Content

What is the Current Pyrophyllite Market Size and Volume?

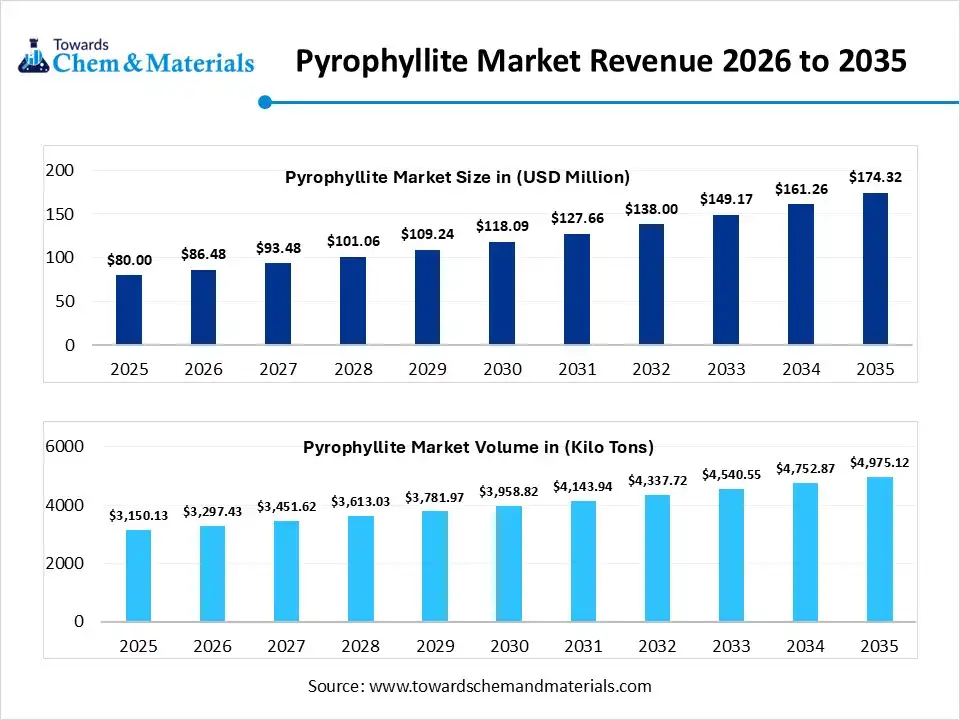

The global pyrophyllite market size was estimated at USD 80.00 million in 2025 and is expected to increase from USD 86.48 million in 2026 to USD 174.32 million by 2035, growing at a CAGR of 8.10% from 2026 to 2035. In terms of volume, the market is projected to grow from 3150.13 kilo tons in 2025 to 4975.12 kilo tons by 2035. growing at a CAGR of 4.68% from 2026 to 2035. Asia Pacific dominated the pyrophyllite market with the largest volume share of 46% in 2025.The increased shift towards the more natural minerals has accelerated industry growth in recent years.

Key Takeaways

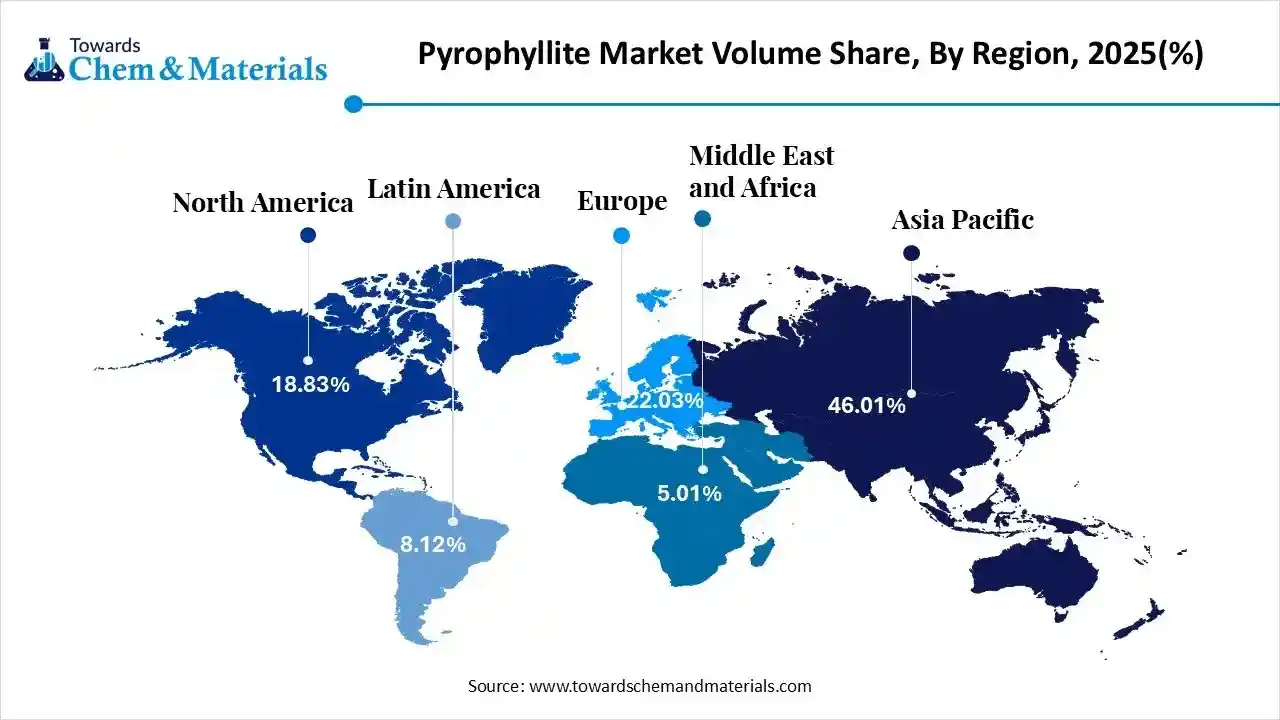

- The Asia Pacific dominated the pyrophyllite market with the largest volume share of 46.01% in 2025.

- The pyrophyllite market in Europe is expected to grow at a substantial CAGR of 4.15% from 2026 to 2035.

- The North America pyrophyllite market segment accounted for the major volume share of 18.83% in 2025.

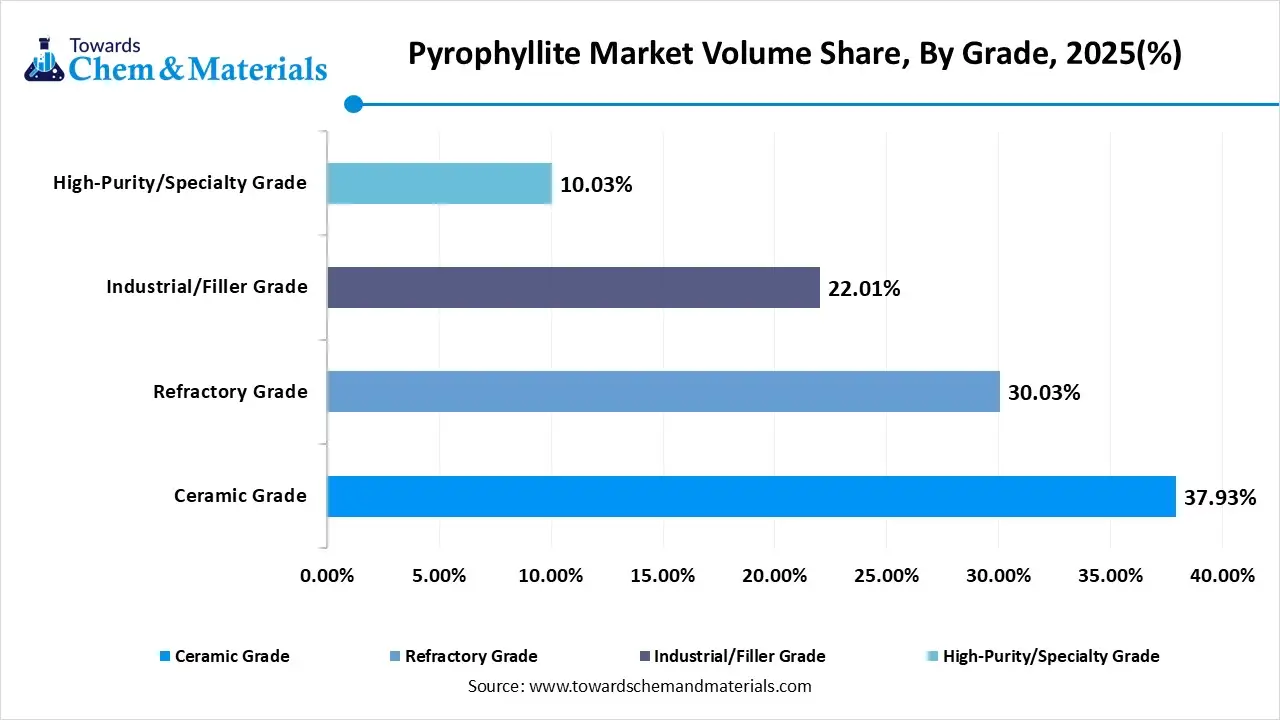

- By grade, the ceramic grade segment dominated the market and accounted for the largest volume share of 38% in 2025.

- By grade, the high purity segment is expected to grow at the fastest CAGR of 7.65% from 2026 to 2035 in terms of volume.

- By end user, the construction and building materials segment led the market with the largest revenue volume share of 36% in 2025.

- By product form, the powder segment dominated the market and accounted for the largest volume share of 52% in 2025.

Pyrophyllite at the Core of Industry

The mineral, which is naturally occurring, soft, and slightly greasy, is known as pyrophyllite. Also, having unique characteristics like it burns or melts easily in high temperatures, the pyrophyllite gained major industry attention in the manufacturing sector nowadays. Moreover, the use of pyrophyllite as a functional mineral is strengthening the foundation of future sector growth in the current period.

Pyrophyllite Market Trends

- The greater shift towards the performance-based use of pyrophyllite has allowed the stakeholders to capitalize on growth opportunities. Moreover, the manufacturers are actively selecting pyrophyllite according to their higher performance needs, like heat resistance, strength, and product life, instead of using it as a cheap raw material.

- The heavy demand from the specialized and small manufacturers is positively impacting revenue potential and industry scalability in recent years. Moreover, due to the reliability of limited batches, specialised manufacturers are heavily using pyrophyllite in applications such as specialised coatings, custom ceramics, and moulded parts in the current period.

- The trend towards the customized pyrophyllite is likely to drive investor confidence in the industry’s future. As the specific region has seen in demanding tailored pyrophyllite due to factors such as climate, fuel, and local raw materials, performance has changed in the past few years.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 86.48 Million / 3297.43 KiloTons |

| Revenue Forecast in 2035 | USD 174.32 Million / 4975.12 KiloTons |

| Growth Rate | CAGR 8.10% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By End-User, By Product Form, By Region |

| Key companies profiled | IMI Fabi, SCR-Sibelco, Golcha Minerals, Ashapura Group, Trimex Group, EICL, Asian Granito, Jyothi Minerals, Earth Industries, Quartz Corp, Mineração Curimbaba, LKAB Minerals, BariteWorld, The Clay Minerals Company, JLD Minerals, Rajmahal Minerals, Fujian Pyrophyllite, Xiamen Winson, Zhejiang Fenghong, Gimpex |

From Raw Material to Smart Material

The market has observed movement from basic mining and grinding toward smart material design and digital quality control. Previously, pyrophyllite was processed the traditional way with simple crushing and screening. Now companies use digital sensors and AI to monitor purity and particle size in real time. This means fewer rejects, more consistent material, and better performance in end products like ceramics, refractories, and coatings.

Trade Analysis of the Pyrophyllite Market:

Import, Export, Consumption, and Production Statistics

- The United States has exported 476 shipments of pyrophyllite, where the world has seen 844 shipments to major countries such as Italy, Turkey, and China as per the published report.

- India has also observed in a heavy export of pyrophyllite as a major country after the United States, with 359 shipments.

Value Chain Analysis of the Pyrophyllite Market:

- Distribution to Industrial Users: The distribution of pyrophyllite to industrial users remains heavily concentrated in the Asia-Pacific region, which accounts for over 75% of the global market volume. The mineral is primarily distributed for use in refractories and ceramics due to its high thermal stability and chemical resistance.

- Key Players: Ashapura Minechem Limited (India) and Sibelco Group (Belgium).

- Chemical Synthesis and Processing: The pyrophyllite industry focuses on advanced enrichment techniques to upgrade low-grade ores and specialized chemical synthesis to create high-performance nanocomposites.

- Key Players: R.T. Vanderbilt Holding Company, Inc. (U.S.) and Trinity Performance Minerals (U.S.)

- Regulatory Compliance and Safety Monitoring: The regulatory landscape for pyrophyllite is defined by intensified oversight of respiratory hazards and streamlined chemical safety assessments. Because pyrophyllite often contains crystalline silica (quartz), compliance focuses heavily on dust management and worker health monitoring.

- Safety Standards- MSHA & OSHA (U.S.) and ECHA (EU)

Pyrophyllite Market Regulatory Landscape: Global Regulations 4x 4

| Country Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | MSHA (Mine Safety and Health Administration) | 30 CFR Part 60 (MSHA Silica Final Rule) | Silica Exposure: Metal and nonmetal mines (including pyrophyllite) must fully comply with the new 50 µg/m³ PEL by April 8, 2026. |

| European Union | ECHA (European Chemicals Agency) | REACH Regulation (EC 1907/2006) | Hazard Classes: For substances already on the market, labels must be updated for new hazard classes (like Endocrine Disruptors) by November 1, 2026. |

| China | MOFCOM (Ministry of Commerce) | Foreign Trade Law | Export Licensing: From January 1, 2026, China is implementing stricter export licensing for critical minerals and steel products to control global supply. |

Segmental Insights

Grade Insights

How did the Ceramic Grade Segment Dominate the Pyrophyllite Market in 2025?

The ceramic grade segment volume was valued at 1194.84 kilo tons in 2025 and is projected to reach 1858.70 kilo tons by 2035, expanding at a CAGR of 5.03% during the forecast period from 2025 to 2035. The ceramic grade segment dominated the market with approximately 38% share in 2025, due to the increasing need for mass ceramic production in recent years. Moreover, by providing better resistance, stable shape, and smooth surface quality, the ceramic grade has gained major industry share in recent years. Also, ceramic manufacturers have been seen as preferring the material that can reduce cracks and defects while achieving a consistent output.

The high-purity grade segment volume was valued at 315.96 kilo tons in 2025 and is projected to reach 613.43 kilo tons by 2035, expanding at a CAGR of 7.65% during the forecast period from 2025 to 2035. The high-purity grade segment is expected to grow with a rapid CAGR, owing to the increasing shift towards performance and precision. Also, the manufacturers from specific industries such as electronics, thermal components, and advanced ceramics have actively seeking materials that have fewer impurities to avoid failures, which is likely to create lucrative opportunities in the coming years.

Pyrophylite Market Volume and Share, By Grade, 2025-2035

| By Grade | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Ceramic Grade | 37.93% | 1194.84 | 1858.70 | 5.03% | 37.36% |

| Refractory Grade | 30.03% | 945.98 | 1502.49 | 5.27% | 30.20% |

| Industrial/Filler Grade | 22.01% | 693.34 | 1000.50 | 4.16% | 20.11% |

| High-Purity/Specialty Grade | 10.03% | 315.96 | 613.43 | 7.65% | 12.33% |

End User Insights

How did the Construction & Building Materials Segment Dominate the Pyrophyllite Market in 2025?

The construction & building materials segment dominated the market with approximately 36% share in 2025, due to pyrophyllite improves long-term building performance. It enhances thermal stability, reduces cracking, and increases surface durability in construction products. These properties are important for buildings exposed to heat, weather, and mechanical stress. Construction companies prefer materials that have lower maintenance needs over time.

The metallurgy & foundry segment is expected to grow, akin to manufacturers focus on process efficiency. Pyrophyllite improves mold stability and reduces deformation during metal casting. This leads to fewer defects and better yield. Foundries also seek materials that maintain shape under repeated heating cycles. Pyrophyllite supports this requirement by offering consistent performance.

Product Form Insights

How did the Powder Segment Dominate the Pyrophyllite Market in 2025?

The powder segment dominated the market with approximately 52% share in 2025, due to it offers high manufacturing flexibility. it can be used in dry or wet processing systems without modification. This flexibility reduces production complexity and cost. Powder pyrophyllite allows manufacturers to adjust formulations quickly based on product requirements. It also improves surface finish and structural uniformity. Industries value materials that adapt to multiple applications, and powder form meets this need.

The granule segment is expected to grow, owing to modern factories that rely heavily on automation. Granulated pyrophyllite flows more consistently through automated systems than powder. This reduces blockages and improves dosing accuracy. Granules also support stable feeding in high-speed production lines. As industries move toward smart manufacturing, materials must perform reliably without manual adjustment.

Regional Insights

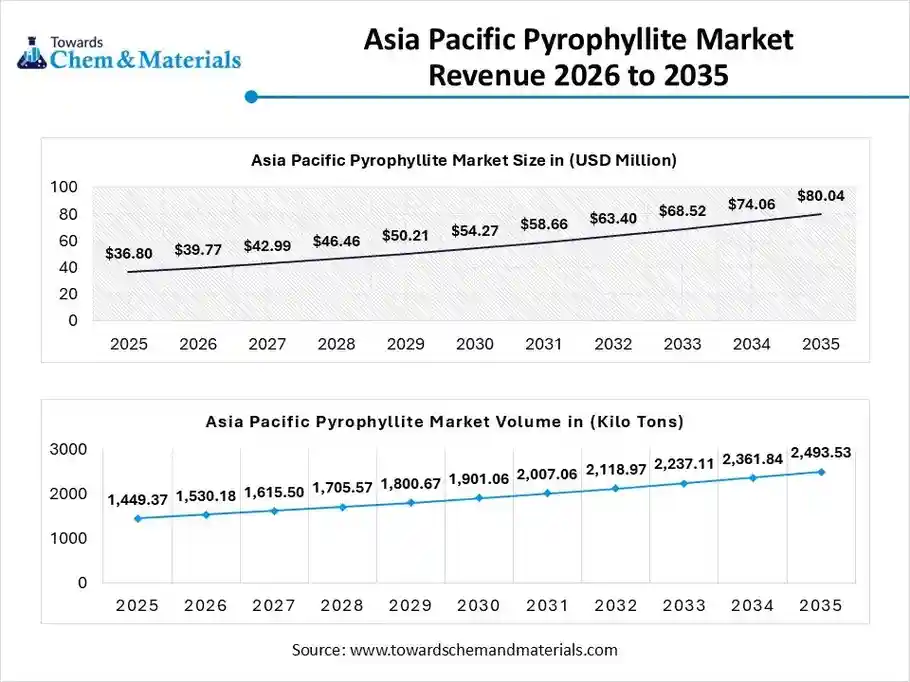

The Asia Pacific pyrophyllite market size was valued at USD 36.80 million in 2025 and is expected to be worth around USD 80.04 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.08% over the forecast period from 2026 to 2035.

The Asia Pacific pyrophyllite volume was estimated at 1449.37 kilo tons in 2025 and is projected to reach 2493.53 kilo tons by 2035, growing at a CAGR of 6.21% from 2026 to 2035. Asia Pacific dominated the pyrophyllite market with approximately 46% share in 2025, due to the regional shift towards more natural minerals instead of costly synthetic material in the current period. also, the factors such as the advanced and heavy manufacturing infrastructure and abundant raw materials is actively contributing to favorable market economies for the industry in recent years as per the observation.

High Volume Manufacturing Fuels China’s Leadership

China maintained its dominance in the market, owing to the greater focus on process continuity and cost control. Moreover, the manufacturer in China has seen a shift toward higher volume outputs and operational capabilities, which is heavily creating profitable pathways for sector participants in the current period.

Europe Pyrophyllite Market Evaluation

The Europe pyrophyllite volume was estimated at 693.97 kilo tons in 2025 and is projected to reach 1000.99 kilo tons by 2035, growing at a CAGR of 4.15% from 2026 to 2035. Europe is expected to capture a major share of the pyrophyllite market with a rapid CAGR, owing to its transition toward advanced material efficiency and sustainable manufacturing practices. European industries increasingly favor natural minerals that enhance durability, thermal performance, and regulatory compliance. Pyrophyllite aligns with these objectives by supporting long product life cycles and reducing dependence on chemically intensive alternatives.

Germany Advances Precision with Pyrophyllite

Germany is expected to emerge as a prominent country for the pyrophyllite market in the coming years due to its precision-driven manufacturing environment. German industries require materials that deliver consistent behavior under high temperature and mechanical stress, particularly in technical ceramics and refractory systems. Pyrophyllite meets these requirements by enhancing structural stability and minimizing production variability.

North America Pyrophyllite Market Examination

The North America pyrophyllite volume was estimated at 593.17 kilo tons in 2025 and is projected to reach 851.24 kilo tons by 2035, growing at a CAGR of 4.10% from 2026 to 2035. North America is notably growing in the market, owing to industry’s shift toward multifunctional material solutions. Manufacturers increasingly value materials that improve thermal stability, surface performance, and production efficiency simultaneously. Pyrophyllite supports these objectives by simplifying material formulations and enhancing process control.

Pyrophyllite Powers High-Performance United States Industries

The United States is expected to gain significant industry share due to its suitability for performance-focused industrial applications. Manufacturers prioritize materials that meet strict quality, safety, and consistency requirements while reducing processing complexity. Pyrophyllite contributes by improving thermal resistance, dimensional stability, and surface finish across industrial products.

Middle East and Africa Pyrophyllite Market Analysis

The Middle East and Africa pyrophyllite volume was estimated at 157.82 kilo tons in 2025 and is projected to reach 253.73 kilo tons by 2035, growing at a CAGR of 5.42% from 2026 to 2035. The Middle East and Africa is notably growing in the market, owing to industries moving from importing finished products to producing materials locally in the region nowadays. Moreover, new cement plants, ceramic units, metal processing sites, and industrial zones need heat-resistant and stable minerals. Pyrophyllite fits these needs because it performs well at high temperatures and lowers production costs, which also creates beneficial future opportunities in the industry.

Saudi Arabia Fuels Next-Gen Industrial Growth

Saudi Arabia is expected to gain significant industry share due to the country has observed in building new industries, not just buildings, as per the latest survey. Moreover, the large industrial projects need refractory materials, ceramics, and thermal insulation products. Pyrophyllite helps reduce healing damage and improves material strength, which is expected to attract increased capital and investment in manufacturing in the upcoming years. Furthermore, the Saudi manufacturers also want minerals that work reliably in high-temperature environments common in the region.

Pyrophylite Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 18.83% | 593.17 | 851.24 | 4.10% | 17.11% |

| Europe | 22.03% | 693.97 | 1000.99 | 4.15% | 20.12% |

| Asia Pacific | 46.01% | 1449.37 | 2493.53 | 6.21% | 50.12% |

| South America | 8.12% | 255.79 | 375.62 | 4.36% | 7.55% |

| Middle East & Africa | 5.01% | 157.82 | 253.73 | 5.42% | 5.10% |

Top Vendors in the Pyrophyllite Market & Their Offerings:

- IMI Fabi: A leading global manufacturer and innovator of mineral solutions, specializing in high-purity talc and pyrophyllite products for high-end polymer, pharmaceutical, and cosmetic applications.

- SCR-Sibelco: A major multinational mineral solutions provider that supplies high-performance pyrophyllite and silica-based materials specifically tailored for the technical ceramics and glass-fiber industries.

- Golcha Minerals: Asia-Pacific’s largest integrated "mining to marketing" firm, renowned for producing high-whiteness, asbestos-free pyrophyllite and talc used as premium industrial fillers.

- Ashapura Group: A top global mineral exporter and the world’s third-largest bentonite producer, specializing in precision-engineered pyrophyllite for refractories, fiberglass, and specialized agricultural carriers.

- Trimex Group

- EICL

- Asian Granito

- Jyothi Minerals

- Earth Industries

- Quartz Corp

- Mineração Curimbaba

- LKAB Minerals

- BariteWorld

- The Clay Minerals Company

- JLD Minerals

- Rajmahal Minerals

- Fujian Pyrophyllite

- Xiamen Winson

- Zhejiang Fenghong

- Gimpex

Segments Covered in the Report

By Grade

- Ceramic Grade

- Refractory Grade

- Industrial/Filler Grade

- High-Purity/Specialty Grade

By End-User

- Construction & Building Materials

- Metallurgy & Foundry

- Ceramics Manufacturing

- Chemicals & Industrial Processing

- Others

By Product Form

- Powder

- Lumps

- Granules

- Processed Blocks & Shapes

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa