Content

U.S. Green Chemicals Market Size, Share, Trends and Forecasts 2034

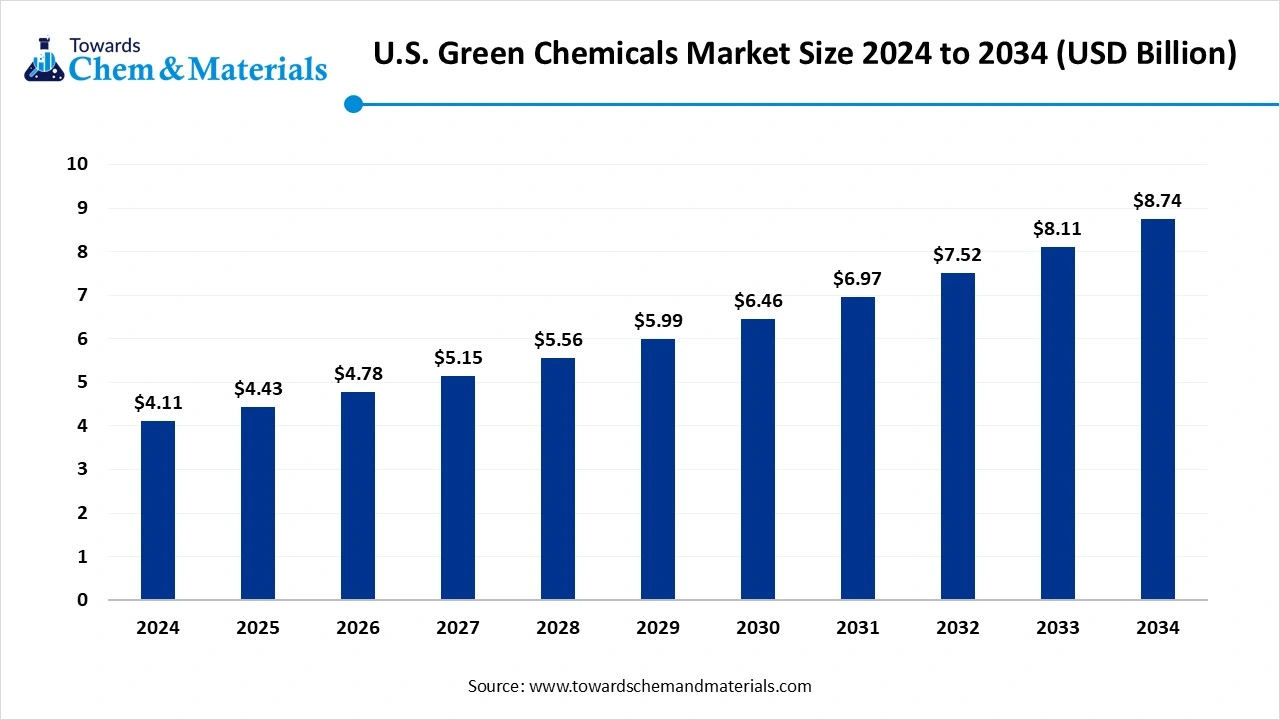

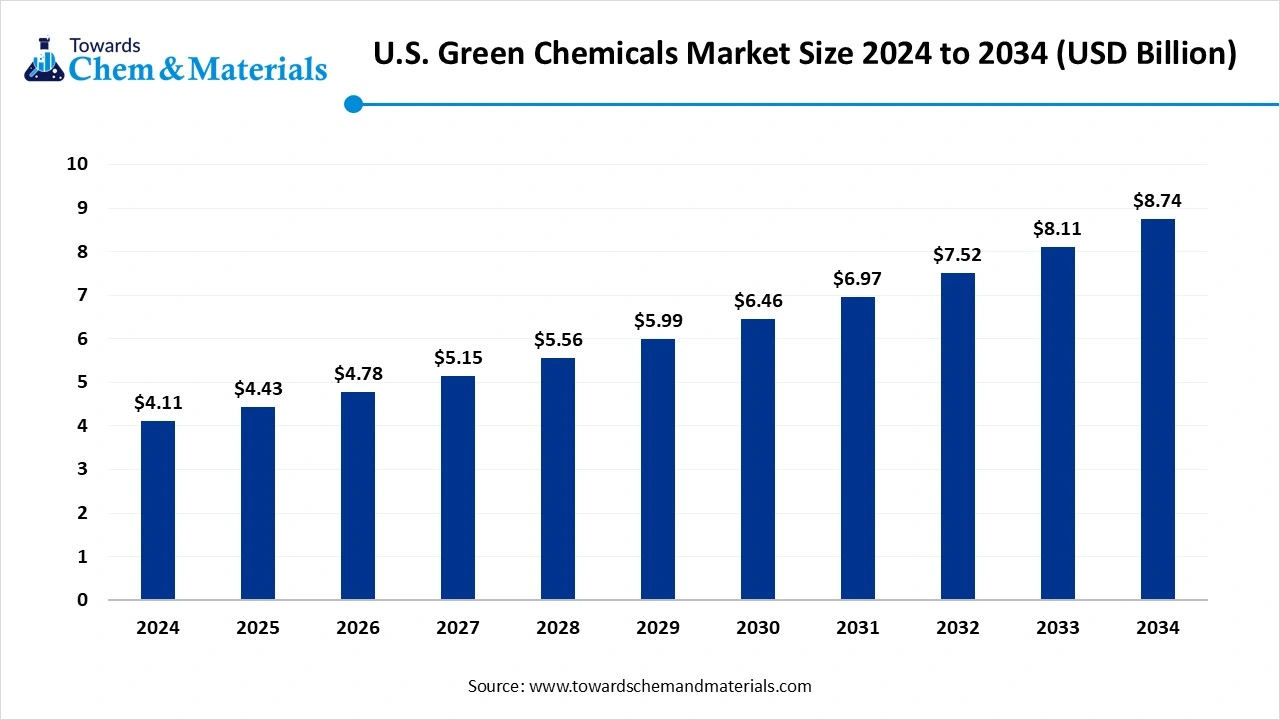

The U.S. green chemicals market size is calculated at USD 4.11 billion in 2024, grew to USD 4.43 billion in 2025, and is projected to reach around USD 8.74 billion by 2034. The market is expanding at a CAGR of 7.84% between 2025 and 2034.The market demand is driven by increasing consumer demand for sustainable products backe d by strong federal regulatory incentives.

Key Takeaways

- By product type, the bio-based solvents segment held approximately 35% share in the market in 2024.

- By product type, the bio-based polymers & bioplastics segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By feedstock, the plant oils & fats segment held approximately 40% share in the market in 2024.

- By feedstock, the lignocellulosic biomass segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the packaging & plastics segment held approximately 30% share in the market in 2024.

- By application, the automotive & transportation segment is expected to grow at the fastest CAGR in the market during the forecast period.

What Do You Mean by the U.S. Green Chemicals Market?

U.S. green chemicals market growth is driven by improvements in bio-based feedstocks and renewable processing technologies, increased consumer demand for sustainable products, and tighter environmental regulations. Two important market segments are bio-alcohols and bio-organic acids. Growth is further fueled by widespread adoption in sectors like packaging, automotive, construction, and specialty chemicals.

- In June 2025, New Iridium announced it had raised seed funding. The Colorado-based green chemicals startup is planning a pilot facility to produce bio-based acetic acid and ethyl acetate using renewable feedstocks and captured CO2(Source: www.industryintel.com)

Market Outlook

- Industry Growth Overview: The U.S. green chemicals market is steadily growing as industries increasingly adopt eco-friendly alternatives to traditional chemicals. Demand is rising across sectors like agriculture, automotive, packaging, and construction, driving companies to invest in innovative, sustainable production methods.

- Sustainability Trends: Sustainability is a top priority, and the market is being shaped by renewable feedstocks, circular economy principles, and regulatory compliance. Businesses are focusing on plant-based materials recycling and cleaner processes in an effort to lessen their impact on the environment.

- Startup Ecosystem: The U. S. has a thriving green chemicals startup ecosystem with an emphasis on sustainable production, recycling technologies, and bio-based materials. To scale technologies and swiftly introduce novel solutions to the market, many startups partner with well-established businesses.

Emerging Trends in the U.S. Green Chemicals Market

Circular Economy and Waste-to-Chemicals Solutions

Emerging trends include converting industrial by-products, agricultural residues, and post-consumer waste into value-added chemicals. This supports circular economy principles by reducing landfill usage, cutting emissions, and creating sustainable feedstock pipelines for chemical production.

Growth of Specialty Bio-Chemicals

Bio-lubricants, bio-solvents, and natural surfactants are examples of specialty chemicals made from renewable resources that are becoming increasingly well-liked. Compared to bulk green chemicals, their uses in personal care, pharmaceutical, and cosmetic products are growing and offer greater value opportunities.

Value Chain Analysis

- Feedstock Procurement: Finding sustainable raw materials such as plant oils, sugars, algae, agricultural waste, and other renewable biomass is known as feedstock procurement. To guarantee that these feedstocks satisfy quality requirements for chemical synthesis, they are gathered, cleaned, and pre-processed.

- Chemical Synthesis and Processing: Through processes like enzymatic reactions, fermentation, catalysis, separation, purification, and drying, chemical synthesis and processing transform the feedstocks into green chemicals. For increased efficiency and less environmental impact, the processes may also use continuous flow systems, modular reactors, or bioreactors.

- Quality Testing and Certification: Quality testing evaluates parameters such as purity, density, viscosity, pH, melting point, and biodegradability, depending on the chemical type. Certifications like USDA BioPreferred, ISCC Plus, or other eco-labels ensure compliance with U.S. regulatory standards and global sustainability benchmarks.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 4.43 Billion |

| Expected Size by 2034 | USD 8.74 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.84% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type / Chemical Class, By Feedstock / Raw Material, By Application / End-Use Industry |

| Key Companies Profiled | Corbion, Evonik Industries (U.S. operations), Genomatica, Inc., Novozymes, Inc., Solvay S.A. (U.S. operations), BioAmber (renewable succinic acid), Amyris, Inc., Green Biologics Ltd.LanzaTech (carbon-to-chemicals technology) |

Market Opportunity

Waste-to-Chemicals and Circular Economy Solutions

The production of chemicals from waste materials offers a significant opportunity for expansion. Businesses can lower their environmental impact, lower the cost of raw materials, and produce innovative goods from agricultural or industrial waste by incorporating the principles of the circular economy.

Market Challenge

High Production Costs

Green chemicals often rely on renewable feedstocks or advanced bio-based processes, which are more expensive than conventional petrochemical routes. This makes price competitiveness a major hurdle. Companies must balance sustainability with profitability, often requiring subsidies or incentives to remain viable. High upfront capital investment for green production facilities further limits rapid expansion.

Segmental Insights

Product Type Insights

Why Bio-Based Solvents Segment Dominate the U.S. Green Chemicals Market?

The bio-based solvents segment dominated the market with approximately 35% share in 2024, motivated by the growing use of these environmentally friendly substitutes for solvents derived from petroleum in paints, coatings, adhesives, and cleaning products. The dominance of bio-based solvents in a variety of industries was further reinforced by growing consumer demand for safer, nontoxic products and regulatory pressure to reduce volatile organic compounds.

The bio-based polymers & bioplastics fastest growing in the market during the forecast period, owing to rising demand from packaging, consumer goods, and automotive sectors looking to replace conventional plastics with sustainable materials. Government initiatives supporting biodegradable packaging and corporate commitments toward carbon neutrality are accelerating adoption, making this segment a key driver of future market expansion.

Feedstock Insights

How the Plant Oils & Fats Segment Held the Largest Share in the U.S. Green Chemicals Market?

The plant oils & fats segment held the largest revenue share of approximately 40% in the market in 2024, motivated by their broad availability and numerous uses in bio-based lubricants, surfactants, solvents, and bioplastics. Their cost-effectiveness, renewable nature, and ease of integration into current chemical processes make them a popular option for manufacturers

The lignocellulosic biomass segment is experiencing the fastest growth in the market during the forecast period due to its capacity to produce high-value chemicals from forestry waste, non-food crops, and agricultural residues. Due to its scalability and ability to avoid competition with the food supply, this feedstock is becoming more appealing to produce advanced green chemicals and second-generation biofuels.

Application Insights

Which Application Segments Dominated the U.S. Green Chemicals Market?

The packaging & plastics segment dominated the market with approximately 30% share in 2024 due to strong demand for environmentally friendly packaging solutions from consumers and regulations. Corporate sustainability commitments, single-use plastic bags, and growing e-commerce have all contributed to the rapid expansion of bio-based polymers and biodegradable plastics in packaging.

The automotive & transportation segment is the fastest growing in the market during the forecast period, owing to the rising use of bio-based polymers, lubricants, and composites to reduce carbon emissions and improve fuel efficiency. Increasing EV adoption and regulatory pressure on automakers to adopt sustainable materials are accelerating demand for green chemicals in this sector.

Country Insights

The United States stands as one of the largest and most progressive markets for green chemicals in 2025, fueled by the growing demand for environmentally friendly products, stringent regulations, and developments in bio-based technologies. Bioplastics are expanding at the fastest rate, while bio-based solvents dominate the market. Feedstocks are mostly composed of plant oils and fats, while lignocellulosic biomass is rapidly increasing.

The United States Export Of Organic / Chemical Products

| Metric | Value / Details |

| U.S. Exports of organic chemicals in 2024 | USD 51.88 billion |

| Share of U.S. total merchandise exports (2023) represented by organic chemicals (HS commodity group 29) | ≈ 2.56% |

| Top export destinations for U.S. organic chemicals (2023) | Mexico (~USD 6.82 billion), China (~USD 4.20 billion), Belgium, Canada, Italy, Japan, Germany, Netherlands, UK, Brazil |

Recent Developments

- In May 2025, HH Chemical introduced BIODEX®, a fully integrated bio-based materials brand offering a comprehensive solution across the entire value chain from renewable raw materials to finished consumer products. This platform establishes a closed-loop ecosystem, enabling seamless integration from green sourcing to end-use applications.(Source: www.prnewswire.com)

- In June 2024, Trillium Renewable Chemicals announced the selection of INEOS Nitriles’ Green Lake facility in Port Lavaca, Texas, to establish the world’s first demonstration plant for converting plant-based glycerol into acrylonitrile. The demonstration plant, named “Project Falcon,” is set to commence operations in early 2025 and run through early 2026.(Source: www.trilliumchemicals.com)

Top Companies in the U.S. Green Chemicals Market

- DuPont: A chemical company providing technology-based materials and solutions.

- Dow Inc.: A materials science company producing plastics, coatings, and performance materials.

- BASF Corporation: The North American subsidiary of a global chemical producer.

- ADM: A food processing and commodities trading company focused on agricultural products.

- Cargill: A global agribusiness and food company providing diverse products and services.

- NatureWorks LLC: A manufacturer of bioplastics made from renewable plant resources.

Other Top Companies

- Corbion

- Evonik Industries (U.S. operations)

- Genomatica, Inc.

- Novozymes, Inc.

- Solvay S.A. (U.S. operations)

- BioAmber (renewable succinic acid)

- Amyris, Inc.

- Green Biologics Ltd.LanzaTech (carbon-to-chemicals technology)

Segments Covered

By Product Type / Chemical Class

- Bio-based Solvents (ethanol, acetone, methyl soyate)

- Bio-based Polymers & Bioplastics (PLA, PHA, PBS)

- Organic Acids (citric acid, lactic acid, succinic acid)

- Surfactants & Detergents

- Specialty Chemicals (bio-lubricants, bio-additives, bio-based coatings)

- Other Bio-based Chemicals

By Feedstock / Raw Material

- Plant Oils & Fats (soybean, canola, palm, sunflower)

- Carbohydrates / Starches / Sugars

- Agricultural & Food Waste

- Lignocellulosic Biomass

- Algae / Microbial Feedstocks

By Application / End-Use Industry

- Packaging & Plastics

- Automotive & Transportation

- Personal Care & Cosmetics

- Pharmaceuticals & Nutraceuticals

- Agriculture & Crop Protection

- Coatings, Adhesives, Sealants

- Industrial & Specialty Applications