Content

Commodity Plastics Market - Size, Share & Industry Analysis

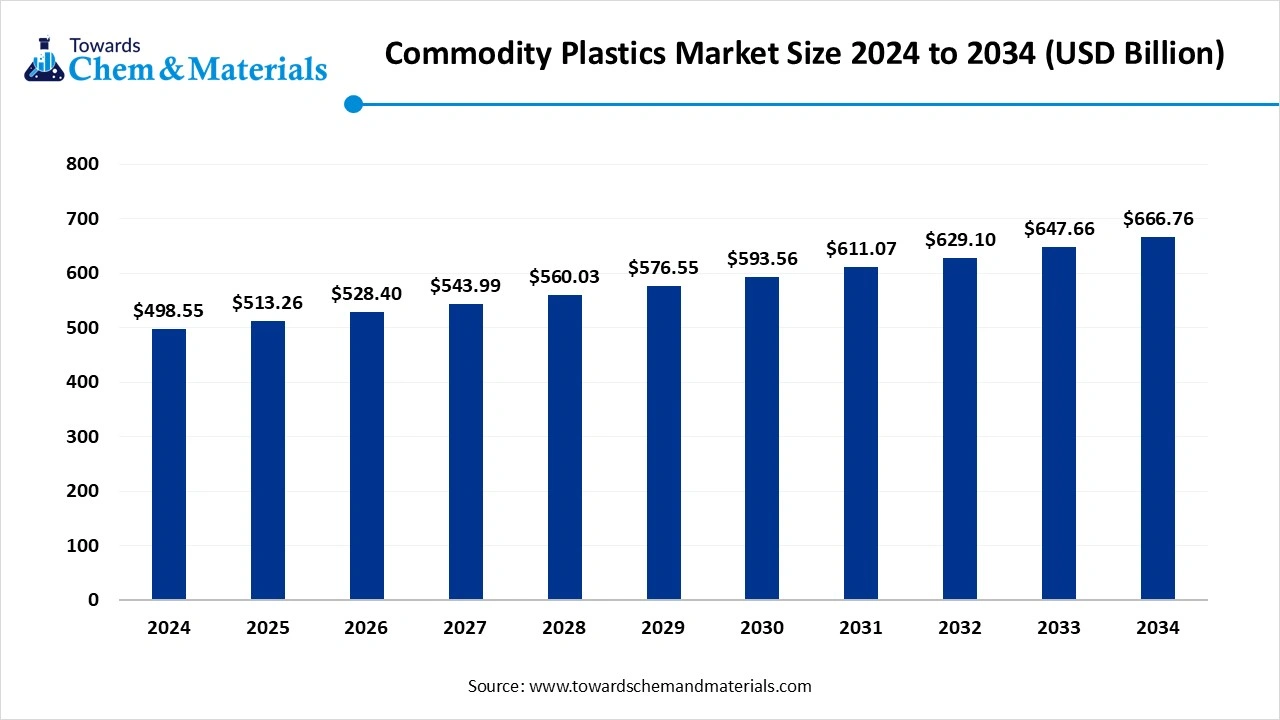

The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

Growing demand for durable and lightweight materials in various sectors is the key factor driving market growth. Also, companies' shift to advanced recycling technologies, coupled with the surge in disposable incomes in emerging economies, can fuel market growth further.

Key Takeaways

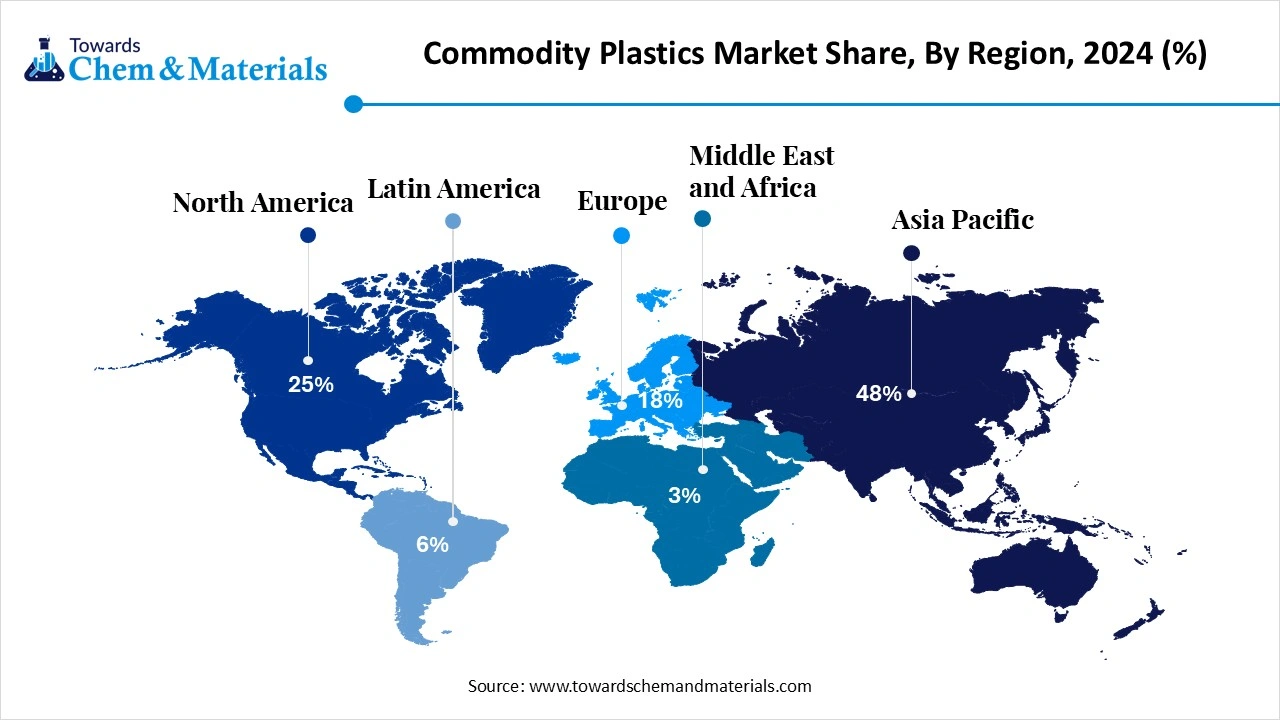

- By region, Asia Pacific dominated the market with approximately 48% share in 2024.

- By region, Middle East & Africa is expected to grow at the fastest CAGR over the forecast period.

- By product type, the polyethylene segment dominated the market with approximately 42% share in 2024.

- By product type, the polypropylene segment is expected to grow at the fastest CAGR over the forecast period.

- By manufacturing process, the extrusion segment held approximately 46% market share in 2024.

- By manufacturing process, the injection molding segment is expected to grow at the fastest CAGR over the forecast period.

- By end-use industry, the packaging segment dominated the market by holding approximately 40% share in 2024.

- By end-use industry, the automotive segment is expected to grow at the fastest CAGR over the forecast period.

- By enterprise size, the large enterprises segment dominated the market with approximately 62% share in 2024.

- By enterprise size, the small & medium enterprises segment is expected to grow at the fastest CAGR during the projected period.

What are Commodity Plastics?

The commodity plastics market refers to the global industry producing widely used, low-cost plastics such as polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and polystyrene (PS). These plastics are used in packaging, automotive, construction, consumer goods, and electrical & electronics applications. The market is driven by rising demand from end-use industries, cost-effectiveness, lightweight material requirements, and the growing adoption of flexible packaging solutions.

What Are the Key Trends Influencing the Commodity Plastics Market?

- There is an increasing investment in biodegradable, recyclable, and bio-based plastics, which is the latest trend in the market. Also, advancements like seaweed-based bioplastics are minimizing the reliance on fossil-based materials to combat plastic waste, leading to further market growth.

- To fulfil surging global demand, market players are increasingly investing in new manufacturing facilities by upgrading existing infrastructure, particularly in developing economies with growing consumption demands. The companies are focusing on closed-loop systems to decrease environmental impact by enhancing material recovery rates.

- Commodity plastics offer a wide range of properties such as durability, flexibility, foldability, and chemical resistance, which makes them convenient for an extensive range of applications across several industries. Their ability to easily transform into different sizes, shapes, and configurations allows market players to tailor them to specific needs.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 513.26 Billion |

| Expected Size by 2034 | USD 666.76 Billion |

| Growth Rate from 2025 to 2034 | CAGR 2.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Manufacturing Process, By End-Use Industry, By Enterprise Size, By Region |

| Key Companies Profiled | LyondellBasell Industries, SABIC, Dow Chemical Company, ExxonMobil Chemical, INEOS Group, Reliance Industries Limited (RIL), Borealis AG, Braskem S.A., Formosa Plastics Group, LG Chem, Covestro AG, Chevron Phillips Chemical, Mitsubishi Chemical Corporation, DuPont de Nemours, Inc., PetroChina Company Limited, Westlake Chemical, TotalEnergies Chemicals, Arkema S.A., Mitsui Chemicals, Hanwha Solutions |

Market Opportunity

Surge in Development In Healthcare Infrastructure

Market players are increasingly investing in healthcare infrastructure, which is the major driver creating lucrative opportunities in the market. There is also a rising demand for packaging materials and medical equipment, devices created from commodity plastics. Furthermore, these plastics give properties like durability, sterility, and flexibility, which make them ideal for applications in clinics, hospitals, and the pharmaceutical industries.

Market Challenge

Increasing Shift Towards Sustainable Alternatives

Growing consumer preference for sustainable products and growing awareness regarding plastic pollution are driving the demand for recyclable and biodegradable alternatives, which is a major factor hindering market growth. Moreover, the market also faces challenges associated with logistics delays, raw material shortages, and increasing transportation costs.

Regional Insight

Commodity Plastics Market Size, Industry Report 2034

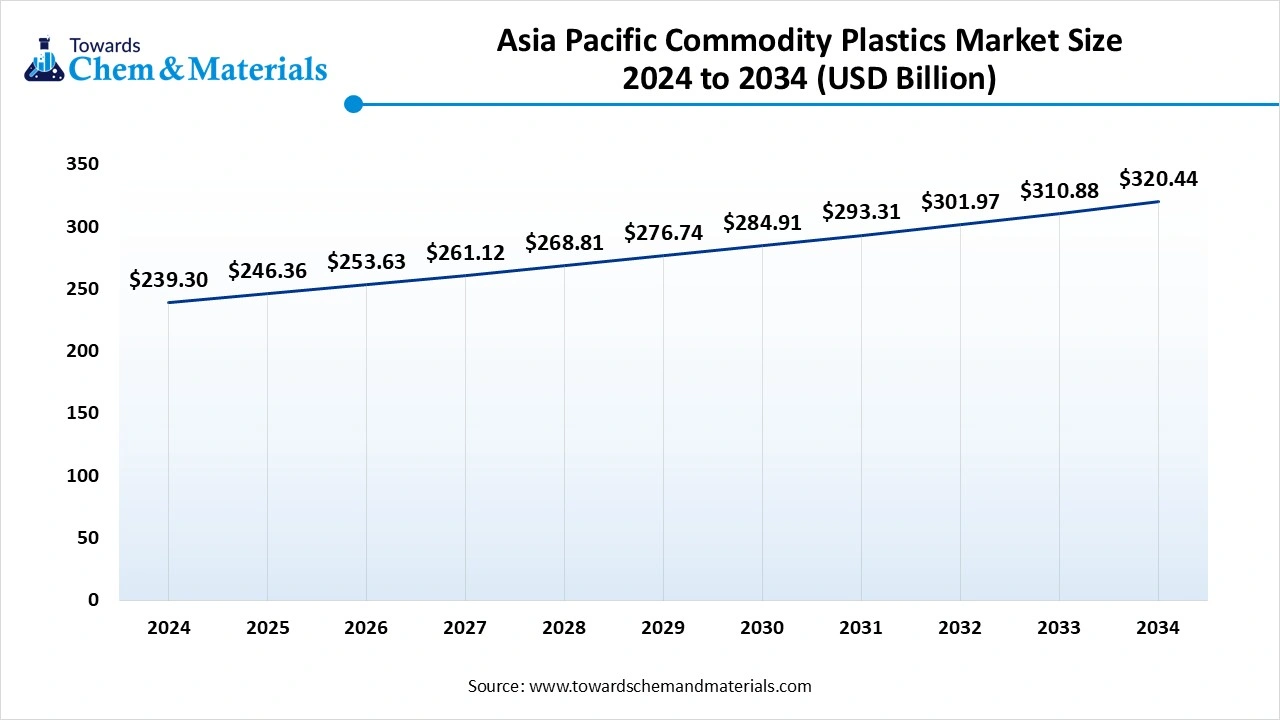

The Asia Pacific commodity plastics market size was valued at USD 239.30 billion in 2024 and is expected to reach USD 320.44 billion by 2034, growing at a CAGR of 2.97% from 2025 to 2034. Asia Pacific dominated the market with approximately 48% share in 2024.

The dominance of the region can be attributed to the rapid urbanization and industrialization, along with the expanding packaging industry for both food and consumer products. In addition, robust growth in the pharmaceutical and medical sectors in developing countries such as China and India increases the need for commodity plastics for medical devices and packaging.

China Commodity Plastics Market Trends

In the Asia Pacific, China dominated the market owing to the rapid urbanization and ongoing industrialization, which led to increased product demand for construction, packaging, automotive, and consumer goods. Also, China's robust automotive sector uses commodity plastics to produce lightweight interior and exterior components to improve overall fuel efficiency.

Middle East & Africa Commodity Plastics Market Trends

The Middle East & Africa is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the ongoing government initiatives supportive of local manufacturing, coupled with the versatility and cost-effectiveness of plastics as alternatives to conventional materials such as metal. Furthermore, plastics are used in construction for lightweight and durable materials, leading to regional growth soon.

Segmental Insight

Product Type Insight

Which Product Type Segment Dominated the Commodity Plastics Market in 2024?

The polyethylene segment dominated the market with approximately 42% share in 2024. The dominance of the segment can be attributed to its low cost, versatility, and extensive adoption in packaging, particularly with the growth of the e-commerce sector. Additionally, PE's excellent flexibility, resistance, and durability make it suitable for a wide array of applications, from containers and bottles to films and sheets.

The polypropylene segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing demand for sustainable and flexible packaging solutions for the food and beverages industry, along with innovations in recycling technologies. Moreover, polypropylene is used in components like dashboards, bumpers, and interior parts.

Manufacturing Process Insight

How Much Share Did the Extrusion Segment Held in 2024?

The extrusion segment held approximately 46% market share in 2024. The dominance of the segment can be linked to the growing product demand from major sectors such as construction, packaging, and automotive, boosted by the need for more durable, lightweight, and cost-effective materials. In addition, the advancements in extrusion technology have led to enhanced product quality with greater customization capabilities, which makes extruded plastics more popular among industries.

The injection molding segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising demand for durable and lightweight plastic components in medical packaging, coupled with the growing need for sterile, high-precision, and durable materials for various healthcare devices. Furthermore, injection molding's ability to create complex geometries with much greater precision is necessary for modern production needs.

End-Use Industry Insight

Why Packaging Segment Dominated the Commodity Plastics Market in 2024?

The packaging segment dominated the market by holding approximately 40% share in 2024. The dominance of the segment is owed to the increasing demand for durable, cost-effective, and lightweight packaging solutions in the consumer goods and food and beverage industries. Also, there is an increasing focus on sustainable packaging, which fuels the use of bio-based polymers, propelling segment growth soon.

The automotive segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to growing demand for fuel-efficient and lightweight materials, which minimize carbon emissions and vehicle weight, particularly for hybrid and electric vehicles. Also, the push towards sustainability boosts innovations in plastic recycling, offering a more circular approach to material use in the sector.

Enterprise Size Insight

Which Enterprise Size Segment Held a Largest Commodity Plastics Market Share in 2024?

The large enterprises segment dominated the market with approximately 62% share in 2024. The dominance of the segment can be attributed to the increasing plastic demand from the packaging sector, particularly for food delivery and e-commerce. Furthermore, a surge in regulatory pressures and environmental awareness is boosting the production and use of sustainable alternatives such as bio-based plastics.

The small & medium enterprises segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the ongoing expansion of the e-commerce industry, along with the rising importance of bio-based and sustainable plastics. Moreover, commodity plastics are popular for their ease of production, cost-effectiveness, and versatility, making them a key choice for SMEs.

Commodity Plastics Market Value Chain Analysis

- Feedstock Procurement: It is the strategic process of sourcing the raw materials essential to produce plastics. Commodity plastics are high-volume and inexpensive plastics used in various applications.

- Chemical Synthesis and Processing: This stage refers to the entire production lifecycle that converts raw materials into finished plastic products.

- Packaging and Labelling: It is the process of enclosing products in wrappers and containers for protection during storage and transportation. Labelling includes attaching information about the product to the packaging.

- Regulatory Compliance and Safety Monitoring: This stage includes the processes and regulations to ensure that plastic products meet environmental, safety, and quality standards throughout their lifecycle.

Recent Developments

- In April 2025, S&P Global Commodity Insights will introduce a combined plastic scrap pricing for the U.S. and Europe. The company says its latest price assessments are created to bring transparency to the market. S&P Global is an independent supplier of data, analysis, and benchmark prices for various markets.(Source: www.recyclingtoday.com)

Commodity Plastics Market Top Companies

- LyondellBasell Industries

- SABIC

- Dow Chemical Company

- ExxonMobil Chemical

- INEOS Group

- Reliance Industries Limited (RIL)

- Borealis AG

- Braskem S.A.

- Formosa Plastics Group

- LG Chem

- Covestro AG

- Chevron Phillips Chemical

- Mitsubishi Chemical Corporation

- DuPont de Nemours, Inc.

- PetroChina Company Limited

- Westlake Chemical

- TotalEnergies Chemicals

- Arkema S.A.

- Mitsui Chemicals

- Hanwha Solutions

Segments Covered

By Product Type

- Polyethylene (HDPE, LDPE, LLDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Others (ABS, PMMA, Polycarbonate)

By Manufacturing Process

- Extrusion

- Injection Molding

- Blow Molding

- Compression Molding

- Others

By End-Use Industry

- Packaging (Flexible & Rigid)

- Automotive

- Construction & Infrastructure

- Electrical & Electronics

- Consumer Goods

- Healthcare & Medical Devices

- Textiles & Apparel

By Enterprise Size

- Large Enterprises (Global Plastic Manufacturers)

- Small & Medium Enterprises (Regional Producers)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait