Content

What is the Sustainable Materials Market Size and Share ?

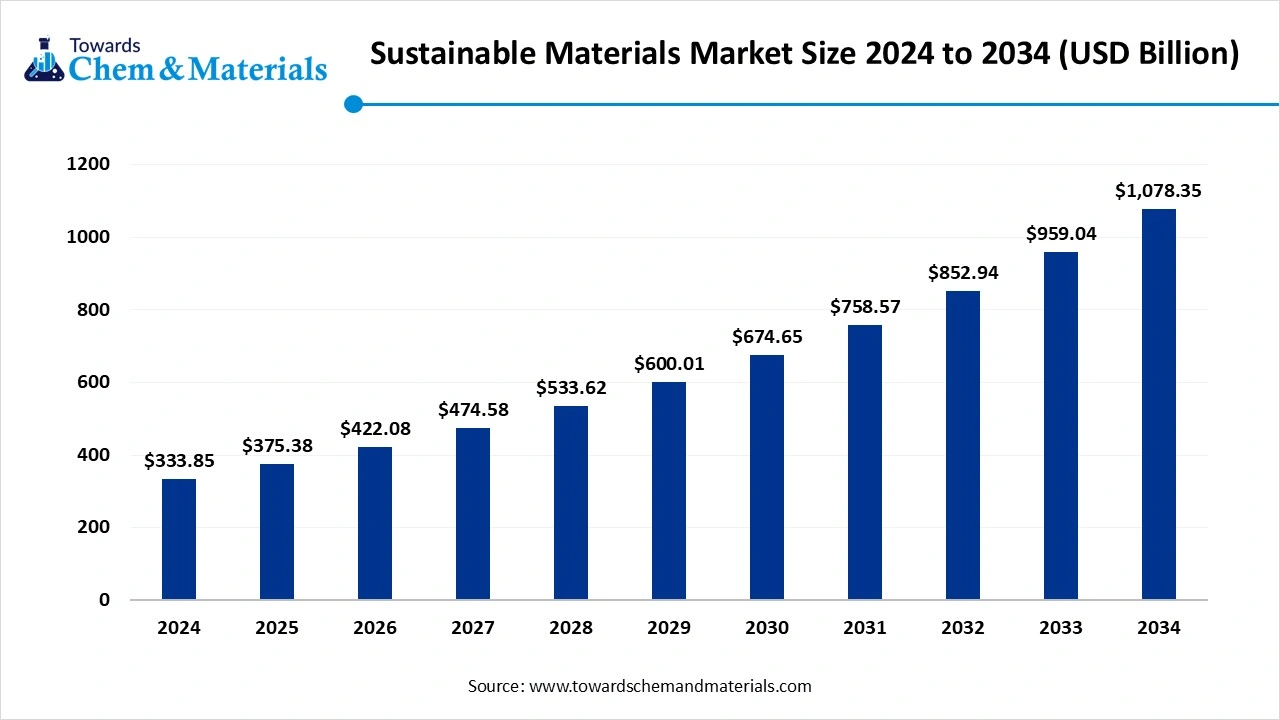

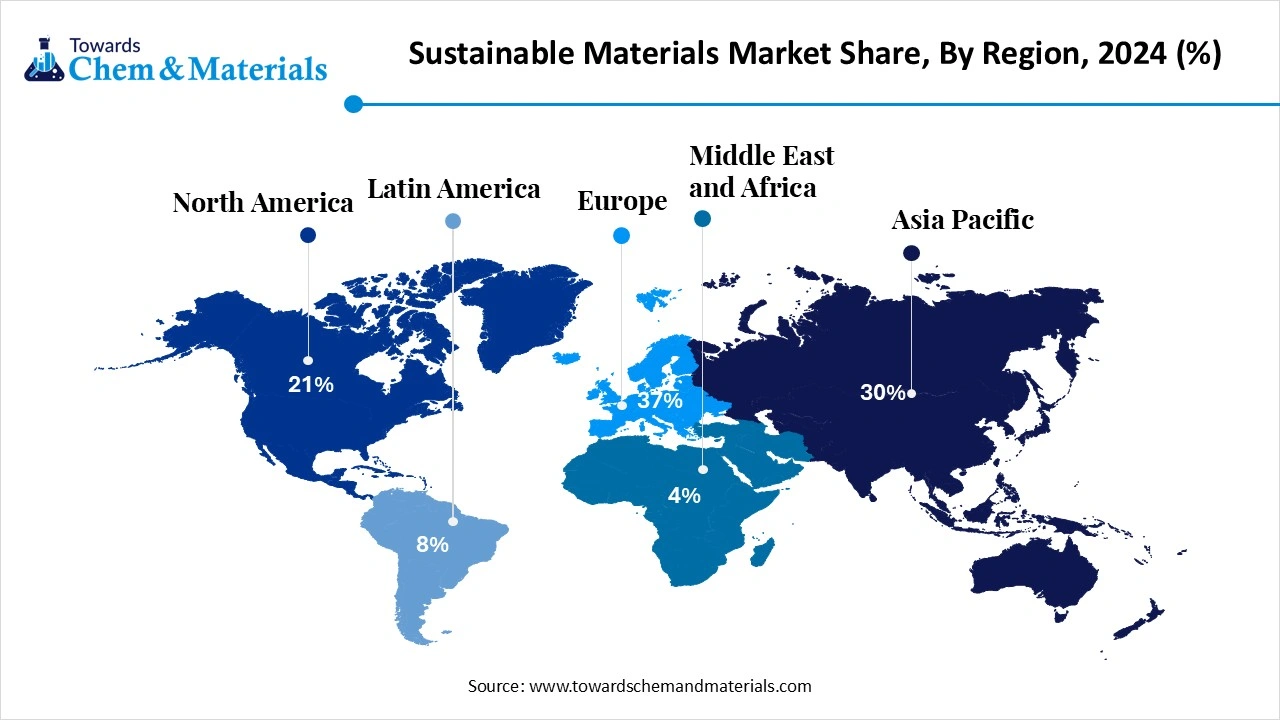

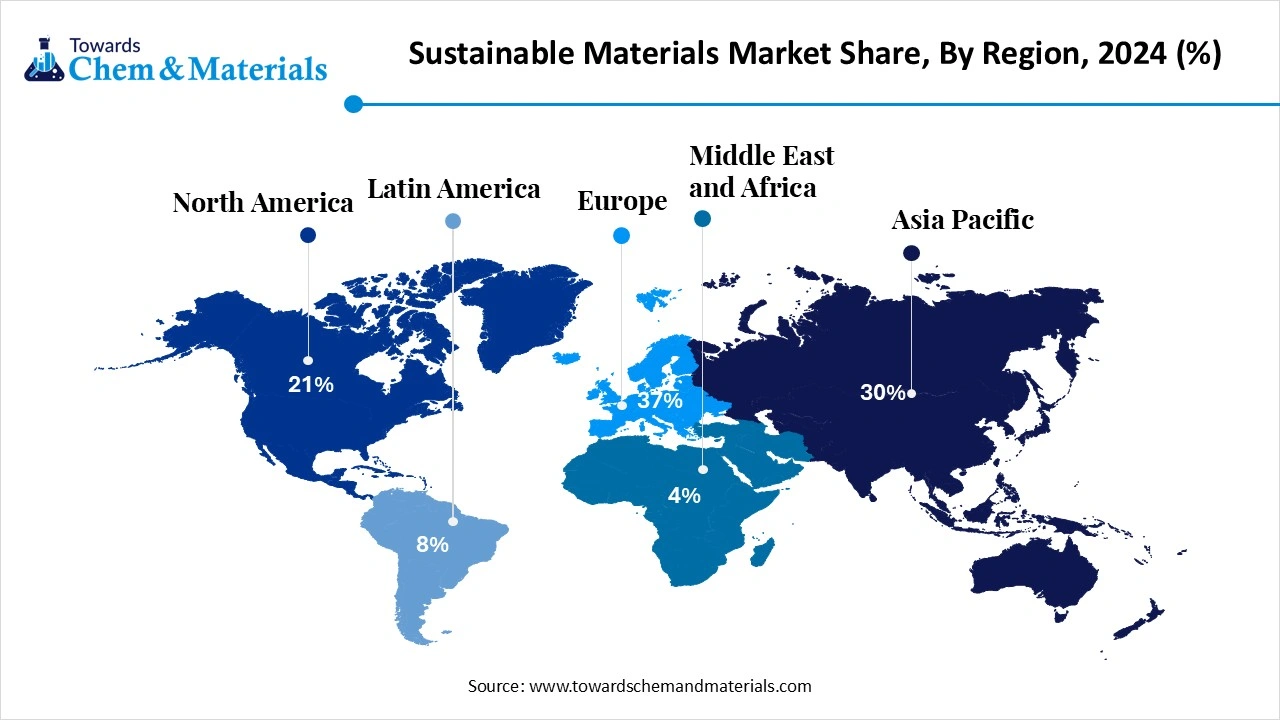

The global sustainable materials market is exhibited at USD 375.38 billion in 2025 and is projected to hit around USD 1,078.35 billion by 2034, growing at a CAGR of 12.44% during the forecast period 2025 to 2034. the Europe dominated the sustainable materials market with a market share of 37% in 2024. the growth of the market is driven by growing environmental concerns and increased awareness among consumers for the use of sustainable and eco-friendly materials fuels the growth of the market.

Key Takeaways

- By region, Europe dominated the market with a share of 37% in 2024.

- By region, Asia Pacific is expected to have significant growth in the market in the forecast period.

- By materials type, the biodegradable plastics segment dominated the market with a share of 36% in 2024.

- By materials type, the sustainable packaging materials segment is expected to grow significantly in the market during the forecast period.

- By application, the packaging segment dominated the market with a share of 33% in 2024.

- By application, the consumer goods segment is expected to grow in the forecast period.

- By end-use industry, the commercial segment dominated the market with a share of 40% in 2024.

- By end-use industry, the industrial segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Sustainable Materials Market?

Sustainable materials are materials selected, produced and managed to minimise environmental and social harm across their whole life cycle, from raw material sourcing and manufacturing through use to end-of-life. They prioritise renewability, low embodied carbon, recyclability/compostability, reduced toxic inputs, and circular-economy design (repair, reuse, remanufacture and recycling) so that resource use is decoupled from environmental degradation while maintaining required performance.

Sustainable Materials Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the sustainable materials market is expected to witness robust growth as industries transition toward circular economy models and carbon-neutral production. Rising adoption across packaging, construction, automotive, and electronics sectors is driving demand for materials that combine performance with reduced environmental impact.

- Sustainability Trends: The market is being reshaped by advances in bio-based polymers, recycled metals, sustainable composites, and low-carbon cement alternatives. Companies are prioritising resource efficiency, recyclability, and renewable feedstocks to align with ESG frameworks. Life-cycle analysis, carbon accounting, and closed-loop manufacturing are becoming standard practices.

- Global Expansion & Innovation: Major corporations and startups are expanding production capacities and forming cross-industry collaborations to accelerate sustainable material innovation. Governments in Europe, North America, and Asia are offering incentives for green manufacturing and sustainable procurement.

Key Technological Shifts In The Sustainable Materials Market:

- Major technological changes in the sustainable materials market involve AI and IoT for process improvements and smart materials, nanotechnology to boost performance, and developments in advanced manufacturing, such as 3D printing. There is an increasing move towards bio-based and recycled materials, driven by regulation and circular economy ideals. Additionally, blockchain technology is enhancing supply chain transparency and traceability.

Trade Analysis Of Sustainable Materials Market: Import & Export Statistics

- India exported six shipments of Biodegradable Plastic between July 2023 and June 2024 (TTM). These exports were carried out by 3 Indian exporters to 2 buyers, reflecting a 0% growth rate compared to the previous twelve months.

- On a global scale, the top exporters of Biodegradable Plastic are China, Vietnam, and Italy. China leads with 650 shipments, followed by Vietnam with 112 shipments, and Italy in third place with 59 shipments.(Source: www.volza.com)

- In the Recycled Material segment, the United States, Vietnam, and China emerge as the top three global exporters. The United States dominates with 87,602 shipments, followed by Vietnam with 6,077 shipments, and China with 5,870 shipments.(Source: www.volza.com)

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 422.08 Billion |

| Expected Size by 2034 | USD 1,078.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR 12.44% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Material Type, By Application, By End-Use Industry, By Region |

| Key Companies Profiledk | DuPont de Nemours, Inc. , Covestro AG , Evonik Industries AG , Eastman Chemical Company , Solvay S.A. , Braskem S.A. , NatureWorks LLC , Novamont S.p.A. , Trex Company, Inc. , Stora Enso Oyj , UPM-Kymmene Corporation , Suzano S.A. , Sappi Limited , Toray Industries, Inc. , Corbion N.V. , Amcor plc , Kingfa Sci & Tech Co., Ltd. |

The majority of India’s Biodegradable Plastic exports were directed to Thailand and Vietnam.

- On a global scale, the top exporters of Biodegradable Plastic are China, Vietnam, and Italy. China leads with 650 shipments, followed by Vietnam with 112 shipments, and Italy in third place with 59 shipments.(Source: www.volza.com)

- In the Recycled Material segment, the United States, Vietnam, and China emerge as the top three global exporters. The United States dominates with 87,602 shipments, followed by Vietnam with 6,077 shipments, and China with 5,870 shipments.(Source: www.volza.com)

Sustainable Materials Market Value Chain Analysis

- Chemical Synthesis and Processing : Sustainable materials are developed using renewable, recycled, or low-carbon resources through processes such as biopolymer synthesis, mechanical recycling, green chemistry, and low-energy manufacturing. These materials aim to reduce environmental impact and carbon emissions.

- Key players BASF SE, Covestro AG, DSM, NatureWorks LLC, Arkema S.A

- Quality Testing and Certification :Sustainable materials are evaluated for biodegradability, recyclability, and life-cycle emissions under certifications such as ISO 14001, Cradle to Cradle, and ASTM D6400 for compostability.

- Key players: SGS, TUV Rheinland, Intertek, UL Solutions

- Distribution to Industrial Users : Sustainable materials are supplied to packaging, construction, automotive, and consumer goods industries to promote circular economy initiatives and eco-friendly product development.

- Key players: Dow Inc., SABIC, Braskem S.A., Mitsubishi Chemical Group.

Sustainable Materials Regulatory Landscape: Global Regulations

| Region / Country | Regulatory Body | Key Regulations / Frameworks | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA), U.S. Department of Energy (DOE), U.S. Green Building Council (USGBC), Federal Trade Commission (FTC) | - EPA Safer Choice & Design for the Environment (DfE) - USDA BioPreferred Program (7 CFR Part 3201) - FTC Green Guides (16 CFR Part 260) - Energy Policy Act & LEED Certification |

- Sustainable product certification - Green labelling and bio-based content - Emission and lifecycle impact assessment |

The USDA BioPreferred label supports renewable material use. LEED promotes sustainable building materials. FTC Green Guides regulate environmental marketing claims to prevent greenwashing. |

| European Union | European Commission (DG ENV), European Chemicals Agency (ECHA), European Committee for Standardisation (CEN) | - EU Green Deal (2019) - Circular Economy Action Plan (2020) - Ecodesign for Sustainable Products Regulation (ESPR, proposed 2024) - REACH & CLP Regulations |

- Circular design and recyclability - Material efficiency and durability - Product carbon footprint disclosure |

The EU’s ESPR mandates product-level sustainability performance and digital product passports. REACH ensures safe material composition. Strongest regional focus on carbon-neutral materials. |

| China | Ministry of Ecology and Environment (MEE), National Development and Reform Commission (NDRC), Standardisation Administration of China (SAC) | - Circular Economy Promotion Law (amended 2021) - Green Manufacturing System (GB/T 36132-2018) - GB/T 41010-2021 – Biobased labelling |

- Resource efficiency and recyclability - Industrial energy management - Green product labelling and certification |

China’s Green Factory Initiative promotes sustainable material use in industry. Eco-label certifications apply to low-carbon, renewable, and recyclable products. |

| India | Ministry of Environment, Forest and Climate Change (MoEFCC), Bureau of Indian Standards (BIS), Ministry of Commerce and Industry | - National Resource Efficiency Policy (Draft, 2019) - E-Waste & Plastic Waste Management Rules (2022) - BIS Green Product Certification Scheme |

- Circular economy and resource reuse - EPR for industrial materials - Sustainable certification |

India’s BIS Green Mark certifies eco-friendly materials. EPR mandates extend to plastics, metals, and electronics. National policies encourage renewable and recycled input in manufacturing. |

| Middle East (UAE, Saudi Arabia) | Environment Agency – Abu Dhabi (EAD), Saudi Standards, Metrology and Quality Organization (SASO), Gulf Organization for Industrial Consulting (GOIC) | - UAE Federal Law No. 12 (2018) – Waste Management - Saudi Vision 2030 Circular Economy Framework - SASO 2879:2021 – Biodegradable plastic regulation |

- Sustainable production and recycling - Energy-efficient manufacturing - Bio-based and recyclable materials |

GCC nations promote Vision 2030 green manufacturing. Focus on renewable polymers, recycled metals, and low-carbon building materials. |

Segmental Insights

Material Type Insight

Which Material Type Segment Dominated The Sustainable Materials Market in 2024?

The biodegradable plastics segment dominated the market with a share of 36% in 2024. Biodegradable plastics are a key focus area in sustainable materials, offering eco-friendly alternatives to traditional polymers. These materials, derived from starch, PLA, and PHA, decompose naturally and reduce landfill waste. Their adoption is rising in food packaging, agriculture, and consumer goods, supported by global regulations limiting conventional plastic use and increasing end-user awareness of environmental impacts.

The sustainable packaging materials segment expects significant growth in the market during the forecast period. Sustainable packaging materials include paper-based composites, recycled plastics, and bio-based films that enhance circularity in product life cycles. The packaging sector is increasingly adopting such materials to reduce carbon footprints and comply with environmental norms. Companies are investing in recyclable mono-material structures and renewable coatings to meet demand for low-impact, high-performance sustainable packaging solutions.

Application Insight

How Did the Packaging Segment Dominate the Sustainable Materials Market in 2024?

The packaging segment dominated the market with a share of 33% in 2024. The packaging segment dominates the sustainable materials market, with rapid adoption of biodegradable and recyclable options across the FMCG, food, and e-commerce industries. Brand owners are transitioning toward compostable and paper-based packaging to align with green consumer preferences and regulatory compliance. Continuous innovation in lightweight and renewable materials further supports sustainable packaging scalability.

The consumer goods segment expects significant growth in the market during the forecast period. Consumer goods manufacturers are embracing sustainable materials to achieve brand differentiation and regulatory compliance. Applications span personal care, electronics, and household items using recyclable polymers and natural fibres. This shift is propelled by growing consumer demand for eco-conscious products and circular design, encouraging manufacturers to adopt renewable feedstocks and sustainable production methods.

End-Use Industry Insight

Which Commercial Segment Dominated The Sustainable Materials Market in 2024?

The commercial segment dominated the market with a share of 40% in 2024. In the commercial sector, sustainable materials are used extensively in packaging, furniture, and retail infrastructure. Businesses are adopting bio-composites and recycled plastics to lower operational carbon emissions. Retail chains and service industries emphasise eco-packaging and reusable materials, integrating sustainability goals into procurement and operational strategies for brand responsibility and cost efficiency.

The industrial segment expects significant growth in the market during the forecast period. The industrial segment utilises sustainable materials in manufacturing, automotive, and construction applications. Industries are replacing virgin plastics with bio-based polymers, recycled composites, and low-carbon raw materials to meet ESG compliance and energy efficiency standards. Investments in circular supply chains and green certifications are fostering industrial-scale adoption of eco-friendly materials.

Regional Analysis

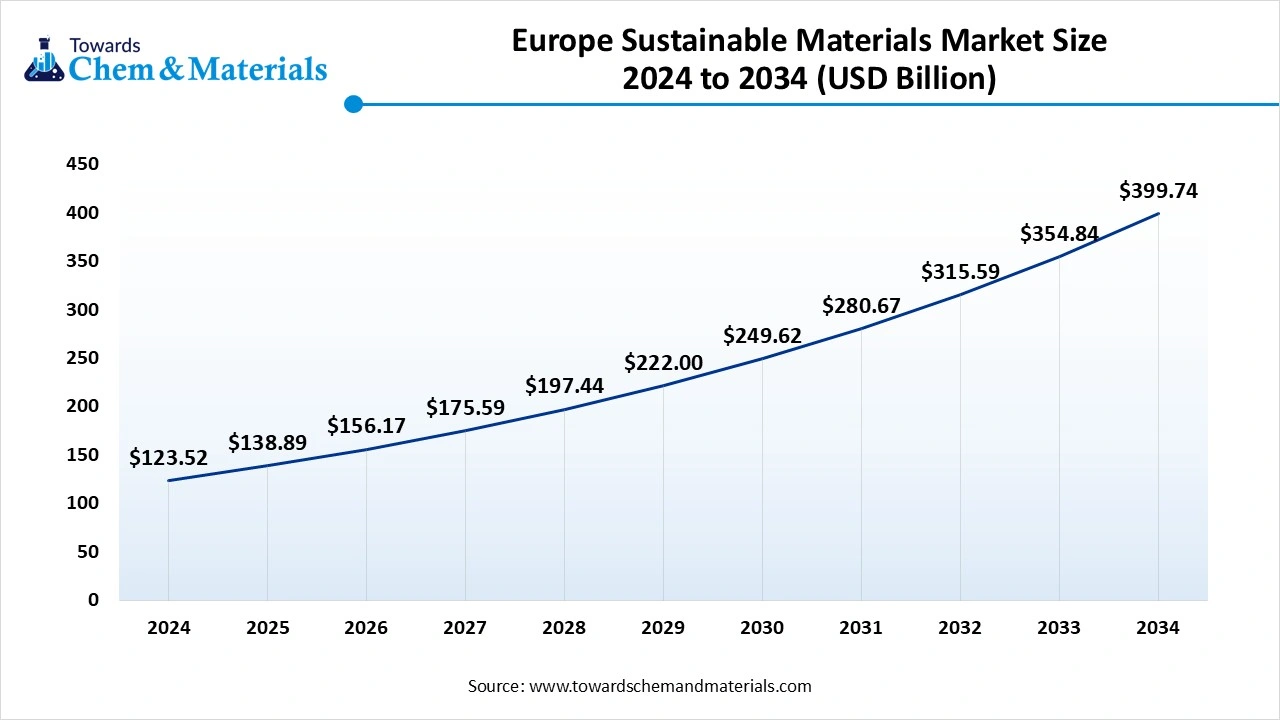

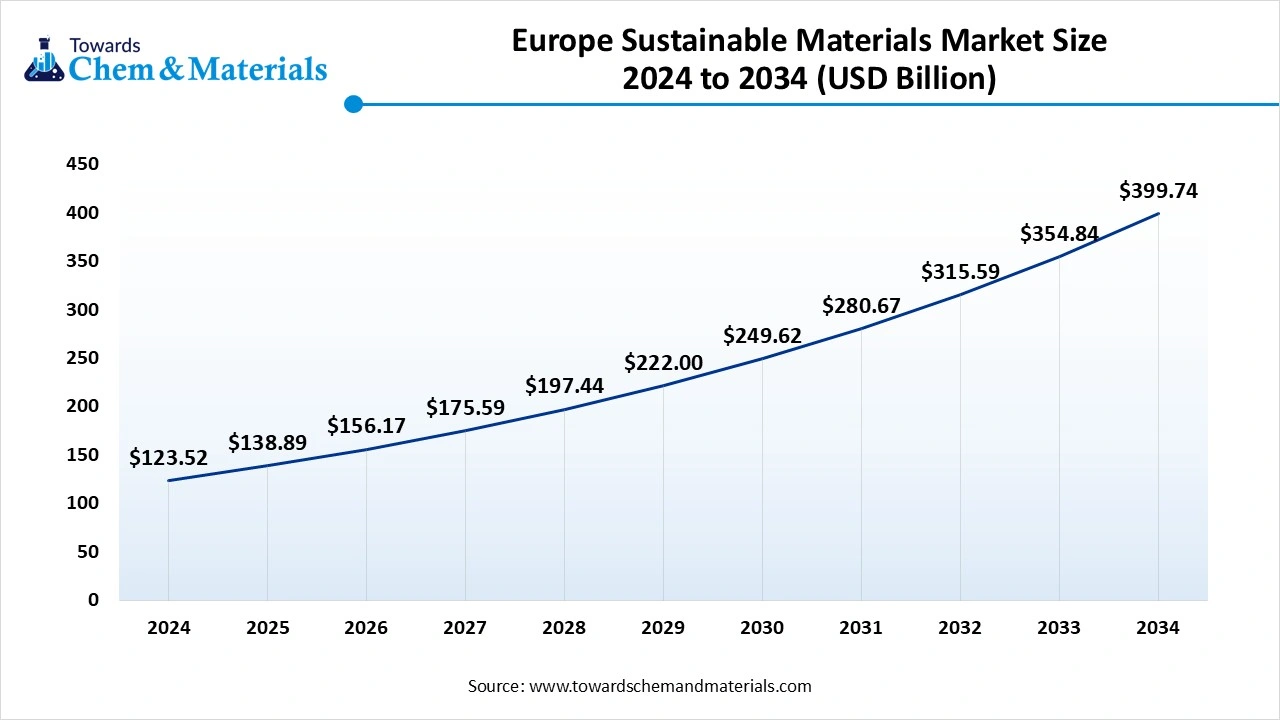

The Europe sustainable materials market size is valued at USD 138.89 billion in 2025 and is expected to surpass around USD 399.74 billion by 2034, expanding at a compound annual growth rate (CAGR) of 12.46% over the forecast period from 2025 to 2034. Europe dominated the market with a share of 37% in 2024. Europe leads the market, driven by stringent environmental regulations, circular economy policies, and strong demand from the packaging and automotive sectors. The EU’s Green Deal and single-use plastics ban have accelerated the shift toward biodegradable polymers and recyclable materials. European manufacturers are increasingly adopting life-cycle assessment (LCA)-based design and closed-loop systems, promoting innovation in compostable packaging, bioplastics, and carbon-neutral materials to meet sustainability targets and consumer expectations for eco-friendly products.

The UK sustainable materials market is characterised by rapid innovation and government-led sustainability programs aimed at achieving net-zero goals. Growing consumer awareness, extended producer responsibility (EPR) regulations, and investments in biobased material startups are enhancing domestic production capacity. Companies are prioritising recyclable packaging and sustainable composites in consumer goods, construction, and retail sectors, while public–private partnerships promote infrastructure for large-scale waste recovery and bio-based material utilisation.

Asia Pacific Sustainable Materials Market Trends

Asia Pacific is expected to have significant growth in the market in the forecast period. Asia Pacific shows strong growth in sustainable materials, fueled by urbanisation, government sustainability initiatives, and expanding consumer demand for green packaging. Major economies such as China, Japan, and South Korea are integrating circular economy frameworks and adopting biodegradable plastics in food packaging and consumer goods. Local producers are scaling bioplastic and recycled material production, while international collaborations accelerate technology transfer, supporting regional self-sufficiency in sustainable resource utilisation.

India Sustainable Materials Market Trends

India’s sustainable materials market is emerging rapidly, supported by government programs such as the Plastic Waste Management Rules and the Make in India initiative. Local startups and packaging manufacturers are investing in biodegradable films, compostable plastics, and fibre-based materials. Growing retail and FMCG sectors drive demand for eco-friendly packaging, while incentives for recycling and renewable raw materials promote industrial adoption and support long-term sustainability goals across manufacturing and logistics.

North America Sustainable Materials Market Analysis

North America is a major market for sustainable materials, driven by corporate sustainability commitments, innovation in bio-based polymers, and policy support for green manufacturing. The U.S. and Canada lead in adopting circular economy principles through public–private collaborations. Demand for compostable packaging, renewable materials, and carbon-neutral supply chains is increasing across automotive, consumer goods, and construction sectors, aligning industrial growth with environmental stewardship.

U.S. Sustainable Materials Market Analysis

The U.S. sustainable materials market benefits from advanced R&D, significant investment in bio-based technology, and regulatory efforts promoting recycling infrastructure. Key industries like packaging, automotive, and construction are transitioning to recyclable and renewable material alternatives. Government funding and corporate ESG initiatives are accelerating the commercialisation of next-generation bioplastics and renewable composites, ensuring sustainable growth within a competitive industrial framework.

Recent Developments

- In October 2025, leading green building organisations such as The Green Building Council of Australia (GBCA), The Building Research Establishment (BRE), Living Future, mindful MATERIALS, the U.S. Green Building Council (USGBC), and he International WELL Building Institute (IWBI) announced a partnership to create consistency across different rating systems for sustainable building materials, such as BREEAM, LEED, and WELL. (Source: www.usgbc.org)

- In July 2024, the Manufacturing Technology Centre opened a new hub dedicated to sustainable additive manufacturing for net-zero products, including polymer and ceramic 3D printing and material reprocessing equipment. (Source: www.the-mtc.org)

- In August 2025, CEAT launched the SecuraDrive CIRCL, a passenger car tyre with up to 90% sustainable (bio-based) materials.(Source: ackodrive.com)

Top players in the Sustainable Materials Market & Their Offerings:

- DuPont de Nemours, Inc.

- Covestro AG

- Evonik Industries AG

- Eastman Chemical Company

- Solvay S.A.

- Braskem S.A.

- NatureWorks LLC

- Novamont S.p.A.

- Trex Company, Inc.

- Stora Enso Oyj

- UPM-Kymmene Corporation

- Suzano S.A.

- Sappi Limited

- Toray Industries, Inc.

- Corbion N.V.

- Amcor plc

- Kingfa Sci & Tech Co., Ltd.

Segments Covered

By Material Type

- Biodegradable Plastics

- Plant-based polymers (e.g., PLA, PHA)

- Starch-based plastics

- Cellulose derivatives

- Recycled Metals

- Recycled aluminium

- Recycled steel

- Recycled copper

- Renewable Fibres

- Bamboo

- Hemp

- Jute

- Flax

- Eco-friendly Textiles

- Organic cotton

- Recycled polyester

- Tencel/Lyocell

- Hemp-based fabrics

- Sustainable Packaging Materials:

- Paper and paperboard

- Mushroom packaging

- Seaweed-based materials

- Edible packaging

By Application

- Packaging

- Food and beverage packaging

- Cosmetic and personal care packaging

- E-commerce packaging

- Construction

- Insulation materials

- Eco-friendly paints and coatings

- Recycled concrete aggregates

- Automotive

- Biodegradable composites

- Recycled metals in vehicle parts

- Natural fibre-based interiors

- Consumer Goods

- Eco-friendly household items

- Sustainable textiles for apparel

- Biodegradable cleaning products

- Electronics

- Recycled metals in components

- Biodegradable casings

- Eco-friendly circuit boards

- Others

- Agricultural applications

- Medical supplies

- Furniture and home decor

By End-Use Industry

- Commercial

- Retail sector

- Hospitality industry

- Office buildings

- Residential

- Eco-friendly home construction

- Sustainable interior furnishings

- Energy-efficient appliances

- Industrial

- Manufacturing facilities

- Industrial equipment

- Sustainable supply chains

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait