Content

What is the Current Precious Metal Market Size and Volume?

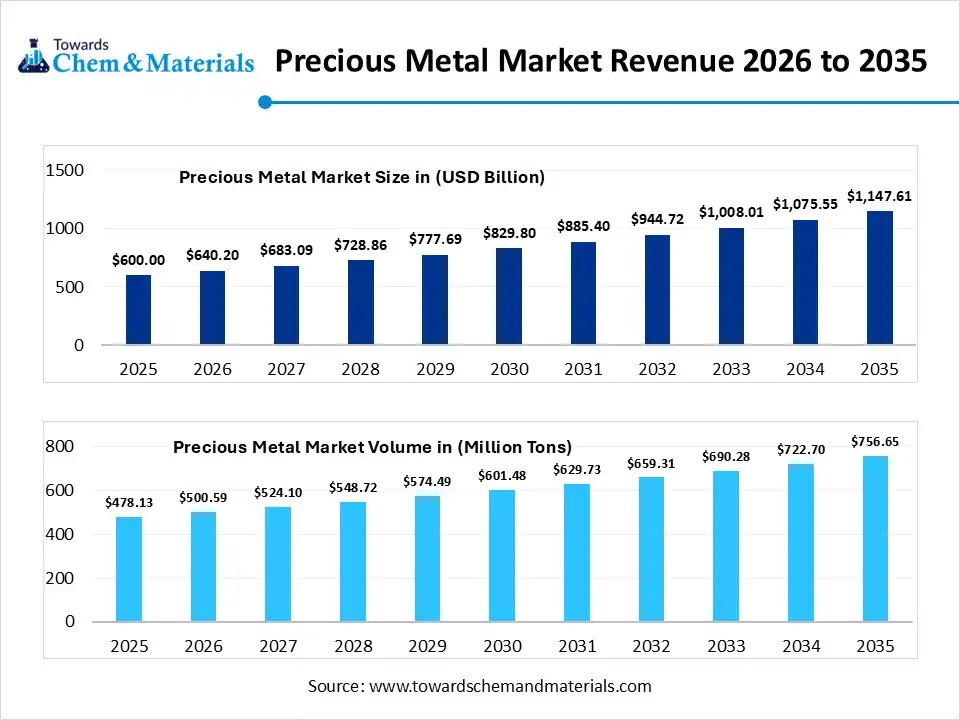

The global precious metal market size was estimated at USD 600.00 billion in 2025 and is expected to increase from USD 640.20 billion in 2026 to USD 1,147.61 billion by 2035, growing at a CAGR of 6.70% from 2026 to 2035. In terms of volume, the market is projected to grow from 478.13 million tons in 2025 to 756.65 million tons by 2035. growing at a CAGR of 4.70% from 2026 to 2035. Asia Pacific dominated the precious metal market with the largest volume share of 39.01% in 2025. The growth of the market is driven by the growing demand, increased investments, and adoption, fueling growth.

Key Takeaways

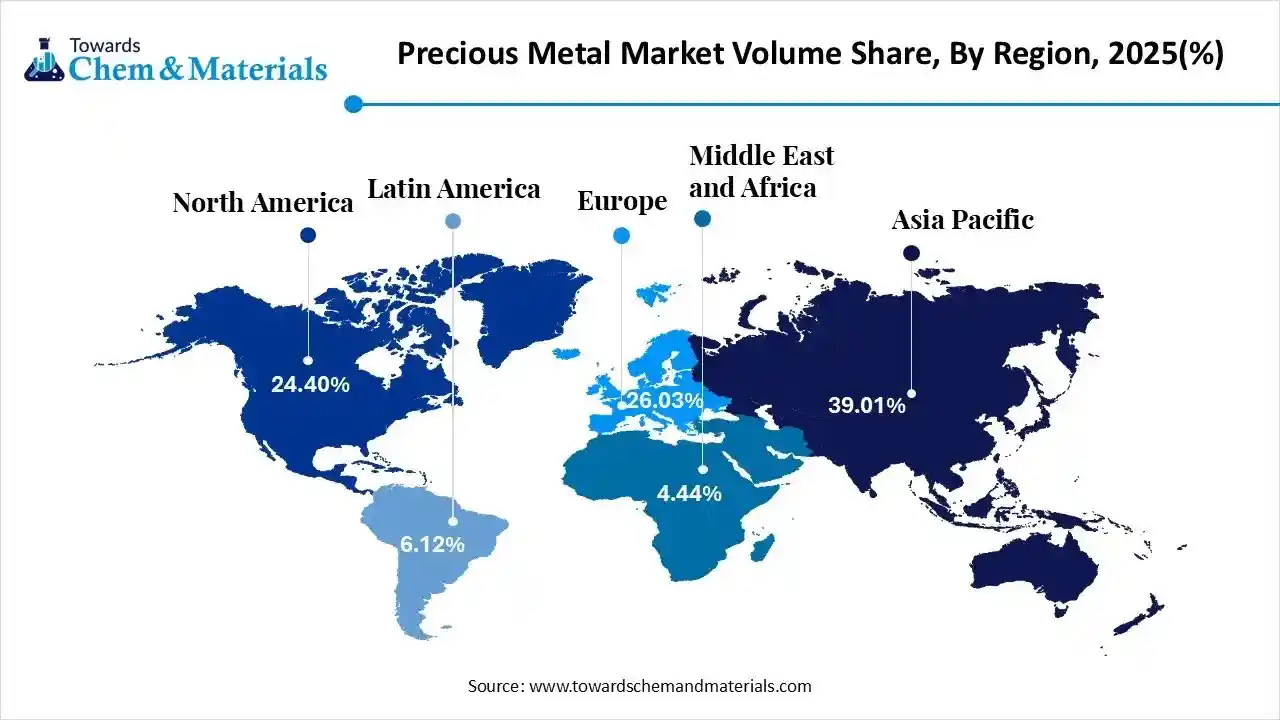

- The Asia Pacific dominated the precious metal market with the largest volume share of 39.01% in 2025.

- The precious metal market in Europe is expected to grow at a substantial CAGR of 3.35% from 2026 to 2035.

- The North America precious metal market segment accounted for the major volume share of 24.40% in 2025.

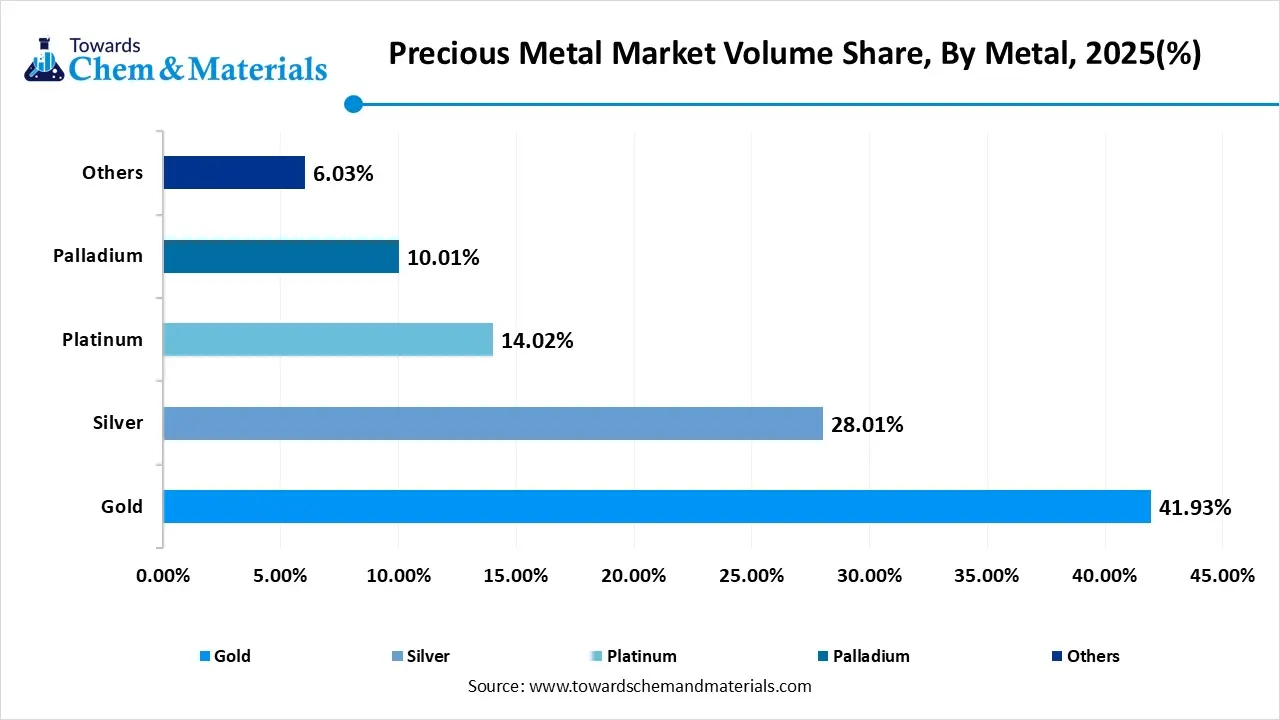

- By metal type, the gold segment dominated the market and accounted for the largest volume share of 41.93% in 2025.

- By metal type, the silver segment is expected to grow at the fastest CAGR of 6.12% from 2026 to 2035 in terms of volume.

- By end-user, the jewelry & luxury goods segment led the market with the largest revenue volume share of 36% in 2025.

- By form, the bars & ingots segment dominated the market and accounted for the largest volume share of 30% in 2025.

Market Overview

What Is The Significance Of The Precious Metal Market?

The precious metal market, covering gold, silver, platinum, and palladium, is significant as a critical hedge against inflation, currency fluctuations, and economic instability. It acts as a safe-haven asset class for portfolio diversification, while providing essential industrial materials for electronics, green technologies, and automotive applications. Market growth is driven by investment demand, automotive emission regulations, electronics miniaturization, renewable energy adoption, and the increasing use of precious metals in advanced industrial and medical applications.

Precious Metal Market Growth Trends:

- Safe-Haven Demand: Economic and geopolitical uncertainties are driving investors toward gold, strengthening its position as a primary hedge.

- Industrial Growth: Demand is surging for metals used in automotive catalysts, electronics, and renewable energy, specifically boosting silver and palladium.

- Supply & Recycling: Increased focus on urban mining and recycling of electronic waste is supplementing supply.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 640.20 Billion / 500.59 Million Tons |

| Revenue Forecast in 2035 | USD 1,147.61 Billion / 756.65 Million Tons |

| Growth Rate | CAGR 6.70% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Metal Type, By End-User Industry, By Form, By Regions |

| Key companies profiled | Newmont, Barrick Gold, Sibanye-Stillwater, Impala Platinum, Vale, Anglo American Platinum, Gold Fields, Norilsk Nickel, Johnson Matthey, Heraeus, Umicore, Tanaka Precious Metals, Asahi Refining, Mitsubishi Materials, BASF, Glencore, Freeport-McMoRan, Royal Gold, MMC Norilsk Nickel, Rand Refinery |

Trade Analysis Of Precious Metal Market: Import & Export Statistics

- According to Global Export data, from June 2024 to May 2025 (TTM), the world exported 66,883 shipments of Precious Metal. These exports involved 1,952 exporters and were sent to 2,676 buyers.

- Most of these exports went to Liechtenstein, Ukraine, and Argentina.

- Globally, the leading exporters of Precious Metals are Vietnam, China, and India. Vietnam tops the list with 59,570 shipments, followed by the China with 56,560 shipments and India with 8,473 shipments.

Precious Metal Market Value Chain Analysis

- Metal Processing & Fabrication: Precision metal products are manufactured through processes such as CNC machining, precision stamping, forging, laser cutting, metal injection molding, surface finishing, and tight-tolerance assembly to meet exact specifications across industrial applications.

- Key players: Amtek Engineering, Smith Metal Products, O’Neal Manufacturing Services, Thyssenkrupp Materials

- Quality Testing and Certification: Precision metal manufacturing requires certifications ensuring dimensional accuracy, material integrity, process control, and industry compliance. Key certifications include ISO 9001 and ISO 14001 standards, AS9100 for aerospace components, IATF 16949 for automotive parts, and ASTM material specifications.

- Key players: ISO (International Organization for Standardization), ASTM International, SAE International, TÜV SÜD

- Distribution to Industrial Users: Precision metal components are supplied to automotive OEMs, aerospace and defense manufacturers, electronics producers, medical device companies, industrial machinery manufacturers, and energy sector operators.

- Key players: Thyssenkrupp Materials, O’Neal Manufacturing Services, Amtek Engineering.

Precious Metal Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Policies | Focus Areas |

| United States | SEC (Securities and Exchange Commission) CFTC (Commodity Futures Trading Commission) EPA (Environmental Protection Agency) Mine Safety and Health Administration (MSHA) |

Commodity market oversight & anti-fraud rules Futures/options trading rules (e.g., COMEX) Environmental compliance (Clean Air/Water Acts) Mining safety regulations |

Market integrity & price transparency Regulated derivatives & spot markets Environmental permitting for mining/refining Worker safety in extraction operations |

| European Union | European Securities and Markets Authority (ESMA) European Commission EU Critical Raw Materials Act |

Market abuse & trading transparency frameworks Critical Raw Materials Act (CRM Act) (secure sustainable supply) Environmental & mining permitting laws |

Market conduct rules Responsible sourcing & sustainability Harmonized environmental standards |

| China | People’s Bank of China (PBOC) China Anti-Money Laundering Monitoring & Analysis Center Ministry of Ecology and Environment (MEE) |

New Anti-Money Laundering & Counter-Terrorism Financing Measures for precious metals dealers Reporting rules for high-value transactions (≥ ~¥100,000) Environmental control standards for mining/refining |

AML/CFT compliance & reporting Transaction reporting & customer due diligence Environmental permits & emissions limits |

Segmental Insights

Metal Type Insights

Which Metal Type Segment Dominated the Precious Metal Market in 2025?

The gold segment volume was valued at 200.48 million tons in 2025 and is projected to reach 312.04 million tons by 2035, expanding at a CAGR of 5.04% during the forecast period from 2025 to 2035. The gold segment dominated the market accounting for approximately 42% share in 2025, due to its dual role as a luxury material and a financial safe-haven asset. Demand for gold is driven by jewelry manufacturing, investment demand, central bank reserves, and expanding use in electronics and medical devices. Its corrosion resistance, conductivity, and long-term value retention make gold essential across both consumer and industrial applications, especially during periods of economic uncertainty and inflationary pressures.

The silver segment volume was valued at 133.92 million tons in 2025 and is projected to reach 228.51 million tons by 2035, expanding at a CAGR of 6.12% during the forecast period from 2025 to 2035.The silver segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, owing to its extensive industrial applications alongside traditional jewelry and investment use. Its superior electrical and thermal conductivity make it indispensable in electronics, photovoltaic cells, automotive electronics, and medical devices. Rising adoption of renewable energy technologies, particularly solar panels, significantly boosts silver demand, positioning it as both a precious and industrial metal with strong long-term growth prospects.

Precious Metal Market Volume and Share,By Metal, 2025-2035

| By Metal | Market Volume Share (%), 2025 | Market Volume (Mn. Tons)2025 | Market Volume (Mn. Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Gold | 41.93% | 200.48 | 312.04 | 5.04% | 41.24% |

| Silver | 28.01% | 133.92 | 228.51 | 6.12% | 30.20% |

| Platinum | 14.02% | 67.03 | 91.63 | 3.53% | 12.11% |

| Palladium | 10.01% | 47.86 | 79.83 | 5.85% | 10.55% |

| Others | 6.03% | 28.83 | 44.64 | 4.98% | 5.90% |

End User Insights

How did the Jewelry and Luxury Goods Segment Dominate the Precious Metal Market in 2025?

The jewelry and luxury goods segment dominated the market accounting for approximately 36% share in 2025, driven by cultural significance, rising disposable incomes, and demand for premium lifestyle products. Emerging economies contribute strongly through wedding and ceremonial demand, while developed markets emphasize design innovation and branded luxury offerings. Precious metals also serve as a store of value, further sustaining jewelry demand across global markets.

The electronic and electrical segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, due to its excellent conductivity, corrosion resistance, and reliability. Gold and silver are widely used in connectors, circuit boards, semiconductors, sensors, and advanced electronic components. The expansion of electric vehicles, 5G infrastructure, renewable energy systems, and smart electronics continues to increase precious metal consumption in high-performance electronic applications.

Form Insights

Which Form Segment Dominated the Precious Metal Market in 2025?

The bars and ingots segment dominated the market accounting for approximately 30% share in 2025, primarily driven by investment, central bank reserves, and institutional trading. These forms offer standardized purity, ease of storage, and liquidity, making them ideal for wealth preservation and large-scale transactions. Growing investor interest in physical assets during volatile economic conditions continues to support demand for precious metal bars and ingots globally.

The powder and granules segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, widely used in industrial and manufacturing applications where precise dosing and material efficiency are required. These forms are essential for electronics manufacturing, additive manufacturing, chemical catalysts, and advanced material processing. Rising demand for miniaturized electronic components, precision coatings, and high-performance industrial processes is driving increased consumption of precious metals in powder and granular forms.

Regional Analysis

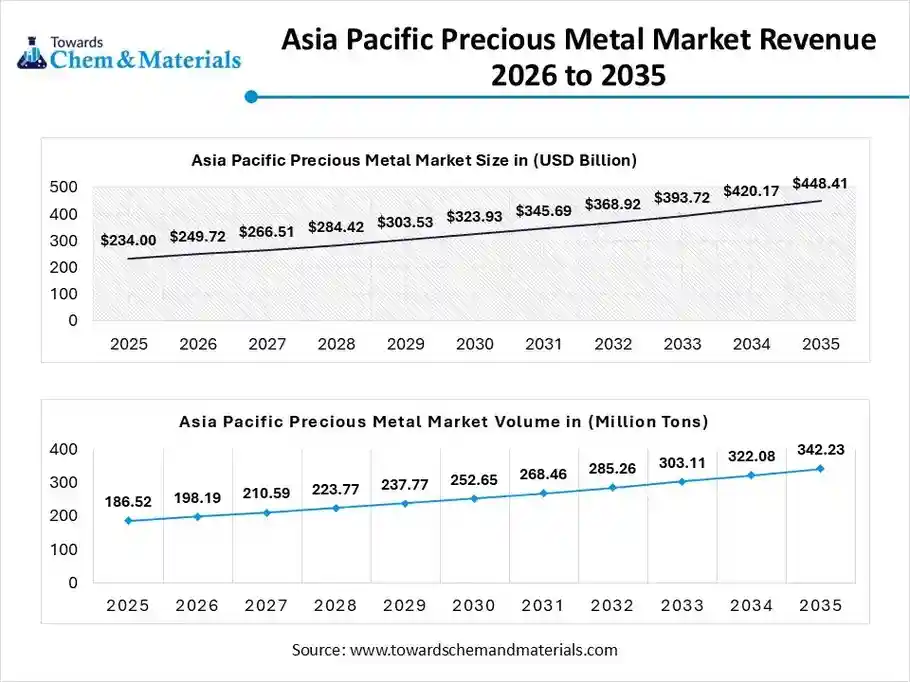

The Asia Pacific precious metal market size was valued at USD 234.00 billion in 2025 and is expected to be worth around USD 448.41 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.72% over the forecast period from 2026 to 2035.

The Asia Pacific precious metal volume was estimated at 186.52 million tons in 2025 and is projected to reach 342.23 million tons by 2035, growing at a CAGR of 6.98% from 2026 to 2035.Asia Pacific dominated the market with a share of approximately 39% in 2025, driven by rapid industrialization, expanding electronics manufacturing, and large-scale automotive production. Countries across the region are investing heavily in advanced machining technologies and precision fabrication to support high-volume manufacturing. Growth in EVs, consumer electronics, industrial automation, and semiconductor fabrication continues to fuel demand for precision metal components.

China: Precious Metal Market Growth Trends

China dominates the Asia Pacific market due to its massive manufacturing base and strong presence in electronics, automotive, and industrial equipment production. Increasing focus on high-precision manufacturing, domestic technological advancement, and supply chain localization drives investments in CNC machining and advanced metal processing. The rapid expansion of EV production and semiconductor equipment manufacturing further accelerates demand for precision metal components.

North America: Precious Metal Market Growth Analysis

North America precious metal volume was estimated at 116.66 million tons in 2025 and is projected to reach 167.07 million tons by 2035, growing at a CAGR of 4.07% from 2026 to 2035. supported by advanced manufacturing infrastructure, high automation adoption, and strong demand from aerospace, automotive, electronics, and medical device industries. The region emphasizes tight tolerances, high-quality machining, and advanced metal forming technologies. Increasing investments in electric vehicles, defense modernization, and semiconductor manufacturing continue to drive demand for precision-engineered metal components across multiple end-use sectors.

United States: Precious Metal Market Growth Trends

The United States dominates the North American market due to its strong aerospace, defense, automotive, and medical manufacturing base. High adoption of CNC machining, additive manufacturing integration, and Industry 4.0 technologies enhances the production of complex, high-precision metal parts. Growing demand for lightweight yet durable components in EVs, medical implants, and industrial automation further strengthens market growth across the country.

Europe: Precious Metal Market Growth Analysis

Europe precious metal volume was estimated at 124.46 million tons in 2025 and is projected to reach 167.45 million tons by 2035, growing at a CAGR of 3.35% from 2026 to 2035. Europe represents a mature and technologically advanced precious metal market, driven by strong engineering expertise and stringent quality standards. The region benefits from high demand in automotive manufacturing, industrial machinery, renewable energy systems, and electronics. Sustainability initiatives, lightweighting trends, and increasing use of high-performance alloys contribute to the rising demand for precision metal components across the region.

Germany: Precious Metal Market Growth Trends

Germany leads the European market, supported by its globally competitive automotive, industrial equipment, and mechanical engineering industries. The country’s emphasis on high-precision machining, toolmaking excellence, and automation technologies drives consistent demand for precision metal parts.

Precious Metal Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Mn. Tons)2025 | Market Volume (Mn. Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 24.40% | 116.66 | 167.07 | 4.07% | 22.08% |

| Europe | 26.03% | 124.46 | 167.45 | 3.35% | 22.13% |

| Asia Pacific | 39.01% | 186.52 | 342.23 | 6.98% | 45.23% |

| South America | 6.12% | 29.26 | 41.99 | 4.10% | 5.55% |

| Middle East & Africa | 4.44% | 21.23 | 37.91 | 6.65% | 5.01% |

Recent Developments

- In November 2025, the Tredo app, a digital investment platform from Physical2Digital Traders Private Limited, was launched to make investing in digital gold and silver more accessible and affordable for Indian investors.(Source: www.passionateinmarketing.com)

- In June 2025, Metallix Refining launched APR4 (Advanced Pyrolytic Reduction). This proprietary thermal reduction technology is designed to recover precious metals from complex waste streams.(Source: www.recyclingtoday.com)

Top players in the Precious Metal Market & Their Offerings:

- Newmont: maintains its position as the world's largest gold producer. Headquartered in Denver, Colorado, the company produces gold, copper, silver, zinc, and lead across operations in North America, South America, Australia, Africa, and Papua New Guinea.

- Barrick Gold: Barrick Mining Corporation (formerly Barrick Gold) remains a dominant global producer of gold and copper, undergoing a significant strategic transformation and leadership transition.

- Sibanye-Stillwater: Sibanye-Stillwater Limited has transitioned to new leadership while continuing its strategic pivot toward battery metals amid ongoing restructuring of its traditional platinum group metal (PGM) operations.

- Impala Platinum: Impala Platinum Holdings Limited (Implats) continues to operate as the world's second-largest producer of platinum group metals (PGMs), navigating a period of significant operational restructuring and geographic consolidation.

- Vale: Vale S.A. is a Brazilian multinational corporation and a global leader in the metals and mining industry, currently focusing on iron ore and energy transition materials like copper and nickel.

- Anglo American Platinum

- Gold Fields

- Norilsk Nickel

- Johnson Matthey

- Heraeus

- Umicore

- Tanaka Precious Metals

- Asahi Refining

- Mitsubishi Materials

- BASF

- Glencore

- Freeport-McMoRan

- Royal Gold

- MMC Norilsk Nickel

- Rand Refinery

Segments Covered

By Metal Type

- Gold

- Silver

- Platinum

- Palladium

- Others (Rhodium, Iridium, Ruthenium, Osmium)

By End-User Industry

- Jewelry & Luxury Goods

- Automotive

- Electronics & Electrical

- Financial & Investment Institutions

- Healthcare & Chemicals

- Others

By Form

- Bars & Ingots

- Coins

- Powder & Granules

- Jewelry & Semi-Fabricated Forms

Others

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa