Content

What is the Current Automotive Paints & Coatings Market Size and Share?

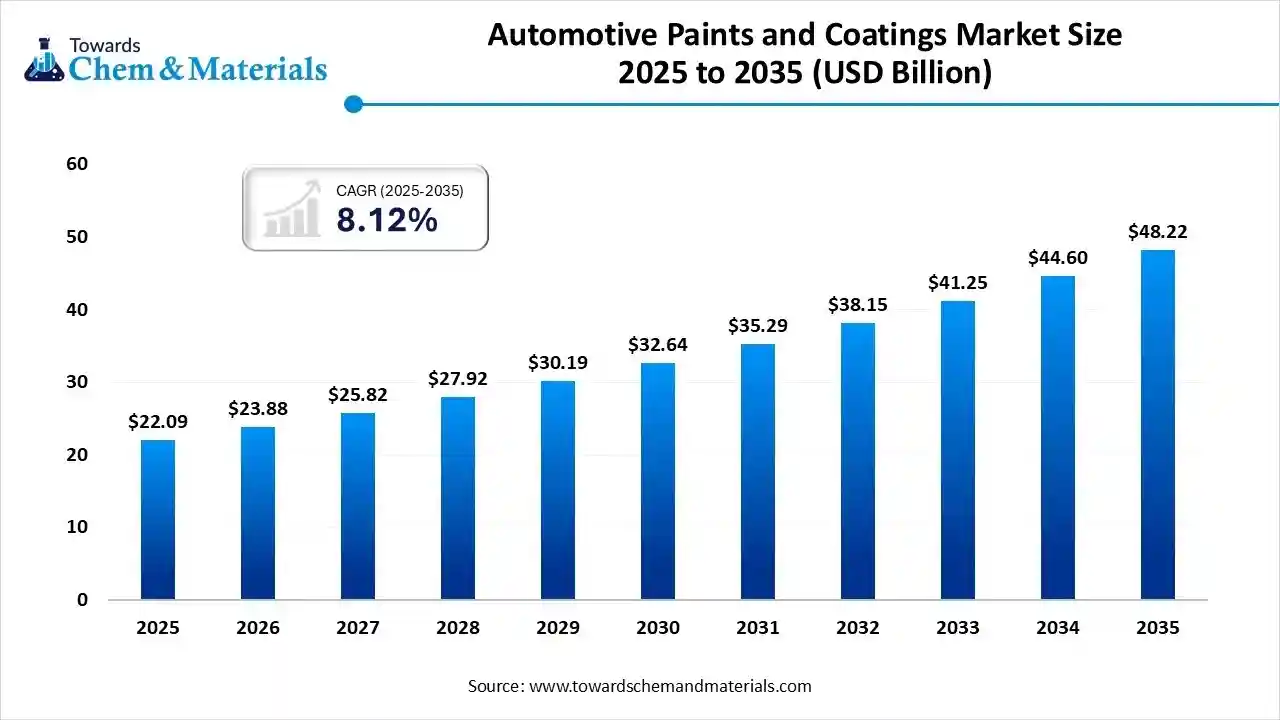

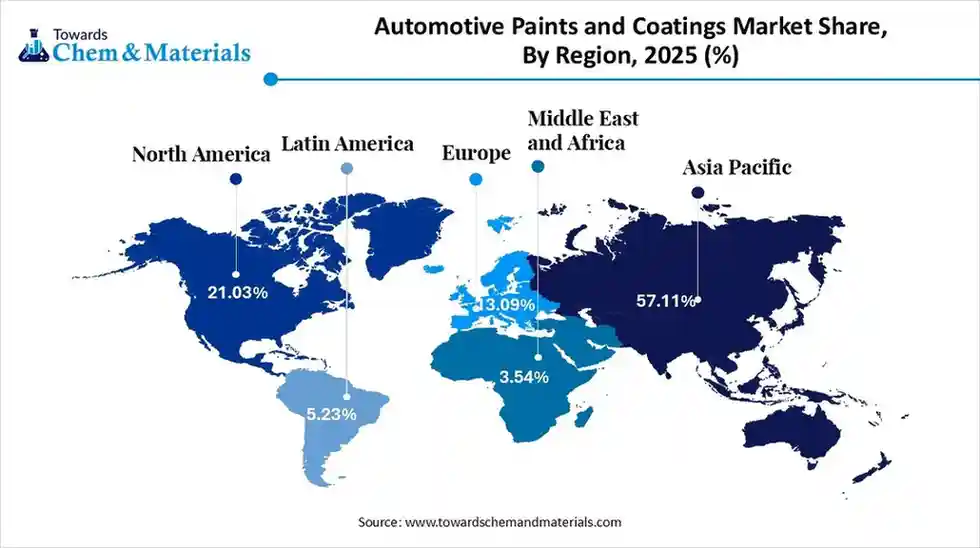

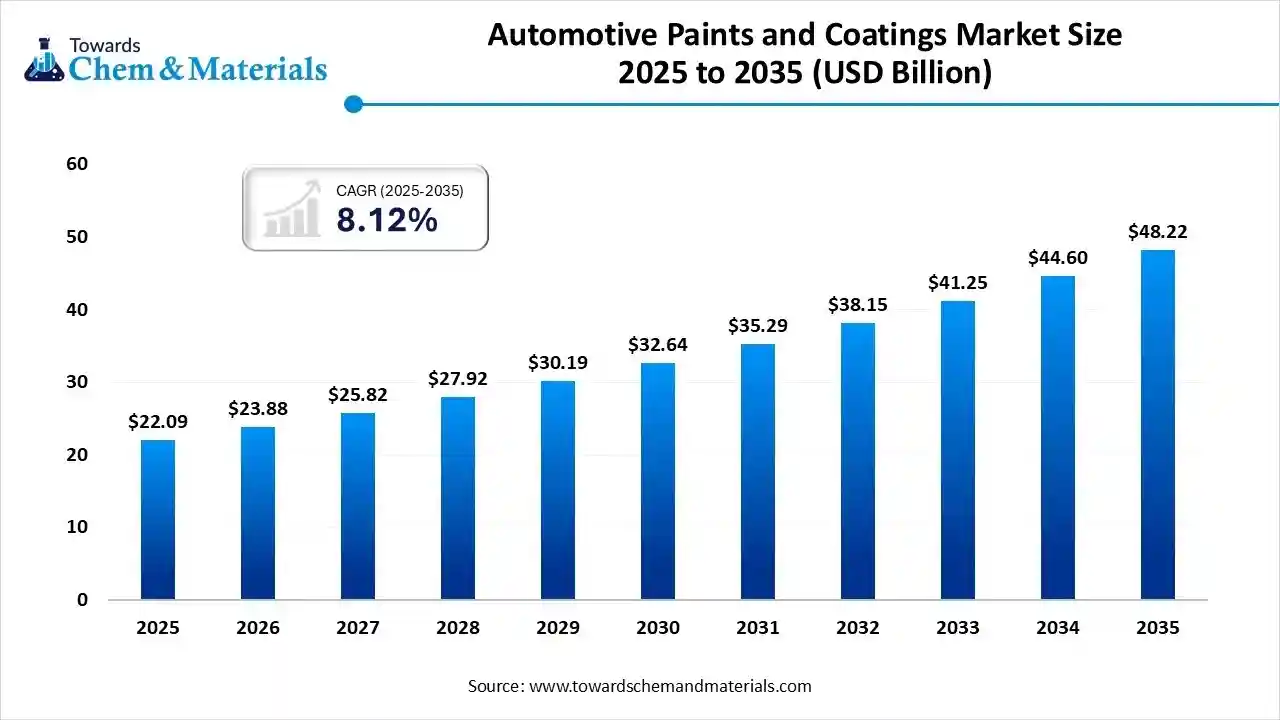

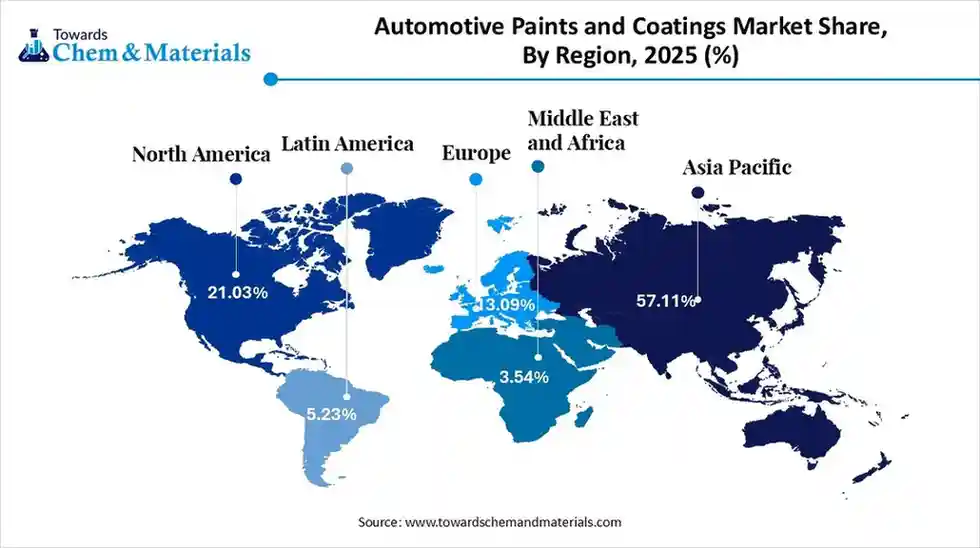

The global automotive paints & coatings market size is calculated at USD 22.09 billion in 2025 and is predicted to increase from USD 23.88 billion in 2026 and is projected to reach around USD 48.22 billion by 2035, The market is expanding at a CAGR of 8.12% between 2026 and 2035. Asia Pacific dominated the automotive paints & coatings market with a market share of 57.11% the global market in 2025.The growing production of vehicles and the increasing need for vehicle refinishes drive the market growth.

Key Takeaways

- Asia Pacific dominated the global automotive paints & coatings market with the largest revenue share of 57.11% in 2025.

- By region, North America is growing at the fastest CAGR in the market during the forecast period.

- By technology, the water-based coatings segment led the market in 2025.

- By technology, the powder coatings segment is growing at the fastest CAGR in the market during the forecast period.

- By type, the basecoats segment led the market in 2025.

- By type, the clearcoats segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By performance, the durability segment led the market in 2025.

- By performance, the corrosion resistance segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the original equipment manufacturer segment led the market in 2025.

- By application, the refinishing segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By vehicle type, the passenger cars segment led the market in 2025.

- By vehicle type, the commercial vehicles segment is expected to grow at the fastest CAGR in the market during the forecast period.

What Factors Drive Growth of the Automotive Paints & Coatings Market?

The automotive paints & coatings market growth is driven by rapid growth in electric vehicles, growing vehicle aftermarket, increasing customization of vehicles, rising use of waterborne coatings, and growing consumer demand for personal vehicles. The increasing production of SUVs and electric vehicles requires paints & coatings to enhance aesthetics and protect structural integrity.

The increasing consumer demand for specific property coatings like scratch-resistant finishes, self-cleaning, anti-corrosion, and self-healing supports the expansion of automotive paints & coatings. The growing adoption of used cars increases demand for attractive coatings.

What are Automotive Paints and Coatings?

Automotive paints & coatings are applications of advanced materials on an automobile's body to protect it from weather, corrosion, and other factors. They are a mixture of binders, additives, pigments, and solvents. The binder offers durability, additives offer surface smoothness, pigments provide color, and the solvent allows for smooth application.

The benefits of automotive paints & coatings are UV damage protection, high-quality vehicle aesthetics, long-lasting durability, improved tire rolling resistance, and a glossy finish. They are applied to dashboards, aluminum wheels, new vehicle production, damaged vehicle repair, door panels, and exterior vehicle bodies.

Automotive Paints & Coatings Market Trends:

- Growing Electric Vehicle Adoption:- The strong focus on sustainability and increasing production of electric vehicles increases demand for high-performance paints & coatings. The increasing use of lightweight materials in EVs and the focus on enhancing performance like thermal management, durability, and EMI shielding require high-performance coatings.

- Growing Vehicle Aftermarket:- The aging vehicle fleets and rise in the number of vehicles on the road increase the vehicle aftermarket. The strong focus on enhancing vehicle lifespan and growing customization of the appearance of vehicles requires specialized paints & coatings.

- Customization Trend:- The strong focus of consumers on expressing their personal style and the increasing popularity of finishes increase customization. Consumers focus on the development of personalised finishes to create a unique style. The customization includes minimalist matte finishes, retro-inspired designs, bold metallic finishes, and a monochromatic look to enhance the appearance of the vehicle.

- Sustainable Paints & Coatings Development:- The growing consumer awareness about environmental concerns and stricter environmental regulations increases the development of sustainable automotive paints & coatings. The strong consumer focus on greener products increases the development of bio-based paints, water-based paints, low VOC coatings, powder coatings & UV-cured systems.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 22.09 Billion |

| Revenue Forecast in 2035 | USD 48.22 Billion |

| Growth Rate | CAGR 8.12% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Technology, By Type, By Performance, By Application, By Vehicle Type, By Region |

| Key companies profiled | Akzo Nobel NV , BASF SE , Cabot Corp , Clariant AG , Covestro, Donglai Coating Technology, Dupont, Eastman, Kansai Paint Co. Ltd, KCC Corporation, Nippon Paint Holdings Co. Ltd, PPG Industries, Inc., The Valspar Corporation., Wanda Refinish |

Key Technological Shifts in the Automotive Paints & Coatings Market:

The automotive paints & coatings market is undergoing key technological shifts driven by the demand for functionality, sustainability, and durability. The technological advancements, such as sustainable materials, smart coatings, zero-VOC technologies, advanced primer coatings, robotics, and nanotechnology, increase coating efficiency. One of the most significant transformations is the integration of artificial intelligence (AI), enabling innovations, enhancing quality control, and improving the efficiency of manufacturing.

AI optimizes formulation by analyzing chemical compositions and raw materials. AI minimizes the development cycle and helps to create eco-friendly formulas. AI easily detects painted surface defects like uneven coverage, pinholes, & dust nibs and detects imperfections in under two minutes. AI performs color matching on vehicles and provides advanced customization options. They also enhance overall equipment effectiveness, reduce unplanned downtime, and minimize emergency repairs. Overall, AI transforms the entire lifecycle, minimizes waste, enables advanced features, and improves the consistency of paints & coatings.

- For instance, BASF uses AI for efficient & precise color matching, and it finds the right shade for automotive refinishing.

Trade Analysis of Automotive Paints & Coatings Market: Import & Export Statistics

- Japan exported 4009 shipments of automobile paint.

- Japan exported 249,726 shipments of powder coating.

- Malaysia exported 231 shipments of automotive primer.

- Germany exported 9,833shipments of basecoat.

Automotive Paints & Coatings Market Value Chain Analysis

- Feedstock Procurement : Feedstock procurement is the process of sourcing raw materials, including binders like acrylics, polyurethanes, & epoxies, additives, pigments like titanium oxide, and solvents.

- Key Players: PPG Industries, Axalta Coating System, Covestro AG, BASF SE, AkzoNobel N.V.

- Chemical Synthesis and Processing : The chemical synthesis and processing involve several steps: synthesis of resins, premixing & dispersion of raw materials, grinding, blending, quality control, and packaging.

- Key Players: Axalta Coating Systems, AkzoNobel N.V., Nippon Paint Holdings Co., Ltd., PPG Industries, BASF SE

- Quality Testing and Certifications : Quality testing involves evaluation of properties like adhesion, abrasion resistance, flexibility, gloss, hardness, viscosity, drying time, color, film thickness, corrosion resistance, UV resistance, and chemical resistance. Certifications like ASTM D3359, ASTM D896, ISO 2813, ISO 2409, and SAE J400 are important for automotive paints & coatings.

- Key Players: Micom Laboratories, Bureau Veritas India, Intertek, TUV India, Mets Laboratories, Eurofins Spectro Analytical Labs

Paints, Primers & Protection: Breakdown of Automotive Coatings

| Coating Type | Application Area | Benefits | Examples |

| E-Coat |

|

|

CathoGuard |

| Clearcoat |

|

|

|

| Basecoat | Exterior Panels Top Layer |

|

|

| Primer |

|

|

|

Segmental Insights

Technology Insights

Why the Water-Based Coatings Segment Dominates the Automotive Paints & Coatings Market?

The water-based coatings segment dominated the automotive paints & coatings market in 2025. The growing awareness about environmental issues and increasing consumer demand for sustainable products increases the adoption of water-based coatings. The increasing new vehicle manufacturing and the rise in vehicle repair require water-based coatings. The growing use of water-based coatings in clearcoats, primers, and basecoats, and the automotive industry's commitment to sustainability, drive the market growth.

The powder coatings segment is the fastest-growing in the market during the forecast period. The growing applicability of powder coatings on composites and plastic materials helps market growth. The rise in electric vehicles and increasing awareness about environmental concerns increases demand for powder coatings. The development of components like engine parts, wheels, and chassis requires powder coatings. The cost-effectiveness, durability, and high-quality of powder coatings support the overall market growth.

The solvent-based coatings segment is growing significantly in the market. The growing utilization of electric and traditional vehicles increases demand for solvent-based coatings. The expansion of vehicle refinishing and the increasing customization of vehicles requires solvent-based coatings. The superior adhesion, faster drying times, wider color range, and long-lasting durability of solvent-based coatings support the overall market growth.

Type Insights

How did Basecoats hold the Largest Share in the Automotive Paints & Coatings Market?

The basecoats segment held the largest revenue share in the automotive paints & coatings market in 2024. The growing production of electric vehicles and the increasing need for precise color during refinishing increase the adoption of basecoats. The increasing customization of basecoats on pearlescent, solid, and metallic finishes helps market growth. The strong focus on extending cars' lifespan and the rise in reselling of vehicles require basecoats, driving the overall market growth.

The clearcoats segment is experiencing the fastest growth in the market during the forecast period. The consumer focus on achieving matte, metallic, glossy, and pearl finishes on vehicles increases demand for clearcoats. The growing consumer demand for long-lasting shine and a strong focus on preventing basecoats increases the adoption of clearcoats. The increasing customization of cars and the rise in utilization of used vehicles increase demand for clearcoats, supporting the overall market growth.

The functional coatings segment is significantly growing in the market. The strong focus on protecting vehicles from corrosion, wear, damage, and tear increases the adoption of functional coatings. The increasing need for improving the aesthetics of automobiles and extending the lifespan of vehicles requires functional coatings. The rising trend of EVs and focus on vehicle maintenance increases the adoption of functional coatings, fueling the overall market growth.

Performance Insights

Why the Durability Segment is Dominating the Automotive Paints & Coatings Market?

The durability segment dominated the automotive paints & coatings market in 2025. The focus on extending vehicles' lifespan and preventing UV damage increases demand for durable coatings. The increasing need for preventing premature fading and enhancing the aesthetic appeal of vehicles requires durable coatings. The growing demand for refinishing & repair vehicles and the rise in EVs require durable coatings, driving the overall market growth.

The corrosion resistance segment is the fastest-growing in the market during the forecast period. The strong focus on maintaining the appearance of vehicles and growing car owners increases demand for corrosion-resistant coatings. The expansion of original equipment manufacturers and the rise in production of electric vehicles require corrosion-resistant coatings. The growing manufacturing of traditional vehicles and the rise in vehicle refinishing increase demand for corrosion-resistant coatings, supporting the overall market growth.

The abrasion resistance segment is significantly growing in the market. The strong focus on preventing vehicles from wear, scratches, and chips increases demand for abrasion-resistant coatings. The growing customization of vehicles and focus on improving the aesthetic appeal of vehicles require abrasion-resistant coatings, helping the overall market growth.

Application Insights

Which Application held the Largest Share in the Automotive Paints & Coatings Market?

The original equipment manufacturers (OEM) segment held the largest revenue share in the automotive paints & coatings market in 2024. The growing buying of new trucks, cars, and vans requires automotive paints & coatings. The strong focus of OEM on the creation of brand identity and the increasing need for enhancing aesthetic appeal increases demand for automotive paints & coatings. The strong presence of OEMs across regions like the Asia Pacific, North America, and Europe drives the overall market growth.

The refinishing segment is experiencing the fastest growth in the market during the forecast period. The growing number of road accidents and increasing vehicles on the road increases demand for refinishing. The strong focus of car owners on enhancing longevity and improving vehicle appearance requires refinishing. The growing personalisation of vehicles and increased buying of used vehicles requires refinishing, supporting the overall market growth.

The maintenance & repair segment is growing at a significant rate in the market. The growing issues like chipping, fading, and corrosion in vehicles increase demand for maintenance & repair. The growing new vehicle buying prices and increasing adoption of used cars require maintenance & repairs. The rise in organized accidents and growing consumer awareness about proper maintenance increases demand for maintenance & repair, supporting the overall market growth.

Vehicle Type Insights

How the Passenger Cars Segment Dominates the Automotive Paints & Coatings Market?

The passenger cars segment dominated the automotive paints & coatings market in 2025. The growing production number of passenger cars and increasing customization of car appearance increase demand for automotive paints & coatings. The growing use of coatings on parts like steering wheels, instrument panels, and door trims helps market growth. The rise of passenger car electrification and increasing global sales of passenger cars require automotive paints & coatings, supporting the overall market growth.

The commercial vehicles segment is the fastest-growing in the market during the forecast period. The growing expansion of passenger transportation services and increasing demand for logistics are increasing the adoption of commercial vehicles. The strong focus on protecting commercial vehicles from harsh conditions like UV radiation, dust, and acid increases demand for automotive coatings & paints. The growing use of commercial vehicles like buses, vans, trucks, & tippers for purposes like urban transport, long-haul logistics, & others requires specialized paints & coatings, supporting the overall market growth.

The aerospace and military segment is growing at a significant rate in the market. The growing expansion of air travel and the development of military equipment require high-performance paints & coatings. The strong focus on enhancing fuel efficiency and lowering the weight of aircraft increases the adoption of automotive paints & coatings. The stringent environmental regulations in the military and aerospace industries increase demand for sustainable paints & coatings, helping the overall market growth.

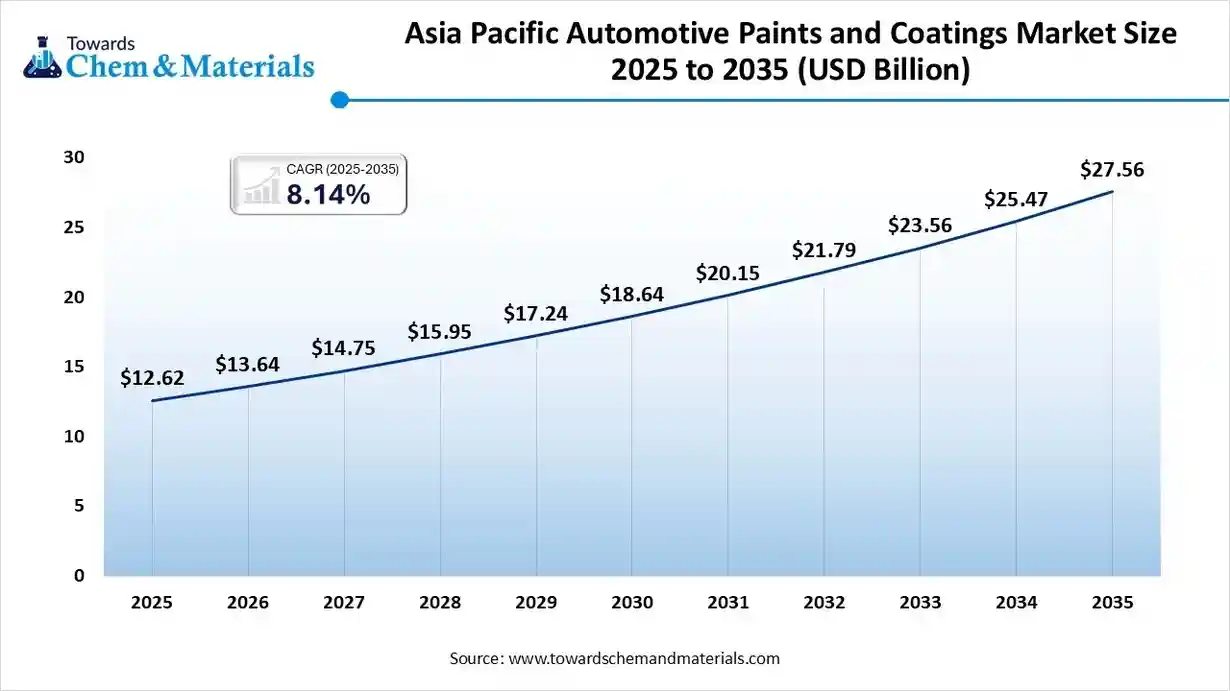

Regional Insights

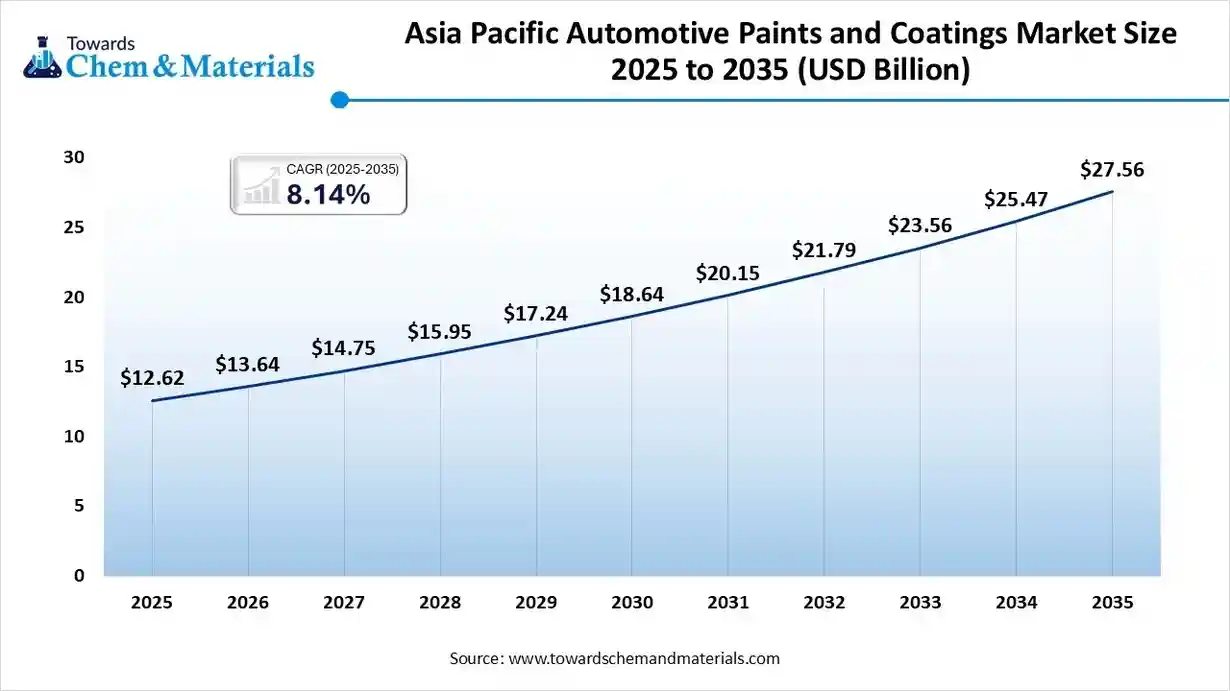

The Asia Pacific automotive paints & coatings market size was valued at USD 12.62 billion in 2025 and is expected to reach USD 27.56 billion by 2035, growing at a CAGR of 8.14% from 2026 to 2035. Asia Pacific dominated the automotive paints & coatings market in 2024. The growing production of vehicles and the rise in new vehicle buyers increase demand for automotive paints & coatings.

The growing presence of automotive original equipment manufacturers in countries like South Korea, China, & India, and the increasing need for aftermarket services like refinishing & repainting, increases demand for high-performance paints & coatings. The growing development of fuel-efficient & lightweight vehicles and the abundance of raw materials increase production of automotive paints & coatings, driving the overall market growth.

From Factory to Finish: China’s Role in Automotive Paints & Coatings

China is a major contributor to the market. The presence of the largest automotive production infrastructure increases demand for refinish & OEM coatings. The growing development of custom vehicles and the rise in production of new vehicles require high-performance paints & coatings. The growing sales of electric vehicles and increasing government investment in EVs require automotive paints & coatings, supporting the overall market growth.

China exported 71 shipments of automobile paint.

North America Automotive Paints & Coatings Market Trends

North America expects the fastest growth in the market during the predicted period. The growing manufacturing vehicles in countries like Canada and the United States increase demand for automotive paints & coatings. The aging vehicle fleet and increasing ownership of vehicles require specialized paints & coatings. The rise in electric vehicles and the presence of original equipment manufacturers increase demand for automotive paints & coatings, driving the overall market growth.

From R&D to Production: Automotive Paints & Coatings Expansion in the U.S.

The United States is a key contributor to the market. The growing electric vehicles and traditional vehicle manufacturing increases demand for specialized paints & coatings. The rise in road accidents increases demand for the repair of vehicles that require automotive paints & coatings. The growing purchasing of pre-owned vehicles and the rise in interest in customization of vehicles increase demand for diverse colors & finishes of coatings & paints, supporting the overall market growth.

- The United States exported 83 shipments of automobile paint.

Europe Automotive Paints & Coatings Market Trends

Europe is emerging at a notable growth rate in the market. The increased manufacturing of vehicles in countries like the UK, Germany, and France increases demand for automotive paints & coatings. The growing vehicle aftermarket sector and the rise in electric vehicles require automotive paints & coatings. The growing development of custom finishes and increasing adoption of powder & water-borne coatings drive the overall market growth.

Coloring Precision: Germany’s Innovations in Automotive Paints & Coatings

Germany is growing at a significant rate in the market. The well-established automotive industry and high production of new cars increase demand for automotive paints & coatings. The rise in production of EVs requires specialized paints & coatings. The growing use of aesthetic and premium finishes in brands like Mercedes-Benz, Volkswagen, and BMW supports the overall market growth.

- Germany exported 493 shipments of automotive primer.

Middle East & Africa Automotive Paints & Coatings Market Trends

The Middle East & Africa are growing significantly in the market. The rapid urbanization and increasing use of commercial vehicles increase demand for automotive paints & coatings. The growing sales of vehicles in countries like Turkey and Saudi Arabia require automotive paints & coatings. The presence of harsh environmental conditions like saltwater corrosion, extreme temperature, and others requires high-performance paints & coatings. The strong government support for the automotive industry drives the overall market growth.

Fueling Finish: Saudi Arabia Ignites Automotive Paints & Coatings Growth

Saudi Arabia is growing substantially in the market. The growing domestic manufacturing of vehicles and a strong focus on customization of vehicles increase demand for high-performance paints & coatings. The government initiatives, like the Saudi Green Initiative, increase the production of eco-friendly automotive coatings. The strong focus on enhancing the aesthetic of vehicles and the presence of vehicle aftermarket require automotive paints & coatings, supporting the overall market growth.

South America Automotive Paints & Coatings Market Trends

South America is growing in the market. The strong focus of automakers on high-performance, aesthetic, and durable coatings & finishes helps market expansion. The growing automotive production, particularly in Brazil, fuels demand for specialized refinish & OEM coatings. The stringent environmental regulations increase the development of water-based and low-VOC coatings, driving the overall market growth.

Coating the Continent: Brazil's Acceleration Towards a Glossy Future

Brazil is growing substantially in the market. The availability of raw materials like titanium dioxide and increasing investment in expanding production facilities increase the production of automotive paints & coatings. The growing production of vehicles and the rise in electric vehicle sales increase demand for specialized paints & coatings, supporting the overall market growth.

Recent Developments

- In November 2025, BASF Coatings launched a new plant of automotive OEM coatings in Muenster, Germany. The plant minimizes CO2 emissions and optimizes the consumption of energy. The plant designs high-quality products and enhances sustainability. (Source: www.basf.com)

- In May 2025, Huntsman launched intumescent polyurethane coating system, POLYRESYST EV 5005, for automotive applications. The coating enhances battery cells' fire protection and protects the structural integrity of EV batteries. (Source: www.indianchemicalnews.com)

- In March 2025, PPG launched a waterborne automotive coating plant in Thailand. The facility increases the domestic manufacturing capacity of waterborne primers and basecoats. The annual production capacity of the facility is 2000 tons.(Source: www.bodyshopbusiness.com)

Top Vendors in the Automotive Paints & Coatings Market & Their Offerings:

Axalta Coating Systems

Corporate Information

- Name: Axalta Coating Systems Ltd.

- Ticker: NYSE: AXTA

- Headquarters: Philadelphia, USA

- Business: A global leader in liquid and powder coatings. Key end markets include automotive (OEM & refinish), industrial, commercial transport, and electrical/electronic applications.

History and Background

- Origins & Legacy: Axalta’s heritage goes back more than 150 years in coatings.

- Formation as Axalta: In 2013, The Carlyle Group acquired DuPont Performance Coatings (for about $4.9 bn), and renamed it Axalta Coating Systems.

- Public Listing: Axalta went public on 12 November 2014 on the NYSE (AXTA).

Milestones:

- 2016: Celebrated 150 years in the coatings business.

- 2018: Opened a 175,000 sq ft Global Innovation Center in Philadelphia.

- 2021: Acquired U-POL, a major supplier in the automotive refinish / aftermarket space.

- 2024: Acquired The CoverFlexx Group (specialized in economy refinish coatings) for ~$285 million.

- 2024: Opened global HQ in Philadelphia Navy Yard (aligning HQ with innovation center).

- 2023: Launched its Irus Mix automated color mixing machine and introduced NextJet™ digital paint technology with Xaar partnership.

Key Developments and Strategic Initiatives

Merger with AkzoNobel (Announced 2025):

- Axalta and AkzoNobel have signed an all stock merger of equals, creating a coatings giant.

- Combined enterprise value: ~ US$25 billion.

- Expected cost synergies: ~ US$600 million, with ~ 90% to be realized within first 3 years post-close.

Sustainability & Innovation Focus:

- Committed to carbon-neutral operations by 2040.

- Heavy emphasis on R&D, innovation, and digital transformation (NextJet, Irus Mix, Nimbus customer platform)

- Investment in global innovation centers

Mergers & Acquisitions

- 2024: Acquired The CoverFlexx Group (aftermarket coatings) for ~$285 million.

- 2025: Merger agreement with AkzoNobel, creating a major coatings company.

Partnerships & Collaborations

- Xaar: Axalta partnered with Xaar (inkjet technology firm) to develop NextJet™, a digital paint system for vehicles.

- Automotive News PACE: Their NextJet™ technology won a 2025 PACE Pilot “Innovation to Watch” award, highlighting its potential and collaborative maturity.

Product Launches / Innovations

- Axalta NextJet™: A next-generation digital paint technology that enables precise paint placement, patterns, two-tone designs, and reduces masking, waste, energy, and labor.

- Irus Mix: Fully automated, hands-free color-mixing machine for refinish shops; improves speed, accuracy, and sustainability.

- Irus Scan: Next-gen spectrophotometer for accurate color matching (launched in 2024).

Key Technology Focus Areas

- Digital Coating Technologies: NextJet™ is a flagship innovation, integrating inkjet / robotics to apply coating.

- Sustainability: Reducing CO₂ emissions, energy usage, and waste in coating operations and applications.

- Automation: Automated color-mixing (Irus Mix) to improve productivity and reduce manual errors.

R&D Organisation & Investment

- R&D Centers: Has multiple dedicated R&D centers globally.

- Investment: Historically, very aggressive in R&D: For example, in 2016, invested US$180 million in R&D.

- Innovation Talent: Through the planned AkzoNobel merger, the combined company is expected to have ~ 4,200 research fellows, scientists, and engineers.

SWOT Analysis

Strengths:

- Strong specialization in coatings (liquid and powder) across automotive OEM, refinish, industrial.

- Rich technological innovation (NextJet, Irus Mix, digital platform)

- Global presence and scale: 140+ countries, large customer base.

- Consolidation potential: The AkzoNobel merger could create a coatings powerhouse with very complementary portfolios.

- Sustainability commitment: Long-term goals to reduce carbon footprint

Weaknesses:

- High debt: (As gleaned from recent financials) - large borrowings could constrain capital flexibility. (Note: from investor commentary)

- Integration risk: Merging with AkzoNobel is big; cultural, operational, and geographic integration could be challenging.

- Capital intensity: High R&D and CAPEX needs to maintain innovation leadership.

Exposure to cyclicality: Automotive refinish and OEM demand are cyclical, tied to macro and vehicle production.

Opportunities:

- Cross selling post merger: With AkzoNobel’s complementary segments (decorative, marine, aerospace), Axalta can reach new markets.

- Digital paint adoption: NextJet™ potentially revolutionizes car painting (design flexibility, waste reduction)

- Expansion in emerging markets: Growth potential in regions where automotive and industrial demand is increasing

- Sustainability products: Demand for greener, low-VOC, efficient coatings is rising Axalta is well placed

Threats:

- Regulatory risk: Environmental regulations could tighten, increasing compliance costs

- Raw material costs: Fluctuations in raw material prices (pigments, resins) can squeeze margins

- Competition: Big, well-funded competitors (PPG, BASF, AkzoNobel, etc.)

- Macroeconomic risk: Auto production downturns, supply chain disruptions

- Integration failure: The big merger may not deliver the promised synergies if poorly executed

Recent News & Strategic Updates

- Merger with AkzoNobel (2025): Definitive all-stock “merger of equals” announced, creating a ~US$25 billion coatings company.

- Synergies: The companies expect ~US$600 million annual cost savings, with 90% to be realized within 3 years.

- R&D Scale for Combined Firm: Post-merger, combined R&D workforce ~4,200 researchers, with ~3,200 patent applications.

Other Top Companies List

- Akzo Nobel NV: The Dutch-based company produces performance coatings and decorative paints for industries like aerospace, marine, and automotive.

- BASF SE: The German multinational company provides products and services like beyond paint solutions, full coating systems, and additives for refinish and OEM markets.

- Cabot Corp: The company manufactures performance materials and specialty chemicals to serve the consumer goods, automotive, and electronics industries. The product range includes battery materials, aerogel, conductive compounds, specialty carbons, fumed metal oxides, and inkjet colorants.

- Clariant AG: The Swiss-based company supplies pigments, dispersing agents, performance additives, and waxes to support a diverse industrial base.

- Covestro

- Donglai Coating Technology

- Dupont

- Eastman

- Kansai Paint Co. Ltd

- KCC Corporation

- Nippon Paint Holdings Co. Ltd

- PPG Industries, Inc.

- The Valspar Corporation.

- Wanda Refinish

Segments Covered

By Technology

- Solvent-Based Coatings

- Water-Based Coatings

- Powder Coatings

- Radiation-Cured Coatings

- High-Solids Coatings

By Type

- Electrocoat Primers

- Primer Surfacers

- Basecoats

- Clearcoats

- Functional Coatings

By Performance

- Corrosion Resistance

- Abrasion Resistance

- Chemical Resistance

- Flexibility

- Durability

By Application

- Original Equipment Manufacturer (OEM)

- Refinishing

- Maintenance and Repair

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Industrial Machinery

- Rail Rolling Stock

- Aerospace and Military

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa