Content

What is the Current Recycled Polyolefin Market Size?

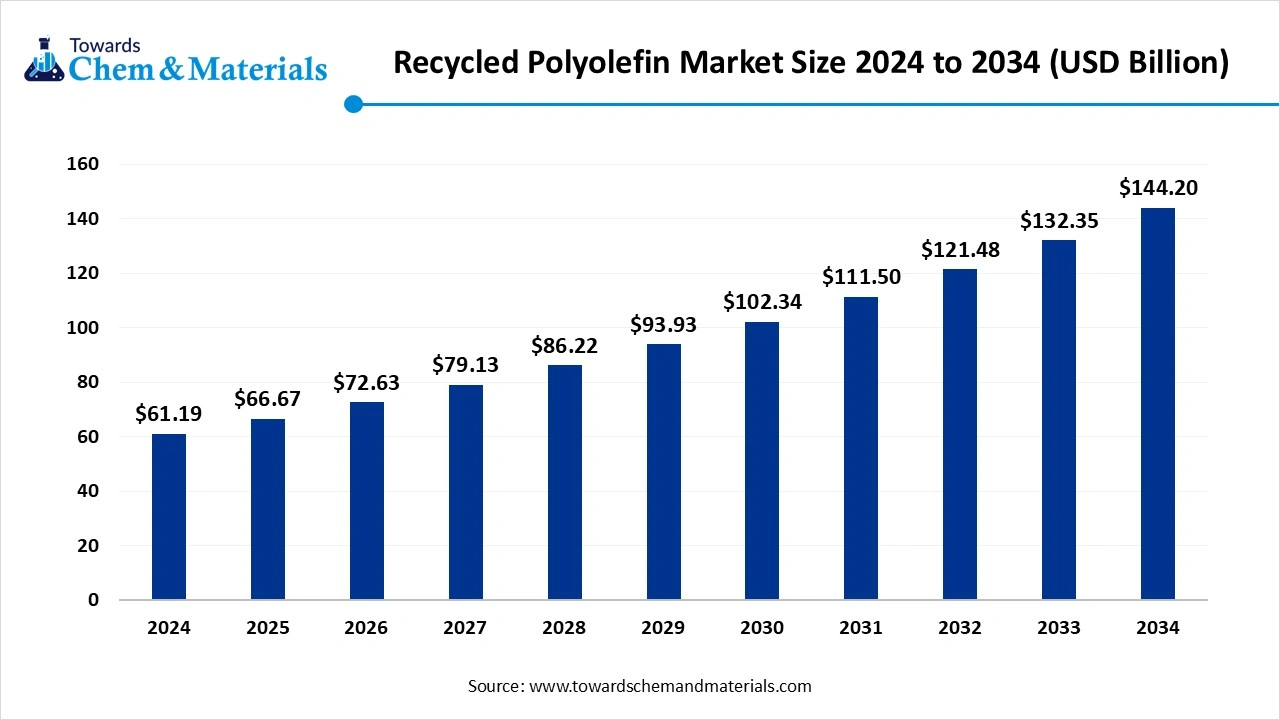

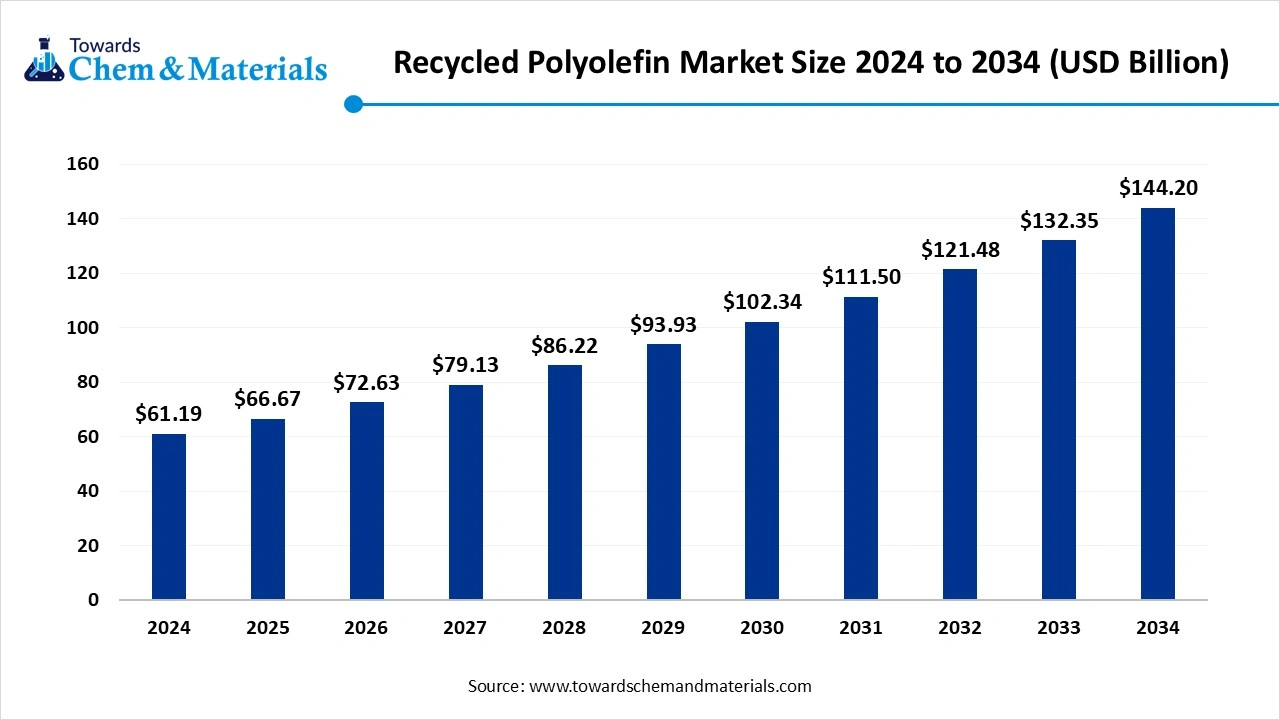

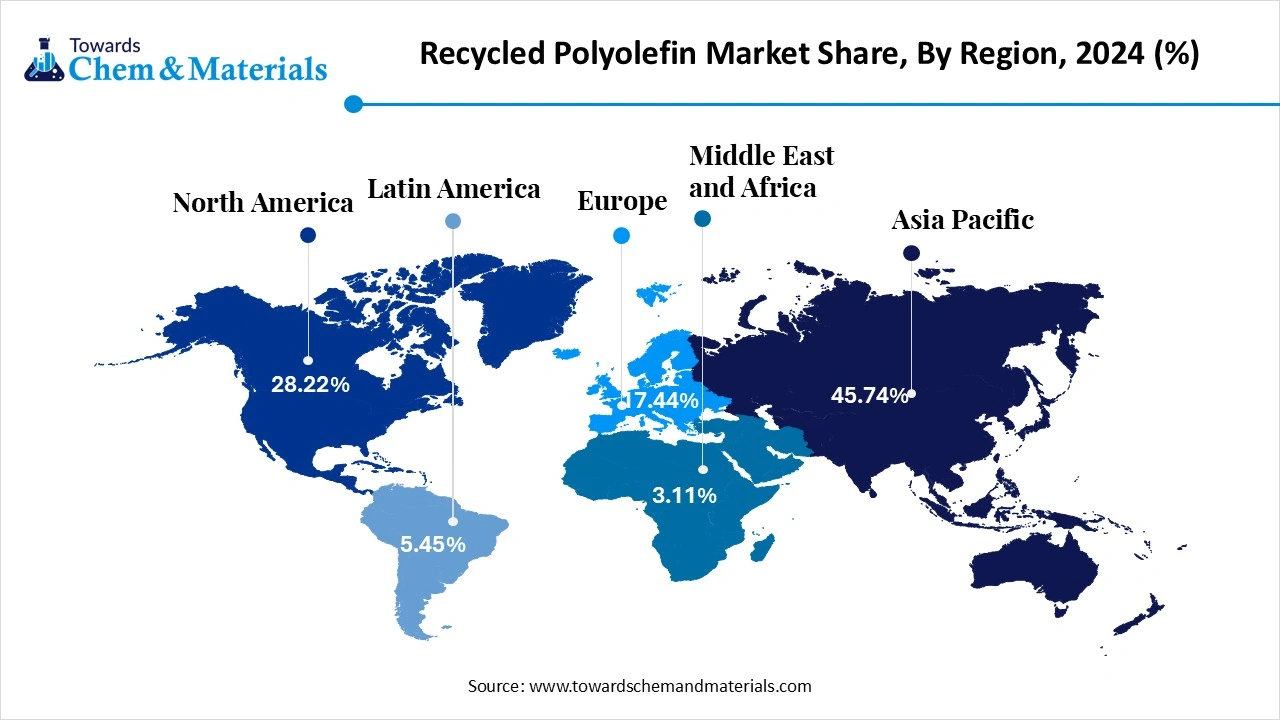

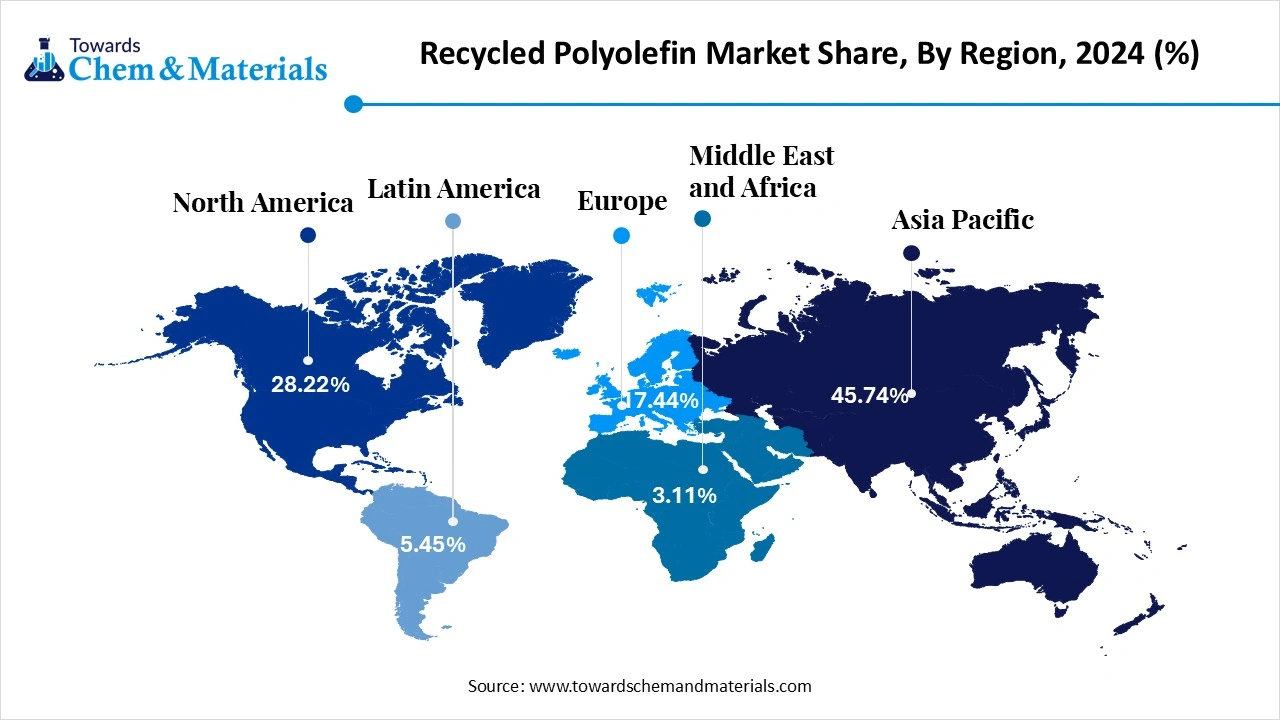

The global recycled polyolefin market size was estimated at USD 66.25 billion in 2025 and is expected to increase from USD 72.38 billion in 2026 to USD 160.47 billion by 2035, growing at a CAGR of 9.25% from 2026 to 2035. Asia Pacific dominated the recycled polyolefin market with the largest volume share of 47.19% in 2025. The ongoing implementation of sustainability standards in major industries has accelerated the industry's potential in recent years.

Key Takeaways

- The Asia Pacific dominated the global recycled polyolefin market with the largest market share of 47.19% in 2025.

- The Europe is expected to grow at a notable rate in the future, owing to newly implemented and strong environmental standards and regulations.

- By product type, the Low-density polyethylene (LDPE) segment dominated the market and accounted for the largest revenue share of 36.38% in 2025.

- By product type, the polyethylene terephthalate (PET) segment is expected to grow at the fastest CAGR of 10.15% from 2026 to 2035 in terms of market revenue.

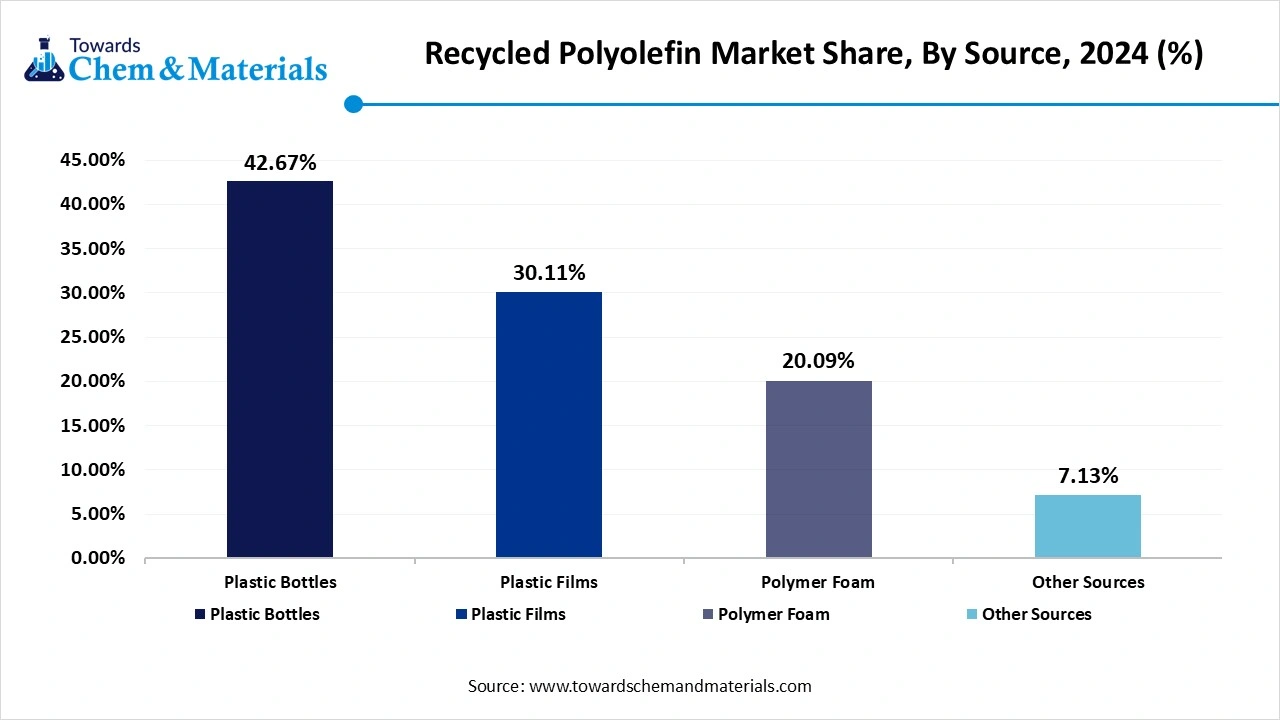

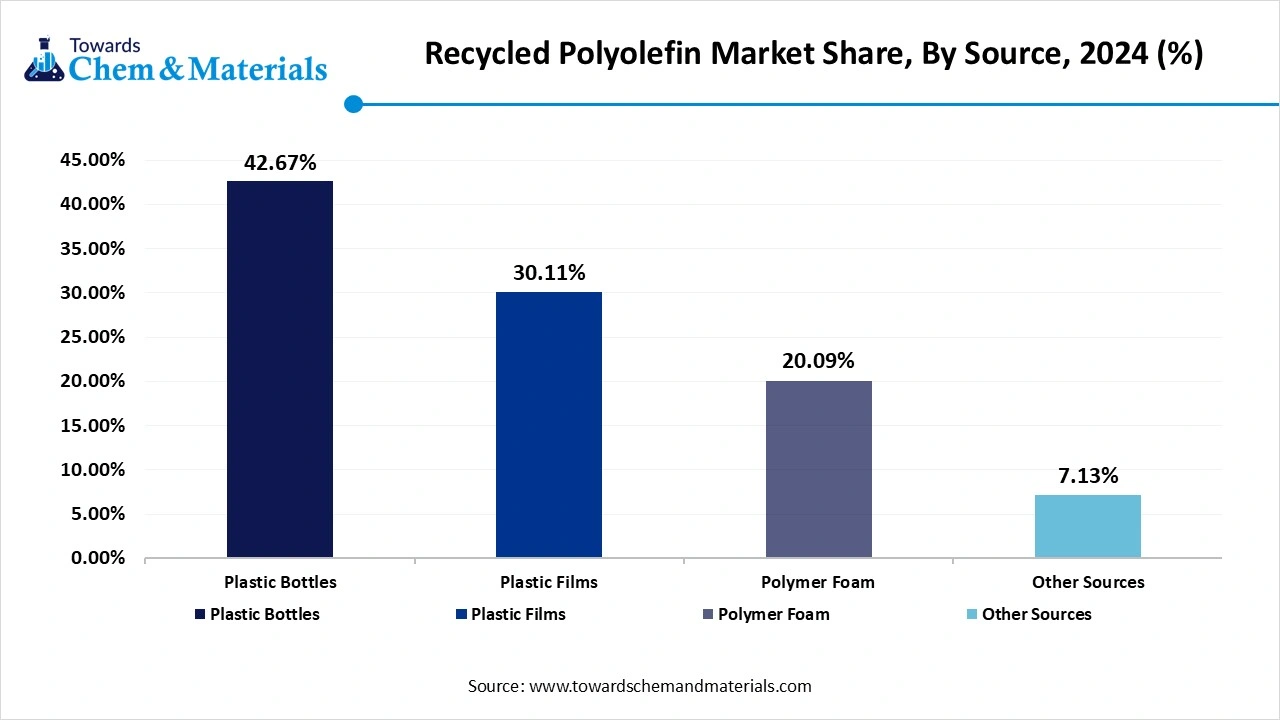

- By source type, the Plastic bottles segment led the market with the largest revenue share of 43.19% in 2025.

- By source type, the plastic film segment is projected to witness a substantial CAGR of 9.26% through the forecast period.

- By application, the food packaging segment dominated the market and accounted for the largest share of 38.64% in 2025.

- By application, the automotive segment is anticipated to grow at a significant CAGR of 10.48% through the forecast period.

Market Overview

Recycled Polyolefins Take Centre Stage in the Global Green Revolution

The recycled polyolefin market is expected to see fast-paced growth owing to the increasing implementation of sustainability standards around the globe. Moreover, these polyolefins, such as polypropylene and polyethylene, are increasingly being used in major sectors like automotive, construction, and packaging.

Also, the rapid expansion of eco-friendly initiatives by global governments is increasingly supporting industry growth as several manufacturing sectors are shifting to eco-friendly production in recent years. Furthermore, several manufacturing companies are heavily investing in research and development activities for innovative materials, which have become cost-effective and eco-friendly in the past few years, as per recent industry observation.

Which Factor Is Driving the Growth of the Recycled Polyolefin Market?

The enlarged expansion of the packaging industry, while recycled polyolefin is an ideal material, is spearheading the industry's potential in the current period. Also, several companies are seen replacing traditional plastics with recycled polyolefin while following governmental rules and reducing their carbon footprints in recent years. Furthermore, the flexible packaging manufacturers, like films and rigid packaging, such as containers, have increasingly been using recycled PE and PP material in the past few years, according to the recent industry survey, which is leading the market growth.

Market Trends

- The innovation of the latest recycling technologies, such as chemical and high-efficiency recycling, is driving industry growth in the current period. As several heavy manufacturers are increasingly putting investment into R&D activities for these technologies.The increasing use of polyolefins in the automotive sector is contributing to the growth of the market.

- The automotive manufacturers are seeking polyolefin materials to use in their vehicle parts, such as the dashboards, bumpers, and interior panels, while reducing vehicle weight and maintaining sophisticated vehicle costs, as per the recent industry observation.

- The sudden investment increase in the development of domestic plastic recycling plants around the regional spaces is leading to industry’s growth in recent years. Moreover, the local governments have been actively seen in supporting these recycling initiatives in the past few years, as per the recent regional observations.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 72.38 Billion |

| Expected Size by 2035 | USD 160.47 Billion |

| Growth Rate from 2026 to 2035 | CAGR 9.25% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By product, By Source, By Application, By Region |

| Key Companies Profiled | LyondellBasell, SABIC, Dow, INEOS, Borealis, GCR, Pashupati Group, Omya International AG |

Market Dynamics

Market Drivers

The recycled polyolefin market is primarily driven by rising regulatory pressure to reduce plastic waste and increase recycled content in packaging, consumer goods, and industrial applications. Governments across major economies are enforcing extended producer responsibility programs and minimum recycled content mandates, directly increasing demand for recycled polyethylene and polypropylene. Brand owners in food packaging, personal care, and consumer products are committing to circular economy targets, accelerating the substitution of virgin polyolefins with recycled grades. Growth in municipal solid waste collection and improvements in mechanical recycling infrastructure are also expanding the availability of recyclable feedstock. Additionally, volatility in virgin polymer prices is encouraging manufacturers to diversify raw material sourcing through recycled polyolefins.

Market Restraints

The market faces restraints related to inconsistent feedstock quality and contamination issues, which limit the performance and application range of recycled polyolefins. Mechanical recycling processes can result in material degradation, restricting use in high-performance or food-contact applications without additional processing. Limited recycling infrastructure in developing regions reduces collection efficiency and increases logistics costs. Price sensitivity remains a concern, as recycled polyolefins must compete with low-cost virgin plastics during periods of low crude oil prices. Regulatory uncertainty around food-grade approvals further constrains adoption in sensitive end-use sectors.

Market Opportunities

Significant opportunities are emerging from rapid advancements in sorting, washing, and compatibilizer technologies that improve the quality and consistency of recycled polyolefins. Growth of chemical recycling and advanced purification processes is opening pathways for food-contact and medical-grade recycled materials. Increasing demand from automotive, construction, and durable goods sectors for lightweight and sustainable materials is expanding application scope beyond packaging. Corporate sustainability commitments and carbon footprint reduction goals are driving long-term procurement contracts for recycled resins. Expansion of closed-loop recycling programs with brand owners presents additional opportunities for stable supply and value-added grades.

Market Challenges

One of the key challenges is scaling recycling capacity fast enough to meet rising recycled content mandates across multiple industries. Ensuring traceability and compliance across complex waste collection and processing chains remains operationally challenging. High capital investment requirements for advanced recycling technologies can limit participation by smaller recyclers. Balancing cost competitiveness with quality improvement continues to pressure margins. Additionally, aligning global standards for recycled polyolefin certification and performance remains a critical hurdle for widespread market acceptance.

Value Chain Analysis

- Design and Production of Virgin Plastics: This involves creating polyolefin-based products with consideration for their eventual end-of-life and recyclability.

- Key Players: LyondellBasell, SABIC, Dow, INEOS, Borealis, ExxonMobil, and Sinopec Corp.

- Consumption and Waste Collection: This involves the use and post-consumption handling of plastic products for ensuring a high-quality, consistent input stream for recyclers.

- Key Players: Republic Services, Waste Management, Inc., SUEZ, Veolia, and TerraCycle.

- Sorting and Pre-Processing: In this collected waste is transported to MRFs where it is sorted by polymer type and color, and contaminants are removed using advanced sorting technologies.

- Key Players: Republic Services, Waste Management, Inc., Veolia, SUEZ, KW Plastics, MBA Polymers Inc., and CarbonLITE Industries.

- Reprocessing and Compounding: This process often involves R&D to enhance material properties to meet specific application requirements.

- Key Players: MBA Polymers Inc., KW Plastics, PureCycle Technologies, Plastic Energy, Alucha, Dow, SABIC, and LyondellBasell.

- Manufacturing and Product Integration: In this, manufacturers purchase the recycled polyolefin pellets and use them as raw materials to produce new goods.

- Key Players: Amcor and Trex Company.

Segmental Insights

Product Type Insights

How Low-Density Polyethylene Segment Dominated the Recycled Polyolefin Market in 2025?

The low-density polyethylene segment held the largest share of the market share of 36.38% in 2025, due to its wide application in making things like containers, packaging films, and bags in the current period. Moreover, by having unique properties such as flexibility, easy processing, and lightweight, the LDPE gained an immense consumer base over the years. Also, this pattern is seen in generating a heavy amount of recycled waste, which is driving the growth of the segment in the last few years. Also, this low-density polyethylene have a low melting point, which allows manufacturers to easily recycle processes as per the observation.

The polyethylene terephthalate segment is seen to grow at a notable rate during the predicted timeframe, owing to the growing need for safe, strong, food-grade plastics. Moreover, by being used in the production of food containers and synthetic fibre, the recycled PET can gain major market share in the coming years. Also, PET plastics are increasingly considered easier to recycle, which can get easier with technology. Also, several brands are seen using recycled PET while getting greater governmental support, which can drive future growth as per expectations.

Source Type Insights

What Made the Plastic Bottles Segment the Dominant Segment in the Recycled Polyolefin Market in 2025?

The plastic bottles segment held the dominant share of the market share of 43.19% in 2025, as they are widely used and easy to collect. Items like water bottles, milk jugs, and cleaning product containers are regularly discarded and recycled at both household and commercial levels. These bottles are usually made from high-quality polymers such as HDPE and PET, making them valuable for recycling. The availability and purity of bottle waste make it an efficient feedstock for recycled plastic production. Since many bottle deposit systems are in place worldwide, collection rates are high, supporting the dominance of plastic bottles in the current recycled polyolefin market.

The plastic films segment is seen to grow at a notable rate during the predicted timeframe, owing to their massive use in packaging for food, consumer goods, and e-commerce. Although film recycling is more challenging because of contamination and thin layers, advances in sorting and washing technologies are improving recovery rates. As more brands adopt recyclable film materials and consumers push for sustainable packaging, the recycling of films is becoming more feasible. Governments are also introducing policies to reduce single-use plastics, encouraging innovations in film collection. This growing focus will drive higher recycling of plastic films, making them a leading source in the future.

Application Insights

How Food Packaging Segment Leading the Dominant Position in the Recycled Polyolefin Market in 2025?

The food packaging segment led the recycled polyolefin market share of 38.64% in 2025, owing to high demand for flexible and rigid plastic containers, films, and trays. These materials help preserve food quality and reduce spoilage. Since food packaging generates consistent plastic waste, it provides a steady supply of recyclable materials, especially LDPE and PP. Many food brands are shifting toward incorporating recycled content in their packaging to meet sustainability goals. As a result, recycling infrastructure has evolved to meet this need. These factors explain why the food packaging segment continues to dominate the market by application type.

The automotive segment is seen to grow at the fastest rate during the forecast period, akin to rising interest in sustainable manufacturing. Automakers are using recycled plastics for interior parts like dashboards, door panels, and under-the-hood components. Recycled polyolefins offer good strength, durability, and cost savings without compromising performance. As regulations around vehicle emissions and environmental impact tighten, manufacturers are shifting to lightweight and eco-friendly materials. Also, recycling partnerships between automakers and plastic recyclers are growing. These industry shifts, along with increasing consumer preference for green vehicles, will drive future growth of the recycled polyolefin market in the automotive segment.

Regional Insights

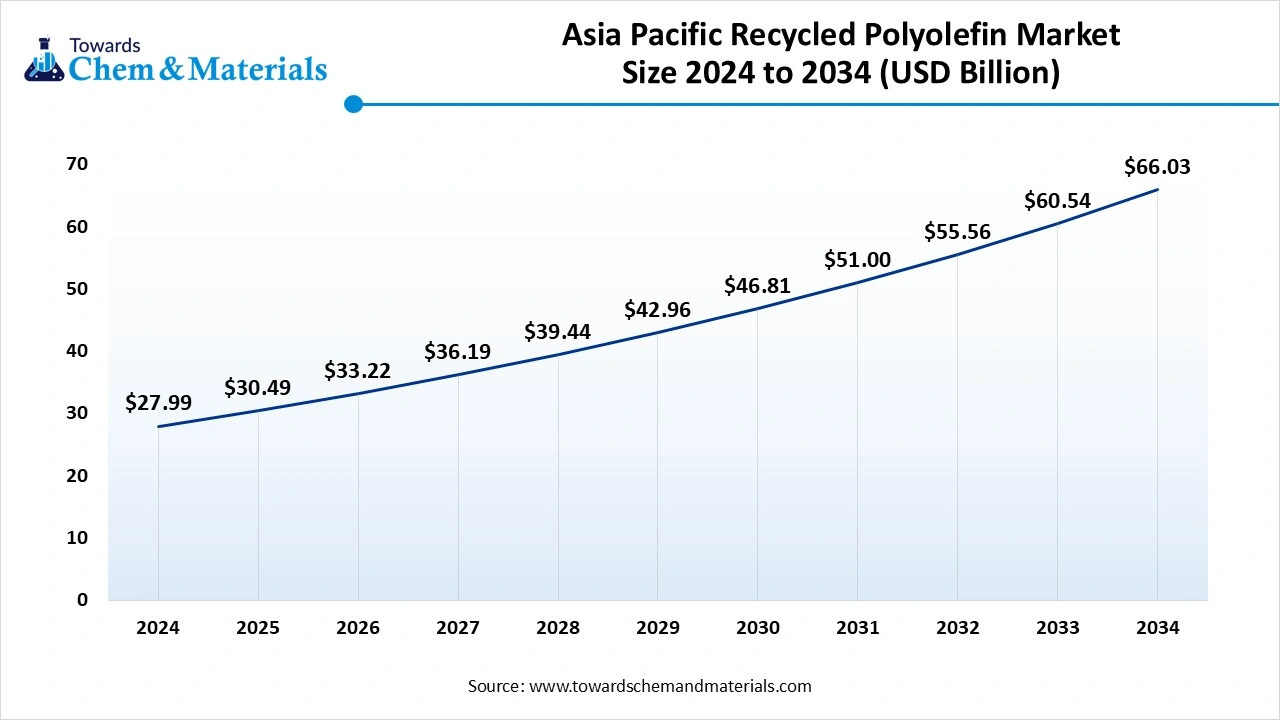

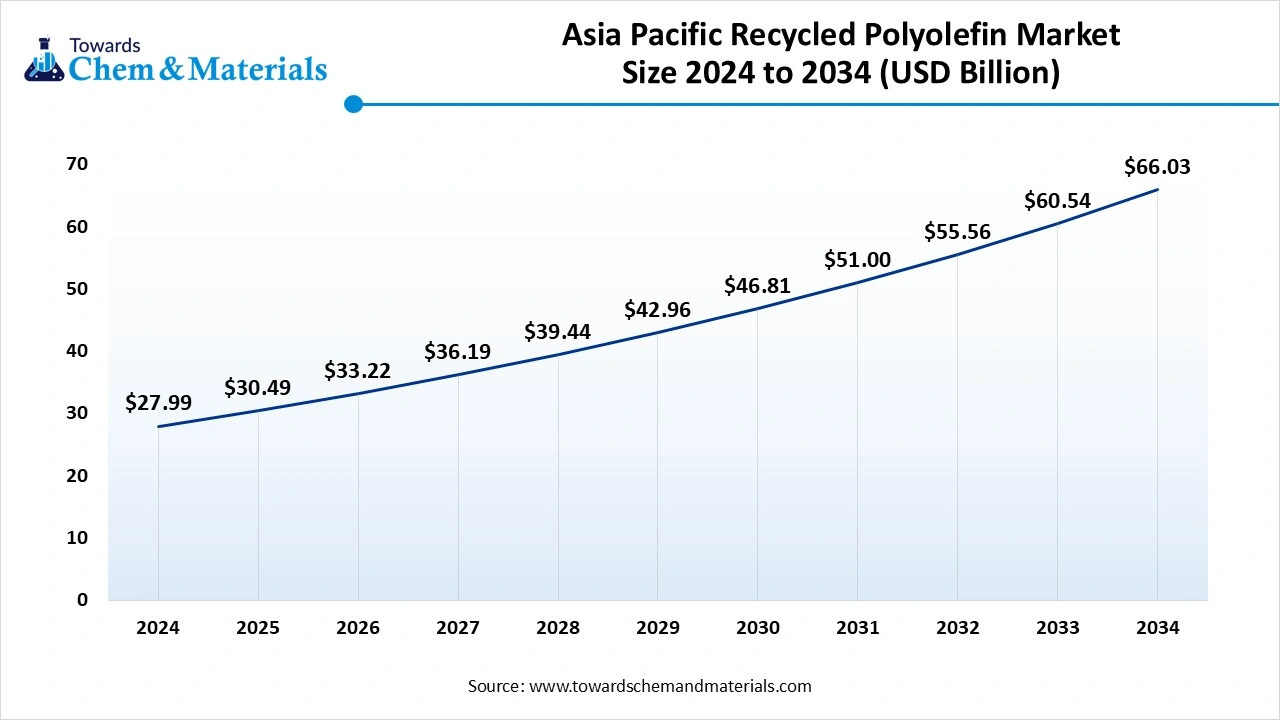

The Asia Pacific recycled polyolefin market size was valued at USD 31.26 billion in 2025 and is expected to be worth around USD 75.73 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.27% over the forecast period from 2026 to 2035.

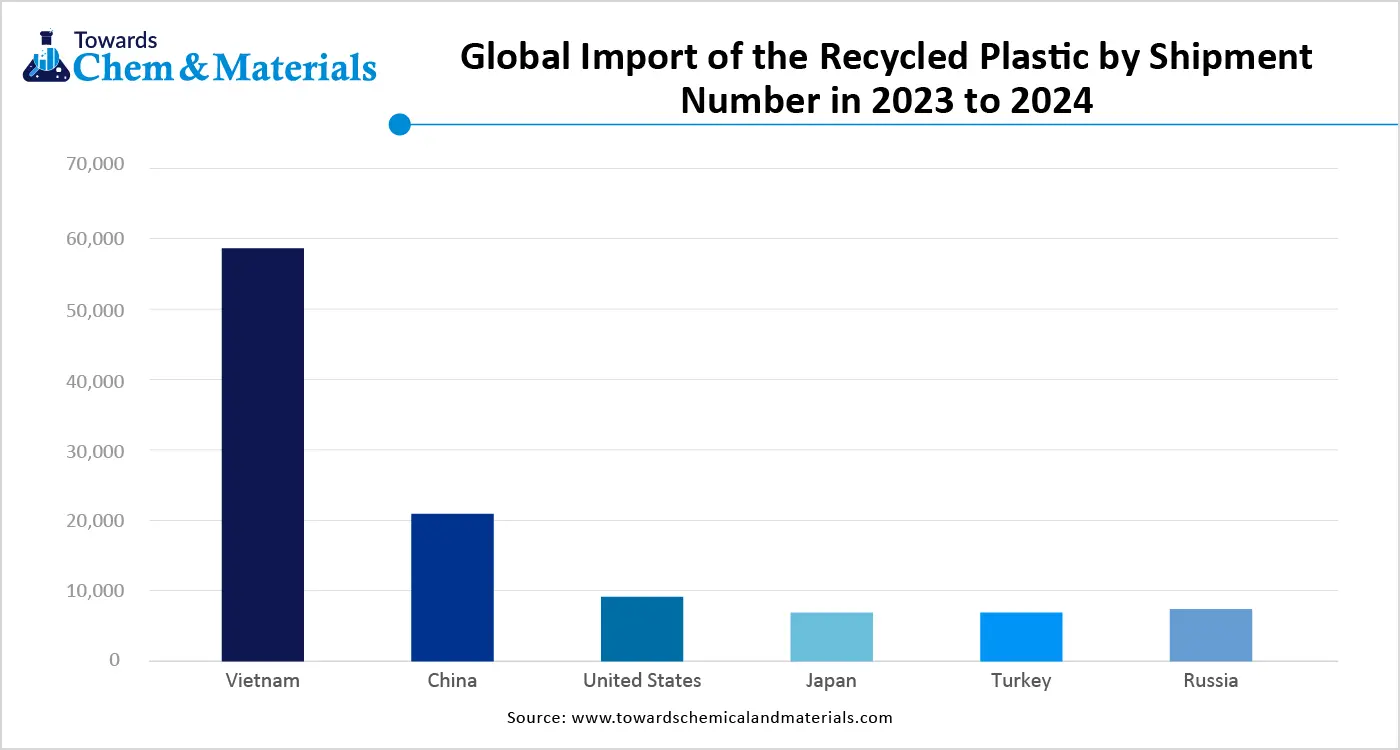

Asia Pacific dominated the market in 2025. Asia Pacific accounted for the heavy revenue in the current sector, akin to the heavy plastic production, with domestic consumption in the current period. Moreover, the countries in the region, such as China, India, and South Asian countries, have enlarged manufacturing sectors, which are consistently leading the plastic growth. Also, these countries’ governments are actively implementing green regulations, which are actively contributing to the market potential, as per the recent regional observation.

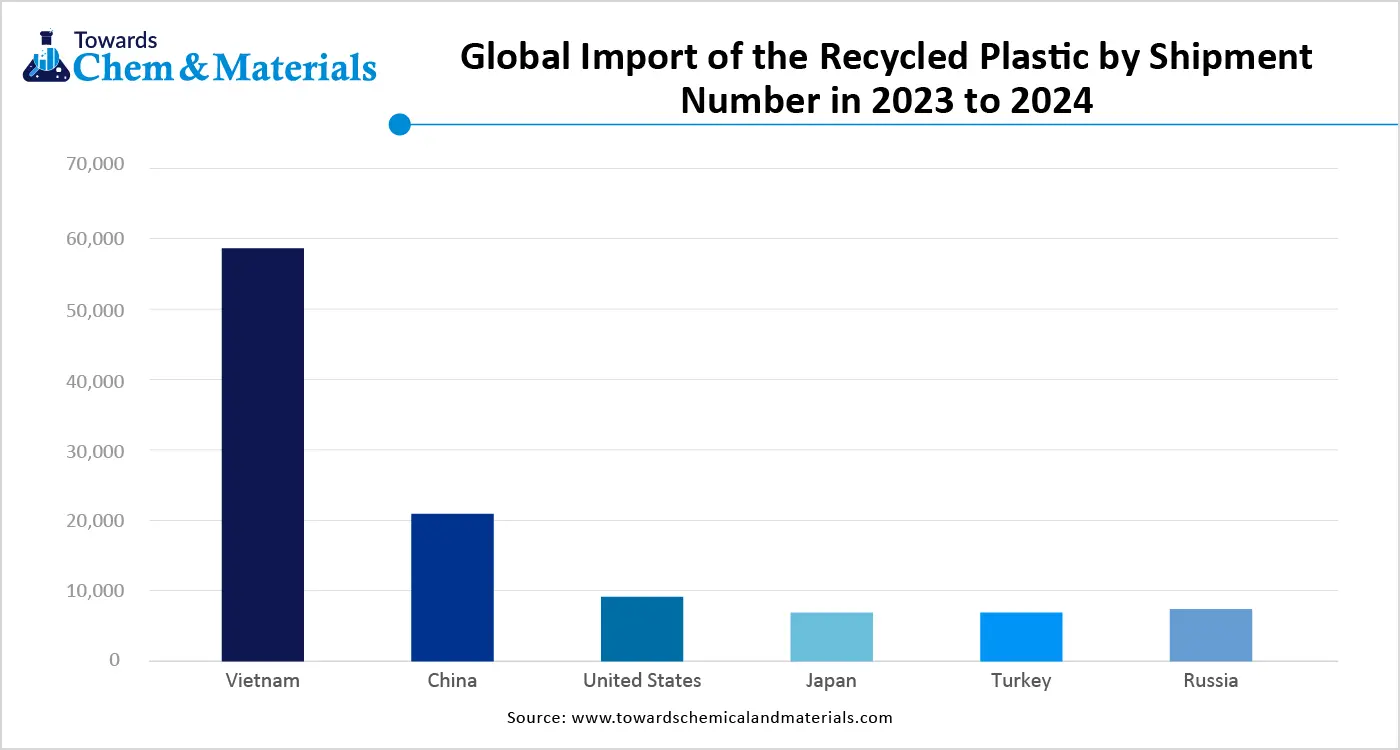

Is China Turning from Importer to Recycling Powerhouse?

China maintained its dominance in the recycled polyolefin market owing as China is considered the world's leading plastic waste importer in recent years. Moreover, after the geopolitical tension increases, the country is seen shifting towards domestic recycling, as per the recent country observation. Also, having the enlarged manufacturing industries has actively contributed to the market potential in the past few years. Also, the government of China is heavily implementing the sustainability standards in every possible field, which is leading the market in many ways.

Europe is expected to capture a major share of the market during the forecast period, owing to newly implemented and strong environmental standards and regulations. Moreover, the heavy manufacturers have increasingly utilized and demanded recycled plastics in recent years. Several major brands are actively promoting their sustainability via specialized digital platforms, as per the observation. These uses and promotions are anticipated to lead to the industry's growth during the forecast period.

Could Germany’s Smart Recycling Systems Lead the Polyolefin Market Shift?

Germany is expected to rise as a dominant country in the European region in the coming years, owing to the modern technology advancements. Moreover, the country has an advanced waste management system, and the country is recognized for its well-organized waste infrastructure. Also, the country has been increasingly investing in research and development activities in recent years, which is expected to gain a first mover advantage over the forecast period.

What Is Behind the Emergence of North America as One of the Regional Leaders in the Recycled Polyolefin Market?

North America is a significantly growing region in the global market, largely due to strong corporate sustainability commitments, a push for a circular economy, technological advancements in recycling, and evolving consumer and state-level regulations. Several U.S. states have implemented specific regulations, such as California's minimum recycled content laws for plastic beverage containers, which require manufacturers to use post-consumer resin. Major brands and manufacturers in the region have established significant ESG targets and net-zero commitments to demonstrate measurable sustainability outcomes.

U.S. Recycled Polyolefin Market Trends

The U.S. is an expanding market characterized by a mix of state-level regulations and private-sector innovation. There are substantial investments in both mechanical and advanced recycling technologies aimed at improving the quality and range of applications for recycled materials. Key players in this market include Waste Management, Republic Services, KW Plastics, and advanced recycling firms like PureCycle, which are driving market growth.

How Will Latin America Emerge as a Key Player in the Recycled Polyolefin Market?

Latin America is also an emerging region in the global market, primarily due to increasing environmental awareness, stricter government regulations, a shift toward sustainable packaging and automotive components, and advancements in recycling infrastructure. Governments throughout the region are implementing more stringent regulations concerning recyclability and minimum recycled content. The rapid expansion of e-commerce in the region has heightened the demand for robust and sustainable packaging solutions, further boosting the market for recycled polyolefins.

Brazil Recycled Polyolefin Market Trends

Brazil is a key market within Latin America, primarily driven by its large packaging and automotive industries. There is a growing focus on sustainability, with brands and converters moving toward mono-material solutions to enhance recyclability. Government initiatives, such as the National Solid Waste Policy, aim to improve waste management, and there is increasing investment in local recycling facilities and infrastructure.

How Will the Middle East and Africa Contribute to Growth in the Recycled Polyolefin Market?

The Middle East and Africa is a key contributing region in the global market, driven by rising environmental concerns, stricter government regulations, and increasing demand for sustainable materials in key industries. Governments in the region, including those in the UAE, South Africa, Saudi Arabia, and Egypt, are implementing tougher waste management laws and promoting circular economy initiatives to combat plastic pollution. Rapid development and population growth are increasing the demand for construction materials and packaging, creating opportunities for cost-effective and durable alternatives.

Saudi Arabia Recycled Polyolefin Market Trends

Saudi Arabia stands out as a key global producer, mainly because the country is heavily investing in new recycling infrastructure to convert plastic waste into high-quality recycled polymers. Major petrochemical companies, such as SABIC, are central to this transition, developing initiatives to integrate recycled plastics into high-performance applications, particularly in the growing construction and packaging sectors.

Recent Developments

- In January 2026, NEXTLOOPP researchers Prof. Edward Kosior at Nextek and Paul Marshall reported conducting a multi-phase project to develop a comprehensive Polyolefin Challenge Test Guide. The aim of the test guide is to validate the decontamination performance of recycling processes to produce recycled polyolefins for contact-sensitive applications in the industry.(Source: interplasinsights.com)

- In December 2025, Borouge and Borealis introduced Recleo, a global brand for mechanically recycled polyolefins. The brand is set to consolidate post-industrial and post-consumer recyclates and compounds into a single product portfolio. Recleo’s range currently comprises polyolefin recyclates and compounds intended for applications in sectors including mobility, building and construction, household appliances, infrastructure, and consumer goods.(Source: www.packaging-gateway.com)

Top Companies list

- LyondellBasell

- SABIC

- Dow

- INEOS

- Borealis

- GCR

- Pashupati Group

- Omya International AG

Segment Covered

By Product

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene

- Other Product Types

By Source

- Plastic Bottles

- Plastic Films

- Polymer Foam

- Other Sources

By Application

- Food Packaging

- Construction

- Automotive

- Non-food Packaging

- Other Applications

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE