Content

What is the Current Industrial Coatings Market Size and Share?

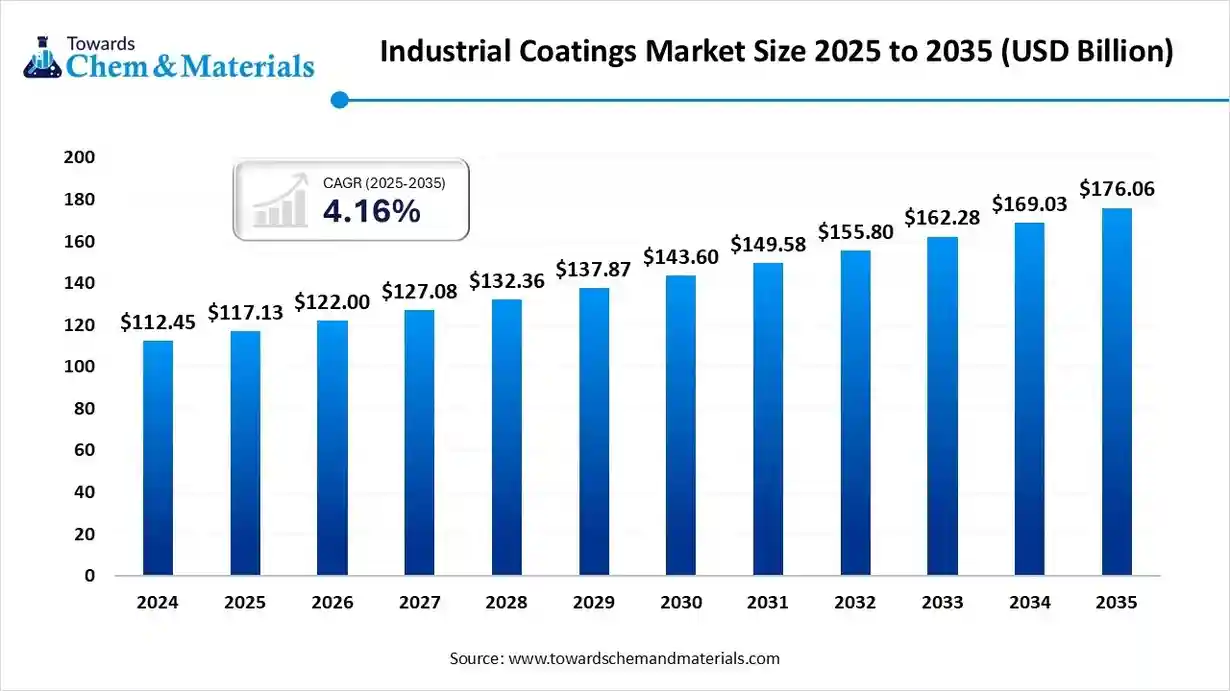

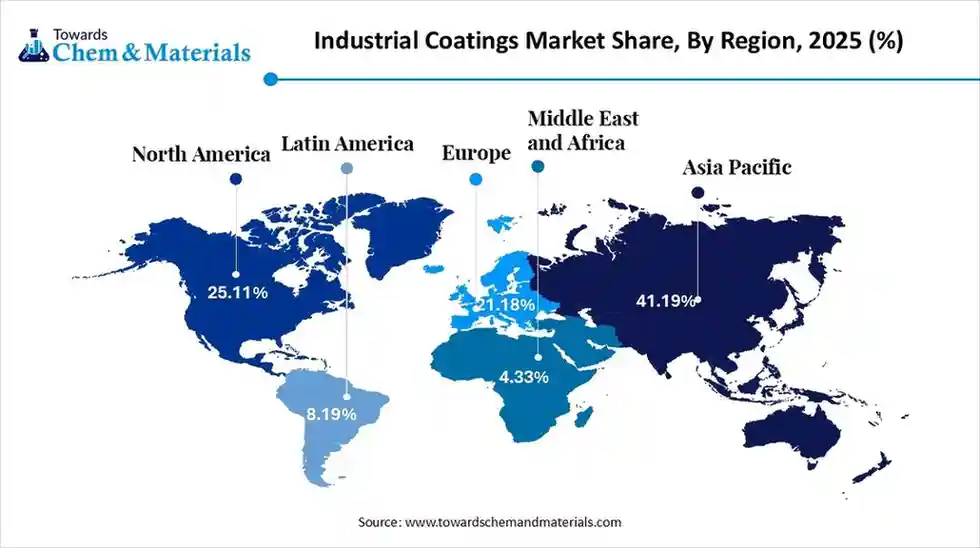

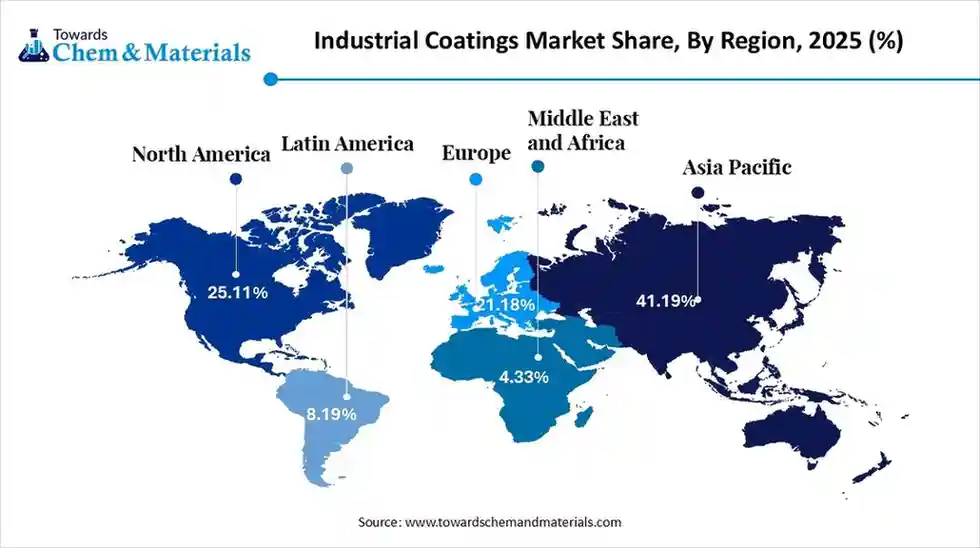

The global industrial coatings market size is calculated at USD 117.13 billion in 2025 and is predicted to increase from USD 122 billion in 2026 and is projected to reach around USD 176.06 billion by 2035, The market is expanding at a CAGR of 4.16% between 2026 and 2035. Asia Pacific dominated the industrial coatings market with a market share 41.19% of the global market in 2025. Ongoing urbanization and infrastructure projects, especially in developing economies, are major drivers of market growth. Also, growing market demand for sustainable coatings, coupled with rapid innovations in coating formulations, can further fuel market growth.

Key Takeaways

- Asia Pacific dominated the industrial coating market and accounted for the largest revenue share of 40.19% in 2025.

- The industrial coatings market in China held the largest share in Asia Pacific in 2025.

- By product, the acrylic segment accounted for the largest revenue share of 37.04% in 2025.

- By technology, the solvent borne segment accounted for the largest revenue share of around 36.80% in 2025.

- By end use, the general segment dominated the market with a share of 46.52% in 2025

What are Industrial Coatings?

The growing demand for corrosion-resistant, durable, and sustainable solutions is the primary driver of market growth. Industries operating in harsh environments increasingly rely on materials that can extend equipment lifespans and reduce long-term maintenance costs. This shift is strengthened by stricter safety requirements and the need for reliable performance in sectors such as manufacturing, energy, transportation, and construction.

The market refers to the sale of specialized coatings and finishes designed to protect and enhance surfaces in industrial settings. These products are applied to machinery, infrastructure, and structural components to improve resilience and maintain operational efficiency. Companies use them to prevent premature wear, maintain asset value, and meet regulatory workplace-safety standards.

These coatings are designed to withstand harsh conditions, including abrasion, corrosion, and extreme temperatures. Their ability to withstand chemical exposure, moisture, and mechanical stress makes them essential in environments where equipment is routinely subjected to challenging conditions. As industries expand and facilities operate under increasing pressure, these performance-focused coatings continue to play a critical role in enabling reliable, long-lasting operations.

Current Trends in Industrial Coatings Market :

- Industry Growth Overview: The industrial coatings market is expanding due to increased demand from the aerospace, marine, heavy machinery, and energy sectors, which require durable, high-performance coatings that withstand extreme conditions. Growth is supported by the need for corrosion resistance, chemical protection, and long service life in infrastructure and manufacturing environments. Investments in advanced application technologies, such as electrostatic spraying and automated coating lines, are also improving consistency and enabling large-scale production across global industries.

- Sustainability Trends: Sustainability continues to reshape the industrial coatings landscape as manufacturers shift toward eco-friendly formulations such as low-VOC, waterborne, and high-solids coatings. There is rising interest in functional coatings that offer thermal insulation, UV protection, and energy savings for industrial facilities. Companies are adopting renewable raw materials, improving solvent recovery systems, and reducing hazardous waste generation. Regulatory pressure in Europe, North America, and parts of Asia is accelerating the transition toward greener chemistries and safer manufacturing processes.

- Global Expansion: Global expansion is driven by strong industrial activity in regions such as the Asia Pacific, where automotive manufacturing, shipbuilding, construction, and electronics assembly continue to grow. North America and Europe are investing in infrastructure refurbishment and advanced manufacturing, which increases demand for protective and performance coatings. Companies are establishing regional production hubs and distribution centres to reduce lead times, comply with local environmental standards, and serve industry-specific requirements such as aerospace approvals or marine certifications.

- Major Investors: Major investors and key players in the industrial coatings market include global companies such as PPG Industries, Akzo Nobel N.V., and BASF SE. These firms are increasing investments in research and development focused on eco-friendly formulations, self-healing coatings, and high-durability surfaces. Many large manufacturers are also expanding production capacity through new plants, upgraded coating lines, and partnerships with raw material suppliers. Strategic acquisitions in specialty coatings segments are helping major players strengthen their portfolios and enter high-growth end-use sectors.

- Startup Ecosystem: The industrial coatings market ecosystem is gaining momentum, with emerging companies working on nanotechnology coatings, antimicrobial surfaces, and advanced corrosion-resistant solutions. Startups are developing smart coatings that change colour with heat exposure, resist biofouling, or improve energy efficiency in industrial facilities. Many young companies use digital manufacturing tools and AI-driven formulation software to accelerate product development. Their focus on niche applications and high-performance additives is contributing to faster innovation across the global coatings industry.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD122.00 Billion |

| Revenue Forecast in 2035 | USD 176.06 Billion |

| Growth Rate | CAGR 4.16% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segments covered | By Product, By Technology,By End-use, By Region |

| Key companies profiled | BASF SE, Akzo Nobel N.V. , Axalta Coating Systems, Jotun , PPG Industries, Inc. , The Sherwin-Williams Company , Nippon Paint Holdings Co., Ltd. , Hempel A/S , RPM International Inc. , Diamond Paints , Kansai Paints |

How Cutting Edge Technologies Are Revolutionizing the Industrial Coatings Market?

Advanced technologies are transforming the market by enabling sustainability, efficiency, and superior performance through innovations such as smart and self-healing materials, nanocoatings, and Industry 4.0 digitalization. These innovations enable coatings to respond to damage, resist wear more effectively, and provide real-time data on surface conditions, helping industries reduce maintenance costs and improve asset reliability.

Also, Advanced ceramic coatings offer excellent thermal insulation and heat resistance for high-temperature applications. These coatings are widely used in aerospace, automotive, and energy sectors where machinery and components are exposed to extreme heat. Their ability to protect surfaces under demanding conditions contributes to longer equipment life and stronger operational performance across industrial settings.

Trade Analysis of Industrial Coatings Market: Import & Export Statistics:

- In 2025, China's coatings exports saw a significant increase in both volume and value, rising by 27.72% to 334,800 tons and 18.65% to $1.065 billion, respectively.(Source: www.echemi.com)

- In 2025, Japan exported ¥235B of Nonaqueous Paints, being the 81st most exported product in Japan. In 2025, the main destinations of Japan's Nonaqueous Paints exports were: China (¥83.9B), South Korea (¥49.9B), Chinese

- Taipei (¥44.7B), the United States (¥11.3B), and Thailand (¥10.1B).

In 2025, Japan imported ¥28.1B of Nonaqueous Paints, being the 393rd most imported product in Japan.(Source: oec.world)

Industrial Coatings Market Value Chain Analysis

- Feedstock Procurement : It is the acquisition of necessary raw and intermediate materials, like pigments, resins, solvents, and additives, which serve as the building blocks for coating products. These inputs determine the durability, adhesion, and performance of finished coatings, making consistent sourcing essential for quality control. Feedstock procurement often depends on global petrochemical and mineral supply chains, which influence pricing and availability.

- Major Players: AkzoNobel, Axalta Coating Systems, BASF SE.

- Chemical Synthesis and Processing :It refers to the market stage that emphasizes the creation and manipulation of specific resins, polymers, and other chemical components. This step determines the chemical properties of coatings, including corrosion resistance, drying time, and environmental compliance. Manufacturers rely on controlled processing environments to ensure uniformity and meet performance standards across industrial applications.

- Major Players: Wacker Chemie AG, PPG Industries, Inc.

- Packaging and Labelling :It involves the crucial process and related regulatory requirements for the containment, presentation, and safe handling of industrial coating products. Proper packaging ensures material stability, prevents contamination, and supports safe transport to distributors and end users. Labelling must meet regulatory guidelines and include safety instructions, hazard details, and compliance certifications.

- Major Players: Jotun, Kansai Nerolac Paints Limited, Altana AG.

- Regulatory Compliance and Safety Monitoring :It refers to the adherence to a complex network of international, national, and local laws and standards created to protect human health. Compliance includes monitoring VOC emissions, handling hazardous substances safely, and meeting environmental and workplace safety regulations. Regular audits and documentation help manufacturers maintain approval for production and distribution.

- Major Players: Nippon Paint Holdings Co., Ltd., RPM International Inc.

Industrial Coatings Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | The United States faces regulatory and environmental pressures with strict limits on VOC emissions. Compliance can be costly for manufacturers, and the regulatory environment is slowing innovation in some solvent-based formulations. |

| China | As part of its "Green Industry" policy, China mandates a phased reduction in the use of solvent-based coatings. This has led many local enterprises to adopt hybrid formulations to comply with environmental regulations and global export standards. |

| India | In India, there is a growing awareness of environmental concerns and indoor air quality. This is leading to a shift towards water-based and low-VOC formulations, and companies are investing in green chemistry and technology-based coatings. |

Segment Insights

Product Insights

How Much Share Did the Acrylic Segment Hold in the Industrial Coatings Market

During 2025?

- The acrylic segment dominated the market with the largest share of 37.04% in 2025. The segment's dominance can be attributed to its properties, such as good adhesion, corrosion resistance, and inhibiting properties. Acrylics are in huge demand in the automotive industry, especially in emerging economies.

- The polyurethane segment is expected to grow at the fastest CAGR over the forecast period. The segment's growth can be credited to its exceptional performance under harsh temperatures and varied environmental conditions.

- The growth of the epoxy segment can be fuelled by rising demand for chemical-resistant, durable materials in the automotive and construction sectors, as well as the rapid shift towards more sustainable water-borne epoxy coatings.

- The polyesters segment held a significant market share in 2025. The segment's growth can be driven by rising demand for weather-resistant, durable coatings. Also, the resistance, durability, and protective qualities of polyester coatings are major factors in various applications.

Technology Insights

Which Technology Type Segment Dominated the Industrial Coatings Market in 2025?

- By technology, the solvent borne segment accounted for the largest revenue share of around 36.80% in 2025. The segment's dominance can be linked to its properties, such as better functionality and shorter drying times in humid, open conditions. These coatings offer exceptional chemical resistance and protection against abrasion and moisture.The water-borne segment is expected to grow at the fastest CAGR over the forecast period.

- The segment's growth can be driven by technological innovations in coating technology. Governments across the globe are implementing stringent regulations on VOC emissions.The powder-based segment held a major market share in 2025. Powder coatings are preferred for their cost-effectiveness, zero VOC emissions, and superior abrasion resistance and longevity in industrial and infrastructure sectors.

- The growth of other segments can be driven by rising demand for high-performance, sustainable coatings and by technological innovations such as AI and digitalization. AI-powered systems are increasingly being used for real-time quality monitoring and predictive maintenance.

End-use Insights

How Much Share Did the General Industrial Segment Hold in 2025?

- The general industrial segment dominated the market, accounting for the largestshare of 46.52% in 2025. The segment's dominance is owed to rapid industrialization and infrastructure development, particularly in developing economies. Powder coatings are gaining traction due to their environmental benefits.

- The automotive & vehicle refinish segment is expected to grow at the fastest CAGR over the forecast period. The segment's growth is driven by a surge in the number of vehicles on the road, which increases the need for repair and refinishing due to general wear and tear.

- The growth of the marine segment can be fuelled by the growing demand for anti-fouling and anti-corrosion coatings to safeguard assets in harsh environments. Anti-fouling coatings play a crucial role in enhancing fuel efficiency and reducing overall maintenance costs.

- The aerospace segment held a significant market share in 2025. Aerospace coatings play an essential role in enhancing aerodynamics and minimizing aircraft weight, thereby improving fuel efficiency and reducing carbon emissions.

Regional Insights

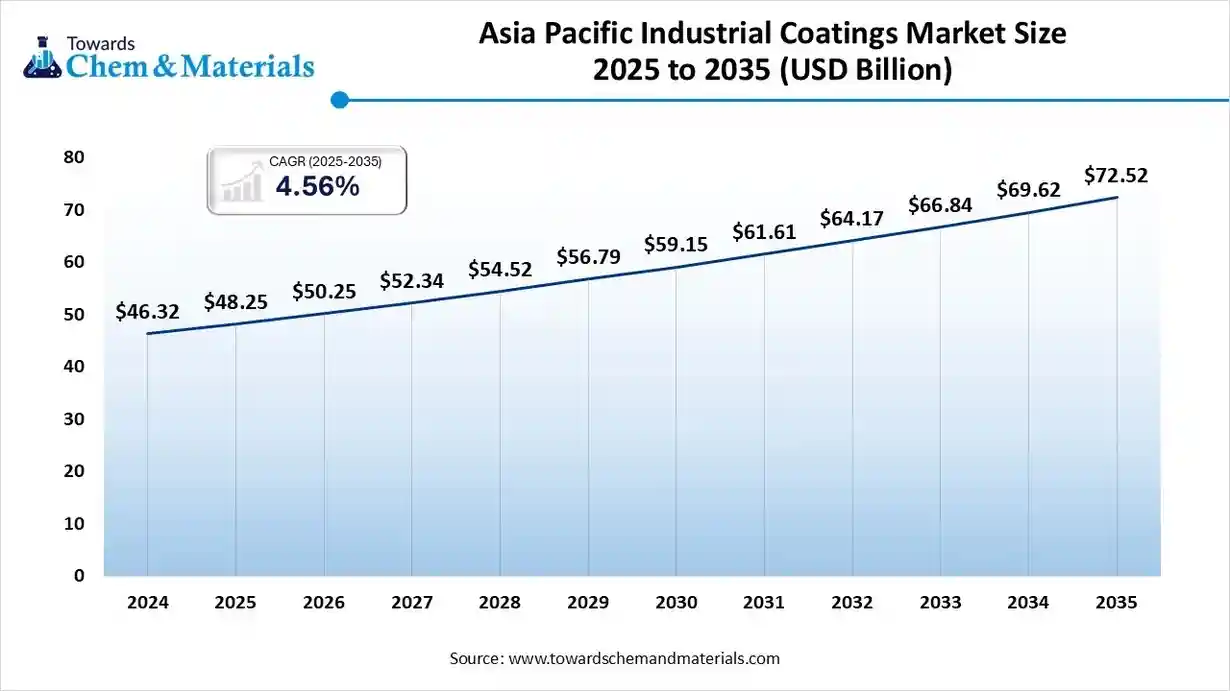

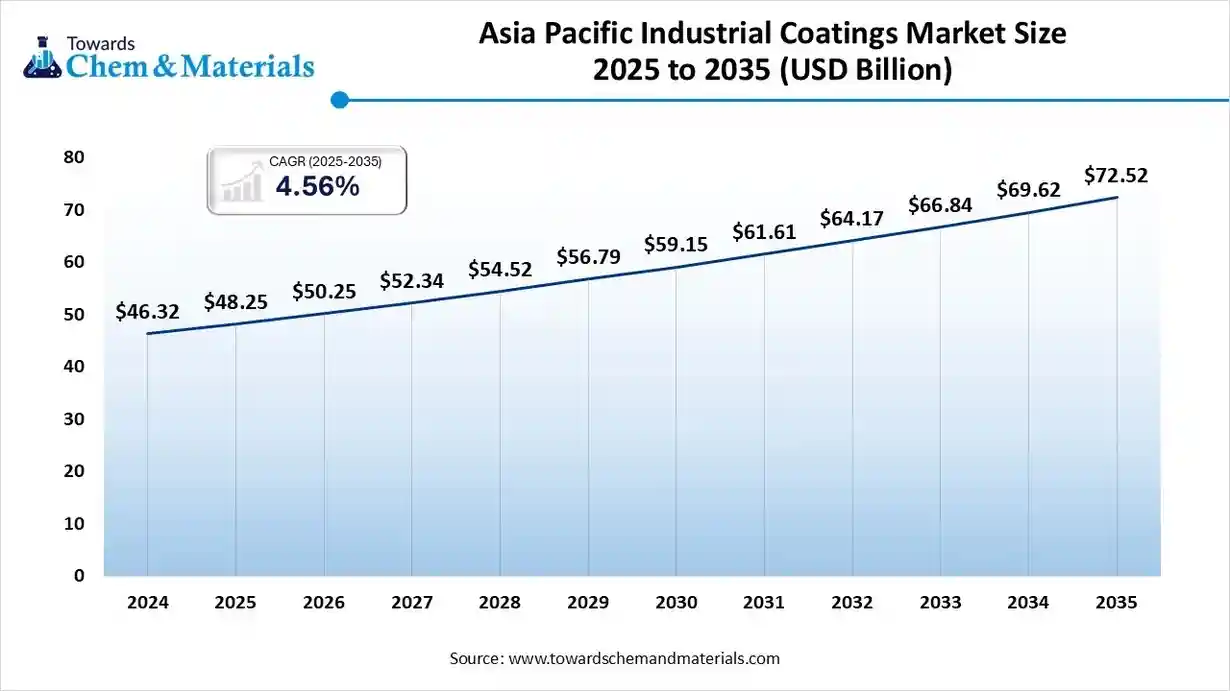

The Asia Pacific industrial coatings market size was valued at USD 48.25 billion in 2025 and is expected to reach USD 72.52 billion by 2035, growing at a CAGR of 4.56% from 2026 to 2035.Asia Pacific dominated the market, Asia Pacific dominated the industrial coating market and accounted for the largest revenue share of 40.19% in 2025.

The region's dominance can be attributed to rising product demand from the automotive industry in developing economies such as India, Japan, and South Korea. These countries continue to expand vehicle manufacturing capacity, and national transport and industry ministries report steady growth in automotive output, which increases the need for protective and high-performance industrial coatings across assembly and component plants.

The region also benefited from a favourable regulatory policy for VOC emissions. Governments across the Asia Pacific have been strengthening environmental guidelines while still supporting industrial expansion, thereby encouraging the use of compliant, low-emission coating technologies. This balance between regulatory support and strong manufacturing activity helped the Asia Pacific maintain its leading position in the global industrial coatings market.

India Industrial Coatings Market Trends

In the Asia Pacific, India led the market owing to rapid industrialization and urbanization, which have boosted demand from the growing construction and automotive sectors, as well as significant infrastructure projects. Also, advancements in coating technologies are creating further opportunities in the market.

Europe is expected to grow the fastest CAGR over the forecast period. The region's growth can be credited to the growing demand for durability and aesthetics in end products, coupled with the rising emphasis on high-performance, sustainable solutions. The expanding aerospace sector in countries such as the UK is a major driver of the regional market.

Germany Industrial Coatings Market Trends

The growth of the German market can be fuelled by the crucial properties of industrial coatings, such as long-lasting color and scratch resistance, which have expanded their end uses across a wide range of industries, including construction, packaging, and electronics.

North America is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by stringent environmental regulations, which lead to demand for sustainable coatings. Furthermore, major market players in the region are increasingly investing in R&D and new coating technologies, which will drive positive market growth in the near future.

U.S. Industrial Coatings Market Trends

In North America, the U.S. dominated the market due to the strong presence of major aircraft manufacturers, such as The Boeing Company and Textron Aviation, Inc. The availability of aerospace engineers, well-trained machinists, and other skilled labourers is attracting significant investment in the U.S. aerospace sector.

The Latin America region held a significant market share in 2025. The region's growth can be boosted by rising product demand from end-user industries such as automotive, construction, and oil and gas. Advancements in coating technologies are expanding their performance and applications, like enhancing adhesion for lightweight materials in the automotive sector.

Brail Industrial Coatings Market Trends

The Brazilian market can be driven by rising demand for decorative coatings and ongoing infrastructure development. Growth in residential and commercial construction, supported by public investment in urban projects, continues to increase demand for coatings for buildings, structural surfaces, and industrial equipment. This steady expansion in infrastructure activity strengthens demand for both aesthetic and protective coating solutions.

There is a growing need for coatings that provide long-lasting protection against corrosion and wear, driving market growth in the near future. Brazil’s humid climate, coastal environments, and heavy industrial operations make corrosion resistance especially important for manufacturers, construction firms, and transportation sectors. As companies seek durable, cost-effective coatings that extend asset lifespans, the industrial coatings market is expected to continue growing.

Recent Developments

- In February 2025, BioBond introduces biobased protective coatings for the food industry. These coatings use plant-based urethanes and epoxies. The coatings are free from microplastics and give protection against fungi, mold, and other microorganisms.(Source: worldbiomarketinsights.com)

- In July 2025, Dunn-Edwards Corporation introduced the ULTRASHIELD coatings series, designed with professionals in mind. ULTRASHIELD provides an unmatched solution for water, commercial, wastewater, and various other projects(Source: www.coatingsworld.com)

Top Industrial Coatings Market Companies

- BASF SE – BASF is a major supplier of industrial coatings and coating raw materials, offering protective, automotive, coil, and specialty coatings with strong R&D capabilities. The company maintains a top-tier global position by integrating advanced chemistry with durable, high-performance solutions.

- Akzo Nobel N.V. – AkzoNobel is a leading global provider of industrial, protective, marine, and powder coatings. Its industrial coatings segment emphasizes corrosion resistance, sustainability, and high-efficiency formulations for manufacturing and infrastructure.

- Axalta Coating Systems – Axalta specializes in liquid and powder industrial coatings for automotive components, heavy equipment, general industrial, and architectural applications. The company focuses on fast-curing, durable, and energy-efficient coating technologies.

- Jotun – Jotun provides industrial, protective, and marine coatings designed for harsh environments. Its offerings include anticorrosive systems widely used in offshore, construction, energy, and heavy industry applications.

- PPG Industries, Inc. – PPG supplies a broad portfolio of industrial coatings, including protective coatings, packaging coatings, coil coatings, and powder coatings. The company emphasizes innovation in sustainability, durability, and advanced material performance.

- The Sherwin-Williams Company – Sherwin-Williams offers industrial and protective coatings for manufacturing, infrastructure, oil & gas, and heavy equipment sectors. The company is known for corrosion protection, performance coatings, and high-durability systems.

- Nippon Paint Holdings Co., Ltd. – Nippon Paint manufactures industrial coatings across automotive, construction, marine, and general industrial applications. The company focuses on advanced finishing technologies and strong regional distribution.

- Hempel A/S – Hempel provides protective and marine coatings with strong expertise in corrosion control and long-term asset protection. Its industrial portfolio targets energy, infrastructure, and marine applications.

- RPM International Inc. – RPM owns multiple brands supplying protective, industrial, and specialty coatings used in manufacturing, construction, and maintenance. Its products focus on corrosion resistance, insulation, and high-performance finishes.

- Diamond Paints – Diamond Paints manufactures industrial coatings used across manufacturing, steel structures, machinery, and infrastructure. The company emphasizes quality, durability, and region-specific industrial formulations.

- Kansai Paints – Kansai Paints offers industrial coatings for automotive, general industrial, construction, and protective applications. Its technologies focus on high durability, energy-efficient curing, and eco-friendly formulations.

Segments Covered in the Report

By Product

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyesters

- Others

By Technology

- Solvent Borne

- Water Borne

- Powder Based

- Others

By End-use

- General Industrial

- Marine

- Automotive & Vehicle Refinish

- Electronics

- Aerospace

- Oil & Gas

- Mining

- Power Generation

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa