Content

What is the Current Produced Water Treatment Market Size and Share?

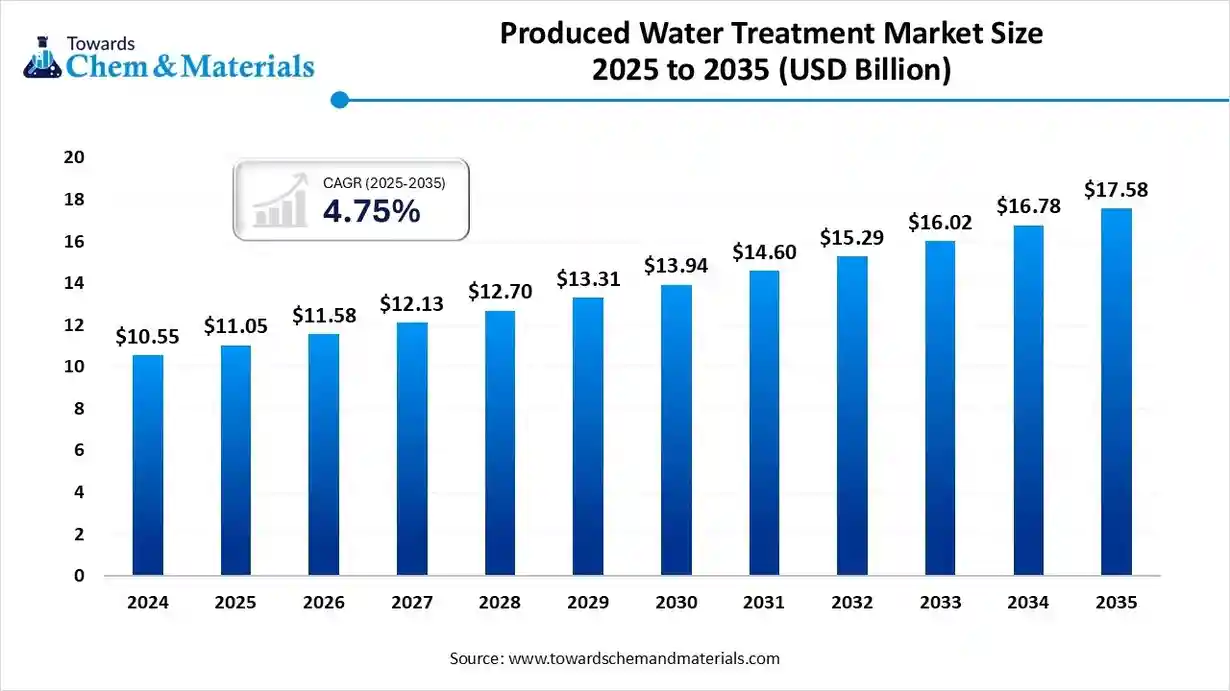

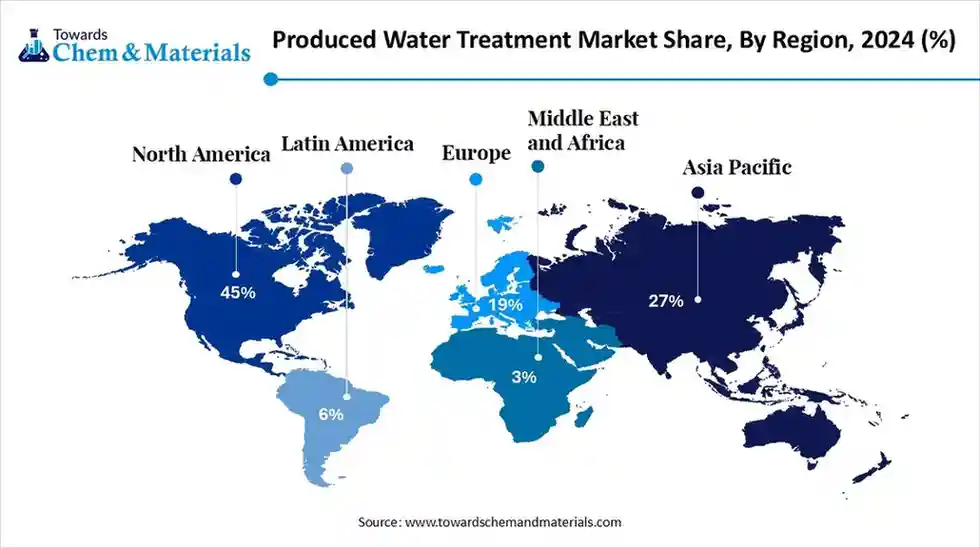

The global produced water treatment market size is calculated at USD 11.05 billion in 2025 and is predicted to increase from USD 11.58 billion in 2026 and is projected to reach around USD 17.58 billion by 2035, The market is expanding at a CAGR of 4.75% between 2025 and 2035. North America dominated the produced water treatment market with a market share of 45% the global market in 2024.The growth of the market is driven by the growing demand from industries, and environmental regulations are driving the growth of the market.

Key Takeaways

- By region, North America dominated the market with a share of 45% in 2024.

- By region, Europe is expected to have significant growth in the market in the forecast period.

- By type, the secondary separation segment dominated the market with a share of 55.3% in 2024.

- By type, the tertiary separation segment is expected to grow significantly in the market during the forecast period.

- By technology, the physical segment dominated the market with a share of 43.4% in 2024.

- By technology, the membrane segment is expected to grow in the forecast period.

- By application, the onshore segment dominated the market with a share of 66.4% in 2024.

- By application, the offshore segment is expected to grow in the forecast period.

- By end use, the oil and gas segment dominated the market with a share of 48.5% in 2024.

- By end use, the power generation segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Produced Water Treatment Market?

The produced water treatment market focuses on technologies and systems used to treat water generated as a byproduct during oil and gas extraction. Treatment aims to remove hydrocarbons, solids, and other contaminants for safe discharge, reinjection, or reuse. Growing environmental regulations, water scarcity concerns, and the need for cost-efficient disposal solutions drive the market. Technological advancements in membrane filtration, electrochemical processes, and biological treatment enhance efficiency, while rising shale production and offshore exploration further boost market demand.

Produced Water Treatment Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the produced water treatment market is expected to witness strong growth, driven by the expansion of oil and gas production and tightening environmental discharge regulations. Increasing volumes of produced water from both onshore and offshore fields are accelerating demand for efficient treatment solutions to enable water reuse and safe disposal.

- Sustainability Trends: Sustainability is a central focus, with operators prioritising technologies that minimise environmental impact and promote water recycling. Advanced oxidation processes, membrane filtration, and electrocoagulation systems are gaining traction for high-efficiency contaminant removal.

- Global Expansion & Innovation: Leading oilfield service providers and technology firms are expanding partnerships to deliver modular, cost-effective, and scalable produced water treatment systems. Investments in mobile treatment units and hybrid systems combining physical, chemical, and biological processes are increasing.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 11.58 Billion |

| Expected Size by 2035 | USD 17.58 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Leading Region | North America |

| Fastest Growing Region | Europe |

| Segment Covered | By Type, By Technology, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | AECOM, Thermax Limited., Alfa Laval AB, Aker Solutions ASA , Veolia Environnement S.A. , SUEZ SA , Xylem Inc. , Siemens Energy AG , Halliburton Company , Ovivo Inc. , Aquatech International LLC, Ecolab Inc. , TechnipFMC plc , Pentair plc , Alderley plc , WorleyParsons Limited , Cetco Energy Services , Global Water Engineering Ltd. |

Key Technological Shifts In The Produced Water Treatment Market:

Key technological shifts in the produced water treatment market include the rise of advanced membrane filtration, electrocoagulation, and advanced oxidation processes, driven by the need for higher efficiency and stricter regulations. Other shifts include increased use of digitalisation and Artificial Intelligence for real-time monitoring and optimisation, the development of Zero Liquid Discharge (ZLD) systems, and a greater focus on beneficial reuse of treated water for purposes like industrial cooling or irrigation, transforming it from a waste stream into a resource.

Trade Analysis Of Produced Water Treatment Market: Import & Export Statistics

- Water Treatment export shipments were exported from the World at 33K, exported by 3,704 World Exporters to 4,113 Buyers.

- The world exports most of its Water Treatment to Vietnam, the United States and Mexico.

- The top 3 exporters of Water Treatment are the United States with 7,763 shipments, China with 5,291 shipments, and Vietnam with 4,721 shipments.(Source: www.volza.com)

- Produced Water Solutions LLC imported 70 shipments exclusively from the Indian supplier Neel Water Treatment Systems Pvt Ltd. These imports primarily consisted of industrial pipe fittings and valves, categorised under HSN Codes 7307 and 8481.(Source: www.volza.com)

- Global Export data for the twelve months ending April 2025, worldwide exports of Water Treatment Chemicals and HSN Code 2815110000 totalled 53 shipments. These exports, facilitated by 33 different exporters to 27 buyers, indicate a significant market expansion, reflecting a 2550% growth rate compared to the previous year.

Most of the Water Treatment Chemicals and HSN Code 2815110000 exports from the World go to Vietnam, Colombia. - Globally, the leading exporters of Water Treatment Chemicals under HSN Code 2815110000 are China, India, and Vietnam. China dominates these exports with 46 shipments, while India ranks second with 10 shipments, and Vietnam secures the third position with 9 shipments.(Source : www.volza.com)

Produced Water Treatment Market Value Chain Analysis

- Chemical Synthesis and Processing : Produced water is treated through physical, chemical, and biological processes, including coagulation, flotation, filtration, membrane separation, and advanced oxidation to remove hydrocarbons, salts, and suspended solids for reuse or safe discharge.

- Key players Veolia Environnement S.A., Schlumberger Limited, Siemens Energy, SUEZ Water Technologies & Solutions, Aquatech International LLC

- Quality Testing and Certification : Treated produced water is tested for total dissolved solids (TDS), oil content, and chemical oxygen demand (COD) under standards such as ISO 14001, EPA discharge regulations, and API guidelines.

- Key players: SGS, Intertek, Bureau Veritas, TÜV SÜD

- Distribution to Industrial Users : Produced water treatment systems and chemicals are supplied to the oil & gas, power generation, and petrochemical industries for wastewater management and recycling.

- Key players: Veolia Environnement S.A., Schlumberger Limited, Aquatech International LLC, SUEZ Water Technologies & Solutions.

Produced Water Treatment Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Frameworks | Focus Areas | Notable Notes |

| United States | U.S. Environmental Protection Agency (EPA) Bureau of Land Management (BLM) State Environmental Agencies (e.g., Texas Railroad Commission) |

- Clean Water Act (CWA, 33 U.S.C. §1251) - Safe Drinking Water Act (SDWA) - 40 CFR Part 435 – Oil and Gas Extraction Effluent Guidelines - Underground Injection Control (UIC) Program |

- Effluent discharge limits (TSS, oil & grease) - Produced water reinjection - Chemical use and spill control - Surface water discharge permits (NPDES) |

EPA regulates discharges under NPDES permits. Offshore discharges are limited under 40 CFR 435. Reinjection wells require UIC Class II permits. States like Texas and North Dakota have their own produced water reuse rules. |

| European Union | European Environment Agency (EEA) OSPAR Commission (for the North Sea) |

- Water Framework Directive (2000/60/EC) - Marine Strategy Framework Directive (2008/56/EC) - OSPAR Decision 2001/1 (Oil in Produced Water) |

- Offshore discharge control - Hydrocarbon concentration limits - Marine environmental protection |

OSPAR limits oil-in-water concentration to 30 mg/L for offshore discharges. Many EU states enforce zero-discharge policies in sensitive marine zones. Produced water is often reinjected or reprocessed for reuse. |

| China | Ministry of Ecology and Environment (MEE) National Energy Administration (NEA) |

- GB 8978 – Integrated Wastewater Discharge Standard - Oilfield Water Pollution Prevention Guidelines (SY/T 5329-2012) - Environmental Protection Law (2015) |

- Discharge and reinjection limits - Chemical use management - Environmental monitoring and permits |

Strict COD, oil content, and salinity standards apply. MEE requires oilfields to install oil-water separation and membrane treatment systems before discharge. |

| India | Central Pollution Control Board (CPCB) Ministry of Environment, Forest and Climate Change (MoEFCC) Directorate General of Hydrocarbons (DGH) |

- Environment (Protection) Act, 1986 - Water (Prevention & Control of Pollution) Act, 1974 - Oilfields (Regulation and Development) Act, 1948 - CPCB Guidelines for Disposal of Produced Water (2022) |

- Discharge standards for onshore/offshore sites - Reuse/reinjection approvals - Monitoring of oil & grease levels |

CPCB’s 2022 guidelines define discharge standards: oil & grease <10 mg/L for offshore and <20 mg/L for onshore. Reinjection is encouraged in mature fields to enhance recovery. |

| Middle East (e.g., GCC) | Saudi Ministry of Environment, Water and Agriculture (MEWA) UAE Ministry of Climate Change and Environment (MOCCAE) Qatar Energy / ADNOC |

- GSO 149/2014 – Industrial Wastewater Standards - National Water Reuse Frameworks - Company-Specific Produced Water Guidelines (e.g., ADNOC 2020) |

- Zero liquid discharge (ZLD) adoption - Reinjection & reuse - Brine management |

Gulf countries promote 100% reuse/reinjection of produced water. ADNOC aims to recycle 90% of produced water by 2030. Oil content limits: typically <10 mg/L for discharge. |

| South America (e.g., Brazil) | National Petroleum Agency (ANP) Brazilian Institute of Environment and Renewable Natural Resources (IBAMA) |

- CONAMA Resolution No. 393/2007 - ANP Resolution No. 143/2020 |

- Offshore discharge standards - Effluent monitoring and treatment - Produced water reuse |

CONAMA 393/2007 limits oil content to 29 mg/L (monthly average). Brazil promotes reinjection and onshore reuse for secondary recovery in mature fields. |

Segmental Insights

Type Insights

Which Type Segment Dominated The Produced Water Treatment Market In 2024?

The secondary separation segment dominated the market with a share of 55.3% in 2024. Secondary separation focuses on removing emulsified oil and finer particles remaining after primary treatment. Techniques like dissolved air flotation (DAF) and induced gas flotation (IGF) are commonly used. This step enhances overall water clarity, ensuring compliance with discharge or reinjection standards.

The tertiary separation segment expects fastest growth in the market during the forecast period. Tertiary separation is the polishing stage designed to eliminate residual hydrocarbons, dissolved solids, and trace contaminants. Advanced technologies like membrane filtration, adsorption, and chemical oxidation are applied to achieve near-zero discharge or reuse quality, particularly in offshore and environmentally sensitive operations.

The primary separation segment has seen notable growth in the market. Primary separation involves the initial removal of free oil, suspended solids, and large contaminants from produced water. It typically employs gravity-based separators like API or hydrocyclones. This stage prepares the water for advanced treatment, ensuring efficiency and reducing the load on secondary and tertiary processes.

Technology Insights

How Did Physical Segment Dominated The Produced Water Treatment Market In 2024?

The physical segment dominated the produced water treatment market with a share of 43.4% in 2024. Physical treatment methods, including gravity separation, centrifugation, and filtration, are widely used for bulk oil and solids removal. These techniques offer cost-effective and energy-efficient operation, serving as the foundation for integrated produced water treatment systems in both onshore and offshore applications.

The membrane segment is expected to experience fastest growth in the market during the forecast period. Membrane technologies, such as ultrafiltration, nanofiltration, and reverse osmosis, provide high purification efficiency for removing dissolved salts and trace contaminants. They are essential in meeting stringent regulatory requirements and are gaining traction in offshore and reuse-focused projects due to their compact design and scalability.

The chemical segment has seen notable growth in the market. Chemical processes involve the use of coagulants, demulsifiers, and biocides to enhance oil-water separation, reduce fouling, and control microbial growth. These methods are particularly effective when integrated with physical or membrane technologies to improve overall system efficiency and water quality.

Application Insights

Which Application Segment Dominated The Produced Water Treatment Market In 2024?

The onshore segment dominated the produced water treatment market with a share of 66.4% in 2024. Onshore produced water treatment systems cater to oilfields, refineries, and industrial wastewater facilities. They prioritise large-volume handling and water reuse, incorporating cost-effective physical and chemical methods. The focus is on minimising environmental discharge and optimising water recycling for enhanced sustainability.

The offshore segment expects fastest growth in the market during the forecast period. Offshore treatment systems are compact, automated, and designed to meet strict discharge norms under space and weight constraints. Advanced flotation and membrane modules dominate this segment, ensuring compliance with international marine environmental standards and supporting sustainable offshore oil production.

End Use Industry Insights

How Did the Oil And Gas Segment Dominated The Produced Water Treatment Market In 2024?

The oil and gas segment dominated the market with a share of 48.5% in 2024. The oil and gas industry accounts for the largest share of the market. With increasing regulatory pressure and environmental concerns, operators are investing in integrated treatment systems to enable reinjection, reduce disposal costs, and improve operational efficiency.

The power generation segment expects fastest growth in the produced water treatment market during the forecast period. Power plants utilise produced water treatment for cooling and boiler feed purposes. Efficient removal of oil, solids, and salts ensures extended equipment life and process reliability. The shift toward zero liquid discharge (ZLD) systems has further increased demand for advanced treatment technologies in this sector.

The mining segment has seen notable growth in the market. Mining operations generate large volumes of water contaminated with hydrocarbons and heavy metals. Produced water treatment in this sector focuses on solids removal, pH adjustment, and metal recovery. Adoption of membrane and hybrid systems is growing to comply with tightening environmental discharge standards.

Regional Insights

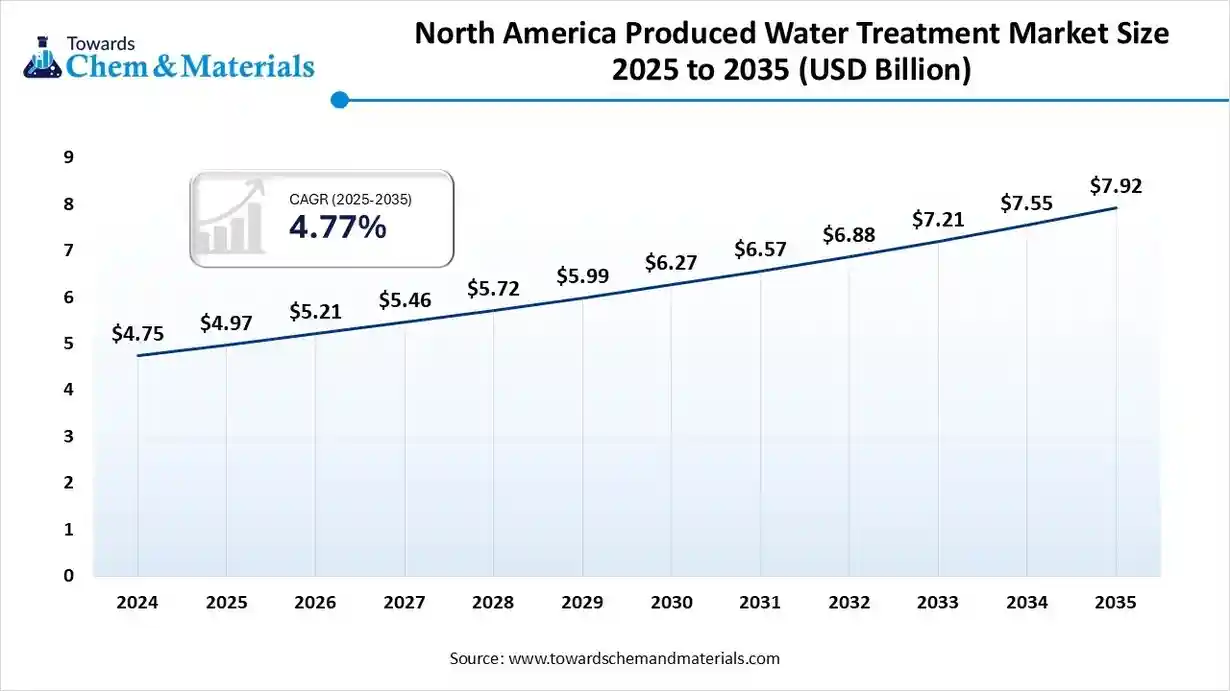

The North America produced water treatment market size was valued at USD 4.97 billion in 2025 and is expected to surpass around USD 7.92 billion by 2035, expanding at a compound annual growth rate (CAGR) of 4.77% over the forecast period from 2025 to 2035. North America dominated the market with a share of 45% in 2024. North America dominates the market due to extensive oil and gas exploration, particularly in shale formations. The region emphasises advanced treatment technologies to meet strict environmental standards. Growing investments in water reuse and zero liquid discharge systems further drive market expansion across both onshore and offshore sectors.

The U.S. Has Seen Growth In The Market Driven By The Presence Of Strong Regulatory Bodies.

The U.S. leads North America’s market with strong regulatory enforcement by the EPA and growing adoption of membrane and chemical treatment systems. Shale oil producers are focusing on cost-effective produced water recycling and reinjection to minimise freshwater usage, fostering innovation in mobile and modular treatment technologies.

Europe's Produced Water Treatment Market Is Driven By The Sustainability Initiatives

Europe is expected to have fastest growth in the market in the forecast period. Europe’s market growth is driven by environmental sustainability initiatives and stringent wastewater discharge norms. Offshore operations in the North Sea encourage the adoption of high-performance membrane and flotation technologies. Additionally, growing collaboration among oilfield service providers and technology firms is supporting advanced produced water treatment infrastructure across the region.

Germany Has Seen Growth Driven By The High Efficiency Treatment

Germany is emerging as a leader in sustainably produced water management, emphasising zero liquid discharge (ZLD) and high-efficiency treatment systems. The nation’s focus on industrial wastewater reuse and circular economy principles drives demand for advanced filtration and chemical treatment solutions, particularly in the petrochemical and power generation sectors.

Asia Pacific Has Seen Growth Driven By Rapid Industrialization

The Asia Pacific region has seen notable growth in the market. Asia Pacific represents one of the fastest-growing regions in the produced water treatment market, driven by rapid industrialisation and expanding oil and gas production. Increased investment in refining and exploration projects, coupled with stricter environmental policies, encourages the adoption of integrated physical and chemical treatment systems across the region.

The Growth Of The Market Is Driven By The Adoption Of Cost-Effective Solutions

India’s market is expanding with rising oilfield operations and growing regulatory attention to water pollution control. Adoption of cost-effective treatment solutions, such as gravity separation and chemical dosing, is increasing. Domestic and international collaborations are further promoting sustainable water management practices in the country’s oil and gas sector.

South America: Produced Water Treatment Market Trends

South America’s produced water treatment market is supported by active offshore oilfields, particularly in Brazil and Venezuela. Growing exploration activities and government initiatives toward sustainable wastewater management are promoting the adoption of membrane-based and hybrid treatment systems, ensuring compliance with international discharge and reinjection regulations.

Brazil: Produced Water Treatment Market Analysis

Brazil leads South America’s market due to its large-scale offshore production in the pre-salt basin. The government’s focus on environmental protection and sustainable oilfield operations encourages the use of advanced flotation and filtration systems. Local partnerships are expanding, supporting long-term growth in produced water recycling and reuse.

Middle East And Africa (MEA): Produced Water Treatment Market Trends

The MEA region exhibits steady market growth driven by large oil reserves and increasing produced water volumes. Nations are investing in advanced separation and chemical treatment technologies to meet environmental requirements and enhance operational efficiency, particularly in offshore and desert-based oil extraction operations.

South Africa: The Expanding Sectors Drive The Growth

South Africa’s market is gaining traction due to its expanding mining and energy sectors. Growing awareness of water scarcity and environmental safety is promoting the adoption of modular and chemical treatment solutions. Government initiatives for sustainable industrial wastewater management further strengthen the country’s produced water treatment landscape.

Recent Developments

- In March 2025, Veolia Water Technologies launched its ToroJet™ nutshell filter, introducing a new produced water treatment system for the oil and gas industry. The system is designed for polishing produced water for reuse, reinjection, or discharge, featuring a shared cleaning skid for cost reduction and grade-level access for enhanced safety.(Source: www.hydrocarbonengineering.com)

- In October 2025, WaterTectonics and Clearvale Capital partnered to launch WT Oil & Gas, LLC, a new company focused on providing high-volume, mobile produced water treatment, recycling, and reuse solutions across the Permian Basin.(Source: www.prnewswire.com)

Top Players in the Produced Water Treatment Market & Their Offerings:

Schlumberger Limited

Corporate Information

- Name: Schlumberger Limited (trading under ticker SLB on NYSE) recently rebranded to SLB N.V. to reflect its broader technology/energy services role.

- Headquarters: Houston, Texas (USA) along with major offices in Paris, London and The Hague.

- Business scope: Global oilfield services & technology company offering reservoir characterization, drilling, production systems, digital & integration services, and increasingly growth into new-energy/low-carbon technologies.

History and Background

- Founded origins: The Schlumberger name dates to the early 20th century (1926 is often cited for the modern form) as an oilfield services firm.

Growth through decades: Over many years, the company expanded from logging and reservoir services into drilling, completions, subsea production systems and integrated oilfield services.

Key Developments and Strategic Initiatives

- Rebranding to SLB: The October 2022 announcement formally set the direction: “Schlumberger becomes SLB a technology company driving the future of energy.”

- Focus areas defined: Four key strategic business pillars identified:

- New energy systems (carbon solutions, hydrogen, geothermal, energy storage, critical minerals)

- Industrial decarbonization (hard-to-abate sectors)

- Digital at scale (software, AI, data-driven services)

- Oil & gas innovation (making upstream operations cleaner, more efficient).

Mergers & Acquisitions

- Acquisition of ChampionX (chemicals, artificial-lift, production-technologies provider): Announced ~April 2024, expected to close in due course.

- Acquisition of Interactive Network Technologies (INT) in Feb 2025 (for data/visualization capabilities).

Partnerships & Collaborations

- Partnership with NVIDIA Corporation to accelerate AI solutions for the energy industry and deploy SLB’s Lumi platform.

- Joint ventures in new energy systems, e.g., the public/private clean‐hydrogen company Genvia in partnership with France’s CEA.

- Collaboration in subsea production & integrated services: historic JV with Subsea7 and others.

Product Launches / Innovations

- Digital and AI: For example, the Neuro™ autonomous geosteering system uses AI to steer drilling operations more efficiently.

- Digital & cloud: Release of its “Enterprise Data Solution” aligned with OSDU™ (open subsurface data universal) standards.

- Treatment technologies / Produced Water: While not always publicized, the company is active in water & waste-water treatment (including produced water) via separation, flotation units, etc. For instance, one source states: “Schlumberger integrates compact flotation units into produced water offerings achieving oil-in-water levels under 50 ppm.”

Key Technology Focus Areas

- Reservoir characterization & digital subsurface: Software tools, AI, data analytics, cloud platforms for exploration and production.

- Drilling & completions: Advanced down-hole tools, autonomous drilling, real-time optimization.

- Production Systems & subsea: Subsea trees, flow-lines, integrated production systems (noting the merger of OneSubsea).

R&D Organisation & Investment

- SLB invests significantly in R&D to support its transition to technology and new energy systems (exact figures vary by year and segment).

- The branding of “Transition Technologies™” and dedicated business units like SEES (methane elimination) indicate structured investment in emerging areas.

SWOT Analysis

Strengths:

- Global scale and presence in the oilfield services sector with deep technical expertise and long history.

- Broad technology portfolio across the whole upstream chain (drilling to production) plus subsea systems.

- Strong digital capabilities and increasing growth in software/data platforms (differentiator).

- Strategic shift toward new energies and decarbonization positions the company for future energy transition.

- Recent acquisitions and partnerships strengthen their competitive positioning.

Weaknesses:

- A large portion of revenue is still tied to oil & gas services and upstream activity, which is cyclical and exposed to commodity price swings.

- Transition to new-energy and decarbonized services is still relatively small as a proportion of total revenue (thus high risk and long horizon).

- Integration risk of large acquisitions (e.g., ChampionX) and realizing the synergies may be challenging.

- Exposure to geopolitics, regulatory risk (including operations in sanctioned or sensitive markets).

Opportunities:

- Growth in new-energy markets: hydrogen, geothermal, energy storage, carbon capture & sequestration (CCS).

- Digital transformation of the energy industry: leveraging AI, data, cloud, remote operations for upstream & midstream.

- Rising demand for environmental / regulatory-driven technologies (e.g., emissions reduction, produced water treatment, water-reuse).

- Expanding into adjacent industries (hard-to-abate sectors) where its technology can be leveraged.

Threats:

- Continued volatility in oil & gas investment and price environment could suppress demand for core services.

- Competitive pressures from other service companies and technology entrants.

- Regulatory / reputational risk (e.g., operations in politically sensitive regions).

- Execution risk in scaling new businesses and ensuring profitability in emerging segments.

Recent News & Strategic Updates

- SLB announced the acquisition of ChampionX in an all-stock transaction with expected annual pretax benefits of ~$400 m over first 3 years; shareholder return programme ~$7 billion.

- SLB to invest approximately $400 m to acquire an 80 % stake in Aker Carbon Capture for modular CCS business.

Other Top Companies

- AECOM: Provides end-to-end engineering, procurement, and construction (EPC) services for produced water treatment and reuse systems in the energy and industrial sectors, emphasising regulatory compliance and sustainability.

- Thermax Limited: Delivers turnkey produced water treatment systems combining chemical, thermal, and membrane technologies, supporting the oil & gas, petrochemical, and refinery sectors.

- Alfa Laval AB: Provides separation and filtration equipment, including decanter centrifuges and heat exchangers, for efficient oil-water-solid separation in produced water treatment.

- Aker Solutions ASA: Develops and produces water treatment systems for offshore oil and gas fields, featuring compact flotation units and advanced separation technologies for high-efficiency oil removal.

- Veolia Environnement S.A.

- SUEZ SA

- Xylem Inc.

- Siemens Energy AG

- Halliburton Company

- Ovivo Inc.

- Aquatech International LLC

- Ecolab Inc.

- TechnipFMC plc

- Pentair plc

- Alderley plc

- WorleyParsons Limited

- Cetco Energy Services

- Global Water Engineering Ltd.

Segments Covered:

By Type

- Primary Separation

- Secondary Separation

- Tertiary Separation

By Technology

- Physical

- Chemical

- Membrane

- Biological

By Application

- Onshore

- Offshore

By End-Use Industry

- Oil & Gas

- Power Generation

- Mining

- Others

By Region

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa