Content

Biobased Adhesives Market Size | Companies Revenue

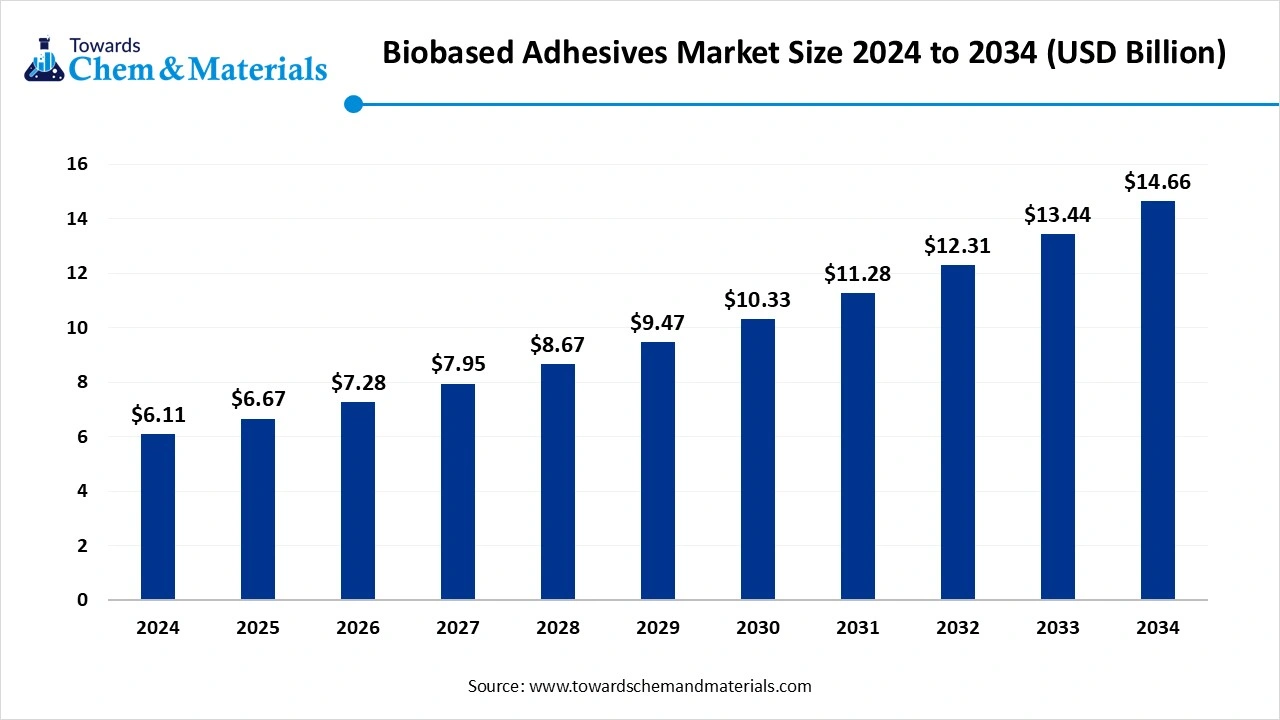

The global biobased adhesives market size was reached at USD 6.11 billion in 2024 and is expected to be worth around USD 14.66 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.16% over the forecast period 2025 to 2034. The growth of the market is driven by the growing demand for sustainable and eco-friendly alternatives by various industries, which fuels the growth of the market.

Key Takeaways

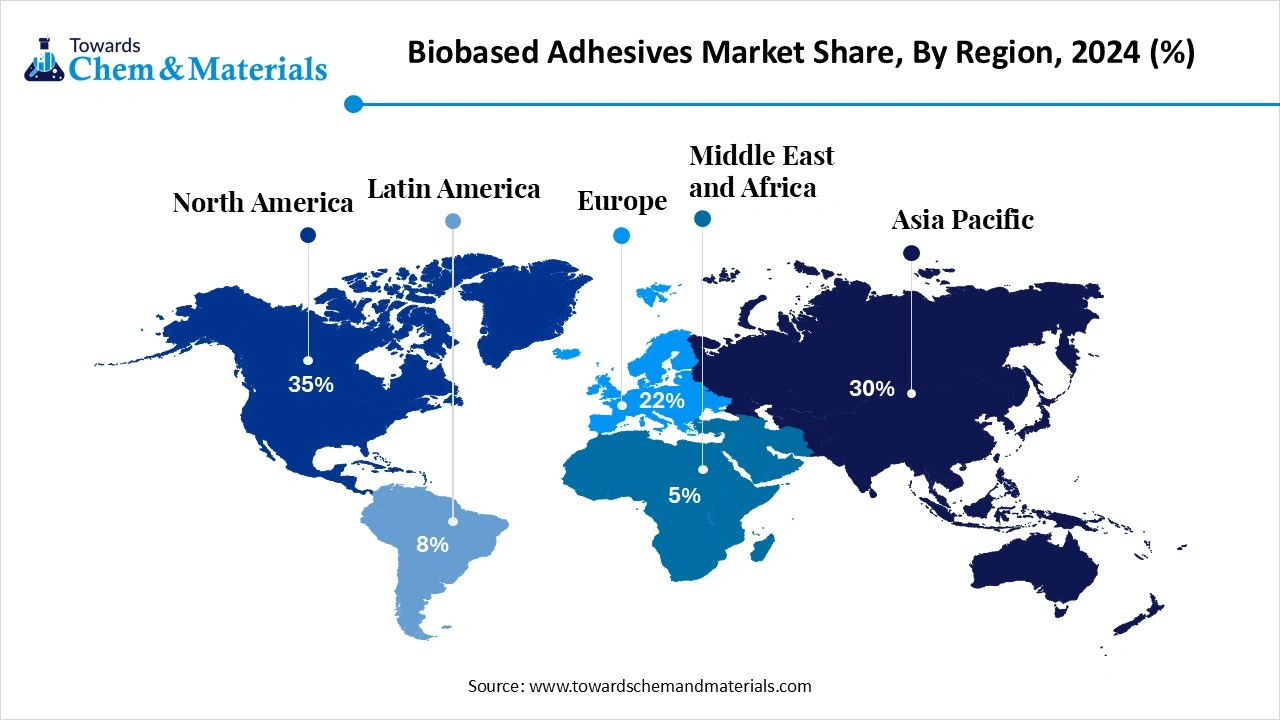

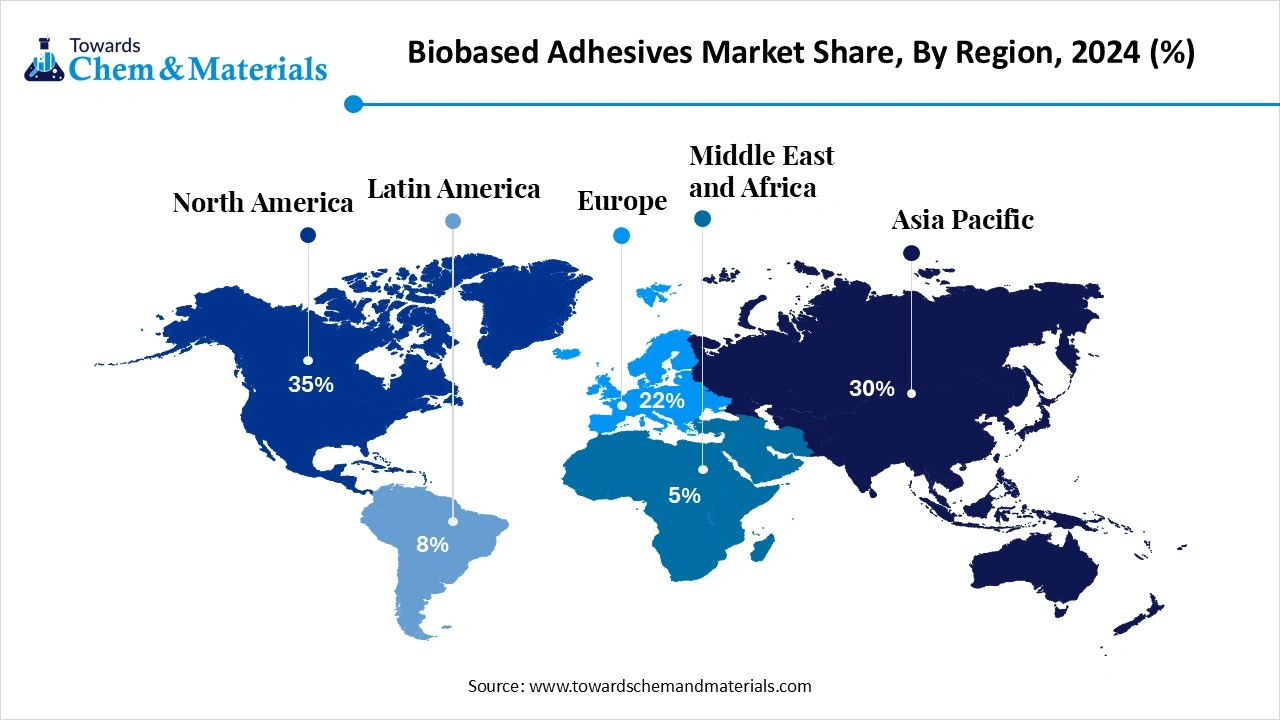

- By region, North America dominated the market in 2024. North America held a 35% share of the market in 2024. Increasing environmental concerns and stringent regulation supports the growth of the market.

- By region, Asia Pacific is expected to have significant growth in the market in the forecast period. The growth is driven by eth technological advancements fueling the growth.

- By type of adhesive, the natural polymer-based segment dominated the market in 2024. The natural polymer-based segment held a 35% share in the market in 2024. Their non-toxic nature and easy compostability make them ideal for eco-conscious end users.

- By type of adhesive, the synthetic biopolymer-based segment is expected to grow significantly in the market during the forecast period. They are increasingly adopted in the automotive, electronics, and construction sectors.

- By application, the packaging segment dominated the market in 2024. The packaging segment held a 40% share in the market in 2024. Packaging is a leading application for biobased adhesives due to the growing demand for sustainable materials.

- By application, the automotive segment is expected to grow in the forecast period. These adhesives are used for interior components, trim assembly, insulation, and lightweight composites.

- By end use, the building & construction segment dominated the market in 2024. The building & construction segment held a 30% share in the market in 2024. Their low VOC emissions, non-toxic nature, and sustainable sourcing align with green building standards like LEED and BREEAM.

- By end use, the medical & healthcare segment is expected to grow in the forecast period. Biobased adhesives are gaining prominence in the medical and healthcare sector for applications.

- By form, the liquid segment dominated the market in 2024. The liquid segment held a 50% share in the market in 2024. They are widely used in packaging, woodworking, textiles, and medical applications due to their flexibility and fast curing capabilities.

- By form, the solid segment is expected to grow in the forecast period. Their ease of storage and reduced need for special handling make them suitable for large-scale manufacturing.

- By chemistry, the polysaccharides segment dominated the market in 2024. The polysaccharides segment held a 25% share in the market in 2024. Their non-toxic and renewable nature aligns with eco-friendly manufacturing practices, making them increasingly preferred

- By chemistry, the polylactic acid (PLA) segment is expected to grow in the forecast period. Their compatibility with various substrates and low environmental footprint support the growing demand for sustainable bonding solutions.

- By source, the vegetable-based segment dominated the market in 2024. The vegetable-based segment held a 60% share in the market in 2024. They are particularly favored in wood, packaging, and textile applications.

- By source, the microbial-based segment is expected to grow in the forecast period. These adhesives offer excellent biodegradability, tunable properties, and minimal environmental impact.

Market Overview

Rising Demand For Durable Materials: Biobased Adhesives Market To Expand

Biobased adhesives are adhesives that are derived from renewable biological sources such as starch, proteins, lignin, vegetable oils, or cellulose, as opposed to those derived from petroleum-based sources. These adhesives offer environmental benefits, such as reduced carbon footprints and enhanced sustainability, and are gaining traction due to increasing awareness of environmental issues and stricter regulations regarding the use of synthetic adhesives. Biobased adhesives are used across various industries, including packaging, automotive, construction, and consumer goods, owing to their eco-friendly properties and strong bonding capabilities.

What Are The Key Growth Drivers That Support The Growth Of The Biobased Adhesives Market?

The growth of the market is driven by the growing demand from key industries like the packaging industry, automotive industry, construction industry, and medical sector, which fuels the growth. The growing advantages offered, like eco-friendly nature, which is in increasing demand due to growing awareness among consumers and among manufacturers amid growing environmental concerns, increase the growth of the market. Other key drivers are the sustainability and environmental concerns, the regulatory framework, and advancements in bio-based technologies, fueling the growth of the market, supporting the expansion.

Market Trends

- The dominance of plant-based adhesives and growing adoption boost the growth of the market.

- The focus on raw material availability and growing accessibility of renewable raw materials is a growing trend that influences growth.

- Emerging applications like drug discovery systems, medical device assembly, due to their biocompatibility and biodegradability, fuel the growth.

- Innovation in bio-based adhesives with ongoing research and focus on developing new biobased adhesive formulations to improve performance and broaden applications fuels the growth.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 6.67 Billion |

| Expected Size by 2034 | USD 14.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.16% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Type of Adhesive, By Application, By End-User Industry, By Form,By Chemistry, By Source, By Region |

| Key Companies Profiled | Henkel AG & Co. KGaA, 3M Company , Arkema SA , BASF SE , Sika AG , Dow Inc. , H.B. Fuller Company , ExxonMobil Corporation , Royal DSM N.V. , Covestro AG , Jowat AG , Ashland Inc. , Wacker Chemie AG , Mondi Group , Avery Dennison Corporation , LG Chem Ltd. , Scotch™ (A part of 3M) , Nexeo Solutions, Inc. , Yokohama Rubber Co., Ltd. , U.S. Adhesives, Inc. |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Biobased Adhesives Market?

The key growth opportunity that supports the growth of the market is the rising demand for sustainable products as consumers and industries are increasingly seeking eco-friendly alternatives to traditional synthetic adhesives, which leads to increased adoption, creating opportunity for growth. Advanced technology for improving biobased adhesives formulation with enhanced performance and wider applications supports the growth and expansion of the market, aligning with the regulatory support.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The Biobased Adhesives Market?

The key challenge that hinders the growth of the market is high production costs. The initial investment as a biobased adhesive has a high initial manufacturing cost due to expensive materials and advanced manufacturing technologies, which limits the growth and adoption of the market. The price sensitivity and scale economies make it harder for biobased adhesive producers to compete with established traditional players, which is a challenge hindering the growth and expansion of the market.

Regional Insights

How Did North America Dominate The Biobased Adhesives Market In 2024?

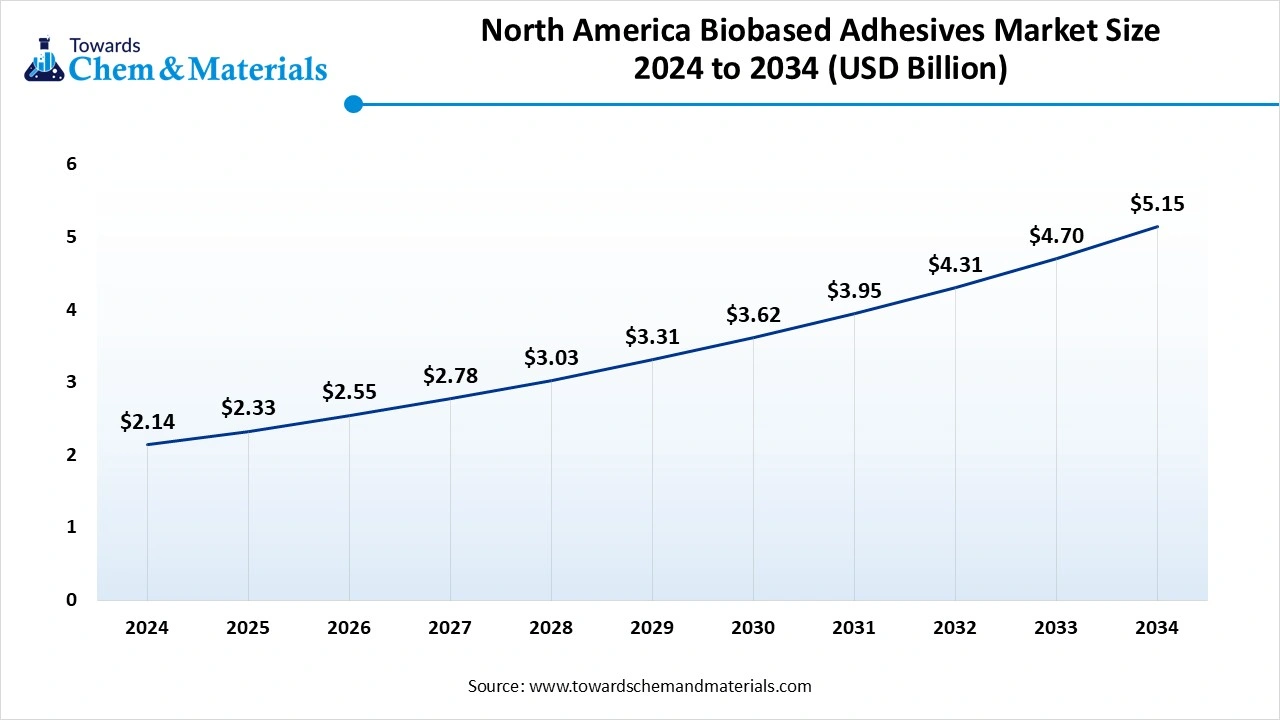

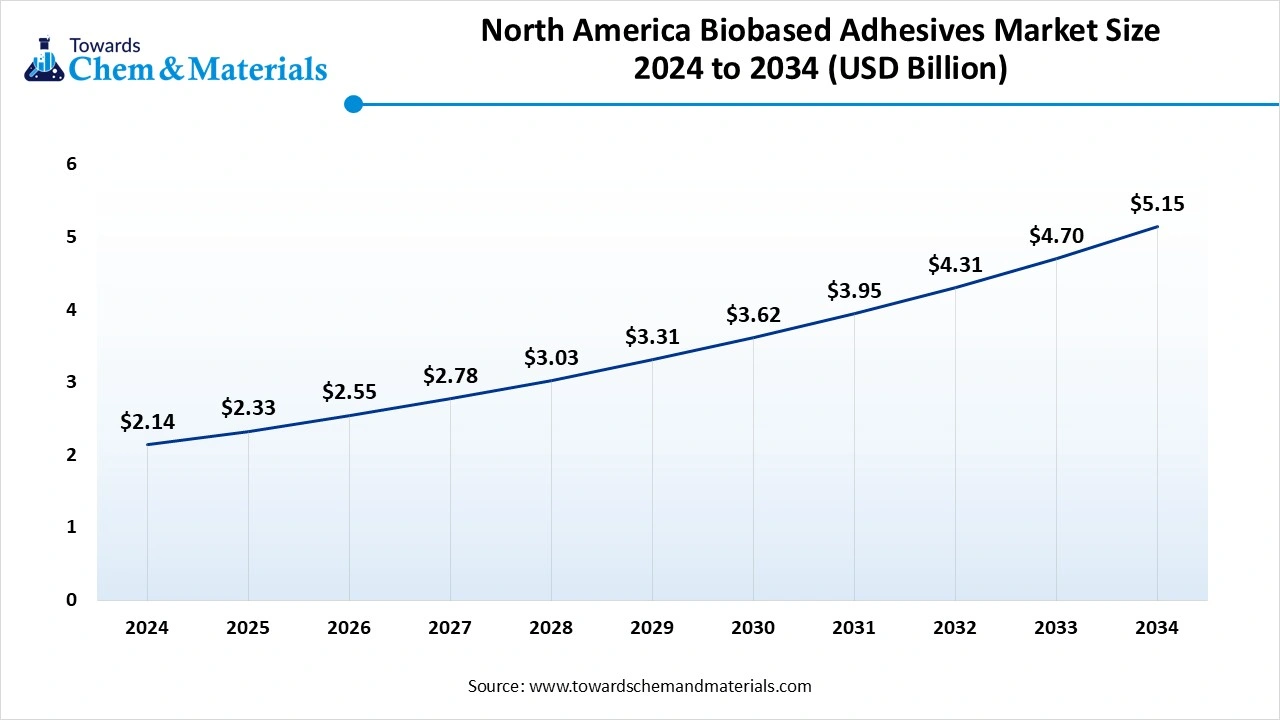

The North America biobased adhesives market size was estimated at USD 2.14 billion in 2024 and is anticipated to reach USD 5.15 billion by 2034, growing at a CAGR of 35% from 2025 to 2034.North America dominated the market in 2024.

The growth of the market in the region is driven by the increasing environmental concerns and stringent regulations pushing manufacturers to adopt more sustainable alternatives, growing awareness of environmental issues, and the need and demand for reducing the reliance on fossil fuels, which drives the adoption and growth of the biobased alternatives, fueling the growth in the region.

The key players like Henkel, DuPont, Arkema, Ashland Global Holdings, Beardow Adams, Paramelt, Jowat, Ingredion, EcoSynthetix, Tate and Lyle, and 3M also play a crucial role in the growth of the market. The growing medical sectors and demand for biobased alternatives for their biocompatibility for surgeries and wound care boost the growth and expansion of the market in the region.

Global Biobased Adhesives Market Revenue, By Regional, 2024-2034 (USD Billion)

| By Regional | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Asia-Pacific | 2.31 | 2.56 | 2.82 | 3.13 | 3.45 | 3.78 | 4.17 | 4.59 | 5.07 | 5.59 | 6.16 |

| Europe | 1.59 | 1.71 | 1.85 | 1.99 | 2.15 | 2.32 | 2.5 | 2.7 | 2.91 | 3.13 | 3.38 |

| North America | 1.47 | 1.59 | 1.72 | 1.86 | 2.01 | 2.18 | 2.36 | 2.55 | 2.76 | 2.99 | 3.23 |

| Latin America | 0.43 | 0.47 | 0.52 | 0.57 | 0.63 | 0.7 | 0.77 | 0.85 | 0.93 | 1.03 | 1.13 |

| Middle East & Africa | 0.31 | 0.34 | 0.37 | 0.4 | 0.44 | 0.49 | 0.54 | 0.59 | 0.65 | 0.71 | 0.78 |

The US Has Seen Significant Growth Driven By Ongoing Research And Development Of Technology.

The growth of the market in the country is driven by the growing demand for biobased adhesives, and the growing demand for biodegradable and low-VOC-emitting adhesives further boosts the growth of the market in the country. The increasing focus on circular economy principles and sustainable practices also supports the growth. The key players like Henkel AG, Arkema S.A., 3M Company, Ashland Global, Dow Inc., H.B. Fuller, Sika AG, Avery Dennison, Huntsman Corporation, and Franklin International also play a crucial role in the growth of the market in the country.

Asia Pacific Has Seen Growth Driven By Government Regulation And Technological Advancements.

Aisa Pacific is expected to have significant growth in the biobased adhesives market in the forecast period. The growth of the market is driven by the increasing environmental concerns, industrialization, and government support for sustainable solutions in the region, which supports growth. The rapid industrialization and growth in the packaging, construction, and personal care sectors due to rising demand increase the growth. The government regulation and incentives for encouraging the use of biobased products further drive the growth of the market. The raw material availability in the region also supports the production of bio-based adhesives, fueling the growth and expansion of the market.

The Growth Of The Market In India Is Driven By The Advancements In Biobased Materials.

The growth of the market in India is driven by the advancements in biobased materials, with ongoing research and development focusing on improving the properties and cost-effectiveness of bio-based adhesives, further driving the growth of the market. The key industries' demand, especially the packaging industry for corrugated boxes, increases the use of biobased adhesives due to their properties, fueling the growth of the market in the country.

- India shipped out 33.1K Adhesives. These exports were handled by 3,036 Indian exporters to 6,228 buyers.(Source: www.volza.com)

- Globally, the United States, China, and Vietnam are the top three exporters of Adhesive. The United States is the global leader in Adhesive exports with 272,796 shipments, followed closely by China with 204,781 shipments, and Vietnam in third place with 177,811 shipments.(Source: www.volza.com)

Segmental Insights

Type of Adhesive Insights

Which Type Of Adhesive Segment Dominated The Biobased Adhesives Market?

The natural polymer-based segment dominated the biobased adhesives market in 2024. Natural polymer-based adhesives, derived from starch, cellulose, proteins, and natural gums, are widely used due to their biodegradability and low environmental impact. These adhesives find applications in packaging, woodworking, paper bonding, and textiles. Their non-toxic nature and easy compostability make them ideal for eco-conscious end users. Advancements in performance characteristics and regulatory push toward sustainable materials are driving the demand for natural polymer-based adhesives across various industries.

The synthetic biopolymer-based segment expects significant growth in the biobased adhesives market during the forecast period. Synthetic biopolymer-based adhesives are formulated using bio-derived monomers such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and other engineered bio-resins. These adhesives offer improved mechanical strength, water resistance, and thermal stability compared to natural variants. They are increasingly adopted in the automotive, electronics, and construction sectors where performance and sustainability are critical. Ongoing R&D and favorable regulations are propelling the growth of these next-generation, eco-efficient adhesive solutions.

Application Insights

How Did Packaging Segment Dominant The Biobased Adhesives Market?

The packaging segment dominated the market in 2024. Packaging is a leading application for biobased adhesives due to the growing demand for sustainable and recyclable materials. These adhesives are used in cartons, labels, tapes, and flexible packaging, offering excellent bonding while maintaining compostability and food safety standards. The shift toward circular economy models and increasing pressure to reduce plastic waste are accelerating the adoption of biobased adhesives across the food, beverage, and consumer goods packaging sectors.

The automotive segment expects significant growth in the biobased adhesives market during the forecast period. In the automotive industry, biobased adhesives are gaining traction as manufacturers aim to reduce vehicle weight and carbon footprint without compromising performance. These adhesives are used for interior components, trim assembly, insulation, and lightweight composites. They offer excellent bonding strength, thermal stability, and resistance to aging. As sustainability becomes a key priority in automotive design, the demand for high-performance, eco-friendly adhesive alternatives is steadily increasing in both OEM and aftermarket segments.

End-User Industry Insights

Which End Use Industry Segment Dominated The Biobased Adhesives Market?

The building & construction segment dominated the market in 2024. Biobased adhesives are increasingly used in building and construction for flooring, insulation panels, wall coverings, and wood joinery. Their low VOC emissions, non-toxic nature, and sustainable sourcing align with green building standards like LEED and BREEAM. As the industry shifts toward eco-friendly materials, biobased adhesives are becoming vital in reducing the environmental impact of construction activities while maintaining structural integrity and indoor air quality.

Global Biobased Adhesives Market Revenue, By End-User, 2024-2034 (USD Billion)

| By End-User | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Packaging & Labeling | 1.59 | 1.75 | 1.92 | 2.11 | 2.33 | 2.56 | 2.82 | 3.1 | 3.39 | 3.73 | 4.11 |

| Furniture & Woodworking | 1.1 | 1.18 | 1.27 | 1.36 | 1.46 | 1.56 | 1.67 | 1.79 | 1.92 | 2.06 | 2.2 |

| Building & Construction | 1.04 | 1.13 | 1.24 | 1.35 | 1.47 | 1.61 | 1.76 | 1.92 | 2.09 | 2.29 | 2.5 |

| Automotive | 0.73 | 0.81 | 0.89 | 0.98 | 1.08 | 1.18 | 1.3 | 1.43 | 1.58 | 1.73 | 1.91 |

| Electronics | 0.55 | 0.61 | 0.67 | 0.74 | 0.82 | 0.9 | 0.99 | 1.09 | 1.21 | 1.33 | 1.47 |

| Consumer Goods | 0.49 | 0.53 | 0.58 | 0.64 | 0.69 | 0.76 | 0.83 | 0.9 | 0.99 | 1.08 | 1.17 |

| Medical & Healthcare | 0.37 | 0.41 | 0.46 | 0.51 | 0.57 | 0.64 | 0.71 | 0.8 | 0.89 | 0.99 | 1.1 |

| Textile & Footwear | 0.24 | 0.25 | 0.25 | 0.26 | 0.26 | 0.26 | 0.26 | 0.25 | 0.25 | 0.24 | 0.22 |

The medical & healthcare segment expects significant growth in the biobased adhesives market during the forecast period. Biobased adhesives are gaining prominence in the medical and healthcare sector for applications like wound dressings, surgical tapes, transdermal patches, and medical device assembly. Their biocompatibility, non-toxicity, and reduced allergenic potential make them ideal for direct skin contact and sensitive use cases. With growing demand for sustainable and safe materials, especially in patient-centric solutions, biobased adhesives are becoming integral to modern healthcare product development and packaging.

Form Insights

How Did Liquid Segment Dominant The Biobased Adhesives Market?

The liquid segment dominated the market in 2024. Liquid biobased adhesives offer excellent surface wetting, ease of application, and strong adhesion across a variety of substrates. They are widely used in packaging, woodworking, textiles, and medical applications due to their flexibility and fast curing capabilities. Formulated from renewable resources, these adhesives support sustainability goals without compromising performance. Their adaptability to automated systems and compatibility with porous and non-porous surfaces contribute to their rising preference across end-use industries.

Global Biobased Adhesives Market Revenue, By Form , 2024-2034 (USD Billion)

| By Form | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Liquid | 2.75 | 2.96 | 3.18 | 3.43 | 3.7 | 3.97 | 4.28 | 4.6 | 4.95 | 5.33 | 5.73 |

| Solid | 1.83 | 1.99 | 2.16 | 2.34 | 2.53 | 2.75 | 2.98 | 3.23 | 3.5 | 3.79 | 4.11 |

| Paste | 1.22 | 1.37 | 1.53 | 1.71 | 1.91 | 2.13 | 2.38 | 2.65 | 2.96 | 3.29 | 3.67 |

| Film | 0.31 | 0.35 | 0.41 | 0.47 | 0.54 | 0.62 | 0.7 | 0.8 | 0.91 | 1.04 | 1.17 |

The solid segment expects significant growth in the biobased adhesives market during the forecast period. Solid biobased adhesives, including hot-melt and pressure-sensitive variants, are valued for their long shelf life, high thermal stability, and minimal solvent emissions. These adhesives are widely used in applications such as packaging, labeling, automotive interiors, and electronics. Their ease of storage and reduced need for special handling make them suitable for large-scale manufacturing. As industries seek clean and efficient bonding solutions, solid biobased adhesives are witnessing growing adoption.

Chemistry Insights

Which Chemistry Segment Dominated The Biobased Adhesives Market?

The polysaccharides segment dominated the market in 2024. Polysaccharide-based adhesives, derived from starch, cellulose, chitosan, and gums, are widely utilized for their natural abundance, biodegradability, and strong bonding to porous surfaces. Common in packaging, paper, wood, and biomedical applications, these adhesives offer excellent film-forming and water retention properties. Their non-toxic and renewable nature aligns with eco-friendly manufacturing practices, making them increasingly preferred in industries aiming to reduce environmental impact and enhance sustainability credentials.

The polylactic with various substrates and low environmental footprint acid (PLA) segment expects significant growth in the biobased adhesives market during the forecast period. Polylactic acid (PLA)-based adhesives are gaining momentum due to their strong mechanical properties, biodegradability, and thermal resistance. Derived from fermented plant sugars, PLA adhesives are used in packaging, automotive interiors, electronics, and medical devices. Their compatibility support the growing demand for sustainable bonding solutions. As innovation advances, PLA-based adhesives are increasingly engineered for higher performance and broader industrial applications.

Source Insights

How Did The Vegetable-Based Segment Dominant the Biobased Adhesives Market?

The vegetable-based segment dominated the market in 2024. Vegetable-based adhesives, derived from sources like soy, corn, and castor oil, are widely used for their renewable origin, low toxicity, and strong adhesion properties. They are particularly favored in wood, packaging, and textile applications. These adhesives align with sustainable production practices and reduce reliance on fossil fuels. With increasing environmental regulations and consumer demand for green products, vegetable-based adhesives are emerging as key alternatives across multiple end-use industries.

The microbial-based segment expects significant growth in the biobased adhesives market during the forecast period.

Microbial-based adhesives are developed using bioengineered microorganisms that produce biopolymers like polyhydroxyalkanoates (PHAs) and bacterial cellulose. These adhesives offer excellent biodegradability, tunable properties, and minimal environmental impact. Used in medical, packaging, and specialty industrial applications, they provide strong bonding and biocompatibility. As biotech innovations advance, microbial-based adhesives are gaining traction as next-generation solutions for sustainable and high-performance bonding in environmentally conscious manufacturing sectors.

Recent Developments

- In November 2024, Henkel and LIKAT, researchers in adhesives and specialists, partnered to develop and launch new bio-based adhesives that can be removed after use, that are debondable adhesives.(Source: www.ofimagazine.com)

- In April 2025, Arkema, a company specializing in biobased adhesives, introduced a new range of specialty additives made from renewable sources, reflecting their commitment to sustainability and environmental issues. These products will be sold under the Thixol, Rheotech, and Viscoatex brands. Notably, they will be the first to contain bio-sourced ethyl acrylate, which is produced at Arkema’s acrylic monomer plant in Carling, France.(Source: worldbiomarketinsights.com)

Biobased Adhesives Market Top Companies

- Henkel AG & Co. KGaA

- 3M Company

- Arkema SA

- BASF SE

- Sika AG

- Dow Inc.

- H.B. Fuller Company

- ExxonMobil Corporation

- Royal DSM N.V.

- Covestro AG

- Jowat AG

- Ashland Inc.

- Wacker Chemie AG

- Mondi Group

- Avery Dennison Corporation

- LG Chem Ltd.

- Scotch™ (A part of 3M)

- Nexeo Solutions, Inc.

- Yokohama Rubber Co., Ltd.

- U.S. Adhesives, Inc.

Segments Covered

By Type of Adhesive

- Natural Polymer-Based Adhesives

- Starch-based

- Protein-based

- Cellulose-based

- Synthetic Biopolymer-Based Adhesives

- Polylactic acid (PLA)-based

- Polyhydroxyalkanoates (PHA)-based

- Thermoplastic Biobased Adhesives

- Polyurethane (PU)-based

- Polyvinyl alcohol (PVA)-based

- Reactive Biobased Adhesives

- Epoxy-based

- Isocyanate-based

- Others

- Lignin-based

- Rubber-based

By Application

- Packaging

- Rigid packaging

- Flexible packaging

- Construction

- Interior

- Exterior

- Automotive

- Interior

- Exterior

- Consumer Goods

- Furniture

- Electronics

- Medical & Hygiene

- Medical devices

- Wound care products

- Others

- Textiles

- Footwear

- Paper & Pulp

By End-User Industry

- Building & Construction

- Automotive

- Packaging & Labeling

- Medical & Healthcare

- Consumer Goods

- Electronics

- Textile & Footwear

- Furniture & Woodworking

By Form

- Solid

- Liquid

- Paste

- Film

By Chemistry

- Polysaccharides

- Proteins

- Vegetable Oils

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

By Source

- Vegetable-Based

- Animal-Based

- Microbial-Based

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait