.90% from 2026 to 2035.Asia Pacific dominated the polymer nanocomposites market with a 48.2% industry share in 2025, due to the region has combined infrastructure of manufacturing and cost efficiency. Moreover, the regional countries such as India, China, and Japan have been seen under the heavy need for lightweight and stronger materials for automobiles, packaging, and electronics, which has created greater opportunities for polymer composites manufacturers in recent years.

Research and Scale Powering China’s Growth

China maintained its dominance in the market, owing to the research, mass application, heavy manufacturing, and exports. Moreover, several manufacturers in the country have been observed under the heavy testing of the nanocomposites, which have also gained global attention in the past few years. Moreover, the stronger domestic demand has played a major role in the industry expansion in the country in recent years.

North America Polymer Nanocomposites Market Examination

The North America polymer nanocomposites market volume was estimated at 233.45 kilo tons in 2025 and is projected to reach 391.36 kilo tons by 2035, growing at a CAGR of 5.91% from 2026 to 2035, owing to the increasing need for the high performance and precision-engineered polymer composites in recent years. Also, the sectors such as aerospace, medical devices, and advanced electronics have observed a heavy demand for polymer nanocomposites in recent years in the region.

United States Leading Nanocomposites Innovation

The United States is expected to emerge as a prominent country for the polymer nanocomposites market in the coming years, akin to early access to advanced technologies and heavier investments. Moreover, the stronger startup activities may drive substantial financial gains in the manufacturing sector during the forecast period, as per the future industry expectations.

Polymer Nanocomposites Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 21.22% | 233.45 | 391.36 | 5.91% | 24.11% |

| Europe | 20.11% | 221.23 | 342.99 | 4.99% | 21.13% |

| Asia Pacific | 48.23% | 530.59 | 748.79 | 3.90% | 46.13% |

| South America | 5.34% | 58.75 | 67.04 | 1.48% | 4.13% |

| Middle East & Africa | 5.10% | 56.11 | 73.04 | 2.97% | 4.50% |

Europe Polymer Nanocomposites Market Evaluation

The Europe polymer nanocomposites market volume was estimated at 221.23 kilo tons in 2025 and is projected to reach 342.99 kilo tons by 2035, growing at a CAGR of 4.99% from 2026 to 2035.Europe is a notably growing region, owing to its focus on sustainability and material efficiency. European industries want materials that last longer, waste less, and fit circular economic goals. Polymer nanocomposites help reduce weight and improve durability, which lowers environmental impact. Furthermore, Europe also highlights regulation-driven innovation, meaning materials must meet strict safety and environmental standards.

High Performance Materials Powering Germany

Germany is expected to gain a major industry share, as the country uses polymer nanocomposites to make products better, instead of cheaper, nowadays. Also, the German companies focus on quality, precision, and long life, whereas these materials are used in cars, machines, and industrial tools, where failure is not acceptable. Polymer nanocomposites help reduce weight while keeping strength high, which can create lucrative advantages in the country.

Polymer Nanocomposites Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the industry, due to regional industries investing in modern infrastructure and advanced materials. Polymer nanocomposites are used to improve durability in harsh environments such as heat, sand, and chemicals. The region is shifting from raw material export toward value-added manufacturing. Lightweight and corrosion-resistant materials are important for construction, energy, and transportation projects.

Engineering Durability for Tomorrow’s Saudi Arabia

Saudi Arabia is expected to emerge as a prominent country, akin to a country that wants to build advanced industries, as the polymer nanocomposites are useful for making strong, lightweight parts that can handle heat and stress. These materials are important for construction, energy equipment, and new manufacturing projects. Saudi Arabia focuses on long-lasting materials that reduce maintenance and improve efficiency.

South America Polymer Nanocomposites Market Evaluation

The South America polymer nanocomposites market volume was estimated at 58.75 kilo tons in 2025 and is projected to reach 67.04 kilo tons by 2035, growing at a CAGR of 1.48% from 2026 to 2035. South America is a notably growing region due to the industries in the region are looking for cost-effective performance improvements. Instead of replacing entire systems, companies use nanocomposites to enhance existing materials. This is specifically useful in packaging, agricultural equipment, and transportation. Also, the region values materials that improve durability without raising costs too much.

Brazil’s Industrial Growth Gains Momentum

Brazil is expected to gain a major industry share, akin to the country focuses on solving real production challenges. Brazilian industries use them in automotive parts, packaging, and consumer goods. The focus is on improving performance while keeping costs under control. Brazil also benefits from strong industrial demand and local manufacturing needs in the current period.

Top Vendors in the Polymer Nanocomposites Market & Their Offerings:

- BASF SE: As a global leader in chemical innovation, BASF develops advanced polymer nanocomposites that offer superior thermal stability and mechanical strength for lightweight automotive components and sustainable construction materials.

- Dow Chemical Company: Dow utilizes its expertise in materials science to produce high-performance nanocomposites that enhance barrier properties and durability in advanced packaging and infrastructure applications.

- DuPont de Nemours, Inc.: DuPont focuses on specialty polymer nanocomposites, such as carbon nanotube-reinforced resins, to provide high-strength, heat-resistant solutions for the aerospace and high-end electronics industries.

- Evonik Industries AG: A specialty chemicals leader, Evonik specializes in silica and metal-oxide-based polymer nanocomposites that improve the scratch resistance, flame retardancy, and transparency of technical plastics.

- Arkema S.A.

- Cabot Corporation

- Mitsubishi Chemical Group Corporation

- Nanocyl SA

- Nanocor, Inc. (Minerals Technologies Inc.)

- Nanophase Technologies Corporation

- 3M Company

- RTP Company

- Avient Corporation

- Clariant AG

- LyondellBasell Industries N.V.

- Mitsui Chemicals, Inc.

- Toray Industries, Inc.

- Solvay S.A.

- Huntsman International LLC

- Unitika Ltd.

Segments Covered in the Report

By Polymer Matrix

- Thermoplastics

- Polypropylene (PP)

- Polyethylene (PE)

- Polyamide (Nylon)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polycarbonate (PC)

- Thermosets

- Epoxy Resins

- Polyurethane (PU)

- Unsaturated Polyester Resins (UPR)

- Phenolic Resins

- Elastomers and Rubbers

- Natural Rubber

- Styrene-Butadiene Rubber (SBR)

- Silicone Rubber

- Bio-based and Biodegradable Polymers

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch-based Polymers

By Nanomaterial Type

- Nanoclays (e.g., Montmorillonite, Kaolinite)

- Carbon Nanotubes (CNTs)

- Single-Walled Carbon Nanotubes (SWCNTs)

- Multi-Walled Carbon Nanotubes (MWCNTs)

- Graphene and Graphene Oxide

- Nanofibers (e.g., Carbon Nanofibers, Polymer Nanofibers)

- Nano-oxides / Metal Oxides

- Antimony Tin Oxide (ATO)

- Zinc Oxide (ZnO)

- Titanium Dioxide (TiO2)

- Alumina (Al2O3)

- Silica (SiO2)

- Metallic Nanoparticles (e.g., Silver, Gold, Copper)

- Nanocellulose (e.g., Nanocrystalline Cellulose, Cellulose Nanofibrils)

- Polyhedral Oligomeric Silsesquioxane (POSS)

By End-Use Industry

- Packaging

- Food and Beverage Packaging

- Pharmaceutical Packaging

- Electronic Component Packaging

- Automotive

- Engine and Under-the-hood Components

- Interior and Exterior Trims

- Fuel Systems and Lines

- Tires and Sealants

- Electrical and Electronics

- Semiconductor Parts

- EMI/RFI Shielding

- Printed Circuit Boards (PCBs)

- Flexible Displays and Sensors

- Aerospace and Defense

- Structural Airframe Components

- Aircraft Interiors

- Ballistic Protection and Armor

- Energy

- Lithium-ion Battery Electrodes

- Solar Cell Encapsulants

- Wind Turbine Blades

- Biomedical and Healthcare

- Drug Delivery Systems

- Bone Tissue Engineering Scaffolds

- Surgical Implants and Tools

- Building and Construction

- Flame Retardant Panels

- High-strength Coatings and Adhesives

- Insulation Materials

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa