Content

What is the Current Smart Textile Polymers Market Size and Share?

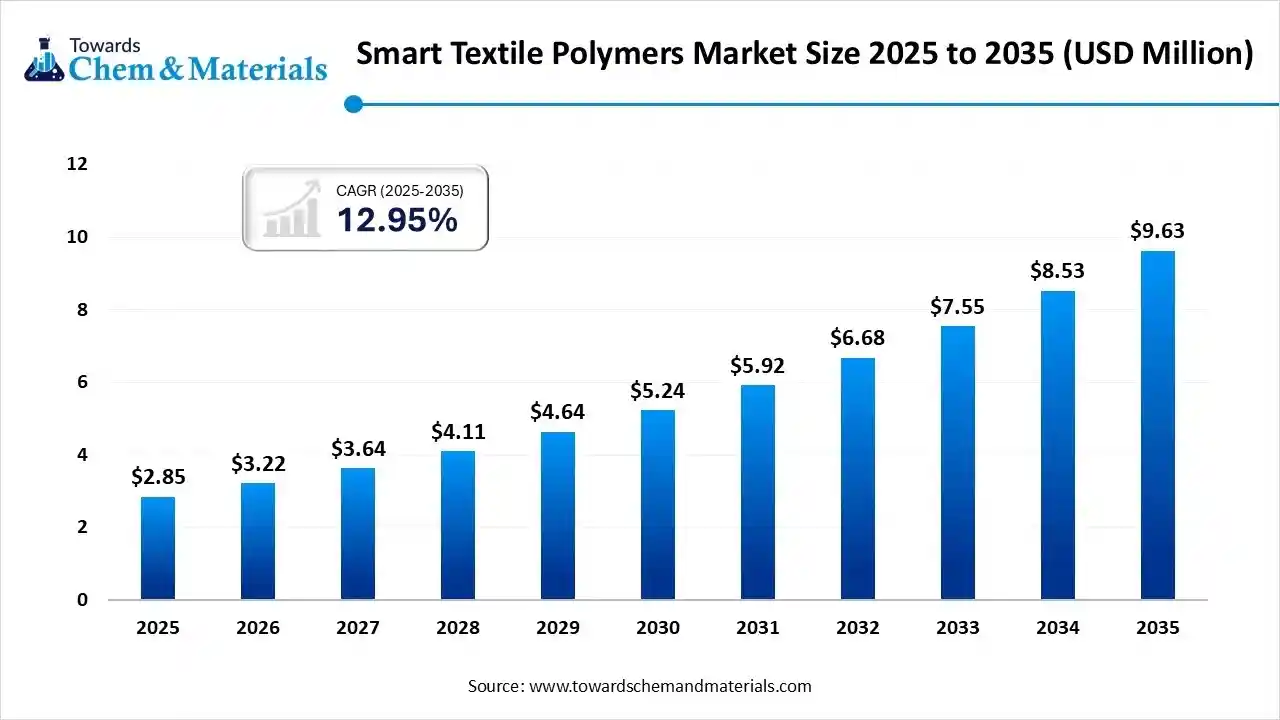

The global smart textile polymers market size is calculated at USD 2.85 million in 2025 and is predicted to increase from USD 3.22 million in 2026 and is projected to reach around USD 9.63 million by 2035, The market is expanding at a CAGR of 12.95% between 2026 and 2035. North America dominated the smart textile polymers market with a market share of 36.11% the global market in 2025.The global shift towards advanced technology and the need for more comfortable and premium clothing have fueled the industry's growth in recent years.

Key Takeaways

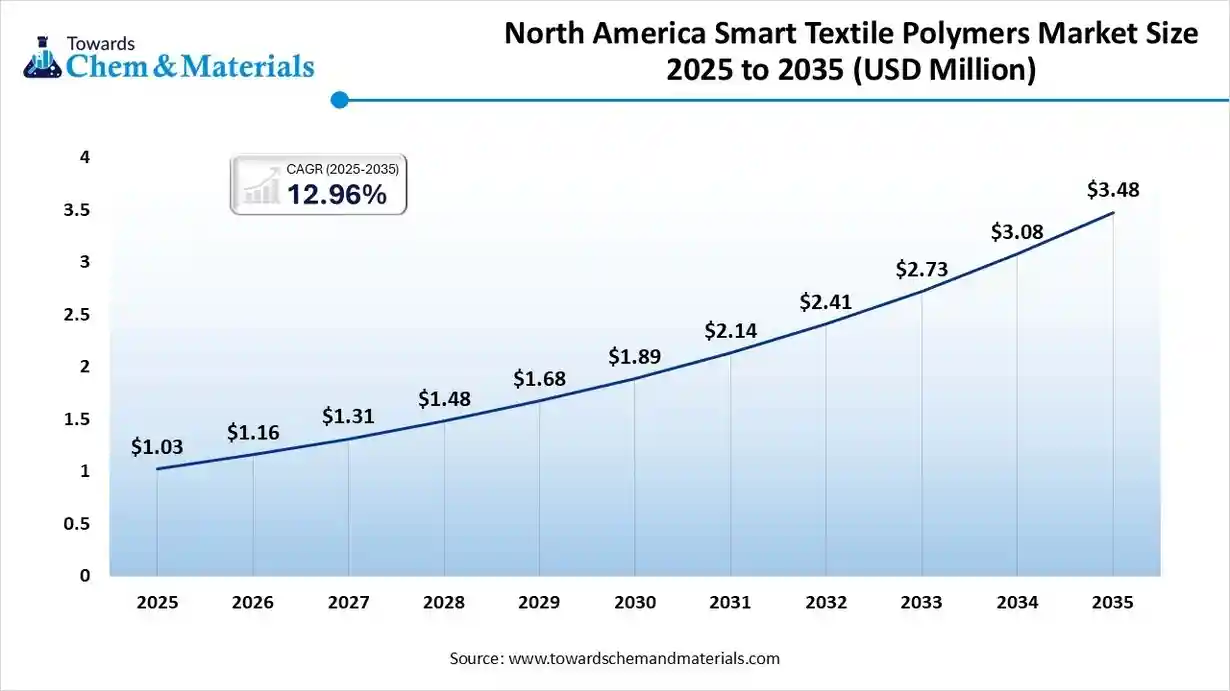

- North America dominated the smart textile polymers market with a revenue share of 36.11% in 2025.

- By polymer type, the conductive polymers segment led the market and accounted for 32% of the global revenue share in 2025.

- By functionality type, the sensing and monitoring segment accounted for the largest revenue share of 35% in 2025.

- By end-use type, the sport and fitness segment dominated with the largest revenue share of 33% in 2025.

- By distribution channel, the direct supply to the OEM segment dominated the market and accounted for the largest revenue share of 55% in 2025.

From Color Shifts to Heat Response: Polymers Making Fabrics Smarter

The smart textiles polymer refers to the materials that have the ability to change their shape, colour, temperature, and even the electrical behaviour while sensing the movement, light, touch, or heat. Moreover, these polymers are directly built into fabrics by manufacturers, which is making clothes smarter without any devices. Also, these are the intelligent materials which is likely to evolve with technological advances.

Smart Textile Polymers Industry Trends:

- The shift towards the self-adapting comforting polymers has presented new business models for the forward-thinking manufacturers in recent years. Moreover, by automatically adjusting to the wearer’s comfort, the self-adapting comfort polymer has created its own industry presence in the current period.

- The increasing need the biobased smart polymers, which are made from the more natural materials, has positively impacted revenue potential and industry scalability in the past few years. The global push for sustainability and eco-friendly manufacturing practices has created profitable pathways for the sector participants nowadays.

- The heavy investment in the energy-free responsive polymers is expected to increase return on investment for manufacturers in the coming years. Also, several major brands are seen in using these energy-free responsive polymers in safety jackets, motion-sensing sportswear, and temperature-indicating gloves, where the use of batteries or energy equipment is not suitable or banned.

When Fabrics Think: Hybrid Textiles Transforming the Future of Wearables

The major manufacturers are increasingly using the latest fabric technology for the development of the hybrid polymer networks that combine two or more behaviors in a single fabric. This technology can revolutionize the textiles industry, where it can monitor health, regulate comfort without adding weight, and power small sensors during the projected period.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 3.22 Million |

| Revenue Forecast in 2035 | USD 9.63 Million |

| Growth Rate | CAGR 12.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Polymer Type, By Functionality, By Application, By End-User Industry, By Distribution Channel, By Region |

| Key companies profiled | Arkema, Covestro AG, Evonik Industries AG, Gentherm Incorporated, Huntsman International LLC, Lubrizol Corporation, Peratech, Schoeller Textiles AG, Sensoria Inc., SMP Technologies Inc. |

Trade Analysis of the Smart Textile Polymers Market:

Import, Export, Consumption, and Production Statistics

- The official textile export of China has gained 2.7% in 2024. The export has reached $301 billion as per the published report. (Source: www.fibre2fashion.com)

- The United States has seen under a heavy export of natural polymers, which has an estimated value of $369M as per the published report.(Source: oec.world)

Value Chain Analysis of the Smart Textile Polymers Market:

- Distribution to Industrial Users :The distribution of smart textile polymers to industrial users primarily involves direct sales from major chemical and polymer manufacturers, specialized material suppliers, and technical textile producers. Key players often have global distribution networks to serve various industrial sectors such as automotive, medical, and aerospace.

- Key Players: BASF SE, DuPont de Nemours, Inc., Clariant, and The Lubrizol Corporation

- Chemical Synthesis and Processing :The chemical synthesis and processing of smart textile polymers involve specialized techniques to create materials that respond to stimuli like temperature or pH, followed by integration into fabrics through various finishing methods. Key players in this market are major chemical and material science companies.

- Key Players: Evonik Industries AG, The Lubrizol Corporation, Arkema S.A.

- Regulatory Compliance and Safety Monitoring :Regulatory compliance and safety monitoring for smart textile polymers involve a fragmented landscape of standards that classify products as clothing, electronics, or medical devices, requiring adherence to various chemical, data, and E-waste regulations.

- Key Agencies: U.S. Food and Drug Administration, European Union, and Occupational Safety and Health Administration (OSHA)

Smart Textile Polymers Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Federal Trade Commission (FTC) | FTC Green Guides | Product safety and chemical compliance |

| European Union | European Commission (EC) | REACH Regulation (EC) 1907/2006 | Promoting circularity and sustainability through mandatory recycling content and EPR schemes |

| China | National Medical Products Administration (NMPA) | GB Standards | Ensuring high product quality and safety for the vast domestic consumer market |

Segmental Insights:

Polymer Type Insights

How did the Conductive Polymers Segment Dominate the Smart Textile Polymers Market in 2025?

- The conductive polymers segment dominated the market with approximately 32% industry share in 2025 due to conductive polymers has seen in providing te stable and easy way to move electrical signals without the requirement of metal wires. Moreover, the factors like easy to bend, fold, and stretch without breaking, the conductive polymers have gained major industry attention in recent years.

- On the other hand, the shape-memory polymers segment is expected to grow at a significant rate owing to the increasing industry shift towards adaptive materials by avoiding reactive electronics in recent years. Moreover, the heavy need for wearable health and performance gear, the SMP is likely to gain significant attention in the upcoming years.

- The electroactive polymer segment is also notably growing, owing to it act like artificial muscles. Also, allowing clothing to have motion support, micro massage, haptics, and a shape-changing surface, the electroactive polymers have gained a significant consumer base in the past few years.

Functionality Insights,

Why does the Sensing & Monitoring Segment Dominate the Smart Textile Polymers Market by Functionality?

- The sensing and monitoring segment dominated the market with approximately 35% industry share in 2025, because most early smart textile products focused on tracking movement, pressure, heart rate, temperature, or location. These were the easiest functions for manufacturers to add using conductive yarns, printed sensors, and small chips. Fitness brands, hospitals, and safety gear companies wanted wearable data collection long before other advanced features.

- The energy harvesting & storage segment is expected to grow at a rapid rate. Future smart textiles will need more power because features like micro-heating, displays, communication, and actuation are increasing. That means clothing must generate or store energy on its own. Energy-harvesting textiles capture power from body movement, sunlight, or temperature differences.

- The thermal regulation segment is also notably growing because people now want clothing that automatically adapts to weather or body heat. These fabrics can warm up, cool down, or release heat when needed. Climate change is making temperatures less predictable, so adaptive clothing is becoming important for comfort, health, and energy savings.

End User Insights,

Why does the Sport & Fitness Segment Dominate the Smart Textile Polymers Market by End User?

- The sport & fitness segment dominated the market with approximately 33% of industry share in 2025 because athletes and active customers were the first to accept smart clothing. They wanted performance tracking, posture feedback, sweal monitoring, and lighter support gear. Smart fabrics fit naturally into workout clothes where comfort, stretchability, and movement data matter the most.

- The healthcare segment is expected to grow at a rapid rate because hospitals and home-care services are shifting to continuous monitoring instead of occasional checkups. Smart textiles can track breathing, heartbeat, posture, swelling, sleep, and muscle activity without uncomfortable devices.

- The automotive segment is also notably growing because car interiors are becoming more intelligent and ergonomic. Smart textiles allow seats to sense posture, adjust temperature reduce pressure points, or even detect drowsiness. They also make cabin surfaces lighter than traditional wiring systems.

Distribution Channel Insights,

Why does the Direct Supply to OEMs Segment Dominate the Smart Textile Polymers Market by Distribution Channel?

- The direct supply to the OEM market segment dominated the market with approximately 55% industry share in 2025, because automotive makers, sports brands, medical device companies, and uniform manufacturers prefer to buy materials straight from polymer producers. This ensures stable quality, consistent performance, and easier certification.

- The E-textile integrators segment is expected to grow at a rapid rate. In the future, brands will not want to manage sensors, circuits, polymers, and textile engineering on their own. They will prefer Integrators- companies that combine electronics, materials, connectivity, and software into ready-to-use fabric solutions

- The online technical material platforms segment is also notably growing because designers, startups, and small manufacturers want fast access to advanced fabrics without negotiating with big suppliers. These platforms list conductive yarns, shape memory sheets, printed sensors and test samples that are normally hard to find.

Regional Analysis:

The North America smart textile polymers market size was valued at USD 1.03 billion in 2025 and is expected to surpass around USD 3.48 billion by 2035, expanding at a compound annual growth rate (CAGR) of 12.96% over the forecast period from 2026 to 2035.

North America dominated the smart textile polymers market with approximately 35% industry share, owing to the region having strong research infrastructure and the presence of major sports brands, which heavily support the advanced textile polymer demand. Moreover, the heavy regional investments in soldier wear programs and wearable electronics have driven the regional growth in recent years.

Smart Uniforms and Sensor Fabrics Elevate the United States Market Position

United States maintained its dominance in the smart textile polymers market due to the heavy medical devices demand and investment in innovations. Furthermore, the country’s military agencies have seen under a heavy investment in smart uniforms and sensor-embedded fabrics, which have heavily contributed to the industry growth in the past few years.

Market players are increasingly focusing on research and development to produce flexible, durable, and multifunctional polymers suitable for wearable health monitors, sports apparel, and protective clothing. Collaborations between universities, research institutions, and private companies are driving innovation in conductive fibers, self-cleaning fabrics, and temperature-regulating materials. Additionally, rising consumer awareness about health monitoring, fitness tracking, and safety-oriented apparel is expected to sustain the adoption of smart textile polymers across both commercial and industrial sectors in the coming years.

Asia Pacific Smart Textile Polymers Market Examination

Asia Pacific is expected to capture a major share of the smart textile polymers market, owing to the region having the world's largest textile hub and exports. Having advantages like lower production cost, a tightly connected supply chain, and upgraded and advanced factories, the region is likely to capture industry share during the projected period.

Countries such as Japan, South Korea, and India are heavily investing in research and development to produce advanced sensor-embedded fabrics, conductive fibers, and temperature-regulating polymers. Rising demand from the fitness, medical, and defense sectors, coupled with government initiatives supporting innovation and industrialization, is fueling market expansion.

- Additionally, the region’s growing textile manufacturing capabilities and export-oriented strategies are attracting international collaborations, further strengthening the smart textile polymers ecosystem.

Local Factories Boost China’s Dominance in Advanced Smart Textiles

China is expected to emerge as a prominent country for the smart textile polymers market in the coming years, owing to having advanced and heavy textile manufacturing base in the current period. Moreover, the local factories in China have seen in heavy production of conductive yarns and stretchable circuits in recent years, as per the latest survey.

Growing awareness of health monitoring devices, fitness apparel, and industrial safety clothing is driving domestic consumption, while government incentives for innovation in smart textiles and collaboration with technology companies are accelerating technological advancements and market growth.

Europe Smart Textiles Polymers Sector Evaluation

Europe is a notably growing region due to greater regional focus on sustainable materials and high-quality engineering. Furthermore, the region has seen in receipt of heavy funding from the European Union for advanced projects like protective clothing, medical wearables, and energy harvesting material, as per the recent regional observation.

Germany’s Collaborative Ecosystem Powering Smart Material Breakthrough

Germany is expected to gain a major industry share, akin to the presence of the heavy automotive industry and world-class textile engineering. Furthermore, the German research institutes have seen in collaborated with manufacturing companies to create reliable and precise smart materials such as the heating fibers, pressure sensing fabrics, and active support textiles in the past few years.

Smart Textile Polymers Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the smart textile polymers market because extreme climate conditions make smart cooling, thermal-regulating, and protective textiles very important. Governments invest in advanced materials for military uniforms, oil-and-gas workers, and healthcare. Many countries in the region are building innovation hubs to diversify their economies beyond energy.

Why Smart Textile Investment is Accelerating in Saudi Arabia?

Saudi Arabia is expected to emerge as a prominent country for the smart textile polymers market in the coming years because it is heavily investing in science, technology, and local manufacturing under Vision 2030. The country supports innovation in smart uniforms for industrial workers, soldiers, and emergency teams.

Recent Developments

- In July 2025, Outlast Technologies created a strategic collaboration with Reggiani Group and unveiled an advanced fabric product line. Moreover, the motive behind these advanced developments is to elevate thermal comfort across fashion as per the company's claim.

Top Vendors in the Smart Textile Polymers Market & Their Offerings:

- AiQ Smart Clothing Inc: A leading player in the smart clothing market that offers a complete vertical integration of wearable technologies.

- DuPont: An innovator in the field of advanced materials, with a focus on protective and ultra-smart fabrics.

- BASF SE: A major chemical company that invests heavily in research and development to create advanced smart polymers.

- Outlast Technologies, LLC: A company specializing in temperature-regulating and moisture-wicking fabrics that provide adaptive thermal comfort.

Other Key Players

- Arkema

- Covestro AG

- Evonik Industries AG

- Gentherm Incorporated

- Huntsman International LLC

- Lubrizol Corporation

- Peratech

- Schoeller Textiles AG

- Sensoria Inc.

- SMP Technologies Inc.

Segments Covered in the Report

By Polymer Type

- Conductive Polymers

- PEDOT:PSS

- Polyaniline

- Polypyrrole

- Shape-Memory Polymers (SMPs)

- Phase-Change Polymers (PCMs)

- Electroactive Polymers

- Thermochromic & Photochromic Polymers

- Self-Healing Polymers

- Biodegradable / Bio-Based Smart Polymers

By Functionality

- Sensing & Monitoring

- Actuation & Motion Response

- Thermal Regulation

- Energy Harvesting & Storage

- Protection & Adaptive Shielding

- Color-Changing & Aesthetic Response

By Application

- Healthcare & Medical Textiles

- Physiological Monitoring Garments

- Pressure & Movement Tracking Fabrics

- Sports & Fitness Wear

- Performance Monitoring Wearables

- Military & Defense Textiles

- Camouflage, Avionics Suits, Ballistic Layers

- Consumer Electronics & Wearables

- Smart Clothing, E-Textiles

- Automotive & Transportation

- Smart Seats, Airbags, Comfort-Control Textiles

- Industrial & Safety Textiles

- Heat/Flame-Resistant Smart Materials

By End-User Industry

- Healthcare

- Sports & Fitness

- Defense & Security

- Consumer Electronics

- Automotive

- Industrial Safety

By Distribution Channel

- Direct Supply to OEMs

- Specialty Material Distributors

- E-Textile Integrators

- Online Technical Material Platforms

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa