Content

What is the Current Acoustic Insulation Market Size and Volume?

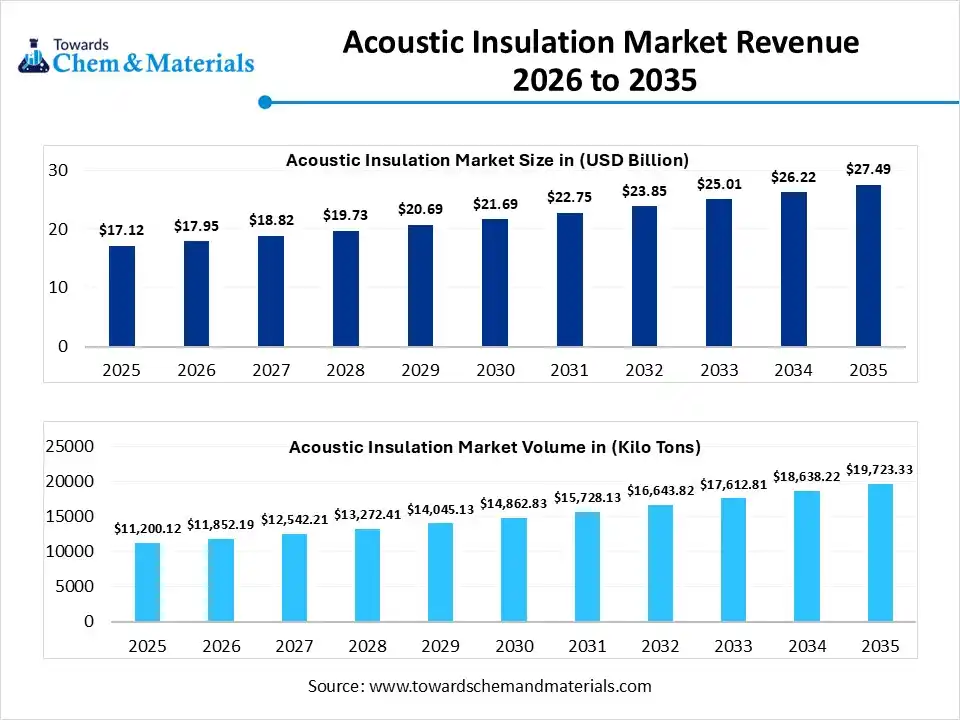

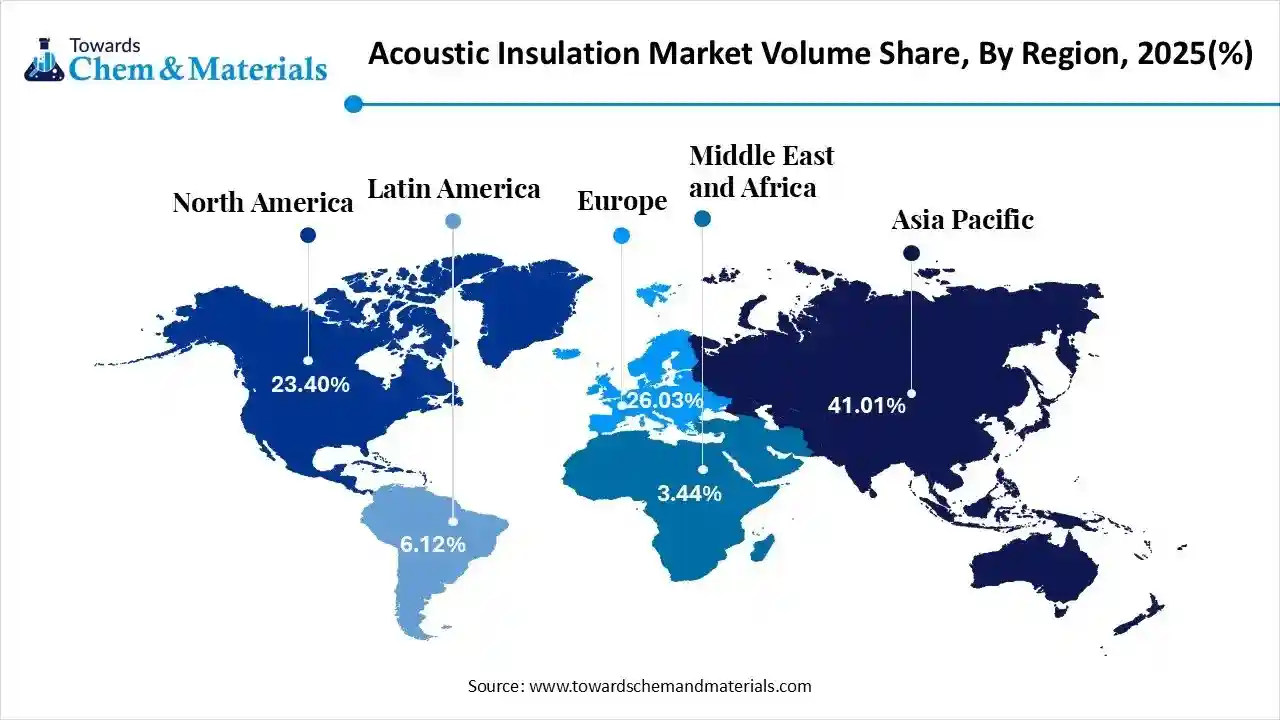

The global acoustic insulation market size was estimated at USD 17.12 billion in 2025 and is expected to increase from USD 17.95 billion in 2026 to USD 27.49 billion by 2035, growing at a CAGR of 4.85% from 2026 to 2035. In terms of volume, the market is projected to grow from 11,200.12 kilo tons in 2025 to 19,723.33 kilo tons by 2035. growing at a CAGR of 5.82% from 2026 to 2035. Asia Pacific dominated the acoustic insulation market with the largest volume share of 41.01% in 2025. The increasing product demand in the construction sector for soundproofing is the key factor driving market growth. Also, the growing need for enhanced comfort in transportation, coupled with the strict building regulations, can fuel market growth further.

Key Takeaways

- The Asia Pacific dominated the acoustic insulation market with the largest volume share of 41.01% in 2025.

- The acoustic insulation market in North America is expected to grow at a substantial CAGR of 7.72% from 2026 to 2035.

- The Europe acoustic insulation market segment accounted for the major volume share of 26.03% in 2025.

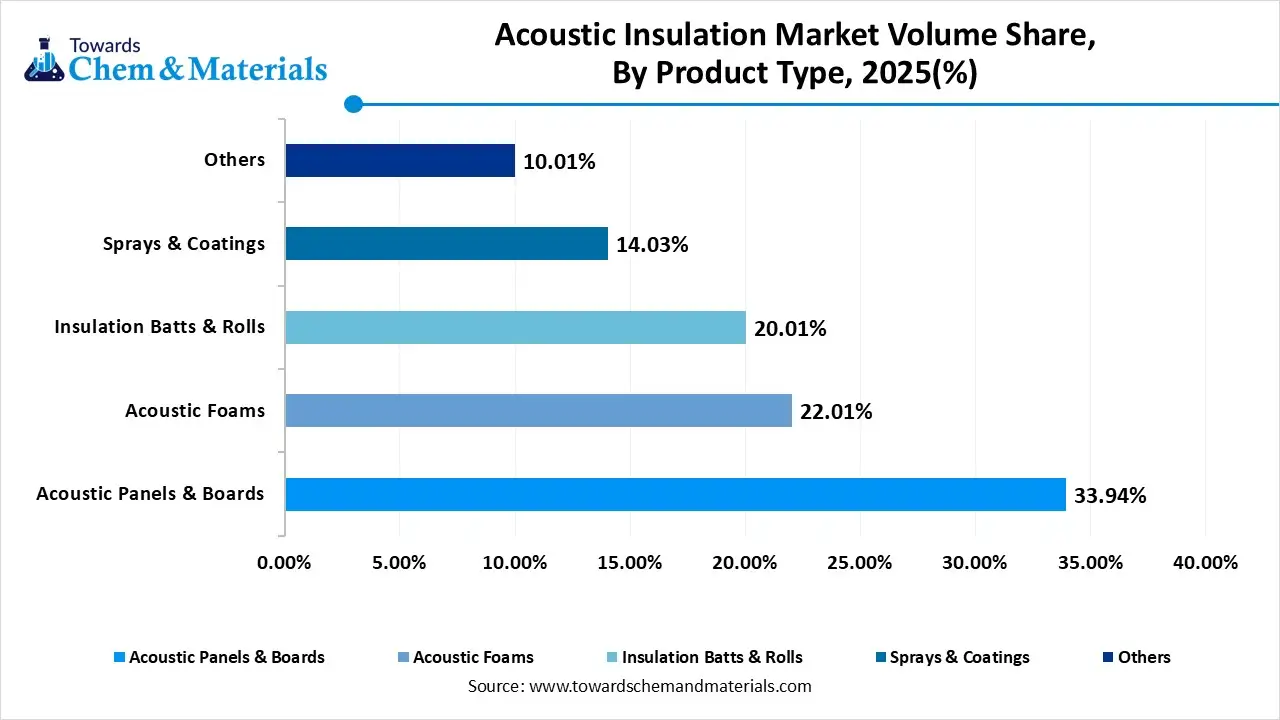

- By product type, the acoustic panels & boards segment dominated the market and accounted for the largest volume share of 34.0% in 2025.

- By product type, the sprays & coatings segment is expected to grow at the fastest CAGR of 9.63% from 2026 to 2035 in terms of volume.

- By material type, the mineral wool segment led the market with the largest revenue volume share of 32.0% in 2025.

- By end user, the building & construction segment dominated the market and accounted for the largest volume share of 40.0% in 2025.

- By application, the walls & ceilings segment led the market with the largest revenue volume share of 36.0% in 2025.

Market Overview

The market includes the manufacturing, processing, and supply of materials and systems designed to reduce, absorb, or block sound transmission across residential, commercial, industrial, automotive, transportation, and infrastructure applications. Acoustic insulation materials include mineral wool, fiberglass, foam plastics, textiles, polymer-based composites, and natural materials used in walls, ceilings, floors, machinery enclosures, vehicles, and public infrastructure.

Acoustic Insulation Market Trends

- The increasing demand for sustainable solutions is the latest trend in the market, shaping positive market growth. There is a growing emphasis on recyclable and sustainable materials to meet environmental standards and address consumer preferences.

- The ongoing technological advancements in the manufacturing process are another major factor driving market growth. Advancements in materials and production processes have led to the development of more sustainable and efficient acoustic insulation solutions.

- Governments across the globe are implementing stringent building codes and noise control laws, pushing producers and builders to add cutting-edge acoustic insulation materials, leading to market growth soon.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 17.95 Billion / 11,852.19 Kilo Tons |

| Revenue Forecast in 2035 | USD 27.49 Billion / 19,723.33 Kilo Tons |

| Growth Rate | CAGR 5.82% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type, By Product Type, By End-User Industry, By Application, By Region |

| Key companies profiled | Saint-Gobain, Rockwool Group, Owens Corning, Knauf Insulation, Kingspan Group, Johns Manville, BASF, 3M, Covestro, Armacell, Huntsman, DuPont, Sika, Saint-Gobain Ecophon, Armstrong World Industries, USG Corporation, Nitto Denko, Autoneum, Lydall, Trelleborg |

How Cutting-Edge Technologies Are Revolutionizing the Acoustic Insulation Market?

Advanced technologies are revolutionizing the market from a conventional, passive industry into a high-performance and proactive sector. Furthermore, major advancements include advanced nanomaterials, smart IoT-enabled systems, and sustainable bio-based products, which are transforming noise management in automotive, construction, and industrial applications.

Trade Analysis of the Acoustic Insulation Market Import & Export Statistics

- Between June 2024 to May 2025, United States imported 5,098 shipments of Acoustic Panel.

- In 2025, the United States maintained its position as the leading global importer of acoustic panels with 7,844 shipments, India (174 shipments) and Germany (96 shipments), which ranked second and third, respectively.

- Most of the insulation materials exported from India go to the United States, Nigeria, and Nepal.

- China leads the global insulation materials exports with 11,993 shipments, followed by the United States (4,466 shipments) and Russia (2,185 shipments). Together, these top three nations lead international trade in this sector.

Acoustic Insulation Market Value Chain Analysis

- Feedstock Procurement: It includes the sourcing, acquisition, and management of raw materials necessary to produce sound-dampening products such as glass wool and mineral wools.

- Major Players: Saint-Gobain S.A, ROCKWOOL International A/S.

- Chemical Synthesis and Processing: It includes the cater specialized chemical engineering method used to manufacture high-performance sound-dampening materials such as aerogels and foamed plastics.

- Major Players:BASF SE, Armacell International.

- Packaging and Labelling: It is a crucial step in maintaining material performance, meeting stringent regulatory standards, and ensuring safe transport for industrial and building safety.

- Major Players: Knauf Insulation, Owens Corning.

- Regulatory Compliance and Safety Monitoring:It refers to the adherence to legal standards and ongoing surveillance of material toxicity in industrial, construction, and transportation sectors.

- Major Players: Kingspan Group, Siderise.

Acoustic Insulation Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| Europe | Energy Performance of Buildings Directive (EPBD): Updated in 2023, this directive integrates acoustic performance into energy efficiency standards for all new buildings. |

| United States | International Building Code (IBC): Sets specific acoustic performance standards for new residential and commercial buildings to reduce noise transmission between units. |

| India | The Energy Conservation Building Code (ECBC) in states like Andhra Pradesh increasingly includes provisions to reduce both energy consumption and noise pollution in commercial buildings. |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated Acoustic Insulation Market in 2025?

The acoustic panels & boards segment volume was valued at 3801.32 kilo tons in 2025 and is projected to reach 6550.12 kilo tons by 2035, expanding at a CAGR of 6.23% during the forecast period from 2025 to 2035. The acoustic panels & boards segment dominated the market with approximately 34.0% share in 2025. The dominance of the segment can be linked to the growing need for soundproofing in commercial and residential construction, along with stringent noise regulations. Greater demand for acoustic panels is associated with green building standards such as LEED and WELL.

The sprays & coatings segment volume was valued at 1571.38 kilo tons in 2025 and is projected to reach 3595.56 kilo tons by 2035, expanding at a CAGR of 9.63% during the forecast period from 2025 to 2035.The growth of the segment can be driven by growing demand for smooth and versatile noise-reduction alternatives in complex and retrofit applications. Moreover, these are rapidly favoured for their ability to be applied on curved, irregular surfaces, offering a joint-free acoustic barrier.

Acoustic Insulation Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Acoustic Panels & Boards | 33.94% | 3801.32 | 6550.12 | 6.23% | 33.21% |

| Acoustic Foams | 22.01% | 2465.15 | 3595.56 | 4.28% | 18.23% |

| Insulation Batts & Rolls | 20.01% | 2241.14 | 4358.86 | 7.67% | 22.10% |

| Sprays & Coatings | 14.03% | 1571.38 | 3595.56 | 9.63% | 18.23% |

| Others | 10.01% | 1121.13 | 1623.23 | 4.20% | 8.23% |

Material Type Insights

How Much Share Did the Mineral Wool Segment Held in 2025?

The mineral wool segment dominated the market with nearly 32.0% share in 2025. The dominance of the segment can be attributed to the growing need for energy-efficient building solutions, along with better sound absorption properties of NRC. In addition, market players are heavily investing in R&D to develop cutting-edge mineral wool products with improved performance.

The textiles & natural materials segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising need for better sound absorption in green buildings and a surge in the use of materials such as cotton, hemp, and cork. Natural fibers possess microscopic structures that provide exceptional sound absorption.

End-User Insights

Which End-User Type Segment Dominated Acoustic Insulation Market in 2025?

The building & construction segment held a nearly 40.0% market share in 2025. The dominance of the segment is owing to the growing need for energy-efficient and comfortable living spaces, coupled with the expanding infrastructure, in emerging regions. The growing demand for sustainable solutions such as rock wool and glass wool, which are preferred for their fire resistance, is driving segment growth shortly.

The automotive & transportation segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing demand for sustainable and lightweight materials to enhance fuel efficiency and NVH reduction technologies. Also, advancements in material design, like enhanced insulation techniques, enable better thermal efficiency.

Application Insights

Which Application Type Segment Dominated Acoustic Insulation Market in 2025?

The walls & ceilings segment dominated the market with nearly 36.0% share in 2025. The dominance of the segment can be attributed to the increasing emphasis on BREEAM and LEED certification, which fuels demand for insulation in walls and ceilings. In addition, governments across the globe are enforcing stringent regulations regarding acoustic insulation use.

The vehicles & transportation segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the growing need for improved in-cabin comfort and the surge in adoption of electric vehicles (EVs). Furthermore, automakers are searching for materials that are lightweight to enhance overall fuel efficiency while offering superior noise reduction.

Regional Insights

The Asia Pacific acoustic insulation market size was valued at USD 7.00 billion in 2025 and is expected to be worth around USD 16.36 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.86% over the forecast period from 2026 to 2035.

The Asia Pacific acoustic insulation volume was estimated at 4,593.17 kilo tons in 2025 and is projected to reach 9,512.56 kilo tons by 2035, growing at a CAGR of 8.43% from 2026 to 2035. Asia Pacific dominated the market with nearly 41.0% share in 2025. The dominance and growth of the region can be attributed to the ongoing urbanisation, stringent noise control standards in emerging nations, and extensive infrastructure development. In addition, governments in the region are increasingly enforcing stringent environmental regulations and building codes regarding noise control in many urban settings.

China Acoustic Insulation Market Trends

In the Asia Pacific, China dominated the market owing to growing product demand in the EV automotive and residential sectors, coupled with the ongoing urbanisation in the country. Also, rapid investment in public infrastructure, like airports, high-speed rail networks, and highway expansions, is increasing the demand for noise barrier systems.

North America Acoustic Insulation Market Trends

The North America acoustic insulation volume was estimated at 2620.83 kilo tons in 2025 and is projected to reach 5116.23 kilo tons by 2035, growing at a CAGR of 7.72% from 2026 to 2035. North America is expected to grow at a fastest CAGR over the forecast period. The growth of the region can be driven by increasing demand for acoustic comfort in commercial and residential sectors, along with the rapid urbanisation across the region. Moreover, advancements in materials, like high-performance and lightweight products, are improving the overall performance of green buildings.

U.S. Acoustic Insulation Market Trends

In North America, the U.S. led the market due to increasing awareness regarding health impacts from noise pollution, along with the substantial investment in transportation and industrial projects. In commercial facilities such as healthcare facilities, offices, and educational institutions, acoustic comfort is crucial to improve employee productivity and overall well-being.

Europe Acoustic Insulation Market Trends

The Europe acoustic insulation volume was estimated at 2915.39 kilo tons in 2025 and is projected to reach 3595.56 kilo tons by 2035, growing at a CAGR of 2.36% from 2026 to 2035. Europe held a significant market share in 2025. The dominance of the region can be credited to the strict regulatory standards and directives to control noise pollution, coupled with the robust emphasis on green building practices. Furthermore, the region has a substantial stock of older buildings that require extensive retrofitting to fulfil energy and modern acoustic standards.

Germany Acoustic Insulation Market Trends

The growth of the market in the country can be driven by increasing consumer awareness of noise pollution and the ongoing demand for enhanced acoustic comfort in working spaces. Additionally, the country's status as an industrial hub fuels demand for noise reduction in logistics centers and manufacturing plants, contributing to market growth in the near future.

Acoustic Insulation Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 23.40% | 2620.83 | 5116.23 | 7.72% | 25.94% |

| Europe | 26.03% | 2915.39 | 3595.56 | 2.36% | 18.23% |

| Asia Pacific | 41.01% | 4593.17 | 9512.56 | 8.43% | 48.23% |

| South America | 6.12% | 685.45 | 887.55 | 2.91% | 4.50% |

| Middle East & Africa | 3.44% | 385.28 | 611.42 | 5.27% | 3.10% |

Recent Developments

- In January 2026, Sprayman introduced a comprehensive online platform providing professional-standard spray foam insulation kits created especially for residential DIY applications. The platforms address increasing demand for energy-efficient home enhancements by offering homeowners quality materials.(Source: www.thenewsstar.com)

Acoustic Insulation Market Companies

- Saint-Gobain: Saint-Gobain is a global leader in the acoustic insulation market, offering a comprehensive range of high-performance glass wool and rock wool solutions for residential, commercial, and industrial sectors.

- Rockwool Group: The Rockwool Group is a global leader in stone wool acoustic insulation, offering sustainable, fire-resistant, and high-performance sound absorption solutions for buildings, marine, and industrial applications.

- Owens Corning: Owens Corning is a dominant global leader in the acoustic insulation market, consistently ranked alongside competitors like Saint-Gobain and ROCKWOOL. The company leverages its massive scale as the world's largest manufacturer of fiberglass composites.

- Knauf Insulation

- Kingspan Group

- Johns Manville

- BASF

- 3M

- Covestro

- Armacell

- Huntsman

- DuPont

- Sika

- Saint-Gobain Ecophon

- Armstrong World Industries

- USG Corporation

- Nitto Denko

- Autoneum

- Lydall

- Trelleborg

Segments Covered in the Report

By Material Type

- Mineral Wool (Stone Wool & Slag Wool)

- Fiberglass

- Foam Plastics

- Textiles & Natural Materials

- Others

By Product Type

- Acoustic Panels & Boards

- Acoustic Foams

- Insulation Batts & Rolls

- Sprays & Coatings

- Others

By End-User Industry

- Building & Construction

- Automotive & Transportation

- Industrial & Manufacturing

- Industrial & Manufacturing

- Others

By Application

- Walls & Ceilings

- Floors

- Machinery & Equipment Enclosure

- Vehicles & Transportation Systems

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa