Content

What is the Current Technical Textiles Market Size and Share?

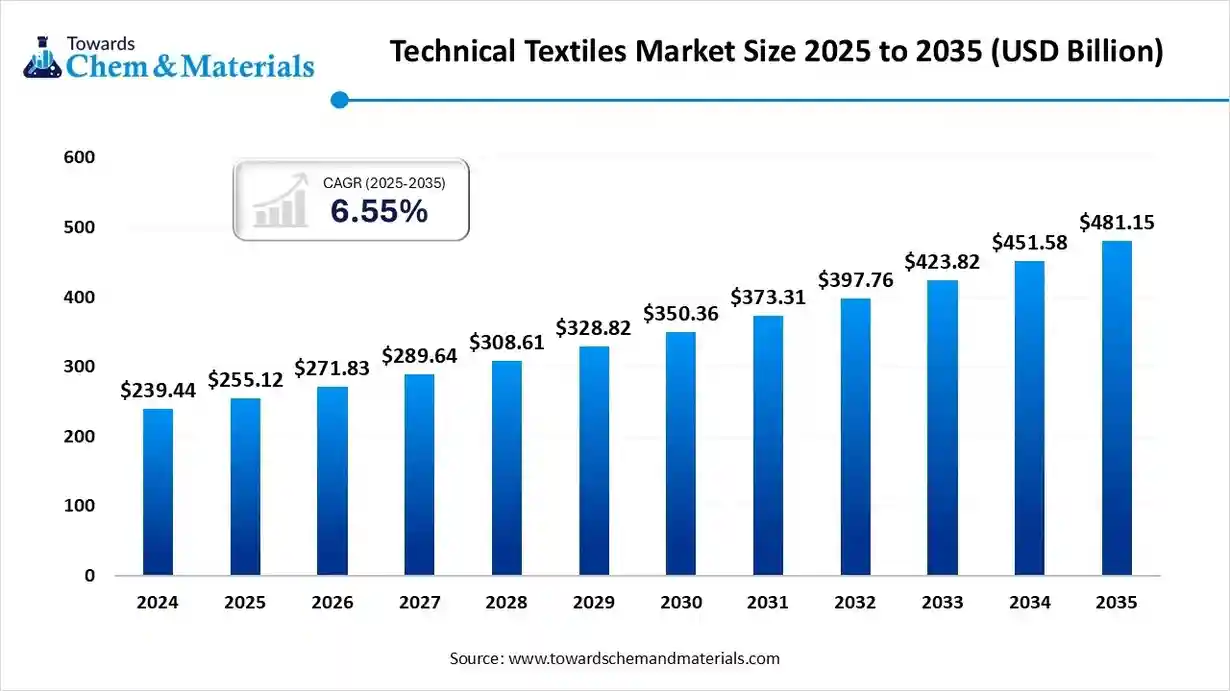

The global technical textiles market size is calculated at USD 255.12 billion in 2025 and is predicted to increase from USD 271.83 billion in 2026 and is projected to reach around USD 481.15 billion by 2035. The market is expanding at a CAGR of 6.55% between 2026 and 2035. Asia Pacific dominated the technical textiles market with a market share of 45.20% of the global market in 2025.The market is driven by expanding demand from end-use industries such as automotive, healthcare, and construction, as well as government support for innovation and manufacturing.

Key Takeaway

- Asia Pacific dominated the technical textiles market and accounted for the largest revenue share of 45.20% in 2025.

- By product type, the nonwoven technical textiles segment accounted for the largest revenue share of 38.60% in 2025.

- By material, the synthetic fibers segment held the largest revenue share of 54.30% in 2025.

- By technology, the nonwoven segment accounted for the largest revenue share of around 42.50% in 2025.

- By application/end-use industry, the mobiltech (automotive & transport) segment dominated the market with a share of 20.60% in 2025.

- By end-use sector, the industrial manufacturing segment held the largest market share of 26.80% in 2025.

- By distribution channel, the direct institutional supply segment dominated the market with a share of 64.50% in 2025.

Market Overview

What Is The Significance Of The Technical textiles Market?

The global Technical Textiles Market encompasses engineered textile materials and products manufactured primarily for functional and technical performance rather than aesthetic purposes. These textiles are designed with enhanced strength, durability, chemical resistance, flame-retardant properties, and insulation to serve industrial, medical, automotive, agricultural, construction, and defence applications.

Technical textiles are produced using advanced fibres such as aramid, carbon, glass, polyester, and high-tenacity nylon and are fabricated through processes like weaving, knitting, nonwovens, and composites. Market growth is driven by industrial automation, infrastructure development, rising demand in the medical and automotive sectors, and increased adoption of geosynthetics and smart textiles.

Technical textiles Market Outlook:

- Industry Growth : The global technical textiles market is expected to grow significantly, driven by expanding applications across automotive, medical, construction, and defence industries. Rising demand for functional, durable, and high-performance fabrics is fueling innovation in composites, nonwovens, and coated textiles.

- Sustainability Trends : Sustainability is a major driver, with companies prioritising bio-based fibres, recycled polymers, and energy-efficient manufacturing processes. Eco-friendly coatings, waterless dyeing, and closed-loop recycling are gaining traction across the value chain. Technical textiles producers are integrating life-cycle assessments and green certifications to align with circular economy principles.

- Global Expansion & Innovation : Leading textile manufacturers and material technology firms are investing in advanced R&D for high-performance and smart textile solutions. Innovations include nanofiber membranes, conductive fabrics, flame-retardant composites, and antimicrobial coatings tailored for defence, healthcare, and mobility applications.

Key Technological Shifts In The Technical textiles Market

Key technological shifts in the technical textiles market include the integration of smart and connected technologies, such as wearable sensors and energy-harvesting fabrics; the rise of digital manufacturing enabled by AI and data analytics; and the development of novel materials, such as lab-grown fibres and nano-engineered fabrics. These changes are driven by the demand for higher performance, customisation, and sustainability, making the industry more efficient, automated, and environmentally friendly.

Trade Analysis Of the Market for Technical textiles: Import & Export Statistics

- According to Volza's Global Export data, worldwide exports of technical textiles reached 36,635 shipments between June 2024 and May 2025 (TTM). This volume, handled by 6,050 exporters and 6,421 buyers, represents a 19% growth rate over the previous twelve months.

- Most of the Technical textiles exports from the World go to Ukraine, Mexico, and Russia.

- Globally, China is the leading exporter of technical textiles with 21,484 shipments. Germany is the second-largest exporter, with 16,076 shipments, and South Korea is third, with 11,159 shipments.(Source: https://www.volza.com/p/technical-textiles/export/)

- Between October 2023 and September 2024, India's technical textiles exports grew by 5%, according to Volza's India Export data. During this period, 141 Indian exporters sent 830 shipments to 258 buyers.

- Most of the Technical textiles exports from India go to the United States, Germany, and Mexico.

- Globally, China is the leading exporter of technical textiles, with 24,174 shipments recorded. The United States follows as the second-largest exporter with 21,369 shipments, and Mexico is the third-largest with 19,726 shipments. Together, these three countries represent the top global exporters of technical textiles.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 271.83 Billion |

| Expected Size by 2035 | USD 481.15 Billion |

| Growth Rate from 2025 to 2035 | CAGR 6.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segment Covered | By Product Type , By Material , By Technology , By Application / End-Use Industry , By End-User Sector , By Distribution Channel , By Region |

| Key Companies Profiled | Low & Bonar PLC; Freudenberg Group; Berry Global Group, Inc.; Ahlstrom-Munksjo; Asahi Kasei Advance Corp.; Kimberly-Clark Corp.; Mitsui Chemicals, Inc; Huntsman International LLC |

Technical textiles Market- Value Chain Analysis

1. Chemical Synthesis and Processing

Technical textiles are produced using synthetic, natural, and specialty fibres through processes such as weaving, knitting, nonwoven fabrication, and coating or lamination to achieve high-performance characteristics, such as strength, durability, and resistance.

-

- Key players: DuPont de Nemours Inc., Toray Industries Inc., Freudenberg Group, Low & Bonar PLC, 3M Company.

2. Quality Testing and Certification

Technical textiles undergo testing for tensile strength, thermal resistance, UV stability, and flame retardancy under standards such as ISO 9001, OEKO-TEX, and ASTM D5035.

-

- Key players: SGS, Intertek, TÜV SÜD, Bureau Veritas

3. Distribution to Industrial Users

Technical textiles are distributed to automotive, healthcare, construction, and agriculture sectors through direct industrial supply chains and specialised distributors.

-

- Key players: DuPont de Nemours Inc., Freudenberg Group, Low & Bonar PLC, 3M Company

Technical textiles Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Standards | Focus Areas |

Notable Notes |

| - GSO 839 (Textile Products Labelling) - National Industrial Safety Regulations |

Federal Trade Commission (FTC) Occupational Safety and Health Administration (OSHA) ASTM International EPA (for coatings and treatments) |

Textile Fibre Products Identification Act (TFPIA) - OSHA Standards for PPE (29 CFR 1910.132–138) - EPA TSCA & VOC emission standards - ASTM D5034 / D5035 / F903 (performance and flammability tests) |

- Fibre labelling and product safety - Worker protection & PPE certification - Chemical treatment restrictions - Performance and durability standards |

Technical textiles in protective clothing, filtration, and composites must meet ASTM and OSHA PPE standards. TSCA regulates surface coatings and flame retardants. Military/medical textiles follow NIOSH and FDA norms. |

| European Union | European Chemicals Agency (ECHA) European Committee for Standardisation (CEN) European Commission (DG GROW) |

REACH & CLP Regulations - EU Textile Regulation (1007/2011) - Regulation (EU) 2016/425 on PPE - Ecodesign for Sustainable Products Regulation (ESPR, 2024) |

- Substance restriction (dyes, coatings) - Product labelling and traceability - Circular design and recyclability - Worker & consumer safety |

- Substance restriction (dyes, coatings) - Product labelling and traceability - Circular design and recyclability - Worker & consumer safety |

| China | State Administration for Market Regulation (SAMR) Ministry of Ecology and Environment (MEE) |

- GB/T Standards (e.g., GB/T 5453, GB 18401) - Regulation on the Control of Pollution by Hazardous Chemicals (2011) - MEE Order No. 12 (New Chemical Substance Registration) |

Quality and safety testing - Chemical management and labelling - Environmental compliance for textile finishing |

China mandates national GB/T standards for technical performance, flammability, and chemical residues. The Dual Carbon goals (2030/2060) are promoting sustainable fibres and low-emission dyeing processes. |

| India | Ministry of Textiles Bureau of Indian Standards (BIS) MoEFCC |

- BIS Standards (IS 11871, IS 17493, IS 17021, etc.) - Textiles (Quality Control) Order, 2023 - Chemical (Management and Safety) Rules (proposed) |

Product certification (geotextiles, aggrotech, Meditech) - Quality testing and labelling - Hazard communication for chemical use |

India’s QCOs make BIS certification mandatory for several technical textiles. The government’s National Technical textiles Mission (NTTM) promotes R&D and compliance infrastructure. |

| Middle East (GCC) | GCC Standardisation Organisation (GSO) National Standards Bodies (SASO, ESMA, QS) |

- GSO 839 (Textile Products Labelling) - National Industrial Safety Regulations |

- GSO 839 (Textile Products Labelling) - National Industrial Safety Regulations |

- GSO 839 (Textile Products Labelling) - National Industrial Safety Regulations |

Segmental Insights

By Product Type Insights

Which Product Type Segment Dominated The Technical textiles Sector In 2024?

The nonwoven technical textiles segment dominated the technical textiles sector with a share of 38.60% in 2025. Nonwoven technical textiles are engineered fabrics made by bonding or felting fibres without weaving. They find extensive applications in filtration, hygiene, automotive, and medical products due to their lightweight, high absorbency, and customizable properties. The growing demand for eco-friendly and cost-efficient alternatives to woven fabrics drives their adoption.

The composites & laminates segment expects significant growth in the market for technical textiles during the forecast period. Composites and laminated technical textiles are high-performance materials formed by combining fabrics with polymers, foams, or films to improve durability and functionality. Increasing demand for structural strength, insulation, and waterproofing capabilities has driven the use of laminated composites.

The knitted technical textiles segment has seen notable growth in the technical textiles industry. Knitted technical textiles provide flexibility, stretchability, and breathability, making them ideal for medical, sportswear, and industrial applications. Their unique structure offers superior comfort and performance for wearable technology and compression garments. Advancements in knitting machinery have enabled the production of functional fabrics with embedded sensors and antimicrobial properties.

By Material Insights

How did the Synthetic Fibres Segment dominate Technical textiles in 2024?

The synthetic fibres segment dominated the technical textiles market, accounting for 54.30% in 2025. Synthetic fibres such as polyester, nylon, and polypropylene dominate the technical textiles space due to their superior strength, resilience, and cost-effectiveness. They are extensively used in automotive, filtration, and construction applications. The development of flame-retardant and UV-resistant synthetic variants enhances performance.

The specialty fibres segment expects significant growth in the technical textiles sector during the forecast period. Speciality fibres include aramids, carbon fibres, and glass fibres that deliver exceptional thermal stability, mechanical strength, and chemical resistance. These fibres are key components in aerospace, defence, and high-performance industrial textiles. The increasing need for safety apparel, advanced composites, and filtration systems has elevated demand.

The natural fibres segment has seen notable growth in the technical textiles industry. Natural fibres such as cotton, jute, wool, and coir are gaining renewed importance due to sustainability concerns and biodegradability. Their use in geotextiles, packaging, and home furnishings reflects the shift toward eco-conscious materials. Government support for natural fibre cultivation and value-added processing has strengthened supply.

By Technology Insights

Which technology Segment Dominated The Technical textiles Market In 2024?

The nonwoven segment dominated the technical textiles market, accounting for 42.50% in 2025. Nonwoven technology plays a crucial role in producing cost-effective technical textiles used in hygiene, filtration, and automotive sectors. The process allows for high-speed, energy-efficient production with adaptable fibre blends. Advancements in spun bond and melt-blown processes have improved texture, strength, and absorbency.

The coating & lamination segment expects significant growth in the technical textiles industry during the forecast period. Coating and lamination technologies enhance the functionality of technical textiles by adding protective layers, waterproof coatings, or flame-retardant finishes. These processes are vital for outdoor, defence, and industrial applications where material resistance is critical.

The woven segment has seen notable growth in the market for technical textiles. Woven technical textiles, produced through interlacing yarns, provide exceptional dimensional stability and strength. They are widely used in geotextiles, industrial fabrics, and reinforcement materials. Innovations in weaving machinery have enabled the production of finer, high-tensile fabrics with tailored mechanical properties.

By Application / End-Use Industry Insights

How Did The Mobiles (Automotive And Transport) Segment Dominated The Technical textiles Industry In 2024?

The mobiles (automotive & transport) segment dominated the technical textiles market, accounting for 20.60% in 2025. Mobiles textiles encompass seat covers, airbags, insulation materials, and reinforcement fabrics used across vehicles and transport systems. Increasing vehicle production and the adoption of lightweight materials drive market growth. Technical textiles improve safety, comfort, and fuel efficiency.

The meditech (medical & hygiene) segment expects significant growth in the technical textiles sector during the forecast period. Meditech applications include surgical gowns, drapes, wound dressings, and hygiene products. The pandemic accelerated the use of disposable and antimicrobial medical textiles. Nonwoven fabrics are predominant due to their sterilizability and low cost.

The aggrotech (agriculture) segment has seen notable growth in technical textiles. Aggrotech Textiles supports modern agriculture with crop covers, shade nets, and soil protection fabrics. They enhance yield, control pests, and optimise resource usage. The growing need for sustainable farming and water conservation has accelerated the adoption of aggrotech.

By End-User Sector Insights

Which End-User Sector Segment Dominated The Technical textiles Space In 2024?

The industrial manufacturing segment dominated the technical textiles space, accounting for 26.80% in 2025. Technical textiles are integral to industrial manufacturing, providing reinforcement, insulation, and filtration capabilities. Their use in conveyor belts, protective clothing, and filtration media ensures operational efficiency and safety.

The healthcare segment expects significant growth in the technical textiles industry during the forecast period. Healthcare remains a rapidly growing user segment driven by demand for disposable, sterile, and biocompatible fabrics. Technical textiles support surgical and wound care, personal protective equipment (PPE), and implants.

The automotive segment has seen notable growth in the technical textiles space. The automotive sector uses technical textiles in airbags, interior trims, insulation, and tyre reinforcements. Lightweight materials improve fuel economy and reduce emissions. Innovation in smart textiles for thermal control and noise reduction enhances comfort and safety.

By Distribution Channel Insights

How Did the Direct Institutional Supply Segment Dominated The Technical textiles Market In 2024?

The direct institutional supply segment dominated the technical textiles market, accounting for 64.50% in 2025. Large-scale institutional contracts remain the primary distribution channel for technical textiles, particularly in industrial, automotive, and healthcare applications. This route ensures consistent quality and bulk delivery.

The online/e-commerce segment expects significant growth in the technical textiles market during the forecast period. Online distribution is gaining traction, especially for specialised and small-batch technical textiles products. Digital platforms provide transparency into pricing and customization, and faster access to emerging buyers.

The retail & distributors segment has seen notable growth in the technical textiles market. Retail outlets and local distributors play a key role in serving smaller end users, the agricultural market, and the construction market. They provide logistical support, inventory management, and product guidance.

By Regional Insights

How Did Asia Pacific Dominate The Technical textiles Market In 2024?

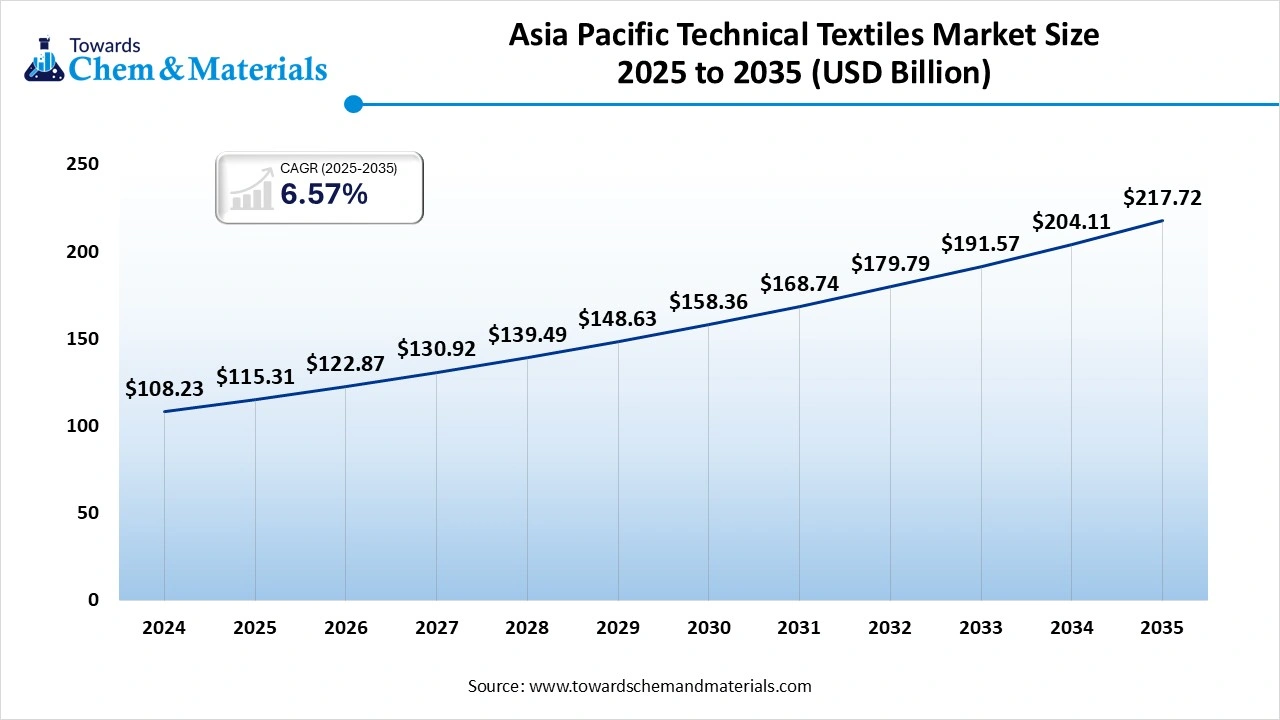

The Asia Pacific technical textiles market size is accounted for USD 115.31 billion in 2025 and is expected to be worth around USD 217.72 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.57% over the forecast period from 2026 to 2035. Asia Pacific dominates the technical textiles market, accounting for 42.50% in 2024.

The Asia Pacific region dominates the global technical textiles space, driven by robust expansion in the automotive, healthcare, and construction industries. Rapid industrialization, urbanization, and government initiatives such as India’s National Technical textiles Mission have accelerated regional growth. Rising focus on sustainable production and the use of advanced fiber technologies further enhances the region’s competitiveness.

India: Government Schemes Play an Important Role In The Growth Of The Market

India is emerging as a major player in the technical textiles industry, driven by strong policy support and increasing domestic consumption. Government schemes such as the Production-Linked Incentive (PLI) and the National Technical textiles Mission promote R&D, infrastructure development, and export-oriented manufacturing. With the establishment of textile parks and increasing private investment, India is poised to become a global technical textiles manufacturing hub.

Europe Has Seen Growth In The Market, Driven By Technological Advancements

Europe is expected to experience significant growth in the technical textiles market in the forecast period. Europe’s technical textiles factories are driven by technological advancement, sustainable innovation, and stringent environmental regulations. The European Union’s focus on green manufacturing, coupled with strong R&D collaborations between industries and research institutions, drives consistent innovation. Demand for reusable and recyclable materials continues to expand the region’s technical textiles capabilities.

United Kingdom (UK): Technical textiles Market Trends

The UK technical textiles market is characterized by innovation in advanced materials, smart fabrics, and high-value industrial applications. Strong research infrastructure and collaborations between universities and industry fuel technological progress. Post-Brexit trade policies have encouraged domestic production and export diversification, enhancing competitiveness in global markets. Continuous innovation in nanotechnology and bio-based textile development supports long-term market expansion.

North America: Growing Applications Drive The Growth In The Technical textiles Market

North America represents a mature and innovation-driven market for technical textiles, with the United States as the key contributor. The region’s focus on high-performance applications in defense, aerospace, healthcare, and automotive sectors sustains steady demand. Strict regulatory standards related to safety, hygiene, and quality further shape production trends. The shift toward domestic manufacturing and reshoring initiatives strengthens regional supply chain resilience.

United States (US): Technical textiles Market Analysis

The United States technical textiles sector exhibits strong growth driven by innovation and high-end applications. Major industries such as defence, aerospace, and healthcare demand advanced fabrics with superior mechanical, thermal, and chemical properties. The presence of major global manufacturers and strong institutional procurement in the defence and healthcare sectors ensures sustained demand. Increasing investments in automation and sustainability initiatives further support long-term growth across the U.S. market.

South America: The Technical textiles Market Has Seen Growth Driven By Domestic Manufacturing

The South American technical textiles space is expanding gradually, supported by industrial diversification and infrastructure development. Countries such as Brazil and Argentina are focusing on strengthening their domestic manufacturing capabilities. Although limited by import dependency for advanced fibres, the region shows potential for growth through increased investment in local production and regional trade collaborations.

Argentina: Technical textiles Market Analysis

Argentina’s technical textiles industry is developing steadily, driven by rising demand from the agriculture, automotive, and healthcare sectors. The government’s initiatives to modernize textile manufacturing and promote innovation are strengthening local production capacity. Agrotech applications such as crop protection fabrics, shade nets, and soil covers are gaining prominence. Local manufacturers are focusing on quality improvement, fibre technology adoption, and export expansion.

Middle East & Africa (MEA): Strong Manufacturing Base Drives The Growth

The Middle East and Africa technical textiles industry is gaining traction due to increasing industrialisation, infrastructure growth, and diversification of the manufacturing base. The region’s demand is primarily driven by construction, oil and gas, and healthcare sectors. Governments are emphasising self-sufficiency through investments in textile clusters and local production facilities. Continued expansion in nonwoven and composite production capacity is likely to strengthen regional competitiveness.

South Africa: Technical textiles Market Trends

South Africa is one of the leading markets for technical textiles in the MEA region, supported by its developed industrial base and expanding agricultural sector. The demand for protective clothing, filtration fabrics, and agrotech materials is increasing rapidly. Investments in infrastructure and industrial modernization drive adoption across multiple sectors. The country’s focus on import substitution and export promotion, along with growing collaboration with global textile firms.

Recent Developments

- In September 2025, three indigenous instruments for testing the heat resistance of protective textiles were developed under India's National Technical textiles Mission (NTTM) by NITRA. These instruments offer a cost-effective, domestic alternative to imported equipment

- In March 2025, India is enhancing its global standing in technical textiles through the National Technical textiles Mission (NTTM), an initiative with a budget of ₹1,480 crore focusing on research, market growth, and skill development. The mission has allocated funds for research projects, supported startups and innovations, and promoted industry collaboration through events like Technotex 2024.

- In September 2025, Monforts introduced the VertiDry, a vertical dryer designed for the special finishing of technical textiless, emphasising space and energy saving. It provides contactless drying for sensitive fabrics used in items like airbags and geotextiles, and can be integrated into existing production lines.

Top players in the Technical textiles Market & Their Offerings:

- DuPont de Nemours, Inc. – DuPont is a global leader in advanced materials and high-performance fibres, manufacturing technical textiles such as Kevlar®, Nomex®, and Tyvek®. These materials are widely used in defines, automotive, industrial safety, and healthcare applications, offering superior strength, flame resistance, and durability.

- 3M Company – 3M provides a wide array of technical textiles, including nonwovens, protective fabrics, and specialty coatings for filtration, safety apparel, and insulation. The company focuses on innovation in reflective materials, smart textiles, and composite fabrics, emphasizing both performance and comfort.

- Toray Industries, Inc. – Toray manufactures a diverse range of technical textiles such as carbon fiber fabrics, high-performance synthetic fibres, and nonwovens. Its materials are used across aerospace, medical, and automotive industries, where lightweight composites and high tensile strength are critical.

- Freudenberg Group – Freudenberg produces nonwoven and technical performance textiles used in filtration, automotive interiors, hygiene products, and construction. The company emphasizes sustainability and resource efficiency, using recycled and bio-based raw materials to develop eco-friendly solutions.

- Teijin Limited – Teijin specializes in high-performance fibres including Taron and Technorama aramids and Polyester FR. These materials are applied in protective apparel, industrial reinforcements, and composites, combining heat resistance, mechanical strength, and sustainability in technical textiles innovations.

- Mitsui Chemicals – Mitsui Chemicals develops functional fibers, nonwovens, and performance materials for industrial and healthcare applications. Its textiles are used in hygiene products, filters, and automotive components, focusing on sustainability and polymer innovation.

- Huntsman Corporation – Huntsman supplies textile dyes, finishes, and chemical treatments that enhance the performance characteristics of technical textiles. Its innovations improve UV resistance, flame retardancy, and water repellence across industrial and protective fabric applications.

- Procter & Gamble (P&G) – P&G manufactures high-quality nonwoven textiles used in hygiene, healthcare, and cleaning applications. The company’s proprietary materials enhance comfort, absorbency, and sustainability in consumer and medical products.

- Ahlstrom-Munksjö – Ahlstrom-Munksjö produces high-performance fibre-based materials including filtration media, medical textiles, and industrial nonwovens. The company focuses on sustainable and specialty fibres for use in construction, automotive, and protective equipment sectors.

- Johns Manville – Johns Manville manufactures fiberglass, nonwoven, and composite textiles used in roofing, insulation, and filtration. Its materials provide thermal stability, mechanical strength, and acoustic insulation, supporting infrastructure and industrial applications.

- Low & Bonar PLC – Low & Bonar produces engineered performance materials for automotive, construction, and geotextile uses. The company’s portfolio includes woven and nonwoven fabrics designed for durability, water management, and reinforcement applications.

- Berry Global, Inc. – Berry Global is a leading producer of nonwoven fabrics used in hygiene, medical, and industrial markets. The company’s focus lies in lightweight, high-strength, and sustainable textile materials for single-use and technical applications.

- Asahi Kasei Corporation – Asahi Kasei develops performance fibres, including Bemberg™ and Roica™, used in sportswear, automotive interiors, and industrial applications. The company integrates advanced fiber chemistry and sustainable innovation in technical textiles.

- SRF Limited – SRF Limited manufactures industrial fabrics, coated textiles, and reinforcement materials for tire cord and conveyor belts. Its technical textiles combine mechanical resilience and weather resistance, serving automotive and infrastructure sectors.

- Milliken & Company – Milliken produces performance fabrics for protective apparel, industrial reinforcement, and specialty coatings. The company’s textiles are recognized for flame resistance, moisture management, and antimicrobial performance in advanced applications.

- Tencate Protective Fabrics – Tencate develops protective fabrics designed for firefighters, military personnel, and industrial workers. Its textiles combine thermal protection, durability, and comfort, serving high-risk professional environments.

- Baltes Technical textiles – Baltes designs technical knitted fabrics and composites for aerospace, defines, and medical applications. The company specializes in 3D knitted structures and lightweight reinforcements for advanced manufacturing.

- Hanes Geo Components – Hanes Geo Components supplies geotextiles and erosion control materials for civil engineering and construction. Its products provide soil stabilization, drainage, and environmental protection in infrastructure projects.

- Hexcel Corporation – Hexcel manufactures advanced composite fabrics and reinforcement materials for aerospace, automotive, and industrial applications. The company’s carbon fiber and glass fibre textiles are known for high stiffness, low weight, and structural strength.

- Kimberly-Clark Corporation – Kimberly-Clark produces nonwoven fabrics for hygiene, healthcare, and industrial use. Its focus on absorbency, softness, and microbial control makes its technical textiles essential in medical and personal care markets.

- TenCate Geosynthetics (Austria) – TenCate Geosynthetics develops high-performance textiles for environmental, transportation, and geotechnical engineering applications. Its geosynthetics provide reinforcement, filtration, and drainage solutions for large-scale infrastructure projects.

- Indorama Ventures Public Company Limited – Indorama Ventures manufactures polyester fibres and performance yarns used in automotive, apparel, and industrial applications. Its technical fibres support durability, strength, and environmental performance in textile products.

- Fibered Nonwovens A/S – Fibered produces advanced nonwoven materials for automotive, filtration, hygiene, and construction industries. The company emphasizes high-performance and sustainable solutions based on recycled and biodegradable fibres.

Key Technical Textiles Companies:

The following are the leading companies in the technical textiles market. These companies collectively hold the largest market share and dictate industry trends.

- Low & Bonar PLC

- Freudenberg Group

- Berry Global Group, Inc.

- Ahlstrom-Munksjo

- Asahi Kasei Advance Corp.

- Kimberly-Clark Corp.

- Mitsui Chemicals, Inc.

- Huntsman International LLC

- Toray Industries, Inc.

Segments Covered:

By Product Type

- Woven Technical textiles

- Industrial Fabrics

- Filtration Meshes

- Nonwoven Technical textiles

- Medical & Hygiene Fabrics

- Geotextiles

- Knitted Technical textiles

- Protective Wear

- Automotive Seat & Airbag Fabric

- Composites & Laminates

- Reinforced Fibre Materials

- Coated and Bonded Fabrics

By Material

- Natural Fibres

- Cotton

- Wool

- Jute

- Synthetic Fibres

- Polyester

- Nylon

- Polypropylene

- Speciality Fibres

- Aramid

- Glass Fibre

- Carbon Fibre

By Technology

- Woven

- Industrial Looms

- Multi-Axial Weaving

- Knitted

- Warp Knitting

- Circular Knitting

- Nonwoven

- Spunbond

- Meltblown

- Needle-Punched

- Coating & Lamination

- Extrusion Coating

- Film Lamination

By Application / End-Use Industry

- Agrotech (Agriculture)

- Crop Protection Nets

- Mulch Mats

- Buildtech (Construction)

- Roofing Membranes

- Insulation Layers

- Meditech (Medical & Hygiene)

- Surgical Gowns

- Wound Care Dressings

- Mobiltech (Automotive & Transport)

- Seatbelts

- Airbags

- Sportech (Sports & Leisure)

- Performance Apparel

- Equipment Reinforcements

- Protech (Personal Protection)

- Flame-Resistant Clothing

- Ballistic Vests

- Geotech (Geosynthetics)

- Soil Stabilisation

- Drainage & Filtration

- Packtech (Packaging)

- Industrial Bags

- Wrapping Materials

- Clothtech (Clothing Components)

- Interlinings

- Threads & Zippers

- Hometech (Home Furnishing)

- Mattresses

- Upholstery

By End-User Sector

- Industrial Manufacturing

- Conveyor Belts

- Machine Components

- Healthcare

- Hospital Textiles

- PPE

- Automotive

- Seat Covers

- Tire Cords

- Construction

- Reinforcement Fabrics

- Roofing & Liners

- Defense & Security

- Protective Clothing

- Armour Materials

By Distribution Channel

- Direct Institutional Supply

- OEM Contracts

- Industrial Partnerships

- Retail & Distributors

- Regional Textile Suppliers

- Authorised Agents

- Online / E-Commerce

- B2B Platforms

- Digital Textile Marketplaces

By Regional

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Itay

- Spain

- Greece

- Asia Pacific

- China

- India

- Central & South America

- Brazil

- Middle East & Africa