Content

What is the Current LTCC and HTCC Market Size and Volume?

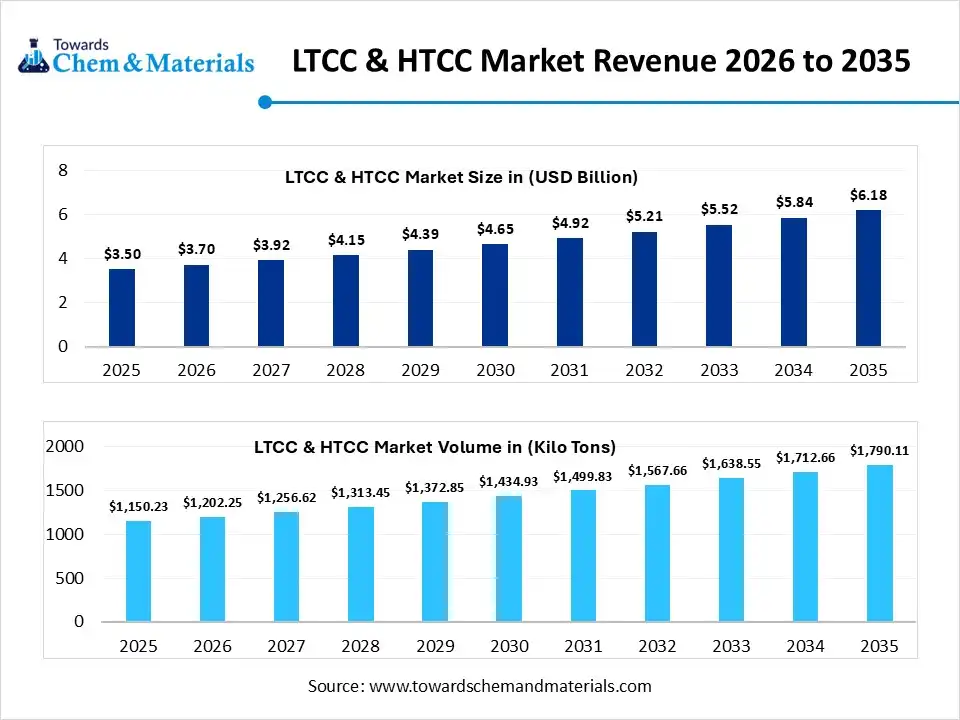

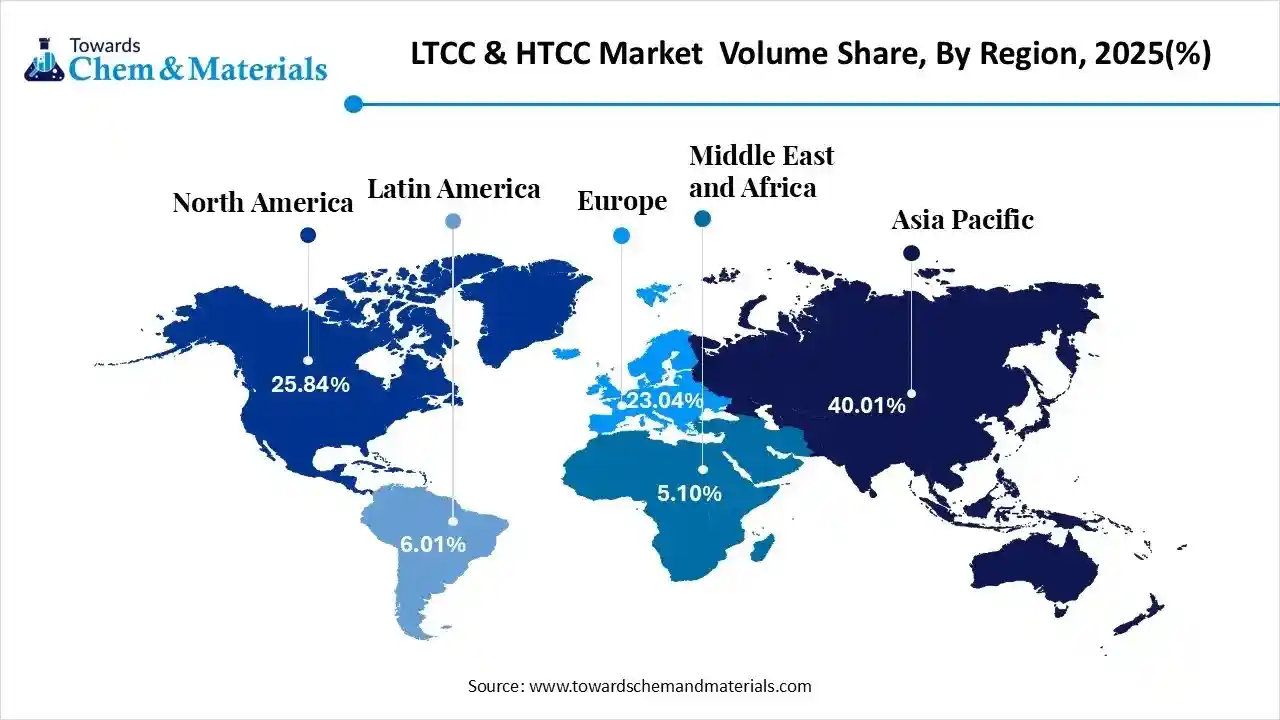

The global LTCC and HTCC market size was estimated at USD 3.50 billion in 2025 and is expected to increase from USD 3.70 billion in 2026 to USD 6.18 billion by 2035, growing at a CAGR of 5.85% from 2026 to 2035. In terms of volume, the market is projected to grow from 1150.23 kilo tons in 2025 to 1790.11 kilo tons by 2035. growing at a CAGR of 4.52% from 2026 to 2035. Asia Pacific dominated the LTCC and HTCC market with the largest volume share of 40.01% in 2025.The market is driven by the rising demand for advanced ceramic materials, 5G & 6G expansion, and its robust application base.

Key Takeaways

- The Asia Pacific dominated the LTCC and HTCC market with the largest volume share of 40.01% in 2025.

- The LTCC and HTCC market in North America is expected to grow at a substantial CAGR of 4.44% from 2026 to 2035.

- The Europe LTCC and HTCC market segment accounted for the major volume share of 23.04% in 2025.

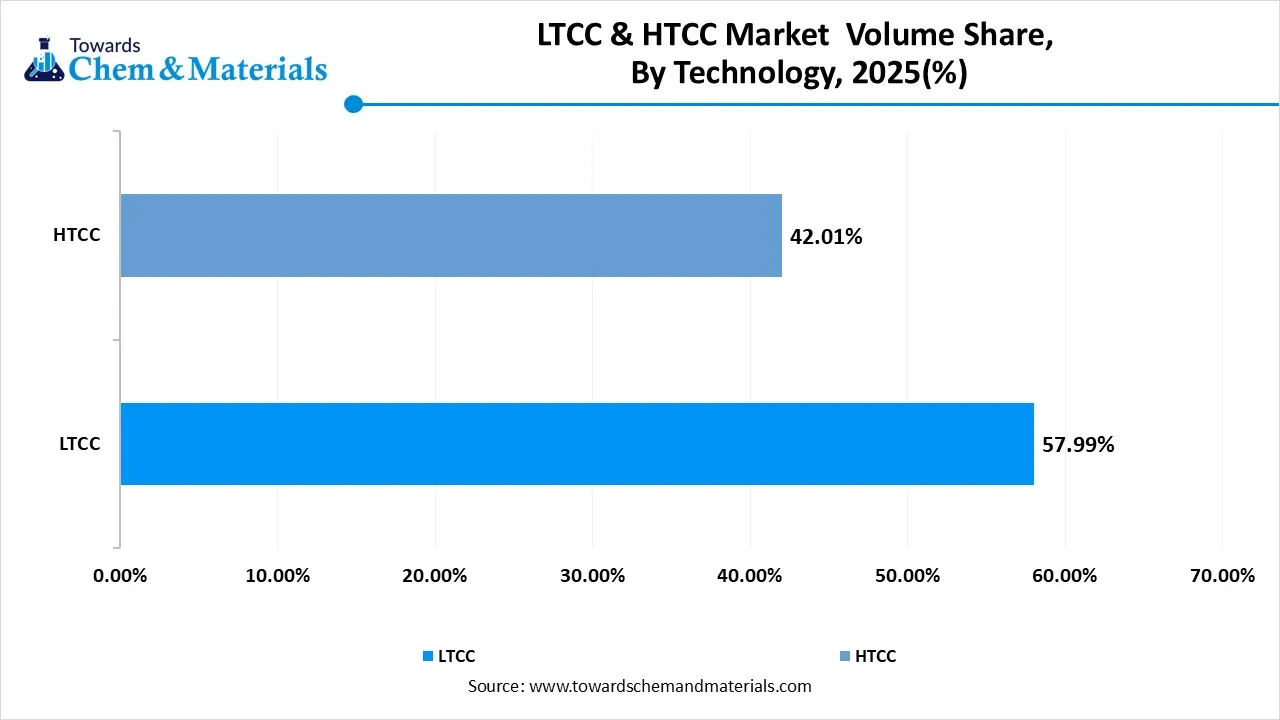

- By technology, the LTCC (Low Temperature Co-Fired Ceramic) segment dominated the market and accounted for the largest volume share of 58% in 2025.

- By technology, the HTCC (High Temperature Co-Fired Ceramic) segment is expected to grow at the fastest CAGR of 3.94% from 2026 to 2035 in terms of volume.

- By material type, the alumina (Al₂O₃) segment led the market with the largest revenue volume share of 55% in 2025.

- By end-user, the automotive electronics segment dominated the market and accounted for the largest volume share of 26% in 2025.

- By application, the RF & microwave module segment led the market with the largest revenue volume share of 30% in 2025.

- By manufacturing process, the tape casting & lamination segment dominated the market and accounted for the largest volume share of 45% in 2025.

Market Overview

What Factors are Driving the Growth in the LTCC and HTCC Market?

The Low Temperature Co-Fired Ceramic (LTCC) support multi-layer integration by offering low dielectric loss, cost-effectiveness and flexibility. The High Temperature Co-Fired Ceramic (HTCC) show high structural strength and thermal conductivity, which is useful in high-power resistant applications. The rising strategic partnership focuses on robust electronic systems with substantial investments, driving innovation and material advancements that accelerate the market growth.

The technological shift and rising demand in various industries are driving the market. The LTCC is used for miniaturized, biocompatible medical implants and healthcare equipment, while the HTCC is used for mission-critical applications, including aerospace & defence, radar systems, and missile guidance by enabling durability and hermetic sealing.

LTCC and HTCC Market Trends

Focus on Material Innovation: The researchers are focusing on innovation in lead-free and bioinert ceramic materials, with a rising surge in eco-friendly solutions to meet stringent environmental regulations, with enhanced mechanical strength and reliability

Technological Advancement: The key trend that is shaping the growth due to its enhancement in multilayer co-firing processes and 3D microsystems fabrication, enabling device efficiency & longevity. While the adoption of 5G and the ongoing development of 6G demand components capable of high-frequency performance and low signal loss.

Substantial investment and Collaboration: Manufacturers invest in eco-friendly processes, including R&D in advanced ceramics and automation, while strategic partnerships enable regional production resilience.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 3.70 Billion / 1202.25 KiloTons |

| Revenue Forecast in 2035 | USD 6.18 Billion / 1790.11 KiloTons |

| Growth Rate | CAGR 5.85% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Technology, By Material Type, By End-User, By Application, By Manufacturing Process, By Region |

| Key companies profiled | Murata Manufacturing, Hitachi Metals, Kyocera, TDK Corporation, NGK Spark Plug, Taiyo Yuden, KOA Corporation, Maruwa, CeramTec, CoorsTek, Rogers Corporation, Morgan Advanced Materials, 3M, AdTech Ceramics, NEC Corporation, Samsung Electro-Mechanics, Yageo Corporation, CTS Corporation, IBIDEN, AT&S |

Key Technological Shifts and AI in the LTCC and HTCC Market

The technological advancement in automated manufacturing is enhancing operational efficiency, reducing costs and improving scalability. The HTCC adopted battery management systems and electric vehicle (EV) power modules that offer high thermal conductivity. The LTCC technology enables advanced driver assistance systems (ADAS) due to its thermal and mechanical strength. While the integration of 5G & IoT devices necessitates low-loss, AI enables manufacturing optimization and quality assurance, which gains technical and operational leadership for future growth.

What is the difference between LTCC and HTCC materials

| Strategic Features | Low Temperature Co-Fired Ceramic (LTCC) | High Temperature Co-Fired Ceramic (HTCC) |

| Firing Temperature | Lower (~850–950 °C) | Higher (~1500–1600 °C) |

| Material | Glass-ceramic composites | Crystalline ceramics like alumina or mullite formulations. |

| Conductor Compatibility | High-conductivity metals with low melting point: gold, silver, copper | Refractory metals with a high melting point: tungsten, molybdenum, and manganese. |

| Mechanical and Thermal Strength | Moderate | High |

| Signal Loss | Low dielectric constant with low loss at higher frequencies. | Higher RF loss due to higher resistance metals |

| Primary Economic Driver | 5G-Advanced & 6G infrastructure | EV Power Modules & Industrial IoT |

| Key Applications | RF modules, medical implants, filters, integrated passive devices and consumer electronics. | High-power electronics, aerospace & defense, automotive engine control units, and harsh environment sensors. |

LTCC and HTCC Market: Value Chain Analysis

- Raw Material Procurement: This is the initial stage that involves sourcing of high-purity alumina, glass-ceramic powders and conductive pastes. While suppliers provide glass-ceramic systems

- Key Players: Ferro Corporation, DuPont, Heraeus, and Namics

- Manufacturing & Processing: This stage involves complex multilayer processing through tape casting, punching, printing, stacking, and then co-firing by using AI.

- Key Players: Kyocera, Murata Manufacturing, TDK Corporation, and NGK Spark Plug.

- Component Integration: The substrates are integrated into Antenna-in-Package (AiP) in LTCC and High-Power Silicon Carbide (SiC) modules

- Key Players: Mini-circuits, Samsung Electro-mechanics, and Taiyo Yuden.

- End-Use Industries: The final stage involves integration in telecommunications, automotive, aerospace, & defense and medical sectors, driving the global economic shift.

- Key Players: Ericsson, Nokia, Bosch, Tesla, and Northrop Grumman.

Regulatory Framework: LTCC and HTCC Market

| Region | Key Regulation | Impact of regulation on the LTCC/HTCC market |

| Global | ISO/EN Glass & Ceramics Standards | New standards for mechanical and thermal conductivity testing of advanced ceramics |

| European Union | RoHS Directive Updates | Standards focus on the industry shift to lead-Free (Green tape) glass-ceramic formulations. |

| United States | CHIPS Act/ ITAR 2026 | Focus on local manufacturing and increase costs for non-compliant global firms. |

| China | GB/T (Silicon Nitride Bare Ceramic), National Power Standards | Standards for the HTCC supply chain for the EV market, especially in power ceramics. |

| India | National policy on Electronics 2025/SPECS 2.0 Scheme, Production Incentives | Financial subsidies for local fabrication to reduce import dependence |

Segmental Insights

Technology Insights

Why the LTCC (Low Temperature Co-Fired Ceramics) Segment Dominates the LTCC and HTCC Market?

The LTCC (Low Temperature Co-Fired Ceramics) segment volume was valued at 667.02 kilo tons in 2025 and is projected to reach 1105.75 kilo tons by 2035, expanding at a CAGR of 5.78% during the forecast period from 2025 to 2035. The LTCC (Low Temperature Co-Fired Ceramics) segment dominated the market with approximately 58% share in 2025, due to its performance in high-frequency applications and efficient manufacturing, prominent for modern satellite communications and automotive radar systems. It allows high-conductivity metals like silver and copper, which improve electrical performance and reduce energy consumption, making it a widespread choice in consumer electronics and telecommunication infrastructure where miniaturization and low signal loss is vital.

The HTCC (High Temperature Co-Fired Ceramic) segment volume was valued at 483.21 kilo tons in 2025 and is projected to reach 684.36 kilo tons by 2035, expanding at a CAGR of 3.94% during the forecast period from 2025 to 2035.The HTCC (High Temperature Co-Fired Ceramic) segment is the fastest-growing in the market during the forecast period, driven by demand for electronic components that endure extreme mechanical and thermal stress, such as power modules for electric vehicles and aerospace sensors. Its durability, efficiency and thermal conductivity make it essential for industrial, medical, aerospace, and defence applications, while the segment alumina-based composition ensures long-term performance in harsh conditions, driving next-generation infrastructure adoption.

LTCC & HTCC Market Volume and Share, By Technology, 2025-2035

| By Technology | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| LTCC | 57.99% | 667.02 | 1105.75 | 5.78% | 61.77% |

| HTCC | 42.01% | 483.21 | 684.36 | 3.94% | 38.23% |

Material Type Insights

How did the Alumina (Al₂O₃) Segment hold the Largest Share in the LTCC and HTCC Market?

The alumina (Al₂O₃) segment held the largest revenue share of approximately 55% in the market in 2025. By offering exceptional strength, versatility, stability, and electrical insulation that provide high-performance, long-term reliability of high-density electronic packaging. Its balance of durability, manufacturing efficiency, and cost makes it fundamental for telecommunication and automotive electrification.

The glass-ceramic segment is experiencing the fastest growth in the market during the forecast period, due to its ultra-high-frequency performance, due to low dielectric loss in satellite communication networks and processability at lower temperatures. It supports high-conductivity metallization, miniaturization, and stability for advanced radar, satellite, and consumer electronics by becoming the key choice for high-reliability applications.

End-User Insights

Which End-User Industry Dominated the LTCC and HTCC Market?

The automotive electronics segment dominated the market with approximately 26% share in 2025. The industrial transition for vehicle electrification and autonomous systems with high-performance reliability. Its dielectric stability and durability support high-frequency sensors, mission-critical engine and control modules, vital for modern automotive safety and transport infrastructure.

The telecommunications segment is anticipated to grow fastest in the market during the forecast period. driven by the need for high-speed network infrastructure and satellite-based internet service. It enables miniaturized, reliable components for base stations, antennas, and compact filters, supporting the growth of advanced wireless communication systems and the adoption of the technological revolution.

Application Insights

How did the RF and Microwave Modules Segment hold the Largest Share in the LTCC and HTCC Market?

The RF and microwave modules segment held the largest revenue share of approximately 30% in the market in 2025. These modules integrate filtering, switching, and amplification into compact packages that preserve signal quality at high frequencies, providing low-loss performance and thermal stability for dense systems. Their electromagnetic shielding and dimensional stability make them the primary choice in electronic devices, supporting miniaturization and reliable operation in demanding environments. This segment is a key part of modern electronics.

The power electronics modules segment is experiencing the fastest growth in the market during the forecast period, driven by rising demand for compact, high-efficiency modules with enhanced thermal management, as well as the ability to withstand high-voltage and high-temperature conditions. They are gaining momentum in end-use applications like automotive, consumer electronics and renewable energy systems, which are fueling their adoption.

Manufacturing Process Insights

Why did the Tape Casting and Lamination Segment hold the Largest Share in the LTCC and HTCC Market?

The tape casting and lamination segment held the largest revenue share of approximately 45% in the market in 2025. Driven by high-density, multilayer substrates due to its producing uniform precision, ultra- thin ceramic sheets are essential for complex circuits. It allows precise layer stacking and internal wiring integration, supporting high-volume scalability and versatile material use. The leadership is due to its reliability in structural integrity and dimensional accuracy, which sets the industry standard for sophisticated packaging.

The screen printing segment is experiencing the fastest growth in the market during the forecast period. driven by the need for ultra-fine circuitry and high-density interconnections. Innovation in emulsion technology and conductive pastes enables precise, complex pattern deposition, crucial for high-frequency devices where consistent trace dimensions and surface finish reduce signal loss. Its scalability makes it dynamic for producing multilayer modules efficiently, supporting next-generation wireless and radar technologies.

Regional Insights

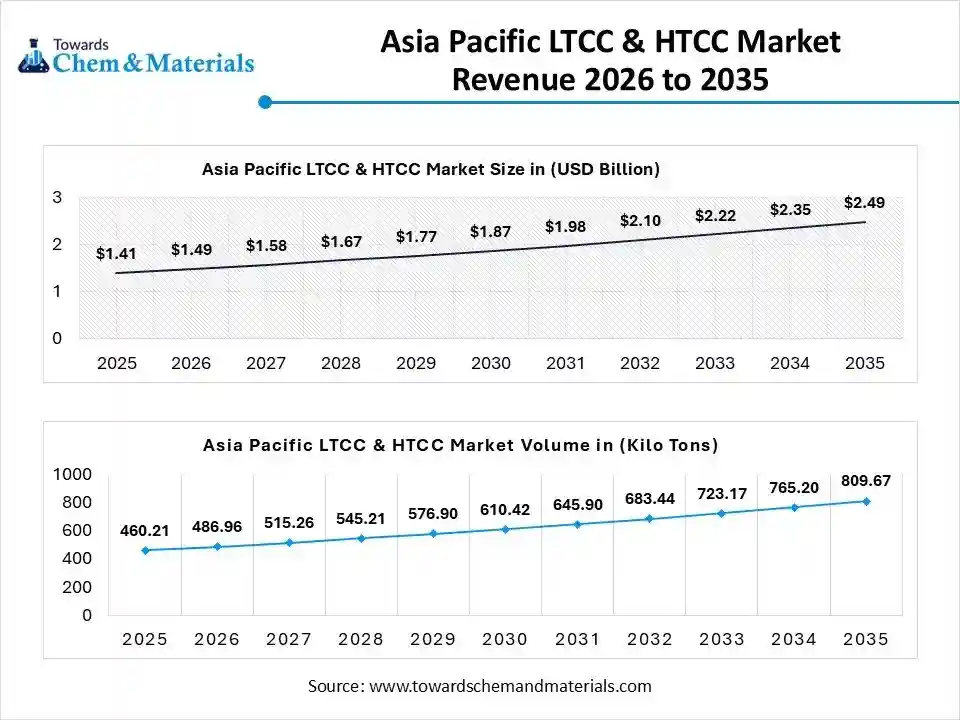

The Asia Pacific LTCC and HTCC market size was valued at USD 1.41 billion in 2025 and is expected to be worth around USD 2.49 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.86% over the forecast period from 2026 to 2035.

The Asia Pacific LTCC and HTCC volume was estimated at 460.21 kilo tons in 2025 and is projected to reach 809.67 kilo tons by 2035, growing at a CAGR of 6.48% from 2026 to 2035.Asia Pacific dominated the market with a 40% share in 2025, driven by its utilization of LTCC for filters and antennas due to its low signal loss. Its leadership is maintained by the adoption of 5G infrastructure and EV technology with its dominant global manufacturing hub for microelectronics and semiconductor ecosystems. Additionally, its strategic government policies and initiatives driving its production and large-scale investment in modernization.

China LTCC and HTCC Market Trends

China serves as a key leader in the electronics manufacturing hub driven by its vast domestic demand smartphone and IoT devices. The strong government initiatives boost technological innovation in high-performance electronic components. Additionally, the shift towards 5G networks and satellite communication infrastructure, and a focus on automotive electrification.

North America is expected to grow at the fastest CAGR in the market during the forecast period, acting as key hub for high-value innovation in the co-fired ceramic industry, especially in aerospace, defense, semiconductor packaging, and satellite communications. The region leads research in high-frequency materials and thermal management for computing and medical diagnostics, maintaining its influence as a leader in setting electronic system standards.

U.S. LTCC and HTCC Market Trends

The United States serves as a key country in both consumption and defense infrastructure. The rapid technological expansion of next-generation connectivity and large-scale satellite internet collections is fueling the market. The robust Research and development network for new ceramic compositions and innovation in semiconductors for sophisticated thermal management solutions is pushing the market towards expansion.

Europe LTCC and HTCC Market Trends

The Europe LTCC and HTCC volume was estimated at 265.01 kilo tons in 2025 and is projected to reach 360.17 kilo tons by 2035, growing at a CAGR of 3.47% from 2026 to 2035.Europe's shift towards sustainable solutions and smart grid monitoring systems is due to its superior proficiency and durability. The rising investments in domestic high-density semiconductor packaging capabilities focus to reduce supply chain resilience and production of ceramic modules. Additionally, the innovation in aerospace & satellite ensuring log-term reliability in harsh environmental conditions by using a navigation system.

Germany LTCC and HTCC Market Trends

Germany shows steady growth driven by its use in electric vehicle power modules, engine control units, and radar sensors. In the innovation of material science globally, especially in ceramic manufacturing and future-adapted to electronic packaging, Germany acts as a key hub. Additionally, the transition to energy infrastructure and its Industry 4.0 adoption maintain its leadership.

LTCC & HTCC Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 25.84% | 297.22 | 439.47 | 4.44% | 24.55% |

| Europe | 23.04% | 265.01 | 360.17 | 3.47% | 20.12% |

| Asia Pacific | 40.01% | 460.21 | 809.67 | 6.48% | 45.23% |

| South America | 6.01% | 69.13 | 99.35 | 4.11% | 5.55% |

| Middle East & Africa | 5.10% | 58.66 | 81.45 | 3.71% | 4.55% |

Recent Development

- In July 2025, Murata Manufacturing announced the large-scale production and commercial shipment by launching the world's first high-frequency filter using XBAR technology, including 5G, Wi-Fi 6E, Wi-Fi 7 and emerging 6G technologies by achieving high performance and low signal loss.(Source: www.businesswireindia.com)

Top Market Players in the LTCC and HTCC Market and Their Offerings

- Murata Manufacturing: The global leader for manufacturing and supply of co-fired ceramic technologies, especially LTCC and HTCC, offering high-frequency and miniaturized applications.

- Hitachi Metals: The global top provider of multilayer ceramic substrates. The focus is on the use of AI-driven inspection to maintain precise tolerances in multilayer HTCC substrates.

- Kyocera: The market player focuses on advancement in metallization paths, product innovation, miniaturization and high-temperature application.

- TDK Corporation

- NGK Spark Plug

- Taiyo Yuden

- KOA Corporation

- Maruwa

- CeramTec

- CoorsTek

- Rogers Corporation

- Morgan Advanced Materials

- 3M

- AdTech Ceramics

- NEC Corporation

- Samsung Electro-Mechanics

- Yageo Corporation

- CTS Corporation

- IBIDEN

- AT&S

Segment Covered in the Report

By Technology

- LTCC (Low Temperature Co-Fired Ceramics)

- HTCC (High Temperature Co-Fired Ceramics)

By Material Type

- Alumina (Al₂O₃)

- Glass-Ceramic

- Aluminum Nitride (AIN)

- Others (Zirconia, Mullite)

By End-User

- Automotive Electronics

- Telecommunications

- Aerospace & Defense

- Industrial Electronics

- Medical Devices

- Consumer Electronics

By Application

- RF and Microwave Modules

- Sensors & Actuators

- Power Electronics Modules

- Multi-Chip Modules (MCMs)

- Other Electronic Packaging

By Manufacturing Process

- Tape Casting & Lamination

- Screen Printing

- Laser Structuring & Drilling

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa