Content

What is the Current Aerospace Adhesives & Sealants Market Size and Share?

The global aerospace adhesives & sealants market size is calculated at USD 1.85 billion in 2025 and is predicted to increase from USD 1.98 billion in 2026 and is projected to reach around USD 3.66 billion by 2035, The market is expanding at a CAGR of 3.66 between 2026 and 2035. North America dominated the aerospace adhesives & sealants market with a market share of 48.19% the global market in 2025.The growing demand for new aircraft is the key factor driving market growth. Also, ongoing innovations in adhesive and sealant technology, coupled with the expansion of commercial fleets, can fuel market growth further.

Key Takeaways

- North America dominated the global aerospace adhesives and sealants market with the largest revenue share of 48.19% in 2025.

- The U.S. aerospace adhesives and sealants market is projected to grow during the forecast period.

- By product type, the Adhesive segment accounted for the largest revenue share of 46.18% in 2025.

- By aircraft type, the commercial aircraft segment dominated with the largest revenue share of 60.19% in 2025.

- By application, the airframe structural bonding segment dominated with the largest revenue share of 65.83% in 2025.

- By end user, the OEMs segment led the market and accounted for 37.13% of the global revenue share in 2025.

- By technology, the epoxy resin segment accounted for the largest revenue share of 42.35% in 2025.

What are Aerospace Adhesives & Sealants?

The aerospace adhesives & sealants market covers specialty adhesives, sealants, and bonding systems developed for aircraft structures, engines, interiors, and aerospace subsystems. These products epoxies, polyurethanes, acrylics, silicones, polysulfides, cyanoacrylates, structural film adhesives, anaerobics, etc. join composites and metal parts, seal joints and gaps, provide environmental/thermal resistance, damp vibration, and replace mechanical fasteners to reduce weight and improve fuel efficiency.

Aerospace Adhesives & Sealants Market Trends

- A surge in the middle-class population across the globe is boosting a substantial rise in air passenger numbers, which then fuels demand for new aircraft and increases the demand for MRO services.

- The rapid shift towards lightweight composite materials in aircraft design is the latest trend in the market, requiring cutting-edge adhesives for structural bonding.

- The ongoing research and development are enhancing the adhesive and sealant formulations that are ideal for different substrates and are more resistant to environmental factors.

- The commercial aerospace industry is the largest end-use segment, and a trend is propelled by increasing passenger demand and expanding aircraft fleets, driving market growth soon.

- Stringent environmental regulations are pushing market players to create solutions with low Volatile Organic Compound (VOC) emissions. This has raised the demand for solvent-free, water-based, and chrome-free formulations.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 1.98 Billion |

| Revenue Forecast in 2035 | USD 3.66 Billion |

| Growth Rate | CAGR 7.05% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segments covered | By Product Type, By Aircraft Type, By Application / Function, By End User, By Technology / Resin, By Region |

| Key companies profiled | Henkel AG & Co. KGaA, 3M Company, B. Fuller, Henkel Corporation, 3M, PPG Industries Inc., Huntsman International LLC, Cytec Solvay Group, Dowdupont, Bostik, Lord Corporation (Parker Hannifin Corp), Hexcel Corporation |

How Cutting Edge Technologies are revolutionizing the Aerospace Adhesives & Sealants Market?

Advanced technologies are transforming the market through nanotechnology, UV-curing, and automated application, which have enhanced precision, speed, and performance. These innovations are crucial for creating lighter, stronger materials such as composites to meet strict safety standards by enabling the development of next-generation aircraft.

Trade Analysis of Aerospace Adhesives & Sealants Market: Import & Export Statistics:

- U.S. aerospace and defense exports increased to $138.6 billion in 2025, an increase from $135.9 billion in 2023, driven by a strong global appetite for American technological advancements.

- The U.S. imported $64.83 billion in goods used to support American technology and services.

- Between May 2025 and April 2025, Germany exported 16 shipments of Aircraft Sealant, with 7 exporters sending goods to 6 buyers. This represents a 129% increase in exports compared to the previous year, and in April 2025 alone, one shipment was exported. (Source: www.volza.com)

Aerospace Adhesives & Sealants Market Value Chain Analysis

- Feedstock Procurement : It is the strategic sourcing and acquisition of high-purity, specialized raw materials, mainly petrochemical-based feedstocks like silicones, epoxy resins, and polyurethanes, which are essential to ensure product performance.

- Major Players: Henkel AG & Co. KGaA, H.B. Fuller Company.

- Chemical Synthesis and Processing :It involves the formulation of specialized polymer-based adhesives and sealants created to withstand harsh conditions to improve overall structural integrity.

- Major Players: Huntsman International LLC, Solvay SA / Cytec Solvay Group

- Packaging and Labelling : It is a highly controlled process of ensuring products are contained safely and marked with crucial information for traceability, safety, and compliance with industry standards.

- Major Players: Hexcel Corporation, Solvay S.A.

- Regulatory Compliance and Safety Monitoring : This stage involves adhering to stringent standards set by national and international authorities to ensure the reliability and safety of aircraft components.

- Major Players: Bostik, Solvay

Aerospace Adhesives & Sealants Market 's Regulatory Landscape: Global Regulation

| Country/Region | Key Regulations |

| North America (Primarily the US) | The FAA serves as the primary authority for aviation safety, setting and enforcing safety and performance standards through its regulations, which are found in Title 14 of the Code of Federal Regulations (14 CFR) and detailed further in Advisory Circulars (ACs). |

| Europe | Like the FAA, EASA oversees aviation safety and airworthiness in the EU, ensuring that materials used in aircraft meet stringent safety standards. |

| Asia Pacific | The national bodies like the Civil Aviation Administration of China (CAAC) oversee aviation safety, the global aviation industry relies heavily on internationally recognized standards set by organizations like the FAA, EASA, SAE, and ASTM. |

Segment Insights

Product Type Insight

How Much Share Did the Adhesive Segment Held in 2025?

The adhesive segment accounted for the largest revenue share of 46.18% in 2025. The dominance of the segment can be attributed to the growing middle class in emerging nations and the growing use of lightweight composite materials, which necessitates innovative bonding.

The sealants segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surge in air passenger numbers, which boosts the demand for new military and commercial aircraft. Sealants are necessary for maintaining the structural integrity of the aircraft.

Aircraft Type Insight

How Much Share Did the Commercial Aircraft Segment Held in 2025?

The commercial aircraft segment held more than 60.19% market share in 2025. The dominance of the segment can be linked to the growing global air travel demand, which requires more production of aircraft and maintenance. The escalating commercial fleet requires more MRO services, boosting segment growth further.

The military & defense aircraft segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing demand for high-performance materials in harsh operating conditions, coupled with the increased defense spending and modernization programs globally.

The regional & business jets segment held a significant market share in 2025. An increase in global air travel is fuelling demand for new business and commercial jets, positively impacting the need for adhesives and sealants used in their construction.

The growth of helicopters & special mission segment can be driven by growing demand for durable, lightweight, and high-performance materials. In addition, helicopters and special mission aircraft are rapidly incorporating cutting-edge materials like hybrid composites and carbon fiber in their manufacturing.

Application Insight

Which Application Type Segment Dominated the Aerospace Adhesives & Sealants Market in 2025?

The airframe structural bonding segment dominated with the largest revenue share of 65.83% in 2025. The dominance of the segment is owed to the growing use of cutting-edge materials such as composites and increased aircraft production rates globally. Adhesives are necessary for assembling modern airframes.

The landing gear & secondary structure bonding segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to rapid advancements in adhesive formulations and the growing use of composite materials. Adhesives and sealants provide an effective barrier against moisture and hydraulic fuels.

The interior adhesives segment held a major market share in 2025. The growth of the segment can be propelled by the rapid development of new and innovative adhesives, such as epoxy, along with a global surge in air travel. Also, automation in assembly processes helps to grow adhesive penetration.

The growth of engine & nacelle adhesives & high-temp sealants segment can be fuelled by ongoing R&D in sealants and high-performance adhesives to fulfil extreme operating conditions. Government programs in emerging regions are boosting growth in the indigenous aerospace manufacturing sector.

End User Insight

How Much Share Did the OEMs Segment Held in 2025?

The OEMs (original equipment manufacturers) segment led the market and accounted for 37.13% of the global revenue share in 2025. The dominance of the segment can be attributed to the growth in MRO activities and the expanding global aerospace sector. OEMs are increasingly using adhesives & sealants to replace heavier mechanical fasteners.

The MRO (maintenance, repair & overhaul) segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be credited to the growing number of aircraft requiring maintenance and a greater dependence on composite materials. The MRO sector is especially focused on reducing aircraft downtime.

The tier-1 & tier-2 suppliers segment held a significant market share in 2025. The growth of the segment can be driven by the growing use of lightweight composite materials in the production of aircraft and the general growth of military, commercial, and space aviation sectors.

The defence & government programmes are one of the major segments in the market. The rise of new defense platforms, like hypersonic aircraft, unmanned aerial vehicles (UAVs), and advanced electronic warfare systems, needs specialized bonding and sealing solutions, driving segment growth soon.

Technology Insight

Which Technology Segment Dominated the Aerospace Adhesives & Sealants Market in 2025?

The epoxy resin dominated the market with approximately 42.35% market share in 2025. The dominance of the segment can be linked to its excellent structural properties and important role in enabling fuel efficiency and lightweight aircraft through the bonding of composite materials.

The polysulfide segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be driven by increasing demand for commercial aircraft with increased spending on defense. Polysulfide sealants offer reliable and long-lasting sealing.

The polyurethane segment held a major market share in 2025. The growth of the segment can be fuelled by their exceptional resistance to oils, fuels, and solvents, which makes them ideal for fluid-immersion and aircraft fuel tanks applications.

The growth of the acrylic & MMA segment can be driven by the increasing use of cutting-edge composite materials in aircraft structures, which requires specialized bonding solutions. This type of adhesive offers a strong and durable bond to a variety of dissimilar substrates such as metals and plastics.

Regional Insights

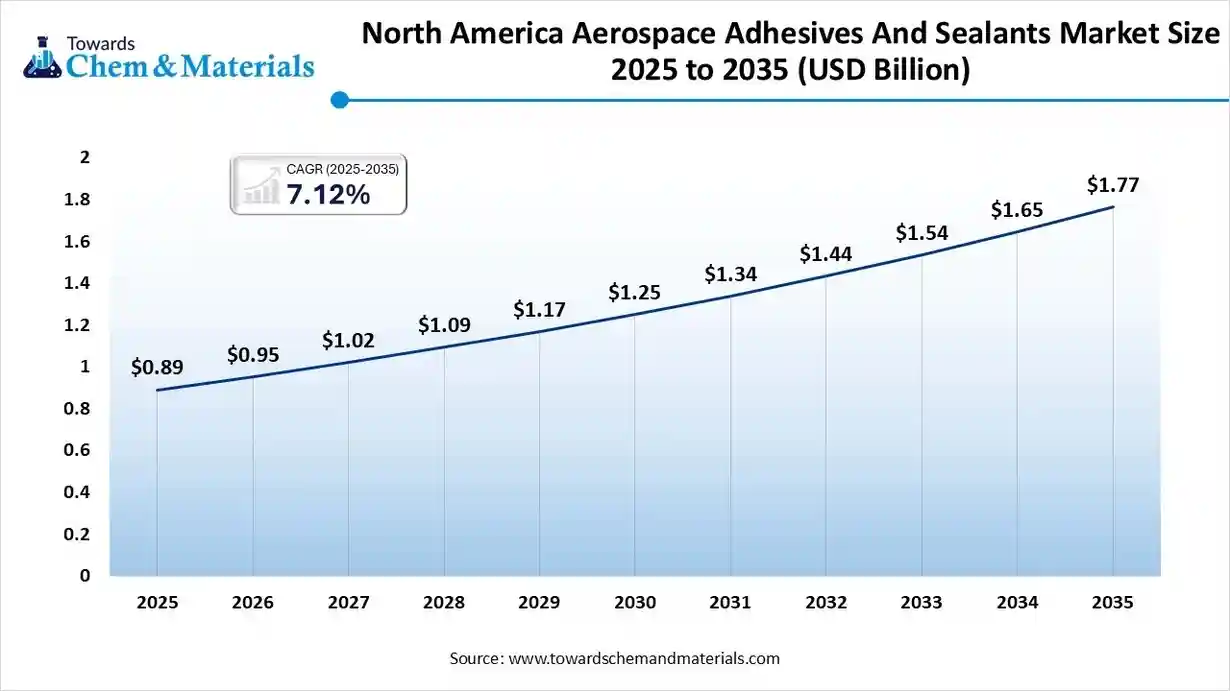

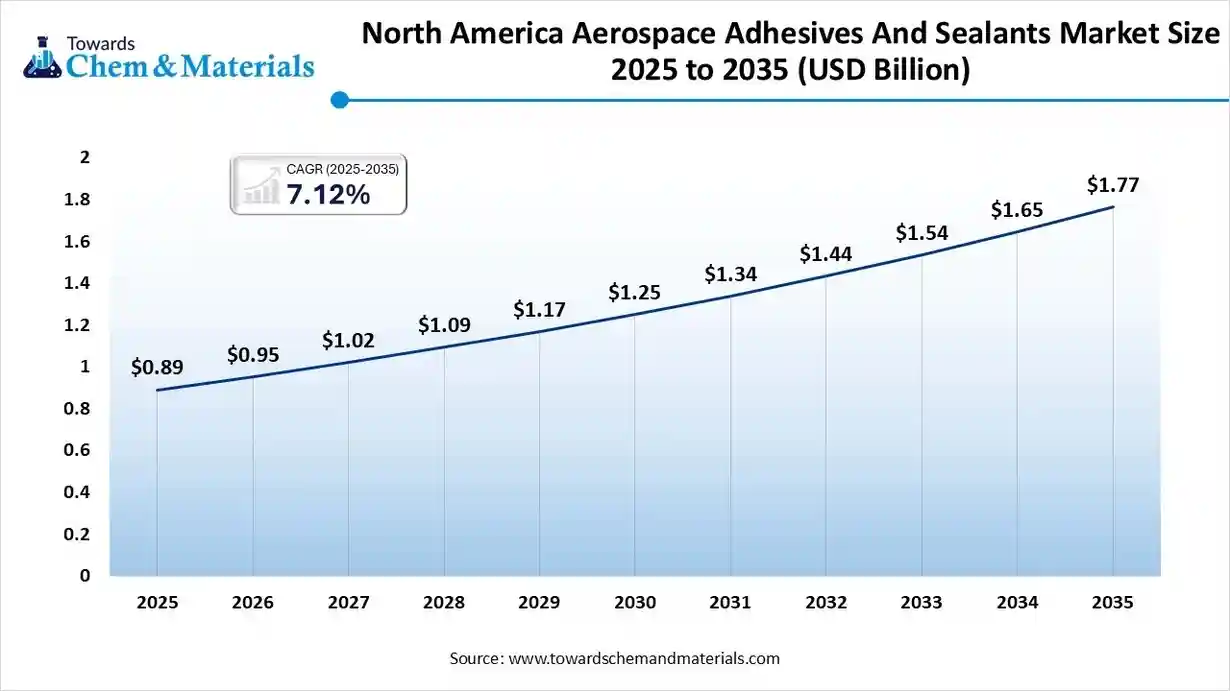

The North America aerospace adhesives & sealants market size was valued at USD 0.89 billion in 2025 and is expected to surpass around USD 1.77 billion by 2035, expanding at a compound annual growth rate (CAGR) of 7.12% over the forecast period from 2026 to 2035.

North America dominated the market with nearly 48.19% share in 2025. The dominance of the region can be attributed to the growing demand for lightweight and fuel-efficient aircraft, which are pushing the conventional traditional fasteners with advanced bonding technologies. Also, a surge in commercial air travel is leading to the growth of the commercial aircraft fleet, fuelling market growth further.

U.S. Aerospace Adhesives & Sealants Market Trends

In North America, the U.S. dominated the market owing to the growing aircraft production and a robust repair, maintenance, and overhaul (MRO) sector, driven by increasing air travel demand and modernization efforts by the government. The market is also benefiting from ongoing advancements in adhesive formulations.

Asia-Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the expanding aerospace industry in countries such as China, India, and Japan, coupled with a shift towards more fuel-efficient and lightweight composites. In addition, the growing demand for air travel is leading to larger airline fleets, which will impede positive market growth soon.

China Aerospace Adhesives & Sealants Market Trends

In the Asia Pacific, China led the market due to innovations in domestic manufacturing capabilities to supply high-quality, cost-effective adhesives and sealants. Also, the Chinese military's raised defence spending is leading to growth in the defense aerospace sector.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by a growing emphasis on MRO and growing aircraft production. The ongoing investments in R&D for new materials and processes are fuelling the demand for more advanced adhesives and sealants.

Germany Aerospace Adhesives & Sealants Market Trends

The growth of the market in Germany can be fuelled by the rising need for high-performance materials to fulfil stringent safety standards and the growing use of advanced composites. The country has a strong, robust engineering and manufacturing sector, which boosts innovation in adhesive and sealant technologies.

The Latin America region held a significant market share in 2025. The dominance of the region is due to the growth of the commercial aviation sector, airline fleet modernization, and increased air travel. Major aircraft manufacturers in the region, such as Boeing and Airbus, have large backlogs of orders, which can ensure demand for various aerospace products.

Brazil Aerospace Adhesives & Sealants Market Trends

The growth of the market in Brazil can be driven by growing demand for air travel and new aircraft deliveries, which are boosted by an expanding economy and more disposable income. Brazil's economy is a major factor propelling the demand for aerospace products, because it supports the growth of the market.

Recent Developments

- In November 2025, Resin Solutions announced a multi-phase manufacturing expansion initiative for its hydroxyl-terminated polybutadiene ("HTPB") product line. The company continues to make significant progress in developing the next generation of aerospace binder technologies.(Source: www.providencejournal.com)

- In April 2023, PPG launched the SEMCO Sealant Removal, Mixing & Application Kit, a tool kit for the removal and application of aerospace sealants, adhesives, and potting compounds on aircraft or at any other site.(Source: www.indianchemicalnews.com)

Aerospace Adhesives & Sealants Market Companies

- Henkel AG & Co. KGaA: Henkel AG & Co. KGaA is a major global player in the aerospace adhesives and sealants market, with its Adhesive Technologies division being the world's leading producer in this sector.

- 3M Company: 3M is a major player in the aerospace adhesives and sealants market, offering a wide range of high-performance products for aircraft manufacturing and maintenance, including adhesives, sealants, and primers.

Other Companies in the Market

- B. Fuller

- Henkel Corporation

- 3M

- PPG Industries Inc.

- Huntsman International LLC

- Cytec Solvay Group

- Dowdupont

- Bostik

- Lord Corporation (Parker Hannifin Corp)

- Hexcel Corporation

Segments Covered in the Report

By Product Type

- Adhesives

- Sealants

By Aircraft Type

- Commercial Aircraft

- Regional & Business Jets

- Military & Defense Aircraft

- Helicopters & Special Mission

By Application / Function

- Airframe structural bonding

- Interior adhesives (cabin panels, seats, carpets)

- Engine & nacelle adhesives & high-temp sealants

- Landing gear & secondary structure bonding

- Sealants for fuel tanks, windows, doors, access panels

By End User

- OEMs (Original Equipment Manufacturers)

- MRO (Maintenance, Repair & Overhaul)

- Tier-1 & Tier-2 suppliers (component integrators)

- Defence & government programmes

By Technology / Resin

- Epoxy

- Polyurethane

- Acrylic & MMA

- Silicone / RTV (sealants)

- Polysulfide (sealants)

- Anaerobics / Cyanoacrylates / Specialty film adhesives

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa