Content

What is the Current Liquid Paints & Coatings Market Size and Share?

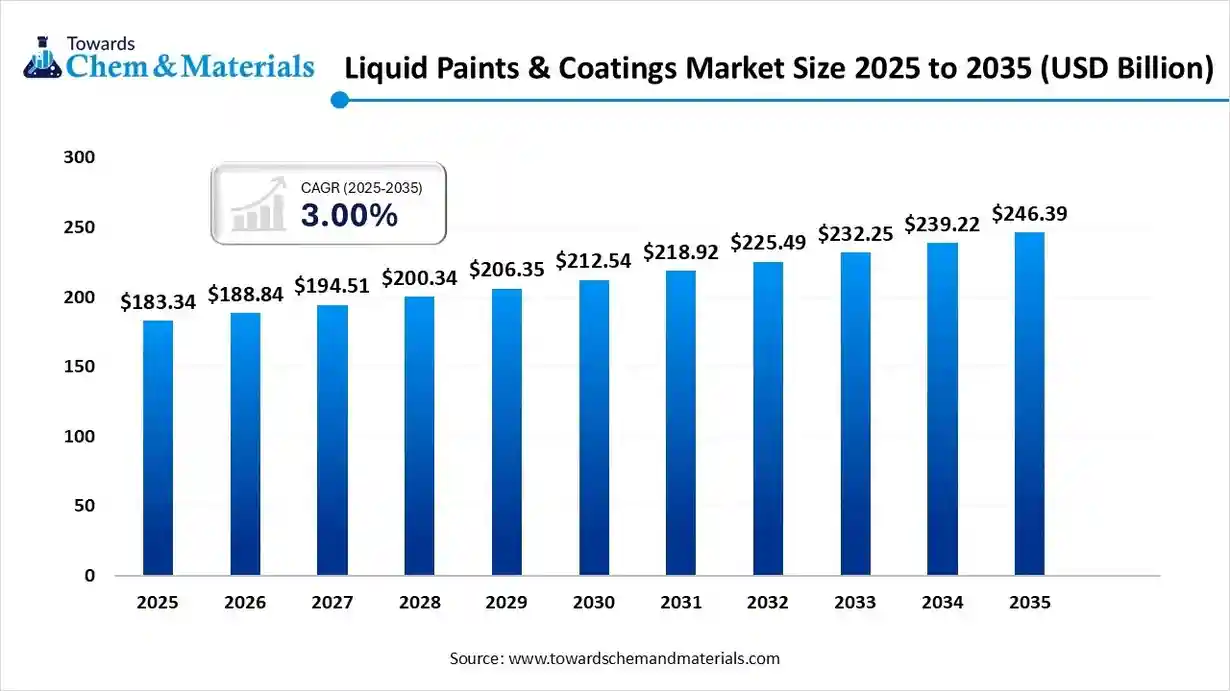

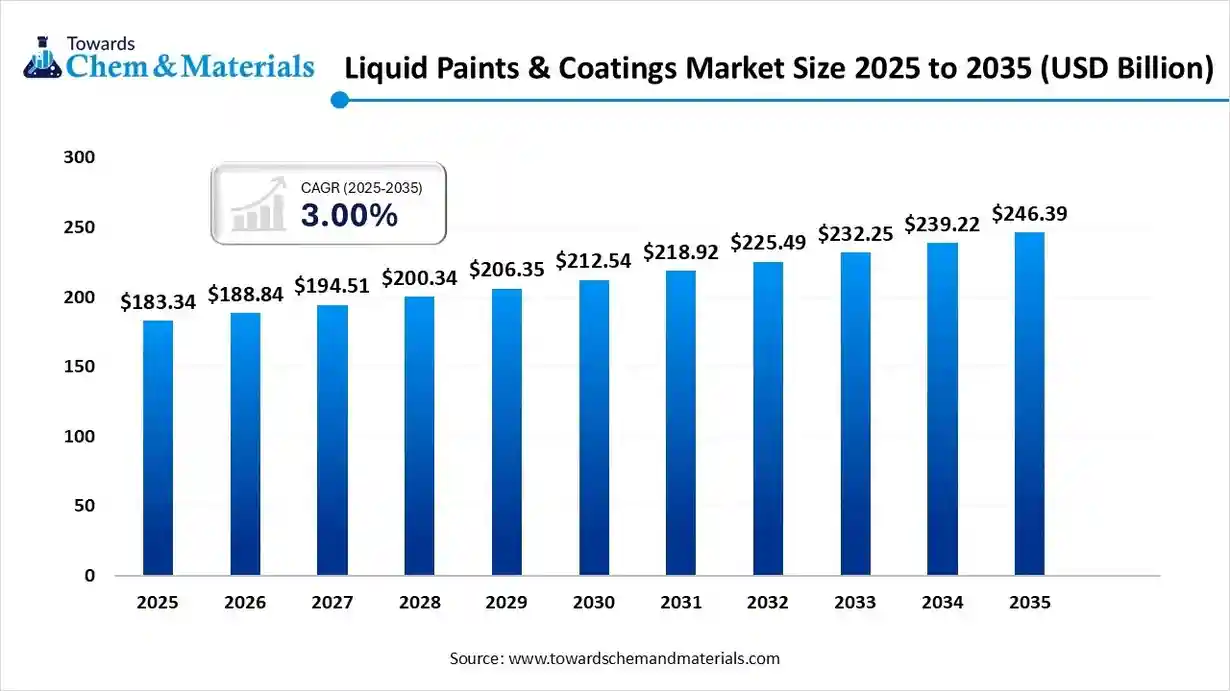

The global liquid paints & coatings market size is calculated at USD 183.34 billion in 2025 and is predicted to increase from USD 188.84 billion in 2026 and is projected to reach around USD 246.39 billion by 2035, The market is expanding at a CAGR of 3.00% between 2026 and 2035. The global shift towards greater surface protection in the construction, automotive, and other industries has accelerated industry growth in recent years.

Key Takeaways

- By region, Asia Pacific dominated the market in 2025.

- By region, North America is anticipated to capture a greater portion of the market with a significant CAGR in the future.

- By type, the water-based coatings segment dominated the market in 2025.

- By type, the UV-curable segment is expected to grow at a rapid CAGR during the forecast period.

- By resin type, the acrylic segment dominated the market in 2025.

- By resin type, the polyurethane segment is expected to grow at the fastest rate in the market with a significant CAGR during the forecast period.

- By application, the building and construction segment dominated the market in 2025.

- By application, the automotive & transportation segment is expected to grow at a rapid CAGR during the forecast period.

- By substrate, the metal segment dominated the market in 2025.

- By substrate, the composites segment is expected to grow at the fastest rate in the market with a significant CAGR during the forecast period.

Liquid Paints Uncovered: Beauty Meets High Performance Protection

The term liquid paints and coatings refers to the fluid protective layer which can be applied on surfaces to improve appearance, durability, and resistance against chemical, physical weather damage. Furthermore, these paints are being made from materials like pigments, resins, solvents, or water, and additives, while creating a uniform, smooth film when cured or dried.

Liquid Paints & Coatings Market Trends:

- The emergence of the AI-enhanced coating formulations has increased the commercial viability of the industry in recent years. Also, several manufacturers are using artificial intelligence for the precise performance profiles and durability prediction with greater colour stability in recent years.

- The sensor integration in liquid coatings is likely to improve the financial performance and sector attractiveness in the coming years. Several manufacturers are developing coatings with microsensors for monitoring temperature, corrosion, and structural stresses in real time as per the latest industry survey.

- The investment for the development of the bio-responsive liquid coatings is anticipated to create profitable pathways for sector participants during the forecast period. Also, these coatings have self-adjusting properties based on current environments, as per the latest released information. Also, this coating is likely to replace traditional bio-based coatings, which only provide protection, not react.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 188.84 Billion |

| Revenue Forecast in 2035 | USD 246.39 Billion |

| Growth Rate | CAGR 3.00% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Type, By Resin Type, By Application, By Substrate, By Region |

| Key companies profiled | Akzo Nobel N.V., PPG Industries, Inc, The Sherwin-Williams Company, BASF SE, Asian Paints, Axalta Coating Systems, Hempel A/S, Jotun A/S, Nippon Paint Holdings Co., Ltd., RPM International Inc. |

From Protection to Intelligence: The Rise of Functional Coatings

The transformative technology shift in the liquid paints & coatings market is the move from "static coatings" to "functional and adaptive coatings.' Traditionally, liquid coatings only provide protection and color. Now, manufacturers are heavily shifting toward multifunctional technologies such as instant-cure UV systems, self-healing polymers, antimicrobial surface chemistry, and energy-saving reflective coatings.

Trade Analysis of the Liquid Paints & Coatings Market:

Import, Export, Consumption, and Production Statistics

- The United States has exported paints and varnishes to India worth USD 5.92 million in 2024, as per the published report.

- China exported a substantial number of paints coatings in 2024, with 23,593 shipments, according to the records.

Value Chain Analysis of the Liquid Paints & Coatings Market:

- Distribution to Industrial Users: The market is highly specialized, requiring products that meet specific performance standards (e.g., corrosion resistance, chemical durability) for demanding applications. The primary distribution channels are direct sales and specialized distributors or agents.

- Key Players: Sherwin-Williams Company and PPG Industries

- Chemical Synthesis and Processing: The chemical synthesis and processing of liquid paints and coatings largely involve the physical blending of raw materials and, critically, the chemical synthesis of the specialized resins (binders) that determine the final properties of the coating.

- Key Players: BASF SE, Dow, and Covestro AG

- Regulatory Compliance and Safety Monitoring: The market is subject to a complex network of regulations and safety monitoring designed to protect human health and the environment from hazardous chemicals. This compliance framework is enforced by various national and international agencies

- Key Agencies: EPA (U.S. Environmental Protection Agency) and Occupational Safety and Health Administration (OSHA)

Liquid Paints & Coatings Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Clean Air Act (CAA) | Reducing smog and ground-level ozone formation by strictly limiting VOC emissions |

| European Union | European Commission (EC) | Decopaint Directive (2004/42/EC) | Harmonizing environmental standards |

| China | Ministry of Ecology and Environment (MEE) | Mandatory GB Standards (e.g., GB 30981.1-2025 and GB 30981.2-2025) | Stricter enforcement of VOC emission standards to combat air pollution |

Segmental Insights

Type Insights

How did the Water-Based Coatings Segment Dominate the Liquid Paints & Coatings Market in 2024?

The water-based coatings segment dominated the market in 2024 due to the sudden shift towards low-VOC coatings. Also, factors like faster drying, producing fewer odors, and being suitable under the governmental sustainability laws have driven the segment growth in the current period.

The UV-curable coatings segment is expected to grow at a significant rate owing to factors like it cures instantly under UV light while reducing production time and energy consumption. Furthermore, having greater chemical resistance, superior hardness, and scratch resistance, the UV curable coating is likely to create lucrative opportunities during the forecast period as per the industry expectations.

The solvent-based segment is also notably growing, owing to factors like its deliver stronger adhesion, greater performance in harsh environments, and excellent moisture resistance. Also, the sectors such as the marine application, oil and gas, and industrial machinery have seen under the heavy usage of the solvent-based coatings in recent years.

Resin Type Insights

Why does the Acrylic Segment Dominate the Liquid Paints & Coatings Market?

The acrylic segment dominated the market in 2024 because they are affordable, easy to formulate, and highly versatile across architectural, automotive, packaging, and industrial uses. They offer good UV resistance, color retention, and weather durability, making them ideal for exterior applications.

The polyurethane segment is expected to grow at a significant CAGR because it provides exceptional durability, abrasion resistance, and flexibility. They are widely used in automotive, aerospace, electronics, flooring, and industrial equipment, where long-lasting and high-performance surfaces are needed.

The epoxy segment is also notably growing because it delivers outstanding adhesion, chemical resistance, and mechanical strength. They are widely used in protective coatings for concrete floors, pipelines, marine structures, industrial machinery, and electronics.

Application Insights

How did the Building and Construction Segment Dominate the Liquid Paints & Coatings Market in 2024?

The building and construction segment dominated the market in 2024 because coatings are essential for protecting walls, roofs, metal structures, wood surfaces, and concrete from weather damage, corrosion, and wear. Rapid urbanization, infrastructure development, and residential housing growth significantly increased demand.

The automotive and transportation segment is expected to grow at a significant rate because coatings are essential for protecting walls, roofs, metal structures, wood surfaces, and concrete from weather damage, corrosion, and wear. Rapid urbanization, infrastructure development, and residential housing growth significantly increased demand.

The industrial equipment segment is also notably growing, because factories, machinery, and heavy-duty systems require strong protective layers to prevent corrosion, chemical damage, and mechanical wear. Growing manufacturing output, automation, and expansion in sectors such as food processing, energy, mining, packaging, and electronics strengthen demand.

Substrate Insights

Why Does The Metal Segment Held The Largest Share In 2024?

The metal segment dominated the market in 2024 because metals are used extensively in construction, automotive, appliances, machinery, infrastructure, and industrial structures. Metals require coatings to prevent corrosion, rust, and environmental damage, making coatings essential for long-term performance.

The composites segment is expected to grow at a significant CAGR because devices are getting smaller, faster, and hotter. PPA can handle high temperatures, making it perfect for connectors, chargers, 5G components, and EV electronics. As industries push for miniaturization, PPA's dimensional stability becomes essential.

The plastic segment is also notably growing because plastics are widely used in automotive interiors, electronics, packaging, consumer goods, appliances, and medical devices. These materials need coatings for scratch resistance, UV stability, aesthetics, and chemical protection.

Regional Insights

Asia Pacific Liquid Paints & Coatings Market Trends

Asia Pacific dominated the market, owing to the region having one of the strongest construction industry and heavy manufacturing bases. Moreover, the regional countries such as China, India, and Japan have seen under an abundant raw material supply heavy automotive, electronics, and infrastructure sectors, where paints and coatings are a crucial element.

Construction Surge Fuels China’s Liquid Paints and Coatings Boom

China maintained its dominance in the liquid paints & coatings market due to factors like heavy residential construction projects and rapid urbanization in recent years. Also, having the world's leading automotive production facilities and demand for metal coatings are actively contributing to the industry growth in the country nowadays. also, the major manufacturers in China have seen a shift towards powder coatings in recent years.

North America Liquid Paints & Coatings Market Examination

North America expects the fastest growth in the liquid paints & coatings market, due to ongoing heavy investment and modern manufacturing technology in aerospace, construction, and industrial equipment. Moreover, the region has seen a heavy demand for UV curable and powder coating, which is likely to create lucrative opportunities in the market for the upcoming years.

Aerospace Excellence Positions the United States for Strong Coating Demand

The United States is expected to emerge as a prominent country for the market in the coming years, owing to the increasing need for paints and coatings in the aerospace and defence manufacturing. Furthermore, the major brands in the United States have made a heavy investment in the research and development program for high-performance paints and coatings in the current period

Europe Liquid Paints & Coatings Market Evaluation

Europe is a notably growing region due to increasing demand for sustainable and technologically advanced coatings in recent years. Also, the stricter environmental standards laws of the region put pressure on manufacturers to develop heavy-duty powder, water-based based and UV-curable coatings in the past few years, as per the recent observation. Moreover, heavy renovation activities of housing and commercial infrastructure have actively created the heavy demand for liquid paints and coatings in the past few years.

Germany’s Automotive Powerhouse Fuels Premium Coating Demand

Germany is expected to gain a major industry due to its strong automotive industry, advanced industrial machinery production, and high-quality manufacturing standards. German automakers require premium coatings for durability, corrosion protection, and aesthetic excellence.

Middle East and Africa Liquid Paints & Coatings Market

The Middle East and Africa are expected to capture a notable share of the market because of expanding construction, infrastructure development and rising industrial activities in major economies. Heavy investments in transportation networks, commercial buildings, oil & gas facilities, and housing drive coating demand.

Saudi Arabia’s Coatings Boom Fueled By Construction Surge

The Saudi Arabian paints & coatings market (which includes liquid/water-borne, solvent-borne and other coating types) is witnessing robust growth. Driven by rapid urbanization, large-scale construction and infrastructure developments including mega projects under Vision 2030 (such as NEOM, Red Sea Project, and other public housing efforts) demand for architectural and decorative coatings is especially high.

The market in South America is robust and growing steadily in 2025. The growth of the market is driven by rapid urbanization, expanding construction activity, and growing industrial production. Demand is rising for architectural coatings used in residential and commercial buildings, especially in Brazil, Argentina, and Colombia. Industrial sectors such as automotive, marine, and protective coatings also contribute significantly to growth. Increasing investments in infrastructure and renovation projects support market expansion, while a shift toward eco-friendly, low-VOC formulations is shaping product development.

Brazil Liquid Paints & Coatings Market Trends

The paints & coatings market in Brazil saw a significant growth in 2024. Industrial and automotive coatings (including OEM and refinish) also contributed strongly in 2024, thanks to surging vehicle production and infrastructural/industrial demand. Continued strength in decorative paints, as many homeowners invest in renovation/maintenance a trend partly fueled by increased consumer confidence and rising living standards.

Recent Developments

- In September 2025, Dulux introduced its latest range of aerosol spray paints. This newly launched spray paint is specifically designed for DIY enthusiasts and creative individuals as per the company's claim. Also, the new range can offer up to 37 colors.(Source: worldaerosols.com)

Leading Companies in the Liquid Paints & Coatings Market:

- Akzo Nobel N.V.: A global leader in paints and coatings with brands including Dulux and Sikkens, known for its focus on sustainable and high-performance solutions for various industries.

- PPG Industries, Inc: A global specialty materials company that offers expertise in a variety of high-performance polymers, including a range of technical polyamides and PPAs under brands like Rilsan and Kepstan, used in automotive, electronics, and construction.

- The Sherwin-Williams Company: A global leader in the manufacture, distribution, and sale of paints, coatings, and related products, with a strong focus on both architectural and industrial markets.

- BASF SE: As a major chemical producer, BASF's Coatings segment offers advanced solutions for automotive OEMs, refinishing, and industrial applications, emphasizing innovation and sustainability.

Top Companies in the Liquid Paints & Coatings Market

- Asian Paints

- Axalta Coating Systems

- BASF SE

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc

- Hempel A/S

- Jotun A/S

- Nippon Paint Holdings Co., Ltd.

- RPM International Inc.

Segments Covered in the Report

By Type

- Solvent-based

- Water-based

- UV-curable

- High-solid coatings

- Powder-in-liquid hybrids (emerging tech)

By Resin Type

- Acrylic

- Epoxy

- Polyurethane

- Polyester

- Alkyd

- Vinyl & Others

By Application

- Building & Construction

- Automotive & Transportation

- Industrial Equipment

- Wood & Furniture

- Packaging

- Marine

- Aerospace

- Consumer Goods (appliances, electronics)

By Substrate

- Metal

- Wood

- Plastic

- Concrete

- Glass

- Composites

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa