Content

What is the Current Asia Pacific Adhesives and Sealants Market Size and Share?

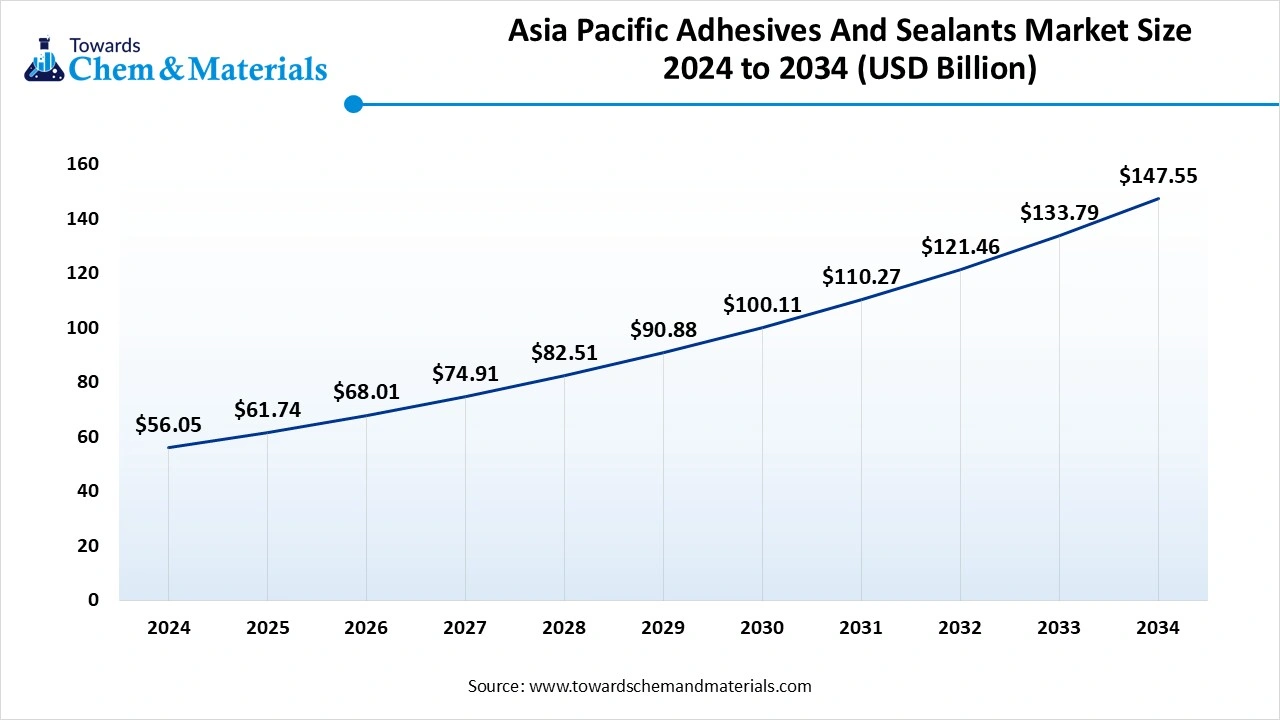

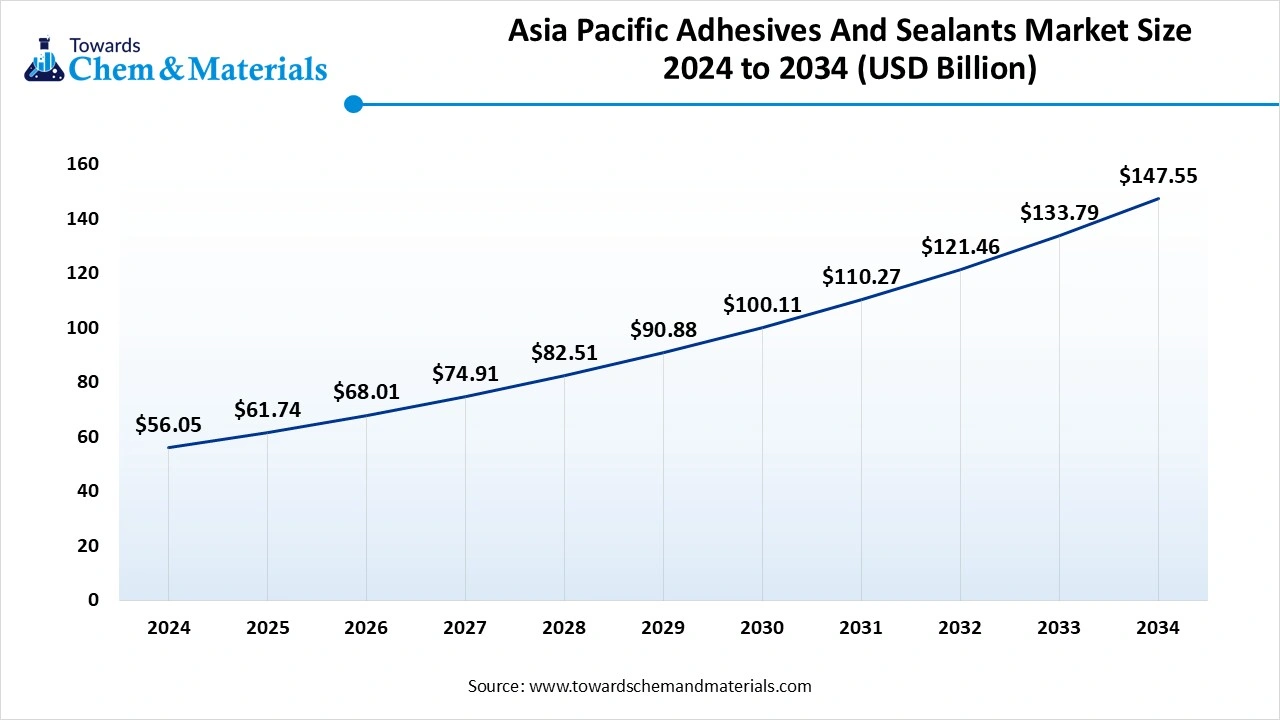

The Asia Pacific adhesives and sealants market size is calculated at USD 32.85 billion in 2025 and is predicted to increase from USD 34.86 billion in 2026 and is projected to reach around USD 59.50 billion by 2035, The market is expanding at a CAGR of 6.12% between 2026 and 2035. The medical device manufacturing expansion and the development of infrastructure projects drive market growth.

Key Takeaways

- By product type, the Acrylic adhesive segment accounted for the largest revenue share of 46.13% in 2025.

- By application, the buildings & construction segment dominated with the largest revenue share of 49.73% in 2025.

- By sealant resin type, the silicone sealants segment dominated with the largest revenue share of 47.11% in 2025.

- By adhesive formulating technology, the water-based segment accounted for the largest revenue share of 51.33% in 2025.

What is the Role of Adhesives and Sealants in the Asia Pacific?

The Asia Pacific adhesives and sealants market growth is driven by the growing development of transportation infrastructure, the increasing number of vehicles, the booming e-commerce sector, the rise in electronics manufacturing, and rising industrial activities.

The increasing investment in construction projects like commercial spaces, new houses, and large-scale infrastructure in countries like India and China increases demand for adhesives and sealants for purposes like roofing, insulation, flooring, and glazing. The high availability of raw materials and low production cost increases the production of adhesives and sealants in the Asia Pacific.

Adhesives are used to create a strong bond between materials. They offer a rigid feel & high strength. Adhesives come in diverse forms like tapes, liquids, and pastes. Adhesives like epoxy resins, acrylics, and polyurethanes are widely used across the Asia Pacific region for diverse applications. The rapid urbanization and industrialization in countries like Japan, China, and India increase demand for adhesives.

Sealants are used to fill joints & gaps, and they offer higher elongation & flexibility. They are widely used across industries like electronics, healthcare, automotive, and packaging. The sealants like acrylic, polyurethane, and silicone are widely used in the Asia Pacific.

Asia Pacific Adhesives and Sealants Market Trends:

- Healthcare Expansion:- The rise in surgical procedures and increasing use of medical devices increases demand for adhesives & sealants. The growing development of wearable health devices, catheters, advanced wound closure, & biosensors, and the rise in medical tourism in countries like China & India require medical-grade adhesives & sealants.

- Development of Sustainable Products:- The stringent environmental regulations and growing environmental concerns increase the development of sustainable products like bio-based adhesives, water-based adhesives, and low-VOC sealants. The increasing consumer awareness about environmental issues increases the adoption of eco-friendly adhesives & sealants.

- Strong Manufacturing Base:- The well-established manufacturing units for construction materials, electrical components, and automotive components across countries like India and China increase demand for high-performance adhesives and sealants.

- Growing Electronic Industry:- The increasing manufacturing of consumer electronic products like laptops, smartphones, computers, & tablets, and the growing miniaturization of electronic devices, increases demand for adhesives and sealants for electrical insulation and thermal management.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 34.86 Billion |

| Revenue Forecast in 2035 | USD 59.50 Billion |

| Growth Rate | CAGR 6.12% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Product Type, By Adhesive Formulating Technology, By Sealant Resin Type, By Application, |

| Key companies profiled | 3M Company, Ashland Inc. , Avery Dennison Corporation , BASF AG , Beardow & Adams (Adhesives) Ltd , Bostik SA, Henkel AG & Co., Dow Chemical Company, Eastman Chemical Company, Ellsworth Adhesives, H.B Fuller Company, Momentive Specialty Chemical Inc, N.D. Industries Inc., Sika AG, Uniseal Inc. |

Key Technological Shifts in the Asia Pacific Adhesives and Sealants Market:

The Asia Pacific adhesives and sealants market is undergoing key technological advancements driven by performance enhancement, productivity, and environmental compliance. The technological innovations like data analytics, bio-based adhesives, solventless adhesives, smart catalysts, and the use of robotics support environmental compliance and enhance the manufacturing process. One of the major shifts is the integration of AI and machine learning (ML) enhances sustainability and improves quality.

AI optimizes adhesive & sealant formulations and easily develops novel materials. ML monitors production parameters in real-time and helps to lower defects. Artificial Intelligence prevents failures of equipment & machinery and supports applying the correct amount of adhesives & sealants during product manufacturing. AI easily identifies bio-based raw materials and develops greener adhesives. Overall, AI and ML enhance quality control, accelerate the research & development process, and improve sustainability.

Trade Analysis of Asia Pacific Adhesives and Sealants Market: Import & Export Statistics

- China exported 73,861 shipments of adhesive glue.

- India exported 1,338 shipments of tile adhesive.

- Malaysia exported 761 shipments of contact adhesive.

- China exported 2,206 shipments of water-based adhesive.

- China exported 31,974 shipments of sealant.

- South Korea exported 1,781 shipments of silicone sealant.

- China exported 919 shipments of industrial sealant.

- India imported 4,495 shipments of silicone sealant.

- India imported 966 shipments of polyurethane sealant.

- India imported 111,984 shipments of adhesive.

Asia Pacific Adhesives and Sealants Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement is the sourcing of raw materials, including petrochemical-based materials like epoxy resins, DCPD, ethylene, isoprene, propylene, & silicones, and bio-based materials like glycerol, recycled plastics, rosin resins, & sugars.

- Key Players:- Dow, Huntsman Corporation, Ashland Inc., LG Chem, BASF SE, Arkema Group, Wacker Chemie AG

- Chemical Synthesis and Processing: The chemical synthesis and processing involve steps like the selection of raw materials, mixing raw materials, curing, testing, and packaging of final products.

- Key Players:- Arkema Group, Avery Dennison Corporation, Henkel AG, 3M Company, Ashland Inc., Dow Inc.

- Quality Testing and Certifications: The quality testing involves testing of qualities like viscosity, shear strength, adhesion, performance, cohesion, durability, & volume shrinkage, and certifications like ISO and ASTM.

- Key Players:- ALS Limited, TUV SUD, Bureau Veritas

Country-Specific Regulations for Adhesives and Sealants in the Asia Pacific

| Country | Regulatory Body | Regulations |

| China |

|

|

| India | Bureau of Indian Standards |

|

| Japan |

|

|

| South Korea |

|

|

Segmental Insights

Product Type Insights

Why Adhesive Segment Dominates the Asia Pacific Adhesives and Sealants Market?

The adhesive segment dominated the Asia Pacific adhesives and sealants market share of 46.13% in 2025. The growing investment in infrastructure development and the increasing construction of commercial & residential projects require adhesives. The rising automotive production and increasing use of lightweight materials in vehicles require adhesives for the assembly of vehicles. The growing industrial activities and rapid growth in e-commerce require adhesives, driving the overall market growth.

The sealant segment is the fastest-growing in the market during the forecast period. The growing production of electric vehicles and the development of fuel-efficient vehicles require sealant. The increasing manufacturing of electronic devices and the rise in miniaturization of electronics require sealant for bonding internal components. The rise in online shopping and the increasing demand for consumer goods require sealants. The growing use of sealants in medical device assembly, wound closure, and surgical procedures supports the overall market growth.

Adhesive Formulating Technology Insights

How did the Water-Based Segment hold the Largest Share in the Asia Pacific Adhesives and Sealants Market?

The water-based segment held the largest revenue share in the Asia Pacific adhesives and sealants industry share of 51.33% in 2025. The growing consumer preference for sustainable products and focus on lowering VOC emissions increases demand for water-based adhesives. The expanding e-commerce sector requires water-based adhesives for lamination, carton sealing, and labeling. The strong focus on green buildings and the development of infrastructure projects requires water-based adhesives, driving the overall market growth.

The solvent-based segment is experiencing the fastest growth in the market during the forecast period. The growing expansion of the automotive sector in countries like South Korea and Japan increases the adoption of solvent-based adhesives. The increasing government investment in the development of infrastructure projects and growing consumer demand for packaged goods require solvent-based adhesives. The rising use of medical devices like pulse oximeters, ventilators, and masks requires solvent-based adhesives, supporting the overall market growth.

The hot-melt segment is growing significantly in the market. The rapid urbanization and growing industrial activities in countries like India and China increase demand for hot-melt adhesives. The increasing use of secure packaging solutions and booming e-commerce requires hot-melt adhesives. The growing production of non-woven hygiene products like medical supplies, diapers, and feminine care items requires hot-melt adhesives, supporting the overall market growth.

Sealant Resin Type Insights

Why the Silicone Sealants Segment is Dominating the Asia Pacific Adhesives and Sealants Market?

The silicone sealants segment dominated the Asia Pacific adhesives and sealants market share of 47.11% in 2025. The growing development of construction projects in countries like India and China increases demand for silicone sealants. The strong preference for electric vehicles and growing adoption of care requires silicone sealants for sealing and automotive assembly. The increasing electronic device manufacturing and development of medical devices require silicone sealants, driving the overall market growth.

The polyvinyl acetate segment is the fastest-growing in the market during the forecast period. The strong government support for the development of infrastructure projects in countries like India and China increases the adoption of polyvinyl acetate sealants. The rapid expansion of e-commerce and the rise in electric vehicles require polyvinyl acetate sealants. The growing demand for flexible packaging, paper, and cardboard requires polyvinyl acetate sealants, supporting the overall market growth.

The polyurethane segment is growing significantly in the market. The growing development of commercial projects and residential buildings requires polyurethane sealants for facades, windows, and joints. The growing trend of electric vehicles and the development of transportation networks require polyurethane sealants. The increasing use of polyurethane sealants in industries like automotive, consumer goods, construction, and packaging drives the market growth.

Application Insights

Which Application Segment Held the Largest Share in the Asia Pacific Adhesives and Sealants Market?

The buildings & construction segment held the largest revenue share in the Asia Pacific adhesives and sealants market share of 49.73% in 2025. The rapid urbanization and growing investment in infrastructure development require high-performance adhesives & sealants. The development of transportation infrastructure, housing, and commercial spaces requires adhesives & sealants. The government initiatives, like smart cities and the rise in green buildings, require adhesives and sealants. The increasing use of adhesives & sealants in panels, flooring, structural glazing, and glass facades drives the overall market growth.

The automotive & transportation segment is experiencing the fastest growth in the market during the forecast period. The growing manufacturing of passenger cars and the development of fuel-efficient vehicles require adhesives & sealants. The increasing adoption of hybrid and electric vehicles requires adhesives & sealants for thermal management, electronic components assembly, and battery packs. The growing development of lightweight vehicle materials and strong government support for vehicle electrification require adhesives & sealants supporting the overall market growth.

The paper, board, & packaging segment is growing at a significant rate in the market. The growing consumer demand for packaged goods and the expansion of online retail require adhesives and sealants. The increasing demand for packaging across personal care, food, and beverages requires adhesives & sealants. The increasing shift towards flexible packaging materials and expansion of the packaging industry requires adhesives & sealants that support the overall market growth.

Country-Level Insights

Bonding Power: China at the Centre of APAC Adhesives and Sealants Expansion

China is a major contributor to the Asia Pacific adhesives and sealants market. The highest manufacturing of vehicles and the rise in adoption of electric vehicles increase demand for adhesives & sealants. The increasing production of electronic devices like computers, laptops, and smartphones requires adhesives and sealants. The growing construction activities and development of infrastructure projects require adhesives and sealants. The well-established packaging manufacturing ecosystem and presence of a robust manufacturing hub require adhesives & sealants, driving the overall market growth.

- China exported 276386 shipments of adhesive.(Source: www.volza.com)

- China exported 640 shipments of tile adhesive.(Source: www.volza.com)

Sticking to Success: India’s Adhesives and Sealants Growth Era

India is growing at a notable rate in the market. The strong government support for the development of projects like metro rail construction, Smart Cities Mission, and Bharatmala increases demand for adhesives & sealants. The increasing production of traditional and electric vehicles requires adhesives & sealants for internal component assembly and thermal management. The growing expansion of packaging and government focus on domestic manufacturing requires adhesives & sealants. The rising demand for furniture, consumer goods, and housing requires adhesives & sealants, supporting the overall market growth.

- From Jun 2024 to May 2025, India exported 12,135 shipments of adhesive.(Source: www.volza.com)

- From Jun 2024 to May 2025, India exported 533 shipments of sealant.(Source: www.volza.com)

Bonding Brilliance: High Tech Sparks South Korea's Adhesives and Sealants

South Korea is growing significantly in the market. The well-established automotive manufacturing hub and growing urban development require high-performance adhesives & sealants. They are widely used in components like dashboards, sensors, and wiring. The increasing need for surgical equipment and medical devices requires biocompatible adhesives. The trending DIY culture and growing domestic aerospace manufacturing require adhesives & sealants that support the overall market growth.

Japan’s Role in the Asia Pacific Adhesives and Sealants Market

Japan is growing substantially in the market. The strong presence of advanced automotive manufacturing and the rise in adoption of hybrid & electric vehicles increase demand for high-performance adhesives for thermal management systems and battery assembly. The growing infrastructure redevelopment, especially in Tokyo, and the construction of high-rise buildings require adhesives & sealants. The strong focus on building earthquake-resistant construction and growing medical sector requires adhesives & sealants, supporting the overall market growth.

Recent Developments

- In March 2024, Jowat inaugurated a modern adhesive manufacturing facility in China. The annual adhesive production capacity is approximately 9000 tonnes, and the facility focuses on the production of water-based dispersion adhesives. (Source: www.jowat.com)

- In September 2024, Sika launched a new sealant, Sikaflex-403, for tanks and silos. It is suitable for floor connection joints and stainless steel silos & tanks. It consists of outstanding chemical resistance and enhanced durability. (Source: www.constructionenquirer.com)

- In September 2024, DuPont launched Great Stuff Wide Spray Foam Sealant. It is useful across joints, irregular surfaces, air sealing seams, hard-to-reach spaces, and irregular surfaces. It supports horizontal & vertical surfaces and adheres to metal, glass, plastics, wood, & masonry.(Source: www.prnewswire.com)

- In November 2024, Nuvoco launched Zero M Tile Adhesive T5. The adhesive fixes all types of stones & tiles on diverse surfaces like Bison panels, Gypsum board, metal, cement sheet, ceramic, wood, and PVC. The adhesive is available in a 4kg bucket and is available across East, North, & West India.(Source: www.rprealtyplus.com)

Top Asia Pacific Adhesives and Sealants Market Companies List

Toyochem

Corporate Information

- Name: TOYOCHEM Co., Ltd.

- Parent / Group: Part of the Toyo Ink SC Holdings Co., Ltd. (Toyo Ink Group).

- Headquarters: Kyobashi, Chuo ku, Tokyo, Japan.

- Factories / Plants: Key plant is in Kawagoe (Saitama Prefecture) where the new polymer pilot facility is located.

History and Background

- Toyochem leverages the polymer design technologies of the Toyo Ink Group, built over many decades, including through experience in resins for printing inks and coatings.

- It was built up as the polymer/coatings arm of the wider ink business, diversifying into adhesives and high-performance polymers.

Key Developments and Strategic Initiatives

- In April 2023, Toyochem brought online a polymer pilot plant at its Kawagoe factory for prototyping and medium-scale production of advanced polymers.

- The first phase is producing condensation polymers with high heat resistance + high flexibility, targeting semiconductor peripheral materials, high-speed communication components, and adhesives for EVs.

- The facility also supports smart-factory initiatives; they will accumulate data to drive digital transformation (DX) in manufacturing.

Mergers & Acquisitions

- Acquisition from Dow (Rohm and Haas):In 2015, Toyochem acquired exclusive rights from Rohm & Haas (Dow’s subsidiary) for 11 solvent-based, one component acrylic pressure-sensitive adhesive (PSA) technologies (formulation + manufacturing + customer data).

- These products were relaunched under their ORIBAIN™ series.

- The move strengthened Toyochem’s global PSA portfolio, especially in industrial applications (automotive, electronics, displays).

Partnerships & Collaborations

- Internal Collaboration: Toyochem works closely with the Polymer Materials Research Institute within its own group to feed R&D into the pilot plant.

- Open Innovation / External R&D: According to the Toyo Ink group’s integrated report, they are pursuing open innovation, combining internal and external knowledge to accelerate development.

- Customer Co-Development: Through the Shenzhen Technical Center, Toyochem engages with electronics brand owners, module makers, and other upstream / downstream partners to jointly develop materials.

Product Launches / Innovations

- Cyabine™ series: Bio-based, ultra-high-solid polyurethane PSAs (up to ~ 80% bio content) for tapes, packaging, labeling.

- Oribain™ series: Acrylic pressure-sensitive adhesives (PSA) relaunched from Dow technology; they have developed versions with very high bio-based content (up to ~ 75%) too.

Key Technology Focus Areas

- Polymer Design & Synthesis: Particularly acrylics, urethanes, polyesters, and their composites.

Advanced / Condensation Polymers: Heat resistant, flexible polymers (first-phase production in pilot plant). - Smart Manufacturing / DX: Use of pilot facility not only for prototyping but to accumulate data for smart factory implementation.

R&D Organisation & Investment

- R&D is strongly supported by the Polymer Materials Research Institute (internal).

- The new polymer pilot building is a major capital investment (launched in April 2023) showing that R&D is not just lab scale, but moving toward semi-commercial prototyping.

- The Toyo Ink Group’s R&D strategy includes digital transformation (DX) to accelerate product development.

SWOT Analysis

Strengths:

- Deep polymer design expertise inherited from Toyo Ink Group; strong technology base in acrylic, urethane, polyester resins.

- New pilot facility gives flexibility to prototype and scale new, high value polymers (condensation, advanced types).

- Strategic alignment with high-growth markets: electronics (semiconductors, 5G), EVs, adhesives for advanced applications.

- Sustainability credentials: bio-based adhesives, low-VOC systems, energy-efficient operations.

- Global engagement via technical centers (e.g., Shenzhen) allows co development and faster customer feedback.

Weaknesses:

- High capex risk: building and running a polymer pilot plant is capital intensive; scaling from pilot to full production could be challenging.

- Technology risk: condensation / advanced polymers for semiconductors and EVs have very high performance demands; failure to meet spec could be costly.

- Dependency on raw materials: advanced polymers may rely on specialized monomers or raw materials, which could be volatile in price or supply.

- Sustainability trade-offs: bio-based adhesives are appealing, but margins may be thinner, or supply chain for bio monomers could be uncertain.

Opportunities:

- Huge growth in semiconductors, 5G / communications, EVs Toyochem’s new polymers are well-positioned to tap into these.

- Increasing demand for green adhesives and coatings; bio-based adhesives could be a differentiator.

- Smart manufacturing: data from pilot facility could improve efficiency, reduce time-to-market, and reduce cost.

- Collaborations with electronics OEMs / module makers could yield custom high-margin products.

Geographic expansion: leveraging the technical center and global customer base to expand beyond Japan.

Threats:

- Competition: many chemical companies are also pushing into advanced polymers (e.g., global majors). Toyochem must defend its niche.

- Economic downturns: demand for electronics or EVs could slow, affecting demand for high-performance adhesives / polymers.

- Regulatory risk: chemical industry is subject to stringent environmental regulation, especially on new monomers, bio-based claims, emissions.

- Raw material price volatility: monomer costs, supply chain disruptions (e.g., for specialty building-blocks) could hurt margins.

- Scale-up risk: pilot plant success doesn’t guarantee full-rate production or commercial viability.

Recent News & Strategic Updates

- Polymer Pilot Plant Commissioned

- The new pilot facility at Kawagoe was completed and started operations in April 2023.

- This is a major step for them to prototype and produce advanced, functional polymers at a mid scale.

- Seishin Factory Name Change

- In March 2024, Toyochem announced the renaming of its “Seishin Factory” to Kobe Factory (Hyōgo Prefecture) effective April 1, 2024.

Other Top Companies

- 3M Company: The multinational company produces 3M Scotch-Weld Structural adhesives, VHB Tapes, and specialty adhesives & sealants to serve diverse industries like construction, medical, automotive, and electronics.

- Ashland Inc.: The company provides raw materials like defoamers, wetting agents, thickeners, surfactants, rheology modifiers, and dispersants for enhancing the performance of adhesives.

- Avery Dennison Corporation: The company produces pressure-sensitive tapes and adhesives using technologies like solvent, emulsion, and hot-melt for applications like labeling, bonding, & sealing in diverse sectors like medical, construction, and automotive.

- BASF AG: The Germany-based company manufactures high-performance additives and raw materials for the production of adhesives and sealants.

- Beardow & Adams (Adhesives) Ltd: The company manufactures adhesives, including water-based, starch, dispersion, hot-melt, dextrin, and solvent-based adhesives to support sectors like labeling, product assembly, packaging, bookbinding, and woodworking.

- Bostik SA

- Henkel AG & Co.

- Dow Chemical Company

- Eastman Chemical Company

- Ellsworth Adhesives

- H.B Fuller Company

- Momentive Specialty Chemical Inc

- N.D. Industries Inc.

- Sika AG

- Uniseal Inc.

Segments Covered

By Product Type

- Adhesive

- Sealant

By Adhesive Formulating Technology

- Water-Based

- Solvent-Based

- Hot-Melt

- Reactive & Others

By Sealant Resin Type

- Silicones

- Polyurethanes

- Acrylic

- Polyvinyl Acetate (PVA)

- Others

By Application

- Paper, Board, and Packaging

- Buildings & Construction

- Automotive & Transportation

- Woodworking and Joinery

- Footwear & Leather

- Healthcare

- Electrical & Electronics

By Regional

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa