Content

Commodity Chemicals Market Size and Forecast 2025 to 2034

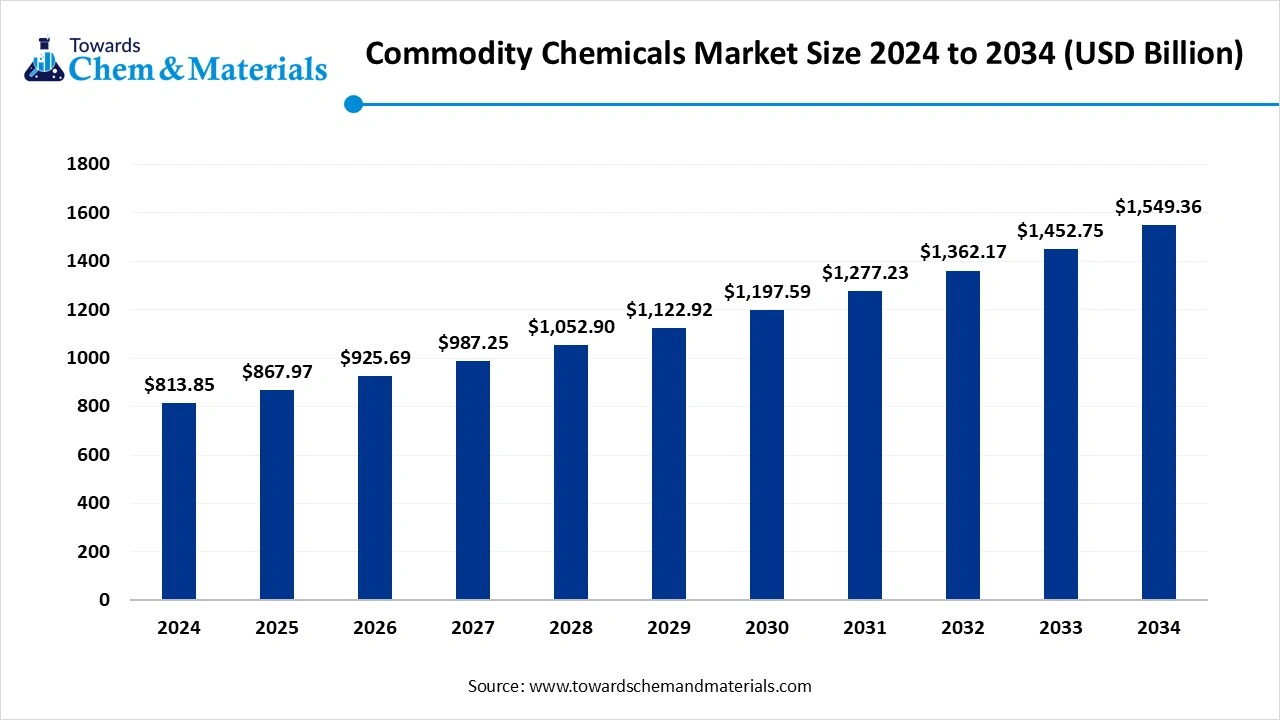

The global commodity chemicals market size was valued at USD 813.85 billion in 2024, grew to USD 867.97 billion in 2025, and is expected to hit around USD 1,549.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period from 2025 to 2034. The focus on the alternative feedstock is anticipated to attract increased capital and investment in manufacturing.

Key Takeaways

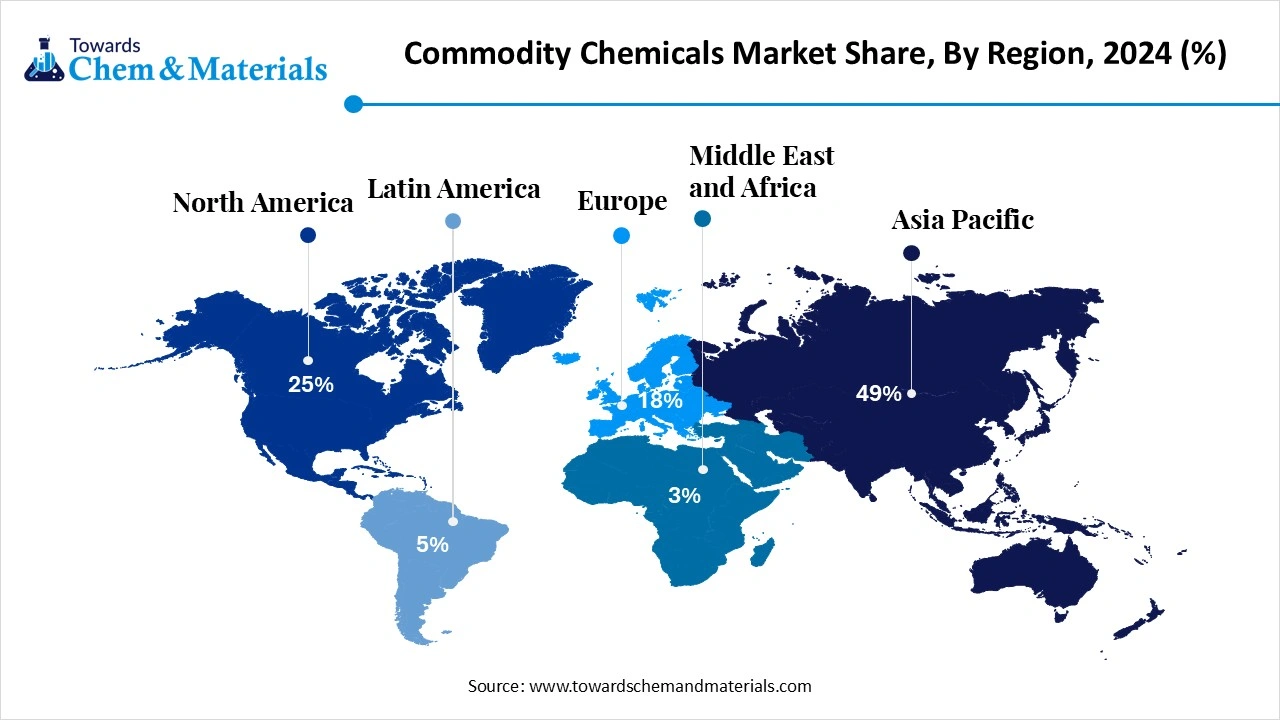

- By region, Asia Pacific dominated the market with approximately 49% industry share in 2024.

- By region, the Middle East & Africa is expected to grow at a notable rate in the future.

- By product type, the petrochemical segment led the market with approximately 46% industry share in 2024.

- By product type, the polymers & biobased chemicals segment is expected to grow at the fastest rate in the market during the forecast period.

- By raw material, the crude oil segment emerged as the top-performing segment in the market with approximately 54% industry share in 2024.

- By raw material, the biomass & renewable feedstock segment is expected to lead the market in the coming years.

- By manufacturing process, the steam cracking segment led the market with approximately 39% share in 2024.

- By manufacturing process, the fermentation and biobased process segment is expected to capture the biggest portion of the market in the coming years.

- By industry vertical, the construction and infrastructure segment emerged as the top-performing segment in the commodity chemicals market with approximately 31% industry share in 2024.

- By industry vertical, the automotive segment is expected to lead the market in the coming years.

- By enterprise size, the large enterprises segment led the market with approximately 64% share in 2024.

- By enterprise size, the SMEs segment is expected to capture the biggest portion of the market in the coming years,

What are the Present Industry Visuals for Commodity Chemicals?

The commodity chemicals industry has experienced sophisticated growth in recent years. The commodity chemicals market refers to the global industry of large-volume, standardized chemicals that serve as fundamental raw materials for manufacturing and industrial processes. These chemicals are produced in bulk and are widely used across multiple sectors such as construction, automotive, packaging, agriculture, textiles, and consumer goods.

- For Instance, the report published by the American Chemistry Council, the sector like chemicals has gained 2.3% growth in 2024 and 2.2% in 2023.(Source: www.americanchemistry.com)

Breaking Free from Fossil Fuels with Innovative Chemical Pathways

The shifting towards alternative feedstocks such as CO2, agricultural waste, and municipal waste for the commodity chemical production is leveraging sustainability goals to unlock new value.

Furthermore, several manufacturers have invested heavily in R&D activities to minimize dependence on traditional crude oil and natural gas in recent years. Also, in several regions, the governments are actively supporting these types of initiatives while converting the municipal e-waste into syngas for downstream chemicals in the past few years.

- In March 2025, Yale chemists introduced the latest method for chemical production, which uses CO2 for chemical production. The main motive behind the innovation is to reduce the carbon footprint in the making of chemicals.(Source: news.yale.edu)

Market Trends

- The adoption of initiatives like Artificial Intelligence -driven reaction optimization in the production of commodity chemicals by major brands has enabled innovation-driven growth in the sector.

- The emergence of bio-integrated petrochemical hybrids has led to the emergence of high-impact solutions in industry nowadays. Manufacturers prefer these types of blends instead of switching totally to biobased chemicals in the current period.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 867.97 Billion |

| Expected Size by 2034 | USD 1,549.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Raw Material, By Manufacturing Process, By Industry Vertical (End-Use), By Enterprise Size, By Region |

| Key Companies Profiled | BASF SE , Dow Chemical Company , SABIC, LyondellBasell Industries , ExxonMobil Chemical , INEOS Group, Sinopec , Reliance Industries Limited (RIL) , Mitsubishi Chemical Group, Formosa Plastics Group, Covestro AG , Borealis AG , LG Chem , DuPont de Nemours, Inc. , PTT Global Chemical, Arkema S.A. , Braskem S.A. , Chevron Phillips Chemical , Yara International (fertilizer & nitrogen chemicals) , Mitsui Chemicals |

Market Opportunity

Sustainability Meets Flexibility in Modular Chemical Systems

The establishment of the onsite modular chemical production systems is likely to create significant industry opportunities for the manufacturer in the coming years. By reducing the heavy investment and complex logistics, the modular plant can give greater advantages for the manufacturers. Also, the sustainability shift is likely to support industry growth, where modular production is seen in cutting down the carbon footprint.

- In February 2025, TCL USA has expanded its facility in North America with the installation of modular and IoT-enabled facilities, as per the report published by the company recently.(Source: www.alchempro.com)

Market Challenge

Energy Dependence Exposes Chemicals Sector to Global Market Shifts

Supply chain disruption due the geopolitical reasons may suppress profit margins and deter investment in the sector during the projected period. Moreover, the major chemicals are produced by natural gas and crude oil feedstock, which have been seen under heavy price volatility in recent years. Furthermore, these price fluctuations can increase chemical prices, which can lead to a decrease in consumer spending in the coming years.

Regional Insights

Commodity Chemicals Market Size, Industry Report 2034

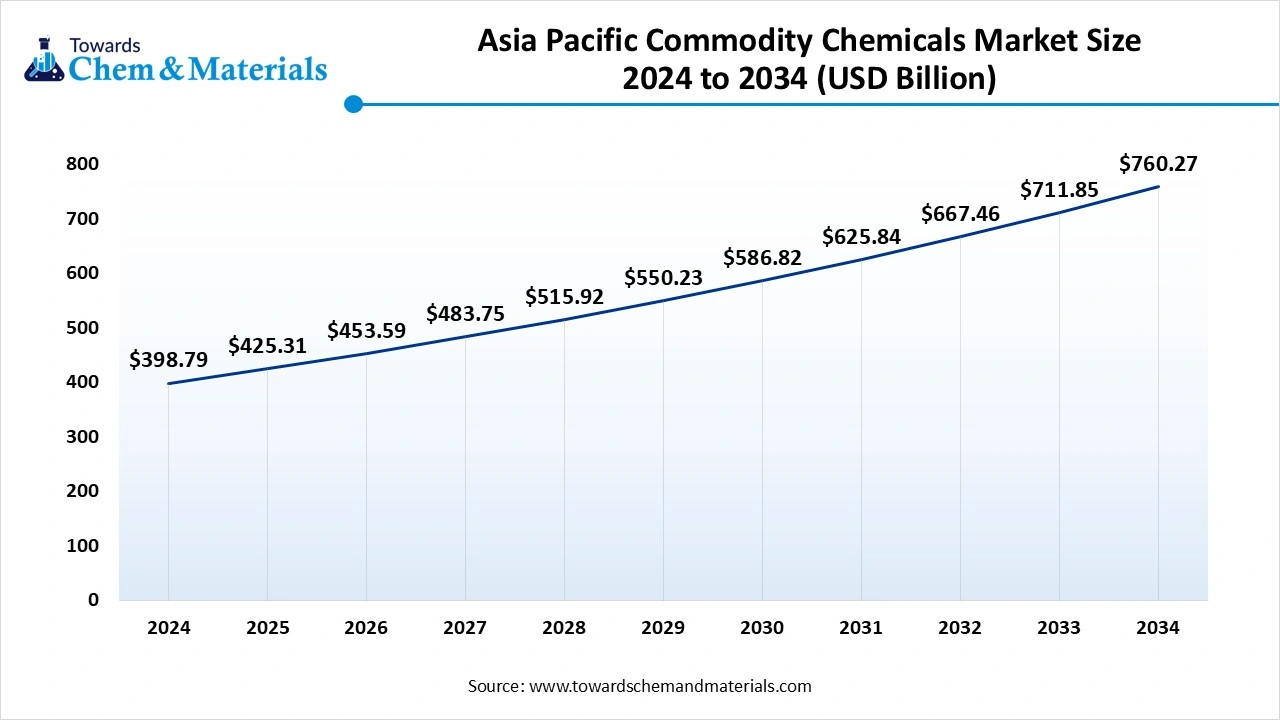

The Asia Pacific commodity chemicals market size was estimated at USD 398.79 billion in 2024 and is projected to reach USD 760.27 billion by 2034, growing at a CAGR of 6.67% from 2025 to 2034. Asia Pacific dominated the market in 2024,

owing to the ongoing manufacturing boom and low-cost raw material availability in the current period. Furthermore, the regional countries like India and China have seen under the enlarged consumption of fertilizers and plastics, where commodity chemicals have received huge demand. Low labor cost plays a major role in the expansion of the regional industry.

What Drives China’s Continued Dominance in Commodity Chemicals?

China maintained its dominance in the market, owing to the country's being known for its advanced refining and chemical production capacity in the current period. Also, the governmental push towards domestic manufacturing infrastructure for chemical production has played a major role in the industry's growth in recent years. Also, the country has recently adopted advanced manufacturing infrastructure and technologies.

- For instance, the government of China is actively providing attractive subsidies to the chemical manufacturers, including direct and indirect subsidies, as per the report published by the Information Technology and Innovation Foundation (ITIF).(Source: tif.org)

Middle East and Africa Commodity Chemicals Market Trends

The Middle East and Africa are expected to capture a major share of the commodity chemicals market during the forecast period, akin to the availability of the low-cost hydrocarbon feed stocks. Also, the regional countries are seen under the heavy investment for downstream chemical production in recent years, where Saudi Arabia and Qatar are focusing on chemical manufacturing while reducing dependence on crude oil exports in the past few years.

Segmental Insights

Product Type Insights

How Did The Petrochemicals Segment Dominate The Commodity Chemicals Market In 2024?

The petrochemical segment held approximately 46% share of the market in 2024, due to its being known as the most crucial element of the commodity chemical industry since traditional times. Also, petrochemicals such as propylene, ethylene, and benzene are seen being used vigorously in the industry, which is forming the basis for fertilizers, plastics, and detergents, where the daily utensils have gained a major industry share.

The polymer and biobased chemicals segment is expected to grow at a notable rate during the predicted timeframe, owing to a global shift towards sustainable material practices and preferences for high-performance materials. Moreover, bio-based materials like PHA and PLA have gained major industry attention in recent years, where the major sectors like automotive and healthcare packaging are seen under the higher consumption.

Raw Material Insights

Why does the Crude Oil Segment Dominate the Commodity Chemicals Market by Raw Material?

The crude oil segment held approximately 54% of the commodity chemicals market in 2024 because it is considered the primary feedstock due to its unique and beneficial factors, like cost-effectiveness and wide availability.

Moreover, most of the large volume chemical infrastructures are designed for the crude oil-derived natural gas and naphtha liquids as base material, as per a recent survey.

The biomass and renewable feedstocks segment is expected to grow at a notable rate during the forecast period, because the chemical industry is under pressure to decarbonize and reduce dependence on volatile oil markets.

Agricultural waste, algae, and forestry residues are emerging as sustainable alternatives for producing ethanol, bioplastics, and green solvents. With carbon pricing and stricter emission rules in place, biomass-derived chemicals will gain cost competitiveness.

Manufacturing Process Insights

How did the Steam Cracking Segment Dominate the Commodity Chemicals Market in 2024?

The steam cracking segment dominated the market with approximately 39% share in 2024, because it is the most efficient and mature technology for producing key olefins like ethylene and propylene. This process has been optimized for decades to run at massive scales, lowering costs per ton. Nearly every major petrochemical hub-like Texas, Saudi Arabia, and China-relies heavily on steam crackers to supply building-block chemicals.

The fermentation and bio-based processes segment is expected to grow at a significant rate during the forecast period, as industries replace fossil-derived chemicals with greener alternatives. Using microbes and enzymes, manufacturers can produce ethanol, lactic acid, and specialty biopolymers at scale with far lower carbon footprints. These processes are highly adaptable, using renewable raw materials like corn, sugarcane, or agricultural residues

Industry Vertical Insights

Is Construction and Infrastructure Fueling a Commodity Chemical Boom in 2024?

The construction and infrastructure segment dominated the market with approximately 31% share in 2024 because of massive demand for cement additives, paints & coatings, adhesives, plastics, and sealants. Commodity chemicals form the backbone of building materials used in everything from residential housing to highways. Government spending on public works, urbanization trends, and real estate projects drove consistent demand.

The automotive segment is expected to grow at a significant rate during the forecast period, as vehicles transition toward electric mobility and lightweighting. Cars now use more polymers, composites, coatings, and specialty resins than ever before, replacing traditional metals. Batteries, EV components, and interiors require chemicals like high-performance foams, adhesives, and bio-based plastics.

Enterprise Size Insights

Are Large Enterprises Getting Consumer Attention?

The large enterprises segment dominated the market with approximately 64% share in 2024 because they have the capital, scale, and infrastructure to operate massive chemical complexes. Commodity chemicals demand billion-dollar facilities, global distribution networks, and integrated supply chains-barriers only large corporations can overcome.

The SME segment is expected to grow at a significant rate during the forecast period, by focusing on specialized, bio-based, and regional solutions. While large firms dominate bulk chemicals, SMEs are agile and can adapt faster to niche markets like biodegradable packaging, green solvents, and customized formulations.

Commodity Chemicals Market Value Chain Analysis

- Distribution to Industrial Users: The commodity chemical is heavily demanded by major industries like automotive, construction, and consumer goods, as per the recent industry information.

- Key Players: Helm AG, Univar Solutions, and IMCD

- Chemical Synthesis and Processing: The chemical synthesis and processing of commodity chemicals involve crucial steps like refining and synthesis.

- Regulatory Compliance and Safety Monitoring: The regulatory and safety framework is globally handled by major agencies like TSCA and REACH.

Recent Developments

- In August 2024, Wanhua established the world’s enlarged Citral production plant. The newly launched plant has a capacity of 48,000 tons of citral production annually, as per the company's claim.(Source: www.coatingsworld.com)

Commodity Chemicals Market Top Companies

- BASF SE

- Dow Chemical Company

- SABIC

- LyondellBasell Industries

- ExxonMobil Chemical

- INEOS Group

- Sinopec

- Reliance Industries Limited (RIL)

- Mitsubishi Chemical Group

- Formosa Plastics Group

- Covestro AG

- Borealis AG

- LG Chem

- DuPont de Nemours, Inc.

- PTT Global Chemical

- Arkema S.A.

- Braskem S.A.

- Chevron Phillips Chemical

- Yara International (fertilizer & nitrogen chemicals)

- Mitsui Chemicals

Segment Covered

By Product Type

- Petrochemicals (Ethylene, Propylene, Benzene, Toluene, Xylene)

- Basic Inorganics (Chlor-alkali, Sulfuric Acid, Nitrogen Compounds, Ammonia)

- Polymers (Polyethylene, Polypropylene, PVC, PET)

- Synthetic Rubber

- Dyes & Pigments

- Others (Solvents, Fertilizers, Adhesives, Explosives)

By Raw Material

- Crude Oil

- Natural Gas

- Coal

- Biomass & Renewable Feedstocks

By Manufacturing Process

- Steam Cracking

- Catalytic Reforming

- Fermentation & Bio-based Processes

- Electrolysis

- Others

By Industry Vertical (End-Use)

- Construction & Infrastructure

- Automotive & Transportation

- Packaging

- Agriculture & Fertilizers

- Textiles & Apparel

- Consumer Goods (Detergents, Cleaning Products)

- Electrical & Electronics

- Industrial Manufacturing

By Enterprise Size

- Large Enterprises (Integrated Chemical Giants)

- Small & Medium Enterprises (Regional/Local Players)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait